|

市场调查报告书

商品编码

1740892

漏水侦测器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Water Leak Detector Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

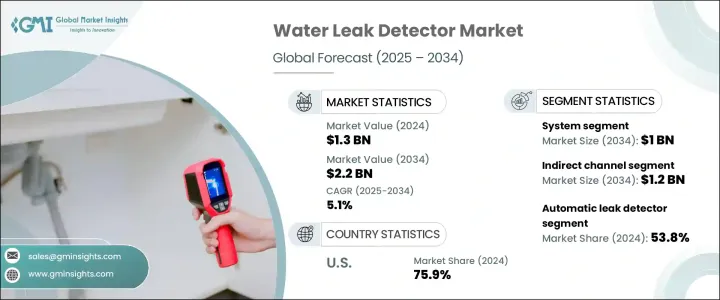

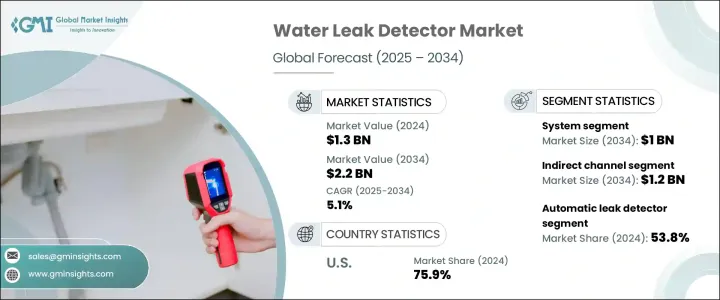

2024年,全球漏水侦测器市场规模达13亿美元,预计到2034年将以5.1%的复合年增长率成长,达到22亿美元。漏水检测技术透过及早发现漏水并及时修復,在最大限度地减少水资源损失方面发挥越来越重要的作用。这些系统采用先进的工具,包括基于感测器的解决方案、声音侦测和连网设备,来精确定位原本可能被忽略的隐藏或微小漏水。这些技术进步显着提高了节水策略的效率。由于城市人口成长、快速工业化以及气候变迁的影响,水资源短缺问题持续恶化。因此,解决水资源浪费问题已成为全球关注的问题。

造成这一问题的最主要因素之一是住宅、商业和工业供水基础设施的系统洩漏,每年造成大量水资源流失。随着人们对水资源保护意识的不断增强和紧迫性,洩漏检测技术的应用正在各个行业中蓬勃发展。这些解决方案提供了一种主动的水资源管理方法,使其能够更轻鬆地监控、控制和修復系统,避免造成代价高昂或不可逆转的损害。对永续资源利用的需求不断增长、监管更加严格以及政府旨在升级老化供水系统的倡议,进一步推动了市场的成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 13亿美元 |

| 预测值 | 22亿美元 |

| 复合年增长率 | 5.1% |

就产品而言,市场分为解决方案和系统两大类。系统细分市场在2024年成为主导力量,创造了5亿美元的收入,并有望在2034年达到10亿美元。这些系统因其易于安装和维护以及整体用户友好的操作而备受青睐,尤其是与服务导向的模式相比。此外,提供即时洞察的智慧互联技术也日益受到青睐。随着越来越多的消费者选择智慧系统,基于物联网的洩漏侦测器正成为标配。这些产品提供及时警报和自动回应,帮助使用者最大限度地减少水损和相关成本。经济实惠、更高精度和更强大的连接性巩固了它们的领先地位。房主倾向于自行安装,这进一步加速了产品的普及,消费者重视这些系统提供的便利性、客製化和现代化功能。

分销方面,间接通路在2024年占据市场主导地位,收入份额达55.4%,预计到2034年将达到12亿美元。间接通路包括经销商、经销商和零售商,已成为寻求扩大覆盖范围并挖掘远端客户群的製造商的首选策略。这些中间商通常会将洩漏侦测产品与管道或供水系统服务等附加服务搭配使用,以增强其吸引力并推动销售。由于产品在实体店和线上平台均有供应,并且可以透过本地库存中心更快地完成配送,因此该通路高效且易于终端用户使用。

按类型划分,漏水探测器分为固定式和便携式。 2024年,自动侦测器占据主导地位,市占率约53.8%。便携式设备因其灵活性、成本效益和易于部署而尤其受欢迎。它们非常适合短期使用、租赁物业或无法安装永久性系统的场所。智慧家庭的普及和DIY家居装修趋势的兴起,引发了人们对便携式产品的兴趣,其中许多产品现在都包含即时监控和行动警报等智慧功能。另一方面,固定式探测器更常部署在需要持续监控的大型商业或工业环境中。然而,它们较高的成本和安装复杂性限制了它们在小型或住宅环境中的使用,因此便携式探测器的整体市场渗透率增长更快。

