|

市场调查报告书

商品编码

1403863

文件管理系统:市场占有率分析、产业趋势/统计、2024年至2029年成长预测Document Management Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

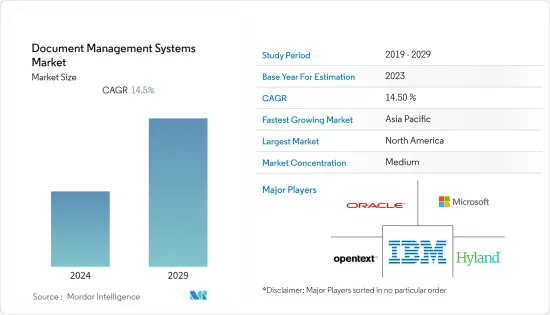

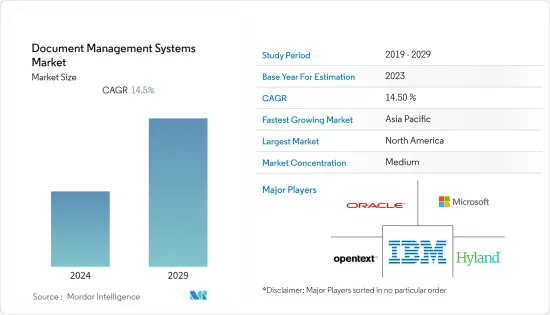

文件管理系统市场规模预计将从2024年的75.2亿美元成长到2029年的148.2亿美元,预测期间内复合年增长率为14.50%。

随着DMS的技术改进和高效执行,传统纸本文件的概念逐渐被淘汰,借助现代扫描技术和适当的文件管理软体,业务得到简化,变得更加有效和高效。

主要亮点

- 文件管理系统是为管理文件和文件并系统地简化资料管理而开发的解决方案。由于职场效率的需求,DMS 市场不断变化。据 Xerox 称,46% 的中小型企业员工每天将时间浪费在低效的纸张相关业务上,这表明先进的文件管理解决方案可以改善这些步骤。拥有先进文件管理系统的公司具有显着的竞争优势。

- 云端服务的普及正在增加对无纸政府和职场的需求,预计这将成为市场成长的驱动力。在职场实现无纸化是组织的最大好处之一,因为使用无纸化文件管理系统将文件数位化占用的空间更少,并且允许您在需要时轻鬆存取文件。 Microsoft Office 和 Adobe Acrobat 等软体具有可与系统整合的本机插件,可让员工归檔文件并只需点击几下即可存取它们。

- 医疗保健行业的自动化和数数位化需要遵守规则和法规,以降低商店营运成本。此外,对无纸化操作的需求不断增加。这些因素无疑将很快改变文件管理解决方案的市场。随着多学科医院和综合诊所的兴起,实时资料库组织、传输和分析的出现,文檔管理系统的采用有望抵消协作医疗保健爆炸性需求、智能手机和连网型使用增加的影响。医疗设备我收到了。

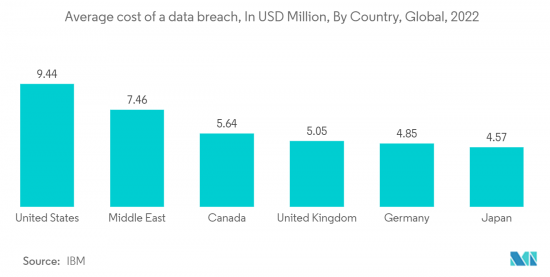

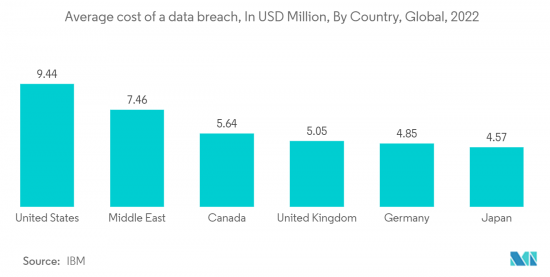

- 然而,由于 DMS 软体像任何其他不安全的机器一样连接到网路和互联网,因此很容易受到访问或操纵它的攻击,导致敏感资讯的使用,从而引起安全问题。担忧是一种威胁。透过实施资料审核、资料即时警报、资料风险评估、资料最小化和过时资料擦除等资料安全技术,组织可以防止违规、降低风险并防止资料遗失,并可以继续采取保护性安全措施。

- 虚拟学习环境在 COVID-19大流行期间受到欢迎。观察了志工完整线上培训解决方案的管理和交付,以及管理培训程序和安全文件检验和发布的文件管理系统。同样,在医疗保健领域,电子健康记录的普及和缺乏一致的患者资料进一步推动了此类工具的采用。创建文件的实用且可靠的管理是所研究市场的重要驱动力。该软体包含组织在后 COVID-19 现实中生存和发展的基本功能,减少并最终消除拖慢业务和服务速度的纸张和基于纸张的流程。

