|

市场调查报告书

商品编码

1331385

碾米机的市场规模和份额分析 - 增长趋势和预测(2023-2028)Rice Milling Machinery Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

碾米机市场规模预计到 2023 年为 2.3014 亿美元,预计到 2028 年将达到 2.8 亿美元,在预测期间(2023-2028 年)复合年增长率为 4%。

主要亮点

- 大米是世界一半以上人口的主食,世界各地均有生产,其中约 90% 产于亚洲。 中国是亚洲最大的稻米生产国。 籼米、香米(茉莉米、巴斯马蒂米)、粳米和糯米是四大品种,但世界各地也生产许多其他特产品种。

- 对经过认证的碾米机的需求正在推动碾米机市场的增长。 经过认证的碾米机是为了确保高质量的大米加工,这是满足不断增长的大米需求所必需的。 由于大米是许多国家的主食,预计大米需求暂时将保持高位。 因此,预计碾米机的需求将持续增加。

- 但是,二手碾米机的供应可能会阻碍市场的增长。 佐竹的NTWP(新美味白工艺)作为碾米技术的最新趋势具有划时代意义。 NTWP 工艺生产出的免淘米在口感和外观方面都具有更高的品质。 这项技术有可能彻底改变碾米行业,提供更高品质的大米,同时减少用水量和加工时间。 对于碾米厂来说,这可以提高效率、降低成本,进而增加利润。

- 随着世界人口的增加,对大米的需求不断增加,许多碾米厂正在开设新碾米厂以支持市场增长。 印度是巴斯马蒂大米的最大生产国和出口国。 碾米也许是印度最古老、最大的农产品加工业。 据联合国粮食及农业组织(FAO)统计,2020年印度水稻产量约为1.17亿吨,相当于精米约9000万吨。

碾米机市场趋势

水稻种植面积增加

- 大米是世界上一半以上人口的主要主食,其中亚洲、撒哈拉以南非洲和南美洲是最大的消费地区。 亚洲是最大的稻米生产国,其中包括中国和印度等国家,它们都是稻米产量和消费量最大的国家之一。 根据联合国粮食及农业组织(FAO)的数据,印度2021年总收穫面积为4620万吨,其次是中国2990万吨、孟加拉国1170万吨、泰国1120万吨和印度尼西亚1040万吨,已经变成了。 收穫面积的增加表明碾米厂从稻谷中提取大米供消费的需求增加。

- 根据 2021 年美国农业部 (USDA) 的报告,美国几乎所有稻米产量均由四个地区生产:阿肯色州大草原城、密西西比三角洲、墨西哥湾沿岸和加利福尼亚州。这就是萨克拉门託山谷。 每个地区通常专门生产一种特定类型的大米,在美国被称为长粒、中粒和短粒。

- 美国的长粒谷物在烹饪时通常是干燥且分离的。 一般来说,美国大米中长粒约占 75%,中粒约占 24%,其余为短粒。 2021年,美国粗米产量将为1.918亿吨,比2020年下降16%,但略高于2019年。

- 水稻种植仅限于高温、高湿、雨量充沛等特定气候条件的地区。 因此主要栽培于中国、印度、东南亚等亚洲地区以及非洲、南美洲。 然而,随着高产品种和新栽培技术(例如干湿交替(AWD))的引入,现在可以在以前不适合种植水稻的地区。

- 对优质大米的需求不断增长,以及新栽培技术和高产品种的不断采用,为碾米机市场的参与者创造了巨大的机会。 这些参与者可以提供先进的机械,可以提高碾米过程的效率、降低劳动力成本并提高最终产品的质量。

亚太地区主导市场

- 水稻、小麦和玉米是世界各地消费的主粮作物,其中水稻是主要的主粮作物,帮助世界上一半以上的人口满足日常热量需求。Masu。 世界上90%以上的稻米产自亚洲,主要是中国、印度、印度尼西亚和孟加拉国。

- 根据联合国粮食及农业组织 (FAO) 的数据,印度 2021 年总收穫面积为 4,620 万吨,其次是中国 2,990 万吨、孟加拉国 1,170 万吨、泰国 1,120 万吨,以及印度尼西亚 1040 万吨。

- 水稻种植的综合作物管理 (ICM) 方法将本土技术与政府、研究机构和推广服务的有效机构支持相结合。 该方法旨在优化现有资源的利用,最大限度地减少病虫害的影响,并提高水稻种植的整体生产力和可持续性。 使用 ICM 方法,农民可以缩小产量差距并增加水稻产量。 政府可以通过提供投入和乡村信贷供应以及加强研究和推广联繫来传播新知识和技术来支持农民。

