|

市场调查报告书

商品编码

1273485

鞣剂市场——增长、趋势和预测 (2023-2028)Tanning Agents Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

预计在预测期内,全球鞣剂市场的复合年增长率将超过 6%。

COVID-19 对 2020 年的市场产生了负面影响。 然而,现在估计已达到大流行前的水平,市场有望稳步增长。

主要亮点

- 在预测期内,对优质皮革的需求激增预计将推动市场增长。

- 高昂的运营成本和严格的环境法规预计会阻碍市场增长。

- 增加研发投资以开发替代製革技术可能会在未来几年带来市场机遇。

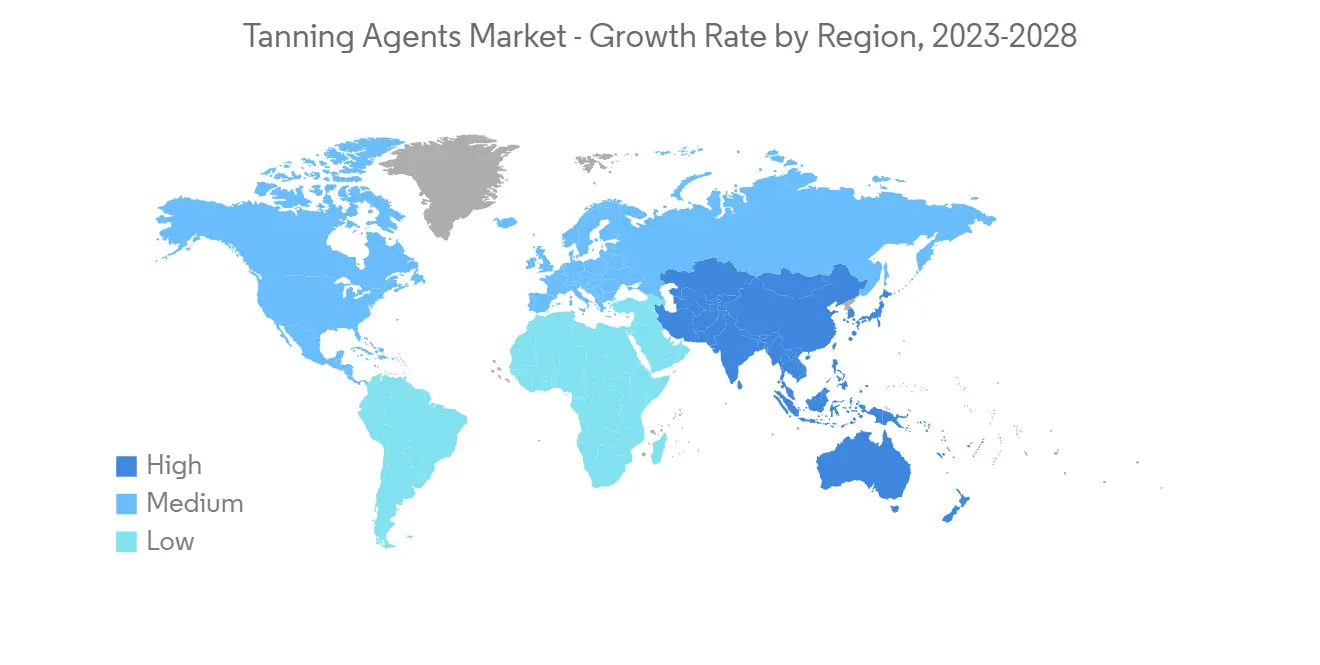

