|

市场调查报告书

商品编码

1404307

智慧水錶:市场占有率分析、产业趋势与统计、2024年至2029年成长预测Smart Water Meter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

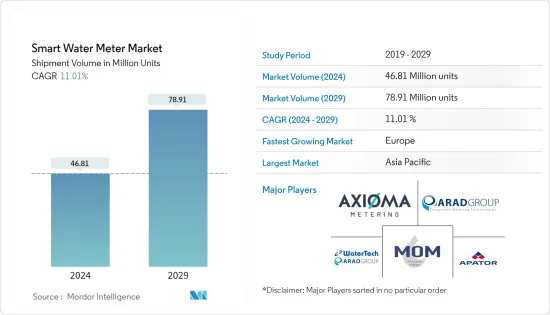

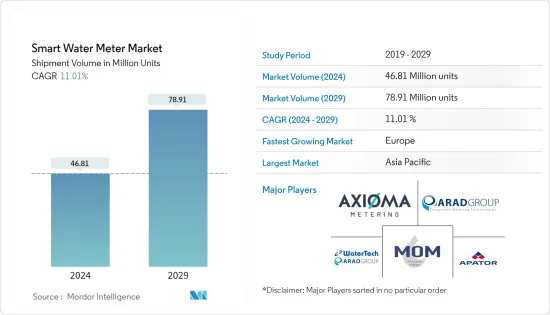

根据出货量计算,智慧水錶市场规模预计将从2024年的4,681万台扩大到2029年的7,891万台,出货期间(2024-2029年)复合年增长率为11.01%。

智慧水錶是一种准确监测用水量的电子设备。这些智慧电錶可以透过行动电话、射频电磁 (RF) 和通讯传输使用资料,帮助公用事业公司有效管理能源消费量。智慧电錶具有许多好处,包括降低抄表成本、防止停水、消除申请效率低以及降低企业和消费者的重新连接成本。

主要亮点

- 由于人口增长、都市化和工业化的快速发展以及人均消费量的增加,消费量每年都在大幅增加。例如,根据美国草坪养护服务供应商LawnStarter的数据,2022年美国人均消费量位居榜首(2,842立方公尺),其次是加拿大、纽西兰和哥斯大黎加等国家。

- 近年来,随着消费量的增加,一些地区开始面临水资源短缺的问题,需要最大限度地减少水的浪费。预计节水需求的成长将成为预测期内调查市场的主要驱动因素。此外,技术进步和政府、私人消费者和企业加大节水力度也促进了市场成长。

- 最近的创新也增强了智慧水錶的功能,使其能够测量水的特性,例如使用情况、流量、pH 平衡和水质。许多现代智慧水錶还能够计算每月水费,为消费者提供有关消费量和申请模式的详细资讯。

- 然而,智慧水錶的高成本和由于认知度低而导致的低安装率对所研究市场的成长构成了重大挑战。此外,缺乏支援智慧水錶的基础设施(例如高速连接)也阻碍了成长,特别是在新兴市场。

- 由于新冠肺炎 (COVID-19) 疫情的爆发,智慧水錶业务的许多产品已停止生产。然而,随着 2022 年报告的 COVID-19 病例减少,供应链恢復动力,市场预计将成长,导致水錶公司满载营运。此外,COVID-19大流行对消费者对环境和数位技术的普遍认识产生了重大影响,大流行期间对数位技术的依赖显着增加。因此,此类趋势预计将产生长期影响,为预测期内的智慧水錶市场创造良好前景。

智慧水錶市场趋势

住宅应用领域预计将占据主要市场占有率

- 智慧水錶在住宅领域的需求不断增加,因为它们可以准确、及时地测量消费量,使消费者能够有效地监控和管理他们的消费量。透过监测消费量,消费者可以确定在哪里减少消费量并改变他们的习惯以节约用水。

- 智慧水錶技术彻底改变了水的申请方式。传统水錶根据预计用量向客户申请,这可能会导致申请不准确和纠纷。智慧水錶可提供准确的读数,因此住宅只需支付水费,从而实现更公平、更有效率的申请方式。

- 智慧水錶还解决了另一个问题:向公寓中的所有家庭收取相同的申请。这种做法是不公平的,因为有些居民在节约用水,而有些居民则不太重视。如果使用单独的电錶,每个家庭将根据使用情况单独申请。

