|

市场调查报告书

商品编码

1403854

交通智慧织物 -市场占有率分析、产业趋势与统计、2024-2029 年成长预测Smart Fabrics For Transportation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

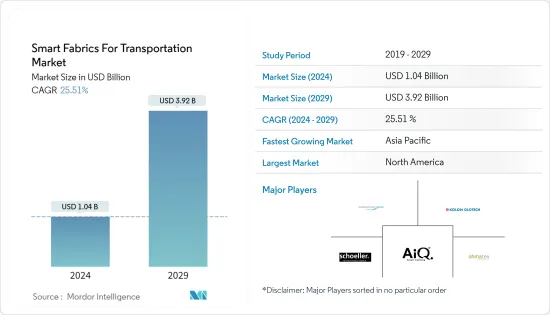

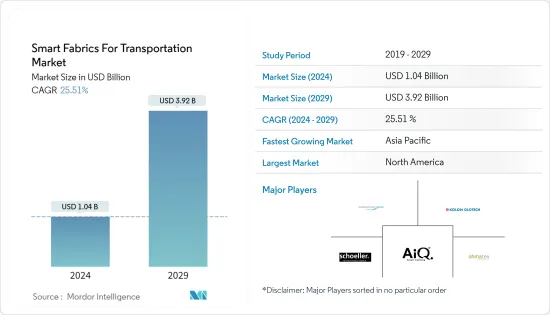

用于交通运输的智慧织物市场规模预计到2024年为10.4亿美元,预计到2029年将达到39.2亿美元,在预测期内(2024-2029年)复合年增长率为25.51%。

主要亮点

- 电子产业的巨大技术进步改变了人们的行为和观念。物联网已经连接了一切。智慧织物是这项技术进步的重要组成部分,并将在未来发挥重要作用,包括在交通运输行业的应用。

- 各种电子元件的小型化和各种先进聚合物的出现正在推动市场向前发展。此外,具有抗静电性能的织物的开发提供了令人难以置信的防污能力,以及织物与环境相互作用以帮助调节温度的整体能力。智慧织物的这些重要特性使其能够在汽车中使用。

- 此外,织物在汽车中的应用不仅限于内装;它还广泛应用于脚踏垫、安全带织带、车内顶棚、方向盘、车门内板、变速桿盖等。此外,织物不仅用于可见的外装表面,还用于准备车内热控制的隔热材料。织物的多功能性使其成为汽车的重要组成部分并推动市场发展。

- 低功耗蓝牙 (BLE) 技术的日益采用和电子元件的小型化是交通智慧织物市场成长的关键驱动力。相容于BLE技术的衣服可以透过连接互联网来感知和监控资料。电子元件和系统的小型化趋势不断增强,加速了製造智慧织物所需组装零件的小型化。无线和电子技术的快速开拓,实现了导电纺织品的小型化和集成,预计将在预测期内推动市场成长。

- 然而,新兴国家普及落后以及缺乏资金和资本投资等因素可能会限制预测期内的整体市场成长。

- 此外,由于COVID-19的爆发,市场不会出现显着成长。智慧织物的生产需要更高的自动化程度和纺织加工技术的进步,包括电子控制系统、电脑辅助设计和自动化检测。该行业被认为属于服装和家庭用品类别,但由于工厂没有运作,因此不属于基本服务行业。然而,在后COVID-19市场场景中,预计市场将出现显着的成长机会,这主要是由于联网汽车和重型车辆数量的增加。

交通智慧布料市场趋势

行动管理确认显着的高成长

- 交通运输中的移动管理主要包括透过在车辆中部署智慧结构,使驾驶员能够以最佳燃油消耗快速安全地到达目的地的所有系统,并提高车辆的整体功能。

- 此外,借助安装在车舱内的智慧织物感测系统,自动驾驶车辆可以透过汽车导航系统取得即时交通资讯。您可以将车辆改道至更好的路线以避免交通拥堵。它还可以提供加油站和停车场的资讯,以节省您的旅行时间。

- 随着交通量的增加和空气污染的日益严重,都市区第一英里和最后一英里的微型电动车代表着巨大的机会。减少总质量可以提高燃油效率,延长行驶里程,对于货运车辆来说,还可以增加负载容量。除了预期的质量减轻之外,纺织品在外装应用中的另一个优点是可以使用感测器和致动器进行功能化。封面材料的弹性及其新颖、陌生的感觉也为创新设计元素创造了可能性。

