|

市场调查报告书

商品编码

1334427

尼龙单丝市场规模和份额分析-增长趋势和预测(2023-2028)Nylon Monofilament Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

尼龙单丝市场规模预计将从 2023 年的 15.9 亿美元增长到 2028 年的 20.8 亿美元,预测期内(2023-2028 年)复合年增长率为 5.50%。

COVID-19 大流行对尼龙单丝市场产生了负面影响。 尼龙单丝主要用于生产渔网。 COVID-19 大流行对渔业和水产养殖业产生了负面影响。 然而,预计市场在未来几年将出现积极增长。

主要亮点

- 推动尼龙单丝市场增长的主要因素是渔网用尼龙单丝的需求不断增加、汽车应用的快速采用以及医疗领域的新应用。

- 但是,与尼龙单丝使用相关的政府法规和原材料价格波动正在阻碍尼龙单丝市场的增长。

- 预计工业纺织品应用需求的大幅增长和生物基尼龙单丝的开发将为预计和预测期内的市场增长提供各种机会。

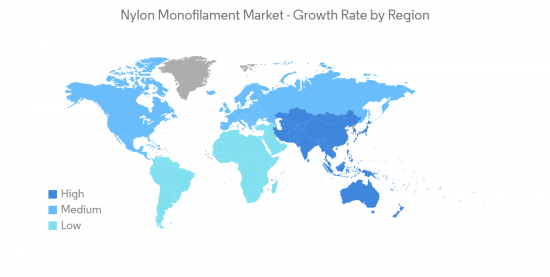

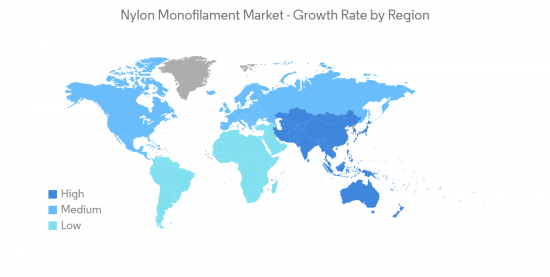

- 亚太地区是全球尼龙单丝市场最大的地区。 由于中国、印度和日本等国家的消费量不断增加,预计该市场也将成为预测期内增长最快的市场。

尼龙单丝市场趋势

渔网领域对尼龙单丝的需求不断增加

- 尼龙单丝是合成纤维的单股连续长丝,最常见的单丝是尼龙钓鱼线。 尼龙单丝的熔点比聚丙烯高,通常在 260度C 的温度范围内挤出。

- 尼龙单丝用于生产各种渔网,因为它具有成本效益且耐用。 渔业的扩张和对鱼类的需求增加可能会在未来几年增加对渔网应用的尼龙单丝的需求。

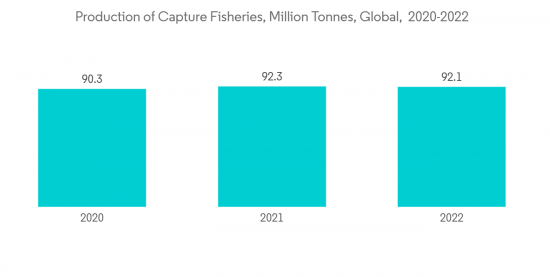

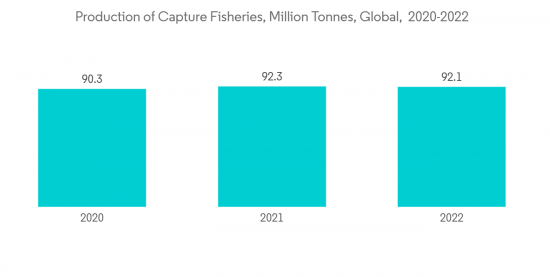

- 根据联合国粮食及农业组织的数据,到 2030 年,水生动物总产量预计约为 2.02 亿吨。 此外,由于废物和损失的减少以及资源管理的改善,预计从 2020 年到 2030 年,捕捞渔业将增长 6%,达到 9600 万吨。

- 根据联合国粮食及农业组织两年一度的粮食展望,2022年全球水产养殖和渔业产量将增长1.2%,达到1.841亿吨,而捕捞渔业将下降0.2%,水产养殖渔业将增长2.6%。 2022 年全球捕捞渔业产量估计为 9210 万吨。

