|

市场调查报告书

商品编码

1329885

智能织物市场规模/份额分析 - 增长趋势和预测(2023-2028)Smart Fabrics Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

智能织物市场规模预计将从2023年的614万套扩大到2028年的1027万套,预测期内(2023-2028年)复合年增长率为10.85%。

智能纺织品是为了集成为用户提供增强功能的技术而製造和设计的纺织品。 近年来,基于可穿戴纺织品的个人系统的研究和开发,例如健康监测、防护和安全以及健康生活方式,引起了人们的极大兴趣。 最近,麻省理工学院(MIT)开发了智能服装,可以追踪人类健康最重要的指标:心率、呼吸频率和体温。 这是通过缝製一个高度敏感的传感器来实现的,该传感器将皮肤贴合到织物中。

主要亮点

- 可穿戴电子行业的增长正在推动市场发展。 各个最终用户行业对智能可穿戴设备的需求不断增长是推动智能织物市场增长的主要因素。 人们正在努力扩大纺织可穿戴设备的支付能力。 万事达卡 (Mastercard) 与 Timex 合作,将非接触式支付集成到其手錶中。 一旦这些出色的应用成为主流,市场可能会发生变化,以适应智能织物的类似趋势。

- 电子产品的小型化和柔性电子产品的发展正在推动市场发展。 传感器、执行器(用于主动智能纺织品)和控制单元(用于高级智能纺织品)等微型电子产品的进步正在提高智能织物的效率。 在多功能塑料製造、纳米级製造和印刷电子领域可以找到重要的专业知识。 例如,麻省大学洛厄尔分校开发柔性电子产品和智能纺织品,并有正在进行的研究项目。 我们正在开发高频印刷共形天线、碳基晶体管、光子器件,并研究军用可穿戴天线。

- 此外,纤维、线和纺织品形式的可穿戴摩擦纳米发电机的开发正在推动研究目标市场的显着发展。 这些纳米发电机在与超级电容器、锂电池、太阳能电池等器件有效集成时,证明了其实现自充电可穿戴系统的可行性,并引起了智能可穿戴设备的关注。

- 例如,纺织品製造公司 Nextiles 最近凭藉可记录生理和生物力学数据的智能纱线技术进入了运动表现行业。 Nextiles 通过将传统缝纫方法与印刷电路板相结合,为日常运动服打造柔性面料。 得益于一项专利製造技术,NexChilds 织物能够在一个平台上记录生物力学和生物识别传感。

- 此外,由于新冠肺炎 (COVID-19) 疫情的爆发,市场不会出现显着增长。 智能织物的生产需要高度自动化,需要电子控制系统、计算机辅助设计和自动化检测等纺织加工技术的进步。 该行业属于"服装和家居用品"类别,因此不属于基本服务领域,因此工厂目前尚未运营。

智能面料市场趋势

时尚和娱乐行业经历显着增长

时尚和娱乐行业利用智能面料为服装带来独特的美感。 服装的颜色、尺寸和形状等外观特征可以通过织入织物的技术来改变。 服装中的智能面料允许用户与周围环境进行交互,并通过嵌入式传感器和导电线通过可穿戴设备所穿的衣服来传输数据。

在时尚行业,设计师通过创新设计出美观的新服装,并与可传递信息的便捷技术架构相结合,正在推动所研究的市场。 包括优衣库和露露柠檬在内的许多品牌都在以智能材料引领其产品系列。

Under Armour、Levi's 和 Tommy Hilfiger 等许多知名品牌,以及 Sensola、Lumia、Hexoskin 和 Cute Circuit 等小型企业,都在使用智能面料提供智能服装,并领先于其他公司开发系列.做。 例如,CuteCircuit 在其高级时装系列和特殊项目中使用智能材料。 CuteCircuit的"拥抱衬衫"可以通过衣服内的传感器向用户发送电子拥抱。

法国初创公司 Spinali Design 生产的豪华沙滩装配有内置紫外线传感器,可以告知何时需要涂抹防晒霜,还配有距离追踪器,可以让父母知道孩子何时离水边太近。

