|

市场调查报告书

商品编码

1849824

汽车微型马达:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Automotive Micro Motor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

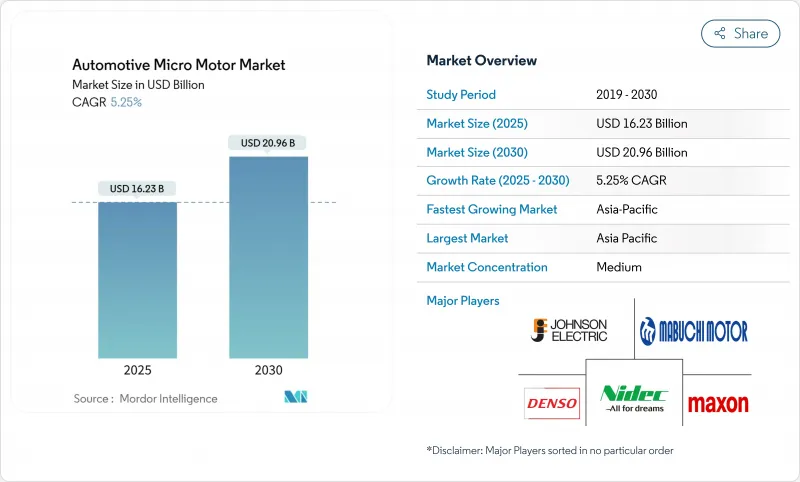

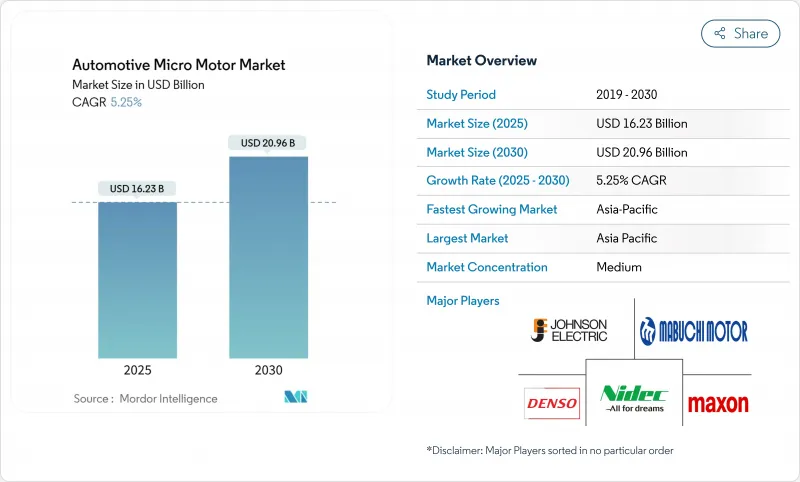

预计2025年汽车微马达市场规模将达162.3亿美元,2030年将达到约209.6亿美元,复合年增长率为5.25%。

这得益于电动车数量的快速成长、向48V轻度混合动力架构的转变,以及每辆车动力传动系统、安全性和舒适性模组的不断增加。日本电产已投入超过70亿美元的累计,用于扩大其电力驱动桥产能,以在无刷马达技术。

全球汽车微电机市场趋势与洞察

电动车产量快速成长

全球电动车出货量持续超过轻型车的整体成长速度,每款纯电池车型都依赖数十台辅助微型马达进行温度控管、空气动力学、转向、煞车和电池组冷却。 《组装杂誌》预测,到 2034 年,牵引马达产量将成长四倍,超过 1.2 亿台,这一趋势将波及整个子系统对小型马达的需求。中国 2023 年汽车出口量将达到 491 万台,超过日本,反映了这一转变,大部分汽车微型马达市场集中在中国。高阶电动车中的 800V 高压架构进一步提高了基于碳化硅元件的微型马达控制电子设备的性能标准,促使供应商转向强大的高频驱动器模组。