在北美,美国在2024年占据了该地区市场的最大份额,达到75.9%。预计到2034年,这一主导地位将持续,复合年增长率将达到4.9%。美国对水资源保护的重视、监管支持以及高科技解决方案的采用,正在为市场创造强劲发展势头。管道老化等基础设施挑战也在推动需求成长,因为每天有大量的水因未检测到的洩漏而流失。智慧感测器和连网设备的广泛应用使得侦测更加精准,反应速度更快,这些工具对于住宅、市政和商业用水管理系统至关重要。

业界领导者凭藉其强大的品牌影响力、尖端技术和广泛的分销网络,合计占据30-35%的市场份额。这些公司持续透过创新和策略合作伙伴关係推动成长,同时紧跟全球永续发展目标,并满足日益增长的节水技术需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 受影响的主要公司

- 策略产业回应

- 供应链重构

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 衝击力

- 成长动力

- 对水资源短缺的担忧日益加剧

- 节水意识不断增强

- 商业和工业应用

- 产业陷阱与挑战

- 初始投资高

- 开发中国家采用率有限

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:漏水侦测器市场估计与预测:依产品类型,2021-2034 年

- 主要趋势

- 解决方案

- 系统

第六章:漏水侦测器市场估计与预测:依类型,2021-2034

- 主要趋势

- 固定式洩漏检测器

- 便携式洩漏检测仪

第七章:漏水侦测器市场估计与预测:按技术,2021-2034 年

- 主要趋势

- 传统的

- 聪明的

第八章:漏水侦测器市场估计与预测:按产品,2021-2034 年

- 主要趋势

- 被动洩漏

- 主动洩漏

第九章:漏水侦测器市场估计与预测:按应用 2021-2034

- 主要趋势

- 住宅

- 商业的

- 工业的

第 10 章:漏水侦测器市场估计与预测:按配销通路2021-2034

- 主要趋势

- 直接的

- 间接

第 11 章:漏水侦测器市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

第十二章:公司简介

- Amprobe

- Bosch Security Systems

- Emerson Electric

- FIBAR Group

- Grove Leak Detection

- Honeywell International

- Johnson Controls

- Krohne Group

- Leak Detection Systems

- PSI Software AG

- RLE Technologies

- Siemens

- Tait Communication

- Water Hero

- Wagner Meters

The Global Water Leak Detector Market was valued at USD 1.3 billion in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 2.2 billion by 2034. Leak detection technologies play an increasingly vital role in minimizing water loss by identifying leaks early and enabling timely repairs. These systems use advanced tools, including sensor-based solutions, sound detection, and connected devices, to pinpoint hidden or minor leaks that would otherwise go unnoticed. Such advancements are significantly improving the efficiency of water conservation strategies. Water scarcity continues to worsen due to growing urban populations, rapid industrialization, and the impacts of climate change. As a result, addressing water wastage has become a global concern.

One of the most significant contributors to this issue is system leakage in residential, commercial, and industrial water infrastructure, which leads to massive water loss each year. With increasing awareness and urgency around water preservation, the adoption of leak detection technology is gaining momentum across sectors. These solutions offer a proactive approach to water management by making it easier to monitor, control, and repair systems before the damage becomes costly or irreversible. Rising demand for sustainable resource use, tighter regulations, and government initiatives aimed at upgrading aging water systems are further fueling market growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.3 Billion |

| Forecast Value | $2.2 Billion |

| CAGR | 5.1% |

In terms of offerings, the market is categorized into solutions and systems. The systems segment emerged as the dominant force in 2024, generating USD 500 million in revenue and is on track to reach USD 1 billion by 2034. These systems have gained favor due to their ease of installation, maintenance, and overall user-friendly operation, especially compared to service-oriented models. There's also growing traction for smart and connected technologies that offer real-time insights. As more consumers opt for intelligent systems, IoT-based leak detectors are becoming standard. These products provide timely alerts and automatic responses, helping users minimize water loss and associated costs. The combination of affordability, improved precision, and enhanced connectivity has solidified their leading position. The trend toward do-it-yourself installations among homeowners is further accelerating product adoption, with consumers valuing the convenience, customization, and modern features these systems provide.

