|

市场调查报告书

商品编码

1849905

智慧功率模组(IPM):市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Intelligent Power Module (IPM) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

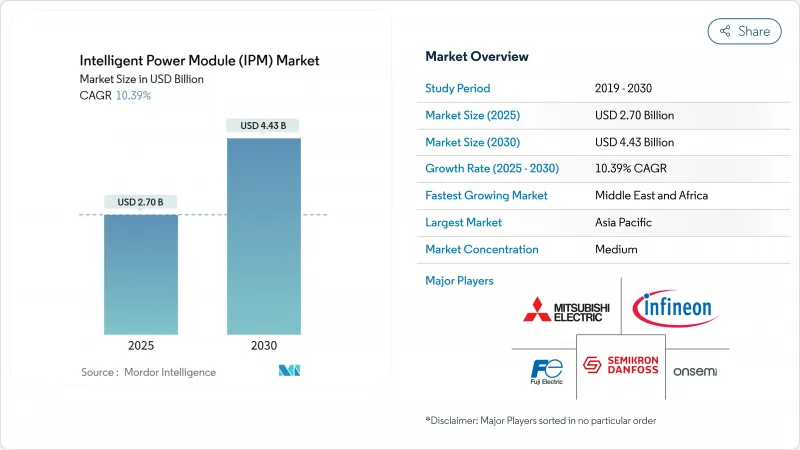

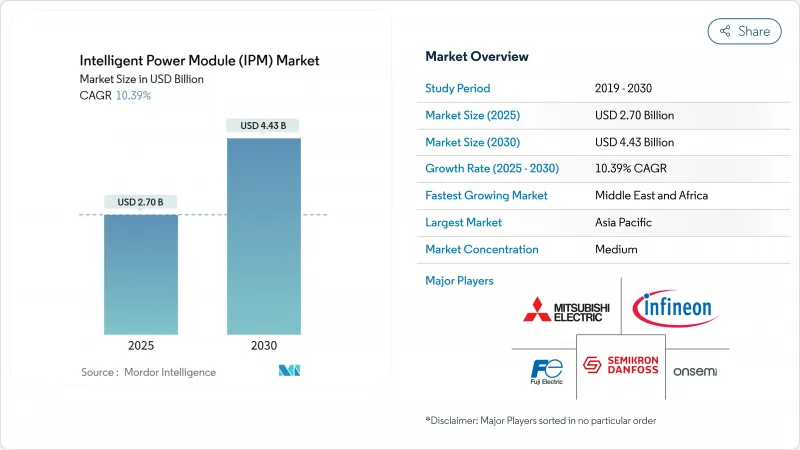

预计到 2025 年,智慧功率模组市场规模将达到 27 亿美元,到 2030 年将达到 44.3 亿美元,年复合成长率为 10.39%。

这一发展轨迹反映了电动车、可再生能源、工业自动化和先进家电领域向高效转换的转变。政策主导的电气化、日益严格的能源效率要求以及紧凑型模组快速取代分离式功率装置(从而缩短设计週期)推动了这一需求。宽能带隙半导体(尤其是碳化硅 (SiC) 和氮化镓 (GaN))的集成,实现了更高的开关频率、更低的损耗和更小的散热器,树立了硅基IGBT无法企及的全新性能标准。供应商随即推出了基于SiC的整合式电源管理 (IPM),这些IPM整合了片上闸极驱动器和保护逻辑,从而实现了提升汽车续航里程的牵引逆变器和降低平准化电力成本的太阳能微型逆变器。同时,围绕SiC晶圆产能和镓出口限制的供应链风险凸显了垂直整合和多源采购策略的重要性。

全球智慧功率模组(IPM)市场趋势与洞察

中国高效率电动车变频器用SiC基IPM需求快速成长

中国汽车製造商正在加速以碳化硅(SiC)MOSFET智慧功率模组取代牵引逆变器中的硅IGBT,从而将开关损耗降低高达50%,逆变器体积缩小30%,进而延长车辆续航里程并降低电池成本。比亚迪等行业一体化企业透过建造国内SiC晶体生长生产线、缩短前置作业时间并规避出口限制,确保了晶圆供应。预计到2027年,中国电动车中SiC智慧功率模组的采用率将超过65%,这一里程碑迫使国际竞争对手加快推进各自的SiC蓝图。这种区域领先地位再形成了全球智慧功率模组市场格局,使量化学习曲线提前两年完成,并比预期更快实现了SiC与硅的成本持平。