- 根据粮农组织的数据,到 2025 年,亚洲的大米消费量将增加 51% 以上。 由于该地区人口增长,对大米的需求增加预计将在预测期内推动精米市场的发展。

碾米行业概况

碾米机市场分散,少数大型企业导緻小型企业之间的竞争。 布勒集团 (Buhler Group)、福勒韦斯特鲁普 (Fowler Westrup)、MillTECH Machinery Private Ltd、Savco Sales Pvt.Ltd 和 Satake Group 都是知名企业,在世界各地设有销售和製造基地。 新产品推出、合作和收购是国内市场领先企业采取的关键策略。

除了技术创新和业务扩张之外,投资研发和开发新颖的产品组合也将是未来几年的重要战略。 通过与国内公司合作,这些公司建立了战略合作伙伴关係,扩大了分销网络,并推出了创新的新型製粉机械,以满足当地农民的需求。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章简介

- 研究假设和市场定义

- 调查范围

第 2 章研究方法

第 3 章执行摘要

第 4 章市场动态

- 市场概览

- 市场促进因素

- 市场抑制因素

- 波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第 5 章市场细分

- 机制

- 独立碾米机

- 碾米机

- 操作

- 预洗机

- 分拣机

- 分级机

- 碾米机

- 其他

- 地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 其他北美地区

- 欧洲

- 德国

- 英国

- 法国

- 意大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 印度

- 中国

- 日本

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 非洲

- 南非

- 其他非洲

- 北美

第 6 章竞争态势

- 最常采用的策略

- 市场份额分析

- 公司简介

- Buhler AG

- Fowler Westrup

- AG Growth International Inc.

- MillTECH Machinery Private Ltd

- Yamanoto

- Zhejiang QiLi Machinery Co. Ltd

- Satake Corporation

- Mill Master Machinery Pvt. Ltd

- G S International

- G.G. Dandekar Machine Work

- Hubei Bishan Machinery Co. Ltd

第 7 章市场机会和未来趋势

The Rice Milling Machinery Market size is estimated at USD 230.14 million in 2023, and is expected to reach USD 280 million by 2028, growing at a CAGR of 4% during the forecast period (2023-2028).

Key Highlights

- Rice, the primary staple for more than half the world's population, is produced worldwide, with about 90 percent grown in Asia. China is the largest producer of rice in Asia. While Indica, Aromatic(Jasmine and Basmati), Japonica, and Glutinous rice are four major categories of rice, many other specialty varieties of rice are also produced globally.

- The demand for certified rice milling machinery is driving the growth of the rice milling machinery market. This is because certified machinery ensures high-quality rice processing, which is necessary to meet the growing demand for rice. As rice is a staple food in many countries, the demand for rice is expected to remain high in the foreseeable future. This, in turn, will continue to drive the demand for rice milling machinery.

- However, the availability of pre-used models of rice milling machinery may impede the market growth. Regarding the latest development in rice milling technology, the Satake New Tasty White Process (NTWP) is a breakthrough in rice processing. The NTWP process produces rinse-free rice of enhanced quality in terms of taste and appearance. This technology has the potential to revolutionize the rice milling industry by offering higher-quality rice while reducing water usage and processing time. This could lead to increased efficiency, reduced costs, and ultimately, higher profits for rice millers.

- The stipulation for rice is expanding with the rising global population, which led to many rice processing plants opening new rice mills and boosting the market's growth. India is the largest producer and exporter of Basmati rice and one of the largest exporters of rice. Rice milling is perhaps the country's oldest and biggest agro-processing industry. According to the Food and Agriculture Organization of the United Nations (FAO), India produced around 117 million metric tons of paddy rice in 2020, which is equivalent to around 90 million metric tons of milled rice.

Rice Milling Machinery Market Trends

Rising Area Under Rice Cultivation

- Rice is the primary staple food for more than half the world's population, with Asia, Sub-Saharan Africa, and South America as the largest consuming regions. Asia is the largest producer of rice, including countries like China and India, which are among the largest producers and consumers of rice. According to the Food and Agriculture Organization (FAO), in 2021, the total area harvested by India accounted for 46.2 million metric tons, followed by China with 29.9 million metric tons, Bangladesh with 11.7 million metric tons, Thailand with 11.2 million metric tons, and Indonesia with 10.4 million metric tons. This increase in the area harvested shows the increase in the requirement for more milling machinery to extract rice from paddy for consumption.

- According to the United States Department of Agriculture (USDA) report 2021, four regions produced almost the entire United States rice crop production: Arkansas Grand Prairie, Mississippi Delta, Gulf Coast, and Sacramento Valley of California. Each region normally specializes in a specific type of rice, referred to in the United States by the long, medium, and short grain length.

- The United States long-grain rice is typically dry and separates when cooked, while medium- and short-grain rice are typically moist and clingy. In general, long-grain production accounts for around 75 percent of United States rice production, medium-grain production for about 24 percent, and short-grain for the remainder. In 2021, the United States produced 191.8 million hundredweight (cwt) of rough rice, down 16 percent from 2020 but slightly above 2019.

