|

市场调查报告书

商品编码

1630366

文件案例管理 -市场占有率分析、产业趋势/统计、成长预测(2025-2030)Document Case Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

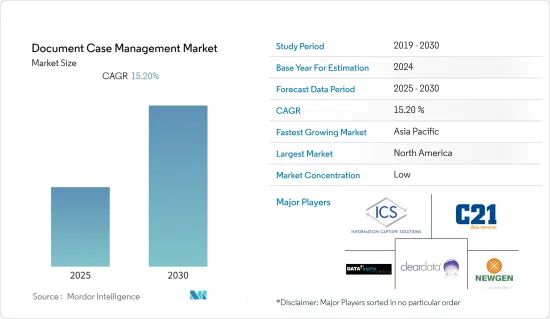

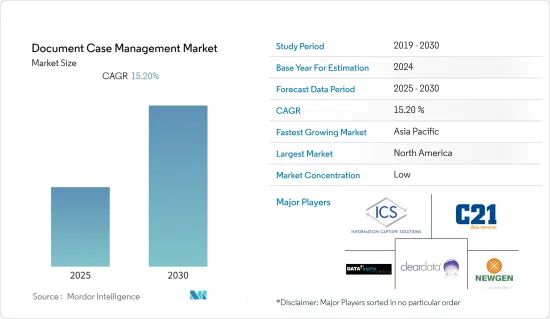

文件箱管理市场预计在预测期内复合年增长率为 15.2%

主要亮点

- 处理案例和尽量减少潜在错误的业务流程效率日益低下,对文件案例管理市场产生了巨大影响。许多公司已经数位化,透过将电子表格和扫描文件附加到电子邮件中并将其随意储存在各种磁碟机上,从而摆脱了实体文件的束缚。所有上述过程都可能非常耗时。因为不正确的资料管理会产生冗余、不准确、遗失和不安全的文件。在此背景下,案件管理的需求不断增加,可望加速并强化传统企业业务的诚信。

- 此外,网路攻击造成的资料遗失可能会对公司造成数亿美元的损失。内部威胁正在导致文件层级的资料遗失。企业越来越注重透过具有内建安全性的文件案例管理来减少漏洞,以防止此类遗失和攻击。

- 文件案例管理解决方案提供了一个活跃的内容架构,使任何公司都能够统一资讯、流程和人员。案例管理应用程式也广泛应用于 BFSI 领域,促进了市场扩张。此外,改进信用卡争议解决程序依赖于案件管理解决方案。它也用于付款申请,特别是汽车保险。几个案例研究表明,该解决方案正在获得业界的认可。

- 例如,IBM Business Process Manager 为信用卡发行银行提供了用于解决信用卡纠纷的案例管理应用程序,从而提高了案例工作人员的效率。 IBM Business Process Manager 也可用于管理和建立汽车保险索赔。该系统透过整合索赔人和提交人均可存取的相关资料,使分析人员能够有效、快速地处理和解决索赔。

- 市场上发现的最重大挑战之一是与从旧有系统迁移和客製化解决方案以满足和实现组织的投资报酬率目标相关的实施挑战。

- 此外,COVID-19 大流行已经暴露了依赖纸本文件的缺点,并导致人们转向远端工作。文件案例管理软体已成为公司应对这场流行病的重要组成部分。随着经济的改善,这些技术将使公司能够更好地适应和应对力远距员工。这场大流行凸显了各种企业进行数位转型和加快流程的必要性。这些因素导致文件案例管理在包括金融机构在内的多个行业中得到更广泛的应用。

记录案例管理市场趋势

BFSI占较大市场占有率

- 在银行和金融服务保险 (BFSI) 行业,每笔交易的重要性都非常高。该行业使用的技术必须高度可靠,才能追踪和管理成本、销售、供应和员工。金融公司正在优先采用文件管理系统 (DMS) 和企业内容管理 (ECM) 系统来维护所有经济事件和活动的安全记录。银行尤其强烈需要所有用户和业务相关资料的安全,同时确保交易的准确性和完整性。银行业拥有庞大的技术投资市场潜力,是DMS和其他IT基础设施组件投资的重要市场。

- 儘管数位文件管理不断发展,许多传统金融企业仍然以纸本形式储存内部和外部通讯。此外,使用过时的 DMS 软体来储存重要文件可能会导致它们无法存取。根据 Eversign 的数据,70% 的办公室废弃物是文件、印刷品、表格等纸张。这表明许多职场,尤其是 BFSI 部门,仍然高度依赖纸张。然而,在主要依赖纸张的职场,重要文件管理不善的可能性很高,因此对 DMS 的需求显着增加,从而增加了预测期内的市场成长机会。

