|

市场调查报告书

商品编码

1403930

VaaS(视讯即服务):市场占有率分析、产业趋势与统计、2024 年至 2029 年成长预测VaaS - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

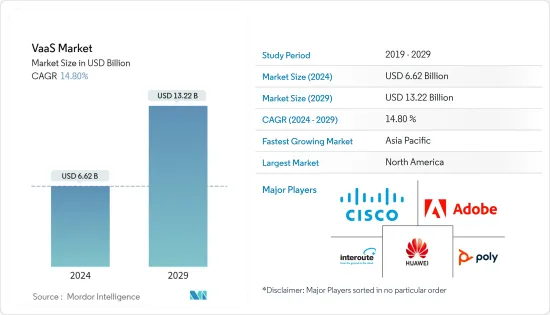

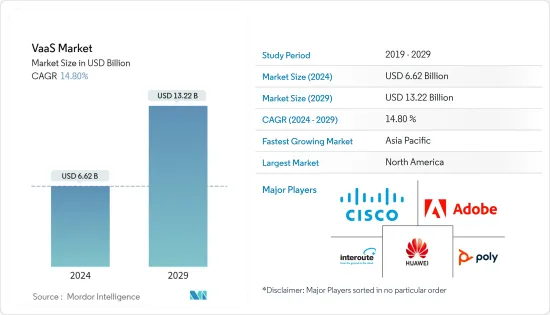

VaaS(视讯即服务)市场规模预计2024年为66.2亿美元,预计2029年将达到132.2亿美元,复合年增长率预计为14.80%。

视讯即服务(VaaS)是云端基础的视讯通讯服务,允许用户透过网路进行视讯会议、视讯通话和即时视讯串流。 VaaS 供应商提供必要的基础设施、软体和工具,使企业和个人能够透过视讯进行沟通。

主要亮点

- 云端架构提供的可扩展性、弹性和经济性正在推动需求从本地视讯会议 (VC) 和协作解决方案向云端基础的解决方案的重大转变。云端基础的解决方案的普及正在加速对视讯即服务 (VaaS) 的需求。 VaaS 让参与者在任何有网路连线的地方进行协作,从而节省时间和差旅成本。 VaaS 还提供会议转录服务,并可以协助产品演示、财务审查和其他类型的会议。

- VaaS 让参与者轻鬆地即时共用和协作处理文件和简报,从而提高生产力和效率。一些视讯会议解决方案供应商引入了各种商业模式,以更好地服务客户。解决方案提供者专注于提供专门客製化的解决方案,以满足多个企业的需求。云端基础的解决方案的使用也在增加,增加身临其境型远距临场系统、语音和脸部辨识、高清音讯和视讯以及人工智慧 (AI) 等新功能的支出也在增加。技术进步、创新以及新的 VaaS 解决方案供应商的进入将进一步加剧市场参与企业之间的竞争,使中小型企业更容易获得经济实惠的云端为基础的混合云的协作和风险投资解决方案。

- 此外,VaaS还可用于医疗保健领域的多种应用,包括远端医疗服务、远端医疗、视讯咨询和医学教育。视讯会议允许医生和医务人员与患者即时互动,无论他们身在何处。此外,医务人员可以利用视讯会议接受远端培训并与其他专业人员即时协作,提高为患者提供的护理品质。

- 市场参与企业正在策略性地部署先进的 VaaS,以扩大其影响力并获得市场占有率。例如,国际视讯技术供应商 Pexip 于 2022 年 10 月推出了 Pexip 的视讯平台即服务。透过这项服务,该公司希望透过创造创新的新产品并将影片纳入其工作流程来帮助大公司进行创新。 (VPaaS) 已推出。 Pexip 的组织结构现在由分布在美洲、欧洲、中东、非洲和亚太地区的拥有专业技术和商业资源的新业务部门组成,以支持公司对影片创新的关注。客户和公民参与、医疗保健和视讯扩增实境是团队重点关注的三个最大成长领域。

