|

市场调查报告书

商品编码

1404329

8K:市场占有率分析、产业趋势与统计、2024年至2029年成长预测8K - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

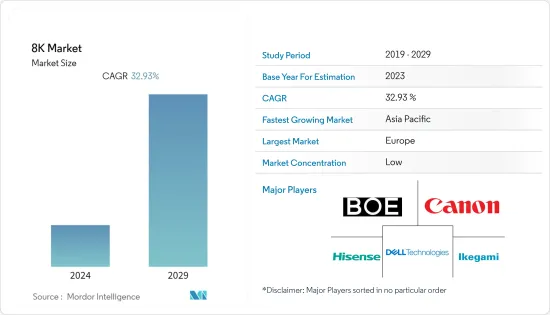

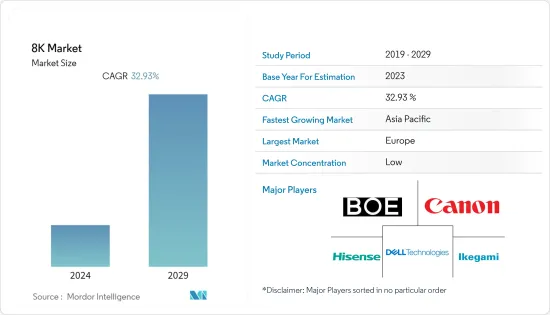

预计 2024 年 8K 市场规模为 104.6 亿美元,预计 2029 年将达到 434.3 亿美元,预测期(2024-2029 年)复合年增长率为 32.93%。

主要亮点

- 8K市场在各个领域都广泛应用,因为它忠实地再现了现实世界的场景,并且可以显着地再现人眼的有效解析度。它也缩小了现实世界和虚拟世界之间的差距。市场对基于 8K 的摄影机的需求不断增长,主要是电影製片人,因为他们可以捕捉更好的影像。此外,日本广播公司 NHK 宣布计划推出8K SHV 频道并大规模分发 8K 媒体。

- 此外,全球智慧电视使用量的不断增加也推动了市场的成长。据 Ofcom 称,英国许多家庭都拥有可以运行应用程式和访问互联网的电视。去年,67% 的英国家庭拥有智慧电视。电视越来越多地采用 8K 技术。因此,各公司正在迅速发布基于 8K 的新型电视。

- 8K显示器适合透过自动升级影片以填充额外像素来提供解析度内容,因此在新兴国家中被用来提供高解析度影像的高品质高解析度,市场研究的需求进一步激增。

- 然而,基于8K技术的产品成本高以及8K内容的取得管道少是阻碍市场扩张的主要挑战。

- 相反,COVID-19 期间串流媒体和主机游戏使用量的激增刺激了对大萤幕高清晰度电视(HDTV)的需求。因此,全球电视製造商纷纷推出优质 OLED 电视型号。例如,2022年2月,MagnaChip宣布并开始量产基于升级的高电压模拟製程技术的UHD TV DDIC产品。

8K技术市场趋势

消费性电子产品占据主要市场占有率

- 本研究涵盖的家用电子电器应用包括 8K 在各种技术中的使用,包括电视、数位相机、8K 显示器、个人电脑和笔记型电脑。由于对高解析度和影像品质的需求不断增加,8K 广泛应用于家用电子电器。

- 8K是一种高解析度为7680 x 4320像素的显示技术。该技术提供了高清晰度和改进角度的图像视觉化。消费性电子不断创新,为客户提供高解析度的产品,创造了对 8K 的需求。例如,三星、LG、TCL、Sharp Corporation等主要厂商之间的8K电视解析度竞争仍在持续。

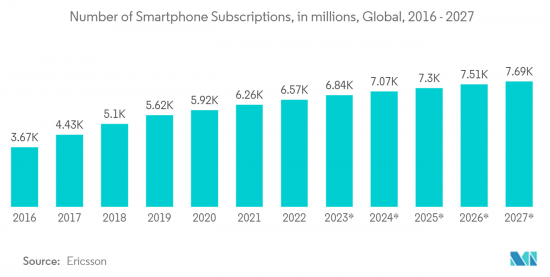

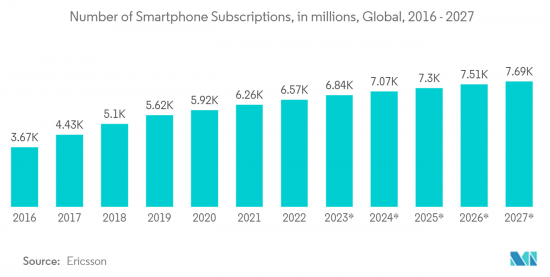

- Z世代和千禧世代对具有更好相机影像品质的智慧型手机的需求不断增长,市场需求进一步增加。根据爱立信预测,到年终,全球智慧型手机用户数量将达到76.9亿。智慧型手机的成长将推动市场对 8K 的需求,因为随着时间的推移,它们需要更高级的要求。

