|

市场调查报告书

商品编码

1403847

混合动力汽车:市场占有率分析、产业趋势与统计、2024年至2029年成长预测Hybrid Vehicle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

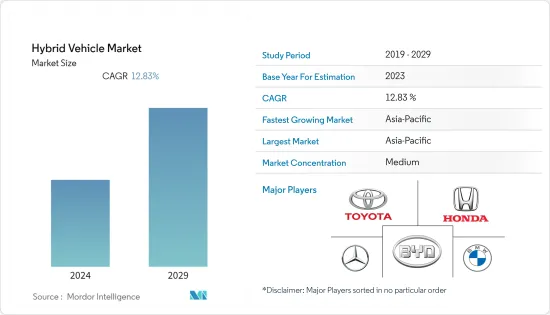

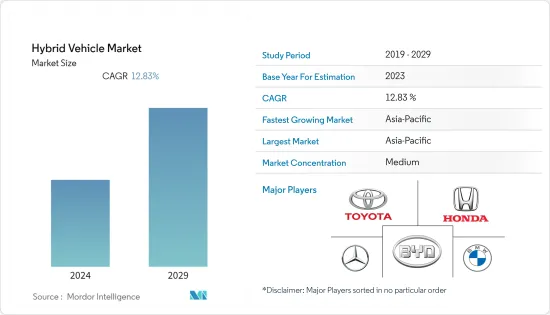

混合动力汽车市场规模为2,317.7亿美元,预计在预测期内将达到4,783.3亿美元,复合年增长率为12.83%。

主要亮点

- COVID-19 大流行对混合动力汽车市场产生了积极影响。 COVID-19 提高了环保意识,这种担忧现在反映在对更永续的电动车和混合的购买意愿中。由于製造商计划推出新型号以吸引客户,因此预计预测期将乐观。例如,澳洲丰田公司于 2022 年 11 月宣布对其广受欢迎的Corolla掀背车和轿车系列进行多项更新,包括丰田连网型服务功能和最新一代混合动力传动系统。

- 从长远来看,制定严格的排放和燃油经济性法规以及政府鼓励购买和采用混合汽车的激励措施是推动市场成长的关键因素。此外,随着各国政府采取严格的监管和奖励措施,以及加强建设电动车公共充电站,混合汽车市场预计将出现高速成长。

- 例如,2022年2月,印度政府表示,2023年混合和电动车早期采用和製造(FAME)计划下的补贴预计为29.8亿印度卢比(3.51亿美元),是印度政府的3.5倍多。本财政年度的拨款为80 亿印度卢比(9,650 万美元),约为2021 财政年度拨款的九倍。

- 亚太地区混合动力汽车市场预计在预测期内将呈现高成长率。该地区市场的成长得益于中国、印度、日本和韩国混合汽车销量的增加。亚太地区是混合动力汽车市场的主要企业,如比亚迪、丰田、日产、本田、起亚、现代等,他们的积极进入该领域为该市场创造了良好的环境。

- 例如,2022年11月:起亚中国在进博会上参展了小型纯电动SUV“EV6”,并宣布将于2023年在中国上市。此外,起亚计画在2026年在中国陆续推出五款混合型,首先是第五代Sportage紧凑型SUV的HEV车型。

混合车市场趋势

政府补贴和政策不断增加推动市场

- 世界各国政府为购买电动车和混合汽车的客户提供许多补贴(退税和奖励)。例如

- 2022年11月,中国工业和资讯化部在其官方网站上公布了《免征车辆购置税的新能源车型目录》。入选的插电式混合型包括14款小客车(包括奇瑞大神和长城汽车摩卡PHEV)、3辆公车、4辆卡车和8辆特种车。

- 巴西、印度和墨西哥等新兴国家对混合的需求不断增加,这些国家的废气法规非常严格,对低排放和零排放气体汽车的需求也增加。巴西政府对混合提供税收减免,包括插电式混合、混合电动车和CNG混合。同样,印度政府宣布将着名的 FAME II 计划延长至 2024 年,以促进全国范围内的电动出行。各大主要企业也计划参与该国的 Eco-Drive。例如,2022年3月,丰田汽车确认计画扩大在印度生态旅游领域的参与,并准备在未来几年推出多款混合。第一批产品将在当地生产,并将于明年推出市场。

