|

市场调查报告书

商品编码

1404527

用于电子和半导体应用的湿化学品 -市场占有率分析、行业趋势和统计、2024-2029 年成长预测Wet Chemicals For Electronics And Semiconductor Applications - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

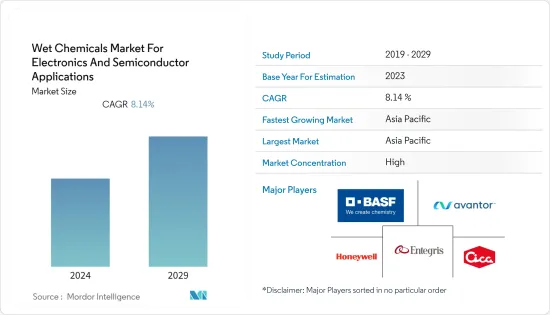

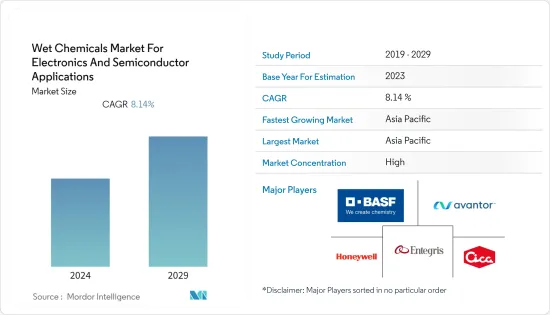

目前,全球电子和半导体应用湿化学品市场预计为 17.3 亿美元,预计未来五年将达到 25.5 亿美元,预测期内复合年增长率为 8.14%。

2020 年,电子和半导体应用的湿化学品市场受到 COVID-19 大流行的抑制。然而,电子产业的不断增长预计将在不久的将来对电子和半导体应用湿化学品市场的需求产生积极影响。

主要亮点

- 从中期来看,市场成长预计将受到半导体产业过氧化氢需求激增以及新兴技术驱动的产业需求增加的推动。

- 然而,另一方面,有关半导体废弃物管理和某些化学品使用的严格卫生和环境法规预计将阻碍市场成长。

- 也就是说,马来西亚的半导体回收和半导体市场的良好成长可能会为所研究的市场创造利润丰厚的成长机会。

- 亚太地区主导全球市场。预计在预测期内仍将维持最高复合年增长率。

电子湿化学品市场趋势

半导体应用需求增加

- 湿化学品广泛用于半导体製造。用于清洗和蚀刻应用。由于人工智慧(AI)、量子计算、5G网路等各种进步的快速增长,半导体产量正在以惊人的速度增长,预计这将在预测期内推动湿化学品市场。 。

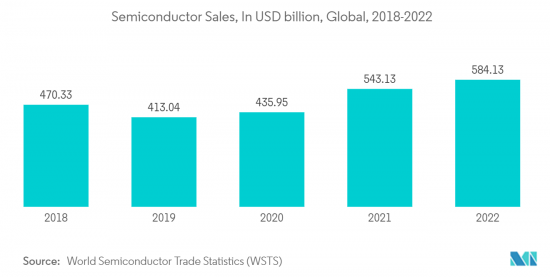

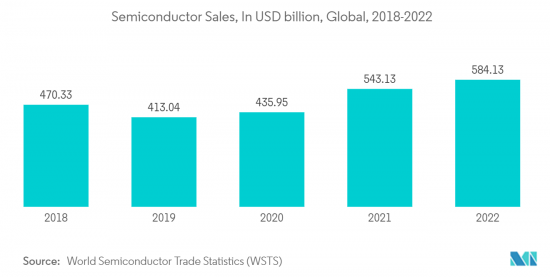

- 根据世界半导体贸易统计,2022年全球半导体市场规模达5,800亿美元,较2021年的5,558.9亿美元成长4.4%。

- 根据半导体产业协会(SIA)的数据,儘管下半年因经济放缓和通膨而放缓,但2022年全球半导体销售额仍成长3.2%。

- 该协会的一项研究显示,到2030年,全球对半导体製造能力的需求预计将增加56%。

- 此外,根据美国创新与竞争法案(USICA),美国政府正在对美国的晶片生产和研究进行大量投资。

- 在北美,美国于2022年8月推出《晶片与科学法案》,支持半导体产业的国内生产与创新。政府宣布将投资520亿美元用于晶片製造激励和研究投资。这包括半导体製造和半导体设备製造的投资税额扣抵。

