|

市场调查报告书

商品编码

1326457

暖通空调设备市场规模和份额分析 - 增长趋势和预测(2023-2028)HVAC Equipment Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

2023年HVAC设备市场规模预计为1413.6亿美元,预计2028年将达到1959.6亿美元,在预测期内(2023-2028年)复合年增长率为6.75%,预计将增长。

暖通空调设备可应用于多种地点和建筑类型,例如购物中心、工业设施和仓库,并提供必要的气压和空气质量,以确保建筑物居住者的舒适和安全。充分的气候控制,包括加热和冷却。

主要亮点

- 全球工业化和城市化的快速进步是推动市场增长的主要因素之一。 由于世界各地各种商业建筑和住宅建筑的建设大幅增加,对空间供暖和製冷系统、通风控制、湿度控制和空气过滤等暖通空调设备的需求大幅增加。 例如,根据IEA的数据,全球建筑施工行业价值同比增长5%,达到超过6.3万亿美元。

- 不断上涨的能源成本对业主和租户的损益表产生直接影响。 乌克兰的入侵影响了全球能源市场,特别是欧洲,由于欧洲国家缺乏这些能源,欧洲是俄罗斯石油和天然气的主要市场。 然而,由于俄罗斯入侵乌克兰,欧盟决定将俄罗斯石油进口量削减三分之二,导致能源价格飙升。 因此,最近对节能 HVAC 系统的需求显着增加。

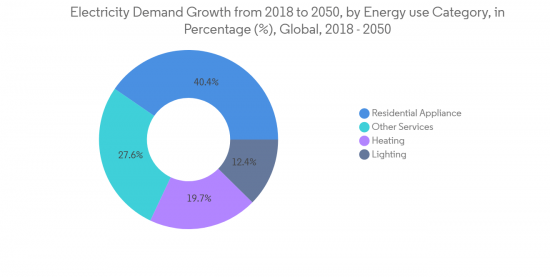

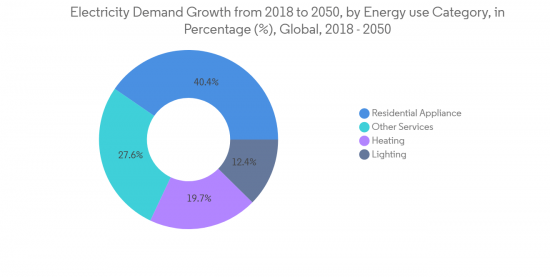

- 商业建筑中的供暖、通风和空调通常比建筑中的任何其他活动消耗更多的能源。 根据美国能源部对商业建筑的一项研究,暖通空调设备通常占建筑物能源使用的 40% 以上。 由于暖通空调系统消耗大量能源,因此可以通过提高设备效率来显着降低建筑运营成本。

- HVAC 设备的初始成本较高,对其需求来说可能是一个挑战。 这是因为高昂的成本可能会阻碍一些客户购买或升级系统。 对于预算紧张且可能无法承担新系统初始成本的房主和小企业主来说尤其如此。 其次,暖通空调设备的高成本会延长客户的投资回收期。 这意味着新系统提高能源效率所节省的成本可能在几年内都无法抵消初始投资。

- 由于新冠肺炎 (COVID-19) 疫情的爆发,越来越多的消费者担心他们购买的服务和产品对环境的影响。 我愿意比其他人支付更多的钱来购买更环保、更健康的选择。 智能暖通空调系统预计会有很大的需求。

暖通空调设备市场趋势

政府支持性法规(包括通过税收抵免激励节能)推动市场增长

- 世界各地许多政府都提供税收优惠,以鼓励安装高效的 HVAC(供暖、通风和空调)设备。 这是减少碳足迹和减轻气候变化影响的更大努力的一部分。 通过加强现有供应,同时加速向可持续能源转型,《通货膨胀控制法》的能源条款将加强能源安全,大幅减少排放,为更美好的未来做出重要贡献,这将是迈出的一大步。