48V轻度混合动力架构的兴起

透过从传统的 12V 电源转换为 48V 电源,汽车製造商可以降低高达 15% 的油耗,同时开闢新的微型马达应用,例如主动悬吊、启动和停止和电动增压。 CLEPA 预测,到 2025 年,每 10 辆新车就有 1 辆将配备 48V 系统。 48V 电池市场预计将随之成长,为汽车微型马达市场创造巨大的设计机会。特斯拉在 Cybertruck 采用 48V 线路正在加速产业转型,但传统製造商将需要彻底改造其线束、连接器和检验工具,以适应更高的电压。

稀土磁铁价格走势

永久磁铁价格波动是汽车微型马达供应商面临的最严峻成本挑战。过去一年,钕铁硼现货价格下跌了42%,但随着中国加强出口限制,长期供应风险隐现。已有报导称,一些汽车项目,例如日本铃木雨燕生产线,因磁铁供应中断而停产。业内企业正在实现采购多元化:日本电产株式会社(Nidec)已签署2025年合同,将使用美国生产的Noveon Ecoflux磁铁,以缓解货币和地缘政治衝击。

細項分析

到2024年,12-24V级马达将占据汽车微型马达市场份额的42.44%。然而,随着汽车製造商采用轻度混合动力和800V电动车传动系统以提高效率,高压(48V及以上)马达市场的复合年增长率将达到5.78%,成为最快的市场。这种转变将扩大汽车微型马达的市场规模,这类马达将高扭力无刷马达与低规格线束结合,从而降低电阻损耗并减轻热负荷。特斯拉推出48V线束,凸显了业界对下一代电气标准的广泛共识。

CLEPA 已确认 48V 技术可降低高达 15% 的燃油消耗,加速其在欧洲二氧化碳合规策略中的应用。因此,供应商正在扩展其模组化定子系列,以涵盖从 24V 鼓风机马达到 400V 牵引配件的所有产品,从而最大限度地提高平台的重复使用率。新兴的低功耗(<11V)细分市场与感测器节点相关,但其收益份额有限。

到2024年,DC马达将占总收入的59.65%,这得益于车窗升降器、座椅调节器和暖通空调风门等经济高效的设计。然而,AC马达的复合年增长率将达到6.5%,因为变速运转可以降低转向、煞车和冷却水泵帮浦的能耗。因此,汽车微型马达市场提供了均衡的产品组合,直流马达平台仍然适用于开关驱动,而逆变器驱动的交流马达则满足了电动方向盘的效率目标。

日本电产 (Nidec) 的 SynRA 产品线标誌着同步磁阻架构的突破,该架构可消除稀土磁铁并提高供应弹性。Johnson Electric2023/24 财年的销售额显示,两种类型的马达均持续受到原始设备製造商的青睐,检验了其多技术蓝图的可行性。

区域分析

预计到2024年,亚太地区将占全球销售额的48.48%,到2030年的复合年增长率将达到6.20%,使该地区成为汽车微电机市场的领头羊。 2023年,中国汽车出口量将达到491万辆,超过日本,从而建立起广泛的微型电机、半导体和磁铁供应基础。日本电产计画将大连工厂的员工人数增加至多50%,使其成为全球最大的电动车马达中心,年产能达到100万台。泰国和印尼将进行新的投资,以建立一体化的电动车供应链,扩大本地采购选择。

随着排放法规趋严,48V 技术的引入以及高端原始设备製造商对主动空气动力学的青睐,欧洲正在稳步发展。欧洲汽车製造商环保署 (CLEPA) 正在大力推动轻度混合动力传动系统的发展,而舍弗勒与 Vitesco 将于 2024 年合併,这将增强欧洲本土的电机专业技术。德国新兴企业DeepDrive 已获得 3,350 万美元融资,用于将双转子设计商业化,该设计使用的磁铁数量将减少 50%,彰显了欧洲在轻质材料创新方面的努力。