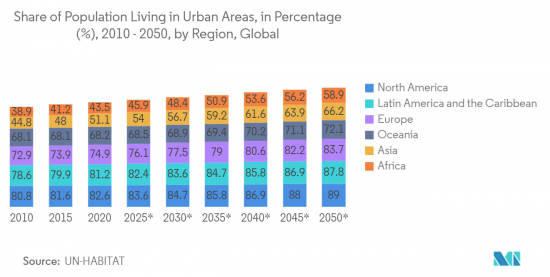

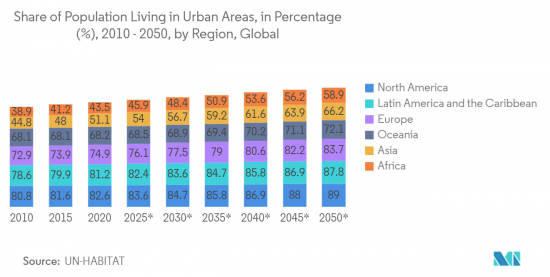

- 此外,大多数国家供水基础设施的改善正在增加住宅消费量。随着都市化的加快,住宅消费是智慧水錶未来成长的重大机会。根据联合国人居署预测,到 2050 年,都市化将增加至 89%。预计到 2050 年,世界全部区域的都市化将提高。

- 此外,一些政府和当局正在推广智慧水錶在节水和永续性工作中的使用。在一些地区,政府法规强制要求在住宅和重建中安装智慧水錶,进一步推动市场成长。

欧洲预计将出现显着成长

- 在预测期内,政府为改善水资源管理而采取的越来越多的倡议正在创造对智慧水錶的需求。此外,由于水资源短缺问题,许多欧洲国家需要更好的水资源管理解决方案,预计将推动市场成长。

- 英国供应商正在推出各种计划来快速部署智慧水錶。例如,2023 年 2 月,英国水务公司 Anglian Water 宣布已开始探索「端到端」智慧电錶交付解决方案,以继续推出其安装计画。此次合作将使智慧电錶的安装成为可能。这将使客户能够透过使用智慧电錶减少用水量。

- 2023 年 1 月,约克郡水务公司宣布在智慧电錶技术领域进行重大投资,作为其网路策略承诺的一部分。此次合作预计将支援先进的客户计量计划,旨在改善服务并减少洩漏。此外,2023 年 3 月,牛津通过立法,要求在整个牛津安装智慧水錶。

- 高额水费推动了对智慧水錶的需求。英格兰和威尔斯的家庭面临着自 2022 年 4 月以来水费近 20 年来首次大幅上涨,这给已经经历了生活成本危机的家庭预算带来了进一步的压力。据英国水务局称,从 4 月开始,典型的水费将上涨至平均每年 448 英镑(565.56 美元),增幅为 7.5%。

- 在欧洲地区新兴经济体之一的法国,饮用水供应的管理部分与传统水錶相关,例如处理营运成本、因洩漏和其他系统故障而导致的水损失和未计费水量水以及水錶。我们正面临重大挑战。法国自来水公司正在安装智慧水錶,并向客户免费提供。

智慧水錶产业概况

智慧水錶市场高度分散,主要参与者包括 Watertech SPA (Arad Group)、Mom Zrt、Apator SA、Arad Group 和 Axioma Metering。市场参与者正在采取联盟和收购等策略来加强其产品供应并获得永续的竞争优势。

- 2023 年 3 月,德国水务公司 ThuWa ThuringenWasser 宣布与代傲表计 (Diehl Metering) 建立策略伙伴关係,安装新水錶并利用代傲表计 (Diehl Metering) 的 LPWAN mioty 技术。 ThuWa 现在凭藉安全的资料、精确的测量技术和数数位化流程变得更加高效和更具成本效益。

- 2023 年 3 月 - Itron Inc. 与 PT. Megalopolis Manunggal Industrial Development (PT. MMID) 签署协议,以收集 MM2100工业城的资料并提高业务效率。作为协议的一部分,PT.MMID 将实施 Itron 的下一代电錶资料收集和管理解决方案 Temetra。透过这个解决方案,PT.MMID透过统一平台收集频繁、准确的水錶使用资料,最大限度地减少申请错误,并创新和节省资金,符合印尼工业4.0时代的蓝图,我们将予以推广。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 产业价值链分析

- 智慧水錶类型技术简介

- 智慧电錶投资报酬率分析

- 使用的主要协议及其比较

- LoraWAN 部署步骤/关键使用案例/长期影响

- 公共产业透过实施智慧电錶/数位化所获得的好处

第五章市场动态

- 市场驱动因素

- 政府支持法规

- 需要提高用水量和效率

- 减少无收益水损失的需求不断增加

- 市场抑制因素

- 高成本和安全问题

- 与智慧电錶整合困难

- 营运商转换成本

第六章市场区隔

- 依技术

- 自动抄表

- 高度测量基础设施

- 按用途

- 住宅

- 商业的

- 产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章竞争形势

- 公司简介

- Watertech SPA(Arad Group)

- Mom Zrt

- Apator SA

- Arad Group

- Axioma Metering

- Badger Meter Inc.

