|

市场调查报告书

商品编码

1403966

商业分析:市场占有率分析、产业趋势/统计、2024-2029 年成长预测Business Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

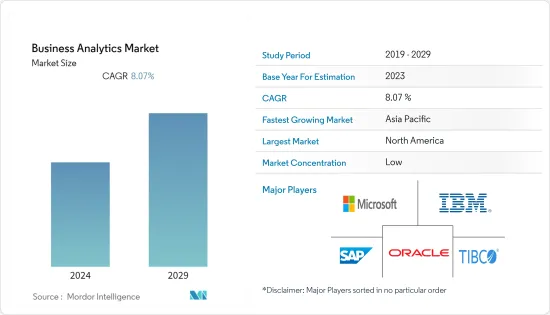

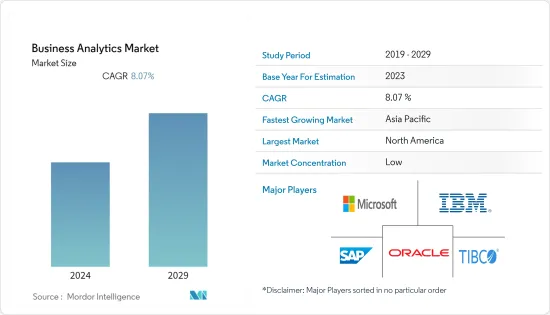

上年度商业分析市场规模为814.6亿美元,预计未来五年将达1,309.5亿美元,预测期内复合年增长率为8.07%。

业务分析市场主要是由最终用户行业数位化的提高以及更好地了解客户和改善业务的需求不断增长所推动的。此外,供应商将先进技术整合到其业务分析解决方案中预计将在未来几年推动市场发展。

主要亮点

- 业务分析市场正在迅速发展。人们越来越重视即时商业智慧 (BI),以实现更快的决策和资料视觉化,从而更清楚地看到资料模式。此外,未来几年各种最终用户的使用量增加预计将推动对更有效率的业务分析解决方案的需求。

- 传统上,许多组织的策略决策都是由依赖大型集中管理资料伺服器和仓库的业务分析所驱动的。然而,最近情况发生了变化,业务分析师从数十个不同的资料来源中提取资料。

- 此外,面向业务用户的视觉化和探索性资料分析正在发展成为业务分析市场中最重要的趋势之一。各个最终用户产业也在利用业务分析的力量来制定策略性业务决策。商业分析解决方案对于製造中的供应链管理、库存管理、目标绩效衡量和风险缓解规划非常有用,同时还可以扩展到诈欺侦测和防御。

- 此外,供应商还透过整合更好的资料储存设施和先进的视觉化技术来引入创新的业务分析解决方案。例如,由现代机器语言 (ML) 支援的业务分析平台正在提高资料可见性和理解。此外,资料的激增使新兴企业有能力建立更好的客製化分析产品,以与老牌公司竞争。

- COVID-19 的爆发带来了跨产业数位转型的热潮,包括云端解决方案、人工智慧 (AI) 和 ML 的采用。这一趋势加速了许多公司对高阶业务分析和人工智慧的使用。这些策略有助于透过数位管道吸引客户,管理脆弱而复杂的供应链,并为工人提供就业和生计中断的支援。对业务分析解决方案的需求已经超过了 COVID-19 之前的需求,预计未来几年将会成长。

商业分析市场趋势

BFSI预计持有主要股份

- 科技正在改变银行和金融业。随着网路使用量的增加以及行动装置和应用程式的普及,当今的金融机构在高度动态的市场中面临着日益激烈的竞争、不断变化的客户需求以及严格的控制和风险管理。此外,数位化的不断发展和数位付款的普及也增加了 BFSI 行业对业务分析的需求。

- 同时,科技正在创造强大的商业分析工具。商业分析工具使银行和金融业能够利用客户资料获得洞察,从而实现更创新、更有效率的管理实践和更好的业务决策。银行和金融机构依靠业务分析解决方案来提高盈利、降低风险并创造竞争优势。

- 此外,业务分析的出现和应用正在帮助银行和金融业透过优化流程和简化业务来提高效率和竞争。世界各地的许多银行和金融机构正在努力改进业务分析,主要是为了获得相对于竞争的优势或预测可能影响其业务的新兴趋势。这是有原因的。

