|

市场调查报告书

商品编码

1331363

全球插秧机市场规模和份额分析——增长趋势和预测(2023-2028)Global Rice Transplanter Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

2023年全球插秧机市场规模预计为14.8亿美元,预计2028年将达到19.6亿美元,在预测期内(2023-2028年)复合年增长率为5.80%,预计将增长。

主要亮点

- 由于世界人口增长,对粮食的需求不断增加,对插秧机等农业机械的需求也在增加,特别是在亚洲等地区。 结果,农业工人正在向城市地区转移。 全球农业劳动力减少是农民选择插秧机等农业机械的主要原因。 根据国际劳工组织(ILO)的数据,2022年全球农业就业人口比例将下降至26%。

- 通过使用自走式插秧机,农民可以获得比手动插秧更高的经济效益。 与手工移植相比,机械移植显着提高了粮食产量,并减少了劳动力和时间。 据印度粮食和农业委员会 (ICFA) 称,到 2050 年,印度农民的比例预计将下降 25.7%。

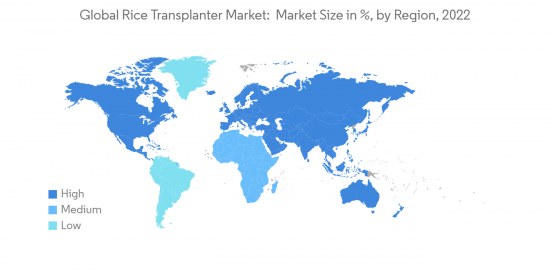

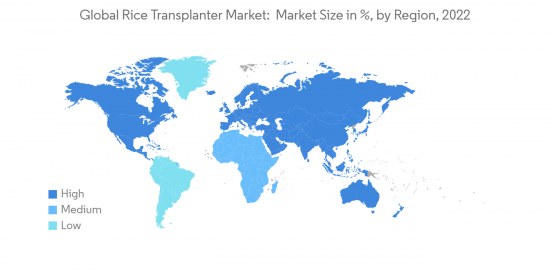

- 亚太地区是所研究市场中最大的区域部分,占总份额的一半以上。 稻田劳动力短缺作业的增加和持续的技术创新等驱动因素正在帮助印度和中国等主要稻米生产国提高插秧机的效率。

插秧机市场趋势

农业工作的减少推动市场

- 在新兴经济体中,越来越多的人口依赖农业,而随着每年越来越多的人迁移到城市地区,这一比例正在逐渐减少。 联合国粮食及农业组织(FAO)的数据显示,2021年中国等国家农业就业人数骤降23.9%,较上年下降24.4%。 这主要是发达国家以现代农业之名占主导地位的农业机械所致。 在贫穷国家,三分之二以上的人口从事农业,而富裕国家这一比例不到 5%。 因此,农机製造商有机会向市场推出新产品,推动未来市场增长。

- 根据国际劳工组织 (ILO) 的数据,到 2022 年,全球农业就业人口比例将下降至 26%。 在包括美国在内的许多发达国家,农民的平均年龄为60岁。 儘管如此,随着来自农村地区的年轻人离开乡村到城市寻找生活,平均年龄仍在上升。 这将推动新兴国家机械市场在预测期内增长。

- 根据印度粮食和农业委员会的数据,到 2050 年,印度农民的比例预计将下降 25.7%,导致该国对农业机械的需求增加。 因此,预计在预测期内插秧机市场的需求将会增加。

亚太地区主导市场

- 水稻是中国和印度等许多亚洲国家的主要农作物,全球近 90% 的水稻种植于亚太地区。 亚洲国家的人口不断增长,对粮食的需求不断增加,尤其是像该地区人口最多的国家印度这样的国家。

- 根据《世界人口评论》(WPR),2022 年印度人口为 141.7 亿,但预计 2025 年仅达到 14.1 亿。 人口的增长增加了该地区对粮食的需求。 大米是 100 多个国家的主食,扩大大米产量对于消除饥饿至关重要,特别是在亚洲。

