|

市场调查报告书

商品编码

1273510

金枪鱼和藻类 Omega-3 成分市场 - 增长、趋势和预测 (2023-2028)Tuna and Algae Omega-3 Ingredient Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

未来五年,金枪鱼和藻类 omega-3 成分市场预计将以 14.03% 的复合年增长率增长。

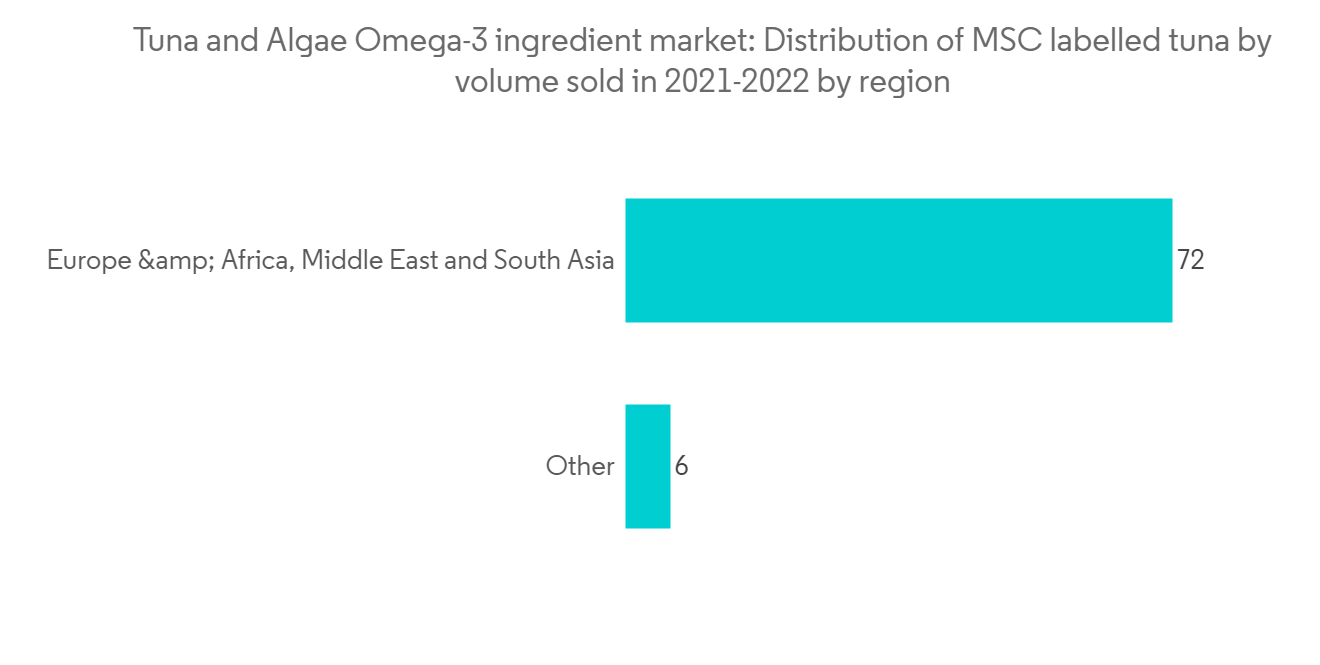

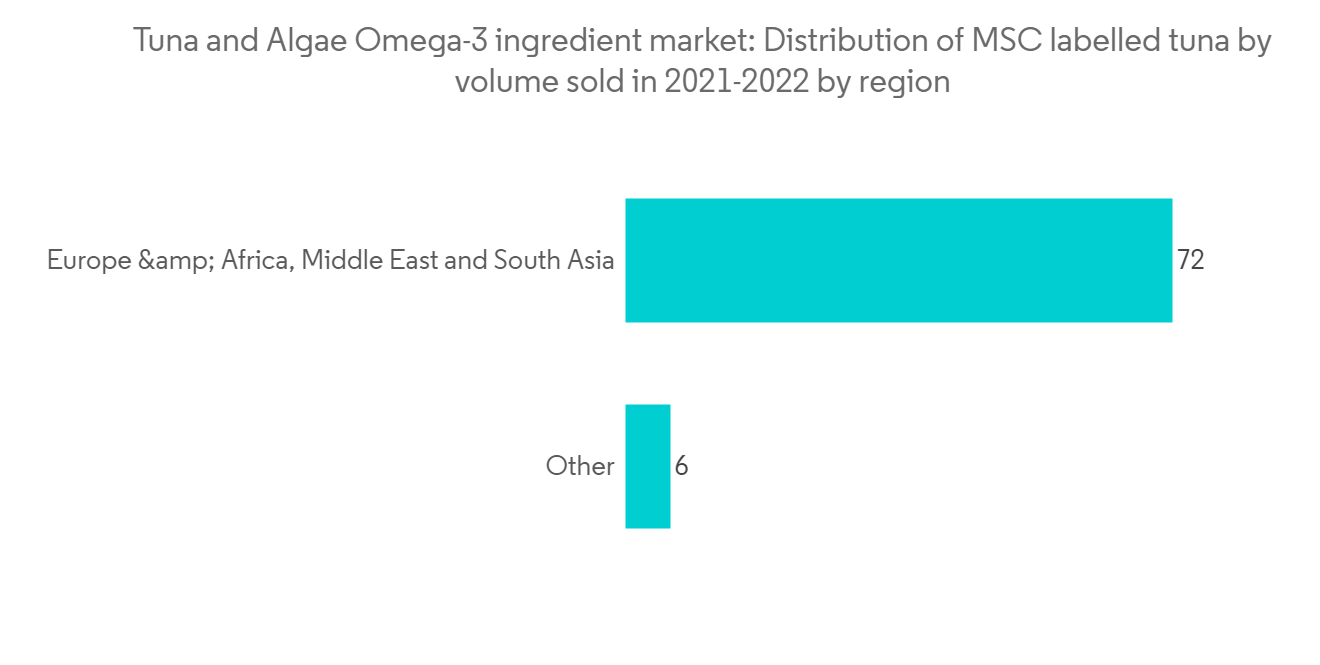

人们认识到 omega-3 脂肪酸(鱼油是其中的主要来源)对健康的益处,这推动了对金枪鱼 omega-3 成分的需求。 金枪鱼鱼油 omega-3 市场正在中国、日本、西班牙和意大利等新兴的全球原料热点地区。 水产养殖业在世界各地蓬勃发展,预计这一推动力将进一步推动鱼油 omega-3 产业的整体增长。 据海洋管理委员会称,2021年和2022年MSC认证的渔获量和MSC认证的金枪鱼渔业数量将继续增加。 到 2022 年 9 月初,将有 19 个金枪鱼渔业获得 MSC 认证,使总数达到 91 个。

