|

市场调查报告书

商品编码

1404085

资料中心网路:市场占有率分析、产业趋势/统计、2024-2029 年成长预测Data Center Networks - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

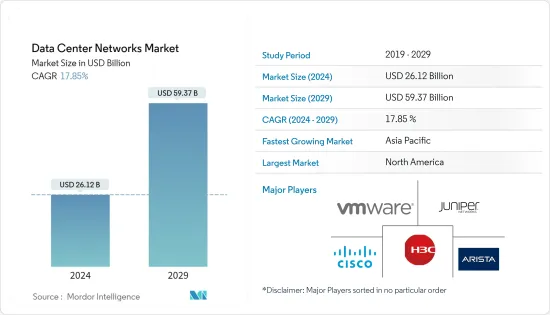

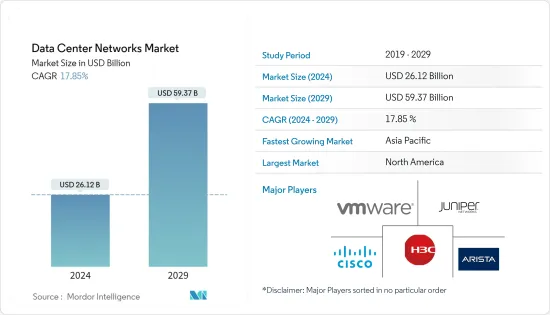

预计2024年资料中心网路市场规模为261.2亿美元,2029年达到593.7亿美元,在市场估计与预测期间(2024-2029年)复合年增长率为17.85%。

边缘运算使运算资源、资料和处理更接近边缘,正在成为资料中心和云端服务不可或缺的一部分。园区网路、行动电话网路、云端和资料中心网路的分散式扩展。

主要亮点

- 资料中心网路透过同时使用多个网路资源来有效管理各种基础架构。它在资料收集和处理中起着至关重要的作用,并得到各种网路资源的支持。使用交换器、伺服器和储存点,资料中心网路可以提供高频宽资料传输。

- 对更快互联网速度的需求不断增长以及大型资料中心和主机代管的显着增加将影响资料中心网路产业的发展。 100GB交换器连接埠的普及以及宽频和网路基础设施的快速发展也有望推动该市场的成长。

- 银行、金融服务、保险 BFSI 政府等领域对资料安全和低延迟的需求不断增长,推动了对先进网路基础设施解决方案的需求。因此,对这些网路技术的兴趣正在推动银行、金融服务、保险、BFSI 政府等各部门的需求。

- 然而,在此期间资料中心网路成长的主要障碍预计将是新兴低度开发国家对更高技能劳动力的需求,以及资料保护监管问题。

- 此外,随着新冠肺炎 (COVID-19) 的爆发,疫情增加了资料流量。巨量资料、人工智慧、物联网等新兴技术的快速发展增加了对储存空间的需求。儘管如此,世界各地对资料中心网路的投资正在增加。

资料中心网路市场趋势

零售和电子商务成长预计将推动市场需求

- 现代技术的一个基本要素是资料中心网络,它使得外部网路上的设备和基础设施之间能够顺利资讯交流。支援虚拟、云端处理等新技术的互联网系统的设计必须确保稳定性、可靠性和安全性。

- 对于零售商来说,要在当今的市场中保持竞争力,必须为客户提供量身定制的购物体验。零售商追踪顾客过去的交易,以便提供个人化的产品推荐。鑑于消费者数量的不断增加,提供有效的资料中心的需求已变得势在必行。

- 对于零售商来说,资料中心网路消除了将交易和客户资料储存在中央位置的需要,从而使资讯更加安全。资料中心网路的这一方面尤其重要,因为它为客户敏感资讯提供了一个安全的环境。

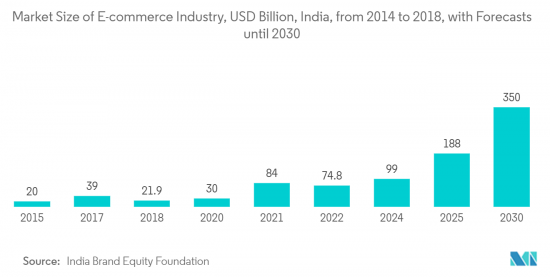

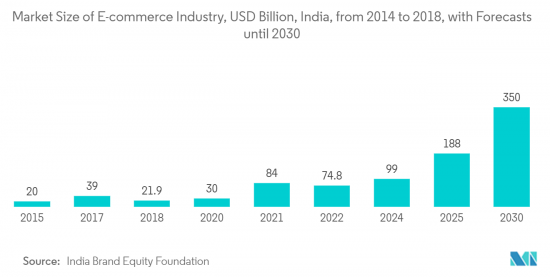

- 在亚太地区,电子商务的强劲成长可能会导致零售额大幅成长,进而进一步扩大市场。印度电子商务产业呈指数级增长,据印度品牌资产基金会 IBEF 称,印度电子商务市场预计到 2021 年将达到约 840 亿美元,到 2030 年将接近 3,500 亿美元。

