|

市场调查报告书

商品编码

1687243

智慧水錶-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Smart Water Meter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

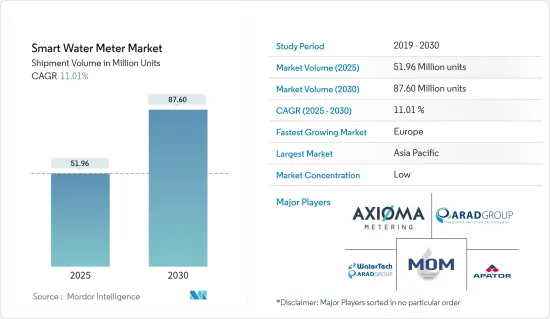

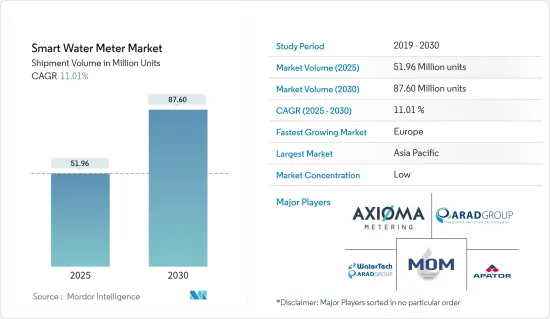

根据出货量计算,智慧水錶市场规模预计将从 2025 年的 5,196 万台扩大到 2030 年的 8,760 万台,预测期内(2025-2030 年)的复合年增长率为 11.01%。

智慧水錶市场推动效率与节约

关键亮点

- 政府支持性法规加速采用:政府措施和法规为智慧水錶市场提供了巨大的推动力。公共和市政当局正在受益于旨在用智慧仪表取代传统仪表的大量资金。例如,西孟菲斯获得了 285 万美元的津贴,用于安装 9,000 多个智慧电錶,圣荷西水务公司获得核准投资 1 亿美元用于先进计量基础设施 (AMI)。这些努力的重点是改善客户服务、减少温室气体排放和促进节约用水。

- 政府资助大规模智慧电錶安装

- 监管支援:允许公用事业公司投资 AMI 技术

- 环境目标:协调永续性与保护工作

- 需要提高用水量和效率:水务公司面临提高效率和解决老化基础设施的压力。智慧水錶可帮助自来水公司侦测洩漏、减少水损失并提供即时使用资料。例如,杜拜电力和水务局(DEWA)检测到超过 130 万起漏水事件,减少了 218,373 吨二氧化碳排放。在美国,每天有近60亿加仑的处理过的水被浪费,基础设施投资正在蓬勃发展。

- 洩漏检测:智慧仪表可快速识别和缓解

- 即时资料:支援改善节水策略

- 基础设施投资:规划进行重大改进

- 减少因需求增加而造成的未计费水量水损失:无收入水(NRW)损失对营业单位在财务和环境方面都构成了重大挑战。智慧电錶可以实现精确测量、洩漏检测和资料分析。亚洲开发银行强调了减少无收益水对于扩大服务覆盖范围和满足日益增长的需求的重要性。例如,马尼拉的梅尼勒德水务公司采用区域计量和智慧技术,将其无收益水量 (NRW) 降低了 30.31%,同时将其服务覆盖率扩大至 95%。

- 减少无收益水(NRW):智慧水錶有助于量化和减少水资源损失

- 区域计量:改善水损控制措施

- 公共产业的成功:利用智慧技术减少NRW以改善运营

- 数位化与业务效率:智慧水錶透过提供准确、详细的用水资讯的 AMI 系统推动水务公司的数位转型。这些资料有助于做出更好的决策、增加收益并提高计费效率。撒丁岛的 Abbanoa SpA 和 Itron 之间的合作展示了智慧电錶技术如何利用超音波技术来帮助检测洩漏并减少 NRW。

- AMI 系统:为公共产业公司提供实际的见解

- 即时监控:快速侦测洩漏并解决问题

- 数位转型:改善公共产业和客户服务

- 市场格局与竞争环境:智慧水錶市场竞争激烈,既有 Badger Meter、Honeywell 和 Itron 等老牌参与企业,也有利用物联网技术的 WaterGroup 等新兴参与企业。技术提供者和公共产业之间加强伙伴关係正在加速各地区采用客製化解决方案。