欧洲工业4.0维修中IPM伺服驱动器的快速应用

一家德国中小型机械製造商对其原有运动系统维修,采用基于IPM的伺服驱动器,实现了25%至40%的节能,并增加了预测性维护功能,以便整合到数位双胞胎平台中。标准化的外形尺寸和内建的安全功能,例如KEB的COMBIVERT F6控制器,简化了试运行,并减少了设备中期升级的停机时间。改装避免了整机更换,符合欧洲能源效率补贴的条件,并为模组供应商释放了利润丰厚的市场。这一趋势也推动了对600V和650V IPM的需求,这些IPM在30kW以下马达的成本和性能之间取得了平衡,巩固了欧洲作为高端自动化市场的地位。

宽能带隙晶圆供应受限

中国限制镓(氮化镓生产的关键原料)出口后,碳化硅晶圆的前置作业时间超过40週,导致市场两极化,汽车级基板的供应受到优先保障。配额政策有利于现有客户,阻碍了新进入者,并延缓了组件供应多元化。製造商纷纷加紧建造晶体生长设施,但炉体安装和晶锭认证需要24至30个月,这意味着在2027年之前不太可能出现实质缓解。

细分市场分析

600V级产品满足了家用电器和太阳能微型逆变器的需求,并支撑着智慧功率模组市场的中阶领域,预计到2024年将维持39.5%的收入成长。设计人员青睐600V级产品,是因为其成熟的供应链、广泛的闸极驱动器生态系统以及具有吸引力的价格分布。然而,在800V电池电动车和三相组串式逆变器的推动下,1200V级产品以14.2%的复合年增长率快速成长。在该领域,SiC CoolSiC MOSFET IPM实现了45 mΩ的导通电阻和低于100ppm的故障率,证明了其在安全至关重要的电动车传动系统中的应用潜力。 650-900V产品系列在工业UPS和机器人领域保持了其市场份额,而1700V产品则面向轨道交通和中压驱动等对长绝缘距离要求极高的应用领域。因此,开发人员越来越多地根据系统级效率目标而不是设备限制来选择电压等级,从而增强了智慧功率模组市场的多样性。

此次电压转变对散热架构和汇流排设计产生了影响。例如,1200V智慧功率模组(IPM)采用了无底板布局,从而降低了热阻并减轻了牵引组件的重量。同时,闸极驱动IC也得到了发展,能够支援负闸极电压、增强隔离并适应快速开关边缘。由于宽能带隙成本的下降,预计1200V智慧功率模组的市场规模将显着扩大,并提升其在该细分市场的份额。

到2024年,IGBT IPM将继续占据71.5%的收入份额,这主要得益于数十年来在製程方面的累积以及在家用电器和通用驱动领域的成本优势。然而,由于SiC MOSFET模组具有更高的击穿场强和更快的开关速度,能够降低导通损耗和关断损耗,从而实现更高的功率密度,因此其复合年增长率将达到27.8%。电动车牵引逆变器正在采用SiC IPM来提高每千瓦时的续航里程并满足重量目标,这促使汽车OEM厂商签署多年晶圆合约。

儘管GaN FET智慧功率模组在智慧功率模组产业仍处于起步阶段,但已被应用于开关频率为1MHz、磁路尺寸不断缩小的紧凑型电源。 Si MOSFET智慧功率模组则继续应用于低压马达驱动器和电动工具领域,在这些应用中,成本因素远比效率更为重要。因此,装置的选择变得更加重视应用细节,系统设计人员也越来越多地在不同子系统中混合使用不同的技术,这不仅拓宽了市场竞争的领域,也使得整合设计服务成为一项重要的差异化优势。