- 美国和欧洲政府也致力于降低排放气体法规,以减少温室气体排放并提高车辆燃油效率。例如,美国运输部製定了汽车企业平均燃油经济性 (CAFE) 标准。英国承诺在2050年实现净零排放,并提案2035年禁止销售所有污染汽车。德国的目标是到年终年底将温室气体排放减少40%,到年终减少55%,到2050年终减少至95%,以支持市场成长。

- 在沿岸地区,电动车和混合动力汽车运输正在变得普及,特别是在以色列、阿曼、约旦、沙乌地阿拉伯和阿拉伯联合大公国。例如,根据杜拜计程车管理局的2021-2023年战略计划,杜拜道路和运输管理局(RTA)宣布已签署采购2,219辆新车的合同,以补充杜拜计程车管理局的车队。此次采购包括 1,775 辆混合汽车,使我们车队的混合汽车持有达到 4,105 辆。

中国在开拓亚太混合汽车市场中发挥关键作用

- 亚太地区混合汽车市场预计在预测期内将成长。中国、日本和韩国对混合汽车的需求不断增长正在推动该地区的市场成长。

- 由于其巨大的生产能力和消费需求,中国是全球混合电动车市场的主要参与企业。疫情过后,中国经济成长动能电动车,混合和插电混合的需求开始呈现正面趋势。

- 例如,2022年10月新能源小客车批发量为67.6万辆,与前一年同期比较成长85.8%。纯电动车(BEV)与前一年同期比较50.8万辆,插混合电动车(PHEV)年增69.6%至50.8万辆,插电式混合动力车(PHEV)与前一年同期比较16.7万辆,内燃机混合小客车年增9 %与前一年同期比较,总数为7,300台。

- 中国政府为购买电动车和混合汽车的客户提供许多补贴(税收减免和奖励)。中国政府最近延长了原定于 2020 年到期的免税和补贴,并暗示新的投资从长远来看可能进一步提振中国的混合电动车市场。出台了支持新能源汽车 (NEV) 行业的措施,受到-19疫情的严重打击。

- 预测期内,Delta的广州、东莞、珠海、佛山、中山以及南京、杭州、陕西、山东等中国30多个城市计划实现公共运输100%电气化,混合公车也有可能增加采用。上述因素以及新兴市场的开拓预计将有助于中国脱颖而出,成为製造商独特的投资目的地,并在预测期内对混合动力汽车市场的整体成长发挥关键作用。

混合车产业概况

进入混合汽车市场的主要企业包括福特汽车公司、通用汽车公司、本田汽车、戴姆勒公司和大众汽车公司,它们计划加强产品系列併在混合汽车市场取得技术突破。例如

三菱汽车公司宣布将于 2022 年 11 月在加拿大和美国推出新款Outlander跨界 SUV 的插电式混合(PHEV) 车型。它提供了SUV在各种天气和路况下所应有的实用性和强劲驾驶性能,并提供了只有电动车才能提供的安全驾驶。

2022年10月,大发汽车宣布打算在2023年秋季推出一款混合小型货车。紧凑型混合(HV)「Rocky」采用的混合系统针对轻型车进行了显着改进,实现了超过30公里/公升(WLTC模式)的燃油效率,处于轻型车级别的顶级水平。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 燃油效率法规和政府奖励

- 市场抑制因素

- 纯电动车需求不断成长

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔(市场规模:美元)

- 按混合型分类

- 微混合

- 轻度混合

- 全混合

- 插电式混合

- 按车型

- 小客车

- 商用车

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 挪威

- 荷兰

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 世界其他地区 中东/非洲

- 南美洲

- 中东/非洲

- 北美洲

第六章竞争形势

- 供应商市场占有率

- 公司简介

- Toyota Motor Corporation

- Nissan Motor Co. Ltd

- Honda Motor company Ltd

- Hyundai Motor Company

- Kia Motors Corporation

- Volvo Group

- Volkswagen Group

- BMW AG

- Ford Motor Company

- Mercedes-Benz Group

- BYD Co. Ltd

第七章 市场机会及未来趋势

- 混合动力引擎技术开发

The hybrid vehicle market was valued at USD 231.77 billion, and it is expected to reach USD 478.33 billion by registering a CAGR of 12.83% during the forecast period.