- 此外,银行、金融服务和保险 (BFSI) 公司正在利用业务分析解决方案来吸引更多客户。例如,随着对零售客户的日益关注,Yes Bank 正在利用资料来了解客户行为。因此,有可能根据特定的预测模型提供理想的产品组合。该银行已经多元化进入零售领域,目前正在利用资料分析开发模型来帮助了解客户行为。该银行已为其资料策略预留了约 12-150 亿卢比的资金,直至 2022-23 年,并将聘请资料科学家和专家作为TechTONic 团队的一部分,该团队拥有100 名内部专家。这是一项计划。

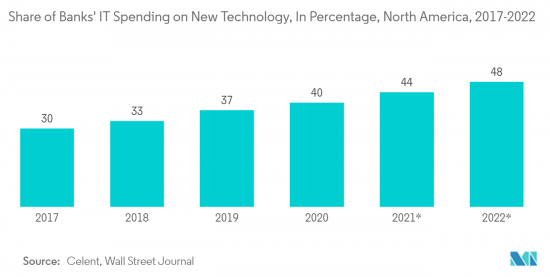

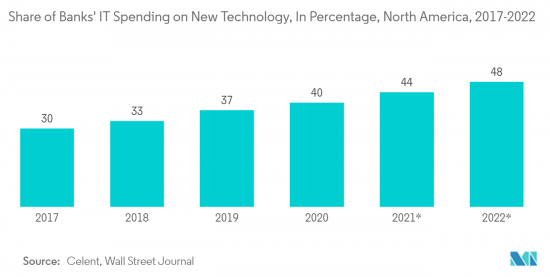

- 此外,随着世界各地的 BFSI 开始采用新技术和先进技术,BFSI 行业采用业务分析解决方案的新机会正在出现。例如,根据 Celent 和《华尔街日誌》的资料,今年新科技将占北美银行 IT 支出的 48%,高于 2017 年的 30%。

预计北美将占据主要份额

- 该地区是市场上一些最着名供应商的所在地,包括 Microsoft、 Oracle和销售团队。这些供应商的持续产品创新和产品业务分析的增强正在该地区的各个最终用户产业中找到重要的应用。

- 此外,新参与企业和新兴企业还与大型商业分析公司竞争,并透过提供创新解决方案和吸引商业分析市场的大量投资来推动市场发展。例如,2022 年 10 月,主导的人工智慧驱动决策智慧平台 Tellius 宣布获得贝尔德资本主导的 1,600 万美元 B 轮资金筹措。资金筹措将用于加强 Tellius 的决策智慧平台,扩大公司的上市能力,并支援销售、行销和产品工程职能的人才招募。

- 此外,该地区是先进技术的早期采用者,帮助供应商为消费者提供客製化的、技术支援的商业分析解决方案。此外,该地区各组织的云端采用率正在不断提高,从而能够成功实施业务分析。

- 此外,数位化的加速、先进分析和云端运算的早期采用已成为获得竞争优势的最基本和最重要的技术之一。因此,该地区的技术领导者越来越多地借助尖端云端服务和工具来扩展其公司的资料和业务分析策略。此类案例预计将推动该地区对业务分析解决方案的需求。

商业分析产业概述

商业分析市场高度分散,许多小型企业和大公司竞争。市场上的技术进步也为公司提供了永续的竞争优势,市场上发生了一些联盟和合併。该市场的主要企业包括 IBM、微软和Oracle。

2022 年 11 月,IBM 宣布发布名为 Business Analytics Enterprise 的商业智慧和分析套件。此解决方案旨在帮助组织打破因不同部门使用不同分析工具而造成的资料墙和协作孤岛。该公司表示,新套件包括一个新的分析内容中心、Planning Analytics 和 Cognos Analytics 的增强版本,以及 IBM Watson(一个可以回答以自然语言提出的问题的问答电脑系统)。它为预算提供了商业智慧工具、报告和预测跨部门的资料。

2022 年 11 月,渣打银行和美国金融科技平台 Upswot 在新加坡推出了商业分析解决方案。借助这项新解决方案,渣打银行的中小型企业客户现在可以将集中与其业务应用程式集成,并使用聚合资料进行仪表板分析和即时洞察。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

