|

市场调查报告书

商品编码

1273333

粉煤灰市场 - 增长、趋势和预测 (2023-2028)Fly Ash Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

预计在预测期内,飞灰市场的复合年增长率将超过 4%。

主要亮点

- 由于 2020 年 COVID-19 爆发导致飞灰需求减少,市场受到负面影响,几乎所有主要最终用户行业都暂时停止了生产。 然而,2021年,随着各地建筑业稳步增长,对粉煤灰的需求增加,促进了市场的增长。

- 市场受到建筑行业不断增长的需求以及促进粉煤灰使用的政府政策不断增加的推动。 另一方面,粉煤灰的有害特性和对寒冷气候的不适应阻碍了市场增长。

- 由于建筑业的快速发展,粉煤灰市场也在增长。 当与石灰和水混合时,飞灰会形成一种类似波特兰水泥的化合物。 对废物处理和预製混凝土产品的需求增加对製造商来说是一个机会,促进了市场的增长。

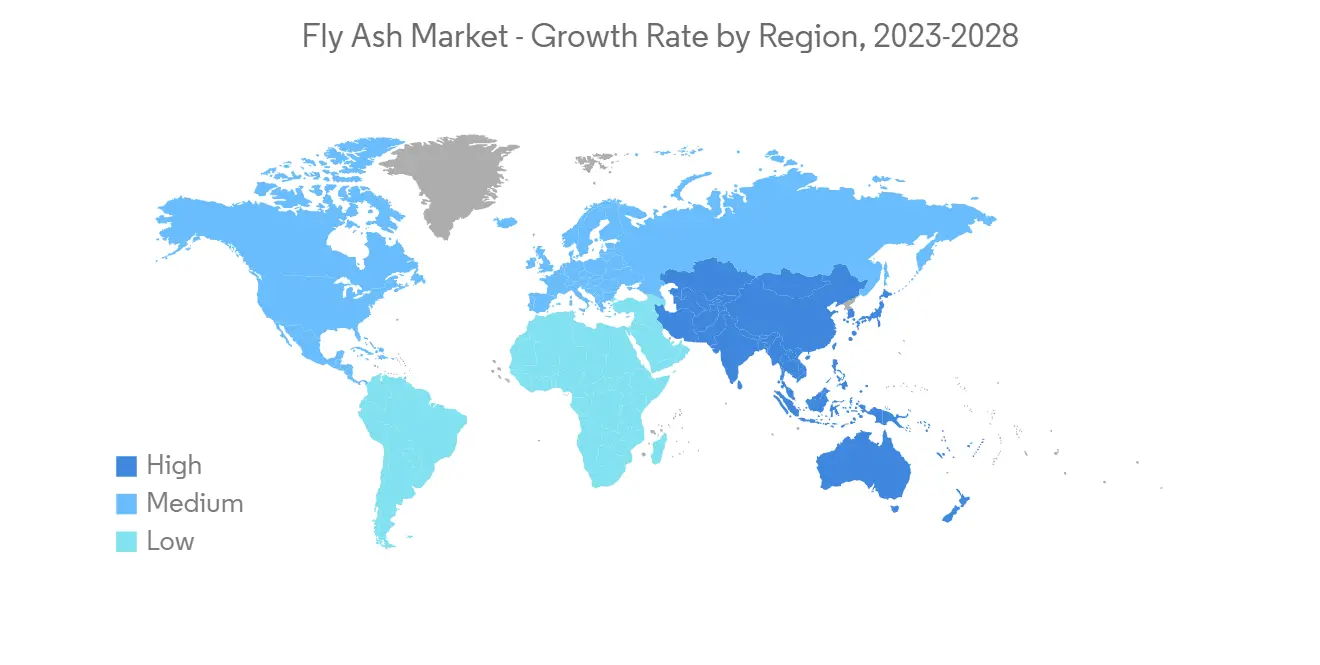

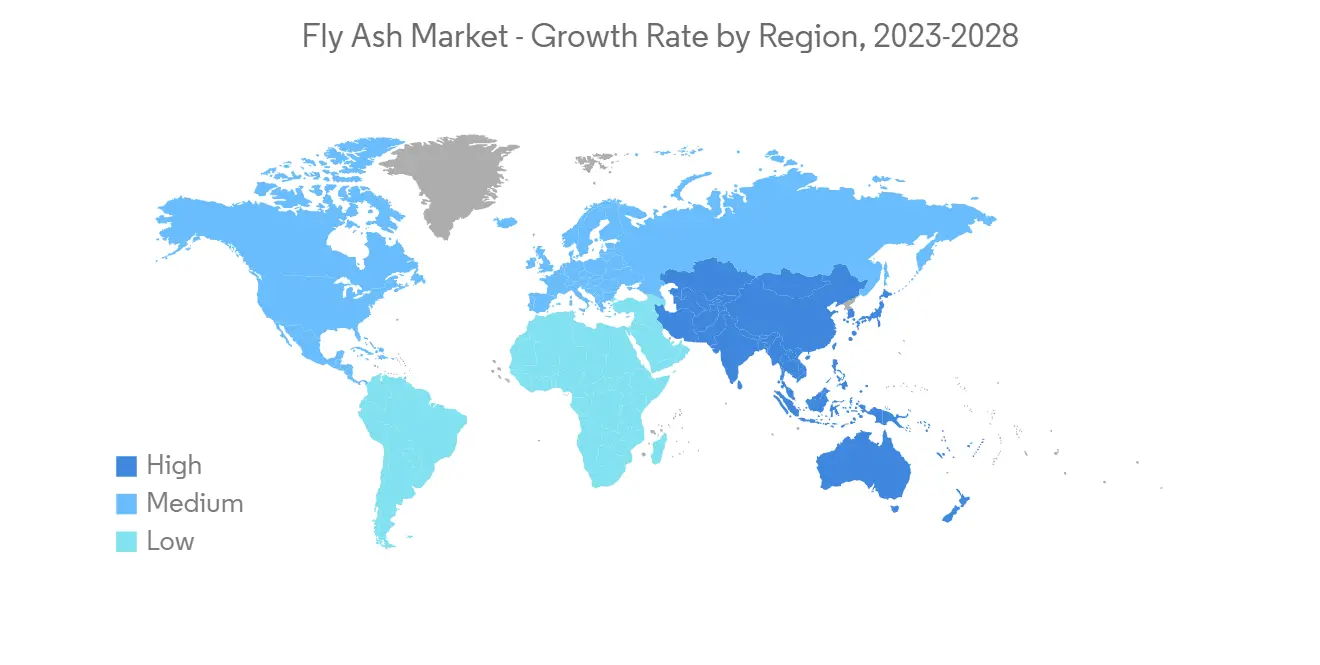

- 预计亚太地区将主导市场,印度和中国等国家/地区的消费量最大。

粉煤灰市场趋势

建筑业需求增加

- 人口增长、工业化进程加快和生活水平提高正在推动建筑行业对粉煤灰的需求。 粉煤灰用于建造堤坝和碾压混凝土坝。 飞灰因其抗渗性和强度而被用作可流动和结构填料中的填料。 在铺设柏油马路时,它也用作填充剂来填充空隙。

- 全球建筑业正在兴起,创造了对粉煤灰的需求。 亚太地区正以世界上最快的复合年增长率增长,其次是北美,因为飞灰的二氧化碳排放量低且对环境友好,因此世界各国政府都在推广使用飞灰。 欧洲是世界第三大粉煤灰市场。