- 透过为现有参与企业提供全面的解决方案来促进创新

- 技术伙伴关係:加速智慧电錶的全球普及

- 多样化产品:满足多样化公共产业需求

随着水资源短缺和高效资源管理变得越来越重要,智慧水錶市场将进一步扩大。先进通讯协定和资料分析的整合将加强智慧水錶的作用,并巩固其在未来水资源管理中的地位。

智慧水錶市场趋势

预计住宅领域将占据主要市场占有率

- 市场主导地位与成长轨迹:自动抄表 (AMR) 技术领域将在智慧水錶市场中占据最大市场占有率,到 2022 年将占整个市场的 63.95%。预计到 2028 年,AMR 技术的出货量将达到 3,273 万台,2023 年至 2028 年的复合年增长率为 5.04%。

- AMR市场占有率:AMR将在智慧水錶产业保持主导地位。

- 复合年增长率预测:预计该部分将以 5.04% 的复合年增长率稳步增长。

- 成本效益:AMR 正在降低公共产业公司的营运成本并提高效率。

- 技术优势推动采用:AMR 技术可让公共产业公司无需实体存取电錶即可收集电錶读数,有助于降低营运成本并提高效率。这项技术可以实现更频繁、更准确的抄表,从而实现更好的水资源管理并减少未计费水量水损失。

- 远端抄表:AMR 允许公共产业公司从远端位置收集电錶资料。

- 营运效益:透过减少人事费用和运输成本来提高效率。

- 水资源管理:频繁抄表可改善水资源管理

- 转向先进的解决方案虽然 AMR 仍然是主流,但市场正在逐渐转向更先进的解决方案。先进计量基础设施 (AMI) 领域虽然规模较小,但成长速度更快,复合年增长率为 18.27%,显示更先进的智慧水计量系统趋势。

- AMI 成长:AMI 技术的复合年增长率为 18.27%。

- 进阶功能:AMI提供更详细的资料和即时监控功能。

- 技术演进:向 AMI 的转变代表着对即时资料日益增长的需求。

- 产业发展与采用:各个地区的公共产业正在将其传统的水计量系统升级为 AMR 技术。例如,2023 年 1 月,Sweetwater 市宣布计划在五个月内在家庭和企业安装约 4,500 台超音波智慧水錶。

- 新发展 Sweetwater 将于 2023 年安装智慧水錶,这将成为区域推广的一个例子。

- 每小时资料:消费者可以详细、即时地了解他们的用水情况。

- 漏水警报:自动漏水警报可提高节水效果并减少水损失。

- 市场驱动因素与展望:许多地区对节水的需求日益增长以及水利基础设施老化,推动着 AMR 技术的应用。例如,在美国,水资源管理是一项重大挑战,有220万人缺乏自来水和基本的室内管道,超过4,400万人缺乏足够的供水设施。预计这些因素将在未来几年维持对 AMR 技术的需求。

- 节约用水:日益严重的水资源短缺是采用 AMR 技术的主要驱动力。

- 基础设施挑战:老化的供水系统正在推动公共产业采用智慧解决方案。

- 未来需求:由于持续存在的水资源挑战,对 AMR 技术的需求预计将保持强劲。

预计欧洲将出现显着成长

- 市场成长与预测:欧洲是智慧水錶市场成长最快的区域,预计出货量将从 2022 年的 1,066 万台增加到 2028 年的 2,101 万台,预测期内的复合年增长率为 12.02%。

- 区域扩张:欧洲将处于领先地位,2023 年至 2028 年的复合年增长率为 12.02%。

- 强劲需求:水资源短缺问题和监管压力正在推动该地区的需求。

- 出货量成长:到2028年,欧洲出货量将成长近一倍。

- 区域成长动力:欧洲的快速成长受到多种因素的推动,包括严格的水资源保护法规、老化的水利基础设施以及对水资源短缺问题认识的提高。欧盟 (EU) 的水资源管理和永续性政策正在推动公共产业公司采用智慧水计量解决方案。

- 监管推动:欧盟节水措施加速采用

- 老化系统:欧洲公用事业公司正在寻找解决其老化基础设施问题的方案。

- 永续性:该地区对永续性的关注正在推动智慧水錶的发展。

- 技术进步与创新:欧洲公司处于智慧水錶技术发展的前沿。例如,丹麦的卡姆鲁普提供多种智慧水錶解决方案,包括flowIQ系列,可提供高精度、长期稳定的水量测量。

- 创新领导者:卡姆鲁普等欧洲公司处于技术发展的前沿。

- 高精度工具:flowIQ 系列提供高精度水计量解决方案。

- 注重永续性:长期稳定性和节约用水。

- 市场倡议和合作欧洲各地的政府和公共产业公司正在启动倡议,以实现其水利基础设施的现代化。 2023 年 6 月,英国水务监管机构 Ofwat 批准了一项价值 22 亿英镑(29.3 亿美元)的计划,以加速推出七个智慧水錶方案,目标是到 2025 年底核准462,000 个智慧水錶。