- 评估 COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 增加资料量和云端部署

- 商业分析/情报提供者与多元化公司合作以利用分析能力

- 市场挑战

- 投资成本高,严重依赖传统工艺

第六章市场区隔

- 按配置

- 本地

- 云端基础

- 混合

- 按最终用户产业

- 银行、金融服务和保险

- 卫生保健

- 製造业

- 零售

- 通讯/IT

- 其他最终用户产业

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章竞争形势

- 公司简介

- Oracle Corporation

- IBM Corporation

- SAP SE

- Microsoft Corporation

- Tibco Software, Inc.

- SAS Institute, Inc.

- Infor, Inc.

- Microstrategy Incorporated

- QLIK Technologies, Inc.

- Salesforce.com Inc.(Tableau Software Inc.)

第八章投资分析

第9章市场的未来

The Business Analytics market size was valued at USD 81.46 billion in the previous year and is expected to reach USD 130.95 billion in the next five years, registering a CAGR of 8.07% during the forecast period. The business analytics market is primarily driven by the increasing digitalization across end-user industries and the need to improve their businesses with a better understanding of the customers. In addition, market vendors' integration of advanced technologies in business analytics solutions is expected to drive the market in the coming years.

Key Highlights

- The business analytics market is evolving quickly. Increasingly, the emphasis is on real-time Business Intelligence (BI) to enable faster decision-making and on Data Visualization, which enables data patterns to be seen more clearly. Additionally, demand for more efficient business analytics solutions is anticipated to be driven by increasing usage among various end users in the upcoming years.

- Traditionally, strategic decisions in many organizations were powered by business analytics that relied on big, centralized-managed data servers or warehouses. However, things have changed recently, and business analysts are pulling data from dozens of heterogeneous data sources.

- In addition, visualization and explorative data analysis for the business user have been evolving into one of the most critical trends in the business analytics market. Various end-user industries also leverage business analytics' power to make strategic business decisions. While business analytics solution helps in supply chain management, inventory management, measuring the performance of targets, and risk mitigation plans in manufacturing, it is extended to include fraud detection and defense.

- Further, the vendors are introducing innovative business analytics solutions by integrating advanced technologies for better data storage facilities and visualization. For instance, modern Machine Language (ML) - powered business analytics platforms offer improved data visibility and comprehension. Furthermore, the proliferation of data has enabled startups to compete successfully with established blue-chip firms by building customized and superior analytics offerings.

- The COVID-19 pandemic led to a boom in digital transformation, such as adopting cloud solutions, Artificial Intelligence (AI), and ML across various industries. The outbreak accelerated many companies' use of advanced business analytics and AI. These strategies helped engage customers through digital channels, manage fragile and complex supply chains, and support workers by disrupting their work and lives. The demand for business analytics solutions exceeded pre-COVID-19 and is expected to grow in the coming years.

Business Analytics Market Trends

BFSI is Expected to Hold Major Share

- Technology is transforming the banking and finance industry. With the rising usage of the internet and the proliferation of mobile devices and apps, today's financial institutions face mounting competition, changing client demands, and strict control and risk management in a highly dynamic market. In addition, the growing digitalization and proliferation of digital payments are driving the need for business analytics in the BFSI industry.

- Further, at the same time, technology has given rise to powerful business analytics tools. The banking and finance industry can use business analytics tools to leverage customer data for insights that can lead to more innovative and efficient management practices and better business decisions. Banking and finance institutions use business analytics solutions to drive profitability, reduce risk, and create a competitive advantage.

- Furthermore, the advent and application of business analytics have helped the banking and finance industry optimize processes and streamline operations, thus improving efficiency and competitiveness. Many banks and financial institutions worldwide are working on improving their business analytics, mainly to give them an edge against the competition or to predict emerging trends that can affect their businesses.

- Moreover, Banking, Financial Services, and Insurance (BFSI) companies are leveraging business analytics solutions to acquire more customers. For instance, with the increasing focus on retail customers, Yes Bank is leveraging data to understand customer behavior. Hence, based on a certain forecasting model, it might provide the ideal mix of products. The bank has already diversified into the retail segment and is now harnessing data analytics to develop models that help understand customer behavior. The bank has built a war chest of about INR 120-150 crore for its data strategy up to 2022-23 and plans to hire data scientists and experts who will be part of the company's TechTONic group, which has 100 in-house experts.

