|

市场调查报告书

商品编码

1273383

皮革化学品市场 - COVID-19 的增长、趋势、影响和预测 (2023-2028)Leather Chemicals Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

在预测期内,皮革化学品市场的复合年增长率预计将超过 6%。

由于供应链中断和劳动力短缺,COVID-19 严重影响了 2020 年的行业增长。 然而,每个国家汽车产量的激增推动了大流行后皮革化学品的消费。

主要亮点

- 亚太地区对汽车内饰材料不断增长的需求以及鞋类和纺织行业的增长正在推动市场增长。

- 日益严重的环境问题、严格的法规和高昂的运营成本可能会阻碍市场增长

- 继续研究开发生物基环保产品有望在未来为市场提供机会。

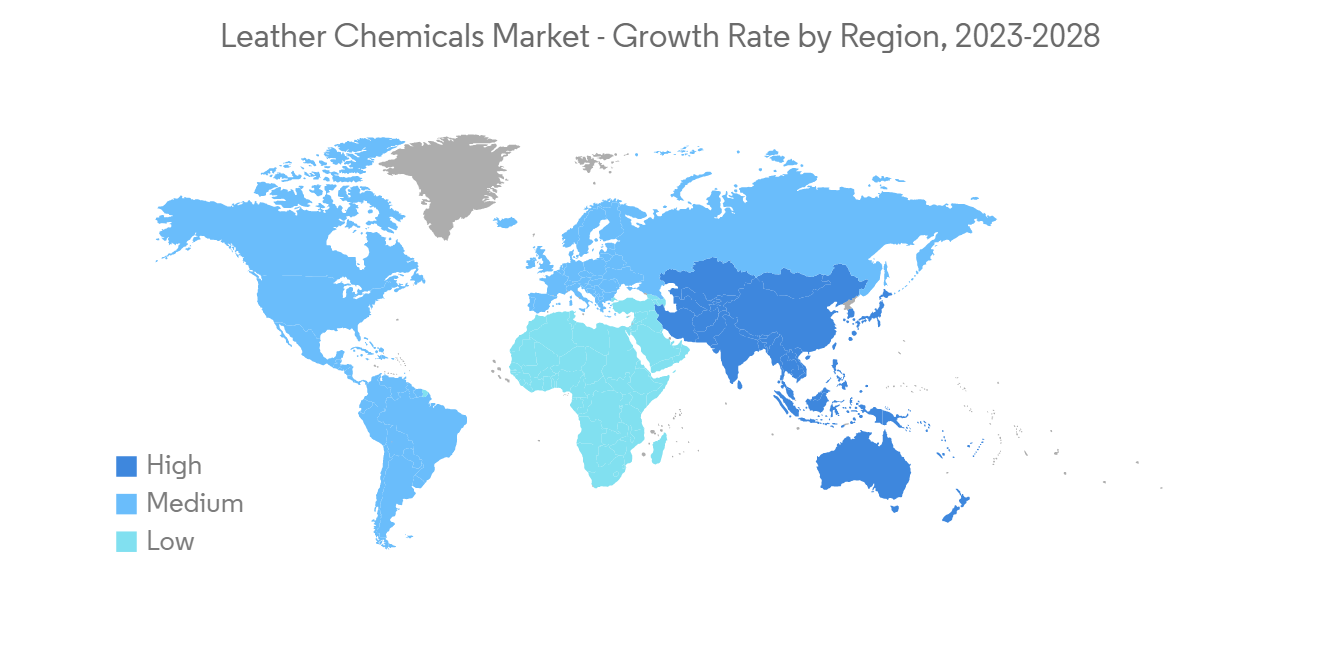

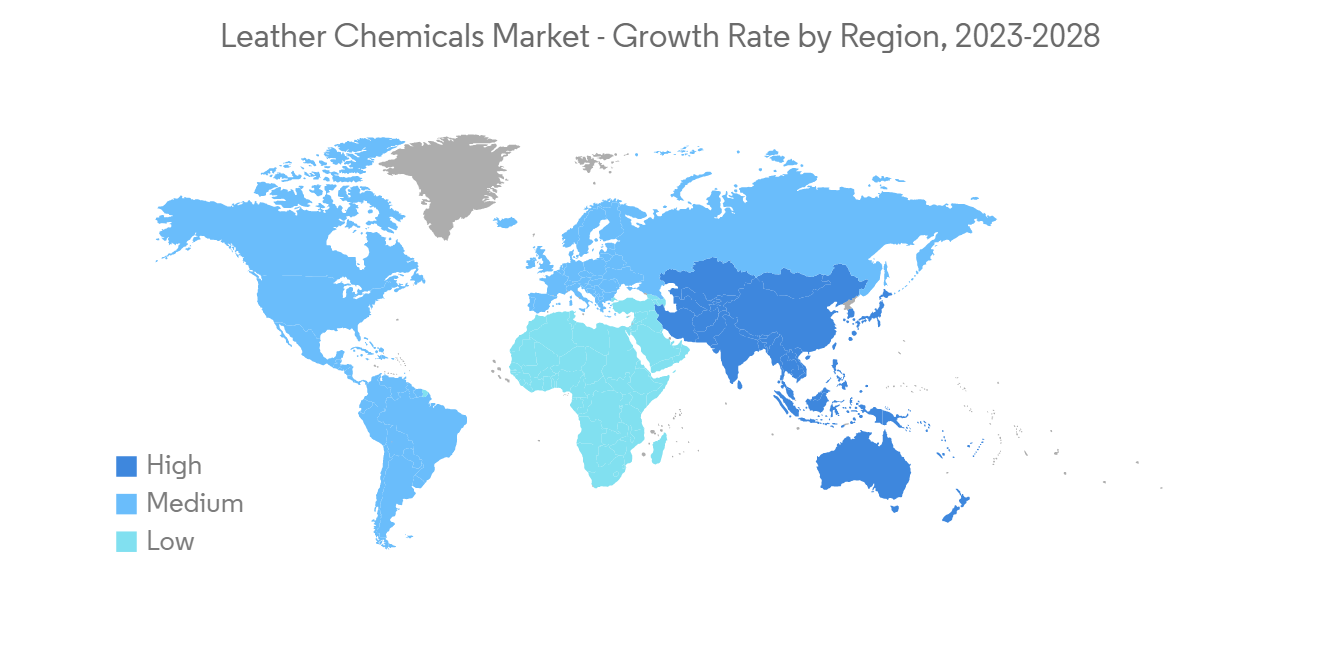

- 由于中国和印度汽车产量的增加,亚太地区在全球皮革化学品市场占据主导地位。

皮革化学品市场趋势

纺织业呈现较高的潜在增长率

- 皮革化学品通常用于皮革,以防止微生物降解、改善皮革质地并使其适合进一步使用。

- 皮革有多种用途,包括纺织和鞋类行业的服装和时装,以及汽车行业的内饰。

- 由于注重时尚的一代品味不断变化,皮革在纺织行业的使用正在增加。

- 世界人口逐年增加,导致纺织业增长。 到 2025 年,世界人口预计将达到 81 亿,这将影响纺织品市场的增长。 中国是世界领先的面料纺织品和服装生产国和出口国之一。