亚太地区预计将推动研究市场的成长

- 由于智慧技术、物联网设备、巨量资料、工业4.0、5G和云端运算的重要性日益增加,预计亚太地区将在预测期内实现高速成长。

- 该地区的资料中心部署也有所增加。例如,2023年1月,泰米尔国有饮料公司TasMAC授予RailTel一份价值3590万美元的合同,作为其IT基础设施提供者。未来五年,Railtel 将为 Tasmac 提供端到端电脑化和连接。其中包括 Railtel计划提供基础设施,包括与泰米尔纳德邦资料中心 (TNSDC) 合作开发双向灾害復原资料中心和资料復原中心。

- 由于资料中心基础设施的采用增加、备份和储存的快速需求以及云端储存使用量的增加,预计2020年将出现导致资料中心网路市场成长的各种新机会。

- 此外,由于中国各地新资料中心建设的增加以及半导体组件相关成本较低的现有技术的替代,预计资料中心网路市场将对网路基础设施产生巨大的需求。

资料中心网路产业概况

资料中心网路市场处于半固体状态,现有供应商和新进业者面临激烈的竞争。云端处理的成长吸引了希望利用该行业成功的新投资者。该市场的主要企业包括思科系统公司、瞻博网路公司、Arista网路公司、H3C控股有限公司和VMware公司。

- 2023 年 4 月 - Arista Networks Inc. 宣布将在云端提供人工智慧驱动的网路身分服务,用于企业安全和 IT 营运。 Arista Guardian for Network Identity 基于 Arista 的旗舰云端视觉平台构建,并将 Arista 的零信任网路方法扩展到企业安全。

- Juniper Networks, Inc.(总公司:东京都港区,总裁兼执行长:Wen-jing Wu,以下简称Juniper Networks)今日宣布,日本的资料中心公司 Greenergy Data Centers(以下简称 GDC) Baltic States 已收购瞻博网络,该公司宣布将资料和人工智慧的企业解决方案来支援该公司的业务和资料中心营运。 GDC 是世界上最大的资料中心之一,使企业、政府机构和服务供应商可以轻鬆储存关键任务资讯,同时以安全的方式减少环境足迹。 GDC拥有14,500平方公尺、31.5兆瓦的资料中心。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 宏观经济走势对市场的影响

- 产业价值链分析

第五章市场动态

- 市场驱动因素

- 扩大云端储存的使用推动市场成长

- 备份和储存需求不断增长推动市场需求

- 零售和电子商务成长预计将推动市场需求

- 市场抑制因素

- 缺乏熟练的专业人员阻碍了市场需求

第六章市场区隔

- 副产品

- 乙太网路切换器

- 储存区域网路

- 路由器

- 其他产品

- 按最终用户产业

- BFSI

- 卫生保健

- 零售

- 政府机关

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 其他亚太地区

- 拉丁美洲

- 中东/非洲

- 北美洲

第七章竞争形势

- 公司简介

- Cisco Systems Inc.

- Juniper Networks Inc.

- Arista Networks Inc.

- H3C Holding Limited

- VMware Inc

- Huawei Technologies Co. Ltd.

- Extreme Networks Inc.

- Equinix Inc.

- Cumulus Networks Inc.

- Dell EMC

- NEC Corporation

- Big Switch Networks Inc.

- Lenovo Group Ltd.

第八章投资分析

第九章 市场机会及未来趋势

The Data Center Networks Market size is estimated at USD 26.12 billion in 2024, and is expected to reach USD 59.37 billion by 2029, growing at a CAGR of 17.85% during the forecast period (2024-2029).

Edge computing, which brings computing resources, data, and processing closer to the edge, is becoming an essential component of data centers and cloud services. It's a decentralized extension of campus networks, cellular networks, cloud and data center networks.

Key Highlights

- The data center's network efficiently manages various infrastructures by using multiple networking resources at one time or another. It has a crucial role to play in data collection and handling, which different network resources can assist. Using switches, servers, and storage points, data center networks can operate data transmission with high bandwidth.

- Increasing demand for faster internet speeds and a significant increase in Mega Data Centres and colocation will influence the development of the data center networking industry. This market growth is also anticipated to be driven by the widespread use of 100 GB switch ports and rapidly developing broadband and internet infrastructure.

- The demand for advanced network infrastructure solutions is driven by increasing data security and lower latency needs in banking, financing services, insuranceBFSI government, etc. Therefore, interest in these network technologies has increased demand from different sectors, including Banking, Financing Services, Insurance, BFSI Government, etc.

- However, it is expected that significant barriers to the growth of data center networking in this period will be a need for a more highly skilled labor force in emerging and underdeveloped economies as well as regulatory issues related to data protection.

- Furthermore, with COVID-19, Data flows are being elevated by the Pandemic. A growing demand for storage space has been caused by the rapid development of emerging technologies such as Big Data and Artificial Intelligence, Internet of Things. Nevertheless, investment in data centres' networks is increasing all over the world.