文件管理系统市场趋势

医疗保健创下最高市场成长纪录

- 在北美和欧洲等地区政府倡议的推动下,以及医生采用数位文件系统的消费者趋势不断增长的推动下,医疗保健行业即将经历一场彻底的转变,推动数位化。最近的一项研究调查了 650 多名医疗保健消费者,发现超过 90% 的患者更喜欢使用数位工具与医疗保健提供者互动。

- 随着物联网的出现和互联网普及的不断提高,对远端医疗、远距照护、远端医疗行动医疗等各种AAL解决方案和服务的需求不断增加。由于效率和安全性的提高,医生对数位医疗工具的接受度也在提高。根据美国医学会 (AMA) 于 2019 年进行并于 2022 年重复进行的一项调查,远端/虚拟就诊的采用率将从14% 增加到28%,远端监控和管理的采用率将从13% 增加到28%,远端监控效率采用率从28%提升至37%。

- 医疗保健产业透过对比内部 IT 系统和大量文件、资料库和表单来手动收集大量资料。透过采用文件管理系统,医疗保健行业的参与者可以创建电子病历,从而最大限度地降低文件遗失的风险并提高安全存取。根据 IBM 的资料外洩研究,医疗保健行业处于同类行业的前列,因此需要适当的文件管理系统来防止诈欺和资料遗失。

- 医疗保健业务有多种应用,包括电子健康记录管理、药物研发、健康保险申请、病患预约安排、会计便利、出院后指南执行和医疗保健工作流程管理。这些申请涉及大量的书面记录。

- 医院和医生对数位医疗资讯安全的信心增强,需求不断增加。但对于科技公司和政府的信任正在下降。此外,开放原始码工具在医疗保健行业中越来越普及,许多从业者采用开放原始码技术来建立他们的 DMS。此外,巨量资料和人工智慧正在进一步改变医疗保健产业。参与者还将这些技术整合到他们的 RPA 平台中,以提高效率和患者照护,同时减少代价高昂的管理不善。

亚太地区创下最高市场成长纪录

- 该地区各国政府越来越多地实施文件管理系统,以防止诈欺非法贸易和运输并改善工作流程。公共组织在保持法规遵从性的同时安全归檔旧资料和文件的需求预计将推动预测期内文件管理系统市场的成长。

- 例如,中国林产工业协会 (CNFPIA) 制定了木材合法性检验标准,该标准被视为 CTLVS 的基本要素。 CNFPIA发布的检验标准定义了森林管理层面和整个监管链的合法性要求,包括木材文件、运输和销售的合法性要求,以及国产和进口木材的合法性。加工和贸易。

- 在亚太地区,大多数学生都会继续上大学,因此大学为每个学生留下痕迹至关重要。这个数字每年都在增加,DMS 供应商可以进入这个市场。例如,在中亚,乌兹别克的教育部门已转向电子文件管理系统,以防止国家教育预算超支,并提高教育机构与上级当局之间资讯交流的透明度。

- 政府、製造业和其他部门越来越多地采用 DMS 解决方案,预计将推动亚洲的采用。 2022 年,Ameex Technologies 与 Optimizely 合作,在亚太地区提供变革性体验和全面的数位文件解决方案。这些合作伙伴关係和趋势正在推动对 DMS 解决方案的需求。

文件管理系统产业概况

近年来,文件管理系统市场的竞争变得更加激烈。该市场由几个主要企业组成。目前,几家主要企业在市场占有率方面占据主导地位。然而,管理快速扩展的患者记录的需求不断增长,促使公司提供创新的策略性文件管理系统。许多公司透过赢得新合约和开拓新市场来扩大其市场份额。

2023年5月,小i公司宣布推出智慧型文檔处理产品。该解决方案由智慧、高效的平台提供,可简化和自动化文件管理流程,使企业进入智慧型营运时代。

2022 年 11 月,Advanced 与 Xperate 合作,将基于云端基础的文件管理与临床和个案管理解决方案整合。量产版本预定于 2023 年初发布。

2022 年 9 月,专门为设备金融业构建的云端基础的联合软体 Syndifi Inc. 宣布了其新文件管理平台的功能,允许卖家使用拖放功能来轻鬆执行上传、重命名、删除、排序和重组文件等操作,让您在几秒钟内上传4 GB 的檔案。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 无纸化办公的出现