- Moreover, the BFSIs across the world have started adopting new and advanced technologies, thus further opening new opportunities for adopting business analytics solutions in the BFSI industry. For instance, according to the data from Celent and Wall Street Journal, the share of banks' IT spending on new technology in North America is expected to increase from 30% in 2017 to 48% in the current year.

North America is Expected to Hold the Major Share

- The region is home to some of the most prominent market vendors, such as Microsoft, Oracle, and Salesforce.com. These players' continuous product innovations and enhanced product business analytics are finding significant applications in various end-user industries across the region.

- Further, new and emerging players are also competing with giant business analytics players by offering innovative solutions and attracting significant investments in the business analytics market, thus driving the market. For instance, in October 2022, Tellius, a leading AI-driven decision intelligence platform, announced a USD 16 million Series B funding round led by Baird Capital. The latest funding will likely be used to enhance Tellius' decision intelligence platform, expand the company's go-to-market capabilities, and support talent acquisition across sales, marketing, and product engineering functions.

- Moreover, the region is an early adopter of advanced technologies, helping market vendors offer customized and advanced technology-enabled business analytics solutions for consumers. In addition, the region is witnessing high adoption of the cloud across organizations, thus enabling the proper implementation of business analytics.

- Further, accelerated digitalization and early adoption of advanced analytics and cloud computing have emerged as one of the most essential and crucial technologies to gain competitive advantage. As a result, technology leaders across the region are increasingly scaling their enterprises' data and business analytics strategies with the help of cutting-edge cloud services and tools. Such instances are expected to drive the region's demand for business analytics solutions.

Business Analytics Industry Overview

The business analytics market is highly fragmented due to the presence of many small and medium-sized companies competing with each other and large enterprises. Technological advancements in the market are also bringing sustainable competitive advantage to companies, and the market is witnessing multiple partnerships and mergers. Some key players in the market include IBM, Microsoft, and Oracle, among others.

In November 2022, IBM announced the release of a business intelligence and analytics suite dubbed Business Analytics Enterprise. The solution was designed to help organizations break down data barriers and silos to collaboration caused by the use of various analytics tools across different divisions. The company said that the new suite - comprising a new Analytics Content Hub and enhanced versions of Planning Analytics and Cognos Analytics with IBM Watson (a question-answering computer system capable of answering questions posed in natural language)- provides business intelligence tools for budgeting, reporting, and forecasting data across different divisions.

In November 2022, Standard Chartered and US-based fintech platform upSwot launched a business analytics solution in Singapore that was to offer small- and medium-sized enterprises (SMEs) clients insights and forecasting capabilities on a single digital platform. The new solution allowed SME clients of Standard Chartered to integrate their business apps with upSWOT to produce dashboard analysis and real-time insights using the aggregated data.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact Of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Volumes of Data and Cloud Deployment

- 5.1.2 Business Analytics/Intelligence Providers' Partnerships with Companies from Diversified Businesses to Leverage Analytics Capabilities

- 5.2 Market Challenges

- 5.2.1 High Investment Costs and Significant Reliance on Traditional Processes

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 On-premise

- 6.1.2 Cloud-based

- 6.1.3 Hybrid

- 6.2 By End-user Industry

- 6.2.1 Banking, Financial Services, and Insurance

- 6.2.2 Healthcare

- 6.2.3 Manufacturing

- 6.2.4 Retail

- 6.2.5 Telecom and IT

- 6.2.6 Other End-user Industries

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Oracle Corporation

- 7.1.2 IBM Corporation

- 7.1.3 SAP SE

- 7.1.4 Microsoft Corporation

- 7.1.5 Tibco Software, Inc.

- 7.1.6 SAS Institute, Inc.

- 7.1.7 Infor, Inc.

- 7.1.8 Microstrategy Incorporated

- 7.1.9 QLIK Technologies, Inc.

- 7.1.10 Salesforce.com Inc. (Tableau Software Inc.)