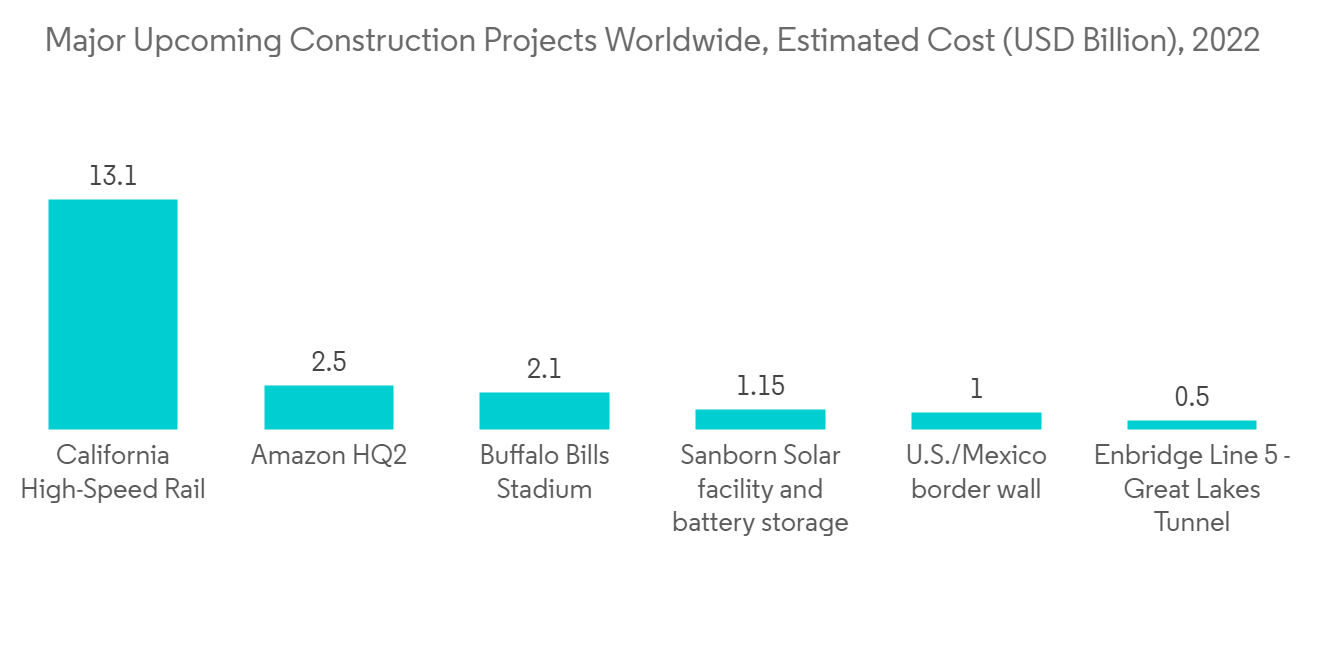

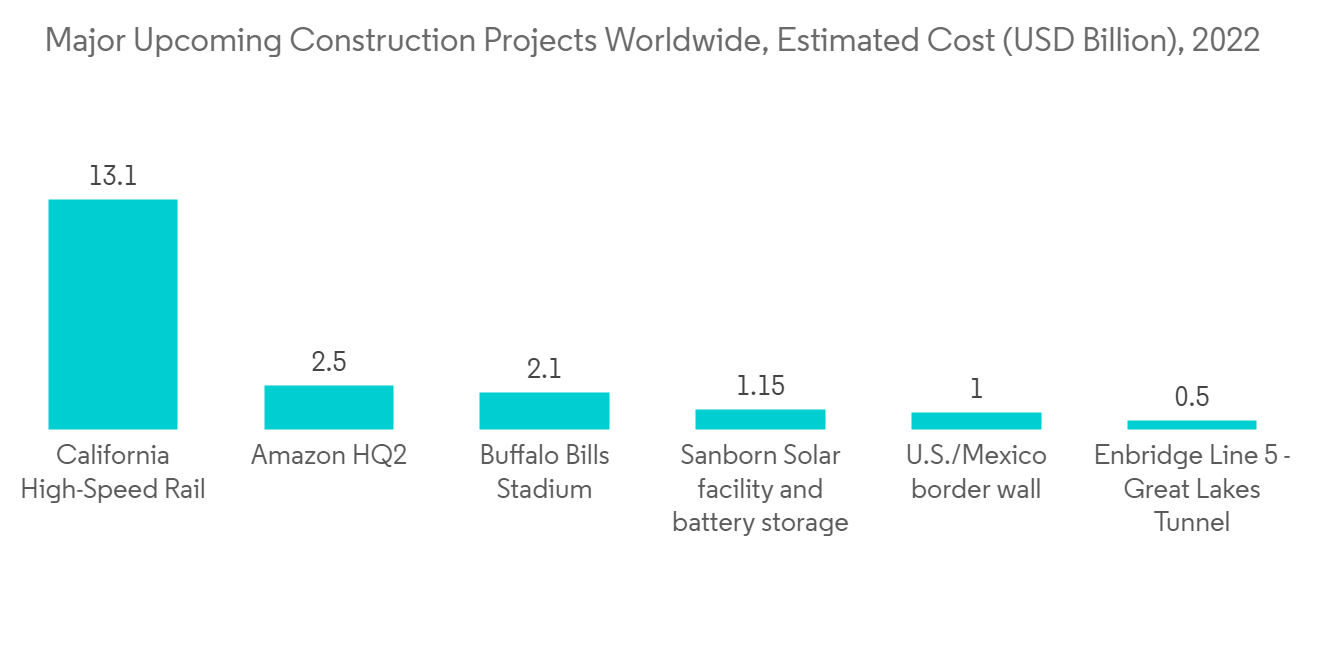

- 高速公路和高速公路大型项目的兴建增加了对粉煤灰的需求。 世界各国政府都在资助建筑业。 例如,2022 年 2 月,法国政府与中国合作在全球建设了七大基础设施项目。 两国签署《第四轮中法第三方市场合作试点项目清单》。 根据该协议,两国同意投资各种基础设施项目。

- 根据美国建筑师协会 (AIA) 的数据,2022 年建筑物的建筑支出增长了 9% 以上。 预计 2023 年将再增长 6%。 据 Statista 估计,2022 年建筑业预计将达到 8.2 万亿美元,2029 年将达到 17 万亿美元。

- 此外,中国的建筑行业正在经历巨大的增长。 根据国家统计局(NBS)的数据,2021 年,中国建筑业产值将达到 4.5 万亿美元左右。 在美国,建筑业受到有利的经济条件、增加的就业机会以及政府对促进建筑业发展的承诺的支持。 在美国,超过 50% 的混凝土是使用粉煤灰製造的。

- 由于这些因素,预计建筑行业对粉煤灰的需求在预测期内将快速增长。

亚太地区主导市场

- 由于中国、印度和日本等国家/地区的需求不断增加,预计亚太地区将成为预测期内规模最大、增长最快的地区。

- 随着各国政府强调飞灰消费的生态原因,对飞灰的需求正在增加。 与不含飞灰的混合物相比,使用飞灰可使类似混合物的水灰比更低。 马来西亚、印度尼西亚、中国和印度等政府正在增加对粉煤灰基础设施的投资。 粉煤灰具有低渗透性和低二氧化碳排放量,有助于减少排放。

- 在到 2025 年的未来五年内,中国将在重大建设项目上投资 1.43 万亿美元。 根据国家发改委的数据,上海计划在未来三年内投资 387 亿美元,而广州则签署 16 个新的基础设施项目,投资 80.9 亿美元。。

- 2022 年,印度通过政府在基础设施和经济适用房方面的举措(例如全民住房和智慧城市计划)为建筑业贡献了约 6400 亿美元。 该国建筑活动的增加可能会推动对硅的需求,进而在预测期内推动氯甲烷市场。