- 此外,国防部门还有一些视讯即服务应用程式。视讯监控就是其中之一,其中摄影机用于安全目的。此外,政府和国防部门还可以使用视讯会议进行沟通和协作。国防部门还可以使用云端服务来储存和存取关键任务资料。此外,军事和国防通讯业可以利用创新的数位应用和服务。国防部门受到各种宏观经济趋势的影响,包括政府支出、经济成长和全球经济状况。各国增加军事和国防费用可能会扩大研究目标市场,并为开发满足多样化需求的新产品创造机会。根据SIPRI的数据,2022年军费开支为8,770亿美元,美国位居军事开支最高国家之首。这约占同年世界军费总额(总计2.2兆美元)的40%。中国以估计 2,920 亿美元的军事开支位居第二,俄罗斯紧随其后,位居第三。

- 另一方面,高昂的采购和整合成本以及对资料安全和隐私的担忧正在限制所研究市场的成长。由于设备故障或恶劣的天气/环境条件,会发生一些误报。资料安全和隐私问题预计将因服务整合不良和缺乏系统同步而受到阻碍。

视讯即服务市场趋势

混合云端领域可望推动市场需求

- 与其他云端服务相比,混合云近年来整体成长显着。混合云允许企业扩展其运算资源。它还减少了花费大量资金来满足短期需求高峰的需要,这在您需要为敏感资料或应用程式释放本地资源时非常有用。使用云端服务的企业只需为暂时使用的资源付费,无需购买、编程和维护额外的资源和设备。这使您能够减少不产生收益的成本。

- 当处理和运算需求波动时,混合云允许公司将本地基础设施扩展到公有云并处理溢出,而无需将所有资料暴露给第三方资料中心。事实证明,这些创新有助于解决最终用户因资料安全问题而不愿迁移到此解决方案的痛点。上市公司利用公有云的弹性和运算能力来执行基本的、非敏感的运算任务,同时将关键业务程序和资料保留在本地并在公司防火墙后面安全地受到保护。为了开发混合云,服务供应商努力建构本地私有云和共享网路共用的公有云的组合。

- 此外,当用户希望在一个平台上利用私有云和公有云解决方案及服务时,混合云具有成本效益。此外,混合云很容易迁移到多重云端,并且不需要客户投资额外的硬体元件。与私有云或公有云不同,混合云将所有控制权留给组织,并且不由第三方或提供者管理。因此,政府机构和银行部门不必担心敏感资产或工作负载的安全。

- 安全性已成为混合云发展的关键问题,近年来该领域的投资大幅增加。提供混合云解决方案的公司专注于安全性。解决方案提供者提供整合安全服务,透过提供多层安全和监控来满足消费者的需求。例如,麦克菲、惠普和思科正在致力于开发先进的安全系统来保护混合云端上储存的资料。随着市场的不断成长和企业扩展其混合云功能,安全性越来越受到关注。用户正在依赖第三方混合云端安全解决方案提供者来进一步提高其能力。

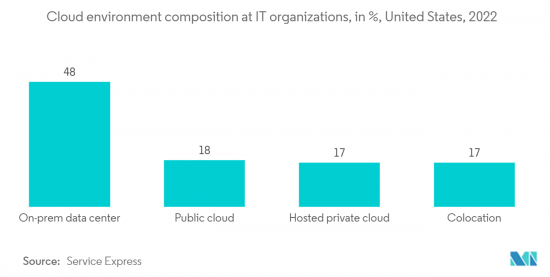

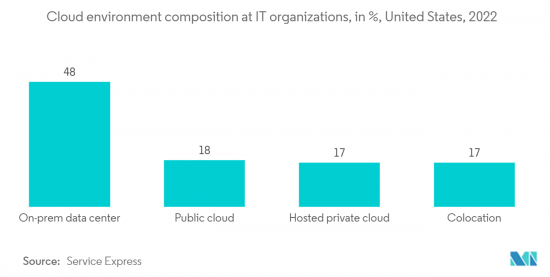

- 根据 Service Express 报道,2022 年美国的一项民调发现,本地资料中心平均占受调查组织IT基础设施环境的 48%。公共云端占18%,主机代管和託管私有云端均占17%。云端的大量使用可能会促使市场参与企业在云端部署其解决方案。