- 由于每天发生大量交易,银行需要提高后台处理和交易记录保存的公共产业。借助正确的 DMS,银行可以降低与管理和分发报表和信件等文件相关的成本和处理时间。维护电子审核追踪、无缝合规性、增强的银行工作流程以及减少纸张使用是 DMS 的其他优势。 2021 年 9 月,印度银行推出了多项数位服务以庆祝其成立 116 週年,并推出了具有改进的安全性、备份和灾难復原功能的 DMS。

- 透过有效利用案例管理软体,银行可以实现各种业务流程的自动化。传统业务的个案管理着重于以客户为中心的问题解决。费用衝突和对客户服务的担忧很常见。随着技术的进步和银行努力利用它,业务的案例管理范围已显着扩大。

- 根据联邦存款保险公司的资料,截至 2022 年 6 月,摩根大通是美国最大的银行,市场占有率约 25%。紧随其后的是美国银行(占银行总资产的 17.8%)和花旗银行(占 12.55%)。 2021年,摩根大通总资产超过3.3兆美元。因此,随着银行整体市场占有率的增加,文件案例管理的需求也同步增加,推动市场成长。

北美占据主要市场占有率

- 预计北美将成为预测期内云支持程度最高的地区。这主要是由于对云端基础的服务的需求不断增长,这也可能受到云端基础的安全文件案例管理服务的成长的推动。

- 此外,在《统一电子交易法》(UETA)和《电子签章法》(E-SIGN)等政府倡议的推动下,在所有交易中使用电子签名正在对市场需求产生重大影响。此外,美国-墨西哥-加拿大协定等数位贸易协定大力鼓励公共部门的文件个案管理。

- 另一方面,移民对加拿大整体劳动力扩张做出了重大贡献。移民约占加拿大总人口成长的 75%。移民在填补医疗保健等行业严重的劳动力短缺、创造就业机会、推动经济成长和丰富加拿大社区方面发挥着重要作用。 2021 年预算承诺在五年内投资约 4.289 亿美元,用于建立和提供全公司范围的数位平台,以取代 IRCC 过时的全球案件管理系统。

- 此外,该地区正在发生各种重大发展,扩大了市场的成长机会。例如,2022年3月,帮助企业加强协作和数数位化资讯管理的ELO Digital Office USA宣布Hopsteiner实施了ELO ECM Suite用于文件和内容管理。 Hopsteiner 使用 ELO 实现财务、会计、采购和营运等关键业务部门的文件管理自动化。

- 此外,2022 年4 月,《国家法律杂誌》将SmartAdvocate 评选为“2022 年最佳”,这是一个位于佛罗里达州的功能强大、完全集成的诉讼案件管理系统,我获得了两个类别的冠军和一个类别的亚军。法律案件管理系统 SmartAdvocate 的发展是为了满足当今技术要求很高的世界的需求。

文件案例管理行业概述

儘管各种全球公司在市场上占据主导地位,但相对较新的参与企业市场,这主要是由于对文件管理的需求不断增加。大多数公司主要专注于创新,以保持整个市场的竞争力。

- 2022 年 4 月 - 法律软体供应商 Paradigm 宣布收购 LollyLaw,后者主要为律师事务所提供云端基础的业务管理解决方案。透过此次收购,Paradigm 致力于提供一流的法律案件管理软体。 LollyLaw 描述了一个直觉的平台,提供时间和申请、摄取量、文件管理、日历和客户入口网站。

- 2021 年 11 月 - 中间市场私募股权公司 Gemspring Capital 宣布其附属公司已收购 AINS Inc. (AINS) 的多数股权,该公司是一家为政府客户提供案例管理软体和 IT 服务的提供者。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 保护敏感资料和防止资料遗失的需求日益增加

- 对跨管道改善檔案内容的需求不断增长

- 持续努力促进职场数位化

- 市场限制因素

- 从旧有系统晶片迁移

- 自订挑战导致部署问题

- 记录案例管理建置区块和关键用途

- COVID-19 大流行的市场影响评估

第五章市场区隔

- 按类型

- 解决方案

- 按服务

- 按最终用户产业

- BFSI

- 医疗保健

- 资讯科技/通讯

- 公共机构

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第六章 竞争状况

- 公司简介

- Cleardata Group

- Information Capture Solutions

- C21 Data Services

- Data Entry India

- Data Entry BPO Services

- Newgen Software

- ALTECiSys Limited

- Pearl Scan Solutions Ltd

- Abbyy UK Ltd

- InfoTech Scandinavia AB

- Adreno Technologies India Pvt. Ltd.

