|

市场调查报告书

商品编码

1404100

汽车零件铝压铸件-市场占有率分析、产业趋势与统计、2024年至2029年成长预测Automotive Parts Aluminum Die Casting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

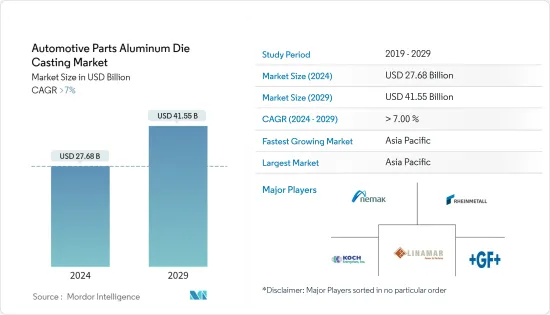

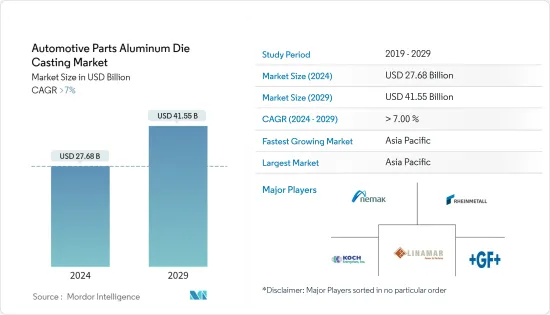

预计2024年汽车零件铝压铸市场规模为276.8亿美元,2029年达到415.5亿美元,预计在预测期内(2024-2029年)复合年增长率将超过7%。

对轻型车辆的需求增加以及压铸汽车零件中铝的使用增加等因素预计将在预测期内推动市场成长。各个地区都实施了严格的环境法规和 CAFE 标准,推动了压铸製程的采用。

对电动车和混合动力汽车不断增长的需求也使汽车製造商开始关注在所有类型的车辆中使用铝等轻量材料来替代较重的钢和铁。此外,石化燃料成本的上升和电动车普及的提高是主要的市场驱动因素。在这个市场上经营的公司正致力于提高产能,以满足不断增长的需求。例如

主要亮点

- 2022年8月,文灿集团在中国投资10亿元人民币(1.4亿美元),在安徽省六安经济技术开发区兴建新能源汽车(NEV)铝压铸件生产基地。

- 2022年5月,泰米尔纳德邦小型工业发展公司投资5,800万印度卢比(约70万美元)建立铝高压铸通用设备中心。

由于各国之间的製裁和贸易争端,以及汽车业越来越多地使用新铸造技术(如3D列印),预计市场将受到铝价波动的限制。

汽车零件铝压铸件市场趋势

铝在汽车中的广泛普及可能会刺激需求

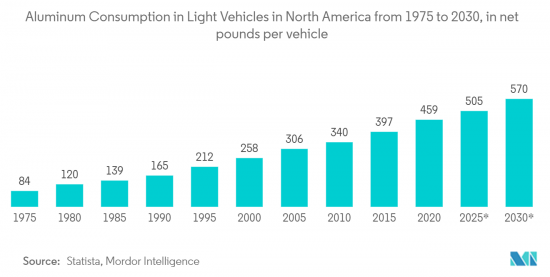

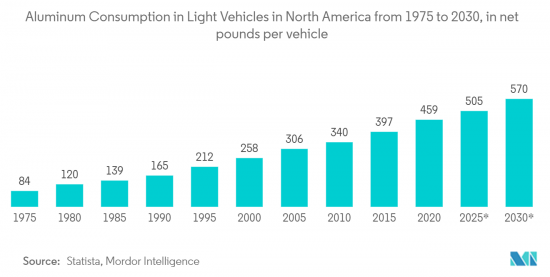

铝是压铸最优选的金属。在汽车应用中,混合动力汽车和电动车技术正在兴起。例如,在北美,自 2016 年以来,每辆车的铝含量增加了 62 磅(28 公斤),到 2020 年将达到 459 磅(208 公斤)。预计到 20230 年将达到 570 磅(258 公斤)。这主要是由转向轻型卡车和电池电动车推动的。

此外,到 2026 年,每辆轻型卡车预计将使用 550 磅(250 公斤)的铝。这种成长主要体现在三个主要材料应用领域:铝车身板、铸件和挤压件。特斯拉的 Model S BEV 就是一个很好的例子,它在结构部件、铸件、挤压件和整个车身中使用了超过 800 磅(360 公斤)的铝。

另一方面,价格上涨和与原材料采购相关的风险预计将在长期预测期内阻碍市场成长。由于美国与中东和非洲其他地区之间迫在眉睫的贸易战,近几週基本金属价格一直面临压力。候任总统对来自美国盟友(包括欧盟、墨西哥和加拿大)的铝(10%)和钢(25%)征收进口关税,预计将提高国内铝价。

