|

市场调查报告书

商品编码

1403909

电动液压式动力转向系统 -市场占有率分析、产业趋势与统计,2024-2029年,成长预测Electro Hydraulic Power Steering - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

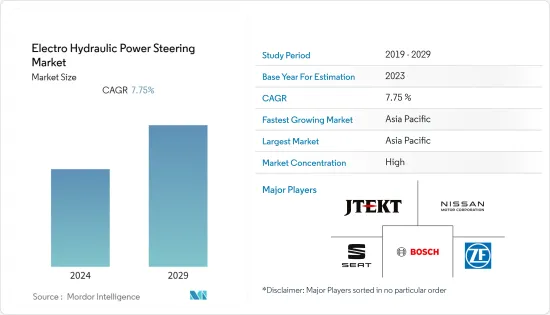

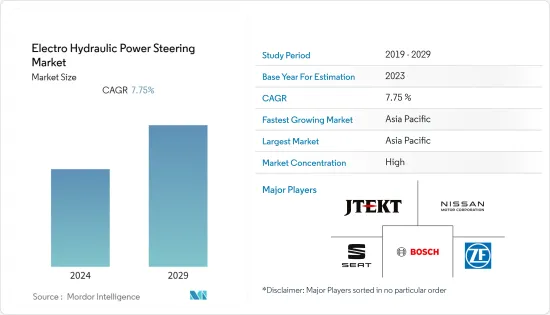

目前汽车电动液压式动力转向系统市场规模为28.4亿美元,预计未来五年将达41.2亿美元,预测期内复合年增长率为7.75%。

从长远来看,行业巨头研发投入的增加、电动车和混合汽车销售的增加以及商用车需求的增加正在促进电子商务行业的成长。这有助于创造汽车和运输行业的需求,并对汽车电动液压式动力转向系统市场的快速成长产生积极影响。有几个因素阻碍了汽车电动液压式动力转向系统产业的成长前景,包括电动液压式动力转向系统的高成本以及主要商用车製造商对降低成本的关注,但仍有可能。

市场主要企业也在进行併购,以扩大产能并加强产品组合,以满足对电动液压式转向系统不断增长的需求。例如,康斯伯格汽车公司于 2022 年 8 月宣布,将以 1.04 亿欧元(1.1 亿美元)的价格将其在加拿大的 Shawinigan 业务出售给庞巴迪休閒产品公司 (BRP)。沙维尼根製造工厂生产用于动力运动和休閒车辆的感测器、致动器、电子辅助转向、线束和仪表板组件。此外,随着ADAS(高级驾驶辅助系统)、自动驾驶和联网汽车的快速转型,人们对引入新时代组件以提高燃油效率的需求不断增长,这正在推动电动液压式动力转向系统市场的发展。对快速成长产生正面影响。

由于各类电动车製造商的存在、商用车销量高以及汽车零件产业的发展,亚太地区是全球最大的汽车电动液压式动力转向系统市场。由于采埃孚股份公司等主要零件製造商的存在以及远距旅游巴士和多轴卡车等商用车销售的强劲前景,北美和欧洲是第二大市场。

电动液压式动力方向机系统市场趋势

方向盘马达领域将成为预测期内的驱动力

消费者对环境问题的意识不断增强,加上政府积极采取的减少碳排放的策略,正在促进全球电动车市场的成长。因此,这对电动液压式动力转向系统所需的方向盘马达的需求产生了积极影响。例如

- 2023年7月,欧洲地区电动车销量较2021年同月成长50%。此外,随着供应链限制的放鬆,2023年7月欧洲纯电动车销量较2022年同期激增54.7%。

为了将电动液压式转向系统整合到车辆模型中,液压动力必须由电动马达产生。对于能够有效改善驾驶因素的转向感觉的先进方向盘马达仍然存在很高的需求。

由于转向方向盘马达的改进和进步,电动液压式动力转向系统技术发生了重大变化,也为电动液压式动力转向系统的销售提供了巨大动力。其他汽车製造商和零件製造商,包括日产、博世和采埃孚,正在积极开发用于电动液压式动力转向系统的先进转向马达。此外,这些OEM还推出了专用自动驾驶汽车设计的电动液压式动力方向盘马达。随着市场上自动驾驶汽车的普及,方向盘马达领域预计将在预测期内快速成长。