因此,MSC 认证的金枪鱼捕捞量从 2021 年 9 月的 198.2 万吨增加到 2022 年 9 月的 246 万吨,增长了 24%。 世界上近 50% 的商业金枪鱼渔获物通过了 MSC 认证,进一步推动了市场的发展。 海藻 omega-3 成分具有与鱼油相似的功效,且无异味和异味,因此海藻 omega-3 在婴儿食品强化中的需求不断增长,对推动整个市场的增长发挥着重要作用。在这里。 此外,全球各个年龄段对强化食品的需求激增也推动了金枪鱼和 omega-3 成分的市场。

金枪鱼和藻类 omega-3 成分的市场趋势

消费者在 Omega-3 补充剂产品上的支出增加

在亚太地区、拉丁美洲和非洲等地区,消费者的健康意识和对健康生活方式的兴趣不断增强,导致对 EPA 和 DHA 等成分的需求增加。 此外,吸烟人口比例的增加、心臟相关并发症的发生率和其他与健康相关的问题正在刺激 omega-3 脂肪酸的增长,包括金枪鱼和藻类 omega-3 脂肪酸,尤其是在新兴经济体。 製造商和供应商积极参与各个地区的 omega-3 供应链。 我们还在战略上努力减缓与富含 omega-3 的饮食相关的健康益处的信息传播,这将对发展中地区 omega-3 成分的销售产生重大而积极的影响。我正在给予