- 更多采用数位转型和在家工作文化

- 由于新兴市场创纪录的数位化措施的进步,医疗保健领域的需求

- 市场挑战

- 安全、隐私和迁移挑战

- 产业吸引力模型—波特五力分析

- 消费者议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 生态系分析

- 价格分析

- COVID-19 对文件管理市场的影响

第五章市场区隔

- 按成分

- 软体

- 服务(咨询、整合、支援)

- 按配置

- 云

- 本地

- 按最终用户产业

- 银行/金融服务

- 製造/建筑

- 教育

- 卫生保健

- 零售

- 法律事务

- 其他最终用户产业(房地产管理、物流、饭店等)

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第六章竞争形势

- 公司简介

- Nuxeo

- Open Text Corporation

- IBM Corporation

- Microsoft Corporation(Sharepoint)

- Oracle Corporation

- Hyland Software

- Document360

- Zoho Corporation

- DocLogix

- Integrify

- Kissflow

- Agiloft, Inc.

- Logicaldoc

- Cflowapps

第七章 投资分析

第八章 市场机会及未来趋势

The Document Management Systems Market size is expected to grow from USD 7.52 billion in 2024 to USD 14.82 billion by 2029, registering a CAGR of 14.50% during the forecast period.

The improving technologies and efficient execution of DMS are expected to gradually eliminate the traditional paper files concept, streamline business operations, and make them more effective and efficient with the help of contemporary scanning technology and the appropriate document management software.

Key Highlights

- A document management system is a solution developed to manage documents and files and simplify data management systematically. The DMS market is ever-changing, driven by the need for increased efficiency in the workplace. According to Xerox, 46% of workers in small and medium-sized firms still waste time daily on ineffective paper-related operations, showing that sophisticated document management solutions can improve these procedures. Businesses with advanced document management systems have a considerable competitive advantage.

- Due to the widespread use of cloud services, there is an increasing desire for paperless government and workplaces, which is anticipated to drive market growth. Digitizing files using a paperless document management system takes up much less space, making this one of the most significant benefits of going paperless in the workplace for organizations, thereby getting easy access to the files when needed. Software like Microsoft Office and Adobe Acrobat can integrate with the system and have native plugins that allow staff to file documents and access them with just a few clicks.

- Compliance with rules and regulations is necessary to reduce the store's operational expenses due to automation and digitization in the healthcare sector. Additionally, a paperless workplace is increasingly required. These elements will undoubtedly revolutionize the market for document management solutions shortly. The growing number of multi-specialty hospitals, polyclinics, real-time database organization, transmission, and analysis are on the anvil, and the adoption of document management systems is being influenced by the explosive demand for linked healthcare and the rising use of smartphones and connected medical devices.

- However, the threat is the security concerns as DMS software is prone to attack to obtain access and manipulate it as they are connected to the network and the internet like any other insecure machine, leading to critical information usage. Implementing data security technologies like Data Auditing, Data Real-time Alerts, Data risk assessment, Data minimization, and Purging of stale data could help organizations prevent breaches, reduce risk, and sustain protective security measures to prevent data loss.

- Virtual learning environments amidst the COVID-19 pandemic gained popularity. Managing and delivering complete online training solutions for volunteers were observed, combined with document management systems to control the validation and publication of those training procedures and safety documents. Similarly, in the healthcare sector, the lack of cohesive data across patients amidst the prevalence of electronic health records is further aiding the adoption of such tools. The practical and reliable management of generated documents significantly drives the market studied. The software includes features critical to helping organizations survive and thrive in a post-COVID-19 reality to reduce and eventually eliminate paper and paper-based processes that slow operations and service.

Document Management System Market Trends

Healthcare to Register the Highest Market Growth

- The healthcare industry is on the verge of a complete turnaround augmented by digitalization drives, driven by government initiatives in regions such as North America and Europe, along with a growing consumer propensity toward physicians who adopt digital documentation systems. A recent study that studied over 650 healthcare consumers found that a prominent share (over 90%) of patients wish to use digital tools to interact with their care providers.

- With the advent of IoT and growing internet penetration, the demand for various AAL solutions and services, such as telehealth, telecare, telemedicine, and mHealth, is gaining traction. Also, physician acceptance of digital healthcare tools is increasing due to improved efficiency and safety. According to a study done by the American Medical Association (AMA) conducted in 2019 and repeated in 2022, tele-visits/virtual visit adoption increased to 28% from 14%, remote monitoring and management adoption grew from 13% to 22%, and remote monitoring efficiency adoption grew from 28% to 37%.

- The healthcare industry involves collecting significant amounts of data manually through contrasting internal IT systems and numerous collections of documents, databases, and forms. Adopting document management systems enables players in the healthcare industry to create electronic patient records, thus minimizing the risk of misplaced documentation and increasing security access. According to the survey by IBM on Data Breaches, the Healthcare Industry is one the top, so a proper document management system is necessary, which prevents fraudulent and misplaced data.