此外,在过去几年中,Google 一直在 Project Jacquard 下与 Levi Strauss & Co. 合作开发未来的智能牛仔夹克。

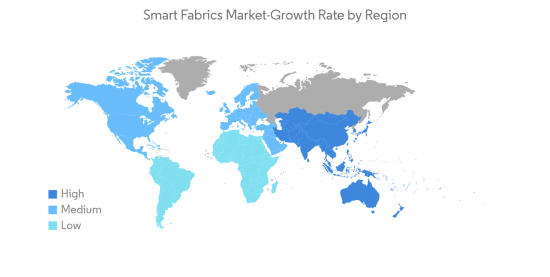

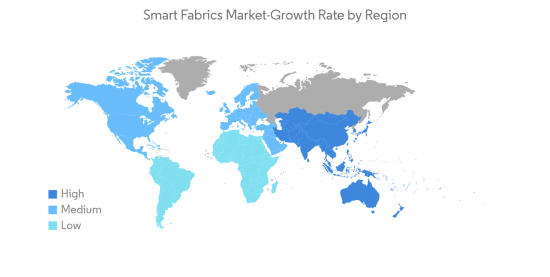

北美占据主要市场份额

北美预计将在智能面料市场中占据较大份额,其中美国占据主要份额。 联网可穿戴产品是一个大趋势,有多种形式,包括健身手环、智能手錶和智能眼镜。

此类可穿戴电子设备的日益普及预计将为智能织物市场开闢新的途径,因为它显着提高了人类的舒适度、健康和福祉。

此外,加拿大武装部队在其 IAV Striker 装置上采用了全织物键盘。 它的设计更轻,携带更舒适,并且易碎部件更少。

此外,智能织物开发的研究水平在该地区领先一步。 该地区正在进行研究和开发,以创造适应性冬季服装,帮助控制每个人周围的微气候。 例如,OtherLab 的衍生公司 Kestrel Materials 将基于纤维双压电晶片结构的热自适应服装技术商业化,该结构具有战略上不匹配的热膨胀係数。

2022 年 7 月,麻省理工学院 (MIT) 的研究人员采用创新製造工艺开发出一种可感知穿着者位置和动作的身体自适应智能织物。 通过集成和热成型特定类型的塑料线,研究团队能够显着提高编织到称为 3DKnITS 的多层针织纺织品中的压力传感器的精度。 该方法被用来开发"智能"鞋子和垫子,并开发了硬件和软件系统来实时收集和分析来自压力传感器的数据。 机器学习算法可以预测人站在智能纺织垫上时的动作和瑜伽姿势,准确率约为 95%。

智能纺织行业概述

由于多家供应商最近筹集了资金并将其投入生产,智能织物市场呈现碎片化。 例如,Zenoma 通过 AOKI 和 Toyoshima 的额外投资筹集了资金。 此类案例助长了市场竞争。 此外,在考虑集成商级别的利益相关者时,可以看到前向集成。 Hexoskin 和 Sensoria 等公司正在加剧针对最终消费者的可製造性的竞争。 近期市场动态如下。

2022 年 7 月,总部位于加利福尼亚州卡尔弗城的 Loomia Technologies 与美国高级功能面料 (AFFOA) 合作,为商业、休閒和军事客户打造高触感面料。我们生产加热手套。 AFFOA 引领消费者发现,提供架构系统设计并创建界面控制单元,而 Loomia 则提供其创新的电子纺织品技术,并为实现加热手饰做出贡献。Masu。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第1章简介

- 研究假设和市场定义

- 调查范围

第2章研究方法

第 3 章执行摘要

第 4 章市场动态

- 市场概览

- 行业吸引力 - 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间的对抗关係

- 替代品的威胁

- 行业价值链分析

- 评估新冠肺炎 (COVID-19) 对行业的影响

第五章市场动态

- 市场驱动因素

- 可穿戴电子行业的增长

- 电子产品的小型化和柔性电子产品的开发

- 市场挑战

- 对高成本和数据安全的担忧

第6章市场细分

- 类型

- 无源智能织物

- 活性面料

- 超智能面料

- 应用

- 时尚和娱乐

- 运动与健身

- 医疗

- 交通/其他

- 太空/军事

- 行业

- 地区

- 北美

- 亚太地区

- 欧洲

- 世界其他地区

第七章竞争格局

- 公司简介

- AIQ Smart Clothing Inc.

- Adidas AG

- NIKE Inc.

- ThermoSoft International Corporation

- Kolon Industries Inc.

- Interactive Wear AG

- Ohmatex

- Schoeller Textil AG

- Sensoria Inc.

- OTEX Specialty Narrow Fabrics Inc.

第8章 投资分析

第9章 市场机会与今后动向

The Smart Fabrics Market size is expected to grow from 6.14 million units in 2023 to 10.27 million Units by 2028, at a CAGR of 10.85% during the forecast period (2023-2028).