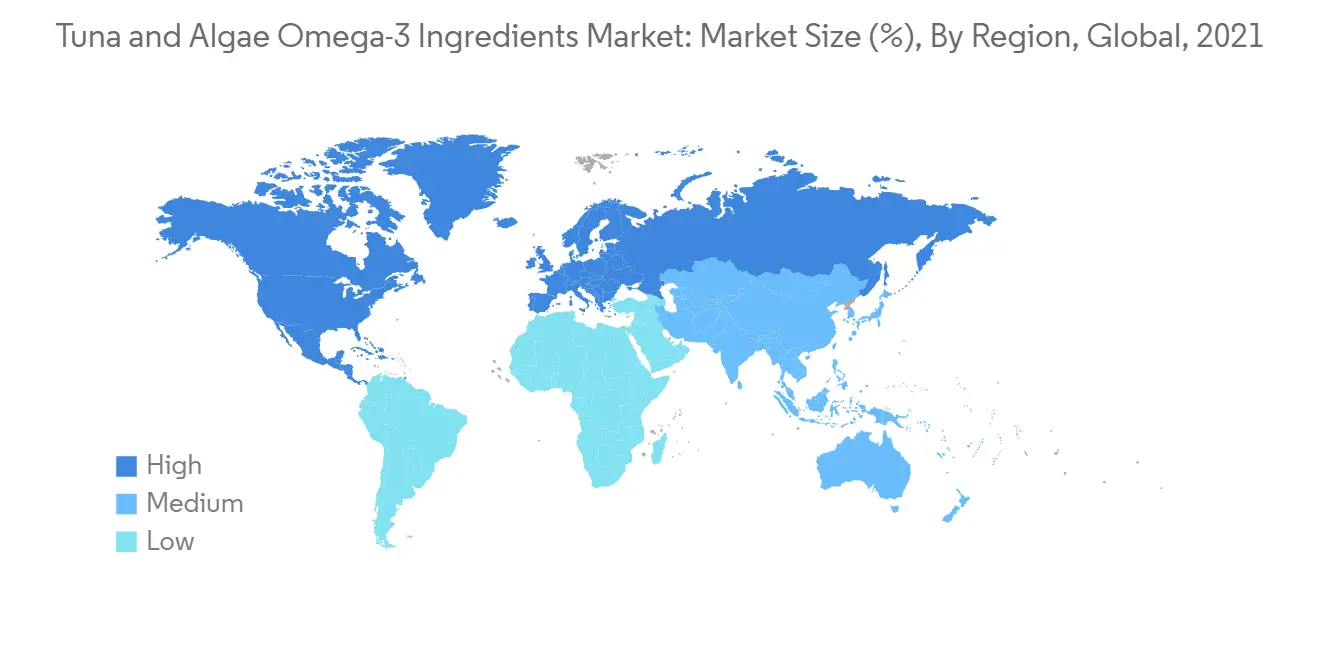

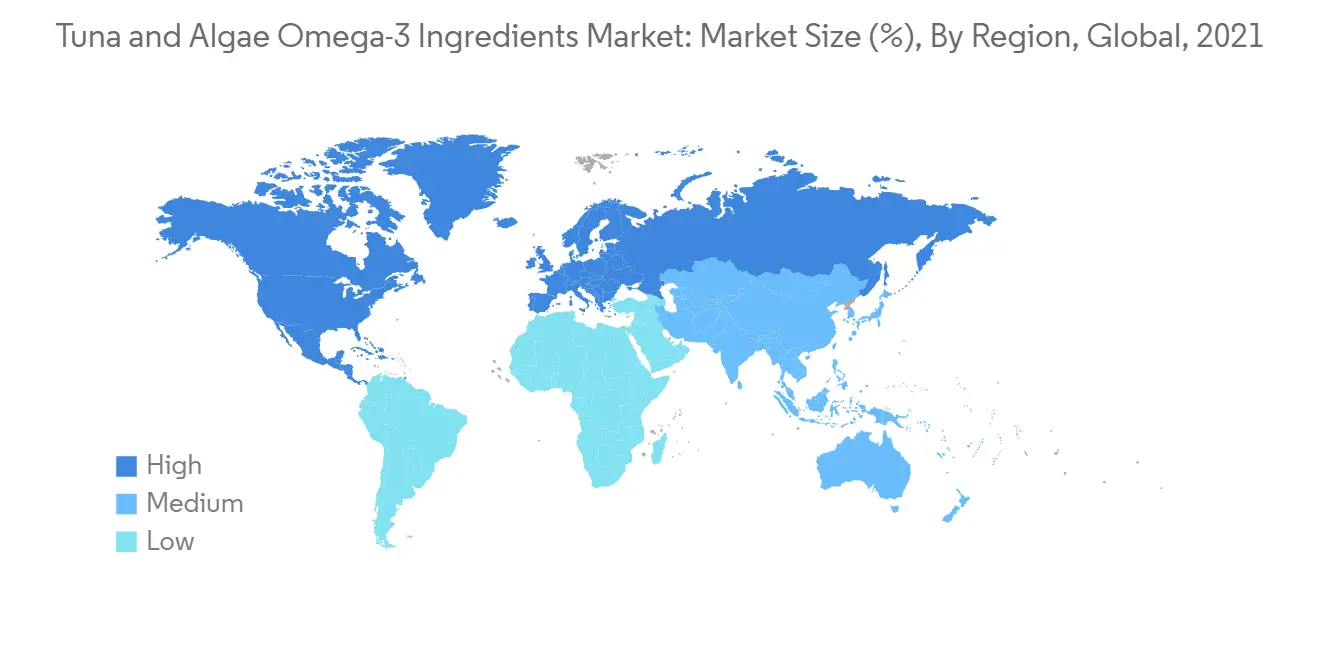

亚太地区成为全球最大的市场

对运动营养的需求不断增长,个性化营养的机会越来越多,这使得 omega-3 成分在亚太地区成为一个前景广阔的市场。 此外,随着中国和日本等国家的老龄化和总人口的增加,对有助于保持大脑健康的补充剂的需求也在增加。 高生育率和中国最近取消的独生子女政策将推动婴儿食品行业的发展。 许多公司,如 Pathway International,都与主要成分製造商建立战略合作伙伴关係,以扩大生产水平和产品线。

金枪鱼和藻类 Omega-3 成分行业概览

全球金枪鱼和藻类 omega-3 市场高度分散。 巴斯夫、Neptune Wellness Solutions Inc. 和 Omega Protein Corporation 是全球金枪鱼和藻类 omega-3 成分市场上最活跃的参与者。 Neptune Wellness Solutions Inc. 和 Cellana Inc. 等主要参与者正专注于合作伙伴关係和合资企业,以提高各自地区的生产能力和消费者基础。 此外,参与者正专注于各种研发活动以及技术投资以提高效率。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 三个月的分析师支持

内容

第一章介绍

- 调查先决条件

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 市场驱动因素

- 市场製约因素

- 波特的五力分析

- 新进入者的威胁

- 买方/消费者议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

