|

市场调查报告书

商品编码

1403134

奈米碳管-市场占有率分析、产业趋势与统计、2024-2029 年成长预测Carbon Nanotubes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

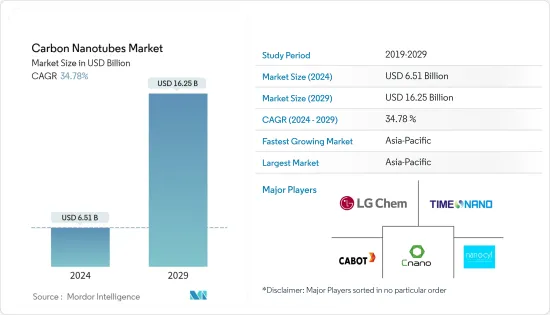

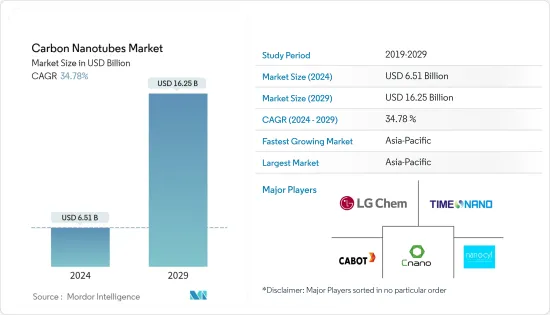

奈米碳管市场规模预计到2024年为65.1亿美元,预计到2029年将达到162.5亿美元,在预测期内(2024-2029年)复合年增长率为34.78%。

儘管COVID-19大流行奈米碳管市场带来了各种挑战,但它也提供了特定领域的成长机会。随着世界从大流行中恢復,奈米碳管市场正在逐渐恢復势头,预计在预测期内将继续成长。

由于能源、汽车、电子、航太和其他工业应用等各行业的应用不断增加,市场需求增加。

从中期来看,奈米碳管在电动车中的使用不断增加,以及许多应用中对先进材料的需求不断增加,是推动市场的关键因素。

另一方面,环境问题和健康安全问题预计将抑制市场成长。

预计未来几年对能源储存设备的需求不断增长对市场来说是个好兆头。

亚太地区占据最高的市场占有率,预计该地区将在预测期内主导市场。

奈米碳管市场趋势

主导市场的能源领域

- 由于其高表面积和导电性,奈米碳管作为主要用于太阳能电池、燃料电池催化剂和储氢等能源应用的催化剂触媒撑体而受到关注。这些独特的性质使得奈米碳管可以用作能量转换和储存装置中的辅助材料。

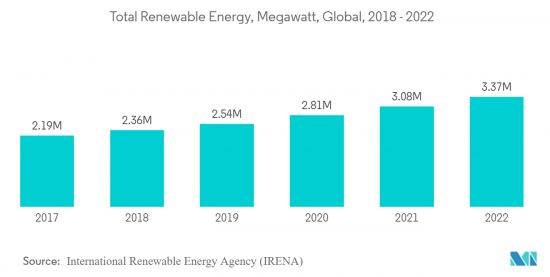

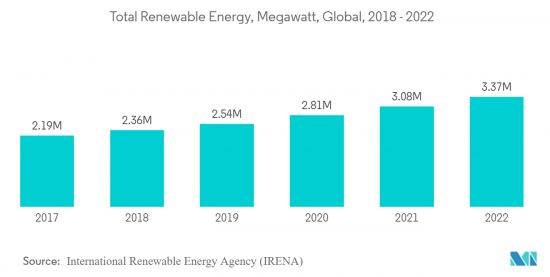

- 可再生能源的成长是由主要市场更雄心勃勃的扩张政策所推动的,部分原因是为了应对当前的能源危机。过去五年可再生能源的采用扩张速度加快主要归因于两个因素。

- 首先,全球能源危机导致石化燃料和电力价格急剧上升,增加了可再生能源发电技术的经济吸引力。

- 其次,俄罗斯入侵乌克兰导致石化燃料进口国,特别是欧洲国家,越来越强调可再生能源的能源安全效益。

- 儘管风能和太阳能补贴逐步取消,但随着未来五年成长阶段,中国将在 2022 年至 2027 年间占全球可再生能源发电量的近一半。我们正计划引入新的补贴。 「十四五」规划中雄心勃勃的可再生能源目标、市场改革和地方政府的大力支持为可再生能源提供了长期收益确定性。