- 在农业领域,飞灰用于稳定土壤,约占飞灰市场的 14%。 采矿业正在寻找替代装载材料,飞灰是一种经过验证的替代材料,因为它可以减少大约 50% 的用水量。 亚太地区约占全球采矿项目的38%,这增加了对粉煤灰的需求。

- 飞灰还用于水处理,降低总溶解固体 (TDS)、总悬浮固体 (TSS) 和水的 PH 值以净化水,因此该地区对飞灰的需求正在促进

- 该地区的主要参与者包括 Boral Limited 和 Ashtech (India) Pvt Ltd。

- 上述因素以及政府的支持促成了粉煤灰市场需求的增加。

粉煤灰行业概况

粉煤灰市场较为分散,主要参与者占据的市场份额很小。 市场上的公司包括 Boral、Cemex SAB de CV、Charah Solutions Inc.、Separation Technologies LLC 和 Cement Australia。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第 1 章介绍

- 调查先决条件

- 本次调查的范围

第 2 章研究方法论

第 3 章执行摘要

第 4 章市场动态

- 促进因素

- 建筑行业的需求增加

- 促进粉煤灰使用的政府政策

- 抑制因素

- 粉煤灰的有害特性

- 在寒冷气候下不相容

- 工业价值链分析

- 波特的五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章市场细分(基于价值的市场规模)

- 类型

- F级

- C级

- 用途

- 建筑

- 砖块

- 道路建设

- 波特兰水泥、混凝土

- 农业

- 矿业

- 水处理

- 其他用途

- 建筑

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 意大利

- 法国

- 其他欧洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙特阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第 6 章竞争格局

- 併购、合资企业、合作、合同

- 市场份额分析**/排名分析

- 主要公司采用的策略

- 公司简介

- Ashtech Industries

- Boral Resources

- Charah Solutions,Inc

- Cemex SAB de CV

- Cement Australia

- LafargeHolcim

- Salt River Materials Group

- Seperation Technologies LLC

- Suyog Suppliers

- Waste Management

第 7 章市场机会与未来趋势

- 由于废物处理和预製混凝土产品的需求增加

简介目录

Product Code: 68701

The fly ash market is estimated to register a CAGR of over 4% during the forecast period.

Key Highlights

- The market was negatively impacted by COVID-19 in 2020, as almost all the major end-user industries halted their production temporarily, leading to a decrease in demand for fly ash. However, the construction industry experienced steady growth in 2021 across all regions, which increased the demand for fly ash and helped the market to grow.

- Increasing demand from the construction industry and increasing government policies to promote the usage of fly ash are driving the market. On the flip side, the harmful properties of fly ash and its non-suitability in cold weather conditions are hindering market growth.

- The fly ash market has been growing due to the construction industry's rapid growth. When mixed with lime and water, fly ash forms a compound like Portland cement. Rising demand from waste management and precast concrete products is an opportunity for the manufacturers and helps the market's growth.

- The Asia-Pacific region is expected to dominate the market, with the largest consumption being registered in countries like India and China.

Fly Ash Market Trends

Increasing Demand from the Construction Industry

- Growing population, increasing industrialization, and living standards have driven the demand for fly ash in the construction industry. Fly ash is used for the construction of embankments and roller-compacted concrete dams. Fly ash is used as a filler in flowable and structural fills as it gives impermeability and more strength. It is also used as a filler material in asphalt road laying to fill voids.

- Globally the construction industry is increasing, generating demand for fly ash. Asia-Pacific region is growing at the fastest CAGR across the globe, followed by North America due to the promotion of fly ash by governments of various countries as it releases less carbon dioxide and is eco-friendly. Europe has the world's third-largest fly ash market.

- The emerging mega projects of expressways and highways have increased the demand for fly ash. Governments of various countries are funding the construction industry. For instance, in February 2022, France government partnered with China to build seven key infrastructure projects globally. Both countries signed the Fourth Round China-France Third-Party Market Cooperation Pilot Project List. Under the agreement, the two countries have agreed to invest in various infrastructure projects.