- Paddy rice cultivation is limited to areas with specific climatic conditions, such as high temperatures, high humidity, and abundant rainfall. As a result, it is grown primarily in regions of Asia, such as China, India, and Southeast Asia, as well as in regions of Africa and South America. However, the rising adoption of high-yielding varieties and new cultivation techniques, such as alternate wetting and drying (AWD), has allowed for increased rice cultivation in areas that were previously unsuitable.

- The rising demand for high-quality rice and the increasing adoption of new cultivation techniques and high-yielding varieties presents a significant opportunity for players in the rice milling machinery market. These players can offer advanced machines that can improve the efficiency of the rice milling process, reduce labor costs, and increase the quality of the final product.

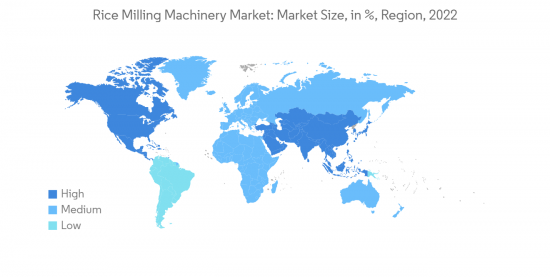

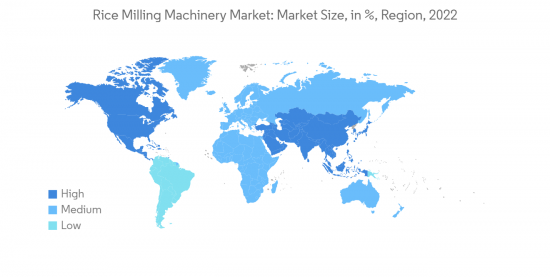

Asia-Pacific Dominates the Market

- Rice, wheat, and corn are the major consumed staple crops worldwide, whereas rice is a major staple crop among the three, helping more than half of the global population meet its daily calorie requirements. More than 90 percent of the world's rice is grown in Asia, principally in China, India, Indonesia, and Bangladesh, with smaller amounts grown in Japan, Pakistan, and various Southeast Asian nations.

- According to the Food and Agriculture Organization (FAO), in the year 2021, the total area harvested by India accounted for 46.2 million metric tons, followed by China with 29.9 million metric tons, Bangladesh with 11.7 million metric tons, Thailand with 11.2 million metric tons and Indonesia with 10.4 million metric tons.

- Integrated Crop Management (ICM) approaches for rice crops involve location-specific technologies combined with effective institutional support from governments, research institutions, and extension services. This approach aims to optimize the use of available resources, minimize the impact of pests and diseases, and improve the overall productivity and sustainability of rice farming. Using ICM approaches, farmers can bridge the yield gap and increase their rice production. Governments can support farmers by providing access to input and village credit supplies, as well as strengthening research and extension linkages to disseminate new knowledge and technologies.

- According to FAO, rice consumption in Asia by 2025 will increase by more than 51 percent. This increase in demand for rice due to the population increase in the region will drive the rice milling market during the forecast year.

Rice Milling Machinery Industry Overview

The rice milling machinery market is fragmented with a few big players, resulting in competition between small players. Buhler Group, Fowler Westrup, MillTECH Machinery Private Ltd, Savco Sales Pvt. Ltd and Satake Group are some of the prominent players with their distribution and manufacturing facilities worldwide. New product launches, partnerships, and acquisitions are the major strategies adopted by the leading companies in the market in the country.

Along with innovations and expansions, investments in R&D and developing novel product portfolios will likely be crucial strategies in the coming years. These companies are making strategic partnerships by partnering with domestic companies to expand their distribution network and launch new innovative milling machinery that caters to the needs of the farmers in the respective regions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Mechanism

- 5.1.1 Fraction Rice Milling Machine

- 5.1.2 Grind Rice Milling Machine

- 5.2 Operations

- 5.2.1 Pre-cleaning Machinery

- 5.2.2 Separating Machinery

- 5.2.3 Grading Machinery

- 5.2.4 Rice Whitening Machinery

- 5.2.5 Other Operations

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Rest of Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Buhler AG

- 6.3.2 Fowler Westrup

- 6.3.3 AG Growth International Inc.

- 6.3.4 MillTECH Machinery Private Ltd

- 6.3.5 Yamanoto

- 6.3.6 Zhejiang QiLi Machinery Co. Ltd

- 6.3.7 Satake Corporation

- 6.3.8 Mill Master Machinery Pvt. Ltd

- 6.3.9 G S International

- 6.3.10 G.G. Dandekar Machine Work

- 6.3.11 Hubei Bishan Machinery Co. Ltd