此外,印度、泰国、印尼、埃及以及其他中东和非洲国家等新兴国家小客车产销量的增加预计将在预测期内推动汽车零件铝压铸件市场的发展。

亚太地区预计将出现显着成长

预计亚太地区在预测期内将呈现最快的成长率。在亚太地区,印度、中国和日本等主要国家预计将在预测期内为市场开拓做出重大贡献。中国是压铸件的主要生产国之一,小客车在该地区不断增长的普及可能会对市场产生乐观的影响。

例如,根据中国工业协会的数据,2022年中国汽车产量达到2702万辆,与前一年同期比较增长3.4%,销售汽车数量增长2.1%,达到2686万辆。

由于亚太地区是世界主要汽车生产国之一,因此往往吸引主要市场製造商。许多製造商正在采取地理扩张和产能扩张等成长策略,以保持在该市场的竞争。例如,

- 2022年1月,一家中国零件供应商向特斯拉合作伙伴订购了一台超级压铸机,显示蔚来和小鹏汽车可能会采用它。该机器可实现整合製造,减少生产时间和成本,并满足特斯拉的供应链效率目标。

在推动市场的因素以及导致市场混乱的因素中,客户对铝产品的强烈偏好以及铝使用量持续增加的趋势预计将为市场提供显着的成长机会。

汽车零件铝压铸产业概况

汽车零件铝压铸市场由全球和地区知名参与企业进行整合和主导。这些公司采用新产品开拓、联盟、合约和协议等策略来维持其市场地位。例如

- 2023 年 3 月,瑞典铝供应商 Granges 与中国山东创新集团合作,开始生产永续铝。此次合作旨在利用 Granges 的永续材料专业知识和山东创新集团的回收和清洁能源能力。两家公司共同致力于满足对环保铝铸造产品日益增长的需求。

该市场的主要参与者包括莱茵金属公司、Nemak、Linmar Corporation、Koch Enterprises 和 George Fischer Limited。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 越来越重视轻量材料

- 其他的

- 市场抑制因素

- 价格波动对报酬率构成持续威胁

- 其他的

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 生产流程

- 压力铸造

- 真空压铸

- 挤压铸造

- 重力铸造

- 应用程式类型

- 身体部位

- 引擎零件

- 传动部件

- 电池及相关零件

- 其他使用类型

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 英国

- 法国

- 德国

- 义大利

- 俄罗斯

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 其他亚太地区

- 其他中东/非洲

- 巴西

- 南非

- 阿根廷

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他国家

- 北美洲

第六章竞争形势

- 供应商市场占有率

- 公司简介

- Form Technologies Inc.(Dynacast)

- Nemak

- Endurance Technologies Ltd(CN)

- Sundaram Clayton Ltd

- Shiloh Industries Inc.

- Georg Fischer Limited

- Kochi Enterprises(Gibbs Die Casting Corporation)

- Bocar Group

- Engtek Group

- Rheinmetall AG

- Rockman Industries

- Ryobi Die Casting Ltd

- Linmar Corporation

- Meridian Light weight Technologies UK Limited

- Sandhar Group

第 7 章 7. 市场机会与未来趋势

- 提高流程自动化程度

- 电动车的普及

The Automotive Parts Aluminum Die Casting Market size is estimated at USD 27.68 billion in 2024, and is expected to reach USD 41.55 billion by 2029, growing at a CAGR of greater than 7% during the forecast period (2024-2029).

Factors such as the rising demand for lightweight vehicles and the growing utilization of aluminum in diecasting auto parts are expected to fuel the market's growth during the forecast period. Stringent environmental regulations and CAFE standards were imposed across various regions to support the adoption of the diecasting process.

In addition, increased demand for electric and hybrid vehicles turned automakers' focus to using lightweight materials like aluminum as a substitute for heavier steel and iron in all types of vehicles. Furthermore, the rising cost of fossil fuels and rising electric vehicle adoption are significant market drivers. Players operating in the market are focused on raising their production capacities to meet this rising demand. For instance,

Key Highlights

- In August 2022, WencanGroup Co., Ltd. Invested CNY 1 billion (USD 0.14 billion) in China to build a production base of aluminum diecast parts for New Energy Vehicles (NEVs) in Lu'anEconomic and Technological Development Zone, Anhui Province.

- In May 2022, Tamil Nadu Small Industries Development Corporation invested an amount of INR 5.8 crore (around USD 0.70 million) to establish a common facility center for aluminum high-pressure die casting.

The market is anticipated to be constrained by the volatility of aluminum pricing due to sanctions and trade disputes between nations and the growing use of novel casting technologies (such as 3D printing) in the automotive industry.

Automotive Parts Aluminum Die Casting Market Trends

Increasing Aluminum Penetration in Automobiles is Likely to Bolster Demand

Aluminum is the most preferred metal for die casting. Within the automotive application, hybrid and electric vehicle technologies are on the rise. Taking North America as an example, since 2016, there was an increase in terms of aluminum content of 62 lbs (28 kg) per vehicle, with 2020 reaching a total vehicle content figure of 459 lbs (208 kg). It is expected to reach 570 lbs (258 kg) by the year 20230. The shift toward the light truck and battery electric vehicles primarily drives it.