- According to the American Institute of Architects (AIA), construction spending on buildings increased by over 9% in 2022. It is estimated to increase further by 6% in 2023. According to the estimation by Statista, the construction industry size amounted to USD 8.2 trillion in 2022 and is expected to reach USD 17 trillion by 2029.

- Furthermore, China is experiencing massive growth in its construction sector. According to the National Bureau of Statistics (NBS), in 2021, the construction output in China was valued at approximately USD 4.5 trillion. In the United States, the construction industry is backed by good economic conditions, increasing job opportunities, and the government's commitment to boosting the construction industry. More than 50% of the concrete in the United States is manufactured using fly ash.

- Owing to the aforementioned factors, the demand for fly ash from the construction industry is projected to grow at a rapid rate during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is forecasted to be the largest and the fastest-growing region over the forecast period owing to the increasing demand from countries such as China, India, and Japan.

- The demand for fly ash is increasing because various governments have emphasized ecological reasons for the consumption of fly ash. The usage of fly ash allows for a low water-cement ratio for similar mixtures when compared to non-fly ash mixes. The government of countries like Malaysia, Indonesia, China, and India is investing more in infrastructure developments from fly ash as it is less permeable and emits less carbon dioxide, contributing towards fewer emissions.

- China is investing USD 1.43 trillion in major construction projects in the next five years till 2025. According to National Development and Reform Commission (NDRC), the Shanghai plan includes an investment of USD 38.7 billion in the next three years, whereas Guangzhou signed 16 new infrastructure projects with an investment of USD 8.09 billion.

- In 2022, India contributed about USD 640 billion to the construction industry due to government initiatives in infrastructure development and affordable housing, such as housing to all, smart city plans, and others. The growing construction activities in the country are driving the demand for silicones, which, in turn, may drive the chloromethane market over the forecast period.

- The agriculture sector uses fly ash for soil stabilization, accounting for about 14% of the fly ash market. The mining industry is looking for alternative stowing materials, and fly ash has been demonstrated as the alternative, as fly ash reduces water consumption by about 50%. Asia Pacific holds about 38% of the global mining project, thus increasing the demand for fly ash.

- It is also used in water treatment to reduce total dissolved solids(TDS), total suspended solids(TSS), and the ph level of water to purify water in the region, thus propelling the demand for fly ash.

- Major companies in the region include Boral Limited and Ashtech (India) Pvt Ltd.

- The aforementioned factors and government support have helped contribute to the increasing demand for the fly ash market.

Fly Ash Industry Overview

The fly ash market is fragmented, with the major players accounting for marginal shares of the market. Some of the companies in the market include Boral, Cemex SAB de CV, Charah Solutions Inc., Separation Technologies LLC, and Cement Australia, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Construction Industry

- 4.1.2 Government Policies to Promote the Usage of Fly Ash

- 4.2 Restraints

- 4.2.1 Harmful Properties of Fly Ash

- 4.2.2 Non-suitability in Cold Weather Conditions

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Class F

- 5.1.2 Class C

- 5.2 Application

- 5.2.1 Construction

- 5.2.1.1 Bricks and Blocks

- 5.2.1.2 Road Construction

- 5.2.1.3 Portland Cement and Concrete

- 5.2.2 Agriculture

- 5.2.3 Mining

- 5.2.4 Water Treatment

- 5.2.5 Other Applications

- 5.2.1 Construction

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Ashtech Industries

- 6.4.2 Boral Resources

- 6.4.3 Charah Solutions,Inc

- 6.4.4 Cemex SAB de CV

- 6.4.5 Cement Australia

- 6.4.6 LafargeHolcim

- 6.4.7 Salt River Materials Group

- 6.4.8 Seperation Technologies LLC

- 6.4.9 Suyog Suppliers

- 6.4.10 Waste Management

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Demand from Waste Management and Precast Concrete Products

02-2729-4219

+886-2-2729-4219