- 未来几年,物联网 (IoT) 技术的进步将使驾驶员能够获取高速公路警告和讯息,以避免发生事故。即时资料分析可以利用物联网和巨量资料功能来增强行动系统并确保密集的设备正常执行时间。最终,它可以降低车队管理成本并使运输业受益。

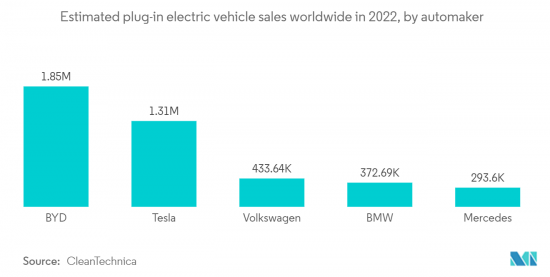

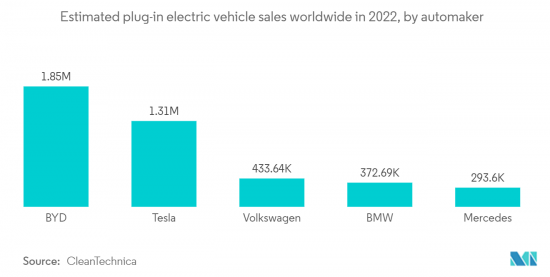

- 随着自动驾驶和电动车车的普及迅速增加,对智慧织物的需求也将增加,并可能推动市场发展。据CleanTechnica称,比亚迪将在2022年超越特斯拉成为最畅销的电动车品牌。同年,比亚迪在全球销售了近 185 万辆插电式电动车。特斯拉和上汽通用五菱合资公司是当年销售前三的品牌,其中特斯拉销售量为131万辆。以销量计算,比亚迪也是中国领先的电动车製造商。

北美占最大市场占有率

- 北美地区占据了最大的市场占有率,这主要是由于技术进步和用户渗透率的提高,以及汽车、航太、海运和铁路等最终用户领域不断增长的需求。

- 此外,该地区的主要企业还推出了许多比其前身更有效率、更先进的产品来提供通用服务。此外,资讯科技的出现以及物联网 (IoT) 设备在汽车应用中的日益使用,为该地区的业务运营增添了全新的维度。此外,基于物联网技术的智慧织物功能係统的实施有助于运输业建立和维护业务流程,这直接推动了所研究的市场。

- 此外,该地区自动驾驶汽车和电动车车的使用量显着增加。随着此类车辆的使用增加,对智慧织物的需求也会增加。预计这将为市场在整个预测期内扩大和成长创造充足的机会。

- 特斯拉公司是一家总公司德克萨斯州奥斯汀的美国跨国汽车和清洁能源公司,2022年总收益约815亿美元,其中汽车销售额超过672亿美元。特斯拉公司 (Tesla, Inc.) 成立于 2003 年,前身为特斯拉汽车公司 (Tesla Motors),是全球插电式电动车品牌。预计这种数量的增长将呈指数级推动整体市场的成长。

交通智慧织物产业概况

智慧织物解决方案在竞争激烈的交通市场中备受关注,许多国内外供应商纷纷进军该市场。市场适度集中,但逐渐变得更加分散。行业领先的参与企业正在采取以产品设计和创新为中心的关键策略。着名的市场参与企业包括 Kolon Glotech Inc.、AIQ Smart Clothing Inc. 和 Interactive Wear AG。

2023 年 2 月,ThermoSiv 推出了一款尖端智慧织物,为生态效率树立了新标准。这种创新的织物以环保的方式散热,使汽车和农业等各行业的客户能够节省能源,改善用户体验并降低成本。 ThermoSiv 织物的特点是能够精确瞄准并向附近的物体(例如个人或植物)辐射热量,确保它们的温暖,而不会不必要地温暖周围的空气。 ThermoSiv 的智慧织物对汽车产业特别有利。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素与市场抑制因素简介

- 市场驱动因素

- 联网汽车和大型车辆的增加

- 电子元件的小型化

- 人们对交通安全和安保的兴趣日益浓厚

- 市场抑制因素

- 新兴国家普及落后

- 缺乏资金和资本投入

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按零件

- 汽车内装地毯

- 汽车安全气囊

- 安全带

- 座椅加热器

- 尼龙轮胎帘布

- 按材质

- 变色材质(光致变色材质、感温变色材质)

- 发光材料(电致发光材料、萤光材料、磷光材料、发光二极体(LED))

- 可移动材料(导电聚合物、压电材料、聚合物凝胶、型态记忆合金(SMA))

- 温变材料(热电材料)

- 按用途

- 行动管理

- 车辆管理

- 安全保障

- 旅客资讯系统

- 按最终用户产业

- 车

- 船运

- 铁路

- 航太

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第六章竞争形势

- 公司简介

- AIQ Smart Clothing Inc.