- 印度的小农通常手工种植水稻。 手工水稻种植每公顷大约需要 238 个小时。 在评估不同水稻种植方法的性能后,发现水稻精耕方法系统的粮食产量最高,其次是机械插秧机。 由于农业所需劳动力的减少,印度机械插秧机的使用正在增加。

- 中国是世界上最大的稻米生产国,占世界稻米产量的30%,并引进了手工、机械等多种方式。 由于缺乏熟练劳动力,农村地区的手工移植正在减少。 在这些由于人口众多且可用劳动力比例高而土地面积较小的地区,这种情况很常见。 中国在该地区占有很大份额,因为它向其他亚洲国家出口水稻。 中国几乎每个省份都种植水稻,年产量占世界水稻的四分之一以上。 印度农民更喜欢手动机械,但中国和其他亚洲国家对骑乘式插秧机的需求量很大。

插秧机行业概况

插秧机市场碎片化,各类中小企业面临激烈竞争。 世界不同地区的区域市场和本地参与者的发展是市场碎片化的主要原因。 像久保田这样的领先公司能够凭藉其研发团队和技术提供智能解决方案。 每个参与者都在以聪明和创新的方式在市场上竞争。 久保田、井关、三菱、CLASS 和凯斯纽荷兰工业是该市场竞争的五家主要公司。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章研究方法

第 3 章执行摘要

第 4 章市场动态

- 市场概览

- 市场驱动因素

- 市场製约因素

- 波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场细分

- 产品类型

- 驾驶式插秧机

- 步行式插秧机

- 地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 其他北美地区

- 欧洲

- 德国

- 英国

- 法国

- 意大利

- 西班牙

- 俄罗斯

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 澳大利亚

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 非洲

- 南非

- 其他中东和非洲地区

- 北美

第6章竞争态势

- 最活跃的公司

- 最常采用的策略

- 市场份额分析

- 公司简介

- Kubota Carporation

- CNH Industrial

- CLAAS KGaA mbH

- Iseki & Co., Ltd.

- Mitsubishi

- Yanmar Co., Ltd

- Mahindra & Mahindra Limited

- TYM Corporation

- Jiangsu World Agriculture Machinery Co., Ltd

- LEMKEN GmbH & Co. KG

- Shandong Fuerwo Agricultural Equipment Co., Ltd

第7章 市场机会与今后动向

The Global Rice Transplanter Market size is estimated at USD 1.48 billion in 2023, and is expected to reach USD 1.96 billion by 2028, growing at a CAGR of 5.80% during the forecast period (2023-2028).

Key Highlights

- The rise in population across the globe is inducing a high demand for food, which in turn is driving the demand for farming machinery such as rice transplanters, especially in regions like Asia. Therefore, agricultural laborers are shifting to urban areas. The global decline in farm labor is the major reason that farm owners opt for agricultural machinery like rice transplanters. According to data from the International Labor Organization (ILO), worldwide, the percentage of people who work in agriculture dropped to 26% in 2022.

- Reducing manpower availability for agricultural work has increased mechanical transplanters' availability because using a self-propelled transplanter gives economic benefits to the farmers over manual transplanting methods. Mechanical transplanting has significantly increased grain yield and decreased drudgery and time compared to manual operations. According to the Indian Council of Food and Agriculture (ICFA), the percentage of agriculture workers in India is estimated to decline by 25.7% in 2050.

- Asia-Pacific is the largest geographical segment of the market studied and accounts for more than half of the total share. Some of the driving factors, like increasing labor shortage work in the paddy fields and continuous technological innovations, have helped increase the efficiency of rice machinery in major rice-producing countries like India and China.