Distribution-wise, the indirect channel led the market in 2024 with a 55.4% revenue share and is expected to hit USD 1.2 billion by 2034. The indirect route, which includes distributors, resellers, and retailers, has become the go-to strategy for manufacturers looking to expand reach and tap into remote customer bases. These intermediaries often pair leak detection products with additional offerings like plumbing or water system services, enhancing their appeal and driving sales. The availability of products in physical stores and online platforms, as well as faster fulfillment through local inventory hubs, makes this channel highly efficient and accessible for end users.

By type, water leak detectors are segmented into fixed and portable units. In 2024, automatic detectors dominated with a market share of approximately 53.8%. Portable devices are especially favored for their flexibility, cost-effectiveness, and ease of deployment. They are an ideal fit for short-term uses, rented properties, or locations where installing a permanent system is not practical. The rise in smart home adoption and DIY home improvement trends has led to greater interest in portable options, many of which now include smart features like live monitoring and mobile alerts. On the other hand, fixed detectors are more commonly deployed in large-scale commercial or industrial environments where continuous surveillance is essential. However, their higher costs and installation complexities limit their use in smaller or residential setups, which is why portable variants are seeing faster growth in overall market penetration.

In North America, the United States held the lion's share of the regional market in 2024, accounting for 75.9%. This dominance is forecast to continue, supported by a CAGR of 4.9% through 2034. The country's focus on water conservation, regulatory support, and the adoption of high-tech solutions is creating strong momentum in the market. Infrastructure challenges such as aging pipelines are also driving demand, as a significant volume of water is lost daily due to undetected leaks. The widespread adoption of smart sensors and connected devices is enabling more accurate detection and faster response times, making these tools essential for residential, municipal, and commercial water management systems.

Leading players in the industry collectively hold a 30-35% share of the market, leveraging their strong brand presence, cutting-edge technology, and expansive distribution networks. These companies continue to drive growth through innovation and strategic partnerships while aligning with global sustainability goals and addressing the rising demand for water-efficient technologies.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factors affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump Administration Tariffs Analysis

- 3.2.1 Impact on Trade

- 3.2.1.1 Trade Volume Disruptions

- 3.2.1.2 Retaliatory Measures

- 3.2.2 Impact on the Industry

- 3.2.2.1 Supply-Side Impact (Raw Materials)

- 3.2.2.2 Price Volatility in Key Materials

- 3.2.2.3 Supply Chain Restructuring

- 3.2.2.4 Production Cost Implications

- 3.2.2.5 Demand-Side Impact (Selling Price)

- 3.2.2.6 Price Transmission to End Markets

- 3.2.2.7 Market Share Dynamics

- 3.2.2.8 Consumer Response Patterns

- 3.2.3 Key Companies Impacted

- 3.2.4 Strategic Industry Responses

- 3.2.4.1 Supply Chain Reconfiguration

- 3.2.4.2 Pricing and Product Strategies

- 3.2.4.3 Policy Engagement

- 3.2.5 Outlook and Future Considerations

- 3.2.1 Impact on Trade

- 3.3 Impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Growing concerns about water scarcity

- 3.3.1.2 Rising Awareness of Water Conservation

- 3.3.1.3 Commercial and Industrial Adoption

- 3.3.2 Industry pitfalls & challenges

- 3.3.2.1 High Initial Investment

- 3.3.2.2 Limited Adoption in Developing Countries

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Water Leak Detector Market Estimates & Forecast, By Offering, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Solution

- 5.3 System

Chapter 6 Water Leak Detector Market Estimates & Forecast, By Type, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Fixed leak detector

- 6.3 Portable leak detector

Chapter 7 Water Leak Detector Market Estimates & Forecast, By Technology, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Conventional

- 7.3 Smart

Chapter 8 Water Leak Detector Market Estimates & Forecast, By Product, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Passive leak

- 8.3 Active leak

Chapter 9 Water Leak Detector Market Estimates & Forecast, By Application 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Residential

- 9.3 Commercial

- 9.4 Industrial

Chapter 10 Water Leak Detector Market Estimates & Forecast, By Distribution Channel 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct

- 10.3 Indirect

Chapter 11 Water Leak Detector Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 United States

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 United kingdom

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 Middle East & Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 United Arab Emirates

Chapter 12 Company Profiles

- 12.1 Amprobe

- 12.2 Bosch Security Systems

- 12.3 Emerson Electric

- 12.4 FIBAR Group

- 12.5 Grove Leak Detection

- 12.6 Honeywell International

- 12.7 Johnson Controls

- 12.8 Krohne Group

- 12.9 Leak Detection Systems

- 12.10 PSI Software AG

- 12.11 RLE Technologies

- 12.12 Siemens

- 12.13 Tait Communication

- 12.14 Water Hero

- 12.15 Wagner Meters