- Diehl Stiftung & Co. KG

- Honeywell International Inc.

- Suntront tech Co., Ltd.

- Maddalena SPA

- Waviot

- Itron Inc.

- BETAR Company

- Kamstrup A/S

- Landis+GYR Group AG

- Integra Metering AG

- G. Gioanola Srl

- Sensus Usa Inc.(Xylem Inc.)

- Zenner International Gmbh & Co. KG

第八章投资分析

第九章 市场机会及未来趋势

The Smart Water Meter Market size in terms of shipment volume is expected to grow from 46.81 Million units in 2024 to 78.91 Million units by 2029, at a CAGR of 11.01% during the forecast period (2024-2029).

Smart water meters are electronic devices that accurately monitor water usage. These smart meters can transmit usage data via cellular, radiofrequency electromagnetic radiation (RF), and power line communication, assisting the utility company in efficiently managing energy consumption. Smart meters provide many advantages, including lower meter reading costs, prevention of disconnection, elimination of billing inefficiencies, and lower reconnection costs for businesses and consumers.

Key Highlights

- Over the years, water consumption has increased significantly due to population growth, rapid urbanization and industrialization rates, and growing per capita consumption. For instance, according to LawnStarter, an American lawn maintenance service provider, the United States was the leading country in per-capita water consumption (2,842 cubic meters) in 2022, followed by countries such as Canada, New Zealand, Costa Rica, etc.

- As a result of the growing consumption, several regions have started facing water shortage issues in recent years, giving rise to the need to minimize water wastage. The growing demand for water preservation is anticipated to be a key driver for the market studied during the forecast period. Moreover, technological advancements and rising efforts by governments, individual consumers, and businesses to save water also contribute to the market's growth.

- Recent innovations have also enhanced the capabilities of smart water meters, enabling them to measure the characteristics of the water, such as the quantity used, its speed of flow, its pH balance, and quality, among others. Many smart water meters nowadays are also capable of calculating monthly water bills, giving consumers detailed information about consumption and billing patterns.

- However, factors such as the higher cost of smart water meters and a lower installation rate, owing to lower awareness, are among the major challenges to the growth of the market studied. Additionally, the lack of supporting infrastructure for smart water meters, such as high-speed connectivity, also hampers the market's growth, especially across developing regions.

- The COVID-19 outbreak halted the production of many items in the smart water meter business. However, as fewer COVID-19 cases were reported in 2022, which resulted in a return of water meter companies operating at total capacity, the market is anticipated to grow as the supply chain regains momentum. Furthermore, a major impact of the COVID-19 pandemic has been on the general awareness of consumers about the environment and digital technologies, as during the pandemic, the reliance of people on digital technologies grew significantly. Hence, such trends are anticipated to have a long-term impact, creating a favorable outlook for the smart water meter market during the forecast period.

Smart Water Meter Market Trends

Residential Application Segment is Expected Hold Significant Market Share

- The demand for smart water meters in the residential segment is increasing as they can accurately and timely measure water consumption, allowing consumers to monitor and manage their water consumption effectively. Consumers can identify areas to reduce consumption and change their habits to save water by monitoring their consumption.

- Smart water meter technology has revolutionized the way water is billed. Traditional water meters bill customers based on estimated usage, which can lead to inaccurate billing and disputes. Smart water meters provide accurate readings, so homeowners only pay for their water, leading to fairer and more efficient billing practices.

- Smart water meters also solve another problem: charging all households in an apartment the same bill. This practice is unfair because some residents conserve water while others pay less attention. With separate meters, each family is billed separately based on usage.

- Moreover, in most countries, residential water consumption is increasing due to improvements in water infrastructure. With the increasing urbanization trend, residential consumption represents a great opportunity for the future growth of smart water meters. According to the UN-HABITAT, urbanization will increase to 89 percent by 2050. Across all major world regions, urbanization is projected to be rising in 2050.

- Additionally, several governments and authorities promote using smart water meters in their water conservation and sustainability efforts. In some regions, there are government regulations mandating the installation of smart water meters in new homes or renovations, further driving market growth.