- 据《水产养殖杂誌》报导,美国粮食及农业组织每半年发布一次的《粮食展望》预测,饮食结构的改变、城市化进程的加快以及收入的迅速增加将导致到2030 年人均海鲜消费量减少。预计人均海鲜消费量将达到21.4 公斤。 海鲜和捕捞渔业生产和消费的增加进一步增加了对渔网的需求。

- 因此,由于上述因素,渔网应用对尼龙单丝的需求不断增加。

亚太地区主导市场

亚太地区引领全球尼龙单丝市场。 中国、日本和印度等国家对渔网用尼龙单丝的需求不断增加,以及汽车行业应用的扩大,预计将推动该地区对尼龙单丝的需求。

- 亚太地区是鱼类养殖的主要地区之一。 据联合国粮食及农业组织称,到2030年,亚太地区渔业和水产养殖产量预计将达到9400万吨。

- 印度品牌资产基金会表示,印度是世界第三大鱼类生产国和第二大水产养殖国。 在2025年计划中,鱼类出口额预计将翻一番,从57.2亿美元增至2025年的122.8亿美元。

- 尼龙单丝广泛应用于汽车行业,可保护线束和软管免遭撕裂,并具有高拉伸强度等有益特性。 弹性好,吸湿性低。

- 根据国际汽车製造商协会 (OICA) 的数据,2022 年中国汽车总产量约为 2700 万辆,销量较 2021 年增长近 3%。 因此,汽车产量的增加预计将带动该国尼龙单丝市场。

- 由于上述因素,亚太地区的尼龙单丝市场预计在预测期内将大幅增长。

锦纶单丝行业概况

尼龙单丝市场部分整合,只有少数大公司主导市场。 主要公司包括 ABC Polymer Industries, LLC、Toray Industries Inc.、Superfil、AstenJohnson 和 Shakespeare Company, LLC。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查的先决条件

- 调查范围

第二章研究方法

第 3 章执行摘要

第 4 章市场动态

- 促进因素

- 渔网中尼龙单丝的需求不断增加

- 在汽车应用中的快速采用

- 医疗领域的新应用

- 抑制因素

- 与尼龙单丝使用相关的政府法规

- 原材料价格波动

- 工业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章市场细分(基于价值的市场规模)

- 共聚物类型

- 尼龙6

- 尼龙66

- 其他共聚物类型(尼龙 610、尼龙 612)

- 应用

- 渔网

- 医疗用途

- 汽车面料

- 消费品

- 针织绳

- 其他用途(食品包装、运动服)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 意大利

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙特阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第6章竞争态势

- 併购、合资企业、联盟、协议

- 市场份额 (%)**/排名分析

- 各大公司的战略

- 公司简介

- ABC Polymer Industries, LLC

- AstenJohnson

- Atkins & Pearce

- ICF Mercantile LLC

- Nanjing Forever Textile Co.,LTD.

- RUICHANG MONOFILAMENT

- Shakespeare Company, LLC

- Shinkey Monofilament Enterprise Co., LTD.

- Superfil

- Toray Industries Inc.

第7章市场机会和未来趋势

- 工业纺织品应用需求显着增加

- 生物基尼龙单丝的开发

The Nylon Monofilament Market size is expected to grow from USD 1.59 billion in 2023 to USD 2.08 billion by 2028, at a CAGR of 5.50% during the forecast period (2023-2028).

The COVID-19 pandemic negatively impacted the nylon monofilament market. Nylon monofilaments are mainly used in the manufacturing of fishing nets. The COVID-19 pandemic negatively impacted the fisheries and aquaculture sectors. However, the market is expected to achieve a positive growth rate over the coming years.

Key Highlights

- The major factors driving the growth of the nylon monofilament market are the growing demand for nylon monofilament in fishing nets, the surge in adoption in automotive applications, and novel applications in the medical sector.

- However, government restrictions related to the use of nylon monofilament and volatility in raw material prices are hindering the growth of the nylon monofilament market.

- Significant increases in demand from industrial textile applications and the development of bio-based nylon monofilament are estimated to offer various opportunities for market growth over the forecast period.

- Asia-Pacific represents the largest region in the global nylon monofilament market. It is also expected to be the fastest-growing market over the forecast period owing to the increasing consumption from countries such as China, India, and Japan.

Nylon Monofilament Market Trends

Growing Demand for Nylon Monofilaments from the Fishing Net Segment

- Nylon monofilament is a single, continuous-strand filament of synthetic fiber, and the most commonly recognized monofilament is a nylon fishing line. Nylon monofilaments have higher melting points than polypropylene and are generally extruded at temperatures in the range of 260 °C.