- 在亚太地区,印度启动了一项综合计划,以发展其国内半导体和显示器製造生态系统。政府宣布支出 7,600 亿印度卢比(约 100 亿美元)。

- 半导体需求的扩张预计将在预测期内推动湿化学品需求。

亚太地区预计将主导市场

- 亚太地区主导全球市场。中国、印度和日本等国家对电子产品的需求增加导致该地区的湿化学品使用增加。

- 中国是全球最大的电子製造基地。智慧型手机、电视和其他个人设备等电子产品在电子产业中成长最快。中国是全球最大的电子设备製造国。中国正积极生产智慧型手机、电视、电线、电缆、可携式运算设备、游戏系统和其他个人设备等电子产品。

- 2022年,中国电子市场较2021年成长10%,成长13%。 2023年预计成长率为7%。中国市场是世界上最大的市场,甚至比工业国家市场的总合还要大。 2022年,中国电子产业将成长14%,预计2023年将成长8%。

- 此外,中国是半导体晶片的净进口国,其生产量不足所用半导体的20%。 2022年国内外市场需求利好,国内101家半导体上市公司公布年度销售净利润,预示产业湿法化学品向好的方向发展。

- 得益于100%外国直接投资(FDI)、无需工业许可证、技术从手工生产流程向自动化生产流程转变等优惠政策,印度国内电子製造业正稳步扩张。印度针对国内电子製造业推出了M-SIPS(修改后的激励特别计画)和EDF(电子发展基金)等新激励措施,预算为1.14亿美元。

- 印度政府推出的其他促进电子产品生产的计划包括生产挂钩激励计划(PLI)、电子元件和半导体製造促进计划(SPECS)以及改进的电子製造群计划(EMC 2.0)。随着印度产量的增加,政府可能会提供奖励,根据 PLI 计划,预计到 2025 年印度产量将达到 55 亿美元。这可能会在预测期内促进该国电子设备的生产并推动湿化学品市场。

- 印度电子与半导体协会预计,到 2026 年,该国半导体市场价值预计将达到 640 亿美元。政府的「印度製造」计画预计将刺激对该国半导体产业的投资。

- 日本的电气和电子工业是世界领先的工业之一。日本在电脑、游戏机、行动电话和其他关键零件的生产方面处于世界领先地位。家电占日本经济产出的三分之一。然而,由于来自中国、印度和韩国等国家的激烈竞争,日本的电子设备产量正在下降。

- 日本电子情报技术产业协会(JEITA)公布的资料显示,2022年日本电子产业总产值约1,11,243亿日圆,较上年成长近8%。根据国际贸易局的数据,日本半导体市场规模预计到 2023 年将达到 515.54 亿美元,而 2021 年为 436.87 亿美元。

- 所有上述因素预计将在预测期内推动亚太地区湿化学品的整体需求。

电子湿化学产业概况

电子和半导体应用湿化学品市场高度集中,五家主要企业占了60%以上的市场占有率。市场上排名前五名的公司是Entegris、 BASF SE、Avantor Inc.、Honeywell International Inc.和Kanto Chemical。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 最新技术驱动的产业需求不断成长

- 半导体产业过氧化氢需求快速成长

- 其他司机

- 抑制因素

- 半导体废弃物管理

- 关于某些化学品使用的严格卫生和环境法规

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模、销售)

- 产品类别

- 醋酸

- 异丙醇 (IPA)

- 过氧化氢

- 盐酸

- 氢氧化铵

- 氢氟酸

- 硝酸

- 磷酸

- 硫酸

- 其他产品类型

- 目的

- 半导体

- 清洗

- 蚀刻

- 其他电子应用

- 积体电路 (IC) 製造

- 印刷基板(PCB) 製造

- 半导体

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 其他欧洲国家

- 世界其他地区

- 亚太地区

第六章竞争形势

- 併购、合资、联盟、协议

- 市场排名分析

- 主要企业策略

- 公司简介

- Avantor Inc.

