|

市场调查报告书

商品编码

1687705

物流自动化:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Logistics Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

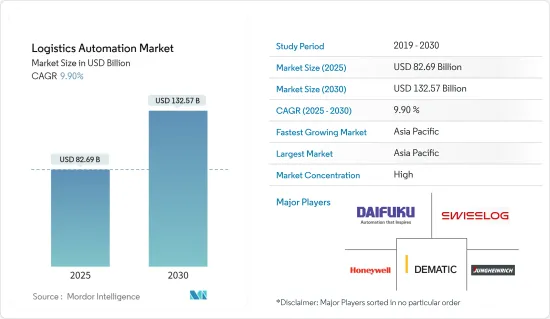

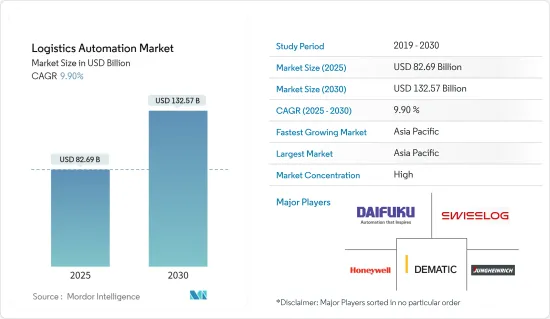

2025 年物流自动化市场规模预计为 826.9 亿美元,预计到 2030 年将达到 1,325.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 9.9%。

主要亮点

- 製造过程日益复杂推动自动化:製造过程日益复杂正在加速物流自动化系统的采用。仓库规模急剧扩大,平均仓库面积从 2000 年的 65,000 平方英尺增加了两倍,达到 20 万多平方英尺。这种扩张对仓库自动化技术产生了巨大的需求。为了解决这些问题,该公司正在转向先进的解决方案,例如物料输送系统和自主移动机器人(AMR)。举个例子,综合供应网络 (Integrated Supply Network) 安装了 49 台 Korber 和 Locus Robotics 的 AMR,结果生产力提高了 266%,拣选效率从每小时 30 次提高到了 110 次。

- 提高工人的安全和效率:自动化技术的实施显着提高了物流环境中工人的安全和工作效率。根据美国劳工统计局统计,仓储业每年发生超过15,000起工作事故,凸显该产业的安全风险。物流自动化系统,包括光导对接解决方案和自动储存和搜寻系统 (ASRS),可以帮助减轻这些危险。此外,自动化系统可消除人为错误,全天候运作,确保高生产力,无需休息或换班。

- 重塑物流的技术进步:物联网、人工智慧(AI)和机器学习等最尖端科技与物流自动化的整合正在彻底改变整个产业。这些进步有助于即时资料处理、智慧仓库管理和增强决策。例如,亚马逊部署了超过 20 万台移动机器人,优化了从供应链自动化到车队管理的一切,凸显了机器人在物流的变革力量。人工智慧仓库管理系统的使用正在增长,从而提高了服务水平,减少了营运瓶颈,并提高了整体效率。

- 竞争格局与投资趋势:物流自动化市场相对分散,凯傲集团、DAIFUKU CO. LTD.、Honeywell等产业领导者透过持续创新和策略投资推动市场成长。这些公司正专注于物流的先进机器人和自动导引运输车(AGV)来加强其产品组合。一个值得注意的发展是 Digit,这是 Agility Robotics 于 2023 年 3 月宣布的多功能物流机器人,旨在彻底改变散装物料输送。此外,市场对人工智慧物流自动化趋势的投资正在增加,总部位于英国的 BotsAndUs 在 2022 年筹集了 1,230 万欧元(1,375 万美元)用于提高仓库自动化程度。

- 未来展望和机会:物流自动化产业的前景表明,随着结合感测器、人工智慧和资料分析的自主系统的广泛应用,未来将实现显着的成长。机器人即服务 (RaaS) 正在成为改变游戏规则的因素,透过降低领先成本和提供扩充性,推动自动化物流系统的广泛采用。自动导引车 (AGV) 和自主移动机器人 (AMR) 预计将主导物流自动化领域,其在消费和产业部门的应用日益广泛。成功整合先进自动化技术并适应不断变化的市场需求的公司很可能在这个不断扩大的市场中占据领导地位。