Further, it is expected that by 2026, 550 lbs (250 kg) of aluminum content per vehicle for light-duty trucks. This increase is seen primarily in three main areas of material usage: aluminum auto body sheets, castings, and extrusions. A good example of this is Tesla's Model-S BEV, which uses over 800 lbs (360 kg) of aluminum for structural components, castings, extrusions, and the whole body of the vehicle.

On the other side, rising prices and risks associated with raw material sourcing are expected to hinder market growth during the longer-term forecast period. Base metal prices are under pressure in recent weeks due to the looming trade war between the United States and the rest of the world. The imposition of tariffs on imports from the US allies (including the European Union, Mexico, and Canada) on aluminum (10%) and steel (25%) by the President-elect is expected to increase the domestic aluminum prices.

Moreover, the increasing production and sales of passenger cars in several emerging economies, such as India, Thailand, Indonesia, Egypt, and other Middle East & African countries, are anticipated to drive the automotive parts aluminum die casting market during the forecast period.

Asia-Pacific Region Anticipated to Witness Significant Growth

Asia-Pacific is expected to witness the fastest growth rate during the forecast period. In the Asia-Pacific region, major countries like India, China, and Japan are expected to contribute significantly to the development of the market over the forecast period. China is one of the major producers of die-casting parts, and the growing adoption of passenger cars in the region is likely to provide an optimistic impact on the market.

For instance, according to the China Association of Automobile Manufacturers, China's car production reached 27.02 million units in 2022, an increase of 3.4% year-on-year, while sales increased by 2.1% to 26.86 million units.

The Asia-Pacific region, being one of the world's largest manufacturers of vehicles, tends to attract major market manufacturers. Many players adopt growth strategies, such as geographic expansion and production capacity expansion, to stay competitive in this market. For instance,

- In January 2022, a Chinese part supplier ordered super die-casting machines from a Tesla partner, hinting at potential adoption by NIO and XPeng. The machines enable one-piece manufacturing, reducing production time and costs, and align with Tesla's goal of improving efficiency in its supply chain.

Amidst all the factors promoting the market and the factors that can lead to disruption in the market, the strong preference of the customers toward aluminum products and the ongoing trend of increased usage of aluminum is expected to provide a significant growth opportunity in the market.

Automotive Parts Aluminum Die Casting Industry Overview

The automotive parts aluminum die casting market is consolidated and led by globally and regionally established players. These companies adopt strategies such as new product developments, collaborations, and contracts and agreements to sustain their market positions. For instance,

- In March 2023, Granges, a Swedish aluminum supplier, joined forces with China's Shandong Innovation Group to produce sustainable aluminum. The partnership aims to leverage Granges' expertise in sustainable materials and Shandong Innovation Group's capabilities in recycling and clean energy. Together, they aim to meet the increasing demand for environmentally friendly aluminum casting products.

Some of the major players in the market include Rheinmetall AG, Nemak, Linmar Corporation, Koch Enterprises, and George Fischer Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Emphasis towards Lightweight Material

- 4.1.2 Others

- 4.2 Market Restraints

- 4.2.1 Volatility in Prices is a Constant Threat for Profit Margin

- 4.2.2 Others

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Production Process

- 5.1.1 Pressure Die Casting

- 5.1.2 Vacuum Die Casting

- 5.1.3 Squeeze Die Casting

- 5.1.4 Gravity Die Casting

- 5.2 Application Type

- 5.2.1 Body Parts

- 5.2.2 Engine Parts

- 5.2.3 Transmission Parts

- 5.2.4 Battery and Related Components

- 5.2.5 Other Application Types

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 France

- 5.3.2.3 Germany

- 5.3.2.4 Italy

- 5.3.2.5 Russia

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 Brazil

- 5.3.4.2 South Africa

- 5.3.4.3 Argentina

- 5.3.4.4 Saudi Arabia

- 5.3.4.5 United Arab Emirates

- 5.3.4.6 Other Countries

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Form Technologies Inc.(Dynacast)

- 6.2.2 Nemak

- 6.2.3 Endurance Technologies Ltd (CN)

- 6.2.4 Sundaram Clayton Ltd

- 6.2.5 Shiloh Industries Inc.

- 6.2.6 Georg Fischer Limited

- 6.2.7 Kochi Enterprises (Gibbs Die Casting Corporation)

- 6.2.8 Bocar Group

- 6.2.9 Engtek Group

- 6.2.10 Rheinmetall AG

- 6.2.11 Rockman Industries

- 6.2.12 Ryobi Die Casting Ltd

- 6.2.13 Linmar Corporation

- 6.2.14 Meridian Light weight Technologies UK Limited

- 6.2.15 Sandhar Group

7 7. Market Opportunities and Future Trends

- 7.1 Increasing Process Automation

- 7.2 Growing Electric Vehicle Adoption