- 这些前所未有的激励措施为消费者提供了一个极具吸引力的机会,可以用先进、高效的技术以极低的成本更换老化、低效的空调系统。

- 例如,2022 年 12 月,美国将再次开始针对高效 HVAC 的联邦税收优惠。 为安装某些HVAC 设备的房主和项目符合某些能效标准的住宅建筑商,以及为实现规定的节能而进行升级的商业建筑业主提供增强的税收抵免。该税收抵免是美国众议院通过的《减少通货膨胀法案》的一部分的代表。 《通货膨胀减少法案》为房主提供高达 2,000 美元的税收抵免,为住宅建筑商提供高达 2,500 美元至 5,000 美元的税收抵免。 安装合格 HVAC 设备的房主可获得 25C 税收抵免,住宅建筑商可获得增强型 45L 税收抵免。 《通货膨胀削减法案》扩大了 179D 税收抵免的适用范围,商业建筑业主通常使用装备来提高能源效率。 所有这些税收优惠都要求您证明特定类别的能源成本降低幅度最低。

- 2022 年7 月,美国参议院正在审议两项法案,将加速暖通空调系统的电气化,最大限度地减少建筑物中使用的化石燃料(例如天然气和石油)的数量,并旨在减少碳排放。 这两项法案都将为某些电动暖通空调设备的製造提供财政激励,包括热泵、地热/空气源和热泵热水器等。

- 美国国会通过的税收和气候法案是美国历史上最大的能源效率投资,为未来 10 年的家庭节能改进提供超过 210 亿美元的退税和联邦税收抵免。分配的。

- 所有这些回扣将通过 2023 年 1 月至 2031 年 9 月期间制定了合格计划的州和部落政府发放。

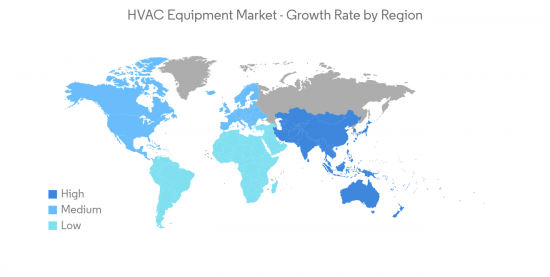

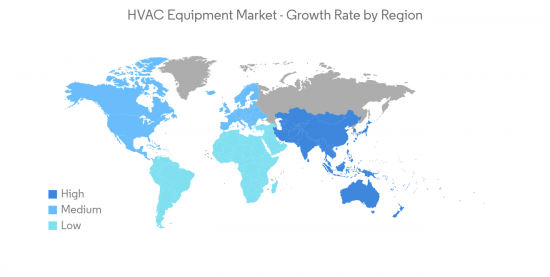

亚太地区预计将创下最快增长

- 由于印度和中国的商业和住宅建筑活动以及奢侈品消费者支出的增加,亚太地区暖通空调系统市场预计将稳定增长。 亚洲的低拥有率和不断增长的可支配收入可能会推动市场增长。 由于印度和中国的需求不断增长,住宅领域占据了亚太空调系统市场的很大一部分。 来自中国製造商的竞争日益激烈,中国製造商提供的产品价格低于世界知名製造商,预计将维持销售增长。 西欧和美国等成熟地区的庞大安装基础预计将为相对尚未开发的亚太市场提供市场发展前景。

- 这家最大的空调公司宣布推出在印度设计和製造的新系列分体式空调,专为挑剔的印度消费者打造。 这一新的 U 系列产品线采用面向未来的技术,使客户能够控制整个设施的空调质量。

- 2023 年 2 月,Godrej 集团旗舰公司 Godrej & Boyce 旗下部门 Godrej Appliances 推出了印度首款采用防漏技术的分体式空调,并为此申请了专利。 Godrej防漏分体空调采用的全新防漏技术,力图解决上述问题。 该空调还具有可根据房间人数调节以节省能源的“5合1可转换冷却技术”、可根据设定温度提供最大舒适度的“i-sense技术”,配备拥有多项有价值的技术和功能,例如52°C 的强大冷却和低降额、节省电力的变频技术以及零臭氧消耗和低全球变暖潜势的环保R32 製冷剂。

- 2023 年 2 月,全球领先的空调製造商之一的日本大金计划为城市周边的公共设施(包括社会住房)提供热泵和冷却系统,并进行远程监控和认证。 这项英国首个协议将在未来两年内通过翻新工程、空气源热泵等低碳供暖系统以及更广泛的数字干预措施,为大曼彻斯特地区的 800 至 1,000 套房屋提供支持。

- 在亚太市场,能源电力行业是供热设备的重要终端用户。 电厂装机容量的增加将是市场扩张的主要驱动力。 根据国际能源署的全球能源投资预测,2014年至2035年间,全球将花费超过9.5万亿美元用于新电厂建设和现有电厂改造。 其中超过三分之一预计将用于使用化石燃料的火力发电厂。 发电能力的增加将主要通过化石燃料火力发电厂实现,这是这些国家的主要发电来源。

