|

市场调查报告书

商品编码

1822611

智慧水錶市场机会、成长动力、产业趋势分析及2025-2034年预测Smart Water Meter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

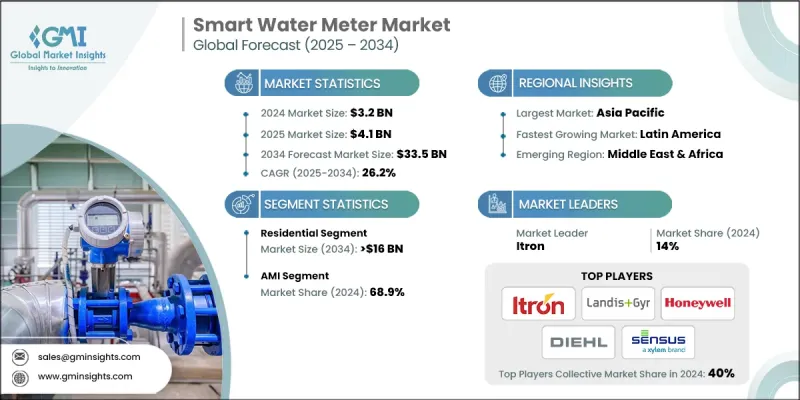

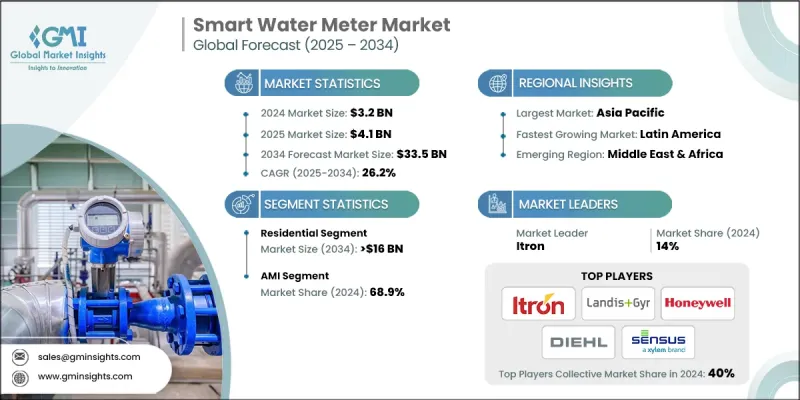

2024 年全球智慧水錶市场价值为 32 亿美元,预计在即时资料需求和智慧城市计画扩展的推动下,该市场将以 26.2% 的复合年增长率增长,到 2034 年达到 335 亿美元。根据联合国的报告,到 2050 年,城市地区预计将容纳全球 68% 的人口,这凸显了对高效水管理系统的需求。即时资料可实现精确监测、快速检测问题和优化水管理,从而提高营运效率和资源节约。随着智慧城市计画的激增,将智慧水錶整合到城市基础设施中对于改善整体水管理和基础设施连接至关重要。对先进资料解决方案和智慧技术整合的日益重视推动了市场扩张和各个领域的应用。

例如,2024年6月,莱森推出了一款支援Sigfox的智慧水錶,旨在满足市场对先进水管理解决方案日益增长的需求。 Sigfox技术的整合增强了连接和资料传输能力,满足了可靠即时监控的需求。这项创新反映了市场向先进互联繫统发展的趋势,并支援智慧水錶在各个领域的更广泛应用。智慧水錶产业根据应用、技术、产品和地区细分。到2032年,商业领域将大幅成长,这归因于企业和产业对精确用水监控的高需求。商业机构需要精确的水管理来优化营运效率、降低成本并遵守监管要求。智慧水錶提供即时资料、洩漏检测和自动计费,使其成为大型用水用户的理想选择。商业应用中对高效水资源管理的需求推动了智慧水錶的广泛应用,巩固了该领域的主导市场地位。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 32亿美元 |

| 预测值 | 335亿美元 |

| 复合年增长率 | 26.2% |

到2032年,热水錶市场将获得显着成长,这得益于住宅、商业和工业环境中对热水使用情况的精确监控需求日益增长。准确测量热水消耗有助于优化能源使用、降低成本并确保高效的资源管理。智慧热水錶整合先进技术,可实现即时资料收集并提高计费准确性。对高效能热水管理解决方案日益增长的需求推动了该市场在市场中的主导地位。到2032年,亚太地区智慧水錶市场份额将维持中等复合年增长率,这得益于快速的城市化、人口增长和水资源短缺问题日益严重。该地区各国政府正在大力投资智慧基础设施,以改善水资源管理和效率。智慧城市计画的日益普及和物联网技术的进步进一步推动了市场的发展。住宅和商业领域对精确用水监控的高需求使亚太地区成为全球智慧水錶产业的核心贡献者。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 进出口贸易分析

- 各地区价格趋势分析(美元/单位)

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

- 新兴机会和趋势

- 数位化和物联网集成

- 新兴市场渗透

- 投资分析及未来展望

第四章:竞争格局

- 介绍

- 按地区分析公司市场份额

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

- 策略倡议

- 竞争性基准描述

- 策略仪表板

- 创新与技术格局

第五章:市场规模与预测:按应用,2021 - 2034

- 主要趋势

- 住宅

- 商业的

- 公用事业

第六章:市场规模及预测:依技术分类,2021 - 2034 年

- 主要趋势

- 急性心肌梗塞

- 抗肿瘤药物

第七章:市场规模及预测:依产品,2021 - 2034

- 主要趋势

- 热水錶

- 冷水錶

第八章:市场规模及预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 瑞典

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 中东和非洲

- 阿联酋

- 沙乌地阿拉伯

- 南非

- 埃及

- 拉丁美洲

- 巴西

- 阿根廷

第九章:公司简介

- ABB

- Apator SA

- Arad Group:

- Badger Meter, Inc.