由于采用氧化铝或氮化铝陶瓷,直接键合铜(DBC)基板在导热性和成本之间取得了良好的平衡,预计到2024年,DBC基板的市场份额将达到46.1%。然而,活性金属硬焊(AMB)铜基板凭藉其更牢固的陶瓷-铜键合,将以16.1%的复合年增长率增长。 AMB基板优异的疲劳寿命使其在30千瓦以上的牵引和工业驱动应用中价格更高。

虽然铝绝缘金属基板仍然是家用逆变器的低成本选择,但Si3N4陶瓷基板已在机械衝击要求极高的领域(例如电子轴)占据了一席之地。基板技术的创新与宽能带隙的普及同步发展。因此,组件供应商透过垂直整合基板工厂或建立长期供应伙伴关係关係来确保产能。

智慧功率模组市场按工作电压(600V 模组,其他)、功率元件(基于 IGBT 的 IPM,其他)、基板材料(绝缘金属基板,其他)、电路拓扑(半桥,其他)、额定电流(高达 50A,其他)、终端用户产业(电器产品,其他)、销售管道(OEM,售后市场/地区进行市场改造和区域市场(OEM,售后市场/地区进行市场改装。

区域分析

预计亚太地区在2024年智慧功率模组市场收入中将维持48.3%的份额,这主要得益于中国积极的电动车生产、日本的消费性电子产业基础以及韩国电池供应链的扩张。中国国内的碳化硅晶体生长计画和电动车补贴政策促进了本地模组采购;日本三菱电机率先研发出1700V铁路模组,以支持该地区的高速铁路建设。印度的「印度製造」计画加速了工业自动化的普及,推动了对650V驱动器的需求。东南亚的契约製造采用基于IPM的AC马达以满足能源法规要求,从而扩大了区域销售量。

北美地区电动车产业的復苏推动了电动车的发展,工厂化生产的电动车外壳、太阳能微型逆变器以及本地化的逆变器和充电器工厂都得到了发展。美国提高了待机效率标准,促进了整合功率级的发展;而加拿大的可再生能源组合则刺激了串接型逆变器中对600V集成功率模组(IPM)的需求。墨西哥则崛起为汽车电力电子产品的出口中心,其组件需求符合美墨加协定(USMCA)的含量要求。

欧洲坚持以技术为中心的发展模式,将工业4.0维修与严格的环境设计规范结合。德国的中型机械製造商采用了符合SIL3安全等级的7级IPM(综合虫害管理),义大利对纺织机械改装,法国升级了暖通空调系统。西班牙和希腊的太阳能强制规定促使它们采用了3级IPM。

中东和非洲地区成长最快,复合年增长率达13.9%。由沙乌地阿拉伯和阿联酋牵头的可再生大型企划整合了智慧电网逆变器,这些逆变器需要性能强大的整合式电源模组(IPM)。南非升级了矿用输送机,采用IPM驱动装置以降低能耗。土耳其投资电动车充电器製造,创造了对1200V碳化硅(SiC)模组的本地需求。

在巴西的太阳能发电竞标和阿根廷的风能走廊中,南美洲公用事业规模的逆变器中使用1700V组件的比例正稳步增长。各地区政府已提供税收优惠,鼓励提高工业效率,以促进水泥厂和造纸厂安装整合式电源管理(IPM)系统。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 中国高效率电动车变频器用SiC基IPM需求快速成长

- 欧洲工业4.0维修中IPM伺服驱动器的快速应用

- 一级汽车OEM厂商车用充电器整合趋势

- 促进北美地区对超低待机功耗电器进行监管

- 美国采用微型/奈米逆变器进行太阳能发电将提升对 600V IPM 的需求。

- 市场限制

- 宽能带隙晶圆供应受限

- 热介面可靠性超过 1200 V 额定值

- 汽车零件製造商的 AEC-Q101检验成本不断上升

- 亚洲价格分布供应商侵害智慧财产权和价格下跌

- 价值链分析

- 监理展望

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 宏观趋势的影响

第五章 市场规模与成长预测

- 透过工作电压

- 600V模组

- 650-900V 模组

- 1200V模组

- 1700V以上模组

- 功率元件

- 基于IGBT的IPM

- 基于硅MOSFET的IPM

- 基于SiC MOSFET的IPM

- 基于GaN FET的IPM

- 材质基板

- 绝缘金属基板(Al)