- Social Solutions

第七章 投资分析

第八章 市场机会及未来趋势

简介目录

Product Code: 70170

The Document Case Management Market is expected to register a CAGR of 15.2% during the forecast period.

Key Highlights

- The document case management market has been dramatically influenced positively by the growing inefficiency of business procedures to handle cases and minimize potential errors. By attaching spreadsheets or scanned documents to emails and storing them on various disk drives in random, disorderly ways, numerous firms have made tremendous progress toward digitization and away from physical papers. All the procedures above may waste time since bad data management results in redundant, inaccurate, lost, and insecure documents. These considerations fuel the demand for case management, which is anticipated to hasten and strengthen the integrity of conventional company operations.

- Moreover, data loss due to cyber-attack can cost businesses millions of dollars. Internal threats are a factor in some data losses at the documentation level. Companies are increasingly focusing on lowering vulnerabilities through document case management, which has built-in security to prevent these losses and attacks.

- A document case management solution enables any firm to integrate information, processes, and personnel by supplying an active-content architecture. Case management applications are also widely used in the BFSI sector, fuelling the market's expansion. In addition, the improvement of credit card dispute resolution procedures depends on case management solutions. It has further utilizations in insurance settlement claims, particularly for auto insurance. Several case studies demonstrate the solutions' expanding industry acceptance.

- For instance, IBM Business Process Manager provides credit card issuing banks with a case management application for handling credit card disputes, which boosts caseworker effectiveness. The IBM Business Process Manager can also give an application for managing and creating auto insurance claims. The system enables the analyst to process and resolve claims effectively and rapidly by integrating relevant data accessible to both the claim and the submitter.

- One of the most crucial challenges witnessed by the market is the transition from legacy systems as well as the implementation challenges, which are well associated with customizing the solution to meet and fulfill the ROI objectives of the organization.

- Additionally, the COVID-19 pandemic showed the shortcomings of depending on paper-based documentation, which led to a shift to remote work. Software for document case management became an essential component of how businesses responded to the pandemic. As the economy picks up, these technologies enable firms to be more adaptable and responsive to remote workers. The pandemic highlighted the necessity of digital transformation and speeding up the process for various enterprises. These elements helped document case management become more widely used across several industries, including financial institutions.

Document Case Management Market Trends

BFSI to Occupy a Significant Market Share

- Each transaction is highly significant in the banking, financial services, and insurance (BFSI) sector. The technology used within the industry must be incredibly reliable to track and manage costs, sales, supplies, and workers. Financial firms prioritize adopting document management systems (DMS) or enterprise content management (ECM) systems to preserve a secure record of all economic events and activities. The security of all user and business-related data is heavily required, especially from banking institutions, while ensuring transaction accuracy and completeness. With significant development potential in technological investment, the banking industry is thus an important market for investments in DMS and other IT infrastructure components.

- A few conventional financial businesses continue to preserve internal and external communications on paper despite the development of digital document management. Furthermore, using outdated DMS software to store important documents can make them inaccessible. As per Eversign, 70% of office waste is paper generated by documents, prints, forms, etc. That shows that there is still a high reliance on paper in many workplaces, particularly in the BFSI sector. However, since there lies a high chance of mismanagement of the crucial documents within the workplaces that primarily rely on paper, the need for DMS is growing significantly, enhancing the market growth opportunities throughout the forecasted time.

- Due to the high volume of transactions that take place every day, banks need to improve their paperwork and transaction record-keeping utilities. By utilizing the appropriate DMS, banks can save the costs and processing times associated with managing and distributing documents like statements and notifications. The ability to maintain an electronic audit trail, seamless compliance, enhanced banking workflow and decreased paper usage are further benefits of DMS. In September 2021, The Bank of India introduced several digital services on the 116th anniversary of its founding and a DMS with improved security, backup, and disaster recovery capabilities.

- Banking companies can efficiently utilize case management software to automate a wide range of their operational processes. Traditional case management in banking was highly focused on resolving customer-centric problems. Conflicts over fees and concerns about customer service have frequently occurred. As technology has advanced and banks have worked to use it, the scope of case management in banking has thus significantly increased.

