|

市场调查报告书

商品编码

1632055

用水和污水产业智慧水洩漏检测解决方案的全球市场:市场占有率分析、产业趋势和成长预测(2025-2030)Global Smart Leak Detection Solutions for Water and Wastewater Industries - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

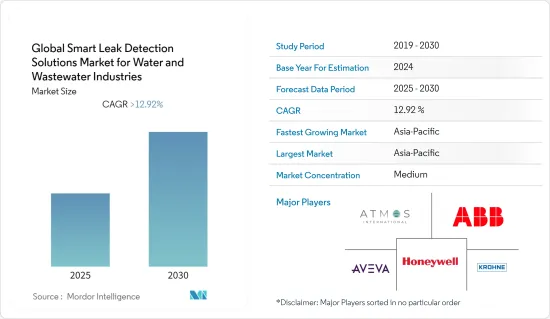

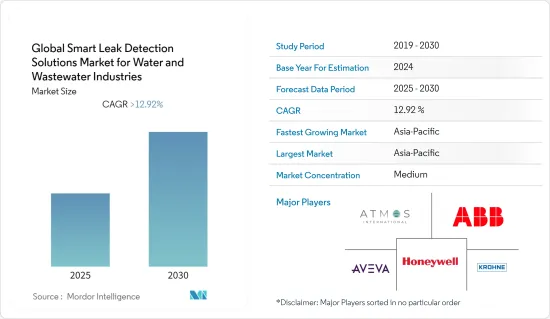

用水和污水产业智慧漏水检测解决方案的全球市场预计在预测期内复合年增长率将超过 12.92%。

智慧漏水检测解决方案主要采用物联网技术。它使用感测器功能来检测是否有洩漏。如果漏水未被发现,可能会导致基础设施潮湿并导致意外滑倒。配备智慧计量技术的创新水流量计甚至可以实现最偏远的供水网路的高效运作。

都市化对水资源的压力越来越大。满足家庭用水需求不断增加以及废水对受纳水道的影响对受纳水质产生累积效应。

由于物联网 (IoT) 感测器、机器学习 (ML)、人工智慧 (AI) 以及基于云端或边缘的资料分析平台的成长,漏水检测市场正在经历重大创新和数位转型。在 NB IoT 和 LTE-M 等蜂窝 LPWAN 技术的推动下,漏水检测系统预计将快速成长,尤其是在欧洲、亚太地区和北美的先进公共中。

此外,2020 年的 COVID-19 大流行重新唤起了人们对漏水检测技术的认识,提醒客户增加供水是满足日益增长的私人和公共需求的必经之路。

智慧漏水检测解决方案市场趋势

据分析,预测期内住宅成长率最高。

消费者正在利用智慧水资源管理解决方案升级他们的家庭。随着软体和硬体变得更加便宜,这种采用率正在迅速增加。数位化与互联技术的结合正在改变智慧水资源管理系统与住宅领域周围环境的互动方式,影响智慧水资源管理解决方案的所有应用。

随着住宅客户越来越意识到智慧水资源管理解决方案在减少预计增加的水浪费方面的好处,住宅和建筑自动化对智慧水资源管理管理解决方案的需求将会增加。例如,2021 年 7 月,全球房地产软体和资料分析供应商 RealPage Inc. 推出了第一个多用户住宅。

政府节约用水的努力推动了对智慧家居用水管理技术不断增长的需求。互联繫统预计将成为智慧水资源管理软体最重要的组成部分之一,主要有助于实现计划的永续性目标。

此外,智慧家用电子电器的普及预计将推动指定市场的发展。 2021年,全球智慧家庭数量将达到25854万个。

亚太地区预计将创下最快成长率

马来西亚、越南和泰国等亚洲国家正在大力建立智慧水系统,凸显了该市场的成长潜力。儘管日本的净收益低于美国(24%),但它仍投资于水资源管理基础设施。日本计划在水技术研究中心 (JWRC) 的支持下,到 2025 年实现 100% 智慧水錶。

此外,开发中国家的数位化和连网技术的采用正在改变智慧水资源管理系统与住宅领域周围环境的互动方式,影响智慧水资源管理解决方案的所有应用,这也影响着我。

用于水资源管理的连网设备和物联网技术的增加正在推动该地区对物联网平台的需求。例如,印度新兴企业Agua Water Systems 使用智慧解决方案来监控用水量。此即插即用系统使用人工智慧 (AI) 来评估用水量、测量泵浦中的水位并控製配水。马达控制器、超音波感测器和流量感测器被用作智慧无线设备。

此外,由于该地区某些地区淡水稀缺,渗漏对本已有限的供水构成严重威胁。因此,节约用水的需求正在推动用水和污水产业智慧洩漏检测解决方案的成长。

用水和污水产业的智慧洩漏检测解决方案产业概述

用水和污水行业的智慧漏水检测解决方案的全球市场被细分,因为多家全球参与企业和新参与企业正在竞争激烈的市场空间中争夺注意力。随着新的物联网和人工智慧新兴企业加剧竞争对手之间的竞争,预计该市场将在预测期内成长。

2021年10月,ABB与丹麦水环境专家合作开发下一代智慧水解决方案,鼓励更谨慎的用水。这些技术使该领域的客户能够更好地控制水资源的可用性,并提高工厂在製程和能源优化方面的营运效率。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 价值链/供应链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 管理日益增长的全球水需求的需求日益增长

- 减少无收益水 (NRW) 损失的需求不断增加

- 市场限制因素

- 基础建设资金投入不足

第六章 市场细分

- 按用途

- 住宅

- 商业的

- 工业的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- Omron Industrial

- Pure Technologies

- Xylem

- D-Link Corporation

- HWM-Water Ltd

- ABB Ltd.