- EI Du Pont De Nemours and Company

- Texas Instruments

- Kolon Glotech Inc.

- Interactive Wear AG

- Ohmatex

- Schoeller Textil AG

- Sensoria Inc.

- Textronics Inc.

- Infineon Technologies

第七章 投资分析

第八章 市场机会及未来趋势

The Smart Fabrics For Transportation Market size is estimated at USD 1.04 billion in 2024, and is expected to reach USD 3.92 billion by 2029, growing at a CAGR of 25.51% during the forecast period (2024-2029).

Key Highlights

- The electronics industry's drastic technological advancement has changed how people do and perceive things. The Internet of Things has connected everything. Smart fabrics are a crucial part of this technological advancement, playing a significant role in the future, with applications in the transportation industry.

- The miniaturization of various electronic components and the emergence of various advanced polymers are driving the market forward. Also, with the development of fabrics with antistatic properties, tremendous stain-proof capabilities and the overall ability of fabrics to interact with the environment, which further helps regulate temperature, are offered. These critical properties of smart fabrics have enabled their use in automotive vehicles.

- Moreover, the use of fabrics in automobiles is not only restricted to upholstery, but they are also widely used in floor mats, seat belt webbings, the interior ceiling, steering wheel, interior door panels, and gear shift covers. Additionally, fabrics are not only meant for the exterior surfaces, which are visible but are also used in the preparation of insulation for thermal control inside the vehicle. The versatile nature of the fabrics has made them a crucial component of automobiles, driving the market forward.

- The increasing adoption of bluetooth low energy (BLE) technology and miniaturization of electronic components is a crucial driver for the smart fabrics for transportation market growth. The BLE technology-enabled garments can sense and monitor data when connected to the Internet. There has been a rising trend of miniaturization of electronic components and systems, which has expedited the need for smaller assembly components for manufacturing smart fabrics. Radical developments in wireless and electronic technologies have enabled miniaturization and their integration into conductive textiles, which is expected to fuel the market growth during the forecast period.

- However, factors like slow penetration rate in developing countries, as well as lack of funding and capital expenditure, could be a matter of concern that could limit the market's overall growth throughout the forecast period.

- Further, with the outbreak of COVID-19, the market did not experience substantial growth. This is because manufacturing smart fabric needed a greater degree of automation and advancements in textile processing techniques such as electronic controlling systems, computer-aided design, automated inspection, etc. The industry did not come under the essential services segment as it was considered in the "apparel and lifestyle goods" category, resulting from which factories were not operating. However, in the post-COVID-19 market scenario, the market is expected to witness significant growth opportunities primarily due to the rising number of connected cars and heavy vehicles.

Smart Fabrics For Transportation Market Trends

Mobility Management to Witness Significantly High Growth Rate

- Mobility management in transportation mainly comprises all the systems that enable a driver to reach their destination quickly and safely, with optimal fuel consumption, by deploying the smart fabrics into the vehicle, which can overall enhance the vehicle features.

- Also, with the help of these smart fabric-sensing systems that are installed in the interior cabins, autonomous vehicles can access real-time traffic information through their onboard navigation systems. They can re-route the vehicle to a better route to avoid traffic jams. They can also provide information on refueling stations and parking lots, saving travel time.

- Because of the increasing traffic volume and high air pollution, micro-electric vehicles of the micro-mobility class, which are used for the first and last mile in urban and rural areas, represent a great opportunity. Textiles are trend-setting in this context: by saving the overall mass, fuel efficiency can be improved for a more extended range, and, in the case of freight transport vehicles, a higher payload is possible. In addition to the expected lower mass, another advantage of textiles in exterior applications is the possibility of functionalization utilizing sensors and actuators. The flexibility of the cover material and a new, unfamiliar feel also create potential as a novel design element.

- Over the next few years, due to the technological advancements in the Internet of Things (IoT), drivers can access highway warnings and messages to avoid accidents. Real-time data analytics can utilize the IoT and Big Data capabilities, enhancing mobility systems and ensuring concentrated device uptime. Ultimately, this can reduce vehicle management costs and benefit the transportation industry.