Smart textiles are fabrics that are manufactured and designed to integrate technologies that offer the user increased functionality. R&D toward wearable textile-based personal systems, such as health monitoring, protection and safety, and healthy lifestyles, gained major interest over the last few years. Recently, MIT developed smart clothing that follows the most important indicators of human health, i.e., heart rate, respiratory rate, and temperature. This was achieved by sewing into the fabric of sensitive sensors that fit the skin.

Key Highlights

- The growth in the wearable electronics industry is driving the market. The growing demand for smart wearables across various end-user industries is the major factor driving the growth of the smart fabric market. A significant amount of effort is witnessed to expand what fabric wearables can do with respect to payments. Mastercard partnered with Timex to integrate contactless payments into their watches, while a U.K.-based CashCuff did the same with the cufflinks. When such distinguished applications become mainstream, which it has, the market is very likely to shift to accommodate similar trends in smart fabrics.

- Miniaturization of electronics and developments across flexible electronics is driving the market. The efficiency of smart fabrics is enhancing with the advancement in miniaturized electronic items, such as sensors, actuators (for active smart textiles), and controlling units (advanced smart textiles). Significant expertise in multifunctional plastics manufacturing, nanoscale manufacturing, and printed electronics has been seen. For instance, UMass Lowell develops flexible electronics and smart textiles-some ongoing research projects. We are developing high-frequency printed conformal antennas, carbon-based transistors, and photonic devices and researching wearable antennas for the military.

- Further, the developments on wearable triboelectric nanogenerators in shapes of fiber, yarn, and textile enable a signficant development in the market studied. These nanogenerators, when effectively integrated with devices such as supercapacitor, lithium battery, and solar cell, their feasibility for realizing self-charging wearable systems have been proven to attract the attention of smart wearables.

- For instance, Nextiles, a textile manufacturing firm, recently entered the sports and performance industry with smart thread technology that records physiological and biomechanical data. The flexible cloth used in everyday sportswear was created by Nextiles by fusing conventional stitching methods with printed circuit boards. Nextiles' fabrics enable biomechanic and biometric sensing recorded on one platform owing to the patented production technique.

- Further, with the outbreak of COVID-19, the market did not experience substantial growth. This is because manufacturing smart fabric needed a high degree of automation and advancements in textile processing techniques such as electronic controlling system, computer-aided design, automated inspection, etc. The industry did not come under the essential services segment as it was considered in the "apparel and lifestyle goods" category, resulting from which factories were currently not under operations.

Smart Fabrics Market Trends

Fashion and Entertainment Industry to Witness Significant Growth

The fashion and entertainment industry uses smart fabrics to incorporate unique aesthetics into clothing. Appearance features, such as color, size, or shape of garments, can be altered using technology woven into fabrics. Smart fabrics in clothes enable the user to interact with their surroundings and communicate data via embedded sensors or conductive yarn through the clothes they wear with wearable devices.

In the fashion industry, the market studied is driven by innovations of the designers coming up with new and aesthetically pleasing outfits integrated with a useful technical architecture capable of relaying information. Many brands, including Uniqlo to Lululemon, use smart fabrics to set their collections ahead of the pack.

Many prominent brands such as Under Armour, Levi's, and Tommy Hilfiger, among others, along with smaller companies such as Sensora, Loomia, Hexoskin, CuteCircuit, are offering their smart clothing that are using smart fabrics to set their collections ahead of the others. For instance, CuteCircuit utilizes smart fabrics for its haute couture collections and special projects. CuteCircuit's 'Hug Shirt' allows the user to send electronic hugs through sensors within the garment.

The French startup Spinali Design makes high-end beachwear with integrated ultraviolet light sensors that tell the wearer when it's time to apply sunscreen and distance trackers that tells the parents when the kids have wandered too close to the surf.

Further, for the past few years, Google worked with Levi Straus on a future smart jean jacket under Project Jacquard, which would eventually lead to a jean jacket with smart fabric sleeves and built-in touch controls.

