|

市场调查报告书

商品编码

1403089

半导体(硅)智慧财产权:市场占有率分析、产业趋势/统计、2024年至2029年成长预测Semiconductor (Silicon) Intellectual Property - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

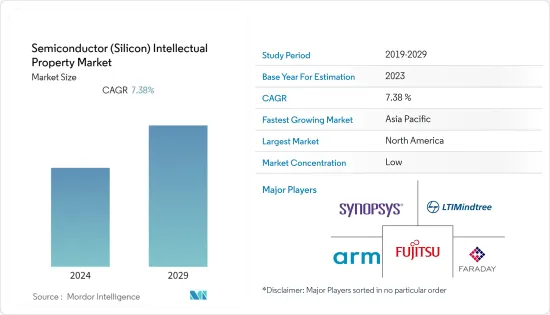

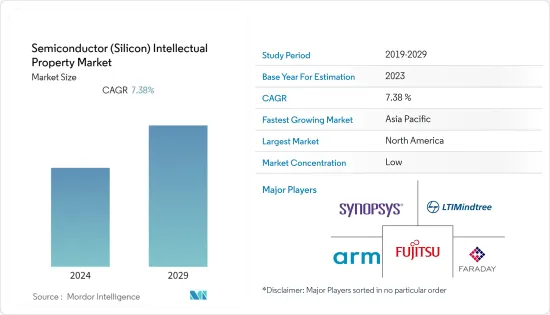

上年度半导体(硅)智慧财产权市场价值为62.6亿美元,预计未来五年将成长96亿美元,预测期内复合年增长率为7.38%。

主要亮点

- 随着半导体销售额的成长,半导体IP(SIP)市场正在经历快速成长。这个市场完全依赖半导体产业。过去 20 年来,半导体业务经历了显着成长。 SIP 业务实践包括与传统半导体、专用积体电路 (ASIC)、电子设计自动化 (EDA) 和设计服务市场类似的元素。然而,与 ASIC 和 EDA 产业中已建立的商业模式不同,SIP 商业模式更加复杂,因为在 IC 设计中成功部署商业性SIP 涉及供应链中的相关人员。

- 儘管业务实践和SIP业务模型已经变得有些统一,但行业仍然需要实现标准化,因为SIP产品类型和客户需求差异很大,而且EDA工具和流程技术经常变化。不断上升的设计成本和不断增加的市场压力正迫使企业寻求半导体IP製造商的服务。该市场的各种应用包括汽车、智慧型装置(行动电话和平板电脑)、电脑、周边设备等。该市场的主要成长动力包括全球消费性设备的普及以及对先进 SOC 设计和连网型设备的需求。嵌入式和可程式 DSP-IP 等新兴技术预计将进一步推动市场发展。

- 根据SEMI最新季度报告《世界晶圆厂预测》,2021年至2023年,全球半导体产业将花费超过5,000亿美元建造84座大型晶片製造设施,其中包括汽车和高效能运算(HPC)领域。投入更多资金并鼓励增加支出。报告也指出,2022年全球半导体材料市场收益将达726.9亿美元,其中台湾产值达201.3亿美元。中国新增产值129.7亿美元,较2021年成长7%。

- 系统晶片(SoC) 设计的复杂性超出了系统工程能力。设计复杂性的增加导致资料量的增加,使半导体开发比以往任何时候都更具挑战性。预计这将抑制市场成长。

- COVID-19大流行从需求和供应双方影响了整个半导体製造市场。此外,全球封锁和半导体工厂关闭加剧了供不应求。这种影响也反映在受调查的市场中。然而,其中许多影响可能是短期的。世界各国政府支持汽车和半导体产业的措施可能会刺激产业成长。

半导体(硅)智慧财产权市场趋势

消费性电子产品成为最大的最终用户领域

- 半导体智慧财产权核心广泛应用于智慧型手机、游戏机、微波炉、冰箱等家电产品。消费性电子产业正在快速发展,消费者需求压力迫使厂商提供差异化产品并引领市场。半导体被纳入行动电话等通讯设备以及游戏机、电视、家用电器等家用电器中。