- The healthcare business involves various applications, such as electronic health record management, drug discovery, health insurance claims, patient appointment scheduling, stimulating account settlements, implementing post-discharge guidelines, and healthcare workflow management. These applications involve an enormous paper trail.

- Trust in hospitals and physicians to secure digital healthcare information is increasing, further augmenting the demand; however, trust decreases when it comes to tech companies and the government. Additionally, open-source tools are gaining traction in the healthcare industry, which has propelled many practitioners to adopt open-source technologies for establishing a DMS. Moreover, Big Data and AI are further revolutionizing the healthcare sector. The players are also integrating these technologies within the RPA platform to improve efficiency and patient care while reducing costly administrative errors.

Asia-Pacific to Register the Highest Market Growth

- The region's governments' increased adoption of document management systems to stop illicit trade and transportation and improve their workflows. The need for public sector organizations to maintain regulatory compliance while securely archiving old data and documents is anticipated to drive growth in the market for document management systems during the forecast period.

- For instance, the China National Forest Products Industry Association (CNFPIA) developed the timber legality verification standard, which has been envisaged as an essential element of CTLVS. CNFPIA released the standard that establishes the requirements for legality at the forest management level and throughout the chain of custody, which covers timber legality requirements for document management, transport, and sales, legality verification for domestic and imported timber, development of a timber legality management system, and processing and trading.

- Asia-Pacific witnesses a majority of students entering the universities for studies, which makes it imperative for the universities to keep a document trail for every student. The number is increasing yearly, allowing DMS providers to tap into the market. For Instance, In Central Asia, Uzbekistan's education sector transformed into an electronic document management system to avoid overspending state budget allocations to education and achieve greater transparency in the exchange of information among educational institutions and higher authorities.

- The rising adoption of DMS solutions by the government, manufacturing, and other sectors is expected to boost the adoption in Asia. In 2022, Ameex Technologies partnered with Optimizely to enable transformative experiences and comprehensive Digital document solutions in Asia-Pacific. Such partnerships and trends drive the need for DMS Solutions.

Document Management System Industry Overview

The document management systems market has gained a competitive edge in recent years. It consists of several major players. A few significant players currently dominate the market in terms of market share. However, the increasing demand to maintain the rapidly growing patient records has enabled companies to innovate and provide strategic document management systems. Many companies are increasing their market presence by securing new contracts and tapping into new markets.

In May 2023, Xiao-I Corporation announced the launch of an intelligent document-processing product. The solution is delivered by a smart and efficient platform that streamlines and automates the document management process, empowering businesses toward an era of intelligent operations.

In November 2022, Advanced partnered with Xperate to integrate cloud-based document management with practice and case management solutions. The full version is expected to launch in early 2023.

In September 2022, Syndifi Inc., the cloud-based syndication software built specifically for the Equipment Finance industry, launched a new document management platform functionalities, making it easier for sellers to perform actions such as upload, rename, delete, sort, and reorganize documents with a drag and drop feature and can upload 4 gigabytes of files in a fraction of seconds.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Emergence of paperless offices

- 4.2.2 Digital transformation and increasing adoption of work-from-home culture

- 4.2.3 Demand from the Healthcare domain due to ongoing measures to digitize records in emerging markets

- 4.3 Market Challenges

- 4.3.1 Security, Privacy & Migration challenges

- 4.4 Industry Attractiveness Model - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Industry Ecosystem Analysis

- 4.6 Pricing Analysis

- 4.7 Impact of COVID-19 on the Document Management Market

5 MARKET SEGMENTATION

- 5.1 By Component

- 5.1.1 Software

- 5.1.2 Services (consulting, integration and support)

- 5.2 By Deployment

- 5.2.1 Cloud

- 5.2.2 On-premise

- 5.3 By End-user Industry

- 5.3.1 Banking & Financial Services

- 5.3.2 Manufacturing and Construction

- 5.3.3 Education

- 5.3.4 Healthcare

- 5.3.5 Retail

- 5.3.6 Legal

- 5.3.7 Other End-user Industries (Property Management, Logistics, Hospitality etc)

- 5.4 By Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Nuxeo

- 6.1.2 Open Text Corporation

- 6.1.3 IBM Corporation

- 6.1.4 Microsoft Corporation (Sharepoint)

- 6.1.5 Oracle Corporation

- 6.1.6 Hyland Software

- 6.1.7 Document360

- 6.1.8 Zoho Corporation

- 6.1.9 DocLogix

- 6.1.10 Integrify

- 6.1.11 Kissflow

- 6.1.12 Agiloft, Inc.

- 6.1.13 Logicaldoc

- 6.1.14 Cflowapps