North America to Account for a Significant Market Share

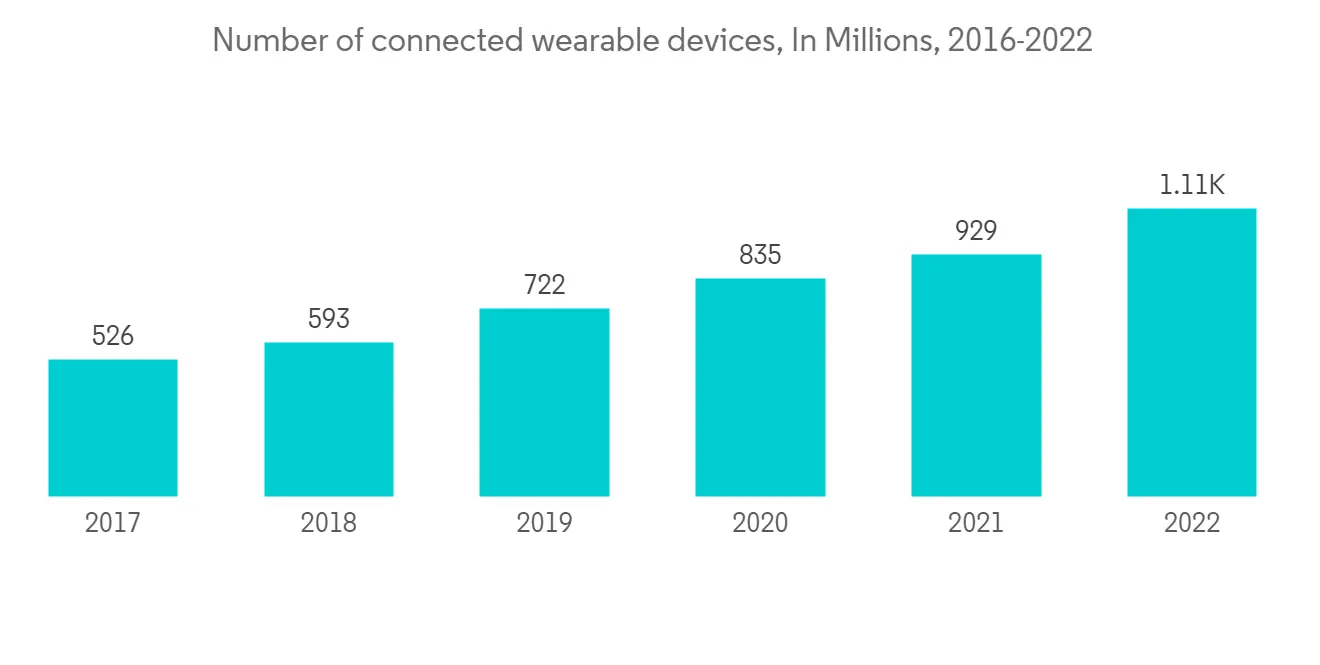

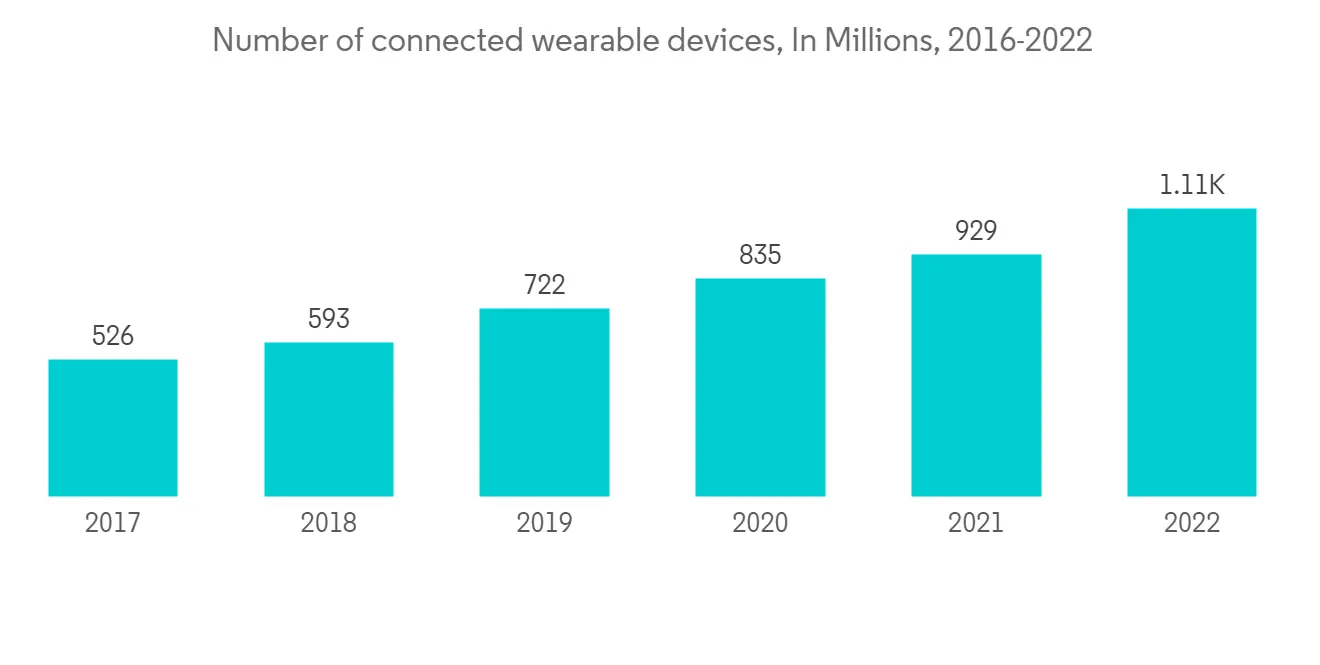

North America is anticipated to substantiate a prominent share in the smart fabrics market, with the United States region accounting for the major share. Connected wearable products are gaining significant trends and have been around in various forms, such as fitness bands, smartwatches, smart glasses, and among others.

This increasing adoption of wearable electronics devices is anticipated to open new avenues for the smart fabrics market as they offer significant enhancements to human comfort, health, and well-being.

Furthermore, the Canadian military has used full-fabric keyboards in its IAV Stryker units, developed to replace the bulky, traditional hardware. These are designed to be lighter, more comfortable to transport, and have fewer components to break.

Moreover, the level of research for developing smart fabrics has taken a step ahead in the region. The region has been witnessing research and developments to create adaptive thermal clothing that could help control the microclimate around each individual. For instance, Kestrel Materials, an OtherLab spin-out company, commercializes thermally adaptive garment technology based on textile bimorph structure with strategically mismatched coefficients of thermal expansion.

In July 2022, MIT researchers developed smart fabrics that adapt to the body to sense the wearer's position and actions using an innovative production process. The researchers were able to significantly increase the precision of pressure sensors woven into multilayered knit textiles known as 3DKnITS by integrating a particular kind of plastic yarn and applying thermoforming. This method was utilized to develop a "smart" shoe and mat, and a hardware and software system was then developed to collect and analyze data from the pressure sensors in real time. With an accuracy rate of roughly 95%, the machine-learning algorithm anticipated the movements and yoga positions that a person would make while standing on the smart textile mat.