- BASF SE

- Eastman Chemical Company

- Entegris

- FUJIFILM Corporation

- Honeywell International Inc.

- Kanto Kagaku

- Linde PLC

- Solvay

- Songwon

- Technic Inc.

- TNC Industrial Co. Ltd

第七章 市场机会及未来趋势

- 半导体回收

- 马来西亚半导体市场稳定成长

The global wet chemicals market for electronics and semiconductor applications is estimated at USD 1.73 billion currently, and it is projected to reach USD 2.55 billion in the next five years, registering a CAGR of 8.14% during the forecast period.

The wet chemicals market for electronics and semiconductor applications was hampered by the COVID-19 pandemic in 2020. However, the rising growth of the electronics industry is expected to positively impact the demand for the wet chemicals market for electronics and semiconductor applications in the near future.

Key Highlights

- Over the medium term, rising demand from industries driven by modern technologies, along with surging demand for hydrogen peroxide from the semiconductor industry, is expected to drive the market's growth.

- However, on the other hand, waste management of semiconductors and stringent health and environmental regulations regarding the use of certain chemicals are anticipated to hinder the market's growth.

- Nevertheless, the recycling of semiconductors and the favorable growth market for semiconductors in Malaysia are likely to create lucrative growth opportunities for the market studied.

- Asia-Pacific dominated the global market. It is also expected to register the highest CAGR over the forecast period.

Electronic Wet Chemicals Market Trends

Increasing Demand Semiconductor Applications

- Wet chemicals are widely used in the production of semiconductors. They are used in both cleaning and etching applications. The production of semiconductors is growing at a staggering pace due to rapid growth from various advancements such as artificial intelligence (AI), quantum computing, and 5G networks, which are estimated to drive the market for wet chemicals during the forecast period.

- According to World Semiconductor Trade Statistics, the global semiconductor market accounted for USD 580 billion in 2022, registering a growth rate of 4.4% compared to USD 555.89 billion in 2021.

- According to the Semiconductor Industry Association (SIA), global semiconductor sales in 2022 rose by 3.2% despite the slowdown in the second half of the year caused by the economic slowdown and inflation.

- According to the survey conducted by the association, the global demand for semiconductor manufacturing capacity is projected to increase by 56% by 2030.

- Moreover, under the United States Innovation and Competition Act (USICA), the US government has made significant investments in chip production and research in the United States.

- In North America, the United States launched the CHIPS and Science Act in August 2022 to support domestic production and innovation in the semiconductor industry. The government announced an investment of USD 52 billion in chip manufacturing incentives and research investments. This also includes an investment tax credit for semiconductor manufacturing and semiconductor equipment manufacturing.

- In Asia-Pacific, India launched a comprehensive program for the development of semiconductors and display manufacturing ecosystems in the country. The government announced an outlay of INR 76,000 crore (~USD 10 billion).

- The growing demand for semiconductors is estimated to drive the demand for wet chemicals during the forecast period.

The Asia-Pacific Region is Expected to Dominate the Market

- The Asia-Pacific region dominated the global market. With the growing demand for electronics in countries such as China, India, and Japan, the usage of wet chemicals is increasing in the region.

- China is the most extensive base for the production of electronics in the world. Electronic products, such as smartphones, TVs, and other personal devices, recorded the highest growth in the electronics segment. China is the largest electronics manufacturer in the world. China is actively manufacturing electronic products, such as smartphones, TVs, wires, cables, portable computing devices, gaming systems, and other personal devices.

- The Chinese electronics market grew by 13% in 2022 compared to 2021, when the market witnessed a 10% rise. The estimated growth rate for 2023 is 7%. The Chinese market is the largest in the world, even more significant than the combined markets of all industrialized countries. In 2022, the Chinese electronic industry expanded by 14%, and it is expected to grow by 8% in 2023.

- Moreover, China is the net importer of semiconductor chips, with it manufacturing less than 20% of semiconductors used. Owing to the lucrative demand in both domestic and international markets in 2022, 101 Chinese-listed semiconductor companies announced net profits in their yearly sales, indicating a positive direction for the wet chemicals used in the industry.