Europe is Expected to Witness Significant Growth

- The increasing government initiatives for better water management are creating a demand for smart water meters over the forecast period. Moreover, many European countries need better water management solutions due to water scarcity issues, which is expected to drive market growth.

- Vendors in the United Kingdom are launching various programs for faster deployment of smart water meters. For instance, in February 2023, Anglian Water, a water company in the United Kingdom, announced that it started to explore an 'end to end' smart metering delivery solution to continue the rollout of its installation program. The collaboration would deliver the installation of a smart meter installation. This would allow customers to use less water by using smart meters.

- In January 2023, Yorkshire Water announced its significant venture in smart meter technology, a part of the company's strategic commitment throughout its network. The partnership is anticipated to help with its advanced customer metering program to improve services and reduce leakage, in addition to helping customers save some money on their bills. Furthermore, in March 2023, Oxford passed legislation stating that smart water meters are set to be fitted throughout Oxford, and the change is compulsory; residents can not refuse the fitting or modification of the existing meters.

- The hefty water bills drive the demand for smart water meters. Households in England and Wales are facing a rapid increase in water bills in almost two decades since April 2022, putting further pressure on budgets already weathering the cost-of-living crisis. According to Water UK, the typical water bill will increase to an average of GBP 448 (USD 565.56) a year from April, an upsurge of 7.5%.

- One of the developed economies of the European region is France, where the management of drinking water supply is facing critical challenges partly related to a traditional water meter, such as handling operational costs, water loss or non-revenue water due to leaks and other system failures, and water conservation. Smart water meters are increasingly being installed by French water utility companies and made available to users free of charge.

Smart Water Meter Industry Overview

The smart water meter market is highly fragmented, with the presence of major players like Watertech S.P.A (Arad Group), Mom Zrt, Apator SA, Arad Group, and Axioma Metering. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- March 2023, German water utility ThuWa ThuringenWasser announced a strategic collaboration with Diehl Metering to install new water meters and leveraged Diehl Metering's LPWAN mioty technology. ThuWa now benefits from secure data, precise measurement techniques, and digitized processes that increase efficiency and cost-effectiveness.

- March 2023 - Itron Inc. signed an agreement with PT. Megalopolis Manunggal Industrial Development (PT. MMID) to improve data collection and operational efficiencies in MM2100 Industrial Town. As a part of the contract, PT MMID will deploy Temetra, Itron's next-generation meter data collection and management solution. The solution will allow PT. MMID to collect frequent and accurate water meter usage data through a unified platform, minimizing billing errors and driving innovation and conservation that aligns with Indonesia's roadmap to enter the Industry 4.0 era.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain Analysis

- 4.4 Technology Snapshot for types of Smart Water Meter

- 4.5 ROI Analysis for Smart Meters

- 4.6 Prominent Protocols Used and their Comparison

- 4.7 Steps Involved in Implementing LoraWAN/Prominent Use-cases/Long-term Implications

- 4.8 Advantages/Digitalization Achieved by Utilities by Smart Meter Implementations

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Supportive Government Regulations

- 5.1.2 Need for Improvement in Water Utility Usage and Efficiency

- 5.1.3 Increasing Demand to Reduce Non-revenue Water Losses

- 5.2 Market Restraints

- 5.2.1 High Costs and Security Concerns

- 5.2.2 Integration Difficulties with Smart Meters

- 5.2.3 Utility Supplier Switching Costs

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Automatic Meter Reading

- 6.1.2 Advanced Metering Infrastructure

- 6.2 By Application

- 6.2.1 Residential

- 6.2.2 Commercial

- 6.2.3 Industrial

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Watertech S.P.A (Arad Group)

- 7.1.2 Mom Zrt

- 7.1.3 Apator SA

- 7.1.4 Arad Group

- 7.1.5 Axioma Metering

- 7.1.6 Badger Meter Inc.

- 7.1.7 Diehl Stiftung & Co. KG

- 7.1.8 Honeywell International Inc.

- 7.1.9 Suntront tech Co., Ltd.

- 7.1.10 Maddalena SPA

- 7.1.11 Waviot

- 7.1.12 Itron Inc.

- 7.1.13 BETAR Company

- 7.1.14 Kamstrup A/S

- 7.1.15 Landis+GYR Group AG

- 7.1.16 Integra Metering AG

- 7.1.17 G. Gioanola Srl

- 7.1.18 Sensus Usa Inc. (Xylem Inc.)

- 7.1.19 Zenner International Gmbh & Co. KG