- 监管支援:Ofwat 的 22 亿英镑(29.3 亿美元)计画将加速英国智慧电錶的推广。

- 广泛部署:2025年,英国将安装462,000台智慧电錶。

- 基础设施现代化倡议旨在实现水利基础设施的现代化。

智慧水錶市场概况

全球参与企业主导整合市场

主要企业利用技术和规模:霍尼韦尔、Itron 和 Landis+Gyr 等全球参与企业利用其大规模营运和广泛的产品系列来引领市场。例如,霍尼韦尔拥有 97,000 名员工,并不断创新用于 AMI 的下一代蜂窝模组 (NXCM)。这些参与企业专注于技术进步和策略伙伴关係关係以保持其优势。

大型企业:市场领导凭藉规模和影响力获得优势

专注于技术:创新是保持领先的关键

产品系列:全面的产品供应巩固了市场地位

市场成功策略:成功的策略包括对物联网、人工智慧和长寿命电池系统的投资。像 Xylem 这样的公司正专注于隐藏收入定位器等创新解决方案。 Sensus 与 Larsen & Toubro 之间的伙伴关係对于解决基础设施挑战至关重要。

创新重点:物联网与人工智慧推动产品开发

託管服务:帮助公用事业提高业务效率

策略联盟:促进市场扩张和解决方案提供

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 产业价值链分析

- 智慧水錶类型的技术简介

- 智慧电錶投资报酬率分析

- 目前使用的主要通讯协定及其比较

- LoraWAN实施步骤/关键使用案例/长期影响

- 公共产业透过智慧电錶实施/数位化获得的效益

第五章市场动态

- 市场驱动因素

- 政府支持限制

- 需要提高用水量和效率

- 减少非收入水损失的需求增加

- 市场限制

- 高成本和安全隐患

- 与智慧电錶整合困难

- 更换供应商的成本

第六章市场区隔

- 依技术

- 自动抄表

- 先进的测量基础设施

- 按应用

- 住宅

- 商业

- 工业的

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章竞争格局

- 公司简介

- Watertech SPA(Arad Group)

- Mom Zrt

- Apator SA

- Arad Group

- Axioma Metering

- Badger Meter Inc.

- Diehl Stiftung & Co. KG

- Honeywell International Inc.

- Suntront tech Co., Ltd.

- Maddalena SPA

- WavIoT

- Itron Inc.

- BETAR Company

- Kamstrup A/S

- Landis+GYR Group AG

- Integra Metering AG

- G. Gioanola Srl

- Sensus Usa Inc.(Xylem Inc.)

- Zenner International Gmbh & Co. KG

第八章投资分析

第九章 市场机会与未来趋势

The Smart Water Meter Market size in terms of shipment volume is expected to grow from 51.96 million units in 2025 to 87.60 million units by 2030, at a CAGR of 11.01% during the forecast period (2025-2030).

Smart Water Meter Market: Driving Efficiency and Conservation

Key Highlights

- Supportive Government Regulations Accelerate Adoption: Government initiatives and regulations are significantly advancing the smart water meter market. Utilities and municipalities are benefiting from substantial funding aimed at replacing traditional meters with smart alternatives. For instance, West Memphis received a USD 2.85 million grant to install over 9,000 smart meters, while San Jose Water secured approval for a USD 100 million investment in Advanced Metering Infrastructure (AMI). These efforts focus on enhancing customer service, reducing greenhouse gas emissions, and promoting water conservation.

- Government funding: Enables large-scale smart meter installations

- Regulatory support: Allows utilities to invest in AMI technology

- Environmental goals: Align with sustainability and conservation efforts

- Need for Improvement in Water Utility Usage and Efficiency: Water utilities are under increasing pressure to improve efficiency and address aging infrastructure. Smart water meters help utilities detect leaks, reduce water loss, and provide real-time usage data. For example, Dubai Electricity and Water Authority (DEWA) detected over 1.3 million leaks, leading to a reduction in CO2 emissions by 218,373 tons. In the U.S., where nearly 6 billion gallons of treated water are lost daily, investments in infrastructure are ramping up.

- Leak detection: Smart meters allow prompt identification and mitigation

- Real-time data: Supports improved water conservation strategies

- Infrastructure investment: Significant improvements are being planned

- Increasing Demand to Reduce Non-revenue Water Losses: Non-revenue water (NRW) losses represent a critical challenge for water utilities, both financially and environmentally. Smart meters help by providing accurate measurements, detecting leaks, and enabling data analysis. The Asian Development Bank highlights the importance of NRW reduction to improve service coverage and meet growing demand. For instance, Maynilad in Manila has reduced NRW to 30.31% while expanding service coverage to 95% using district metering and smart technology.

