|

市场调查报告书

商品编码

1273534

山药市场 - 增长、趋势和预测 (2023-2028)Yams Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

在预测期内,山药市场的复合年增长率预计为 3.5%。

主要亮点

- 山药是大型块茎状淀粉质主食,由生长在非洲、美国、加勒比海、南太平洋和亚洲的一年生和多年生攀缘植物生产。 白几内亚山药 (D. rotundata) 是西非和中非最重要的物种。 水芋 (D. alata) 原产于亚洲,是世界上分布最广的物种,也是第二大栽培物种。 全球消费者对山药的需求非常高,儘管生产成本很高,但种植山药还是有利可图的。 如果没有稳定的优质块茎供应,山药加工商不愿投资新的加工能力。

- 消费者对山药有益健康的认识不断提高,这推动了全球需求的增长。 山药营养丰富,含有维生素C、镁、钾、锰、铜和膳食纤维。 山药还有改善脑功能、缓解关节炎症状的作用。 山药含有一种称为薯蓣皂甘元的独特化合物,可促进神经细胞生长,改善大脑功能,并减缓骨质疏鬆症和类风湿性关节炎的进展。 山药还有助于维持胆固醇水平。

- 山药块茎含有约 21% 的膳食纤维,并富含碳水化合物、维生素 C 和必需矿物质。 2021 年全球山药年消费量为 1800 万吨,其中西非消费量为 1500 万吨。 截至 2021 年,西非的人均年消费量为 61 公斤。 山药可以煮、烤或炸。 在非洲,有时将其煮沸,然后捣碎成粘稠的糊状物或麵团。

山药市场趋势

山药在世界各地对健康的益处不断增加

- 山药是一种块根类蔬菜,富含纤维、蛋白质、维生素、矿物质、镁、钾、铜、叶酸和硫胺素,对支持骨骼健康、生长、新陈代谢和心臟功能很重要。

- 山药含有一种叫做薯蓣皂□元的独特化合物,已证明它可以促进神经细胞生长并增强大脑功能。 此外,它还有改善荷尔蒙平衡和治疗女性更年期、经前综合症、不孕不育和性慾低下的功效,而且随着世界上山药产量的不断增加,将促进山药的市场需求。

- 山药的种植方法是种植上一季保留下来的部分块茎或整个小块茎(“种子山药”)。 占生产者大多数的小农通常将山药与谷物和蔬菜混合。

- 由于土壤肥力下降、虫害增加和劳动力成本上升,一些传统种植区的山药产量正在下降。 为了根除这种农业文化,种植者正在采用精准农业和病虫害综合治理 (IPM) 技术来稳定当地作物的生产力。

- 根据 FAO(联合国粮食及农业组织)的数据,尼日利亚和加纳等非洲地区的国家在 11,000 年前就开始种植山药。 贝宁、喀麦隆、中非共和国、科特迪瓦、乍得和埃塞俄比亚是世界领先的山药生产国。