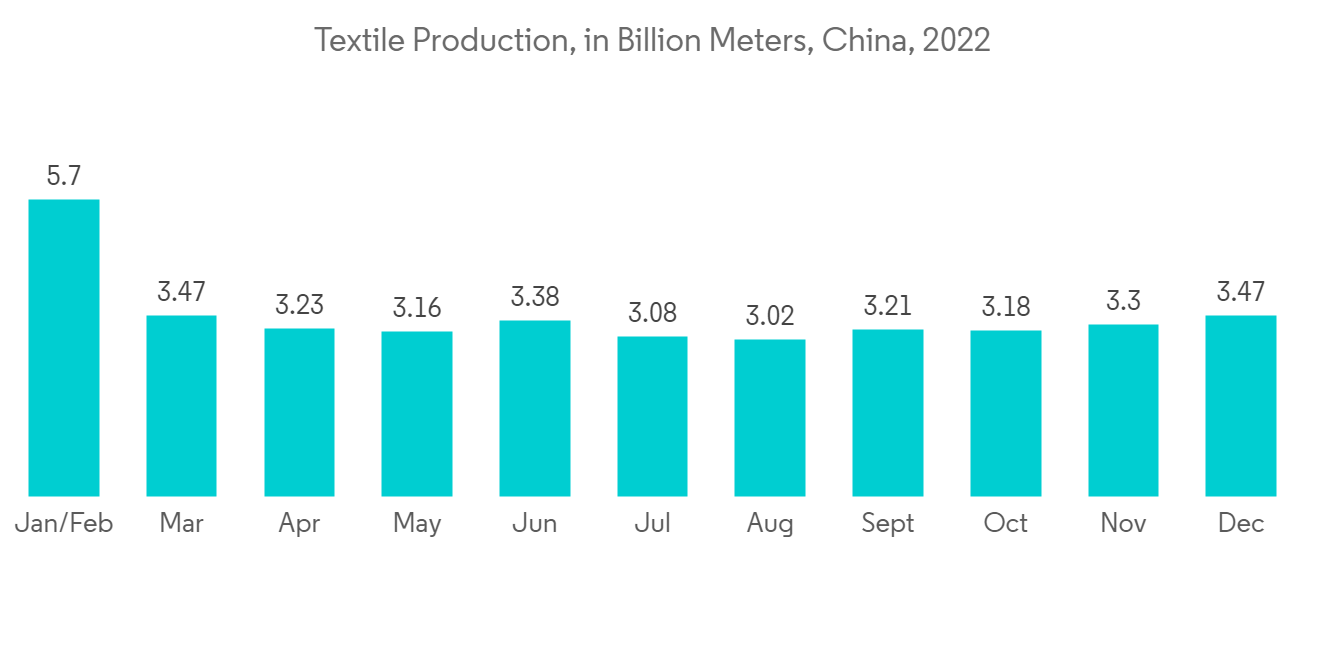

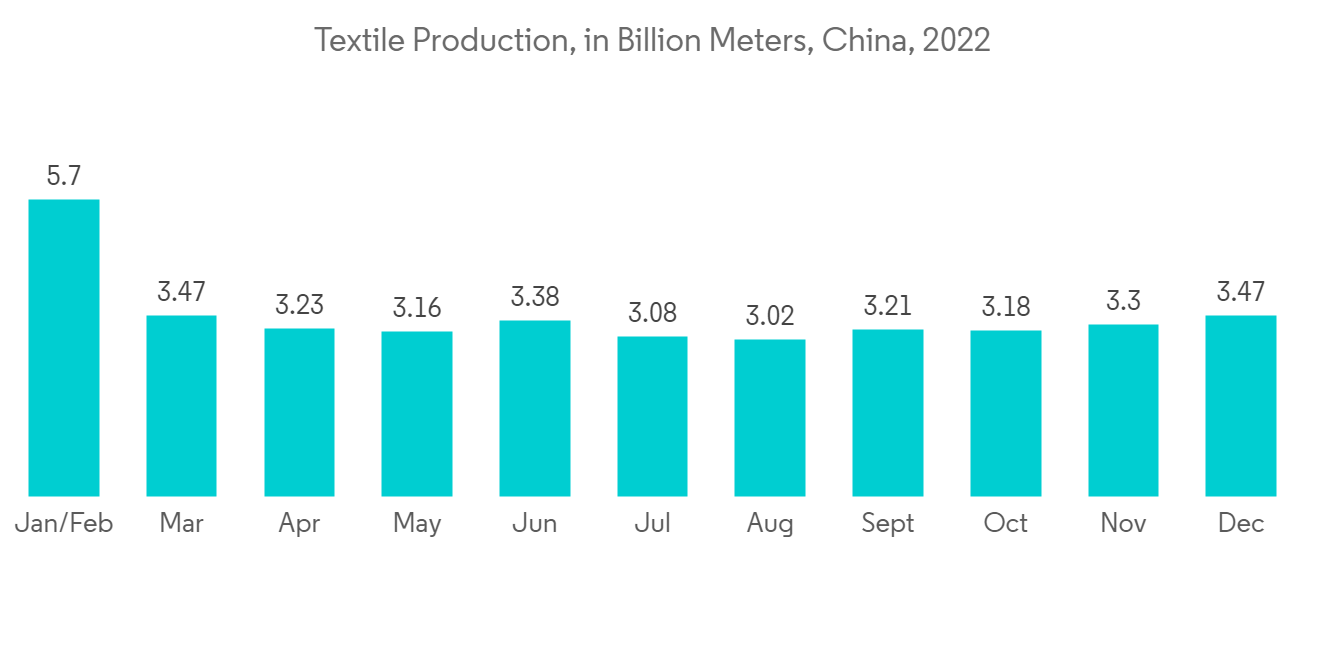

- 到 2021 年,中国将占全球纺织品出口的 41% 以上,其次是欧盟和印度。 2022年12月,中国服装面料产量约34.7亿米。 每月纺织品产量始终在30亿米以上。