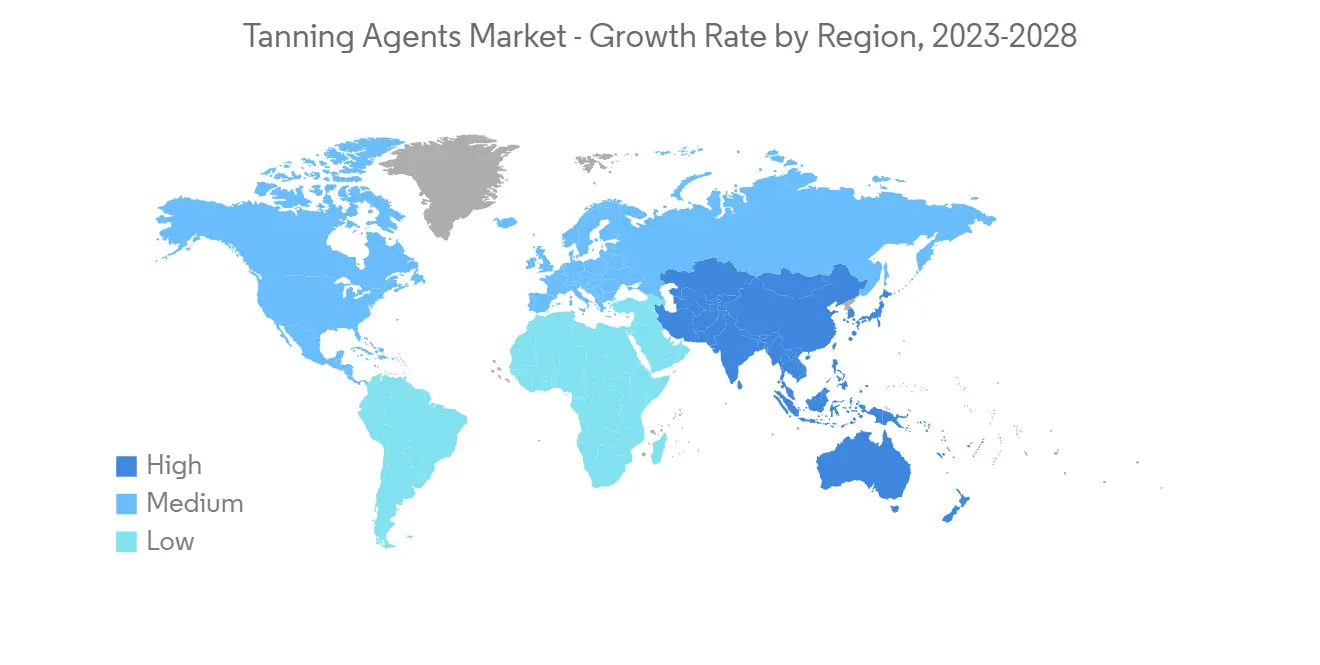

- 亚太地区主导市场,预计在预测期内将继续保持最高的复合年增长率。

鞣剂市场趋势

皮革鞣製——应用领域增长最快

- 鞣剂市场中增长最快的应用是皮革鞣製。 鞣製是加工生皮和毛皮以製成皮革的过程。 这个过程创造了一种柔软、耐用和灵活的材料。

- 在皮革的鞣製过程中使用了各种材料。 铁、铝、钛、锆和铬是典型的例子。 铬鞣因其在高温下的高拉伸强度和收缩性能而被广泛使用。

- 鞣製皮革产品广泛用于各种最终用户行业,例如製鞋业和包装业。

- 根据印度工业和内部贸易发展部的数据,2021 财年,皮鞋为印度的皮革出口贡献了约 15 亿美元。 同年皮革出口总值约为 37 亿美元,从而支持了预测期内的市场增长。