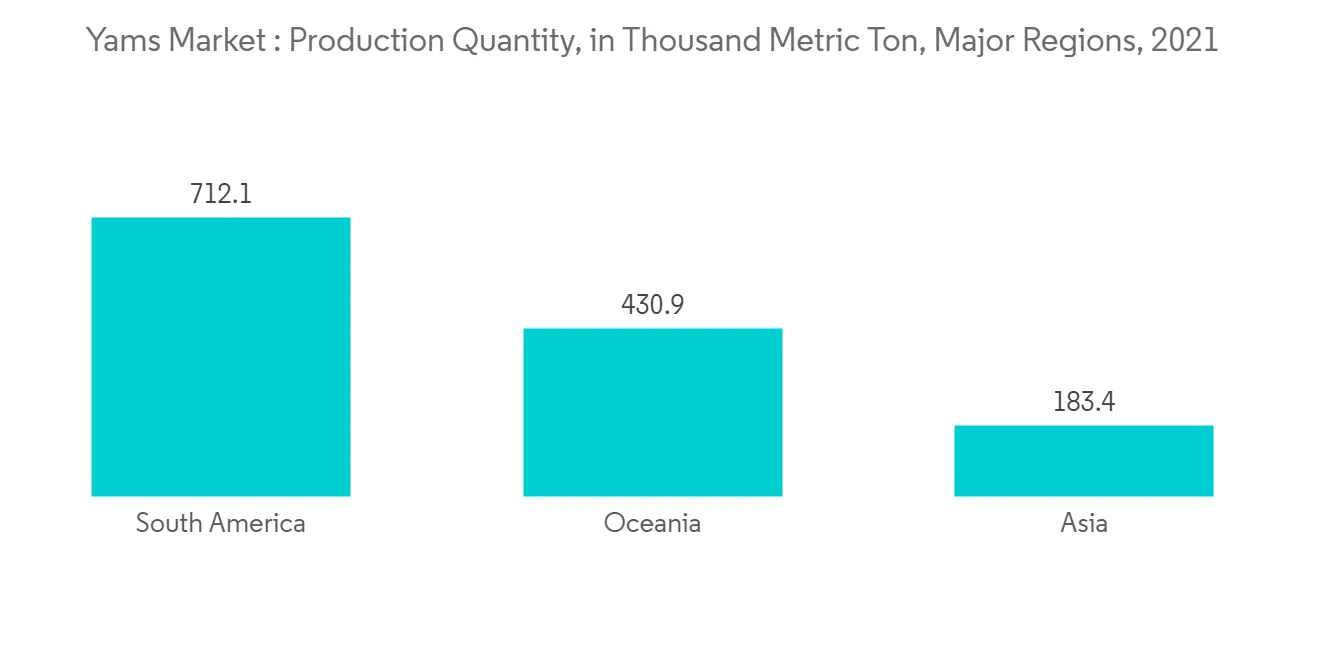

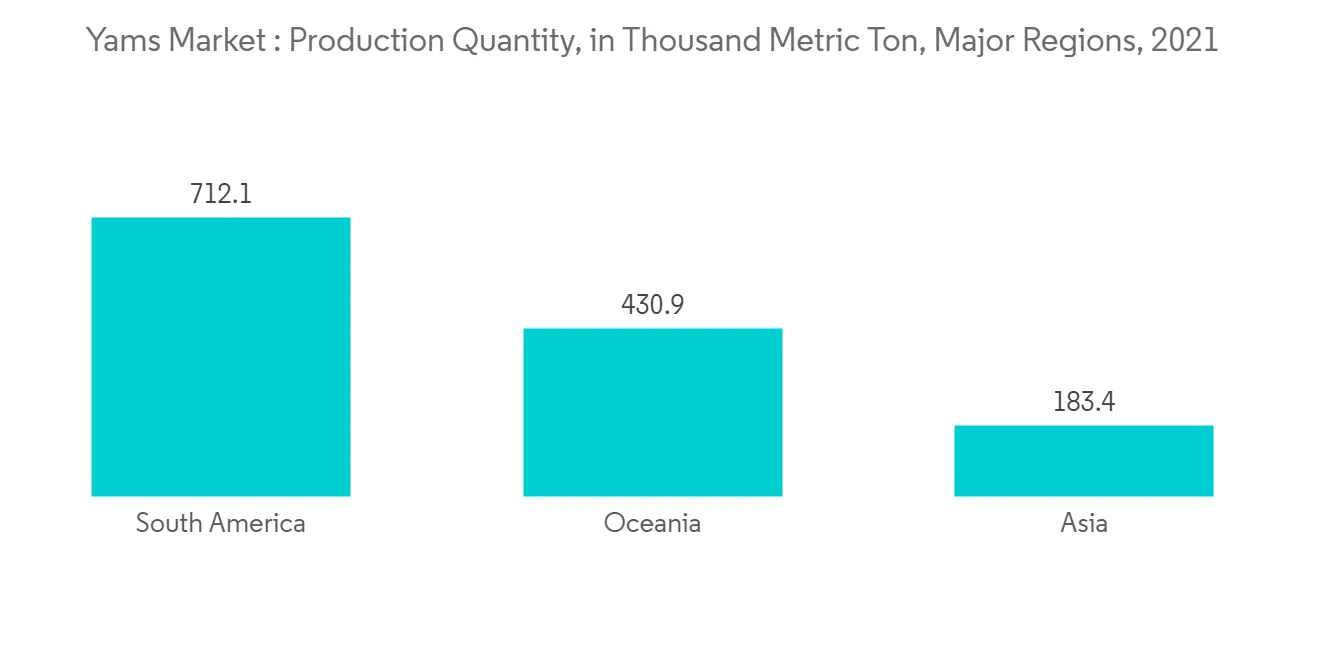

- 根据国际热带农业研究所 (IITA) 的数据,世界上大部分产量都在西非,占 94%,仅尼日利亚在 2021 年的产量就占 71%。

山药出口趋势上升

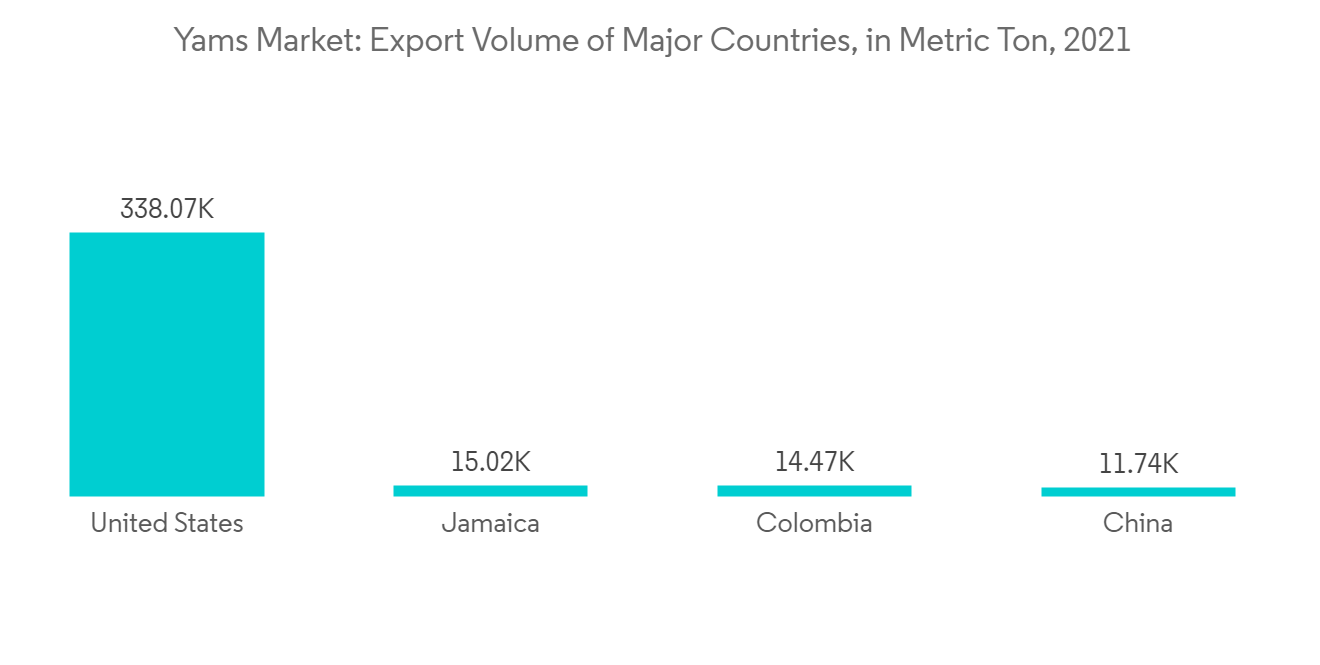

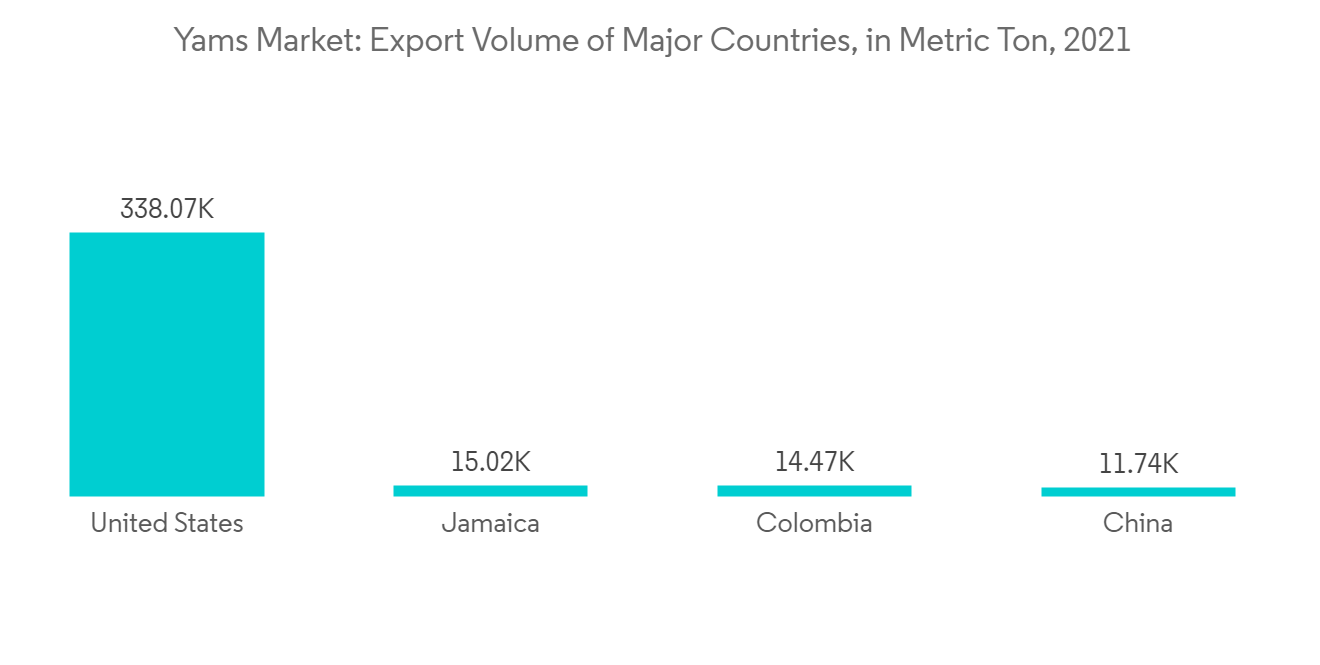

- 根据 ITC Trademap 预计,到 2021 年,加纳、美国、牙买加、哥伦比亚、中国、哥斯达黎加和印度将成为世界领先的山药出口国,出口量为 447,620 公吨和 199,179,000 美元。

- 山药块茎含有约 21% 的膳食纤维,并富含碳水化合物、维生素 C 和必需矿物质。 大多数非洲山药在国内消费,占世界 1800 万吨中的 1500 万吨。

- 加纳占山药出口的很大份额,占 24.4%,其次是美国 (20.1%) 和牙买加 (11.0%)。 根据加纳出口促进局 2019 年的数据,加纳山药的主要出口目的地是英国,为 557.6 万美元,其次是美国,为 322.5 万美元。 这些市场加起来占加纳 2019 年 27,282 吨总出口量的 69.2%。 随着全球对山药的需求不断增加,出口机会有望扩大。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查假设和市场定义

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 市场概览

- 市场驱动力

- 市场製约因素

- 价值链分析