预计北美将占据最大的市场占有率

- 美国是全球最大经济体,也是北美地区VaaS(视讯即服务)的重要市场。弹性、舒适性、内容个人化、多样化内容的可得性和内容量是推动影片即服务采用的主要驱动力。随着智慧型手机通讯速度的大幅提高,该国正迅速从 4G 转向 5G。

- 随着 5G 速度的提高,对高解析度影片的需求预计也会增加。 5G 预计将实现更快、更可靠的影片串流,以及高清影片和 XR 服务等新影片服务。此外,5G 的引入预计将影响企业视讯监控和视讯串流产业,从而导致连网型生态系统快速成长。 5G将对VaaS(视讯即服务)市场产生重大影响,为消费者带来新的服务和改善的体验。

- 此外,由于许多公司突然转向在家工作文化,Zoom、Microsoft Teams 和 Google Workspace 的视讯软体和服务需求激增。积极使用这些网站的人数显着增加。根据报道,2022 年 1 月 Microsoft Teams 的月有效用户为 2.7 亿,比 2021 年 7 月增加了 2,000 万。

- 该地区的主要行业参与企业不断增强其产品供应,以保持竞争并满足最终用户不断变化的需求。这就是为什么我们将 VaaS 与人工智慧、深度学习和机器学习等先进技术相结合。此外,视讯即服务 (VaaS) 市场的参与企业正在采用先进的基于人工智慧的 VaaS,以提供一种自足式的方式来即时监控和增强视讯内容服务。例如,美国通讯技术开发商 Zoom Video Communications, Inc. 最近在其 VaaS(视讯即服务)中添加了端到端解决方案,该解决方案已向全球免费和付费用户提供.我们宣布增加加密功能。此外,将这些先进技术整合到 VaaS 中可以显着提高准确性并减少误报。预计这些因素将在未来几年为该行业创造新的机会。

- 2023 年 3 月,Amazon Web Services (AWS) 宣布推出 Amazon Interactive Video Service (Amazon IVS),这是一种託管直播解决方案,使开发人员能够创建互动式视讯体验。开发人员目前正在使用 Amazon IVS 为各种行业创建应用程序,包括社交网路、电子商务和健身。自Amazon IVS推出以来,协作直播已成为重要趋势。 Twitch 等公司正在推出 Guest Star 等工具,帮助主播吸引观众参与直播视讯节目,让节目更加精彩、更具互动性。

VaaS(影片即服务)产业概述

随着全球参与企业不断创新其服务以为用户提供具有成本效益的服务,VaaS(视讯即服务)市场变得支离破碎,导致市场竞争之间的激烈竞争。主要参与企业包括思科系统公司、华为技术有限公司、Adobe系统公司和宝利通。

- 2022年7月-浙江行动、精友科技、华为联合推出全新呼叫解决方案New Calling。为了重新定义现有的呼叫服务,为个人用户和企业客户提供卓越的语音和视讯通话质量,该解决方案采用「1平台+3功能+N服务」的架构模型。 New Calling系统在核心语音网路上建构New Calling平台与统一媒体功能,实现超高画质视讯通话、智慧型视讯通话、互动式视讯通话三大竞争通话功能。

- 2022年3月-全球行动互联网通讯、企业和客户技术解决方案的主要供应商中兴通讯宣布推出优质视讯平台2.0(PVP2.0)大视讯解决方案Did。 「新生态」的PVP2.0解决方案可以提供以营运商为中心的ATV启动器,让营运商可以根据需要采用自己喜欢的业务展示方式。营运商可以快速有效地整合第三方功能和应用程序,例如 Google Assistant 和 Google Ads。透过对融合视讯平台的支持,营运商可以将服务扩展到更多新市场并创造商业合作机会。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 评估宏观经济趋势对市场的影响

第五章市场动态

- 市场驱动因素

- 增加对云端基础视讯服务的投资

- 赋能数位化劳动力

- 市场抑制因素

- 创建和检验影片内容的高成本

第六章市场区隔

- 按平台

- 应用程式管理

- 设备管理

- 网路管理

- 按设备

- 行动装置

- 企业运算

- 按服务

- 管理

- 专业的

- 按部署模型

- 公共云端

- 私有云端

- 混合云端

- 按最终用户产业

- 政府/国防

- BFSI

- 医疗保健

- 资讯科技/通讯

- 媒体与娱乐

- 製造业

- 其他最终用户产业

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章竞争形势

- 公司简介

- Cisco Systems, Inc.