物流自动化市场趋势

仓库自动化占据市场主导地位

仓库自动化主导仓库自动化市场版图

- 领先的市场份额:仓库自动化技术将占据物流自动化市场的大部分份额,到 2022 年将占据 41.58% 的主导市场占有率。 2022 年该领域价值 263.1 亿美元,预计到 2028 年将达到 459.2 亿美元,复合年增长率为 10.01%。电子商务的快速扩张以及对更智慧、更自动化的履约中心的需求推动了需求。

- 技术进步提高效率:物料输送系统和人工智慧主导的分析等创新正在显着增强仓库自动化流程。先进的机器人、感测器和物联网在物流中的使用可以实现即时库存跟踪,减少人工干预并简化整个供应链的运作。人工智慧物流自动化软体的整合是提高整个仓库效率的关键因素。

- 电子商务热潮推动市场成长:电子商务的激增是自动化仓库需求不断增长的主要驱动力。预计 2022 年第四季美国零售电子商务销售额将达到 2,619.7 亿美元,凸显了物流自动化对支援更高订单量的需求。为了有效应对这种成长,电子商务巨头优先投资智慧仓储解决方案。

- 仓库数量的增加推动需求:全球仓储设施数量的增加促进了物流自动化市场的成长。由于越来越依赖自动化物流系统来管理复杂的供应链,光是在美国,仓库业者的数量就从 2016 年的 16,992 人增加到 2021 年的 20,002 人。

- 一种新的经营模式——机器人即服务(RaaS),因其提供经济实惠且可扩展的自动化解决方案而受到市场欢迎。透过提供使用最尖端科技的机会而无需承担完全所有权的财务负担,RaaS 降低了零售、电子商务和第三方物流等行业公司的进入门槛。

交通自动化:快速成长的领域

- 高成长潜力:虽然仓库自动化占据最大份额,但运输自动化是物流自动化产业中成长最快的部分。由于自动交付系统、智慧运输管理系统 (TMS) 和人工智慧主导的物流解决方案的进步,该部门预计将实现 10.77% 的复合年增长率。自动驾驶汽车的日益普及正在重塑物流业务的运输方面。

亚太地区:物流自动化的成长引擎

- 引领市场:亚太地区占据全球物流自动化市场的主导地位,2022 年的份额为 47.16%。预计到 2028 年,该地区将保持主导,成长至 228.4 亿美元,复合年增长率高达 10.99%。中国、日本和澳洲等主要市场的电子商务和製造业的扩张推动了对物流自动化系统的需求。

- 电子商务和製造业推动区域成长:亚太国家快速的工业化和电子商务的采用对该地区物流自动化趋势的成长做出了重大贡献。例如,澳洲的电子商务产业在全球排名第 11 位,预计到 2024 年将创造 323 亿美元的收益。

- 策略投资与扩张:物流自动化市场的主要企业正在亚太地区进行大力投资。 2022年12月,Omron Corporation将在新加坡开设一个物流自动化中心,旨在满足东南亚和大洋洲对自动化解决方案日益增长的需求。

- 政府措施推动机器人技术的应用 在整个亚洲,政府支持的倡议正在加速智慧机器人在物流的应用。韩国将于 2022 年拨款 1.722 亿美元用于机器人创新,显示该地区对推进物流自动化技术的重视。

物流自动化行业概况

全球参与者主导高度整合的市场物流自动化市场由罗伯特德马泰克集团、霍尼韦尔国际公司和大福等全球领导企业主导,它们总合占据超过 26% 的市场占有率。这些公司与 SSI Schaefer AG 一起,继续推动物流自动化系统的创新,并透过尖端解决方案和策略伙伴关係关係保持其市场地位。

创新和策略伙伴关係推动市场领导地位:物流自动化领域的主要企业透过持续的研发投入和物流机器人创新保持了优势。例如,KNAPP 的 Open Shuttle Fork 和 Kardex Group 的 AutoStore 系统正在为物流自动化树立新的标准。此外,FANUC America 与博世力士乐之间的伙伴关係也扩大了其能力和市场范围,凸显了合作策略的重要性。