- 欧盟(EU)是仅次于中国的第二大成长市场,过去五年(2010年至2015年)再生能源可再生量稳定成长。然而,2022 年至 2027 年间,发展速度预计将增加一倍以上。甚至在俄罗斯入侵乌克兰之前,一些欧盟成员国就已经制定了雄心勃勃的目标和政策,以加速可再生能源的部署,石化燃料到零。

- 在美国,可再生能源的部署在过去五年中几乎翻了一番。 IRA 于 2022 年 8 月通过,将再生能源税额扣抵延长至 2032 年,为风能和太阳能发电工程提供了前所未有的长期前景。在太阳能发电和竞争性竞标的推动下,印度的竞争装机量将在预测期内增加,以实现政府在 2030 年实现 500 吉瓦可再生能源的雄心勃勃的目标。预计将翻倍。

- 因此,这些因素预计将推动奈米碳管在能源产业的消费。

亚太地区主导市场

- 中国是亚太地区最大的碳奈米材料生产国和消费国。丰富的可用原材料和低廉的生产成本支撑着该国碳奈米材料市场的成长。

- 由于其非凡的电气性能,奈米碳管在电气和奈米碳管应用中具有广泛的应用,例如光伏、感测器、半导体装置、显示器、导体、燃料电池、收集器和电池。

- 中国拥有世界上最广泛的电子产品生产基地,为韩国、新加坡和台湾等老牌上游生产商提供了激烈的竞争。智慧型手机、OLED电视和平板电脑等电子产品在家用电子电器领域成长最快。随着中阶可支配收入的增加,对电子产品的需求预计将增长,这将很快带动奈米碳管市场。

- 印度政府正在与重要的半导体公司进行谈判,以建立本地生产。印度政府已根据「印度改良半导体计画」邀请从 2023 年 6 月起在印度设立半导体和显示器工厂的新申请,投资额为 7,600 亿印度卢比(约 100 亿美元)。

- 印度在汽车产业进行了大量投资。汽车业近期的投资和发展计画如下。

- 2023年1月,名爵汽车印度公司宣布投资1亿美元扩大产能。 2022 年 12 月,Mahindra & Mahindra 透露计画投资 1,000 亿印度卢比(12 亿美元)在浦那建造电动车製造厂。这项投资凸显了电动车产业日益增长的重要性。

- 日本电子产品产业是拉动日本半导体销售需求的最重要因素。日本约有 30 个半导体晶圆厂,涉及製造各种半导体晶片。日本半导体产量2021与前一年同期比较13%,2022年将成长10%,产值达30746亿日圆(233.1亿美元)。 2023年的成长率预计为1%。

- 根据日本工业协会(JAMA)的报告,2022年日本的小客车产量为7,427,179辆,卡车产量为1,286,414辆。这可能会影响奈米碳管市场。

- 因此,由于上述原因,亚太地区预计将在预测期内推动市场成长。

奈米碳管产业概况

全球奈米碳管市场本质上是部分一体化的,国际和国内的参与企业数量较少,分布在不同地区。市场主要企业包括LG化学、成都有机化学(时代纳米)、卡博特公司、江苏纳诺科技、Nanocyl SA等。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 扩大奈米碳管在电动车的使用

- 许多应用对先进材料的需求不断增长

- 抑制因素

- 环境问题以及健康与安全问题

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 专利分析

第五章市场区隔(市场规模(金额/数量))

- 按类型

- 多壁奈米碳管(MW奈米碳管)

- 单壁奈米碳管(SW奈米碳管)

- 其他类型(扶手椅奈米碳管、锯齿形奈米碳管)