- 此外,近几个月来,许多智慧型手机都推出了拍摄8K影像。使用 8K 技术产生的影像比 4K 等之前的技术更细緻、更清晰。例如,2022年12月,三星宣布推出Galaxy S23系列,该系列将支援高解析度的影片,并可选择以30fps录製影片。该公司的 Galaxy S22 Ultra 可以录製 24fps 的 8K影片。

- Sharp Corporation也宣布将与徕卡合作,为 Aquos R7 设计主相机。新摄影机的入光量比前代摄影机多 1.8 倍,从而实现更好的低照度性能。相机采用7片徕卡Summicron镜头,提供8K影片拍摄、19mm等效焦距及Octa PD自动对焦。

亚太地区正在经历显着成长

- 中国是全球最大的家电生产国和出口国,这是推动该地区市场成长的关键因素之一。此外,2022年9月,工业资讯部透露,将大力推动内容、运算、储存、显示等产业链升级。此外,地方政府透过家电补贴促进销售的努力也大大促进了市场的开拓。

- 在日本,医疗领域对市场需求做出了巨大贡献。日本家电产业是全球最大的家电产业之一,也是推动8K技术需求的主要因素。根据 JEITA(一般电子情报技术产业协会)的数据,2021 年日本电子设备运作额与去年相比成长了 10.6%。

- 此外,近年来,日本公共广播公司NHK开设了全球最新的8K频道。它是一种超高清格式,可提供四倍于 4K 的解析度、3,300 万像素和 22.2 多声道音讯。自 1995 年以来,NHK 一直在东京的 NHK 广播技术研究所扩展 8K。这种扩张预计将为市场创造积极的成长前景。

- 此外,韩国在市场上占据着重要地位,因为它是三星和 LG 电子等知名企业的所在地。此外,该地区的产品创新持续成长。许多广播公司开始利用 8K 技术为客户提供高品质的内容。 5G 预计也将在未来的广播领域中发挥关键作用。

- 2022年5月,电子通讯研究所(ETRI)宣布将参加2022年美国国家广播协会(NAB),展示最新的8K-UHD广播和5G融合媒体广播技术。我们希望透过NAB2022展示韩国8K-UHD广播技术与5G融合媒体服务技术的优势,引领韩国企业走向世界。这些努力预计将显着促进市场成长。

8K技术产业概况

8K市场分散化,竞争激烈,主要企业林立。该市场的主要企业包括 LG Display、三星电子、京东方日本、Canon、戴尔、海信和通讯。强大的品牌是卓越绩效的代名词,因此我们预期老字型大小企业将拥有优势。由于竞争公司有能力渗透市场并提供先进产品,预计它们之间的竞争将持续下去。此外,大规模投资增加了现有参与者的退出壁垒,产业竞争日益激烈。此外,供应商正在提高技术力并加剧市场竞争。

- 2023 年 4 月 - Kinefinity 发布了其最新的广播级旗舰相机。此型号称为 MC8020,配备 45MP 全片幅 CMOS 感光元件,可在 70fps 和 HDR 模式下拍摄高达 8K解析度的照片。 MC8020 是一款「强大」的 8K广播公司级摄影机,加上高品质 8K/4K HDR 影像感测器,4500 万像素,8K解析度高达 70 fps,相容于电影/摄影机/TV-ENG 镜头。提供规格。目前,MC8020可供国内使用(中国)。

- 2023 年 1 月:LG 电子宣布推出 2023 年有机发光二极体电视系列。 Z3系列是2023年最新的8K 有机发光二极体电视系列,率先采用EX面板和散热器技术,预计比之前的Z系列更亮。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 产业价值链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 家电市场对高阶显示器的需求不断增加

- 相机和资料传输技术不断进步

- 市场挑战

- 8K产品的价格和成本更高

第六章市场区隔

- 按设备

- 监视器

- 电视机

- 相机

- 全圆顶

- 其他的

- 按用途

- 医疗保健/医疗

- 消费性电子产品

- 商业的

- 其他用途

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 韩国

- 其他亚太地区

- 拉丁美洲

- 中东/非洲

- 北美洲

第七章竞争形势

- 公司简介

- BOE Japan Co. Ltd

- Canon Inc.