Data Center Networks Market Trends

The Growth in Retail and E-Commerce is Anticipated to Drive the Market Demand

- The essential element of modern technology is the networking of data centres, making it possible to exchange information across equipment and infrastructure over external networks in a smooth manner. It shall be designed to ensure the stability, reliability and security of an Internet system which supports new technologies such as virtualisation and cloud computing.

- In order for retailers to remain competitive in today's market, it is essential to tailor the shopping experience to the customer. Retailers are recording customers' past transactions for the purpose of providing personalised recommendations. The need to provide effective data centers is becoming mandatory in view of an increasing number of consumers.

- The requirement for retailers to store transaction and customer data in a central location is eliminated with the implementation of Data Center Networking, making information more secure. In particular, this aspect of the data centre network is important as it gives a secure environment for customer's confidential information.

- It is likely that retail sales will increase significantly in the Asia Pacific region and lead to further market expansion as a result of this strong surge in e commerce. According to India Brand Equity FoundationIBEF, eCommerce Industry in India is growing exponentially; the market of electronic commerce in India has been around USD 84 billion by 2021, and estimates have shown that this will be close to USD 350 billion by 2030.

The Asia-Pacific Region is Expected to Drive the Growth of the Market Studied

- Asia Pacific, due to the increased importance of smart technologies, internet of things enabled equipment, Big Data, Industry 4.0, 5G and cloud computing in this region, is expected to rise at a high rate over the forecast period.

- In the region, data centers have also been deployed at an increasing rate. For instance, a contract of USD 35.9 million was awarded in January 2023 by the Tamil State owned beverages company TasMAC to RailTel as an IT infrastructure provider. In the course of the next 5 years, this contract will ensure that RailTel provides end to end computerisation and connectivity for TASMAC. This would also involve RailTel supplying the project's infrastructure, including developing a data center and data recovery center that can offer two-way disaster recovery in conjunction with the Tamil Nadu state data center (TNSDC).

- The various new opportunities that will lead to the growth of the data centre networking market during this period, which is expected to be a year from now, are driven by increasing adoption of Data Centre Infrastructure and quick need for backup and storage as well as increased use of Cloud Storage.

- In addition, huge demand for network infrastructure is expected to be created in the data center networking market as a result of an increase in building new data centers and replacing current technologies with lower costs associated with semicondcutor components across China.

Data Center Networks Industry Overview

The Data Center Networsk market is Semi-consolidated, with existing vendors and new entrants facing intense competition. The growth of cloud computing has attracted new investors keen on capitalizing on the sector's success. Key players in the market include Cisco Systems Inc, Juniper Networks Inc, Arista Networks Inc, H3C Holding Limited, and VMware Inc.

- April 2023 - Arista Networks Inc. has anoounced its new launch cloud-delivered, AI-driven network identity service for enterprise security and IT operations. CV AGNI, offers to secure IT operations with simplified deployment and cloud scale for all enterprise network users, their associated endpoints, and Internet of Things (IoT) devices and Based on Arista's flagship cloud vision platform, Arista Guardian for Network Identity expands Arista's Zero trust networking approach to enterprise security

- February 2023- Juniper Networks, a prominent company in secure, AI-driven networks, today announced that Greenergy Data Centers (GDC), a data center company in the Baltics, deployed Juniper's cloud-ready data center and AI-driven enterprise solutions to support its business and data center operations. GDC is the world's largest data centre, making it easy for businesses, government agencies and service providers to store their missioncritical information while reducing its environmental footprint in a safe manner. A 14,500 square meter, 31.5 megawatt data center is located at the GDC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of Macro Economic Trends on the Market

- 4.4 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Utilization of Cloud Storage is Driving the Market Growth

- 5.1.2 Rising Need for Backup and Storage is Expanding the Market Demand

- 5.1.3 The Growth in Retail and E-Commerce is Anticipated to Drive the Market Demand

- 5.2 Market Restraints

- 5.2.1 Lack of Skilled Professionals is Hindering the Market Demand

6 MARKET SEGMENTATION

- 6.1 Product

- 6.1.1 Ethernet Switches

- 6.1.2 Storage Area Network

- 6.1.3 Router

- 6.1.4 Other Products

- 6.2 End-user Vertical

- 6.2.1 BFSI

- 6.2.2 Healthcare

- 6.2.3 Retail

- 6.2.4 Government

- 6.2.5 Other End-user Verticals

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems Inc.

- 7.1.2 Juniper Networks Inc.

- 7.1.3 Arista Networks Inc.

- 7.1.4 H3C Holding Limited

- 7.1.5 VMware Inc

- 7.1.6 Huawei Technologies Co. Ltd.

- 7.1.7 Extreme Networks Inc.

- 7.1.8 Equinix Inc.

- 7.1.9 Cumulus Networks Inc.

- 7.1.10 Dell EMC

- 7.1.11 NEC Corporation

- 7.1.12 Big Switch Networks Inc.

- 7.1.13 Lenovo Group Ltd.