|

市场调查报告书

商品编码

1403928

车队管理解决方案 -市场占有率分析、产业趋势/统计、2024-2029 年成长预测Fleet Management Solutions - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

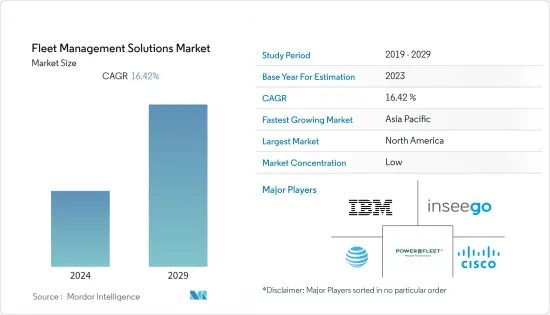

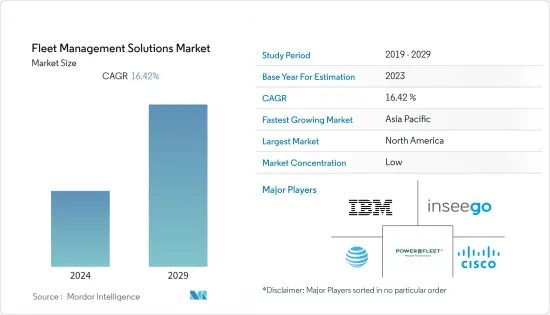

本财年车队管理解决方案市场规模估计为 244.8 亿美元。

预计五年内将达到 523.6 亿美元,预测期内复合年增长率为 16.42%。

公司正在寻求的功能包括远端工作、监控生产力和即时追踪车辆资料的能力,这有望创造商机。自动驾驶汽车的引入可能会促进市场成长,因为车队管理解决方案正在成为有效协调路线和交付时间表的关键要素。

主要亮点

- 免费和管理系统市场主要由软体、硬体、连接解决方案和网路基础设施组成,为车队营运商提供有效的监控和彙报。该解决方案使车队营运商能够降低成本和资源支出,同时确保车辆符合既定标准,从而使他们受益匪浅。市场供应商的主要关注点是透过消除非营利服务来提高车队效率。

- 货运和物流软体开发背后的第二个关键趋势是自动化的快速采用,而车队管理解决方案正在迅速采用这种方法。该市场正在从物联网、连网型卡车和货柜等新技术中获得巨大的吸引力。此外,将车辆连接到互联网将为高效的业务运营提供更多机会。

- 5G 的引入也将对车队管理产生重大影响,因为它提高了资讯传输速度,使车队能够减少延误并提高生产力。使用行动车队管理应用程式的组织使 5G 的使用成为可能。引入扩大的覆盖范围和即时通知,使车队经理及其工作人员能够保持联繫并提高生产力。

- 车队管理解决方案的功能有限,初期成本较高,每月每项资产的成本依管理系统的功能而有所不同。最终,每个解决方案的确切价格都会有所不同,并且会根据追踪的车辆数量、供应商提供的支援品质以及供应商的许可和维护费用的价格而变化,这些费用通常包含在总成本中。取决于因素。

- 由于 COVID-19 的传播导致怠速熄火车辆激增,旨在管理其他类型车辆的供应商提供的车队管理解决方案受到的打击最为严重。这是由于世界各地的封锁、旅行限制和在家工作文化所造成的。随着公司继续扩大在家工作政策以及人们避免使用叫车服务服务,这种趋势仍在继续。

车队管理解决方案市场趋势

资产管理业务预计将占据较大份额

- 资产管理系统和解决方案可以透过消除重复资料库并保持与资产管理系统 (FAST) 的直接连接,在资产和维护管理与财务之间建立联繫。这使得资料可用性和有效研究能够监控每项活动资产的有效性并审查成本效益分析。