Key Highlights

- The COVID-19 pandemic positively impacted the hybrid vehicle market as the pandemic has crystallized attitudes toward the environment by revealing cleaner air and lower pollution levels during the lockdown. COVID-19 increased their environmental awareness, and these concerns are now reflected in intentions to purchase more sustainable electric and hybrid vehicles. The forecast period is expected to be optimistic as manufacturers plan to launch new models to attract customers. For instance, in November 2022, Toyota Australia announced several updates to its popular Corolla hatch and sedan lineups, including Toyota Connected Services functionality and the latest-generation hybrid powertrain.

- Over the long term, some of the major factors driving the market's growth are the enactment of stringent emission and fuel economy norms and government incentives for promoting the purchase and adoption of hybrid vehicles. Additionally, with governments taking stringent actions in the form of regulation and incentives, along with the increased initiatives for the provision of public charging stations for electric vehicles, the hybrid vehicle market is expected to grow at a high rate.

- For instance, in February 2022, According to the government of India, the subsidy under the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) program for fiscal 2023 is expected to be INR 2,908 crore (USD 351 million), which is more than three-and-a-half times the allocation of INR 800 crore (USD 96.5 million) for this fiscal year and nearly nine times the allocation for FY21.

- The Asia-Pacific hybrid vehicles market is expected to witness a high growth rate during the forecast period. The market growth in this region can be attributed to the increased sales of hybrid vehicles in China, India, Japan, and South Korea. As the Asia-Pacific region is home to major players in the hybrid vehicles market, such as BYD, Toyota, Nissan, Honda, Kia, and Hyundai, their active engagement in this segment creates a positive environment in the market.

- For instance, November 2022: Kia China announced that its EV6 compact battery electric SUV was on display at the CIIE and would be available in China in 2023. Kia will also launch 5 hybrid models in China in succession by 2026, beginning with the HEV model of the 5th generation Sportage compact SUV.

Hybrid Vehicle Market Trends

Rising Government Subsidies and Policies to Drive the Market

- Governments are offering many subsidies (tax rebates and incentives) for customers purchasing electric and hybrid vehicles globally. For instance,

- in November 2022, The Ministry of Industry and Information Technology (MIIT), China, published a "Catalog of New Energy Models Exempt from Vehicle Purchase Tax" on its official website. The plug-in hybrid models chosen include 14 passenger vehicles (such as Chery's Dasheng and Great Wall Motor's Mocha PHEV), three buses, four trucks, and eight specialty vehicles.

- Demand for hybrid vehicles is increasing in developing countries such as Brazil, India, and Mexico due to strict emission regulatory rules and a growing need for low or zero-emission vehicles. The Brazilian government is cutting taxes on hybrid vehicles such as plug-in hybrids, hybrid electric vehicles, and CNG hybrids. Similarly, the Indian government has announced that its well-known FAME II program will be extended until 2024 in order to promote electric mobility throughout the country. Major key players are also planning to participate in the country's green drive. For instance, in March 2022, Toyota Motor confirmed plans to increase its participation in India's green mobility segment, with the company preparing to launch a number of hybrid vehicles in the coming years. The first of these products, which will be manufactured locally, will hit the market next year.

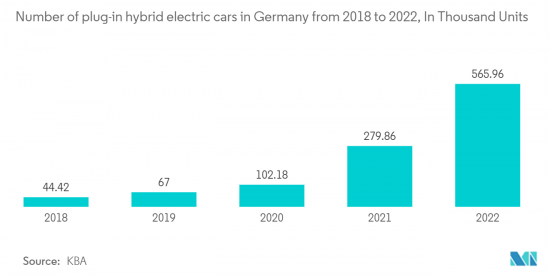

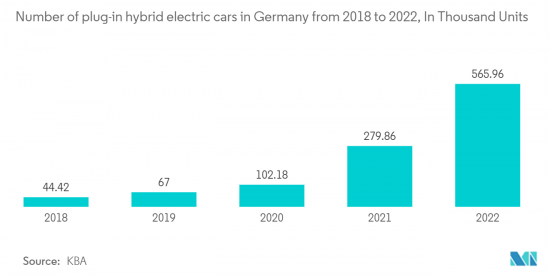

- Governments in the United States and Europe are also focusing on lowering emission limits to reduce the greenhouse gas effect and improving vehicle fuel economy. For example, the US Department of Transportation has established Corporate Average Fuel Economy (CAFE) standards for vehicles. The United Kingdom committed to achieving net-zero emissions by 2050 and proposed a 2035 ban on selling all polluting vehicles. Germany intends to reduce greenhouse gas emissions by 40% by the end of 2020, 55% by the end of 2030, and up to 95% by the end of 2050, supporting market growth.