- Dell Technologies Inc.

- Hisense Co. Ltd

- Ikegami Tsushinki Co. Ltd

- LG Electronics Inc.

- Panasonic Corporation

- Red Digital Cinema Camera Company

- Samsung Electronics Co. Ltd

- Sharp Corporation

第八章投资分析

第九章 市场机会及未来趋势

The 8K Market size is estimated at USD 10.46 Billion in 2024, and is expected to reach USD 43.43 Billion by 2029, growing at a CAGR of 32.93% during the forecast period (2024-2029).

Key Highlights

- The 8K market is witnessing growth in adoption across various fields as it allows for true-to-life reproduction of real scenes, signficantly recreating the effective resolution of the human eye. It also curtails the gap between real and virtual worlds. The market is undergoing robust growth, due to the growing need for 8K-based cameras, mainly from filmmakers, owing to their ability to catch better images. Further, NHK, a Japanese broadcasting company, announced plans to launch 8K SHV channels to deliver 8K media on a considerable scale.

- Moreover, the growth in smart TV use throughout the world drives the market growth. According to Ofcom, televisions that can operate apps and access the internet can be seen in many households in the United Kingdom (UK). In the last year, 67% of homes in the United Kingdom owned a Smart TV. Televisions are noticing the increased adoption of the 8K technology. Due to this, companies are rapidly launching new 8K-based televisions.

- The rising need for premium products with high-resolution displays in developing countries in various end use sectors such as rising use of high resolution devices by sports and medical industries in order to provide high quality images with the clearer picture are further rampantly driving the demand for market studied as 8K displays are well-equipped to deliver lower-resolution content by automatically upscaling the video to fill the extra pixels.

- However, the expensive cost of 8k technology-based products & little 8k content accessibility is major challenges predicted to hinder market expansion.

- On the contrary, the surge in streaming and console gaming use during COVID-19 fueled the need for large-screen high-definition TVs. As a result, global television makers are introducing premium OLED TV models. For instance, in February 2022, Magnachip announced a DDIC product for UHD TVs based on upgraded high-voltage analog process technology & started mass production.

8K Technology Market Trends

Consumer Electronics to Hold Major Market Share

- Consumer electronics applications covered under the study contain the usage of 8K in different technologies like televisions, digital cameras, 8K monitors, PCs, and laptops, among others. Owing to the growing need for high resolution & image quality, 8K is broadly utilized across consumer electronics.

- 8K is a display technology with 7680 X 4320 pixels high resolutions. The technology delivers image visualization with high clarity and improved angles. The consumer electronics segment constantly innovates technologies to provide customers with better-resolution products, creating a demand for 8K. For instance, there has been a constant resolutions war among major vendors like Samsung, LG, TCL, & Sharp for 8K TVs.

- The growing need for smartphones among Gen Z and millennials with better camera quality further boosts the market need. According to Ericsson, the number of smartphone subscriptions globally will reach 7.69 billion by the end of 2027; such an increase in the smartphone will require more advanced requirements across time, thus driving the need for 8K in the market.

- Moreover, many smartphones have been introduced in the last few months to capture 8K video. The video from an 8K technology is better detailed and crisper than earlier technology like 4K. For instance, in December 2022, Samsung unveiled the launch of the Galaxy S23 series, which will support higher resolution videos with a choice to shoot videos in 30fps. The company's Galaxy S22 Ultra can record 8K video at 24fps.

- Also, Sharp announced a partnership with Leica to design the main camera of the Aquos R7. The new camera seizes 1.8 times more light than the last model, thus delivering better low-light performance. The camera utilizes a seven-element Leica Summicron lens & offers 8K video recording, a 19 mm equivalent focal length, and Octa PD autofocus.

Asia Pacific to Witness Significant Growth

- China is the biggest producer & exporter of consumer electronics globally, which is one of the significant factors fueling the market growth in the region. In addition, in September 2022, the Ministry of Industry and Information Technology revealed that considerable efforts would be made to drive the upgrading of content, computing, storage, & display industrial chains, among others, in the country. Further, many current local government actions to promote the sale of more home appliances by subsidizing their purchase contribute immensely to the market development.