北美市场受回流政策和特斯拉主导的电压标准化所推动。 KPS资本合伙公司以35亿欧元收购西门子Innomotics部门,彰显了私募股权对高价值汽车品牌的兴趣。南美市场基数较小,但成长强劲,这得益于巴西和阿根廷电子产品在生产中的比例不断上升。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 电动车产量快速成长

- 对豪华和高檔内装的需求不断增长

- 推动车辆轻量化和零件小型化

- 48V轻度混合动力架构的兴起

- 整合到主动空气动力学系统中

- 客房保健设施普及(离子产生器、空气清新剂)

- 市场限制

- 稀土元素磁铁价格上涨

- 持续的技术升级推动单位成本上升

- 严格的公差规范增加了认证成本

- 压电致动器替代品的出现

- 价值链/供应链分析

- 监管格局

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场规模和成长预测(价值(美元)和数量(单位))

- 按功耗

- 11V或更低

- 12~24V

- 25~48V

- 48V或更高

- 依马达类型

- DC马达

- AC马达

- 依技术

- 有刷微电机

- 无刷微电机

- 按用途

- 车身电子设备(车窗、座椅、后视镜)

- 动力传动系统传动系统

- 底盘和转向

- 安全性和 ADAS 模组

- 资讯娱乐和连接

- 按车辆类型

- 搭乘用车

- 商用车

- 按销售管道

- OEM

- 售后市场

- 按地区

- 北美洲

- 美国

- 加拿大

- 其他北美地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲和纽西兰

- 其他亚太地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Nidec Corporation

- Johnson Electric Holdings Ltd.

- Mabuchi Motor Co., Ltd.

- Maxon Motor AG

- Mitsuba Corporation

- Buhler Motor GmbH

- Denso Corporation

- Robert Bosch GmbH

- Continental AG

- Valeo SA

- Brose Fahrzeugteile SE

- Ametek Inc.

- MinebeaMitsumi Inc.

- Mitsumi Electric Co., Ltd.

- Shenzhen Kinmore Motor Co.

- Constar MicroMotor

- Wellings Holdings Ltd.

第七章 市场机会与未来展望

The automotive micromotor market size stood at USD 16.23 billion in 2025 and is forecast to reach about USD 20.96 billion by 2030, advancing at a 5.25% CAGR.

Gains stem from fast-rising electric-vehicle (EV) volumes, the migration to 48 V mild-hybrid architectures and growing content per vehicle across powertrain, safety and comfort modules. Manufacturers are scaling regional production hubs to meet local sourcing rules; Nidec alone earmarked more than USD 7 billion for expanded E-Axle capacity to capture additional automotive micromotor market share. Asia-Pacific remains the demand epicentre, helped by China's export leadership, while higher-voltage platforms spur the fastest adoption of brushless motor technologies in North America and Europe.

Global Automotive Micro Motor Market Trends and Insights

Surge in EV Production Volumes

Global EV shipments continue to outpace overall light-vehicle growth, and each pure battery model relies on dozens of auxiliary micromotors for thermal management, aerodynamics, steering, braking and battery-pack cooling. Assembly Magazine forecasts a fourfold jump in traction-motor output to more than 120 million units by 2034, a trend that cascades into parallel demand for smaller motors across sub-systems. China's rise to 4.91 million vehicle exports in 2023, surpassing Japan, reflects this shift and concentrates much of the automotive micromotor market in the region. Higher 800 V architectures in premium EVs further raise the performance bar for micromotor control electronics built around silicon-carbide devices, pushing suppliers toward robust, high-frequency driver modules.

Rise in 48V Mild-Hybrid Architectures

Moving from traditional 12 V electrics to 48 V boards allows automakers to cut fuel use by up to 15% while unlocking new micromotor applications in active suspension, start-stop and electric superchargers. CLEPA projects 48 V systems in one out of every ten new cars by 2025. The accompanying 48 V battery segment is anticipated to climb, giving the automotive micromotor market a sizeable design-in opportunity. Tesla's adoption of 48 V wiring in the Cybertruck accelerates industry conversion, although legacy manufacturers must overhaul harnesses, connectors and validation tools to cope with higher voltages.