暖通空调设备行业概览

暖通空调设备市场分散,主要参与者包括特灵科技(Trane Technologies PLC)、Aermec SpA(佐丹奴利雅路国际集团SpA)、大金工业有限公司(Daikin Industries Ltd)、Clivet SpA(美的集团)、Emicon Innovation 和Comfort SRL。 市场参与者正在采取合作伙伴关係和收购等策略来增强其产品供应并获得可持续的竞争优势。

- 2022 年 11 月,大金推出了 Emra,这是一种室内气候控制系统,旨在净化空气以及加热和冷却室内空间。 Emra 外形纤薄、低调,适合从客厅到办公室的各种室内区域,并致力于有效的温度控制。

- 2022 年9 月,世界气候创新者之一的Tran Technologies 将通过两台着名的屋顶机组扩大其电气化供暖和製冷产品组合,以提高能源效率、建筑连通性和控制力。我们宣布了一项创新升级。 推出 Thermafit 空气对水模块化热泵型号 AXM。 我们还更新了 Voyager 3 和 IntelliPak2 屋顶装置,以提高仓库和大型设施的室内舒适度和空气质量。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章研究方法

第 3 章执行摘要

第 4 章市场洞察

- 市场概览

- 行业吸引力 - 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的对抗关係

- 行业价值链分析

- 新冠肺炎 (COVID-19) 疫情对行业的影响

- 法规对市场的影响

- 分销渠道分析

- 行业生态系统分析

第五章市场动态

- 市场驱动因素

- 政府支持法规,包括通过税收抵免计划提供节能激励措施

- 对节能设备的需求增加

- 增加建筑和改造活动以支持需求

- 市场挑战

- 节能係统的初始成本较高

- 对宏观经济状况的依赖

- 竞争加剧导致利润率受到限制

- 市场机会

- 物联网的出现和产品创新支持替代

第六章市场细分

- 按类型

- 空调设备

- 供暖设备

- 热泵

- 加湿器/除湿器

- 按最终用户行业

- 住房

- 工业/商业

- 按地区

- 北美

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲地区

- 中东/非洲

- 沙特阿拉伯

- 阿拉伯联合酋长国

- 非洲

- 其他中东/非洲

- 北美

第7章竞争格局

- 公司简介

- Trane Technologies PLC

- Aermec SpA(Giordano Riello International Group SpA)

- Daikin Industries Ltd

- Clivet SpA(Midea Group)

- Emicon Innovation and Comfort SRL

- G.I. Industrial Holding SpA

- Mitsubishi Electric Hydronics & IT Cooling Systems

- Rhoss SpA(NIBE Group)

- MTA SpA

- Hitema International

- Swegon Group AB

- Systemair AB

- Lennox International Inc.

- Carrier Corporation

- Rheem Manufacturing Company Inc.

- Midea Group

- Gree Electric Appliances

第8章 投资分析

第9章 市场将来

The HVAC Equipment Market size is estimated at USD 141.36 billion in 2023, and is expected to reach USD 195.96 billion by 2028, growing at a CAGR of 6.75% during the forecast period (2023-2028).

HVAC equipment can be applied in a wide range of locations, and building types, such as shopping centers, industrial facilities, warehouses, etc., ensuring that a building has proper climate control with heating and cooling, along with the necessary air pressure and air quality to make the occupants in the building comfortable and safe.

Key Highlights

- The rapid rise in industrialization and urbanization worldwide is one of the primary factors driving the market's growth. The significant increase in the construction of different commercial and residential buildings worldwide is creating considerable demand for HVAC equipment as a space heating and cooling system, ventilation control, humidity control, and air filtration. For instance, as per the IEA, the global building construction sector's value increased by 5% compared to the previous year, reaching over USD 6.3 trillion.

- Rising energy costs directly impact building owners' and tenants' profit/loss statements. The invasion of Ukraine affected energy markets worldwide, particularly in Europe, which remains the primary market for Russian oil and gas due to the lack of these energy sources in European countries. However, due to Russia's invasion of Ukraine, the European Union decided to cut Russian oil imports by two-thirds, resulting in a surge in energy prices. Consequently, the demand for energy-efficient HVAC systems has recently increased significantly.