第 5 章市场细分

- 按地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 其他北美地区

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 西班牙

- 其他欧洲

- 亚太地区

- 印度

- 中国

- 日本

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 尼日利亚

- 加纳

- 其他中东和非洲地区

- 北美

第六章市场机会与未来趋势

简介目录

Product Code: 70134

The Yams market is projected to register a CAGR of 3.5% over the forecast period.

Key Highlights

- Yams are starchy staples in the form of large tubers produced by annual and perennial vines grown in Africa, the United States, the Caribbean, South Pacific, and Asia. White Guinea yam, D. rotundata, is the most critical species in western and Central Africa. Water yam, D. alata, the second most cultivated species, originated from Asia and is the most widely distributed species in the world. Consumers' demand for yam is generally very high globally, and yam cultivation is profitable despite high production costs. Yam processors are reluctant to invest in new processing capacity without a steady supply of high-quality tubers.

- The increasing awareness among consumers of yams' health benefits increases global demand. Yams are nutrient-rich and contain vitamin C, magnesium, potassium, manganese, copper, and fiber. Yams also help in improving brain functions and relieving arthritis symptoms. They contain a unique compound called diosgenin, which promotes neuron growth, enhances brain function, and inhibits the progression of both osteoporosis arthritis and rheumatoid arthritis. Yams also help to maintain cholesterol levels.