Up-trend in Rare-Earth Magnet Prices

Permanent-magnet pricing volatility is the most acute cost challenge for automotive micromotor suppliers. Neodymium spot values slid 42% over the past year, yet long-term supply risk looms as China tightens export controls. Vehicle programmes already report production pauses, such as Suzuki's Swift line in Japan, when magnet shipments stalled. Industry players are diversifying sourcing: Nidec signed a 2025 deal to adopt Noveon Ecoflux magnets produced in the United States, buffering currency and geopolitical shocks.

Other drivers and restraints analyzed in the detailed report include:

- Growing Demand for Luxury & Premium Interiors

- Vehicle Lightweighting & Component Miniaturisation Push

- Constant Tech Upgrades Inflating Unit Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The 12 to 24 V class held 42.44% of the 2024 automotive micromotor market share, reflecting legacy electrical architectures across the light-vehicle parc. Higher-voltage (More than 48 V) segments, however, register the fastest 5.78% CAGR as OEMs adopt mild-hybrid and 800 V EV drivetrains for efficiency gains. This shift enlarges the automotive micromotor market size for high-torque brushless units paired with low-gauge wiring harnesses, cutting resistive losses and easing thermal loads. Tesla's 48 V harness rollout underscores broad industry alignment on the next electrical standard.

CLEPA confirms that 48 V technology can trim fuel use by up to 15%, accelerating its inclusion in European CO2-compliance strategies. Suppliers therefore scale modular stator families that cover 24 V blower motors through 400 V traction auxiliaries, maximising platform reuse. Emerging low-power (Less than 11 V) niches remain relevant for sensor nodes yet represent a limited portion of revenue.

DC motors commanded 59.65% of 2024 revenue thanks to cost-effective designs for window lifts, seat adjusters and HVAC flaps. Nevertheless, AC machines record a robust 6.5% CAGR because variable-speed operation reduces energy draw in steering, braking and coolant pumps. The automotive micromotor market therefore witnesses a balanced portfolio where DC platforms remain viable for on-off actuation, while inverter-driven AC options satisfy efficiency targets in electric power steering.

Nidec's SynRA line illustrates the push toward synchronous-reluctance architectures that remove rare-earth magnets, boosting supply resilience. Johnson Electric's FY23/24 sales indicate sustained OEM uptake across both motor types, validating a multi-technology roadmap.

The Automotive Micro Motors Market Report is Segmented by Power Consumption (Below 11V, 12 To 24V, and More), Motor Type (DC Motor and AC Motor), Technology (Brushed Micromotor and Brushless Micromotor), Application (Body Electronics and More), Vehicle Type (Passenger Cars and Commercial Vehicles), Sales Channel (OEM and Aftermarket), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia-Pacific generated 48.48% of global revenue in 2024, and its 6.20% CAGR to 2030 keeps the region at the forefront of the automotive micromotor market. Chinese exporters shipped 4.91 million vehicles in 2023, surpassing Japan and consolidating a broad supply base for micromotors, semiconductors and magnets. Nidec plans to raise headcount at its Dalian complex by up to 50%, turning it into the world's largest EV-motor site capable of one-million-unit output a year. Thailand and Indonesia court fresh investment to create integrated EV supply chains, broadening regional sourcing options.

Europe advances at a steady rate as strict emissions targets spur 48 V roll-outs and premium OEMs adopt active aerodynamics. CLEPA's promotion of mild-hybrid powertrains and Schaeffler's 2024 merger with Vitesco bolster local motor expertise. German start-up DeepDrive secured USD 33.5 million to commercialise dual-rotor designs using 50% fewer magnets, highlighting Europe's push for material-light innovations.