- Heating, ventilating, and air-conditioning in a commercial building usually consume more energy than any other activity in the building. According to the US Department of Energy's studies of commercial buildings, HVAC equipment usually account for over 40% of a building's energy usage. Owing to the huge amount of energy, HVAC systems use improvements in equipment efficiency translate to significant reductions in building operating costs.

- The high initial cost of HVAC equipment can be challenging for its demand because the high cost may deter some customers from purchasing or upgrading their systems. This is especially true for homeowners or small business owners who may have limited budgets and may not be able to afford the upfront costs of a new system. Secondly, the high cost of HVAC equipment can result in long payback periods for customers. This means that the cost savings resulting from the new system's improved energy efficiency may not offset the initial investment for several years.

- With the outbreak of COVID-19, more consumers are expressing concerns about the environmental impact of the services and products they buy. They are willing to pay more for more eco-friendly and health-friendly options than others. Smart HVAC systems are expected to have significant demand.

HVAC Equipment Market Trends

Supportive Government Regulations, Including Incentives for Saving Energy Through Tax Credit Programs, Drive the Market's Growth

- Many governments worldwide are offering tax incentives to encourage the installation of efficient HVAC (heating, ventilation, and air conditioning) equipment. This is part of a larger effort to reduce carbon emissions and mitigate the impact of climate change. By bolstering current supplies while accelerating the sustainable energy transition, the energy provisions of the Inflation Reduction Act will strengthen energy security and meaningfully reduce emissions, representing an important step toward a better future.

- These unprecedented incentives present consumers with a compelling opportunity to replace any aging, lower-efficiency HVAC systems with advanced, high-efficiency technology at a fraction of the cost.

- For instance, in December 2022, the federal tax incentives in the United States for greater HVAC efficiency were on again. Enhanced tax credits have been provided for homeowners who install certain HVAC equipment and home builders whose projects meet specific energy-efficiency standards, and tax deductions for the owners of commercial buildings that are upgraded to achieve defined energy savings are part of the Inflation Reduction Act, passed in the US House of Representatives. Through the Inflation Reduction Act, a tax credit of up to USD 2,000 is available to homeowners, followed by USD 2500-5000 for home builders with qualified heat pumps installed. The 25C credit is available to homeowners with eligible HVAC equipment, while home builders can take advantage of enhanced 45L credits. The Inflation Reduction Act broadened the availability of 179D tax deductions, which commercial building owners generally use outfitted to increase energy efficiency. All these tax rebates require specific categories to show minimum energy cost savings.

- In July 2022, two bills pending in the US Senate were designed to speed the electrification of HVAC systems, minimize the number of fossil fuels (such as natural gas and oil) used in buildings, and cut carbon emissions. Both offered financial incentives for producing certain electric-powered HVAC equipment, particularly heat pumps, geothermal and air sources, and heat-pump water heaters.

- The Tax-and-Climate bill passed by Congress is the largest investment in energy efficiency in US history, with more than USD 21 billion allocated for rebates and federal tax deductions for household energy-saving upgrades over the next 10 years.

- All these rebates were expected to be distributed beginning in January 2023 and continue through September 2031 through state and tribal governments that establish their qualifying programs.

Asia-Pacific Expected to Register Fastest Growth

- The Asia-Pacific HVAC systems market is predicted to rise steadily due to commercial and residential construction activity in India and China and rising consumer expenditure on luxury products. Low ownership rates and increased disposable income in Asia are likely to boost the market's growth. Due to rising demand from India and China, the residential sector accounted for a significant portion of the Asia-Pacific air conditioning systems market. Increased competition from Chinese producers offering products at lower prices than globally recognized names is projected to sustain sales growth. A large installed base in established regions like Western Europe and the United States is expected to create development prospects in the comparatively untapped Asia-Pacific market.

- The largest air conditioning firm introduced a new line of split-room air conditioners designed and built in India for discerning Indian consumers. This new U Series line features future-ready technologies that enable clients to control the quality of air conditioning across their facilities.

- In February 2023, Godrej Appliances, a division of Godrej & Boyce, the Godrej Group's flagship firm, launched India's first leakproof split air conditioner with anti-leak technology and has filed a patent for it. The all-new anti-leak technology found in Godrej Leak Proof Split ACs strives to solve the issues mentioned above. This AC also includes several other valuable technologies and features, such as 5-in-1 Convertible Cooling Technology, which can be adjusted based on the number of people in the room to save energy, i-sense technology to match the set temperature for maximum comfort, powerful cooling even at 52°C with lower derating, inverter technology for power savings, and eco-friendly R32 refrigerant, which has zero ozone depletion and low global warming potential.