- The domestic Indian electronics manufacturing sector has been expanding steadily, owing to favorable government policies, such as 100% foreign direct investment (FDI), no requirement for an industrial license, and the technological transformation from manual to automatic production processes. New incentives, such as the Modified Incentive Special Package Scheme (M-SIPS) and Electronics Development Fund (EDF), were started in the country with a budget of USD 114 million for domestic electronics manufacturing in India.

- Some of the other schemes that the Government of India launched to promote electronics production are the Scheme for Promotion of Manufacturing of Electronic Components and Semiconductors (SPECS) and the Scheme for Modified Electronics Manufacturing Clusters (EMC 2.0), alongside the Production Linked Incentive (PLI). According to the PLI scheme, the government is likely to offer incentives as manufacturers increase production in India, which is expected to be USD 5.5 billion by 2025. This is likely to boost the production of electronics in the country, thereby driving the market for wet chemicals during the forecast period.

- According to the Indian Electronics and Semiconductor Association, the semiconductor market in the country is expected to be worth USD 64 billion by 2026. The Make in India initiative by the government is expected to result in investments in the semiconductor industry in the country.

- The electrical and electronics industry in Japan is one of the world's leading industries. The country is a world leader in producing computers, gaming stations, cell phones, and other key components. Consumer electronics account for one-third of the Japanese economic output. However, Japan's electronics production has declined due to stiff competition from countries such as China, India, and South Korea.

- According to the data released by the Japanese Electronics and Information Technology Industries Association (JEITA), in 2022, the total production value of the electronics industry in Japan accounted for around JPY 11,124.3 billion, displaying a rise of nearly 8% from the previous year. According to the International Trade Administration, the Japanese semiconductor market size is estimated to reach USD 51,554 million in 2023, compared to USD 43,687 million in 2021.

- All the aforementioned factors are expected to boost the overall demand for wet chemicals in the Asia-Pacific region during the forecast period.

Electronic Wet Chemicals Industry Overview

The wet chemicals market for electronics and semiconductor applications is highly concentrated, with the top five players accounting for over 60% of the market share. The top five players in the market are Entegris, BASF SE, Avantor Inc., Honeywell International Inc., and Kanto Kagaku.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Demand from Industries Driven by Modern Technologies

- 4.1.2 Surging Demand for Hydrogen Peroxide from the Semiconductor Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Waste Management for Semiconductors

- 4.2.2 Stringent Health and Environmental Regulations on the Use of Certain Chemicals

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Revenue)

- 5.1 Product Type

- 5.1.1 Acetic Acid

- 5.1.2 Isopropyl Alcohol (IPA)

- 5.1.3 Hydrogen Peroxide

- 5.1.4 Hydrochloric Acid

- 5.1.5 Ammonium Hydroxide

- 5.1.6 Hydrofluoric Acid

- 5.1.7 Nitric Acid

- 5.1.8 Phosphoric Acid

- 5.1.9 Surfuric Acid

- 5.1.10 Other Product Types

- 5.2 Application

- 5.2.1 Semiconductor

- 5.2.1.1 Cleaning

- 5.2.1.2 Etching

- 5.2.2 Other Electronic Applications

- 5.2.2.1 Integrated Circuit (IC) Manufacturing

- 5.2.2.2 Printed Circuit Boards (PCB) Manufacturing

- 5.2.1 Semiconductor

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Russia

- 5.3.3.5 Rest of Europe

- 5.3.4 Rest of the World

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Avantor Inc.

- 6.4.2 BASF SE

- 6.4.3 Eastman Chemical Company

- 6.4.4 Entegris

- 6.4.5 FUJIFILM Corporation

- 6.4.6 Honeywell International Inc.

- 6.4.7 Kanto Kagaku

- 6.4.8 Linde PLC

- 6.4.9 Solvay

- 6.4.10 Songwon

- 6.4.11 Technic Inc.

- 6.4.12 TNC Industrial Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Recycling of Semiconductors

- 7.2 Favorable Growth Market for Semiconductors in Malaysia