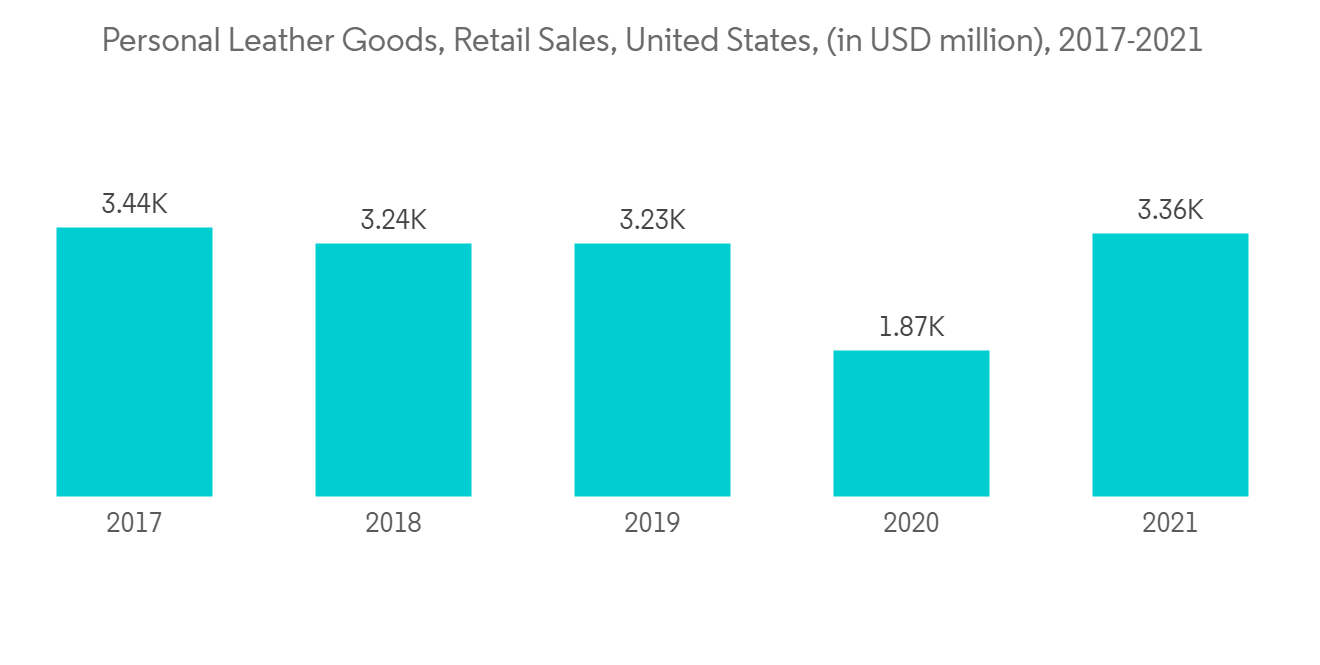

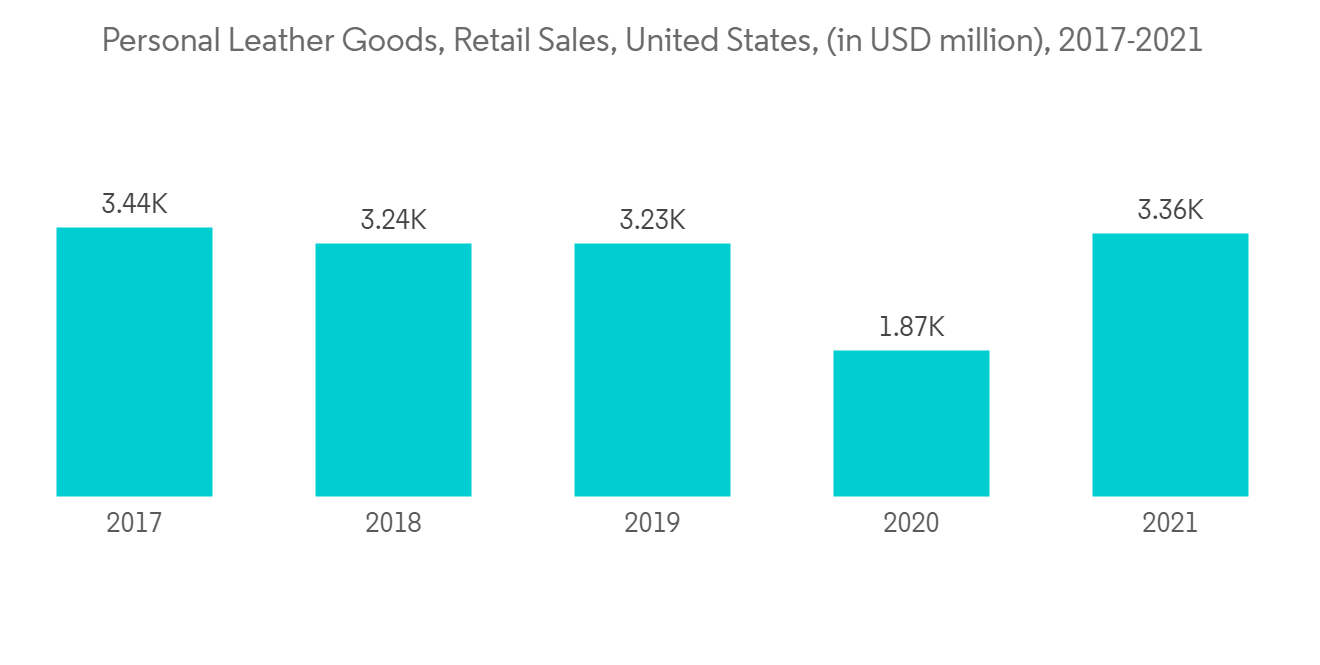

- 此外,根据旅游用品协会的数据,从 2020 年到 2021 年,美国个人皮革製品的零售额增长了 80% 以上,从 19 亿美元增至约 34 亿美元。 因此,它将积极增加市场的增长。

- 由于这些因素,预计在预测期内,全球鞣剂市场将出现增长。

亚太地区主导市场

- 亚太地区主导着全球市场。 中国、印度、日本和韩国等国家不断发展的鞋类和个人护理行业正在增加鞣剂的消耗。

- 个人护理是中国和印度等国家/地区增长最快的行业之一。 例如,印度的电子行业是世界上发展最快的行业之一。

- 随着零售店和精品店的货架空间增加,印度的个人护理和化妆品行业预计将继续增长。 因此,它将支持市场的增长。

- 得益于 100% 外商直接投资 (FDI)、无需工业许可证以及从手动生产工艺向自动化生产工艺的技术转换等有利的政府政策,国内电子製造业正在稳步扩张。

- 根据经济产业省的一份报告,到 2021 年,中国美容和个人护理 (BPC) 行业的产值预计将超过 100 亿美元,这将推动市场的增长。

- 此外,中国是世界上最大的鞋类生产国。 2021 年全球生产的鞋类中有近 54.1% 将在中国製造。 到 2021 年,中国将生产全球一半以上的鞋子。 因此,它将积极增加市场的增长。

- 考虑到所有这些因素,预计该地区的鞣剂市场在预测期内将稳步增长。

鞣剂行业概览

鞣剂市场就其本质而言是部分整合的。 市场参与者包括 BASF SE、LANXESS、Merck KGaA、Leather International、CLARIANT 等(排名不分先后)。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查先决条件

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 主持人

- 对优质皮革的需求快速增长

- 其他司机

- 约束因素

- 运营成本高

- 严格的环境法规

- 工业价值链分析

- 波特的五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章市场细分

- 类型

- 无机材料

- 铬

- 锆

- 其他

- 醛鞣剂

- 甲醛

- 戊二醛

- 其他

- 植物鞣剂

- 其他类型

- 无机材料

- 用法

- 鞣革

- 防晒霜、个人护理产品

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 意大利

- 法国

- 其他欧洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙特阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作、合同等。

- 市场份额 (%)**/排名分析

- 主要公司采用的策略

- 公司简介

- ANGUS Chemical Company

- BASF SE

- Chemtan Company, Inc.

- CLARIANT

- Ecopell GmbH

- LANXESS

- Leather International

- Merck KGaA

- SCHILL+SEILACHER GMBH

- Silvateam S.p.a.

- TRUMPLER GmbH & Co. KG

- Viswaat Chemicals Limited

- VOLPKER SPEZIALPRODUKTE GMBH

- Smit & Zoon

第七章市场机会与未来趋势

- 增加研发投资以开发替代製革技术

简介目录

Product Code: 61794

The global tanning agents market is anticipated to register a CAGR of more than 6% during the forecast period.

COVID-19 negatively impacted the market in 2020. However, the market is now estimated to reached pre-pandemic levels and is expected to grow steadily.

Key Highlights

- The rapid increase in demand for high-quality leather is expected to drive market growth during the forecast period.

- High operational costs and stringent environmental regulations are anticipated to hinder the market's growth.