- In February 2023, Daikin Japan, one of the world's major air conditioning manufacturers, plans to supply heat pumps and cooling systems to public buildings, including social housing, around the city, which will be remotely monitored and certified. The signing of this UK-first agreement will assist between 800-1000 houses in Greater Manchester over the next two years via retrofitting efforts, low-carbon heating systems such as air-source heat pumps, and broader digital interventions.

- In the Asia-Pacific market, the energy and power sectors will be essential end users of heating equipment. Rising power plant capacity will be a primary driver of market expansion. According to the International Energy Agency's Global Energy Investment Forecast, between 2014 and 2035, over USD 9.5 trillion will be spent on constructing new power plants and rehabilitating existing ones worldwide. Over one-third of this will likely be used for fossil-fuel-based thermal power plants. Increasing generation capacity is planned to be achieved primarily through fossil-fuelled thermal power plants, which are the primary source of electricity generation in these countries.

HVAC Equipment Industry Overview

The HVAC equipment market is fragmented with the presence of major players like Trane Technologies PLC, Aermec SpA (Giordano Riello International Group SpA), Daikin Industries Ltd, Clivet SpA (Midea Group), Emicon Innovation and Comfort SRL. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- In November 2022, Daikin introduced the Emuraindoor climate management system, designed to purify the air and heat and cool interior areas. Emura is a slim and unobtrusive shape designed to fit in various indoor areas, from living rooms to offices, and strives to provide effective temperature control.

- In September 2022, Trane Technologies, one of the global climate innovators, announced innovations that expanded its electrified heating and cooling portfolio and upgraded two well-known rooftop units to improve energy efficiency, building connectivity, and control. Trane introduced the new ThermafitAir-to-Water Modular Heat Pump Model AXM, which offers flexible, all-electric heating and cooling. It also added updates to its Voyager 3 and IntelliPak2 Rooftop Units to improve indoor comfort and air quality in warehouses and large facilities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Outbreak on the Industry

- 4.5 The Impact of Regulations on the Market

- 4.6 Distribution Channel Analysis

- 4.7 Industry Ecosystem Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Supportive Government Regulations, Including Incentives for Saving Energy Through Tax Credit Programs

- 5.1.2 Increasing Demand for Energy-efficient Devices

- 5.1.3 Increased Construction and Retrofit Activity to Aid Demand

- 5.2 Market Challenges

- 5.2.1 High Initial Cost of Energy Efficient Systems

- 5.2.2 Dependence on Macro-economic Conditions

- 5.2.3 Growing Competition to Limit Margins

- 5.3 Market Opportunities

- 5.3.1 Emergence of IoT and Product Innovations to Aid Replacements

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Air Conditioning Equipment

- 6.1.2 Heating Equipment

- 6.1.3 Heat Pumps

- 6.1.4 Humidifiers/Dehumidifiers

- 6.2 By End-user Industry

- 6.2.1 Residential

- 6.2.2 Industrial and Commercial

- 6.3 By Geography***

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 Argentina

- 6.3.4.4 Rest of Latin America

- 6.3.5 Middle East and Africa

- 6.3.5.1 Saudi Arabia

- 6.3.5.2 United Arab Emirates

- 6.3.5.3 Africa

- 6.3.5.4 Rest of Middle East

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Trane Technologies PLC

- 7.1.2 Aermec SpA (Giordano Riello International Group SpA)

- 7.1.3 Daikin Industries Ltd

- 7.1.4 Clivet SpA (Midea Group)

- 7.1.5 Emicon Innovation and Comfort SRL

- 7.1.6 G.I. Industrial Holding SpA

- 7.1.7 Mitsubishi Electric Hydronics & IT Cooling Systems

- 7.1.8 Rhoss SpA (NIBE Group)

- 7.1.9 MTA SpA

- 7.1.10 Hitema International

- 7.1.11 Swegon Group AB

- 7.1.12 Systemair AB

- 7.1.13 Lennox International Inc.

- 7.1.14 Carrier Corporation

- 7.1.15 Rheem Manufacturing Company Inc.

- 7.1.16 Midea Group

- 7.1.17 Gree Electric Appliances