- 积体电路(IC)的发明是消费性电子产业发展的主要驱动力之一,包括宽频和行动应用的兴起。

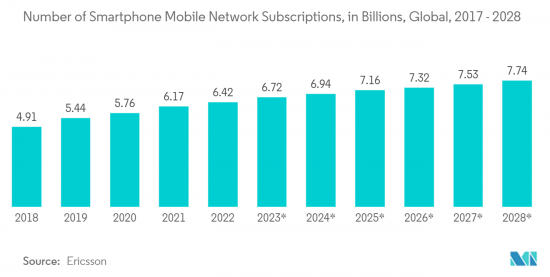

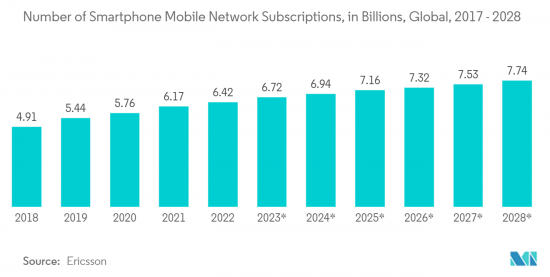

- 由于通讯市场平板设备和智慧型手机销量的增加,预计该市场将稳定成长。例如,根据爱立信的数据,全球智慧型手机行动网路用户数量预计将从2022年的64.2亿增加到2028年的77.4亿人。中国、印度和美国的智慧型手机行动网路订阅数量最多。

- 如今,智慧产品由复杂的电子系统组成,必须无错误运作。提高资料速度、小型化设备、支援多种无线技术以及延长电池寿命都需要详细的分析。此外,需要将各种功能整合到一台设备中,这使得 PCB 设计变得更加复杂。

- 由于消费性电子产品个人运算的进步以及智慧型手机八核心处理器的推出,多核心处理器市场正在经历显着成长。预计多核心处理器的成长将为所研究的市场提供强劲的成长机会。

北美占据主要市场占有率

- 从供应商和最终用户的角度来看,美国是整个半导体市场的领先市场之一。美国许多产业对智慧型命令和控制的需求不断增长,为许多半导体製造商提供了重要的市场机会。

- 许多市场供应商正在扩大在该地区的业务。此外,许多市场供应商都位于美国,这使得该区域市场具有竞争优势。美国政府也在该地区开拓半导体业务、支持半导体硅知识产权(IP)市场方面发挥重要作用。

- 加拿大的半导体IP产业包括多种产品和服务,惠及许多产业,包括消费性电子、医疗保健、交通和通讯。半导体开发在全国范围内获得国内资本来源方面面临差异,特别是在种子期前、种子期、早期轮次和后期阶段。因此,加拿大公司的外资持股比例整体相当高。同时,资金的缺乏为加拿大企业提前退出创造了不利的环境。

- 加拿大市场是一个新兴市场,CMC Microsystems 和 LSI Computer Systems 等知名公司在物联网连接、5G 和人工智慧/机器学习 (AI/ML)开拓等领域处于领先地位。创新不断进步。希望产学合作能进一步加强加拿大在全球半导体智慧财产权领域的地位,推动技术进步,并支持整个产业。

半导体(硅)智慧财产权产业概况

半导体(硅)智慧财产权市场是分散的,大型经销商能够进行向后和向前整合,并且许多参与者在国内和国际地区运作。重要参与者主要采取产品创新、併购等策略来维持优势。市场参与企业智原科技、摘要、ARM(Softbank Corporation)、LTI 和 Mindtree Limited。

2023年7月,智原科技宣布推出完整的SerDes(串列器/解串器)解决方案,包括联华电子28奈米製程节点上的SerDes IP设计。此外,我们还提供 IP 高级 (IPA) 服务,包括 IP 子系统整合、PHY 硬核实施、彻底的讯号完整性/电源完整性(SI/PI) 分析,以及整合封装和 PCB 设计。

2023 年 6 月,Synopsys Inc. 扩大了与 Samsung Foundry 的合作关係,合作创造多种专为半导体製造设计的智慧财产权 (IP)。目标是最大限度地降低设计风险并加快晶片成功的进程。过去,Synopsys 和三星合作开发了多种三星製程的 IP 解决方案,包括 8LPU、SF5、SF4 和 SF3。这些产品包括 Foundation IP、USB、PCI Express、112G 乙太网路、UCIe、LPDDR、DDR、MIPI 和各种其他 IP 元件。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

- 评估主要宏观趋势的影响

第五章市场动态

- 市场驱动因素

- 对连网型设备的需求不断增长

- 对现代 SoC 设计的需求不断增长

- 市场抑制因素

- IP商业模式与规模经济

第六章市场区隔

- 按收益类型

- 执照

- 版税

- 服务

- 按IP类型

- 处理器IP

- 有线/无线介面IP

- 其他IP类型

- 按行业分类

- 消费性电子产品

- 电脑及周边设备

- 车

- 产业

- 其他行业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 台湾

- 日本

- 韩国

- 印度

- 其他亚太地区

- 世界其他地区

- 北美洲

第七章竞争形势

- 公司简介

- Faraday Technology Corporation

- Fujitsu Ltd

- LTIMindtree Limited

- ARM Ltd(SoftBank)

- Synopsys Inc.