按组件子区隔,方向盘马达方向盘马达市场占整个汽车电动液压式动力转向市场的大部分收益占有率份额,因为转向马达比感测器等其他组件更具成本效益且更易于维护。预计将有助于先进的方向盘马达引入,透过减少驱动电路数量,简化了结构并减轻了重量。这些新一代电动液压式动力转向系统马达预计将进一步加强方向盘马达子区隔市场在零件领域的市场占有率。

预测期内亚太地区仍将是最大市场

都市化的提高、汽车持有的增加以及消费者人均可支配收入的增加正在推动亚太汽车市场的发展。因此,这对该地区汽车电动液压式辅助转向系统的需求产生了积极影响。随着越来越多的消费者迁移到都市区寻找更好的工作和经济机会,对使用私人交通的偏好也增加。这将对该地区的小客车市场产生积极影响。此外,政府对新能源汽车的日益重视,带动了电动车的融合,促进了电动车市场的成长,催生了电动液压式动力转向系统等新时代技术。影响对零件的需求。

- 2023财年印度新型电动四轮车销量达48,105辆,与前一年同期比较%。

- 根据国际能源总署(IEA)的数据,2021年中国新电动车销量仅330万辆,但2022年将达到600万辆。

除了小客车成长外,亚太地区商用车产业也是该细分市场成长的主要催化剂。这是由于电子商务领域的进步、最后一哩交付领域的成长以及建设活动的增加。由于商用车重量较重,开发先进的动力转向系统至关重要。需要平稳的转向系统来保持最佳扭矩。因此,随着亚太地区商用车销售的增加,对先进转向系统的需求也会增加。预计这将对该地区汽车电动液压式辅助转向系统市场的成长做出积极贡献。

- 2022年印度商用车新车销量为93.3万辆,而与前一年同期比较为67.7万辆,较去年同期成长37.8%。

由于汽车转向原始OEM的强大存在以及道路运输作为主要运输行业的普及,欧洲和北美也是主要市场,并且这些地区的商用车销量很高。因此,随着该公司在该领域的创新和能力的扩展,商用车领域的电动液压式动力转向系统市场预计将在预测期内成长。

电动液压式动力转向系统产业概况

汽车电动液压式动力转向系统市场整合度高、竞争激烈。该市场的特点是存在相当大的参与者,他们与主要汽车製造商签订了长期供应协议。这些参与者也参与合资、併购和产品开发,以加强其品牌组合。

主导全球市场的主要公司包括JTEKT、Nissan Motor Corporation、SEAT、Robert Bosch GmbH、ZF Friedrichshafen、Danfoss A/S、Mitsubishi Heavy Industries 和 Evamo。主要企业正在推出新产品,以确保其市场地位并保持市场领先地位。例如

- 2023年6月,罗伯特博世宣布与Arnold NextG合作,将线控转向系统大规模生产推向汽车市场。透过此次合作,罗伯特·博世致力于为客户提供先进的转向系统,包括电动液压式动力转向系统。此次合作旨在为汽车製造商提供必要的新时代零件,以支持自动驾驶领域的积极发展。

随着这些公司寻求透过产品系列多样化来获得竞争优势,预计未来几年市场将出现各种先进的电动液压式动力转向系统。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 电动车的普及

- 市场抑制因素

- 电动液压式动力方向机系统初始成本较高

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔(市场规模-美元)

- 按车型

- 小客车

- 商用车

- 依组件类型

- 转向电机

- 感应器

- 其他(帮浦、软管等)

- 按销售管道

- 目的地设备製造商(OEM)

- 售后市场

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 印度

- 中国

- 日本

- 韩国

- 其他亚太地区

- 世界其他地区

- 阿拉伯聯合大公国

- 巴西

- 南非

- 其他国家

- 北美洲

第六章竞争形势

- 供应商市场占有率

- 公司简介

- JTEKT Corporation

- Nissan Motor Corporation

- SEAT

- Robert Bosch GmbH

- ZF Friedrichshafen

- Danfoss A/S

- Eaton

- Danotek Motion Technologies

- Allied Motion Inc

- Mitsubishi Heavy Industries

- Dana TM4

- Evamo

第七章 市场机会及未来趋势

- 强化ADAS(进阶驾驶辅助系统)技术

The Automotive Electro-Hydraulic Power Steering Market is valued at USD 2.84 billion in the current year and is anticipated to reach a net valuation of USD 4.12 billion within the next five years, registering a CAGR growth of 7.75% over the forecast period.