- 据 IBEF 称,印度的纺织业预计将达到 2500 亿美元。 印度纺织业贡献了印度 15% 的出口收入,预计未来几年还会进一步增加。

- 2010 财年印度的纺织品和服装出口(包括手工艺品)达到 444 亿美元,比上一年增长 41%。 印度的纺织服装行业预计将以 10% 的复合年增长率增长,并在 2025-26 年达到 1900 亿美元。 印度占世界纺织品和服装贸易的 4%。

- 此外,根据美国纺织协会理事会的数据,美国纺织品和服装的装运价值估计约为 779 亿美元。 美国纺织品、纺织品和服装出口总值达286亿美元。 预计未来几年会进一步增加。

- 预计在整个预测期内,这些因素将推动纺织行业的皮革化学品市场。

在亚太地区,印度有望主导市场

- 预计到 2030 年,印度将成为汽车行业的领导者,为电动汽车和商用汽车提供机会。 需求的增加是由于中产阶级收入的增加和年轻人口的增加。

- 此外,印度的汽车工业位居世界第四,销售额以每年 8% 的速度增长。 由于汽车工业的增长,用于内外饰件的皮革化学品市场有望扩大。

- 根据印度鞋业报告,鞋类产量每年超过 220 亿双,约占世界产量的 9.6%。 印度是仅次于中国和美国的世界第三大鞋类消费国。 印度生产的鞋约 90% 在国内市场消费,其余出口。

- 美国是印度最大的皮革和皮革製品进口国,占该国 2022 年 4 月至 8 月皮革出口总量的 25.19%。 德国占同期出口额的10.86%,英国占9.71%。

- 在印度,与 2021 年 4 月至 8 月期间的 18.31 亿美元相比,2022 年 4 月至 8 月期间印度皮革、皮革製品和鞋类的出口额达到 23.77 亿美元,增幅为 29.81%。录得增长

- 由于上述因素,该国的皮革化学品市场有望增长。

皮革化学品行业概况

皮革化学品市场预计将部分整合,前 5-6 家公司占据重要市场份额。 皮革化学品市场的主要参与者是 Stahl International BV、Dystar Singapore Pte Ltd、Lanxess、Elementis PLC 和 Chemtan Company(排名不分先后)。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查先决条件

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 主持人

- 亚太地区的鞋类和纺织业增长

- 对汽车内饰材料的需求增加

- 约束因素

- 运营成本高

- 环境问题和严格法规的兴起

- 工业价值链分析

- 波特的五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章市场细分(市场规模:基于金额)

- 产品类型

- 鞣製和染色化学品

- 梁屋化学品

- 整理化学品

- 最终用户行业

- 鞋类

- 家具

- 汽车

- 纺织品和时装

- 其他最终用户行业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 意大利

- 法国

- 西班牙

- 其他欧洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙特阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作、合同等。

- 市场份额 (%)**/排名分析

- 主要公司采用的策略

- 公司简介

- Balmer Lawrie Co. Ltd

- Chemtan Company

- Clariant

- DyStar Group

- Elementis PLC

- Indofil Industries Ltd

- Lanxess

- Papertex Specialty Chemicals Pvt Ltd

- Schill Seilacher GmbH Co.

- Stahl International BV

- TASA Group International

- TEXAPEL

- Zschimmer Schwarz Co. KG

第七章市场机会与未来趋势

- 持续研究开发生物基和环保产品

- 其他商业机会

The market for leather chemicals is anticipated to register a CAGR of more than 6% during the forecast period.

COVID-19 severely impacted industry growth in 2020 due to the disruption in the supply chain and the lack of labor. However, surging automotive production in various countries propelled leather chemicals consumption after the pandemic.

Key Highlights

- Increasing demand for automotive upholstery and growing footwear and textile industries in Asia-Pacific are augmenting the market's growth.

- Growing environmental concerns, stringent regulations, and high operational costs will likely hinder the market's growth.

- Ongoing research to develop bio-based, eco-friendly products is projected to act as an opportunity for the market in the future.

- Asia-Pacific dominates the global leather chemicals market due to China and India's rising automotive production.