- Cadence Design Systems Inc.

- CEVA Inc.

- Andes Technology Corporation

- MediaTek Inc.

- Digital Media Professionals

- Imagination Technologies Ltd

- VeriSilicon Holdings Co., Ltd

- Achronix Semiconductor Corporation

- Rambus Incorporated

- eMemory Technology Inc.

- MIPS Tech, LLC

- 供应商市场占有率

第八章投资分析

第9章 市场的未来

The semiconductor (silicon) intellectual property market was valued at USD 6.26 billion in the previous year and is expected to register a CAGR of 7.38% during the forecast period to become USD 9.6 billion by the next five years.

Key Highlights

- The semiconductor IP (SIP) market is witnessing rapid growth, with growing semiconductor sales. The market studied is entirely dependent on the semiconductor industry. The semiconductor business has experienced significant growth in the last two decades. The SIP business practices include elements similar to those in traditional semiconductor or application-specific integrated circuits (ASIC), electronic design automation (EDA), and design services markets. However, unlike the well-established business models in the ASIC and EDA industries, SIP business models tend to be more complex, as several parties in the supply chain are involved with successfully deploying commercial SIP in an IC design.

- Although business practices and SIP business models have become somewhat uniform, the industry still needs to achieve standardization due to the wide variety of SIP product types, customer needs, and frequent changes in EDA tools and process technologies. Rising design costs and increasing market pressures are forcing companies to seek the services of semiconductor IP manufacturers. The various applications of this market include automobiles, smart devices (mobiles and tablets), computers, and peripherals. The significant growth driver of the market studied includes the emerging global adoption of consumer devices and the demand for advanced SOC designs and connected devices. Emerging technologies such as embedded and programmable DSP-IP are expected to further boost the market.

- According to SEMI's latest quarterly World Fab Forecast report, the worldwide semiconductor industry will invest more than USD 500 billion between 2021 and 2023 in building 84 large-scale chip manufacturing facilities, including automotive and high-performance computing ( HPC), fueling the spending increases. The source also states that the global semiconductor materials market generated revenues of USD 72.69 billion in 2022, of which USD 20.13 billion was made in Taiwan. A further USD 12.97 billion was generated in China, a 7 percent increase from 2021.

- The complexity of system-on-chip (SoC) designs is outpacing systems engineering capabilities. Increasing design complexity has given rise to growing data size and, thus, making semiconductor development more challenging than before. This is expected to restrain the growth of the market.

- The COVID-19 pandemic impacted the entire semiconductor manufacturing market on both the demand and supply sides. Additionally, global lockdowns and semiconductor factory closures have exacerbated supply shortages. The impact was also reflected in the studied market. However, many of these effects may be short-term in nature. Measures by governments around the world to support the automotive and semiconductor sectors could stimulate industry growth.

Semiconductor (Silicon) Intellectual Property Market Trends

Consumer Electronics to be the Largest End-user Vertical

- Semiconductor intellectual property cores are widely used in consumer electronics like smartphones, gaming consoles, microwaves, refrigerators, etc. The consumer electronics industry is evolving by leaps and bounds, and consumer demand pressures are forcing vendors to offer differentiated products and be ahead of the market. Semiconductors are incorporated into communication devices such as mobile phones and home appliances such as game consoles, televisions, and home appliances.

- The invention of integrated circuits (ICs) is one of the main drivers of the development of the consumer electronics industry, such as broadband and increasingly mobile applications.

- The market is anticipated to witness robust growth driven by increased tablet and communications market smartphone sales. For instance, according to Ericsson, the number of smartphone mobile network subscriptions worldwide was estimated to increase from 6.42 billion units in 2022 to 7.74 billion units in 2028. China, India, and the United States have the highest number of smartphone mobile network subscriptions.

- Today, smart products consist of complex electronic systems that require error-free operation. Increasing data speeds, miniaturizing devices, supporting multiple wireless technologies, and extending battery life require detailed analysis. Additionally, the requirement to integrate various functions into one device complicated PCB design.

- The market for multi-core processors is growing significantly with advancements in personal computing for consumer electronics and the advent of octa-core processors for smartphones. The growth in multi-core processors is anticipated to offer robust growth opportunities for the market studied.