物流自动化市场的未来成功因素:为了在这个竞争激烈的市场中取得成功,公司需要专注于技术进步,例如人工智慧机器人、物联网整合和扩充性自动化系统的开发。此外,正如沃尔玛收购 Alert Innovation 所表明的那样,併购是扩大产品系列的关键。为了确保在快速发展的环境中保持领先地位,公司需要提供根据其特定行业需求量身定制的物流自动化解决方案。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

- 分析新冠疫情及其他宏观经济因素对市场的影响

第五章 市场动态

- 市场驱动因素

- 重塑物流的技术进步

- 製造复杂性和技术可用性不断提高

- 提高效率和工作场所安全性

- 市场挑战

- 高资本投入

第六章 市场细分

- 仓库自动化市场

- 按组件

- 硬体

- 移动机器人(AGV、AMR)

- 自动储存和搜寻系统 (AS/RS)

- 自动分类系统

- 卸垛/码垛系统

- 输送机系统

- 自动识别和资料收集(AIDC)

- 拣货

- 软体

- 服务

- 按最终用户产业

- 饮食

- 邮政和小包裹

- 食物

- 通用产品

- 服饰

- 製造业

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

- 按组件

- 全球运输自动化市场模式

- 其他全球交通自动化市场场景

第七章 竞争格局

- 公司简介

- Dematic Corp.(Kion Group AG)

- Daifuku Co. Limited

- Swisslog Holding AG(KUKA AG)

- Honeywell International Inc.

- Jungheinrich AG

- Murata Machinery Ltd

- Knapp AG

- TGW Logistics Group GmbH

- Kardex Group

- Mecalux SA

- Beumer Group GmbH & Co. KG

- SSI Schaefer AG

- Vanderlande Industries BV

- WITRON Logistik

- Oracle Corporation

- One Network Enterprises Inc.

- SAP SE

- 供应商市场占有率分析

第八章投资分析

第九章市场机会与未来成长

The Logistics Automation Market size is estimated at USD 82.69 billion in 2025, and is expected to reach USD 132.57 billion by 2030, at a CAGR of 9.9% during the forecast period (2025-2030).

Key Highlights

- Manufacturing Complexity Fueling Automation Adoption: The growing complexity in manufacturing processes is accelerating the adoption of logistics automation systems. Warehouse sizes have expanded dramatically, with average warehouse space tripling from 65,000 sq. ft. in 2000 to over 200,000 sq. ft. This scale-up has led to a significant demand for warehouse automation technology, as it becomes increasingly challenging to manage higher volumes and an ever-growing variety of SKUs. To address these issues, companies are turning to advanced solutions like automated material handling systems and autonomous mobile robots (AMRs). A prime example is the 266% productivity increase achieved by Integrated Supply Network after deploying 49 AMRs from Korber and Locus Robotics, with picking efficiency skyrocketing from 30 to 110 picks per hour.

- Workforce Safety and Efficiency Improvements: The introduction of automation technologies is substantially enhancing workforce safety and operational efficiency in logistics environments. According to the U.S. Bureau of Labor Statistics, over 15,000 work-related incidents are reported annually in storage and warehousing, highlighting the industry's safety risks. Logistics automation systems, including light-guided docking solutions and automated storage and retrieval systems (ASRS), help mitigate these hazards. Additionally, automated systems eliminate human error and operate 24/7, ensuring higher productivity without the need for breaks or shift changes.

- Technological Advancements Reshaping Logistics: The integration of cutting-edge technologies such as IoT, artificial intelligence (AI), and machine learning into logistics automation is revolutionizing the industry. These advancements facilitate real-time data processing, smart warehousing, and enhanced decision-making. For instance, Amazon's deployment of over 200,000 mobile robots underscores the transformative power of robotics in logistics, optimizing everything from supply chain automation to fleet management. The growing use of warehouse execution systems, powered by AI, is improving service levels, reducing operational bottlenecks, and elevating overall efficiency.