Smart Fabrics Industry Overview

The Smart Fabrics Market is fragmented because multiple vendors have been witnessed raising funding recently to be channelized onto productions. For instance, Xenoma raised funds through additional investment by AOKI and TOYOSHIMA. These instances cater to market rivalry. Further, forward integration has been witnessed when considering the integrator-level stakeholders. With companies like Hexoskin and Sensoria, the competition has risen concerning end-consumer manufacturability. Recent developments in the market are -

In July 2022, Loomia Technologies, based in Culver City, California, collaborated with Advanced Functional Fabrics of America (AFFOA) to produce highly tactile, heated handwear for commercial/recreational and military customers. AFFOA will lead consumer discovery, provide architectural system designs, and create an interface control unit, while Loomia will contribute its innovative e-textile technology to making heated handwear a reality.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth in Wearable Electronics Industry

- 5.1.2 Miniaturization of Electronics and Developments across Flexible Electronics

- 5.2 Market Challenges

- 5.2.1 High Cost and Data Security Concerns

6 MARKET SEGMENTATION

- 6.1 Type

- 6.1.1 Passive Smart Fabrics

- 6.1.2 Active Fabrics

- 6.1.3 Ultra-smart Fabrics

- 6.2 Application

- 6.2.1 Fashion and Entertainment

- 6.2.2 Sports and Fitness

- 6.2.3 Medical

- 6.2.4 Transportation and Others

- 6.2.5 Space and Military

- 6.2.6 Industrial

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Asia Pacific

- 6.3.3 Europe

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 AIQ Smart Clothing Inc.

- 7.1.2 Adidas AG

- 7.1.3 NIKE Inc.

- 7.1.4 ThermoSoft International Corporation

- 7.1.5 Kolon Industries Inc.

- 7.1.6 Interactive Wear AG

- 7.1.7 Ohmatex

- 7.1.8 Schoeller Textil AG

- 7.1.9 Sensoria Inc.

- 7.1.10 OTEX Specialty Narrow Fabrics Inc.