- As per data from Federal Deposit Insurance Corporation, with a market share of approximately 25% as of June 2022, JPMorgan Chase was the top bank in the U.S. Following closely after, with 17.8 and 12.55 percent of the total banking assets, was Bank of America and Citibank respectively. In 2021, JPMorgan Chase's total assets were worth more than 3.3 trillion dollars. Thus with the rise in the overall market share of the banks, the need for Document Case Management will also increase simultaneously, thereby enhancing the market's growth.

North America to Occupy Significant Market Share

- North America is expected to be the most cloud-ready region throughout the forecasted time frame. This is mainly due to the rising need for cloud-based services, which will probably also encourage the growth of secure cloud-based document case management services.

- Moreover, using e-signatures for any transaction is made possible by government initiatives like the Uniform Electronic Transactions Act (UETA) and the Electronic Signatures in Global and National Commerce Act (E-SIGN), which have a substantial impact on market demand. Additionally, digital trade agreements like the United States-Mexico-Canada Agreement strongly encourage document case management in the public sector.

- On the other hand, immigration contributes a significant amount in terms of all of Canada's labor force expansion. Immigration accounts for approximately 75% of total Canada's population increase. Immigrants play a crucial role in filling essential labor shortages in industries like healthcare, generating jobs, enhancing economic growth, and enriching Canadian communities. The Budget 2021 declared to invest around USD 428.9 million over five years, with USD 398.5 million remaining amortization, to create and deliver an enterprise-wide digital platform that will eventually replace IRCC's outdated Global Case Management System.

- Moreover, various vital developments are occurring within the region, thereby expanding the growth opportunities in the market. For instance, in March 2022, ELO Digital Office USA, a company that assists businesses in increasing collaboration and digitizing information management, revealed that Hopsteiner had implemented the ELO ECM Suite for document & content management. Hopsteiner uses ELO to automate document management in business-critical areas, including finance, accounting, procurement, and operations.

- Further, in April 2022, the National Law Journal's Best of 2022 chose Florida-based SmartAdvocate, a powerful, wholly integrated legal case management system, as the winner in two categories and runner-up in one. The legal case management system SmartAdvocate was created to fulfill the needs of today's fast-paced, technologically demanding world.

Document Case Management Industry Overview

Although various global players are predominating the market, relatively new participants are also entering the market, mainly because of the rising need for the management of documents. Most firms primarily focus on innovations to remain competitive in the entire market.

- April 2022 - Paradigm, a legal software provider, declared the acquisition of LollyLaw, which mainly provides cloud-based practice management solutions to law firms. With this acquisition, Paradigm has promised to give the best-in-class legal case management software. LollyLaw delivers a single intuitive platform that offers time and billing, intake, document management, calendaring, and a client portal.

- November 2021 - Gemspring Capital, a middle-market private equity company, declared that an affiliate had acquired a majority interest in AINS Inc. ("AINS"), a provider of case management software and IT services, especially for government customers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Need for Securing Confidential Data and Protection Against Data Loss

- 4.1.2 Growing Demand for Improving Archived Content across Channels

- 4.1.3 Ongoing efforts to promote Digitization at Workplaces

- 4.2 Market Restraints

- 4.2.1 Transition from Legacy Systems Chips

- 4.2.2 Customization Challenges Leading to Implementation Issues

- 4.3 Building Blocks of Document Case Management and Major Applications

- 4.4 Assessment of the Impact of the COVID-19 Pandemic on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Solution

- 5.1.2 Services

- 5.2 By End-user Industry

- 5.2.1 BFSI

- 5.2.2 Healthcare

- 5.2.3 IT & Telecom

- 5.2.4 Public Agencies

- 5.2.5 Other End-user Industries

- 5.3 By Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Cleardata Group

- 6.1.2 Information Capture Solutions

- 6.1.3 C21 Data Services

- 6.1.4 Data Entry India

- 6.1.5 Data Entry BPO Services

- 6.1.6 Newgen Software

- 6.1.7 ALTECiSys Limited

- 6.1.8 Pearl Scan Solutions Ltd

- 6.1.9 Abbyy UK Ltd

- 6.1.10 InfoTech Scandinavia AB

- 6.1.11 Adreno Technologies India Pvt. Ltd.

- 6.1.12 Social Solutions

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219