- Huawei Technologies Co., Limited

- Adobe Systems

- Interoute Communications Limited

- Polycom, Inc.

- Avaya, Inc.

- Vidyo, Inc.

- BlueJeans Network

- Applied Global Technologies, LLC

- AVI-SPL, Inc.

第八章投资分析

第九章 市场机会及未来趋势

The VaaS Market size is estimated at USD 6.62 billion in 2024, and is expected to reach USD 13.22 billion by 2029, growing at a CAGR of 14.80% during the forecast period (2024-2029).

Video as a Service (VaaS) is a cloud-based video communication service that allows users to conduct video conferences, video calls, and live video streaming over the Internet. VaaS providers offer the necessary infrastructure, software, and tools to enable businesses and individuals to communicate through video.

Key Highlights

- Due to the high scalability, flexibility, and affordability provided by the cloud architecture, there is a discernible movement in demand away from on-premises video conferencing (VC) and collaboration solutions to cloud-based solutions. The popularity of cloud-based solutions has accelerated the demand for video as a service (VaaS). It saves time and travel expenses, as participants can collaborate from anywhere with an Internet connection. It also provides meeting transcription services, which can assist with product presentations, financial reviews, and other types of meetings.

- VaaS enhances productivity and efficiency, as participants can easily share and collaborate on documents and presentations in real time. Several video conferencing solutions vendors have implemented various business models to better serve their clients. Solution providers are putting their efforts into providing solutions specifically tailored to satisfy the needs of multiple enterprises. The use of cloud-based solutions is also increasing, as are the expenditures made to add new capabilities like immersive telepresence, voice and face recognition, HD audio and video, and artificial intelligence (AI). There will likely be more competition among the market players due to advancements in technology, innovations, and the entry of new VaaS solution providers, which would facilitate small and medium businesses to utilize affordable hybrid cloud-based collaboration and VC solutions.

- Further, VaaS can have various uses in the healthcare sector, such as remote healthcare services, telemedicine, video consultations, medical education, etc. With video conferencing, physicians and medical staff can interact with patients in real time, regardless of their physical location, which can be beneficial for patients who may have difficulty traveling. Additionally, medical staff can receive remote training and collaborate with other professionals in real time using video conferencing, which can improve the quality of care provided to patients.

- The market players are strategically deploying advanced VaaS to expand their presence and capture the market share. For instance, in October 2022, Pexip, an international provider of video technology, launched Pexip's Video Platform as a Service. With the service, the company hopes to empower big businesses to create innovative new products, incorporate video into workflows, and innovate. (VPaaS). Pexip's organizational structure, which currently comprises a new business unit with dedicated technical and commercial resources throughout the Americas, EMEA, and APAC, supports the company's focus on video innovation. Customer and citizen engagement, healthcare, and video-enabled extended reality are claimed to be the three major growth areas that this team is focusing on.

- Additionally, there are several uses of video as a service in the defense sector. Video surveillance is one such use, where cameras are used for security purposes. Additionally, video conferencing can be used by the government and defense sector for communication and collaboration. The defense sector can also use cloud services to store and access mission-critical data. Furthermore, innovative digital applications and services can be leveraged by the military and defense communication industry. The defense sector is influenced by various macroeconomic trends such as government spending, economic growth, and global economic conditions. The increasing spending of the various countries on military and defense would create an opportunity for the studied market to grow and develop new products to cater to a diverse range of needs. According to SIPRI, With USD 877 billion allocated to the military in 2022, the United States leads the ranking of countries with the largest military spending. That equated to approximately 40% of overall global military spending that year, which totaled USD 2.2 trillion. With an estimated USD 292 billion spent, China was the second-highest military spender, with Russia coming in third.