North America to Hold Major Market Share

- The United States is one of the major markets in the overall semiconductor market, from vendors' and end-user perspectives. The growing need for intelligent command and control in many industries in the United States presents essential market opportunities for many semiconductor manufacturers.

- Most of the market vendors are expanding their presence in the region. Furthermore, many market vendors are US-based, which provides a competitive advantage to the regional market. The US government is also playing a significant role in developing the regional semiconductor business, supporting the semiconductor silicon intellectual property (IP) market.

- The Canadian semiconductor IP industry includes a variety of products and services that benefit a number of sectors, including consumer electronics, healthcare, transportation, and telecommunication. Semiconductor development has faced a gap in access to domestic sources of capital, especially in pre-seed, seed, and early-stage rounds and later stages across the country. This led to a significant percentage of foreign ownership across Canadian companies. At the same time, a lack of funding created an unfavorable environment for Canadian companies to exit too early.

- The market in Canada is experiencing development and innovation in areas like IoT connection, 5G, and artificial intelligence/ machine learning (AI/ML) acceleration due to prominent players like CMC Microsystems and LSI Computer Systems, Inc. driving the pace. It is anticipated that industry-academia collaboration would further solidify Canada's position in the global semiconductor IP environment, advancing technology and boosting the industry as a whole.

Semiconductor (Silicon) Intellectual Property Industry Overview

The semiconductor (Silicon) intellectual property market is fragmented, with large-scale dealers capable of backward and forward integration and many players running the business in national and international territories. The significant players primarily adopt strategies like product innovation and mergers and acquisitions to stay ahead. The players in the market are Faraday Technology Corporation., Synopsys Inc., Fujitsu Ltd., ARM Ltd (SoftBank), LTI, and Mindtree Limited. among others.

In July 2023, Faraday Technology Corporation introduced a complete SerDes (serializer/deserializer) solution that includes SerDes IP design on the UMC 28 nm process node. Additionally, they offer an IP advanced (IPA) service, encompassing IP subsystem integration, PHY hardcore implementation, and thorough signal integrity/power integrity (SI/PI) analysis on the system, incorporating package and PCB design.

In June 2023, Synopsys Inc. extended its partnership with Samsung Foundry to collaborate on creating a range of intellectual property (IP) designed for semiconductor manufacturing. The aim is to minimize design risk and expedite the process of achieving successful silicon outcomes. In the past, Synopsys and Samsung partnered to develop IP solutions for several of Samsung's processes, such as 8LPU, SF5, SF4, and SF3. These offerings included foundation IP, USB, PCI Express, 112 G Ethernet, UCIe, LPDDR, DDR, MIPI, and various other IP components.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 An Assessment of the Impact of Key Macro Trends

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Connected Devices

- 5.1.2 Growing Demand for Modern SoC Designs

- 5.2 Market Restraints

- 5.2.1 IP Business Model and Economies of Scale

6 MARKET SEGMENTATION

- 6.1 By Revenue Type

- 6.1.1 License

- 6.1.2 Royalty

- 6.1.3 Services

- 6.2 By IP Type

- 6.2.1 Processor IP

- 6.2.2 Wired and Wireless Interface IP

- 6.2.3 Other IP Types

- 6.3 By End-user Vertical

- 6.3.1 Consumer Electronics

- 6.3.2 Computers and Peripherals

- 6.3.3 Automobile

- 6.3.4 Industrial

- 6.3.5 Other End-user Verticals

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia Pacific

- 6.4.3.1 China

- 6.4.3.2 Taiwan

- 6.4.3.3 Japan

- 6.4.3.4 South Korea

- 6.4.3.5 India

- 6.4.3.6 Rest of the Asia Pacific

- 6.4.4 Rest of the World

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Faraday Technology Corporation

- 7.1.2 Fujitsu Ltd

- 7.1.3 LTIMindtree Limited

- 7.1.4 ARM Ltd (SoftBank )

- 7.1.5 Synopsys Inc.

- 7.1.6 Cadence Design Systems Inc.

- 7.1.7 CEVA Inc.

- 7.1.8 Andes Technology Corporation

- 7.1.9 MediaTek Inc.

- 7.1.10 Digital Media Professionals

- 7.1.11 Imagination Technologies Ltd

- 7.1.12 VeriSilicon Holdings Co., Ltd

- 7.1.13 Achronix Semiconductor Corporation

- 7.1.14 Rambus Incorporated

- 7.1.15 eMemory Technology Inc.

- 7.1.16 MIPS Tech, LLC

- 7.2 Vendor Market Share