- DBC陶瓷(AlN/Al2O3)

- AMB铜

- Si3N4陶瓷

- 透过电路配置

- 半桥

- 六块肌

- 七包等等。

- 按目前评级

- 最大电流 50A

- 51-100 A

- 100安培或以上

- 按最终用途行业划分

- 家用电器

- 工业自动化和伺服驱动器

- 电动和混合动力汽车

- 可再生能源和储能係统

- 铁路牵引和基础设施

- 暖通空调和楼宇系统

- 其他(医疗、航太)

- 按销售管道

- OEM

- 售后/改装

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 东南亚

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Mitsubishi Electric Corporation

- Infineon Technologies AG

- Fuji Electric Co., Ltd.

- ON Semiconductor Corporation

- Semikron Danfoss GmbH & Co. KG

- ROHM Co., Ltd.

- Vincotech GmbH

- STMicroelectronics NV

- Powerex Inc.

- Toshiba Electronic Devices & Storage Corp.

- Wolfspeed, Inc.

- Microchip Technology Inc.(Microsemi)

- Renesas Electronics Corporation

- Littelfuse, Inc.(IXYS)

- Dynex Semiconductor Ltd.

- CRRC Times Electric Co., Ltd.

- StarPower Semiconductor Ltd.

- Hitachi Energy Ltd.

- Navitas Semiconductor Corp.

- Alpha & Omega Semiconductor Ltd.

- Sanken Electric Co., Ltd.

- BYD Semiconductor Co., Ltd.

- Nanjing SilverMicro Electronics Co., Ltd.

- Vishay Intertechnology Inc.

- Danfoss Silicon Power GmbH

第七章 市场机会与未来展望

The Intelligent Power Module market size was valued at USD 2.70 billion in 2025 and is forecast to reach USD 4.43 billion by 2030, expanding at a 10.39% CAGR.

This trajectory reflected the shift toward high-efficiency conversion in electric vehicles, renewable energy, industrial automation, and advanced consumer appliances. Demand was reinforced by policy-driven electrification, tighter energy-efficiency mandates, and rapid substitution of discrete power devices with compact modules that shorten design cycles. The integration of wide-bandgap semiconductors, especially silicon carbide (SiC) and gallium nitride (GaN), allowed higher switching frequencies, lower losses, and smaller heat sinks, setting new performance baselines that silicon IGBTs could not match. Vendors responded by releasing SiC-based IPMs with on-chip gate drivers and protection logic, enabling traction inverters that improve vehicle range and solar micro-inverters that lower the levelized cost of electricity. At the same time, supply-chain risk surrounding SiC wafer capacity and gallium export controls underscored the importance of vertical integration and multi-sourcing strategies.

Global Intelligent Power Module (IPM) Market Trends and Insights

Surge in SiC-Based IPMs for High-Efficiency EV Inverters in China

Chinese automakers accelerated the replacement of silicon IGBTs with SiC MOSFET Intelligent power modules in traction inverters to cut switching losses by up to 50% and shrink inverter volume by 30%, thereby extending vehicle range and reducing battery cost. Vertically integrated players such as BYD secured wafer supply by adding domestic SiC crystal growth lines, shortening lead times, and insulating themselves from export restrictions. The adoption rate of SiC IPMs in Chinese EVs is projected to exceed 65% by 2027, a benchmark that forces international competitors to accelerate their own SiC roadmaps. This regional leadership reshaped the global Intelligent power module market by shifting volume learning curves two years ahead of schedule, driving cost parity between SiC and silicon earlier than expected.

Rapid Adoption of IPM Servo Drives in European Industry 4.0 Retrofits

Small and medium-sized German machine builders retrofitted legacy motion systems with IPM-based servo drives, achieving 25-40% energy savings while adding predictive maintenance hooks that integrate into digital-twin platforms. Standardized form factors with embedded safety functions, such as KEB's COMBIVERT F6 controllers, simplified commissioning, and reduced downtime for mid-life equipment upgrades. Retrofits avoided full machine replacement and qualified for European energy-efficiency subsidies, unlocking a high-margin niche for module suppliers. The trend also stimulated demand for 600 V and 650 V IPMs that balance cost and performance for motors below 30 kW, reinforcing Europe's position as a premium automation market.