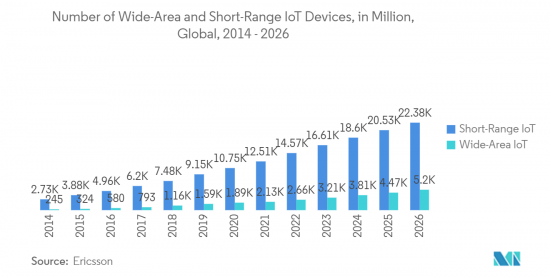

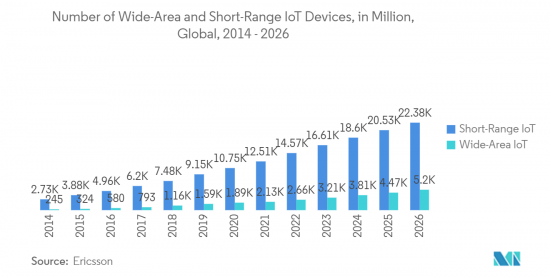

- 在当前製造和办公环境快速数位化的市场场景中,资产管理和追踪解决方案对于确保更高的业务效率变得更加重要。物联网技术的最新发展使一些最终用户能够购买经济高效的资产追踪设备。资产追踪系统的销售是由现代广域和短程物联网设备推动的,与标准的传统资产追踪系统相比,这些设备使用最少的电力和基础设施。

- 全球定位系统GPS广泛应用于车辆,但应用不限于此。全球定位系统可协助您在户外追踪您的确切位置。作为初步应用,车辆追踪系统旨在帮助运输和物流等企业追踪其所有资产,包括车辆和服务提供者。

- 在工业物联网中,资产追踪预计将在未来十年显着增加,而位置感知将成为互连设备的关键要素。随着低功耗射频晶片技术的进步以及低功耗广域网路 (LPWAN)、蓝牙 LBLE 信标的采用,物联网资产监控的新解决方案已经出现。一旦使用 RFID 技术实施资产追踪器,多个行业的需求预计将增加,包括工业自动化、供应链、物流、农业、建筑、采矿和相关市场。

北美有望成为最大市场

- 由于製造、运输和物流等工业部门的强大存在,北美是资产管理的重要市场。该地区的市场成长也得到了适用于各个最终用户领域的政府措施和法规的支持。

- 随着国内消费者越来越接受更快的运输,联合承运商和托运人必须维持对时间敏感的供应链。承运商之间在最后一英里的竞争正在推动传统车队和新兴企业向更有效率的方式转变,将小包裹直接送到消费者家中。此外,这个国家还有另一个因素极大地影响了车队所有者的营运效率:最后一个假期购物季。

- 采用车队管理解决方案被认为是该国 5G 车队管理的关键驱动因素。车队应该能够利用 5G 的关键功能来减少延迟并提高生产力。随着覆盖范围的扩大和生产力的提高,车队管理应用程式的用户可以受益于更好的 5G通讯。

- 从供应商的角度来看,汽车租赁公司开始向国内客户提供车队管理解决方案。这些公司中的大多数也利用协作和伙伴关係来建立其地理影响力。

车队管理解决方案产业概述

由于跨国公司和中小企业的存在,车队管理解决方案市场高度分散。此外,车队管理资料的增加正在推动企业转向云端技术。这个市场由包括 iD 在内的几家重要公司主导。 Systems、Cisco Systems Inc.、IBM Corporation、AT&T Inc.、Ctrack (Inseego Corp.) 市场参与者正在寻求联盟和收购等策略,以加强其产品阵容并获得永续的竞争优势。我们正在招聘。

Charles Jackson and Co. 将于 2023 年 7 月将由 InseegoAI 提供支援的 AI 车队摄影机解决方案扩展到专业运输业务,以改善安全和保险、减少碰撞并提高安全性。即时追踪、事件警报和诱发因素的状态监测相结合可以鼓励负责任的驾驶并减少碰撞事故。当事故发生时,您可以做出反应以确保引发因素的安全性并管理保险申请流程。您还可以使用影片和支援资料快速进行有效的调查。个人化或匿名的影像支援有针对性的辅导员回馈和培训策略。