- 按最终用户产业

- 电子产品

- 航太/国防

- 车

- 医疗保健

- 活力

- 其他最终用户产业(纺织、塑胶/复合材料、建筑)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 中东和非洲其他地区

- 亚太地区

第六章竞争形势

- 合併、收购、合资、合伙和协议

- 市场占有率(%)/排名分析

- 主要企业策略

- 公司简介

- Arkema

- Cabot Corporation

- CHASM

- Chengdu Organic Chemicals Co. Ltd(Timesnano)

- Hyperion Catalysis International

- Jiangsu Cnano Technology Co. Ltd

- Kumho Petrochemical

- LG Chem

- Meijo Nano Carbon

- Nano-C

- Nanocyl SA

- Ocsial

- Raymor Industries Inc.

- Showa Denko KK(Resonac Holdings Corporation)

第七章 市场机会及未来趋势

- 能源储存设备需求增加

- 製药领域需求量大的材料

The Carbon Nanotubes Market size is estimated at USD 6.51 billion in 2024, and is expected to reach USD 16.25 billion by 2029, growing at a CAGR of 34.78% during the forecast period (2024-2029).

The COVID-19 pandemic posed various challenges in the Carbon nanotubes market but also represented opportunities for growth in specific areas. The industry has adapted to the changing landscape in the automotive sector and various other advanced applications, As the world is recovering from the pandemic, the carbon nanotubes market is gradually regaining its momentum and will continue to grow during the forecast period.

The market saw a rise in demand with the increase in applications in various industries, including energy, automotive, electronics, aerospace, and other such industrial applications.

In the medium term, the major factors driving the market studied are the growing usage of carbon nanotubes in electric vehicles and the increasing demand for advanced materials in numerous applications.

On the flip side, environmental concerns and health safety issues are anticipated to restrain the market growth.

Increasing demand for energy storage devices is expected to act as an opportunity for the market in the coming years.

Asia-Pacific accounted for the highest market share, and the region is expected to dominate the market during the forecast period.

Carbon Nanotubes Market Trends

Energy Segment to Dominate the Market

- Carbon nanotubes (CNTs) received much attention as catalyst support for energy applications, primarily solar cells, fuel cell catalysts, and hydrogen storage, due to their high surface area and conductivity. These unique properties allow CNTs to be used as supplemental material for energy conversion and storage devices.

- Renewable growth is propelled by more ambitious expansion policies in critical markets, partly in response to the current energy crisis. The accelerated adoption of renewable energy in the last five years' expansion rate results primarily from two factors.

- First, high fossil fuel and electricity prices resulting from the global energy crisis made renewable power technologies much more economically attractive,

- Second, Russia's invasion of Ukraine increasingly caused fossil fuel importers, especially in Europe, to value renewable energy's energy security benefits.

- China plans to install almost half of new global renewable power capacity over 2022-2027, as growth accelerates in the next five years despite the phaseout of wind and solar PV subsidies. Ambitious renewable energy targets in the 14th Five-Year Plan, market reforms, and provincial solid government support provide long-term revenue certainty for renewables.

- The European Union, the second-largest growth market after China, had stable renewable capacity expansion in the past five years compared to 2010-2015. But its pace of development is expected to more than double during 2022-2027. While several EU member countries had already introduced ambitious targets and policies to accelerate renewable energy deployment before Russia invaded Ukraine since then, the European Union proposed even more aggressive goals under the REPowerEU package to eliminate Russian fossil fuel imports by 2027.

- In the United States, renewable energy expansion almost doubled in the last five years. The IRA passed in August 2022 extended tax credits for renewables until 2032, providing unprecedented long-term visibility for wind and solar PV projects. In India, new installations are set to double over our forecast period, led by solar PV and driven by competitive auctions implemented to achieve the government's ambitious target of 500 GW of renewable power by 2030.

- Therefore, these factors are projected to boost the consumption of carbon nanotubes in the energy industry.

Asia-Pacific to Dominate the Market

- China is the largest producer and consumer of carbon nanomaterials in Asia-Pacific. The abundance of available raw materials and the low cost of production supported the growth of the carbon nanomaterials market in the country.