- In Japan, the medical sector is one of the major contributors to market needs. Japan's consumer electronics industry, one of the biggest in the world, is another influential factor driving the demand for 8K technology. As per the JEITA (Japan Electronics and Information Technology Industries Association), in 2021, the operation value of electronic devices in Japan increased by 10.6% compared to last year.

- Moreover, in current years, the world's latest 8K channel has been founded in Japan by the country's public broadcaster NHK. The ultra-HD format facilitates four times the resolution of 4K, weighing in with 33 million pixels, and 22.2 multi-channel sound. The host had been expanding 8K at its NHK Science & Technical Research Laboratories in Tokyo since 1995. Such expansions are anticipated to construct a positive growth outlook for the market.

- Furthermore, South Korea has a primary position in the market as it is home to some notable players like Samsung & LG Electronics. Moreover, rising product innovation also persists in in the region. Many broadcasting companies have begun utilizing 8K technology to provide customers with high-quality content. 5G is also anticipated to create a significant role in the future of broadcasting.

- In May 2022, the Electronics and telecommunications research institute (ETRI) unveiled that it would participate in the National Association of Broadcasters (NAB) 2022 and present the latest 8K-UHD broadcasting & 5G convergence media broadcasting technologies. The team desired to utilize the NAB 2022 to publicize the strengths of Korea's 8K-UHD broadcasting technology & 5G convergence media service technology and lead the Korean companies' worldwide expansion. Such endeavors are also anticipated to increase market growth significantly.

8K Technology Industry Overview

The 8K market is fragmented and competitive because of the presence of major players. Some key players in the market include LG Display Co. Ltd, Samsung Electronics Co. Ltd, BOE Japan Co. Ltd, Canon Inc., Dell Inc., Hisense Co. Ltd, and Ikegami Tsushinki Co. Ltd., among others. Strong brands are synonymous with good performance, so long-standing players are expected to have the upper hand. Owing to their market penetration and the ability to offer advanced products, the competitive rivalry is expected to continue to be high. Moreover, the involvement of large-scale investment also increases the barriers to exit for existing players, pushing the industry toward improved competition. Additionally, vendors are enhancing their technological capabilities, intensifying market competition.

- April 2023 - Kinefinity introduced its latest camera, which can be described as a broadcast flagship. The model titled MC8020 includes a full-frame CMOS sensor with a 45MP capable of capturing up to 8K resolution in 70fps and HDR mode. In addition to a 'powerful' 8K broadcast-level camera, the MC8020 is compatible with film/camera/TV-ENG lenses, delivering high-quality 8K/4K HDR imagery sensor specs of 45 megapixels, up to 70fps in 8K resolution. Currently, the MC8020 is served for domestic use (China).

- January 2023: LG Electronics Inc. announced a series of OLED TVs for 2023. Its Z3 series, the latest range of 8K OLED TVs for 2023, is anticipated to aid from EX panels and heat sink technologies for the first time, making them brighter than the last Z series models.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Defnition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for High-end Displays in the Consumer Electronics Market

- 5.1.2 Increasing Technological Advancements in Camera and Data Transfer Technology

- 5.2 Market Challenges

- 5.2.1 High Price and Prime Costing of 8K Products

6 MARKET SEGMENTATION

- 6.1 By Device

- 6.1.1 Monitor

- 6.1.2 Television

- 6.1.3 Camera

- 6.1.4 Full Dome

- 6.1.5 Other Devices

- 6.2 By Application

- 6.2.1 Healthcare and Medical

- 6.2.2 Consumer Electronics

- 6.2.3 Commercial

- 6.2.4 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 South Korea

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 BOE Japan Co. Ltd

- 7.1.2 Canon Inc.

- 7.1.3 Dell Technologies Inc.

- 7.1.4 Hisense Co. Ltd

- 7.1.5 Ikegami Tsushinki Co. Ltd

- 7.1.6 LG Electronics Inc.

- 7.1.7 Panasonic Corporation

- 7.1.8 Red Digital Cinema Camera Company

- 7.1.9 Samsung Electronics Co. Ltd

- 7.1.10 Sharp Corporation

![8K 技术市场:趋势、机会与竞争分析 [2023-2028]](/sample/img/cover/42/1341967.png)