2023 年 3 月,Powerfleet 宣布推出一款利用该公司车队智慧平台 Unity 上的安全和保全资料的应用程式。 Unity 摄取、编译和丰富来自任何 IoT 设备或第三方业务系统的资料。 Powerfleet 新增强的资料主导解决方案使企业能够透过一套全面且高度集中的仪表板和彙报从现实世界的安全和安保事件中获得可见性和洞察力。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 评估 COVID-19 对产业的影响

第五章 汽车晶片短缺及下游影响

第六章 Telematics概述(车载硬体)

第七章市场动态

- 市场驱动因素

- 再次强调简化车队运营

- 提供广泛的彙报和分析服务

- 经济实惠的硬体和改进的连接性

- 市场抑制因素

- 小型车队车主缺乏意识

- COVID-19 为运输业带来的不确定性

第八章市场区隔

- 按部署模型

- 本地

- 一经请求

- 混合

- 按解决方案

- 资产管理

- 资讯管理

- 驾驶人管理

- 安全与合规管理

- 风险管理

- 营运管理

- 其他解决方案

- 按最终用户

- 运输

- 活力

- 建造

- 製造业

- 其他最终用户

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 拉丁美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 北美洲

第9章竞争形势

- 公司简介

- Cisco Systems Inc.

- AT&T Inc.

- Ctrack(Inseego Corp.)

- ID Systems

- IBM Corporation

- Astrata Group

- Mix Telematics Limited

- Omnitracs LLC

- Tomtom NV

- Trimble Navigation Limited

- Verizon Communications Inc.

- Wheels Inc.

- Tenna LLC

- Samsara Network Inc.

- KeepTrucking Inc.

- Fleet Complete Inc.

- Odoo SA

- Fleetable(Affable Web Solutions Company)

- Octo Group SpA

- Geotab Inc.

- Rarestep Inc.(FLEETIO)

- Switch Board Inc.

- Azuga holdings Inc.

- Chevin Fleet Solutions

- One Step GPS LLC

- Transflo

- Go Fleet Inc.

- Advance Tracking Technologies Inc.

- Donlen Corporation By Hertz Holdings

第十章市场展望

The Fleet Management Solutions Market size is estimated at USD 24.48 billion in the current year. It is expected to reach USD 52.36 billion in five years, registering a CAGR of 16.42% during the forecast period.

Some of the features businesses are looking for, which they expect will create opportunities, include monitoring tasks and productivity in a remote environment, along with real-time tracking of fleet data. Introducing autonomous vehicles will likely contribute to market growth as fleet management solutions are becoming a key factor in effectively coordinating routes and delivery schedules.

Key Highlights

- The Fleet Management System market mainly comprises software, hardware, connectivity solutions, and network infrastructure to provide fleet operators with effective monitoring and reporting. The solution will benefit fleet operators by reducing costs and resource expenditures while making it possible to ensure that the fleet is complying with established standards. Market vendors' primary focus has been increasing fleet efficiency by eliminating services that offer no appreciable benefit.

- The second significant trend behind software development for freight and logistics is the rapid adoption of automation, where fleet management solutions rapidly adopt this approach. The market is gaining considerable traction from new technologies such as the Internet of Things, connected trucks, and containers. There would also be further opportunities for efficient business with the connection of vehicles to the Internet.

- Fleet management will also be immensely affected by 5G deployment, as it increases the speed of information transfer and allows fleets to reduce delays and productivity gains. The use of 5G will be made possible by organizations using a mobile fleet management application. The increased coverage and the introduction of immediate notifications enable fleet managers and their crews to remain in touch with each other and increase productivity.

- Fleet management solutions have high initial costs with limited functionality, and the cost per asset per month varies according to the management system's features. Ultimately, the exact price of each solution is unique and is dependent on a variety of factors, such as the number of vehicles tracked, the quality of support offered by the vendor, and the price of the vendor's licensing and maintenance fees, which are typically bundled into the total cost.

- As a result of the spread of COVID-19, which resulted in high levels of idled vehicles, fleet management solutions offered by vendors designed to manage other types of fleets have been hit hardest. This is due to a global lockdown, travel restrictions, and the culture of working from home. The trend stays in place as firms continue to expand work-from-home policies and people avoid using ride-hailing services.

Fleet Management Solutions Market Trends

Asset Management Segment Expected to Hold Significant Share

- Asset management systems and solutions allow for the creation of connections between property and maintenance management and financial by maintaining a direct connection to the (FAST) along with eliminating duplicate databases and maintaining a This allows for the monitoring of an asset's effect on each activity to be carried out so that a review of cost benefits analysis may take place, thanks to data availability and effective research.

- In the present market scenario for rapid digitalization in manufacturing and office environments, asset management and tracking solutions have become even more important to ensure a higher efficiency of operations. Several end users have benefited from recent developments in the Internet of Things technologies, enabling them to purchase economical and efficient asset-tracking equipment. The sales of asset tracker systems are driven by modern wide area and short-range Internet of Things equipment, which use minimal power and infrastructure compared with standard traditional Asset Tracker Systems.

- Global positioning systems GPS are widely used in vehicles, but the application is not limited. The use of it by organizations to monitor employees has also been reported-global positioning systems aid in tracking precise outdoor locations. As a preliminary application, the vehicle tracking system is designed to help businesses such as transport or logistics keep track of all their assets, including vehicles and drivers.

- In the Industrial Internet of Things, asset tracking is projected to increase significantly in the coming decade, and location awareness will become a key element for interconnected devices. New solutions for asset monitoring of the Internet of Things have emerged due to developments in low-power radio frequency chip technology and the adoption of Low Power Wide Area Networks, LPWAN, and Bluetooth LBLE beacons. Demand in several sectors, such as industry automation, supply chains, logistics, agriculture, construction, mining, and related markets, is anticipated to increase when asset trackers are implemented using RFID technology.

North America is Expected to Register the Largest Market

- Given the strong presence of industry sectors such as manufacturing, transportation, and logistics, North America is an important market for asset management. In addition, market growth in the region is supported by government initiatives and regulations applicable to different end-user sectors.

- Allied carriers and shippers must keep a time-definite supply chain in place, given the increasing adoption of more rapid delivery by consumers at home. The competition between carriers for the last mile has resulted in a shift to efficient methods of delivering small packages directly into consumers' homes from traditional fleets and start-ups. In addition, there is a significant factor influencing the driving efficiency of fleet owners in this country: the last holiday shopping season.

- Adopting fleet management solutions is considered a critical driving factor in this country regarding 5G fleet management. Fleets should be able to shorten delays and improve productivity using 5G's main features. Due to improved coverage and higher productivity, users of fleet management applications can benefit from better communication with 5G.

- In vendor terms, vehicle leasing companies have started offering fleet management solutions to clients in the country. In addition, most of those companies have been using cooperation and partnerships to build their geographic presence.

Fleet Management Solutions Industry Overview

The fleet management solutions market is highly fragmented due to the presence of both global players and small and medium-sized enterprises. Furthermore, companies have become interested in cloud technologies due to growing fleet management data. Several important players, I.D, dominate this market. Systems, Cisco Systems Inc., IBM Corporation, AT&T Inc., Ctrack (Inseego Corp.), and others. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

Charles Jackson and Co. expand its A.I. fleet camera solution with an InseegoAI-powered fleet dashcam solution in July 2023 to its specialist haulage operation to target safety and insurance improvements and to reduce collisions and improve safety, where the combination of live tracking, incident alerting, and driver status monitoring will help us encourage responsible driving and reduce crashes. If an incident does occur, we will be able to respond to ensure driver welfare and manage the insurance claims process, as well as use video and supporting data to undertake an effective investigation quickly. Individual or anonymized footage will support our targeted driver feedback and training strategy.

Powerfleet Inc. launched its safety and security data-powered application to Unity, its fleet intelligence platform, in March 2023. Unity ingests, compiles, and enriches data from any IoT device or third-party business system. Mixed fleets, over the road or in the warehouse or distribution center, now have a single source of truth to revolutionize the safety of assets, vehicles, and, most importantly, its people; with Powerfleet's new and enhanced data-science-driven solution, businesses have improved visibility and insights from real-world safety and security incidents under one comprehensive and highly focused set of dashboards and reporting.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 IMPACT OF CHIP SHORTAGE IN AUTOMOTIVE AND DOWNSTREAM EFFECTS

6 TELEMATICS (FLEET HARDWARE) OVERVIEW

7 MARKET DYNAMICS

- 7.1 Market Drivers

- 7.1.1 Renewed Emphasis on Streamlining Fleet Operations

- 7.1.2 Availability of a Wider Range of Reporting and Analytics Services

- 7.1.3 Affordable Hardware and Access to Greater Connectivity

- 7.2 Market Restraints

- 7.2.1 Lack of Awareness among Smaller Fleet Owners

- 7.2.2 Uncertainties in transport industry due to COVID-19

8 MARKET SEGMENTATION

- 8.1 By Deployment Model

- 8.1.1 On-Premise

- 8.1.2 On-Demand

- 8.1.3 Hybrid

- 8.2 By Solution

- 8.2.1 Asset Management

- 8.2.2 Information Management

- 8.2.3 Driver Management

- 8.2.4 Safety and Compliance Management

- 8.2.5 Risk Management

- 8.2.6 Operations Management

- 8.2.7 Other Solutions

- 8.3 By End User

- 8.3.1 Transportation

- 8.3.2 Energy

- 8.3.3 Construction

- 8.3.4 Manufacturing

- 8.3.5 Other End-Users

- 8.4 By Geography

- 8.4.1 North America

- 8.4.1.1 United States

- 8.4.1.2 Canada

- 8.4.2 Europe

- 8.4.2.1 Germany

- 8.4.2.2 United Kingdom

- 8.4.2.3 France

- 8.4.2.4 Rest of Europe

- 8.4.3 Asia Pacific

- 8.4.3.1 China

- 8.4.3.2 Japan

- 8.4.3.3 India

- 8.4.3.4 Rest of Asia Pacific

- 8.4.4 Latin America

- 8.4.4.1 Brazil

- 8.4.4.2 Argentina

- 8.4.4.3 Rest of South America

- 8.4.5 Middle East and Africa

- 8.4.5.1 United Arab Emirates

- 8.4.5.2 Saudi Arabia

- 8.4.5.3 South Africa

- 8.4.5.4 Rest of Middle East and Africa

- 8.4.1 North America

9 COMPETITIVE LANDSCAPE

- 9.1 Company Profiles

- 9.1.1 Cisco Systems Inc.

- 9.1.2 AT&T Inc.

- 9.1.3 Ctrack (Inseego Corp. )

- 9.1.4 I.D. Systems

- 9.1.5 IBM Corporation

- 9.1.6 Astrata Group

- 9.1.7 Mix Telematics Limited

- 9.1.8 Omnitracs LLC

- 9.1.9 Tomtom NV

- 9.1.10 Trimble Navigation Limited

- 9.1.11 Verizon Communications Inc.

- 9.1.12 Wheels Inc.

- 9.1.13 Tenna LLC

- 9.1.14 Samsara Network Inc.

- 9.1.15 KeepTrucking Inc.

- 9.1.16 Fleet Complete Inc.

- 9.1.17 Odoo SA

- 9.1.18 Fleetable (Affable Web Solutions Company)

- 9.1.19 Octo Group SpA

- 9.1.20 Geotab Inc.

- 9.1.21 Rarestep Inc. (FLEETIO)

- 9.1.22 Switch Board Inc.

- 9.1.23 Azuga holdings Inc.

- 9.1.24 Chevin Fleet Solutions

- 9.1.25 One Step GPS LLC

- 9.1.26 Transflo

- 9.1.27 Go Fleet Inc.

- 9.1.28 Advance Tracking Technologies Inc.

- 9.1.29 Donlen Corporation By Hertz Holdings