- Atmos International

- Honeywell International Inc.

- AVEVA

- KROHNE Group

第八章投资分析

第9章 未来趋势

The Global Smart Leak Detection Solutions Market for Water and Wastewater Industries Industry is expected to register a CAGR of greater than 12.92% during the forecast period.

A smart water leak detection solution mainly uses IoT technology. It utilizes sensor abilities to detect the presence of leakages. If the leakages are left undetected, they might cause infrastructural dampness, leading to accidental slips. Innovative water flowmeters with smart instrument technology can help even the most remote water networks operate efficiently.

The transformation of cities into metropolitan cities increases pressure on water resources. The rising demand for water to meet domestic needs and the impact of wastewater discharge on receiving waterways have a cumulative effect on receiving water quality.

With the growth of the Internet of Things (IoT) sensors, machine learning (ML), artificial intelligence (AI), and cloud- or edge-based data analytics platforms, the leak detection market has seen a considerable rate of innovation and digital transformation. Leak detection systems are expected to grow faster owing to cellular LPWAN technologies such as NB IoT and LTE-M, notably among advanced utilities in Europe, Asia-Pacific, and North America.

Furthermore, the 2020 COVID-19 pandemic has revived awareness of leak detection technology, with customers being reminded that increasing water supply is a definite method to satisfy the growing need for private and public sanitation.

Smart Leak Detection Solutions Market Trends

Residential is analyzed to witness highest growth rate during the forecast period

Consumers are using smart water management solutions to upgrade their homes. This adoption rate is rapidly growing as software and hardware become more affordable. Digitization, combined with the adoption of connected technologies, is transforming how smart water management systems interact with their surroundings in the residential sector, affecting all applications of smart water management solutions.

The demand for smart water management solutions for home and building automation is predicted to rise over the forecast period as customers in residential applications become more aware of the benefits of smart water management solutions in terms of reduced water wastage. For instance, in July 2021, RealPage Inc., a global provider of real estate software and data analytics, announced Smart Water, the first multifamily solution to leverage submeter technology to dramatically reduce the cost of water management for both residential units and common areas.

Government initiatives to save water contribute to the growing demand for smart household water management technologies. Connected systems are expected to become one of the most important components of smart water management software, contributing primarily to the projects' sustainability aims.

In addition, an increase in the popularity of smart home appliances is expected to boost the given market. In 2021, there were 258.54 million smart homes across the world.

Asia Pacific is Expected to Register the Fastest Growth Rate

Significant efforts to construct smart water systems are evident in Asian nations such as Malaysia, Vietnam, Thailand, and others, highlighting the market's potential for growth. Japan has invested in water management infrastructure despite having a lower NRW (US-24%). Japan plans to bring out 100 percent smart water meters by 2025 with the help of its Japan Water Research Center (JWRC).

Additionally, digitization, combined with the adoption of connected technologies in developing countries, is changing how smart water management systems interact with their surroundings in the residential sector, affecting all applications of smart water management solutions.

The growing number of connected devices and IoT technologies for water management are driving demand for IoT platforms in the region. For instance, Agua Water Systems, an Indian start-up, uses smart solutions to enable water usage monitoring. Artificial intelligence (AI) is used in the plug-and-play system to assess water usage, the measure water level in the pump, and control water distribution. Motor controllers, ultrasonic, and flow sensors are the smart wireless devices used.

Furthermore, in several parts of this region, water leaks pose a serious threat to an already limited water supply considering the scarcity of fresh water. Thus, the need to save usable water drives the growth of smart leak detection solutions for water and wastewater industries.

Smart Leak Detection Solutions Industry Overview

The Global Smart Leak Detection Solutions Market for Water and Wastewater Industries is fragmented, as the market comprises several global players and emerging new players vying for attention in a somewhat contested market space. The market is witnessing intensifying competitive rivalry due to new startups in IoT and AI-based offerings, which are expected to rise through the forecast period.

In October 2021, ABB collaborated with a Danish water environment specialist to develop the next generation of smart water solutions encouraging more careful water use. Clients in this sector could better control water availability and boost plant operational efficiency in both process and energy optimization with these technologies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain / Supply Chain Analysis

- 4.4 Assessment of the Impact of COVID -19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Need to Manage the Increasing Global Demand for Water

- 5.1.2 Increasing Demand to Reduce Non-revenue Water (NRW) Losses

- 5.2 Market Restraints

- 5.2.1 Lack of Capital Investments to Install Infrastructure

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Residential

- 6.1.2 Commercial

- 6.1.3 Industrial

- 6.2 Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Latin America

- 6.2.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Omron Industrial

- 7.1.2 Pure Technologies

- 7.1.3 Xylem

- 7.1.4 D-Link Corporation

- 7.1.5 HWM-Water Ltd

- 7.1.6 ABB Ltd.

- 7.1.7 Atmos International

- 7.1.8 Honeywell International Inc.

- 7.1.9 AVEVA

- 7.1.10 KROHNE Group