Leather Chemicals Market Trends

Textile Industry to Witness Higher Potential Growth

- Leather chemicals are generally applied on skins to prevent the deterioration caused by microorganisms and improve the texture of leather by making leather suitable for further applications.

- Leather is used for various applications, such as clothing and fashion in the textile and footwear industries, in interiors for the automotive industry, etc.

- The application of leather in the textile industry is on the rise, owing to the changing preferences toward the fashion-oriented generation.

- The world population is increasing annually, leading to a rise in the textile industry. The global population is anticipated to reach 8.1 billion by 2025, impacting the textiles market's growth. China is the world's leading producer and exporter of raw textiles and garments.

- In 2021, China accounted for over 41% of the world's textile exports, followed by the European Union and India. In December 2022, approximately 3.47 billion m of clothing fabric was produced in China. Monthly textile production volume was consistently above three billion m.

- According to IBEF, the Indian textiles industry is expected to reach USD 250 billion. India's textiles industry contributed 15% to the export earnings of India and is estimated to rise further in the upcoming years.

- India's textile and apparel exports (including handicrafts) stood at USD 44.4 billion in FY22, a 41% increase YoY. The Indian textile and apparel industry is expected to grow at 10% CAGR and reach USD 190 billion by 2025-26. India includes a 4% share of the global trade in textiles and apparel.

- Moreover, according to the National Council of Textile Organizations in the United States, the shipment value for US textiles and apparel was estimated at around USD 77.9 billion. US fiber, textiles, and apparel exporters were USD 28.6 billion. It is expected to rise further in the upcoming years.

- Through the forecast period, such factors are expected to drive the market for leather chemicals in the textile industry.

India to Dominate the Market in Asia-Pacific Region

- India is expected to become a leader in the automotive industry by 2030, providing opportunities for electric and commercial vehicles. The rise in demand is due to an increase in middle-class income and young population growth.

- Moreover, the Indian automotive industry became the fourth largest in the world, with sales increasing by 8% annually. The increasing automotive industry is expected to increase the market for leather chemicals for its applications in the interior and exterior parts.

- According to the Indian footwear industry report, footwear production is crossing approximately 22 billion pairs annually, accounting for around 9.6% of the global output contribution. India is the world's third-largest footwear consumer, followed by China and the United States. The domestic market consumes about 90% of the footwear produced in India, and the country exports the rest.

- The United States is India's largest importer of leather and leather products, accounting for 25.19% of the country's total leather exports from April-August 2022. Germany and the United Kingdom accounted for 10.86% and 9.71% of the exports during the same period.

- In India, the export of leather, leather products, and footwear for April-August 2022 touched USD 2,377 million against the performance of USD 1,831 million in April-August 2021, recording a growth of 29.81%.

- The factors above are expected to drive market growth for leather chemicals in the country.

Leather Chemicals Industry Overview

The leather chemicals market is expected to be partially consolidated, with the top five-six players accounting for a significant market share. The leading players in the leather chemicals market include Stahl International BV, Dystar Singapore Pte Ltd, Lanxess, Elementis PLC, and Chemtan Company (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Footwear and Textile Industries in Asia-Pacific

- 4.1.2 Increasing Demand for Automotive Upholstery

- 4.2 Restraints

- 4.2.1 High Operational Cost

- 4.2.2 Growing Environmental Concerns and Stringent Regulations

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Tanning and Dyeing Chemicals

- 5.1.2 Beam House Chemicals

- 5.1.3 Finishing Chemicals

- 5.2 End-user Industry

- 5.2.1 Footwear

- 5.2.2 Furniture

- 5.2.3 Automotive

- 5.2.4 Textile & Fashion

- 5.2.5 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Balmer Lawrie Co. Ltd

- 6.4.2 Chemtan Company

- 6.4.3 Clariant

- 6.4.4 DyStar Group

- 6.4.5 Elementis PLC

- 6.4.6 Indofil Industries Ltd

- 6.4.7 Lanxess

- 6.4.8 Papertex Specialty Chemicals Pvt Ltd

- 6.4.9 Schill Seilacher GmbH Co.

- 6.4.10 Stahl International BV

- 6.4.11 TASA Group International

- 6.4.12 TEXAPEL

- 6.4.13 Zschimmer Schwarz Co. KG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Ongoing Research to Develop Bio-based, Eco-friendly Products

- 7.2 Other Opportunities