- Yam tubers comprise about 21% dietary fiber and are rich in carbohydrates, vitamin C, and essential minerals. Worldwide annual consumption of yams is 18 million tons, with 15 million in West Africa in 2021. Annual consumption in West Africa is 61 kilograms per capita in the year 2021. Yams are boiled, roasted, baked, or fried. In Africa, they are also mashed into a sticky paste or dough after boiling.

Yams Market Trends

Rising Health Benefits of Yams across the Globe

- Yams are a kind of tuber vegetable rich in fiber, protein, vitamins, minerals, magnesium, potassium, copper, folate, and thiamine which are important for supporting bone health, growth, metabolism, and heart function.

- Yams contain a unique compound called diosgenin, which has been found to promote neuron growth and enhance brain function. Additionally, it improves hormonal balance to treat menopause, PMS, infertility, and low libido in females, owing to greater yams production across the globe, which will propel the demand for yams in the market.

- Yams are grown by planting pieces of tuber or small whole tubers ('seed yams') saved from the previous season. Small-scale farmers, the majority of producers, often intercrop yams with cereals and vegetables.

- Due to declining soil fertility, increasing pest pressures, and the high cost of labor, yam production is declining in some of the traditional producing regions. To eradicate this farming culture, the growers are modulating precision agricultural and integrated pest management (IPM) techniques to stabilize crop productivity in the regions.

- According to the Food and Agricultural Organization (FAO), countries like Nigeria and Ghana of the African region holds a significant share in the production as yam cultivation started 11,000 years ago and is one of the primary commodity in the region. Benin, Cameroon, Central African Republic, Cote d'Ivoire, Chad, and Ethiopia, are some of the major producers of yam in the world.

- According to the International Institute of Tropical Agriculture (IITA), most of the world's production comes from West Africa, representing 94%, with Nigeria alone producing 71% in 2021.

Rising Export Trend for Yams

- According to the ITC Trademap, in 2021, Ghana, the United States, Jamaica, Colombia, China, Costa Rica, and India were the major yam exporters globally, accounting for 447,6200 metric tons valued at USD 199,179 thousand.

- Yam tubers comprise about 21% dietary fiber and are rich in carbohydrates, vitamin C, and essential minerals. Most of the African yam produced is consumed domestically, accounting for 15 million tons out of 18 million tons worldwide.

- Ghana accounts for a major share of 24.4% export of yam, followed by the United States (20.1%) and Jamaica (11.0%). According to the Ghana Export Promotion Authority in 2019, the United Kingdom was the main export destination for yams from Ghana valued at USD 5,576 thousand, closely followed by the United States with USD 3,225 thousand. Together, these markets comprise 69.2% of the total Ghanaian export value, 27,282 metric tons in 2019. The increased demand for yams globally is expected to increase the export opportunity.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Value Chain Analysis

5 MARKET SEGMENTATION (Production Analysis in Volume, Consumption Analysis by Volume and Value, Import Analysis by Value and Volume, Export Analysis by Value and Volume, and Price Trend Analysis)

- 5.1 Geography

- 5.1.1 North America

- 5.1.1.1 United States

- 5.1.1.2 Canada

- 5.1.1.3 Mexico

- 5.1.1.4 Rest of North America

- 5.1.2 Europe

- 5.1.2.1 Germany

- 5.1.2.2 United Kingdom

- 5.1.2.3 France

- 5.1.2.4 Russia

- 5.1.2.5 Spain

- 5.1.2.6 Rest of Europe

- 5.1.3 Asia Pacific

- 5.1.3.1 India

- 5.1.3.2 China

- 5.1.3.3 Japan

- 5.1.3.4 Rest of Asia Pacific

- 5.1.4 South America

- 5.1.4.1 Brazil

- 5.1.4.2 Argentina

- 5.1.4.3 Rest of South America

- 5.1.5 Middle East and Africa

- 5.1.5.1 Nigeria

- 5.1.5.2 Ghana

- 5.1.5.3 Rest of Middle East and Africa

- 5.1.1 North America

6 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219