- On the other side, high acquisition and integration costs and data security and privacy concerns restrain the growth of the studied market. Several false alarms are triggered as a result of malfunctioning equipment and unfavorable weather or environmental conditions. Data security and privacy issues are anticipated to be a roadblock due to the service's poor integration or lack of system synchronization.

Video-as-a-Service Market Trends

The Hybrid Cloud Segment is Anticipated to Drive the Market Demand

- The hybrid cloud has seen significant overall growth in recent years compared to other cloud services, as it provides several benefits to organizations with large data volumes. Companies can scale computing resources by using a hybrid cloud. It also reduces the need to invest large sums of money to handle short-term surges in demand, which is useful when the company has to free up local resources for sensitive data or applications. Companies that use cloud services must pay only for the resources they use momentarily rather than purchasing, programming, and maintaining extra resources and equipment that sit dormant for long periods. This assists businesses in reducing costs that do not generate revenue.

- When processing and computing demand fluctuates, hybrid cloud computing enables businesses to scale out their on-premises infrastructure to the public cloud to address any overflow without exposing all of their data to third-party data centers. These innovations have proved beneficial in addressing the worries of end-users who were previously unwilling to migrate to this solution due to concerns about data security. Organizations benefit from the public cloud's flexibility and computing capacity for basic and non-sensitive computing tasks while keeping business-critical programs and data on-premises and secure behind a company firewall. To develop a hybrid cloud, service providers strive to create a combination of on-premise private cloud and public cloud that share a network connection.

- Further, a hybrid cloud is cost-effective when the user wishes to use both private and public cloud solutions or services on a single platform. In addition, the hybrid cloud allows an easy transition to the multi-cloud and does not require the customers to invest in an additional hardware component. Unlike private and public clouds, in the hybrid cloud, all the control is given to the organization and is not managed by a third party or the provider. Therefore, government organizations and banking sectors need not worry about the security of sensitive assets or workloads.

- The investment in this space has also grown exponentially over the past few years, as security is becoming one of the significant challenges for the growth of the technology. Companies offering hybrid cloud solutions are focusing heavily on security. Solution providers are offering integrated security services to cater to the consumer's requirements by providing multilayer security and monitoring. For example, McAfee, HP, and Cisco are working towards the development of high-level security systems to protect the data stored on hybrid clouds. With the market size growing significantly and companies expanding their hybrid cloud capabilities, the focus on security is increasing. Users rely on third-party hybrid cloud security solution providers to improve their abilities further.

- According to Service Express, an average of 48% of surveyed organizations' IT infrastructure environments were on-premises data centers, according to a 2022 poll in the United States. The public cloud accounted for 18%, while colocation and hosted private cloud both accounted for 17%. Such massive usage of the cloud would push the market players to deploy their solutions to the cloud.

North America is Anticipated to Hold the Largest Market Share

- The United States is the largest economy in the world and has been a significant market for Video as a Service in the North America region. The flexibility, comfort, content personalization, availability of diverse content, and content volume have primarily driven the adoption of Video as a Service. With smartphone transmission speeds increasing dramatically, the country is witnessing an early transition from 4G to 5G.

- With increased rates of 5G, higher-resolution videos are expected to witness an uptick in demand. It is expected that 5G will enable faster and more reliable video streaming, as well as new video services such as HD video and XR services. Moreover, the introduction of 5G is anticipated to affect video surveillance for businesses and the video streaming industry, leading to rapid growth in the connected ecosystem. 5G would have a significant impact on the Video as a Service market, allowing for new and improved services and experiences for consumers.

- Further, Zoom, Microsoft Teams, and Google Workspace have all seen a spike in demand for video software and services as a result of the abrupt shift of many firms to a work-from-home culture. The number of individuals who are actively using these sites is significantly increasing. Microsoft Teams reported 270 million monthly active users in January 2022, an increase of 20 million from July 2021.