Over the long term, increasing investments in R&D by major industry players, a rise in sales of electric and hybrid vehicles coupled with rising demand for commercial vehicles, attributed to the growth in the e-commerce sector. It is assisting in creating demand in the automotive and transportation industry, thereby positively impacting the surging growth of the automotive electro-hydraulic power steering market. Some factors like the high cost of electro-hydraulic power steering systems and the strong focus of major commercial vehicle manufacturers on cost-cutting may hamper the growth outlook of the automotive electro-hydraulic power steering systems industry.

Major players in the market are expanding their production capacity to cater to the increased demand for electro-hydraulic power steering systems and also engaging in mergers and acquisitions to bolster their portfolio. For instance, in August 2022, Kongsberg Automotive announced the divestiture of its Shawinigan operations in Canada to Bombardier Recreational Products, Inc.(BRP Inc.) for EUR 104 million (USD 110 million). The Shawinigan manufacturing facility produces sensors, actuators, electronic power steering, wire harnesses, and dashboard assemblies for power sports and recreational vehicles. Further, with rapid transformation in advanced driver assistance systems (ADAS), automated driving, and connected cars, there exists a greater demand for introducing new-age components to improve fuel consumption capability, which in turn is positively impacting the surging growth of the electro-hydraulic power steering market.

Asia-Pacific is the largest automotive electro-hydraulic power steering market in the world, owing to the presence of various electric vehicle manufacturers, high sales of commercial vehicles, and a well-developed automotive components industry. North America and Europe are the next biggest markets due to the presence of major parts and components manufacturers like ZF Friedrichshafen AG and the strong prospect of commercial vehicle sales, including long-distance touring coaches and multi-axle trucks.

Electro Hydraulic Power Steering Market Trends

Steering Motors Segment to gain Traction during the Forecast Period

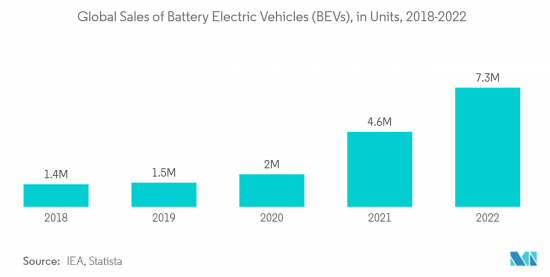

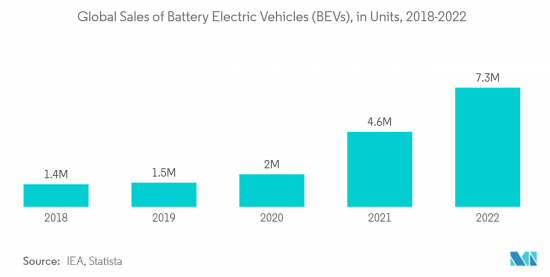

Consumers' growing awareness of environmental hazards, coupled with the government's aggressive strategy to promote the reduction of carbon emissions, is contributing to the growth of the electric vehicle market across the world. It, in turn, positively impacts the demand for steering motors required for electro-hydraulic power steering systems. For instance,

- In July 2023, sales of electric vehicles in the European region recorded a growth of 50% compared to the same month in 2021. Further, battery electric vehicle sales in Europe surged 54.7% in July 2023, compared to the same period in 2022, owing to the easing supply chain restriction.

The integration of an electro-hydraulic steering system in vehicle models requires hydraulic power to be generated by an electric motor. There remains a greater need for advanced steering motors, which can efficiently improve the driver's steering experience.

The significant changes in electo-hydro power steering technologies that are driven by the improvements and advancements in steering motors are also providing a big impetus to the sales of electro-hydraulic power steering systems. Many vehicle and parts manufacturers, such as Nissan Motor, Bosch, and ZF, among others, are actively engaging in the development of advanced steering motors that can be utilized in an electro-hydraulic power steering system. Further, these OEMs are also launching electro-hydraulic power steering motors designed specifically for autonomous vehicles. With the greater adoption of autonomous vehicles in the market, the steering motors segment is anticipated to witness a rapid surge during the forecast period.

The steering motor sub-segment is expected to contribute the majority revenue share to the overall automotive elector-hydraulic power steering market by component type, as steering motors are more cost-effective and easy to maintain than other components like sensors. The introduction of advanced steering motors will assist in simplifying the structure and offer good weight reduction by maintaining fewer drive circuits. These new generation electro-hydraulic power steering motors are expected to further strengthen the market share of the steering motor sub-segment in the component segment.