Wide-Band-Gap Wafer Supply Constraints

SiC wafer lead times stretched beyond 40 weeks after China restricted gallium exports critical to GaN production, creating a bifurcated market where automotive-grade substrates commanded priority access. Allocation policies favored incumbent customers, delaying new entrants and slowing diversification of module supply. Manufacturers raced to add crystal-growth capacity, yet furnace installations and crystal ingot qualification required 24-30 months, meaning meaningful relief is unlikely before 2027.

Other drivers and restraints analyzed in the detailed report include:

- On-Board Charger Integration Trend Among Tier-1 Automotive OEMs

- Regulatory Push for Ultra-Low-Standby Appliances in North America

- Thermal-Interface Reliability Beyond 1200 V Ratings

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The 600 V class retained 39.5% revenue in 2024 because it matched appliance and solar micro-inverter needs, anchoring the mid-range of the Intelligent Power Module market. Designers favored its mature supply chain, broad gate-driver ecosystem, and attractive price points. Yet the 1200 V segment expanded swiftly at a 14.2% CAGR, propelled by 800 V battery electric vehicles and three-phase string inverters. Here, SiC CoolSiC MOSFET IPMs achieved an on-resistance of 45 mΩ and failure rates under 100 ppm, validating their use in safety-critical EV drivelines. The 650-900 V range preserved share in industrial UPS and robotics, while 1700 V products addressed rail traction and medium-voltage drives where high insulation distances matter. Consequently, developers now select voltage classes by system-level efficiency targets rather than device limitations, reinforcing a diverse Intelligent power module market.

This voltage migration influenced cooling architecture and busbar design. For instance, 1200 V IPMs adopted baseplate-less layouts that lowered thermal resistance and trimmed weight in traction packs. At the same time, gate-driver ICs evolved to support negative gate voltages and reinforced isolation, aligning with rapid switching edges. As wide-bandgap costs fell, the Intelligent power module market size for 1200 V designs is projected to lift the segment's Intelligent power module market share at a significant rate.

IGBT IPMs still commanded 71.5% revenue in 2024, owing to decades of process learning and competitive cost positioning across appliances and general-purpose drives. However, SiC MOSFET modules posted a 27.8% CAGR because their higher breakdown field and faster switching cut conduction and turn-off losses, enabling higher power density. Electric-vehicle traction inverters adopted SiC IPMs to squeeze extra kilometers per kilowatt-hour and meet weight targets, pushing automotive OEMs to lock multi-year wafer agreements.

GaN FET IPMs gained traction in compact power supplies where 1 MHz switching shrinks magnetics, though they remained a nascent slice of the Intelligent power module industry. Si MOSFET IPMs continued in low-voltage motor drives and power tools, where cost weightings trumped efficiency. As a result, device selection became application-specific; system designers increasingly mixed technologies across sub-systems, broadening the competitive field and elevating design-in services as a differentiator.

Direct bonded copper (DBC) substrates held 46.1% in 2024 because their alumina or AlN ceramics balanced thermal conductivity and cost. Yet active-metal-brazed (AMB) copper rose at a 16.1% CAGR by offering stronger ceramic-copper bonds that survived more than 20,000 power cycles, a key metric for automotive warranties. AMB's superior fatigue life justified its higher price in traction and industrial drives above 30 kW.

Insulated metal substrate aluminium remained the low-cost option for residential inverters, while Si3N4 ceramics gained footholds where mechanical shock mattered, such as e-axles. Substrate innovation progressed hand in hand with wide-bandgap adoption, because higher power density required better thermal spreading. Consequently, module vendors vertically integrated substrate shops or formed long-term supply partnerships to secure capacity.

The Intelligent Power Module Market is Segmented by Operational Voltage (600 V Modules, and More), by Power Device (IGBT-Based IPMs, and More), by Substrate Material (Insulated Metal Substrate, and More), by Circuit Configuration (Half-Bridge, and More), by Current Rating (Up To 50 A, and More), by End-Use Industry (Consumer Electronics and Home Appliances, and More), by Sales Channel (OEM and Aftermarket/Retrofit), and Geography.