North America is powered by reshoring policies and Tesla-led voltage standardisation. KPS Capital Partners' EUR 3.5 billion takeover of Siemens' Innomotics division signals private equity appetite for high-value motor brands. South America exhibits the highr growth off a smaller base, aided by rising electronics content in Brazilian and Argentine production.

- Nidec Corporation

- Johnson Electric Holdings Ltd.

- Mabuchi Motor Co., Ltd.

- Maxon Motor AG

- Mitsuba Corporation

- Buhler Motor GmbH

- Denso Corporation

- Robert Bosch GmbH

- Continental AG

- Valeo SA

- Brose Fahrzeugteile SE

- Ametek Inc.

- MinebeaMitsumi Inc.

- Mitsumi Electric Co., Ltd.

- Shenzhen Kinmore Motor Co.

- Constar MicroMotor

- Wellings Holdings Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in EV production volumes

- 4.2.2 Growing demand for luxury & premium interiors

- 4.2.3 Vehicle lightweighting & component miniaturisation push

- 4.2.4 Rise in 48 V mild-hybrid architectures

- 4.2.5 Integration in active aerodynamics systems

- 4.2.6 Proliferation of cabin wellness features (ionizers, scent dispensers)

- 4.3 Market Restraints

- 4.3.1 Up-trend in rare-earth magnet prices

- 4.3.2 Constant tech upgrades inflating unit costs

- 4.3.3 Tight tolerance specs raising qualification costs

- 4.3.4 Emerging piezo-actuator substitutes

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Power Consumption

- 5.1.1 Below 11 V

- 5.1.2 12 to 24 V

- 5.1.3 25 to 48 V

- 5.1.4 Above 48 V

- 5.2 By Motor Type

- 5.2.1 DC Motor

- 5.2.2 AC Motor

- 5.3 By Technology

- 5.3.1 Brushed Micromotor

- 5.3.2 Brushless Micromotor

- 5.4 By Application

- 5.4.1 Body Electronics (window, seat, mirror)

- 5.4.2 Powertrain & Drivetrain Systems

- 5.4.3 Chassis & Steering

- 5.4.4 Safety & ADAS Modules

- 5.4.5 Infotainment & Connectivity

- 5.5 By Vehicle Type

- 5.5.1 Passenger Cars

- 5.5.2 Commercial Vehicles

- 5.6 By Sales Channel

- 5.6.1 OEM

- 5.6.2 Aftermarket

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Rest of North America

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 Germany

- 5.7.3.2 United Kingdom

- 5.7.3.3 France

- 5.7.3.4 Italy

- 5.7.3.5 Spain

- 5.7.3.6 Russia

- 5.7.3.7 Rest of Europe

- 5.7.4 Asia-Pacific

- 5.7.4.1 China

- 5.7.4.2 Japan

- 5.7.4.3 India

- 5.7.4.4 South Korea

- 5.7.4.5 Australia & New Zealand

- 5.7.4.6 Rest of Asia-Pacific

- 5.7.5 Middle East and Africa

- 5.7.5.1 Saudi Arabia

- 5.7.5.2 United Arab Emirates

- 5.7.5.3 Turkey

- 5.7.5.4 South Africa

- 5.7.5.5 Rest of Middle East and Africa

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 Nidec Corporation

- 6.4.2 Johnson Electric Holdings Ltd.

- 6.4.3 Mabuchi Motor Co., Ltd.

- 6.4.4 Maxon Motor AG

- 6.4.5 Mitsuba Corporation

- 6.4.6 Buhler Motor GmbH

- 6.4.7 Denso Corporation

- 6.4.8 Robert Bosch GmbH

- 6.4.9 Continental AG

- 6.4.10 Valeo SA

- 6.4.11 Brose Fahrzeugteile SE

- 6.4.12 Ametek Inc.

- 6.4.13 MinebeaMitsumi Inc.

- 6.4.14 Mitsumi Electric Co., Ltd.

- 6.4.15 Shenzhen Kinmore Motor Co.

- 6.4.16 Constar MicroMotor

- 6.4.17 Wellings Holdings Ltd.