Asia-Pacific to Remain the Largest Market during the forecast period

The increasing urbanization rate, growing vehicle parc, and the rising per capita disposable income of consumers are driving the automotive market in the Asia-Pacific region. It, in turn, is positively impacting the demand for automotive electro-hydraulic power steering systems in this region. As more consumers migrate to urban for better employment and financial opportunities, the preference towards availing private transportation shoots up. It positively impacts the passenger car market in the region. Coupled with that, the integration of electric vehicles owing to the increasing government's focus on the adoption of new-energy vehicles contributes to the growth electric vehicle market, subsequently impacting the demand for new-age components such as electro-hydraulic power steering systems.

- In FY 2023, new electric four-wheeler sales in India touched 48,105 units, representing a 143.2% Y-o-Y growth compared to FY 2022.

- According to the International Energy Agency, new sales of electric cars in China touched 6 million units in 2022, compared to only 3.3 million units in 2021.

Apart from the growth in passenger vehicles, the commercial vehicles industry in the Asia-Pacific region also acts as a major catalyst for the growth of this segment. It is owing to the advancement in the e-commerce sector, growth in the last-mile delivery sector, and increasing construction activity. The development of advanced power steering systems is essential for the commercial vehicle industry due to the higher weight of these vehicles. It requires a smooth steering system to maintain optimal torque. Therefore, with the increasing sales of commercial vehicles in the Asia-Pacific region, there will exist a greater demand for advanced steering systems. It, in turn, will positively contribute to the growth of the automotive electro-hydraulic power steering market in this region.

- In 2022, new sales of commercial vehicles in India touched 933 thousand units, compared to 677 thousand units in 2021, recording a Y-o-Y growth of 37.8%.

Europe and North America are also major markets due to the large presence of automotive steering OEMs and the prevalence of road transport as a major transport industry, which leads to high commercial vehicle sales in these geographies. Thus, with companies coming up with innovations and capacity expansions in this segment, the market for electro-hydraulic power steering systems is expected to grow over the forecast period for the commercial vehicles segment.

Electro Hydraulic Power Steering Industry Overview

The automotive electro-hydraulic power steering market is highly consolidated and competitive. The market is characterized by the presence of considerably large players who secured long-term supply contracts with major automotive OEMs. These players also engage in joint ventures, mergers and acquisitions, and product development to enhance their brand portfolio.

Some of the major players dominating the global market are JTEKT Corporation, Nissan Motor Corporation, SEAT, Robert Bosch GmbH, ZF Friedrichshafen, Danfoss A/S, Mitsubishi Heavy Industries, and Evamo, among others. Key players are launching new products to secure their market position and stay ahead of the market curve. For instance,

- In June 2023, Robert Bosch announced its partnership with Arnold NextG to introduce steer-by-wire steering systems to the automotive market in large-scale production. This partnership ensured its commitment to offering advanced steering systems, such as electro-hydraulic power steering systems, to its customers. The partnership aims to support the active development in the automated driving space by supplying automakers with essential new-age parts and components.

The market is anticipated to witness the launch of various advanced electro-hydraulic power steering systems in the coming years as these players try to gain a competitive edge with the diversification of their product portfolio.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Adoption of Electric Vehicles

- 4.2 Market Restraints

- 4.2.1 High Upfront Cost of Electro-Hydraulic Power Steering Systems

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD)

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Commercial Vehicles

- 5.2 By Component Type

- 5.2.1 Steering Motors

- 5.2.2 Sensors

- 5.2.3 Others (Pumps, Hoses, etc.)

- 5.3 By Sales Channel

- 5.3.1 Original Equipment Manufacturer (OEM)

- 5.3.2 Aftermarket

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 United Arab Emirates

- 5.4.4.2 Brazil

- 5.4.4.3 South Africa

- 5.4.4.4 Other Countries

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 JTEKT Corporation

- 6.2.2 Nissan Motor Corporation

- 6.2.3 SEAT

- 6.2.4 Robert Bosch GmbH

- 6.2.5 ZF Friedrichshafen

- 6.2.6 Danfoss A/S

- 6.2.7 Eaton

- 6.2.8 Danotek Motion Technologies

- 6.2.9 Allied Motion Inc

- 6.2.10 Mitsubishi Heavy Industries

- 6.2.11 Dana TM4

- 6.2.12 Evamo

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Enhancement in Advanced Driver Assistance Systems (ADAS) Technology