- Nylon monofilament is used to produce a variety of fishing nets owing to its cost-effective and durable properties. Expansion in the fishing industry and increasing demand for fish are likely to boost the demand for nylon monofilament for fishing net applications over the coming years.

- According to the Food and Agriculture Organization of the United Nations, by 2030, the total production of aquatic animals is projected to account for around 202 million metric tons. Moreover, owing to reduced waste and losses and improved resource management, the capture fisheries are projected to grow by 6% from 2020 to 2030 in order to reach 96 million metric tons.

- According to the Biannual Food Outlook of the Food and Agriculture Organization of the United Nations, in 2022, global aquaculture and fisheries production will have increased by 1.2% to 184.1 million metric tons, with capture fisheries decreasing by 0.2% and aquaculture increasing by 2.6%. The global production of capture fisheries was estimated at 92.1 million metric tons in 2022.

- The Aquaculture Magazine stated that, according to the Biannual Food Outlook of the Food and Agriculture Organization of the United Nations, the average per capita consumption of seafood is projected to reach 21.4 kg by 2030, owing to shifting dietary habits, growing urbanization, and a surge in income. The increase in the production and consumption of seafood and capture fisheries is further boosting the demand for fishing nets.

- Hence, the demand for nylon monofilament is increasing in fishing net applications due to the abovementioned factors.

Asia-Pacific Region to Dominate the Market

The Asia-Pacific region is the leader in the global nylon monofilament market. Nylon monofilament's rising demand for fishing nets and its growing applications in the automotive sector in countries like China, Japan, and India are expected to drive the demand for nylon monofilaments in this region.

- Asia-Pacific is one of the leading regions in fish farming. According to the Food and Agriculture Organization of the United Nations, fisheries and aquaculture production in the Asia Pacific is estimated to reach 94 million metric tons by 2030.

- The Indian Brand Equity Foundation stated that India is the third-largest producer of fish and the second-largest aquaculture nation in the world. As per the plan set for FY 2025, fish export is expected to double from USD 5.72 billion to USD 12.28 billion by 2025.

- Nylon monofilament is extensively used in the automotive industry in order to protect wire harnesses and hoses from tearing and offers beneficial properties such as high tensile strength. Superior elasticity and low moisture absorption.

- According to the International Organization of Motor Vehicle Manufacturers (OICA), the total vehicle production volume in China stood at around 27 million units in 2022, which was an increase of nearly 3% in terms of sales compared to 2021. Thus, an increase in vehicle production volume is likely to drive the market for nylon monofilament in the country.

- Owing to the abovementioned factors, the market for nylon monofilament in the Asia-Pacific region is projected to grow significantly during the forecast period.

Nylon Monofilament Industry Overview

The nylon monofilament market is partially consolidated in nature, with only a few major players dominating the market. Some of the major companies are ABC Polymer Industries, LLC, Toray Industries Inc., Superfil, AstenJohnson, and Shakespeare Company, LLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for Nylon Monofilament in Fishing Nets

- 4.1.2 Surge in Adoption in Automotive Applications

- 4.1.3 Novel Applications in the Medical Sector

- 4.2 Restraints

- 4.2.1 Government Restrictions Related to the Use of Nylon Monofilament

- 4.2.2 Volatility in Raw Material Prices

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Co-polymer Type

- 5.1.1 Nylon 6

- 5.1.2 Nylon 66

- 5.1.3 Other Co-polymer Types (Nylon 610, Nylon 612)

- 5.2 Application

- 5.2.1 Fishing Net

- 5.2.2 Medical

- 5.2.3 Automobile Fabrics

- 5.2.4 Consumer Goods

- 5.2.5 Braided Ropes

- 5.2.6 Other Applications (Food Packaging, Sports Wear)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ABC Polymer Industries, LLC

- 6.4.2 AstenJohnson

- 6.4.3 Atkins & Pearce

- 6.4.4 ICF Mercantile LLC

- 6.4.5 Nanjing Forever Textile Co.,LTD.

- 6.4.6 RUICHANG MONOFILAMENT

- 6.4.7 Shakespeare Company, LLC

- 6.4.8 Shinkey Monofilament Enterprise Co., LTD.

- 6.4.9 Superfil

- 6.4.10 Toray Industries Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Significant Increase in Demand from Industrial Textile Applications

- 7.2 Development of Bio-Based Nylon Monofilament