Geography Analysis

Asia-Pacific retained 48.3% of 2024 revenue for the Intelligent Power Module market, underpinned by China's aggressive EV production, Japan's consumer electronics heritage, and South Korea's battery supply chain scaling. China's domestic SiC crystal growth programs and EV subsidies anchored local module sourcing, while Japan's Mitsubishi Electric pioneered 1700 V rail modules that served regional high-speed trains. India accelerated industrial automation adoption through "Make-in-India," boosting demand for 650 V drives. Southeast Asia's contract manufacturers adopted IPM-based AC motors to meet energy codes, broadening regional volume.

North America followed, driven by factory-built housing, solar micro-inverters, and a resurgent EV industry that localized inverter and charger plants. The United States mandated tighter standby efficiency that favored integrated power stages, while Canada's renewable portfolios spurred demand for 600 V IPMs in string inverters. Mexico emerged as an export base for automotive power electronics, tying module demand to USMCA content rules.

Europe maintained a technology-centric profile, combining Industry 4.0 retrofits with stringent eco-design rules. Germany's Mittelstand machine builders adopted seven-pack IPMs with SIL3 safety, Italy's retrofit textile machinery, and France's upgraded HVAC networks. Solar mandates in Spain and Greece favored three-level IPMs.

The Middle East and Africa posted the fastest growth at 13.9% CAGR on renewable mega-projects led by Saudi Arabia and the UAE, which integrated smart-grid inverters requiring rugged IPMs. South Africa upgraded mining conveyors with IPM drives to cut energy intensity. Turkey invested in EV charger manufacturing, creating local demand for 1200 V SiC modules.

South America remained smaller yet steadily rising, with Brazil's solar auctions and Argentina's wind corridors utilizing 1700 V modules for utility-scale converters. Regional governments offered tax incentives for industrial efficiency, encouraging IPM installations in cement and paper mills.

- Mitsubishi Electric Corporation

- Infineon Technologies AG

- Fuji Electric Co., Ltd.

- ON Semiconductor Corporation

- Semikron Danfoss GmbH & Co. KG

- ROHM Co., Ltd.

- Vincotech GmbH

- STMicroelectronics N.V.

- Powerex Inc.

- Toshiba Electronic Devices & Storage Corp.

- Wolfspeed, Inc.

- Microchip Technology Inc. (Microsemi)

- Renesas Electronics Corporation

- Littelfuse, Inc. (IXYS)

- Dynex Semiconductor Ltd.

- CRRC Times Electric Co., Ltd.

- StarPower Semiconductor Ltd.

- Hitachi Energy Ltd.

- Navitas Semiconductor Corp.

- Alpha & Omega Semiconductor Ltd.

- Sanken Electric Co., Ltd.

- BYD Semiconductor Co., Ltd.

- Nanjing SilverMicro Electronics Co., Ltd.

- Vishay Intertechnology Inc.

- Danfoss Silicon Power GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in SiC-based IPMs for high-efficiency EV inverters in China

- 4.2.2 Rapid adoption of IPM servo drives in European Industry 4.0 retrofits

- 4.2.3 On-board charger integration trend among Tier-1 automotive OEMs

- 4.2.4 Regulatory push for ultra-low-stand-by home appliances in North America

- 4.2.5 Solar micro-/nano-inverter build-outs boosting 600 V IPM demand in the US

- 4.3 Market Restraints

- 4.3.1 Wide-band-gap wafer supply constraints

- 4.3.2 Thermal-interface reliability beyond 1200 V ratings

- 4.3.3 High automotive AEC-Q101 validation costs for module makers

- 4.3.4 IP infringement and price erosion by low-end Asian vendors

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macro Trends

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Operational Voltage

- 5.1.1 600 V Modules

- 5.1.2 650-900 V Modules

- 5.1.3 1200 V Modules

- 5.1.4 1700 V and Above Modules

- 5.2 By Power Device

- 5.2.1 IGBT-based IPMs

- 5.2.2 Si MOSFET-based IPMs

- 5.2.3 SiC MOSFET-based IPMs

- 5.2.4 GaN FET-based IPMs

- 5.3 By Substrate Material

- 5.3.1 Insulated Metal Substrate (Al)