- Major industry players in the region are constantly enhancing their product offerings to maintain a competitive edge and suit the evolving needs of end customers. Therefore, they combine VaaS with advanced technologies like AI, deep learning, and machine learning. Additionally, VaaS market players embrace advanced AI-based VaaS to offer a self-contained way to monitor and enhance video content services in real time. For instance, the American company Zoom Video Communications, Inc., which develops communications technology, recently announced the addition of end-to-end encryption capabilities to its already-available video-as-a-service offerings for free and premium users worldwide. Additionally, integrating these sophisticated technologies into VaaS can lead to significant improvements in accuracy and a decrease in false alarms. These factors are anticipated to present new chances for the industry in the coming years.

- In March 2023, Amazon Interactive Video Service (Amazon IVS), a managed live streaming solution enabling developers to create interactive video experiences, was introduced by Amazon Web Services (AWS). Currently, developers create apps for various industries, such as social networking, e-commerce, and fitness, using Amazon IVS. Since the introduction of the Amazon IVS, collaborative live streaming has been a significant trend. Companies like Twitch have introduced tools like Guest Star that let streamers draw viewers into live video shows, resulting in more exciting and interactive programming.

Video-as-a-Service Industry Overview

The video as a service market is fragmented as the global players are innovating their services to provide cost-benefit offers to the users, which gives a high rivalry to the market competitors. Key players are Cisco Systems, Inc., Huawei Technologies Co., Adobe Systems, Polycom, Inc., etc. Recent developments in the market are -

- July 2022 - New Calling, a brand-new calling solution, was jointly launched by Zhejiang Mobile, Jingyou Technology, and Huawei. To redefine current call services and offer great audio and video call quality to individual users as well as business customers, this solution uses the "1 platform + 3 capabilities + N services" architectural model. The New Calling system allows three competitive calling capabilities-UHD video calling, intelligent video calling, and interactive video calling-by creating the New Calling Platform and Unified Media Function on top of the core voice network.

- March 2022 - ZTE Corporation, a significant global supplier of telecommunications, enterprise, and customer technology solutions for the mobile internet, announced the debut of its Premium Video Platform 2.0 (PVP2.0) big video solution. The PVP2.0 solution for "New Ecosystem" can offer an operator-centric ATV launcher, allowing operators to adopt their preferred service display styles as necessary. Operators can rapidly and efficiently incorporate third-party features and apps like Google Assistant and Google Ads. With the support of a converged video platform, it enables operators to expand their service into more new markets, creating opportunities for business partnerships.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Impact of Macro Economic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Investment on Cloud-Based Video Services

- 5.1.2 Enabling Digital Workforce

- 5.2 Market Restraints

- 5.2.1 High Cost of Video Content Creation and Validity

6 MARKET SEGMENTATION

- 6.1 By Platform

- 6.1.1 Application Management

- 6.1.2 Device Management

- 6.1.3 Network Management

- 6.2 By Device

- 6.2.1 Mobility Devices

- 6.2.2 Enterprise Computing

- 6.3 By Service

- 6.3.1 Managed

- 6.3.2 Professional

- 6.4 By Deployment Model

- 6.4.1 Public Cloud

- 6.4.2 Private Cloud

- 6.4.3 Hybrid Cloud

- 6.5 By End-user Industry

- 6.5.1 Government and Defense

- 6.5.2 BFSI

- 6.5.3 Healthcare

- 6.5.4 IT & Telecom

- 6.5.5 Media & Entertainment

- 6.5.6 Manufacturing

- 6.5.7 Other End-user Industries

- 6.6 Geography

- 6.6.1 North America

- 6.6.2 Europe

- 6.6.3 Asia-Pacific

- 6.6.4 Latin America

- 6.6.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems, Inc.

- 7.1.2 Huawei Technologies Co., Limited

- 7.1.3 Adobe Systems

- 7.1.4 Interoute Communications Limited

- 7.1.5 Polycom, Inc.

- 7.1.6 Avaya, Inc.

- 7.1.7 Vidyo, Inc.

- 7.1.8 BlueJeans Network

- 7.1.9 Applied Global Technologies, LLC

- 7.1.10 AVI-SPL, Inc.