第 5 章市场细分

- 类型

- 藻类类型

- 浓缩型

- 高浓度

- 中浓度

- 低浓度

- 金枪鱼类型

- 生金枪鱼油

- 精製金枪鱼油

- 藻类类型

- 用法

- 食品和饮料

- 婴儿配方奶粉

- 强化食品和饮料

- 膳食补充剂

- 医药

- 动物营养

- 临床营养学

- 食品和饮料

- 地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 其他北美地区

- 欧洲

- 西班牙

- 英国

- 德国

- 法国

- 意大利

- 俄罗斯

- 其他欧洲

- 亚太地区

- 中国

- 日本

- 印度

- 澳大利亚

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 南非

- 阿拉伯联合酋长国

- 其他中东/非洲

- 北美

第六章竞争格局

- 最常采用的策略

- 市场份额分析

- 公司简介

- Archer Daniels Midland Company

- Koninklijke DSM NV

- Corbion NV

- Lonza

- Bioprocess Algae LLC

- Neptune Wellness Solutions Inc.

- Polaris SA

- BASF SE

- Source-Omega LLC

- AlgaeCytes

第七章市场机会与未来趋势

第 8 章免责声明

The tuna and algae omega-3 ingredient market is projected to grow at a CAGR of 14.03% in the next five years.