- BMETERS Srl

- Diehl Stiftung & Co. KG

- Honeywell International Inc.

- Itron Inc.

- Kamstrup

- Landis+Gyr

- Neptune Technology Group Inc.

- Ningbo Water Meter Co., Ltd.

- Schneider Electric

- Siemens

- Sontex SA

- Xylem (Sensus)

- ZENNER International GmbH & Co. KG

- Suez

- Baylan Water Meters

- BOVE Technology

The Global Smart Water Meter Market was valued at USD 3.2 billion in 2024 and is estimated to grow at a CAGR of 26.2% to reach USD 33.5 billion by 2034, driven by the demand for real-time data and the expansion of smart city initiatives. According to a report by the United Nations, urban areas are expected to house 68% of the world's population by 2050, highlighting the need for efficient water management systems. Real-time data allows for precise monitoring, quick detection of issues, and optimized water management, enhancing operational efficiency and resource conservation. As smart city projects proliferate, integrating smart water meters into urban infrastructure becomes crucial for improving overall water management and infrastructure connectivity. This growing emphasis on advanced data solutions and smart technology integration fuels market expansion and adoption across various sectors.

For instance, in June 2024, LAISON introduced a Sigfox-enabled smart water meter designed to meet the increasing demand for advanced water management solutions in the market. The integration of Sigfox technology enhances connectivity and data transmission capabilities, catering to the need for reliable real-time monitoring. This innovation reflects the market trend towards advanced, connected systems and supports the broader adoption of smart water meters across various sectors. The smart water meter industry is fragmented based on application, technology, product, and region. The commercial segment will see a considerable surge by 2032, attributed to the high demand for accurate water usage monitoring in businesses and industries. Commercial establishments require precise water management to optimize operational efficiency, reduce costs, and comply with regulatory requirements. Smart water meters offer real-time data, leak detection, and automated billing, making them ideal for large-scale water consumers. The need for efficient water resource management in commercial applications drives significant adoption, solidifying this segment's dominant market position.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.2 Billion |

| Forecast Value | $33.5 Billion |

| CAGR | 26.2% |

The hot water meter segment will garner remarkable gains by 2032, fueled by the rising need for precise monitoring of hot water usage in residential, commercial, and industrial settings. Accurate measurement of hot water consumption helps optimize energy usage, reduce costs, and ensure efficient resource management. The integration of advanced technologies in smart hot water meters allows for real-time data collection and improved billing accuracy. This growing demand for effective hot water management solutions drives the dominance of this segment in the market. Asia Pacific smart water meter market share will secure a moderate CAGR through 2032, owing to rapid urbanization, increasing population, and rising water scarcity issues. Governments in the region are investing heavily in smart infrastructure to improve water management and efficiency. The growing adoption of smart city initiatives and advancements in IoT technology further drive the market. High demand for accurate water usage monitoring in both residential and commercial sectors positions APAC as a central contributor to the global smart water meter industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Import/Export trade analysis

- 3.4 Price trend analysis, by region (USD/Unit)

- 3.5 Industry impact forces

- 3.5.1 Growth drivers

- 3.5.2 Industry pitfalls & challenges

- 3.6 Growth potential analysis

- 3.7 Porter's analysis

- 3.7.1 Bargaining power of suppliers

- 3.7.2 Bargaining power of buyers

- 3.7.3 Threat of new entrants

- 3.7.4 Threat of substitutes

- 3.8 PESTEL analysis

- 3.8.1 Political factors

- 3.8.2 Economic factors

- 3.8.3 Social factors

- 3.8.4 Technological factors

- 3.8.5 Legal factors

- 3.8.6 Environmental factors

- 3.9 Emerging opportunities & trends

- 3.9.1 Digitalization & IoT integration

- 3.9.2 Emerging market penetration

- 3.10 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiatives

- 4.4 Competitive benchmarking depictions

- 4.5 Strategy dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & '000 Units)

- 5.1 Key trends

- 5.2 Residential

- 5.3 Commercial

- 5.4 Utility

Chapter 6 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million & '000 Units)

- 6.1 Key trends

- 6.2 AMI

- 6.3 AMR

Chapter 7 Market Size and Forecast, By Product, 2021 - 2034 (USD Million & '000 Units)

- 7.1 Key trends

- 7.2 Hot water meter

- 7.3 Cold water meter

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & '000 Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Sweden

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Middle East & Africa

- 8.5.1 UAE

- 8.5.2 Saudi Arabia

- 8.5.3 South Africa

- 8.5.4 Egypt

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 Apator S.A.

- 9.3 Arad Group:

- 9.4 Badger Meter, Inc.

- 9.5 BMETERS S.r.l

- 9.6 Diehl Stiftung & Co. KG

- 9.7 Honeywell International Inc.

- 9.8 Itron Inc.

- 9.9 Kamstrup

- 9.10 Landis+Gyr

- 9.11 Neptune Technology Group Inc.

- 9.12 Ningbo Water Meter Co., Ltd.

- 9.13 Schneider Electric

- 9.14 Siemens

- 9.15 Sontex SA

- 9.16 Xylem (Sensus)

- 9.17 ZENNER International GmbH & Co. KG

- 9.18 Suez

- 9.19 Baylan Water Meters

- 9.20 BOVE Technology