- In the Gulf region, electric and hybrid modes of transportation are gaining traction, particularly in Israel, Oman, Jordan, Saudi Arabia, and the United Arab Emirates. For example, In accordance with the Dubai Taxi Corporation's Strategic Plan 2021-2023, The Roads and Transport Authority (RTA) of Dubai has announced the signing of a contract for the procurement of 2,219 new vehicles to supplement the fleet of the Dubai Taxi Corporation. The new batch includes 1,775 hybrid vehicles, bringing the fleet's total number of hybrid vehicles to 4,105.

China to Play a Key Role in the Development of the Hybrid Vehicle Market in Asia Pacific

- The Asia-Pacific hybrid vehicle market is expected to grow during the forecast period. Increased demand for hybrid vehicles in China, Japan, and South Korea are driving market growth in this region.

- China is a significant player in the global hybrid electric vehicle market due to its significant production capabilities and consumer demand. Following the pandemic, China gained momentum, and demand for hybrid and plug-in hybrid electric vehicles started seeing positive trends.

- For instance, in October 2022, The wholesale volume of NEV passenger cars was 676,000 units, up 85.8% year on year. Battery electric vehicle (BEV) volumes increased by 69.6% year on year to 508,000 units; plug-in hybrid electric vehicle (PHEV) volumes increased by 161.6% year on year to 167,000 units, and ICE-powered hybrid passenger vehicle volumes increased by 9% year on year to 67,362 units.

- The Chinese government provides numerous subsidies (tax breaks and incentives) to customers who purchase electric and hybrid vehicles. The Chinese government recently introduced measures to support the new energy vehicle (NEV) industry, which was hard hit by the COVID-19 outbreak, by extending tax exemptions and subsidies that were set to expire by 2020 and hinting at new investments that could further boost the country's hybrid electric vehicle market in the long run.

- During the forecast period, the country may also see an increase in the adoption of hybrid electric buses, as more than 30 Chinese cities, including Guangzhou, Dongguan, Zhuhai, Foshan, and Zhongshan in the Pearl River Delta, as well as Nanjing, Hangzhou, Shaanxi, and Shandong, have made plans to achieve 100% electrified public transportation. All of the aforementioned factors and developments are expected to help China stand out as a unique destination for manufacturer investments and play a significant role in the overall growth of the hybrid vehicle market over the forecast period.

Hybrid Vehicle Industry Overview

Some of the key players operating in the hybrid vehicles market are Ford Motor Company, General Motors Company, Honda Motor Co., Ltd, Daimler AG, and Volkswagen AG, which are also planning to provide enhanced product portfolios and technological breakthroughs in the hybrid vehicles market. For instance,

In November 2022, Mitsubishi Motors Corporation announced that the plug-in hybrid electric vehicle (PHEV) model of the all-new Outlander crossover SUV would be available in Canada and the United States. The new model provides the practicality and powerful ride expected of an SUV in various weather and road conditions, a safe ride unique to an electrified vehicle.

In October 2022, Daihatsu Motor Co., Ltd intended to release a hybrid minivan in the fall of 2023. The series hybrid system used in the compact hybrid vehicle (HV) Rocky will be significantly improved for mini vehicles to achieve a fuel efficiency of 30 kilometers per liter (WLTC mode) or higher, which would be among the best in the micro-mini class.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Fuel Economy Norms and Government Incentives

- 4.2 Market Restraints

- 4.2.1 Growing Demand For Battery Electric Vehicles

- 4.3 Industry Attractiveness-Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in USD)

- 5.1 By Hybrid Vehicle Type

- 5.1.1 Micro-hybrid

- 5.1.2 Mild-hybrid

- 5.1.3 Full-hybrid

- 5.1.4 Plug-in Hybrid

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United states

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North america

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Norway

- 5.3.2.6 Netherlands

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share**

- 6.2 Company Profiles*

- 6.2.1 Toyota Motor Corporation

- 6.2.2 Nissan Motor Co. Ltd

- 6.2.3 Honda Motor company Ltd

- 6.2.4 Hyundai Motor Company

- 6.2.5 Kia Motors Corporation

- 6.2.6 Volvo Group

- 6.2.7 Volkswagen Group

- 6.2.8 BMW AG

- 6.2.9 Ford Motor Company

- 6.2.10 Mercedes-Benz Group

- 6.2.11 BYD Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Development In Hybrid Engine