The perceived health benefits of omega-3 fatty acids, for which fish oil is the primary extraction source, drives the demand for tuna omega-3 ingredients. The tuna fish oil omega-3 market has witnessed emerging global raw material hotspots in China, Japan, Spain, and Italy. There has been a surge in the aquaculture sector around the world, and this boost is expected to provide further impetus to the overall growth of the fish oil omega-3 industry. According to the Marine Stewardship Council, the quantity of MSC-certified catch and the number of MSC-certified tuna fisheries continued to increase in 2021 and 2022. Nineteen tuna fisheries received MSC accreditation at the beginning of September 2022, bringing the total to 91.

This resulted in a 24% rise in the amount of MSC-certified tuna catch, from 1,982,000 tonnes in September 2021 to 2,460,000 in September 2022. Nearly 50% of the commercial tuna catch worldwide has MSC certification, boosting the market further. Algae omega-3 ingredients play a key role in driving the overall market growth due to the growing demand for algae omega-3 in infant food fortification, as it provides benefits similar to fish oil and has no off-odor or taste. Additionally, the surge in demand for fortified foods among various age groups across the globe is driving the tuna and omega-3 ingredients market.

Tuna and Algae Omega-3 Ingredient Market Trends

Increasing Consumer Expenditure on Omega-3 Supplements Products

Growing consumer health awareness and concerns toward a healthy lifestyle, majorly in regions like Asia-Pacific, Latin America, and Africa, are leading to an increased demand for ingredients such as EPA and DHA. Moreover, the increase in the percentage of the smoking population, incidences of heart-related complications, and other health-related issues across the world are fueling the growth of omega-3 ingredients, including tuna and algae omega-3 ingredients, especially in developing economies. Manufacturers and suppliers are actively involved in the supply chain of omega-3 in various regions. They are also making strategic efforts to ensure a gradual flow of information regarding the health benefits associated with omega-3 enriched diets, which has largely and positively affected the sales of omega-3 ingredients in developing regions.

Asia-Pacific Emerges as the Largest Market Globally

Driven by the growing demand for sports nutrition and the increase in opportunities for personalized nutrition, omega-3 ingredients hold a promising future market in Asia-Pacific. Moreover, the increasing aging population in the countries such as China and Japan, with a proportionate rise in the general population, is emerging as one of the key factors leading to the demand for brain health supplements, which, in turn, has led many key players to invest on their research and development activities regarding new innovations in omega-3 supplements. The high birth rate and the recent abolition of the one-child policy in China are slated to boost the infant food industry. Many players, such as Pathway International, are strategically partnering with key ingredient manufacturers to expand the production level or product line.

Tuna and Algae Omega-3 Ingredient Industry Overview

The global tuna and algae omega-3 ingredient market is highly fragmented. BASF, Neptune Wellness Solutions Inc., and Omega Protein Corporation are the most active companies in the global tuna and algae omega-3 ingredients market. Key players, like Neptune Wellness Solutions Inc. and Cellana Inc., are focusing on partnerships and joint ventures to increase their production capabilities and consumer base across various regions. Moreover, players are focusing on investing in technology to increase efficiency as well as various research and development activities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Algae Type

- 5.1.1.1 Concentration type

- 5.1.1.1.1 High Concentration

- 5.1.1.1.2 Medium Concentration

- 5.1.1.1.3 Low Concentration

- 5.1.2 Tuna Type

- 5.1.2.1 Crude Tuna Oil

- 5.1.2.2 Refined Tuna Oil

- 5.1.1 Algae Type

- 5.2 Application

- 5.2.1 Food and Beverage

- 5.2.1.1 Infant Formula

- 5.2.1.2 Fortified Food and Beverages

- 5.2.2 Dietary Supplements

- 5.2.3 Pharmaceutical

- 5.2.4 Animal Nutrition

- 5.2.5 Clinical Nutrition

- 5.2.1 Food and Beverage

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Spain

- 5.3.2.2 United Kingdom

- 5.3.2.3 Germany

- 5.3.2.4 France

- 5.3.2.5 Italy

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Archer Daniels Midland Company

- 6.3.2 Koninklijke DSM NV

- 6.3.3 Corbion NV

- 6.3.4 Lonza

- 6.3.5 Bioprocess Algae LLC

- 6.3.6 Neptune Wellness Solutions Inc.

- 6.3.7 Polaris SA

- 6.3.8 BASF SE

- 6.3.9 Source-Omega LLC

- 6.3.10 AlgaeCytes