- NRW reduction: Smart meters help quantify and reduce water losses

- District metering: Improves water loss management efforts

- Utility success: NRW reduction through smart technology enhances operations

- Digitalization and Operational Efficiency: Smart water meters are driving the digital transformation of water utilities through AMI systems, which provide accurate, detailed information on water usage. This data improves decision-making, increases revenue, and enhances billing efficiency. Itron's collaboration with Abbanoa SpA in Sardinia demonstrates how smart metering technology can help detect leaks and reduce NRW using ultrasound technology.

- AMI systems: Offer actionable insights for utilities

- Real-time monitoring: Enables rapid leak detection and issue resolution

- Digital transformation: Improves utility operations and customer service

- Market Landscape and Competitive Environment: The smart water meter market is highly competitive, featuring established players like Badger Meter, Honeywell, and Itron, along with emerging startups such as WaterGroup, which leverage IoT technologies. Increased partnerships between technology providers and utilities are accelerating the adoption of tailored solutions across regions.

- Established players: Drive innovation through comprehensive solutions

- Tech partnerships: Accelerate smart meter adoption globally

- Diverse offerings: Cater to a variety of utility needs

As water scarcity and efficient resource management grow in importance, the smart water meter market is poised for further expansion. The integration of advanced communication protocols and data analytics will enhance the role of smart water meters, solidifying their place in the future of water management.

Smart Water Meter Market Trends

Residential Application Segment is Expected Hold Significant Market Share

- Market dominance and growth trajectory: The Automatic Meter Reading (AMR) technology segment holds the largest market share in the Smart Water Meter Market, accounting for 63.95% of the total market in 2022. AMR technology shipments are projected to reach 32.73 million units by 2028, growing at a CAGR of 5.04% from 2023 to 2028.

- AMR market share: AMR remains dominant in the smart water meter industry.

- CAGR forecast: The segment is projected to grow steadily at 5.04% CAGR.

- Cost efficiency: AMR reduces operational costs for utilities, enhancing efficiency.

- Technological advantages driving adoption: AMR technology offers utilities the ability to collect meter readings without physical access to the meter, reducing operational costs and improving efficiency. This technology enables more frequent and accurate readings, leading to better water management and reduced non-revenue water losses.

- Remote readings: AMR allows utilities to collect meter data remotely.

- Operational benefits: Improved efficiency through reduced labor and transportation costs.

- Water management: Frequent readings enable better management of water resources.

- Transition to advanced solutions: While AMR remains dominant, the market is witnessing a gradual shift towards more advanced solutions. The Advanced Metering Infrastructure (AMI) segment, though smaller, is growing at a much faster rate of 18.27% CAGR, indicating a trend towards more sophisticated smart water metering systems.

- AMI growth: AMI technology is growing at 18.27% CAGR.

- Advanced features: AMI provides more detailed data and real-time monitoring capabilities.

- Technological evolution: The shift towards AMI represents the growing demand for real-time data.

- Industry developments and implementations: Utilities across various regions are upgrading their traditional water metering systems to AMR technology. For instance, in January 2023, the city of Sweetwater announced plans to install approximately 4,500 Ultrasonic Smart Water Meters in homes and businesses over a five-month period, allowing customers to view hourly water usage data and receive automatic leak alerts.

- New deployments: Sweetwater's 2023 smart water meter installation exemplifies regional adoption.

- Hourly data: Consumers benefit from detailed, real-time water usage insights.

- Leak alerts: Automatic leak alerts improve water conservation and reduce water loss.

- Market drivers and future outlook: The growing need for water conservation, coupled with the aging water infrastructure in many regions, is driving the adoption of AMR technology. The United States, for example, faces significant water management challenges, with 2.2 million people lacking running water and basic indoor plumbing, and over 44 million having inadequate water systems. These factors are expected to sustain the demand for AMR technology in the coming years.

- Water conservation: Rising water scarcity is a key driver for AMR technology adoption.

- Infrastructure challenges: Aging water systems push utilities to adopt smart solutions.

- Future demand: AMR technology demand is expected to remain strong due to ongoing water challenges.

Europe is Expected to Witness Significant Growth

- Market growth and projections: Europe represents the fastest-growing regional segment in the Smart Water Meter Market, with shipments expected to increase from 10.66 million units in 2022 to 21.01 million units by 2028, registering a CAGR of 12.02% during the forecast period.

- Regional expansion: Europe leads with a 12.02% CAGR from 2023 to 2028.