- 5.3.2 DBC Ceramic (AlN / Al2O3)

- 5.3.3 AMB Copper

- 5.3.4 Si3N4 Ceramic

- 5.4 By Circuit Configuration

- 5.4.1 Half-Bridge

- 5.4.2 Six-Pack

- 5.4.3 Seven-Pack and Others

- 5.5 By Current Rating

- 5.5.1 Up to 50 A

- 5.5.2 51-100 A

- 5.5.3 Above 100 A

- 5.6 By End-Use Industry

- 5.6.1 Consumer Electronics and Home Appliances

- 5.6.2 Industrial Automation and Servo Drives

- 5.6.3 Electric and Hybrid Vehicles

- 5.6.4 Renewable Energy and ESS

- 5.6.5 Rail Traction and Infrastructure

- 5.6.6 HVAC and Building Systems

- 5.6.7 Others (Medical, Aerospace)

- 5.7 By Sales Channel

- 5.7.1 OEM

- 5.7.2 Aftermarket / Retrofit

- 5.8 By Geography

- 5.8.1 North America

- 5.8.1.1 United States

- 5.8.1.2 Canada

- 5.8.1.3 Mexico

- 5.8.2 South America

- 5.8.2.1 Brazil

- 5.8.2.2 Argentina

- 5.8.2.3 Rest of South America

- 5.8.3 Europe

- 5.8.3.1 Germany

- 5.8.3.2 United Kingdom

- 5.8.3.3 France

- 5.8.3.4 Italy

- 5.8.3.5 Spain

- 5.8.3.6 Russia

- 5.8.3.7 Rest of Europe

- 5.8.4 Asia-Pacific

- 5.8.4.1 China

- 5.8.4.2 Japan

- 5.8.4.3 India

- 5.8.4.4 South Korea

- 5.8.4.5 South-East Asia

- 5.8.4.6 Rest of Asia-Pacific

- 5.8.5 Middle East and Africa

- 5.8.5.1 Middle East

- 5.8.5.1.1 Saudi Arabia

- 5.8.5.1.2 United Arab Emirates

- 5.8.5.1.3 Turkey

- 5.8.5.1.4 Rest of Middle East

- 5.8.5.2 Africa

- 5.8.5.2.1 South Africa

- 5.8.5.2.2 Nigeria

- 5.8.5.2.3 Rest of Africa

- 5.8.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Mitsubishi Electric Corporation

- 6.4.2 Infineon Technologies AG

- 6.4.3 Fuji Electric Co., Ltd.

- 6.4.4 ON Semiconductor Corporation

- 6.4.5 Semikron Danfoss GmbH & Co. KG

- 6.4.6 ROHM Co., Ltd.

- 6.4.7 Vincotech GmbH

- 6.4.8 STMicroelectronics N.V.

- 6.4.9 Powerex Inc.

- 6.4.10 Toshiba Electronic Devices & Storage Corp.

- 6.4.11 Wolfspeed, Inc.

- 6.4.12 Microchip Technology Inc. (Microsemi)

- 6.4.13 Renesas Electronics Corporation

- 6.4.14 Littelfuse, Inc. (IXYS)

- 6.4.15 Dynex Semiconductor Ltd.

- 6.4.16 CRRC Times Electric Co., Ltd.

- 6.4.17 StarPower Semiconductor Ltd.

- 6.4.18 Hitachi Energy Ltd.

- 6.4.19 Navitas Semiconductor Corp.

- 6.4.20 Alpha & Omega Semiconductor Ltd.

- 6.4.21 Sanken Electric Co., Ltd.

- 6.4.22 BYD Semiconductor Co., Ltd.

- 6.4.23 Nanjing SilverMicro Electronics Co., Ltd.

- 6.4.24 Vishay Intertechnology Inc.

- 6.4.25 Danfoss Silicon Power GmbH

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment