|

市场调查报告书

商品编码

1687291

远端资讯处理控制单元:市场占有率分析、产业趋势与统计资料、成长预测(2025-2030 年)Telematics Control Unit - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

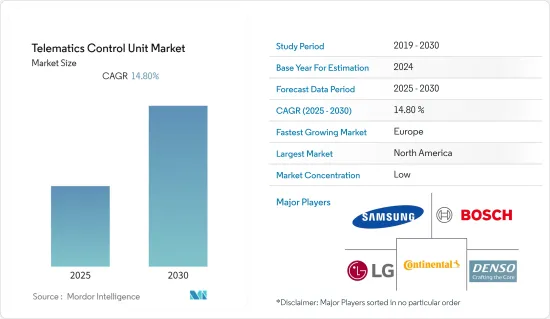

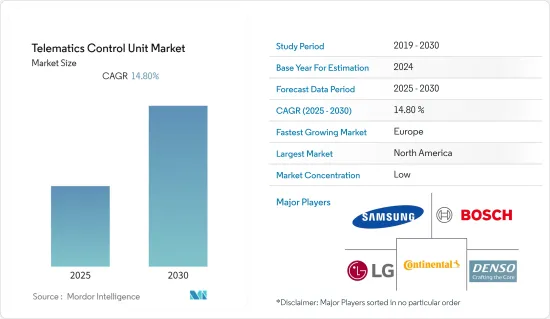

预计预测期内远端资讯处理控制单元市场将以 14.8% 的复合年增长率成长。

远端资讯处理是汽车产业采用的一种通讯系统,依赖透过无线网路与汽车交换的资料。随着无线技术、定位技术和汽车电子的结合,汽车产业正步入资讯时代。

关键亮点

- 资料在车载单元产生并通讯到后勤部门系统,或后勤部门系统将地图、库存更新、天气预报、互联网资料封包等资料推送到车载单元。这种通讯是透过行动电话或车载设备进行的。该汽车使用行动电话塔矩阵和卫星技术进行通讯,以绘製其位置图。该技术整合到远端资讯处理控制单元中并由其控制。

- 远端资讯处理控制单元最近已成为汽车行业的关键部件。远端资讯处理控制单元 (TCU) 的采用率较低。联网汽车的概念仍处于起步阶段,纳入联网汽车的汽车公司非常少。然而,随着 5G 和自动驾驶汽车的出现,联网汽车的覆盖范围可能会扩大。据Appinventiv称,联网汽车预计将成为全球5G物联网端点市场中最大的部分,预计到2023年底将达到1,900万个端点。

- 远端资讯处理控制单元透过引入额外的数据机和处理器来增强车辆的连接性,从而实现从汽车到云端、基础设施或其他车辆的通讯。此外,电流感应、诊断和杂讯抑制方面的改进使得天线功率最佳化成为可能。它还会产生车辆运行每个组件的数位蓝图,使车队管理人员能够评估可以在哪些方面进行改进,以预防事故并执行驾驶员安全法规。此外,远端资讯处理控制单元可以透过分析使用资讯、安排维护检查、保固恢復、引擎小时数追踪和记录服务记录追踪来协助维护。

- 然而,已开发地区的认知度较低、新兴市场和欠发达地区的客户价格敏感性以及与远端资讯处理控制单元相关的网路安全威胁等因素继续对所研究市场的成长构成挑战。此外,全球缺乏远端资讯处理解决方案的通用法规结构也影响了所研究市场的成长。

远端资讯处理控制单元市场趋势

乘用车占市场主导地位

- 乘用车是指载客量为 8 人或以下(包括驾驶人)的小型、中型和大型车辆。安装在乘用车上的远端资讯处理控制单元 (TCU) 可用于多种应用,包括紧急服务通知、失窃车追踪和远端车辆防盗。 TCU收集和传输车辆诊断资料,实现远端监控和分析。这有助于预防性维护、识别潜在问题并提高整体车辆性能。

- TCU 通常用于乘用车队管理系统,以监控和追踪车辆位置、性能和使用情况。这使得他们能够优化路线并监控驾驶员行为和整体车队效率。它还为保险公司提供车辆资料,以支援资讯娱乐连接、导航和地图绘製。

- 电动车的普及正在推动乘用车需求的增加。随着政府和个人对永续性的重视,人们开始转向更清洁的交通方式。例如,根据国际能源总署的预测,2022年全球纯电动车销量预计将达到730万辆,高于2021年的460万辆左右。 2021年的销量将比2020年成长一倍以上,2022年电动车销量将创下新高。此外,许多国家的中阶不断壮大,购买力增强,因此对乘用车的需求也随之增加。

- 根据国际汽车工业组织(OICA)预测,2023年全球乘用车销量约6,530万辆,与前一年同期比较成长约11.3%。 2023年,中国以约2,610万辆的保有量位居第一,成为最大的区域汽车市场。

- 在汽车产业,乘用车的产量也在增加。例如,根据美国经济分析局 (BEA) 的数据,2022 年美国汽车产量约为 180 万辆。与 2021 年相比,这一数字增长了约 13%。预计此类发展将推动市场的成长。

北美占最大市场占有率

- 由于对汽车产业和最新技术的投资不断增加,北美成为研究市场的主要投资和采用国家之一。许多地区都使用远端资讯控制设备来为汽车领域提供安全性、舒适性和便利性。

- 美国联网汽车,因为美国拥有大量的汽车OEM、普通联网汽车者俱有较高的技术意识、对汽车资讯娱乐和远端资讯处理的偏好、4G/5G 的广泛采用以及该国电动、连网和自动驾驶汽车销量的不断增长。

- KBB 的数据显示,2023 年第一季美国电动车销量略低于 258,900 辆。与 2022 年第一季的销售额相比,这一同比增长约为 44.9%。

- 工业巨头加大研发投入、互联网普及率上升、资料成本下降、5G 普及、越来越多的客户更青睐连接功能而非车辆的机械规格、电动和自动驾驶汽车销量达到顶峰,这些因素都在推动汽车和运输行业的需求,这可能会进一步推动该地区的研究市场。

远端资讯处理控制单元产业概况

远端资讯处理控制单元 (TCU) 市场高度分散,主要企业包括 LG 电子公司、三星电子 (Harman International)、罗伯特博世有限公司、大陆集团和电装株式会社。为了加强市场竞争,公司正在采取合作和收购等策略来扩大产品系列。

2023年3月,LG电子宣布一项重大进展,其位于越南的研发中心正式转型为研发子公司。该子公司将在车载资讯娱乐 (IVI) 系统软体的开发和验证中发挥关键作用。 IVI 系统包括视讯、远端资讯处理、音讯和导航 (AVN) 解决方案,是未来行动出行必不可少的技术。此外,该子公司还将提供各种与驾驶相关的资讯和娱乐功能。

2022 年 12 月,Ficosa 加入 SELFY 联盟,展现了对汽车技术进步的承诺。 SELFY 联盟是一个开创性的计划,旨在增强自动驾驶和联网汽车抵御网路攻击和紧急情况的能力。该联盟的总体目标是设计能够产生、监控和收集资料的协作工具,以有效识别潜在威胁。这项措施将加强业界应对网路威胁和其他潜在服务中断的能力。透过该倡议开发的工具将保护自动和互联移动系统的隐私、机密性和完整性,从而推动汽车领域的重要技术进步。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 技术简介

- 宏观趋势如何影响市场状况

第五章市场动态

- 市场驱动因素

- 汽车领域对安全性、舒适性和便利性的需求不断增加

- 扩大5G技术的使用

- 市场限制

- 开发中地区的远距资讯处理普及率正在下降

- 监管制裁延迟

- 连结技术趋势(2G/3G、4G、5G)

第六章市场区隔

- 按应用

- 安全与保障

- 资讯和导航

- 其他的

- 按类型

- 嵌入式OEM

- 售后服务

- 按车辆类型

- 搭乘用车

- 商用车

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 拉丁美洲

- 中东和非洲

第七章竞争格局

- 公司简介

- LG Electronics Inc.

- Samsung Electronics Co. Ltd(Harman International)

- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- Marelli Europe SPA

- Visteon Corporation

- Valeo SA

- Ficosa International SA

第八章投资分析

第九章:市场的未来

The Telematics Control Unit Market is expected to register a CAGR of 14.8% during the forecast period.

Telematics is a communication system employed in the automotive industry that depends on data traveling to and from automobiles over wireless networks. The automobile industry is being propelled into the information age by combining wireless technology, location technology, and in-vehicle electronics.

Key Highlights

- Data is either generated in the vehicle unit and communicated to the back-office systems, or the back-office systems push data to the vehicle unit like maps, stock updates, weather reports, internet data packets, etc. This exchange occurs by cellphone or the unit installed in the vehicle. The car communicates and maps its whereabouts utilizing a matrix of cellphone towers and satellite technologies. This technology is incorporated into and controlled by a telematics control unit.

- The telematics control unit has recently become a crucial component in the automobile industry. The adoption of telematics control units (TCU) has been low. The concept of connected cars is still in its early stages, with very few automobile companies including them. However, the emerging prospects of 5G and autonomous vehicles will likely expand the scope of connected cars. According to Appinventiv, connected cars are anticipated to become the largest segment of the global 5G Internet of Things endpoint market, having a projected 19 million endpoints by the end of 2023.

- The telematics control unit facilitates increasing the vehicle's connectivity by introducing additional modems and processors to enable communication from the car to the cloud, infrastructure, or other vehicles. It enables antenna power optimization through improved current sensing, diagnostics, and noise reduction. It generates a digital blueprint of every component of a vehicle's operation, enabling fleet management to evaluate where enhancements in accident prevention and driver safety regulations can be applied. In addition, the telematics control unit can help with maintenance by analyzing hours-of-use information, planning maintenance inspections, and taking note of guaranteed recovery, engine hour tracking, and service records tracking.

- However, factors such as a lower awareness in developed regions, price sensitivity of customers in developing and less developed regions, and the cyber security threat associated with telematics control units continue to challenge the growth of the studied market. Furthermore, the lack of a common global regulatory framework for telematics solutions challenges the growth of the market studied.

Telematics Control Unit Market Trends

Passenger Vehicles to Dominate the Market

- Passenger cars are used for compact, mid-size, and full-size vehicles that convey not more than eight passengers (including the driver). The telematics control units (TCUs) in passenger vehicles can be used for several purposes: emergency services notification, stolen vehicle tracking, and remote vehicle immobilization. TCUs can collect and transmit vehicle diagnostics data, allowing for remote monitoring and analysis. This can help with proactive maintenance, identifying potential issues, and improving overall vehicle performance.

- TCUs are commonly used in passenger vehicles for fleet management systems to monitor and track vehicle location, performance, and usage of vehicles. This helps optimize routing and monitor driver behavior and overall fleet efficiency. They also provide vehicle data to insurance companies for enhanced infotainment connectivity, navigation, and mapping.

- The increasing adoption of electric vehicles contributes to the growing demand for passenger vehicles. As governments and individuals prioritize sustainability, there is a shift towards cleaner transportation options. For instance, according to IEA, global battery-electric vehicle sales reached an estimated 7.3 million in 2022, up from around 4.6 million in 2021. In 2021, these sales more than doubled compared to 2020, and 2022 marks a new record in all-electric sales volume. Moreover, the growth of the middle class in many countries has resulted in increased purchasing power and a higher demand for passenger vehicles.

- According to OICA (International Organization of Motor Vehicle Manufacturers), Around 65.3 million passenger cars were sold worldwide in 2023, showing an increase of approximately 11.3 percent compared to the previous year. China held the top spot as the largest regional automotive market in 2023, with approximately 26.1 million units.

- The automotive industry is also witnessing an increase in the production of passenger vehicles. For instance, according to the Bureau of Economic Analysis (BEA), in 2022, approximately 1.8 million automobiles were produced in the United States. It represents an increase of about 13 percent compared with 2021. Such developments are likely to boost the growth of the studied market.

North America Holds Largest Market Share

- North America is one of the significant investors and adopters in the studied market owing to growing investment in automotive sectors and the latest technologies. Telematics control unit devices are used in various regional verticals to provide Safety, Comfort, and Convenience in the Automotive Sector.

- The United States is anticipated to be the significant market for connected cars in the region due to the significant presence of automotive OEMs, high levels of technology awareness amongst the general car buyers, preference for infotainment and telematics in vehicles, widespread adoption of 4G/5G and increasing sales of electric, connected and autonomous cars in the country.

- According to KBB, in the first quarter of 2023, just under 258,900 battery-electric vehicles were sold in the United States. This year-over-year increase was around 44.9% compared to the sales recorded in the F1Q of 2022.

- The increasing investments in R&D by major industry players, rising Internet penetration, falling data costs, availability of 5G, growing preference of customers for connectivity features over mechanical specifications of cars, and a peak in sales of electric and autonomous automobiles are creating demand in the automotive and transportation industry may further propel the studied market in the region.

Telematics Control Unit Industry Overview

The telematics control unit (TCU) market is characterized by significant fragmentation, with major industry players including LG Electronics Inc., Samsung Electronics Co. Ltd (Harman International), Robert Bosch GmbH, Continental AG, and Denso Corporation. To strengthen their competitive position, companies in this market are employing strategies such as partnerships and acquisitions to augment their product portfolios.

In March 2023, LG Electronics Inc. announced a significant development, as its research and development center in Vietnam officially transformed into an R&D subsidiary. This subsidiary is poised to play a pivotal role in the development and evaluation of software for vehicle infotainment (IVI) systems. IVI systems encompass vital technologies for the future of mobility, encompassing video, telematics, audio, and Navigation (AVN) solutions. Additionally, this subsidiary will facilitate the provision of diverse driving-related information and entertainment functionalities.

In December 2022, Ficosa demonstrated its commitment to advancing automotive technology by participating in the SELFY consortium, a pioneering project aimed at enhancing the resilience of autonomous and connected vehicles against cyber-attacks and emergency situations. The consortium's overarching objective is to devise collaborative tools capable of generating, monitoring, and collecting data to identify potential threats effectively. This effort will strengthen the industry's ability to respond to cyber threats and other potential service disruptions. The tools developed through this initiative are poised to usher in a significant technological advancement in the automobile sector, safeguarding the privacy, confidentiality, and integrity of Autonomous and Interconnected Mobility Systems.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.4 Impact of Macro Trends on the Market Landscape

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in Demand for Safety, Comfort, and Convenience in the Automotive Sector

- 5.1.2 Increased Deployment of 5G Technology

- 5.2 Market Restraints

- 5.2.1 Slower Rate of Penetration of Telematics in Developing Regions

- 5.2.2 Delayed Regulatory Sanctions

- 5.3 Connectivity Technology Trends (2G/3G Vs. 4G Vs. 5G)

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Safety and Security

- 6.1.2 Information and Navigation

- 6.1.3 Other Applications

- 6.2 By Type

- 6.2.1 Embedded OEMs

- 6.2.2 Aftersales

- 6.3 By Type of Vehicle

- 6.3.1 Passenger

- 6.3.2 Commercial

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 LG Electronics Inc.

- 7.1.2 Samsung Electronics Co. Ltd (Harman International)

- 7.1.3 Robert Bosch GmbH

- 7.1.4 Continental AG

- 7.1.5 Denso Corporation

- 7.1.6 Marelli Europe S.P.A.

- 7.1.7 Visteon Corporation

- 7.1.8 Valeo SA

- 7.1.9 Ficosa International SA