- With the surge in the penetration of autonomous and electric vehicles, the demand for smart fabrics may also increase, driving the market forward. According to CleanTechnica, BYD overtook Tesla as the best-selling electric vehicle brand in 2022. That year, BYD sold just under 1.85 million plug-in electric vehicles globally. Tesla and the SAIC/GM/Wuling joint venture completed the top three brands that year, with Tesla reporting 1.31 million sales. BYD is also the leading manufacturer of electric vehicles in China, based on sales.

North America Occupies the Largest Market Share

- The North American region occupies the most significant market share, primarily due to the technological advancements and rising technological penetration among users, as well as growing demand from end-user segments, such as automobiles, aerospace, shipping, and railways, which are the primary growth drivers for the smart fabrics for the transportation market, in this region.

- Moreover, major players in this region have launched many efficient and highly advanced products compared to older products to deliver the prevailing services. Also, the emergence of information technology and increased usage of the Internet of Things (IoT) devices in automotive applications have added a whole new dimension to conducting business operations in this region. Also, deploying smart fabric functional systems based on IoT techniques is helping the transportation industry establish and maintain an operational process, directly boosting the market studied.

- Moreover, the region is witnessing a significant rise in the use of autonomous and electric automobiles. A rise in the usage of such vehicles will drive the demand for smart fabrics. This is expected to create ample opportunities for the market to expand and grow throughout the forecast period.

- The total revenue streams of Tesla, Inc., an American multinational automotive and clean energy company headquartered in Austin, Texas, reached approximately 81.5 billion U.S. dollars in 2022, with automotive sales accounting for over 67.2 billion U.S. dollars. Tesla, which began as Tesla Motors in 2003, is a brand of plug-in electric vehicles worldwide. This rise in such numbers will drive the market's overall growth exponentially.

Smart Fabrics For Transportation Industry Overview

In the competitive transportation market, smart fabric solutions have gained prominence, with numerous vendors operating domestically and internationally. The market exhibits a moderate level of concentration, but it is gradually moving towards a more fragmented state. Leading industry players employ key strategies centered around product design and innovation. Notable market participants include Kolon Glotech Inc., AIQ Smart Clothing Inc., and Interactive Wear AG, among others.

In February 2023, ThermoSiv introduced a cutting-edge smart fabric that sets a new standard in environmental efficiency. This innovative fabric emits heat in an eco-friendly manner, enabling clients in diverse sectors, including automotive and agritech, to conserve energy, enhance the user experience, and reduce costs. What sets ThermoSiv's fabric apart is its ability to precisely target and radiate heat to nearby objects, such as individuals or plants, thus ensuring their warmth without unnecessarily warming the surrounding air. The smart fabric from ThermoSiv is particularly beneficial for the automotive industry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Increasing Number of Connected Cars and Heavy Vehicles

- 4.3.2 Miniaturization of Electronic Components

- 4.3.3 Increasing Safety and Security Concerns in Transportation

- 4.4 Market Restraints

- 4.4.1 Slow Penetration Rate in Developing Countries

- 4.4.2 Lack of Funding and Capital Expenditure

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Component

- 5.1.1 Automobile Interior Carpets

- 5.1.2 Automotive Airbags

- 5.1.3 Seat Belt Webbings

- 5.1.4 Heated Seats

- 5.1.5 Nylon Tire Cord Fabrics

- 5.2 By Material

- 5.2.1 Color Changing Material (Photo Chromic Material and Thermo Chromic Material)

- 5.2.2 Light Emitting Materials (Electroluminescent Materials, Fluorescent Material, Phosphorescent Material, and Light Emitting Diodes (LED))

- 5.2.3 Moving Materials (Conducting Polymers, Piezoelectric Material, Polymer Gel, and Shape Memory Alloys (SMA))

- 5.2.4 Temperature Changing Material (Thermoelectric material)

- 5.3 By Application

- 5.3.1 Mobility Management

- 5.3.2 Vehicle Management

- 5.3.3 Safety and Security

- 5.3.4 Passenger Information System

- 5.4 By End-user Industry

- 5.4.1 Automobiles

- 5.4.2 Shipping

- 5.4.3 Railways

- 5.4.4 Aerospace

- 5.5 Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia-Pacific

- 5.5.4 Latin America

- 5.5.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 AIQ Smart Clothing Inc.

- 6.1.2 EI Du Pont De Nemours and Company

- 6.1.3 Texas Instruments

- 6.1.4 Kolon Glotech Inc.

- 6.1.5 Interactive Wear AG

- 6.1.6 Ohmatex

- 6.1.7 Schoeller Textil AG

- 6.1.8 Sensoria Inc.

- 6.1.9 Textronics Inc.

- 6.1.10 Infineon Technologies