- An increase in investment in R&D to develop alternate tanning technologies will likely create opportunities for the market in the coming years.

- Asia-Pacific region is expected to dominate the market and is also likely to witness the highest CAGR during the forecast period.

Tanning Agents Market Trends

Leather Tanning - The Fastest Growing Segment by Application

- The fastest-growing application in the tanning agents market is the leather-tanning application. Leather tanning involves treating the skins and hides of skins to produce leather. The process produces soft, durable, and flexible material.

- Various materials are used in the tanning process of leather. Most are iron, aluminum, titanium, zirconium, and chromium. Chrome tanning is widely employed due to its high tensile strength and high-temperature shrinkage property.

- Leather-tanned products are widely used in various end-user industries, such as the footwear and packing industry.

- According to the Department for Promotion of Industry and Internal Trade (India), in the fiscal year 2021, leather footwear contributed to around USD 1.5 billion of India's leather exports. That year, total leather exports were around USD 3.7 billion, thus, supporting the market growth during the forecast period.

- Furthermore, according to the Travel Goods Association, retail sales of personal leather items in the United States increased by over 80% from 2020 to 2021, from USD 1.9 billion to approximately USD 3.4 billion. Thus, positively increasing the growth of the market.

- Owing to all these factors, the market for tanning agents will likely grow worldwide during the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific dominated the global market. With growing footwear and personal care industries in countries like China, India, Japan, and South Korea, the consumption of tanning agents is increasing.

- Personal care is one of the fastest-growing sectors in countries like China and India. For example, the Indian electronics industry is one of the fastest-growing industries globally.

- India's personal care and cosmetics sector is expected to grow continuously, with increasing shelf space in retail stores and boutiques. It will, thus, support the growth of the market.

- The domestic electronics manufacturing sector is expanding at a steady rate, owing to favorable government policies such as 100% foreign direct investment (FDI), no requirement for industrial licenses, and the technological transformation from manual to automatic production processes.

- According to a Ministry of Economy and Industry report, the country's beauty and personal care (BPC) industry was expected to reach more than USD 10 billion by 2021, driving the market's growth.

- Furthermore, China is the world's largest producer of footwear. Almost 54.1% of the footwear produced worldwide in 2021 was produced in China. China manufactured more than half of the world's shoes in 2021. Hence, positively increasing the market growth.

- Due to all such factors, the region's tanning agents market is expected to grow steadily during the forecast period.

Tanning Agents Industry Overview

The tanning agents market is partially consolidated in nature. Some of the major players in the market include BASF SE, LANXESS, Merck KGaA, Leather International, and CLARIANT, among others (in no particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rapid Increase in Demand for High Quality Leather

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 High Operational costs

- 4.2.2 Stringent Environment Regulations

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Inorganic Materials

- 5.1.1.1 Chromium

- 5.1.1.2 Zirconium

- 5.1.1.3 Others

- 5.1.2 Aldehyde Tanning Agents

- 5.1.2.1 Formaldehyde

- 5.1.2.2 Glutaraldehyde

- 5.1.2.3 Others

- 5.1.3 Vegetable Tanning Agents

- 5.1.4 Other Types

- 5.1.1 Inorganic Materials

- 5.2 Application

- 5.2.1 Leather tanning

- 5.2.2 Sun Tanning and Personal Care Products

- 5.2.3 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ANGUS Chemical Company

- 6.4.2 BASF SE

- 6.4.3 Chemtan Company, Inc.

- 6.4.4 CLARIANT

- 6.4.5 Ecopell GmbH

- 6.4.6 LANXESS

- 6.4.7 Leather International

- 6.4.8 Merck KGaA

- 6.4.9 SCHILL+SEILACHER GMBH

- 6.4.10 Silvateam S.p.a.

- 6.4.11 TRUMPLER GmbH & Co. KG

- 6.4.12 Viswaat Chemicals Limited

- 6.4.13 VOLPKER SPEZIALPRODUKTE GMBH

- 6.4.14 Smit & Zoon

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increase in Investment of R&D to Develop Alternate Tanning Technologies

02-2729-4219

+886-2-2729-4219