- Because of CNT's extraordinary electrical properties, CNT finds applications in electrical and electronic applications such as photovoltaics, sensors, semiconductor devices, displays, conductors, fuel cells, harvesters, and batteries.

- China includes the world's most extensive electronics production base and offers tough competition to existing upstream producers, such as South Korea, Singapore, and Taiwan. Electronic products, such as smartphones, OLED TVs, tablets, etc., include the highest growth in the market in the consumer electronics segment. With the increase in the disposable income of the middle-class population, the demand for electronic products is estimated to grow, thereby driving the CNT market shortly.

- The Indian government is talking with significant semiconductor companies to set up local manufacturing. The government invited new applications for setting up Semiconductor Fabs and Display Fabs in India from June 2023 under the Modified Semicon India Programme with an outlay of INR 76,000 crore (~10 billion USD).

- The country saw large investments in the automotive sector. Recent and planned investments and developments in the automobile sector include

- In January 2023, MG Motor India announced a USD 100 million investment to expand capacity. In December 2022, Mahindra & Mahindra revealed plans to invest INR 10,000 crore (USD 1.2 billion) in an EV manufacturing plant in Pune. This investment emphasizes the growing significance of the EV sector.

- Japan's electronic products industry is the most significant factor driving demand for semiconductor sales in Japan. Japan includes about 30 semiconductor fab industries that are involved in the manufacturing of various semiconductor chips. Japan's semiconductor production registered a 13% y-o-y in 2021 and 10% in 2022, with production value reaching JPY 3,074.6 billion (USD 23.31 billion). The growth for the year 2023 is forecasted at 1%.

- As per the reports by the Japan Automobile Manufacturers Association (JAMA), the country produced 7,427,179 units of passenger cars and 1,286,414 units of trucks in 2022. It is likely to impact the CNT market.

- Hence, due to the reasons mentioned above, Asia-Pacific is anticipated to drive the market's growth during the forecast period.

Carbon Nanotubes Industry Overview

The global carbon nanotube market is partially consolidated in nature, with a few international and domestic players across different regions. Some of the major companies in the market include LG Chem, Chengdu Organic Chemicals Co. Ltd (Timesnano), Cabot Corporation, Jiangsu Cnano Technology Co. Ltd, and Nanocyl SA, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Usage of Carbon Nantotubes in Electric Vehicles

- 4.1.2 Increasing Demand for Advance Materials in Numerous Applications

- 4.2 Restraints

- 4.2.1 Environmental Concerns and Health Safety Issues

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Patent Analysis

5 MARKET SEGMENTATION (Market Size in Value and Volume)

- 5.1 By Type

- 5.1.1 Multi-walled Carbon Nanotubes (MWCNT)

- 5.1.2 Single-walled Carbon Nanotubes (SWCNT)

- 5.1.3 Other Types (armchair carbon nanotubes and zigzag carbon nanotubes)

- 5.2 By End-user Industry

- 5.2.1 Electronics

- 5.2.2 Aerospace and Defense

- 5.2.3 Automotive

- 5.2.4 Healthcare

- 5.2.5 Energy

- 5.2.6 Other End-user Industries (Textiles, Plastics and Composites, and Construction)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)/Ranking Analysis**

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Arkema

- 6.4.2 Cabot Corporation

- 6.4.3 CHASM

- 6.4.4 Chengdu Organic Chemicals Co. Ltd (Timesnano)

- 6.4.5 Hyperion Catalysis International

- 6.4.6 Jiangsu Cnano Technology Co. Ltd

- 6.4.7 Kumho Petrochemical

- 6.4.8 LG Chem

- 6.4.9 Meijo Nano Carbon

- 6.4.10 Nano-C

- 6.4.11 Nanocyl SA

- 6.4.12 Ocsial

- 6.4.13 Raymor Industries Inc.

- 6.4.14 Showa Denko KK (Resonac Holdings Corporation)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand for Energy Storage Devices

- 7.2 Highly Desired Material in the Pharmaceutical Sector

![奈米碳管市场:趋势、机会与竞争分析[2024-2030]](/sample/img/cover/42/1496967.png)