- Competitive Landscape and Investment Trends: The logistics automation market is relatively fragmented, with industry leaders like Kion Group, Daifuku, and Honeywell driving market growth through consistent innovation and strategic investments. These companies focus on enhancing their portfolios with advanced robotics in logistics and automated guided vehicles (AGVs). A notable development is the March 2023 launch of Digit, a versatile logistics robot by Agility Robotics, which is set to revolutionize bulk material handling. Furthermore, the market is witnessing robust investments in AI-powered logistics automation trends, as seen with UK-based BotsAndUs raising EUR 12.3 million (USD 13.75 million) in 2022 to enhance warehouse automation.

- Future Outlook and Opportunities: The logistics automation industry outlook suggests significant future growth driven by the proliferation of autonomous systems embedded with sensors, AI, and data analytics. Robotics-as-a-Service (RaaS) is emerging as a game-changer, enabling broader adoption of automated logistics systems by reducing upfront costs and offering scalability. Automated guided vehicles (AGVs) and autonomous mobile robots (AMRs) are expected to dominate the logistics automation landscape, with increasing use in both consumer and industrial sectors. Companies that successfully integrate advanced automation technologies and adapt to evolving market demands will secure leadership in this expanding market.

Logistics Automation Market Trends

Warehouse Automation Dominating the Market Landscape

Warehouse Automation: Dominating the Market Landscape

- Leading market share: Warehouse automation technology accounts for a significant portion of the logistics automation market, holding a dominant 41.58% market share in 2022. This segment, valued at USD 26.31 billion in 2022, is forecast to grow at a CAGR of 10.01%, reaching USD 45.92 billion by 2028. The demand is being driven by rapid e-commerce expansion and the need for smart fulfillment centers that incorporate automation.

- Technological advancements driving efficiency: Innovations such as automated material handling systems and AI-driven analytics are significantly enhancing warehouse automation processes. The use of advanced robotics, sensors, and IoT in logistics is enabling real-time inventory tracking, reducing human intervention, and streamlining operations across the supply chain. The integration of AI-powered logistics automation software is a crucial factor in improving overall warehouse efficiency.

- E-commerce boom propelling market growth: The e-commerce surge is a primary driver behind the growing demand for automated warehousing. U.S. retail e-commerce sales reached USD 261.97 billion in Q4 2022, emphasizing the need for logistics automation to support higher order volumes. E-commerce giants are prioritizing investments in smart warehousing solutions to handle this growth effectively.

- Rising number of warehouses boosting demand: The increasing number of warehousing facilities worldwide is contributing to the growth of the logistics automation market. The U.S. alone saw warehousing enterprises grow from 16,992 in 2016 to 20,002 in 2021, reflecting a greater reliance on automated logistics systems to manage complex supply chains.

- Emerging business models: Robotics-as-a-Service (RaaS) is gaining traction in the market, offering affordable and scalable automation solutions. By providing access to cutting-edge technology without the financial burden of full ownership, RaaS lowers barriers to entry for companies in sectors such as retail, e-commerce, and third-party logistics.

Transportation Automation: The Fast-Growing Segment

- High-growth potential: While warehouse automation commands the largest share, transportation automation is the fastest-growing segment in the logistics automation industry. This sector is projected to achieve a CAGR of 10.77%, driven by advancements in autonomous delivery systems, smart transportation management systems (TMS), and AI-driven logistics solutions. The increasing deployment of autonomous vehicles is reshaping the transportation aspect of logistics operations.

Asia-Pacific: The Growth Engine of Logistics Automation

- Leading the market: The Asia-Pacific region dominates the global logistics automation market with a 47.16% share in 2022. This region is forecast to maintain its leadership, growing to USD 22.84 billion by 2028, driven by a robust CAGR of 10.99%. The demand for logistics automation systems is fueled by the expansion of e-commerce and manufacturing in key markets such as China, Japan, and Australia.

- E-commerce and manufacturing driving regional growth: Rapid industrialization and e-commerce adoption across Asia-Pacific countries are significant contributors to the growth of logistics automation trends in the region. For example, Australia's thriving e-commerce sector, ranked eleventh globally, is forecast to generate USD 32.3 billion in revenue by 2024.

- Strategic investments and expansions: Key players in the logistics automation market are investing heavily in the Asia-Pacific region. In December 2022, Omron Corporation opened a logistics automation center in Singapore, aiming to cater to Southeast Asia and Oceania's growing demand for automation solutions.