Rice Transplanter Market Trends

Decline in Farm Labor is Driving the Market

- Developing economies have larger percentages of the population dependent on agriculture, decreasing over time as many people have migrated to the urban area every year. According to Food and Agriculture Organization (FAO), employment in the agriculture sector declined drastically in countries like China in 2021 by 23.9% compared to the previous year, with 24.4%. This is primarily due to agricultural machinery ruling under the name of modern agriculture in developed countries. While more than two-thirds of the population in poor countries work in agriculture, less than 5% of the population does in rich countries. This is making opportunity for the players to produce new products in the market, hence boosting the market's growth in future years.

- According to data from the International Labor Organization, worldwide, the percentage of people who work in agriculture will have dropped to 26% in 2022. In many developed countries, including the United States, the average age of a farmer is 60. Still, the average age is rising as the rural youth has branched out from their countries to seek a life in the city. This pushes the machinery market to grow in developed countries during the forecast period.

- According to the Indian Council of Food and Agriculture, the percentage of agriculture workers in India is estimated to decline by 25.7% in 2050, which has led to increasing demand for agricultural equipment in the country. Hence, the rice transplanter market demand will increase during the forecast period.

Asia-Pacific Dominates the Market

- Rice is the staple crop for many Asian countries like China and India, with almost 90% of the world's rice grown in the Asia Pacific. The growing population in Asian countries is raising the demand for food, especially in countries like India which is the most populated country in the region.

- According to the World Population Review (WPR), India's population was 141.7 cr in 2022, and it is expected to only have a population of 1.41 billion by 2025. This increase in population has increased the demand for food in the region. Rice is the main staple food in more than 100 countries, and enhancement in rice production is crucial to ending hunger, especially in Asia.

- Small farmers in India usually perform rice transplanting manually. Manual paddy transplanting required about 238 man hours per hectare. The performance of different rice establishment methods was evaluated, and the maximum grain productivity was found under the system of rice intensification method followed by mechanical transplanter. Reducing manpower availability for agricultural work has increased the availability of mechanical transplanters in India.

- China is the world's largest producer of rice, making up 30% of global rice production, which deploys various methods like manual or mechanical. Manual transplanting is declining in rural areas due to a lack of skilled labor. It is common in these areas with smaller land due to high populations and higher rates of available labor. China dominates the market in this region with a major market share as it exports paddy to other Asian countries. Nearly every province in China plants rice and produces more than one-fourth of the world's rice annually. Farmers in India prefer manually operated machines, while China and countries in Asia witness a higher demand for riding type of rice transplanter machines.

Rice Transplanter Industry Overview

The rice transplanter market is fragmented, with various small and medium-sized companies resulting in stiff competition. The development of regional markets and local players in different parts of the world is the major factor for the fragmented nature of the market. Major Player like Kubota Inc, with their R&D team and technology, is able to provide a smart solution. Every player is working smartly and in an innovative way to compete in the market. Kubota, Iseki, Mitsubishi, CLASS, and CNH Industrial are the five major players competing in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Ride-on Rice Transplanter

- 5.1.2 Walking Rice Transplanter

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Mexico

- 5.2.1.4 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Italy

- 5.2.2.5 Spain

- 5.2.2.6 Russia

- 5.2.2.7 Rest of Europe

- 5.2.3 Asia Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 India

- 5.2.3.4 Australia

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Africa

- 5.2.5.1 South Africa

- 5.2.5.2 Rest of Middle East & Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Active Companies

- 6.2 Most Adopted Strategies

- 6.3 Market Share Analysis

- 6.4 Company Profiles

- 6.4.1 Kubota Carporation

- 6.4.2 CNH Industrial

- 6.4.3 CLAAS KGaA mbH

- 6.4.4 Iseki & Co., Ltd.

- 6.4.5 Mitsubishi

- 6.4.6 Yanmar Co., Ltd

- 6.4.7 Mahindra & Mahindra Limited

- 6.4.8 TYM Corporation

- 6.4.9 Jiangsu World Agriculture Machinery Co., Ltd

- 6.4.10 LEMKEN GmbH & Co. KG

- 6.4.11 Shandong Fuerwo Agricultural Equipment Co., Ltd