- Strong demand: Water scarcity concerns and regulatory pressures drive demand in the region.

- Shipment growth: European shipments are set to nearly double by 2028.

- Drivers of regional growth: The rapid growth in Europe can be attributed to several factors, including stringent water conservation regulations, aging water infrastructure, and increasing awareness of water scarcity issues. The European Union's policies on water management and sustainability are driving utilities to adopt smart water metering solutions.

- Regulatory push: EU water conservation policies accelerate adoption.

- Aging systems: European utilities seek solutions for aging infrastructure.

- Sustainability: The region's focus on sustainability promotes smart water metering.

- Technological advancements and innovations: European companies are at the forefront of smart water meter technology development. For instance, Kamstrup, a Danish company, offers a range of smart water metering solutions, including the flowIQ series, which provides high accuracy and long-term stability in water measurement.

- Innovation leaders: Kamstrup and other European firms lead in technology development.

- Precision tools: flowIQ series offers high-accuracy water metering solutions.

- Sustainability focus: Long-term stability and water conservation are core features.

- Market initiatives and collaborations: Governments and utilities across Europe are launching initiatives to modernize water infrastructure. In June 2023, Britain's water regulator, Ofwat, approved a GBP 2.2 billion (USD 2.93 billion) plan to accelerate the rollout of seven smart water meter schemes, aiming to install 462,000 smart meters by the end of 2025.

- Regulatory support: Ofwat's GBP 2.2 billion (USD 2.93 billion) plan accelerates smart meter adoption in the UK.

- Broad rollout: By 2025, 462,000 smart meters will be installed in the UK.

- Infrastructure modernization: These initiatives target water infrastructure modernization.

Smart Water Meter Market Overview

Global Players Dominate Consolidated Market

Top Players Leverage Technology and Scale: Global players such as Honeywell, Itron, and Landis+Gyr lead the market, capitalizing on their large-scale operations and extensive product portfolios. Honeywell, for example, employs 97,000 people and continues to innovate with its Next Generation Cellular Module (NXCM) for AMI. These players focus on technological advancements and strategic partnerships to maintain dominance.

Large-scale operations: Market leaders dominate through size and reach

Technological focus: Innovation is key for maintaining leadership

Product portfolios: Comprehensive offerings strengthen market position

Strategies for Market Success: Successful strategies include investing in IoT, AI, and long-life battery systems. Companies like Xylem are focusing on innovative solutions like the Hidden Revenue Locator. Partnerships, such as Sensus's collaboration with Larsen & Toubro, are crucial for addressing infrastructure challenges.

Innovation focus: IoT and AI drive product development

Managed services: Support operational efficiency for utilities

Strategic collaborations: Drive market expansion and solution delivery

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain Analysis

- 4.4 Technology Snapshot for types of Smart Water Meter

- 4.5 ROI Analysis for Smart Meters

- 4.6 Prominent Protocols Used and their Comparison

- 4.7 Steps Involved in Implementing LoraWAN/Prominent Use-cases/Long-term Implications

- 4.8 Advantages/Digitalization Achieved by Utilities by Smart Meter Implementations

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Supportive Government Regulations

- 5.1.2 Need for Improvement in Water Utility Usage and Efficiency

- 5.1.3 Increasing Demand to Reduce Non-revenue Water Losses

- 5.2 Market Restraints

- 5.2.1 High Costs and Security Concerns

- 5.2.2 Integration Difficulties with Smart Meters

- 5.2.3 Utility Supplier Switching Costs

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Automatic Meter Reading

- 6.1.2 Advanced Metering Infrastructure

- 6.2 By Application

- 6.2.1 Residential

- 6.2.2 Commercial

- 6.2.3 Industrial

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Watertech S.P.A (Arad Group)

- 7.1.2 Mom Zrt

- 7.1.3 Apator SA

- 7.1.4 Arad Group

- 7.1.5 Axioma Metering

- 7.1.6 Badger Meter Inc.

- 7.1.7 Diehl Stiftung & Co. KG

- 7.1.8 Honeywell International Inc.

- 7.1.9 Suntront tech Co., Ltd.

- 7.1.10 Maddalena SPA

- 7.1.11 Waviot

- 7.1.12 Itron Inc.

- 7.1.13 BETAR Company

- 7.1.14 Kamstrup A/S

- 7.1.15 Landis+GYR Group AG

- 7.1.16 Integra Metering AG

- 7.1.17 G. Gioanola Srl

- 7.1.18 Sensus Usa Inc. (Xylem Inc.)

- 7.1.19 Zenner International Gmbh & Co. KG