- Government initiatives boosting robotics adoption: Government-backed initiatives across Asia are promoting the adoption of intelligent robotics in logistics. South Korea's USD 172.2 million allocation to robotics innovation for 2022 exemplifies the region's focus on advancing logistics automation technology.

Logistics Automation Industry Overview

Global players dominate a fairly consolidated market: The logistics automation market is dominated by global leaders like Robert Dematics Group, Honeywell International Inc., and Daifuku Co. Ltd., which collectively account for over 26% of the market share. These companies, along with SSI Schaefer AG, continue to drive innovation in logistics automation systems and maintain a strong market presence through cutting-edge solutions and strategic partnerships.

Innovation and strategic partnerships drive market leadership: Leading companies in the logistics automation sector maintain their edge through consistent R&D investments and innovation in robotics in logistics. For example, KNAPP's Open Shuttle Fork and Kardex Group's AutoStore system are setting new standards in logistics automation. Additionally, partnerships like that between FANUC America and Bosch Rexroth have expanded their capabilities and market reach, highlighting the importance of collaborative strategies.

Factors for future success in the Logistics Automation Market: To thrive in this highly competitive market, companies need to focus on technological advancements such as AI-powered robotics, IoT integration, and developing scalable automation systems. Mergers and acquisitions are also key to expanding product portfolios, as demonstrated by Walmart's acquisition of Alert Innovation. Companies must provide tailored logistics automation solutions to meet specific industry needs, ensuring they stay ahead in this rapidly evolving landscape.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products and Services

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Analysis of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Technological Advancements Reshaping Logistics

- 5.1.2 Increasing Manufacturing Complexity and Technology Availability

- 5.1.3 Improved Efficiency and Workforce Safety

- 5.2 Market Challenges

- 5.2.1 High Capital Investment

6 MARKET SEGMENTATION

- 6.1 Warehouse Automation Market

- 6.1.1 By Component

- 6.1.1.1 Hardware

- 6.1.1.1.1 Mobile Robots (AGV, AMR)

- 6.1.1.1.2 Automated Storage and Retrieval Systems (AS/RS)

- 6.1.1.1.3 Automated Sorting Systems

- 6.1.1.1.4 De-palletizing/Palletizing Systems

- 6.1.1.1.5 Conveyor Systems

- 6.1.1.1.6 Automatic Identification and Data Collection (AIDC)

- 6.1.1.1.7 Order Picking

- 6.1.1.2 Software

- 6.1.1.3 Services

- 6.1.2 By End-user Industry

- 6.1.2.1 Food and Beverage

- 6.1.2.2 Post and Parcel

- 6.1.2.3 Groceries

- 6.1.2.4 General Merchandise

- 6.1.2.5 Apparel

- 6.1.2.6 Manufacturing

- 6.1.2.7 Other End-user Industries

- 6.1.3 By Geography***

- 6.1.3.1 North America

- 6.1.3.2 Europe

- 6.1.3.3 Asia

- 6.1.3.4 Australia and New Zealand

- 6.1.3.5 Latin America

- 6.1.3.6 Middle East and Africa

- 6.1.1 By Component

- 6.2 Global Transportation Automation Market Scenario

- 6.3 Other Global Transportation Automation Market Scenarios

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Dematic Corp. (Kion Group AG)

- 7.1.2 Daifuku Co. Limited

- 7.1.3 Swisslog Holding AG (KUKA AG)

- 7.1.4 Honeywell International Inc.

- 7.1.5 Jungheinrich AG

- 7.1.6 Murata Machinery Ltd

- 7.1.7 Knapp AG

- 7.1.8 TGW Logistics Group GmbH

- 7.1.9 Kardex Group

- 7.1.10 Mecalux SA

- 7.1.11 Beumer Group GmbH & Co. KG

- 7.1.12 SSI Schaefer AG

- 7.1.13 Vanderlande Industries BV

- 7.1.14 WITRON Logistik

- 7.1.15 Oracle Corporation

- 7.1.16 One Network Enterprises Inc.

- 7.1.17 SAP SE

- 7.2 Vendor Market Share Analysis