|

市场调查报告书

商品编码

1687889

演算法交易 -市场占有率分析、产业趋势与统计、成长预测(2025-2030)Algorithmic Trading - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

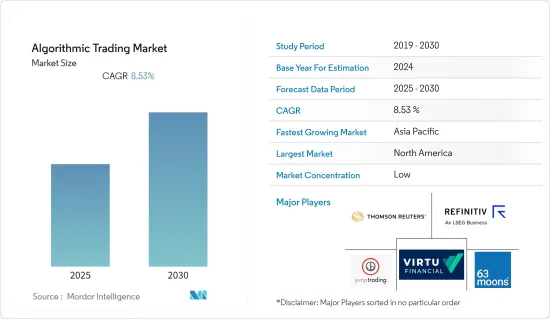

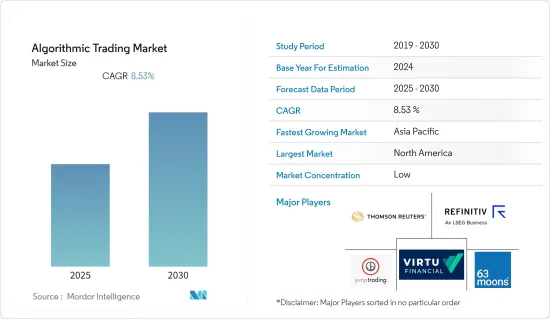

预测期内演算法交易市场预计将实现 8.53% 的复合年增长率

关键亮点

- 由于政府监管有利、对快速、可靠和高效订单执行的需求不断增长、对市场监控的需求不断增加以及交易成本下降,演算法交易行业的需求预计将会增长。大型经纪公司和机构投资者使用演算法交易来降低大额交易的成本。此外,人工智慧(AI)和金融服务演算法的发展预计将创造有吸引力的市场扩张机会。对云端基础的解决方案的需求不断增长也有望推动演算法交易市场的成长。

- 科技革命极大地改变了我们与世界互动的方式以及我们开展业务的方式。然而,这些技术和方法还远未成熟,甚至出现了更具颠覆性的技术和方法,它们有可能颠覆整个产业,并催生全新的经营模式。近年来,先进的智慧交易系统随着市场和技术的进步而不断发展。由于这些系统允许不同程度的自动交易,近年来变得越来越受欢迎。

- 自从现代交易所引入匹配引擎以来,演算法交易在全球范围内变得流行起来。透过消除人为的限制,这些技术进步提高了市场处理订单和交易的能力。结果,研究的市场时间尺度从秒变成毫秒,市场监控从交易大厅转移到电脑。市场监控,无论是由政府还是交易所进行,都维护着市场的完整性并保护市场参与企业免受不道德行为的侵害。

- 演算法交易虽然有其优势,但也有可能透过引发崩盘(所谓的「闪电崩盘」)和即时丧失流动性来放大所研究的负面市场趋势。流动性的即时丧失可能会抑制市场成长。

- 由于全球封锁,COVID-19 疫情导致人们对科技的依赖增加。动盪的市场状况、高交易量以及为适应远端工作环境而进行的快速数位转型的需求都促进了演算法交易的兴起。

演算法交易市场趋势

云端部署领域可望推动市场成长

- 云端技术提供了一种自动化流程和高效储存和管理资料的方法。云端基础的交易还具有在远端伺服器上处理交易的优势。这降低了现场IT基础设施成本并增强了交易测试和建模的云端功能。

- 在云端运算时代,云端基础的演算法交易平台有望在市场成长中发挥关键作用。云端基础的交易解决方案具有众多优势,包括使投资者能够自动化其交易流程以实现利润最大化、轻鬆维护交易资料、可扩展性、成本效益和有效管理。

- 云端基础的交易基于云端运算模型,该模型使用通常可透过互联网存取的远端伺服器网路来管理、储存和处理资料。云端的便利性使得投资者可以在云端部署演算法交易,从而可以在交易运行时探索、回测并对新的交易策略进行时间序列分析。

- 众所周知,在主要股票市场中,大多数股票交易都是自动化的,由应用程式和机器人执行交易策略。最近,金融服务业的新趋势是转向基于云端的交易解决方案,例如演算法交易解决方案。过去几年,投资者越来越多地转向基于云端的演算法交易解决方案。

- 云端运算的一大优势就是业务敏捷性。它利用轻鬆快速地存取云端服务供应商提供的技术和持续创新的能力,加上计量收费模式,使投资者无需进行大量的前期投资即可试验和测试新技术和解决方案。具体来说,资本市场公司将其内部部署解决方案扩展到云端或建置云端原生解决方案有各种使用案例和好处。据Flexera Software称,截至2023年,72%的受访企业表示他们将采用混合云端。

预计北美将占据较大的市场占有率

- 预计北美将占据受调查市场的最大份额。在整个预测期内推动市场成长的关键因素是增加对交易技术(如区块链)的投资、演算法交易供应商的不断增长以及政府对该地区国际贸易的支持不断增加。

- 随着包括高频交易(HFT)在内的演算法交易策略在美国证券市场变得越来越普遍,这些策略对市场和企业稳定产生不利影响的可能性也随之增加。

- 现代技术正在透过自动化所有相关交易程序迅速改变传统投资模式的形式,从而可以开发一个所有潜在投资者都可以存取的安全有效的生态系统。

- 北美演算法交易市场在美国证券交易委员会(SEC)和金融业监管机构(FINRA)等机构管理的法律规范内运作。这些监管机构制定规则和指导方针,以确保市场诚信、公平行为和风险管理。

- 演算法交易得到了资产管理公司、避险基金和退休基金等机构投资者的大力支持。这些机构正在采用演算法交易策略来提高效率、优化执行和管理风险。先进的交易平台和市场资料有助于推动演算法交易的普及。

演算法交易行业概览

演算法交易市场高度分散,主要参与者包括汤森路透、Jump Trading LLC、Refinitiv Ltd、63 Moons Technologies Limited 和 Virtu Financial Inc. 该市场的参与企业正在采用合作和收购等策略来加强其产品供应并获得可持续的竞争优势。

2023 年 6 月,Virtu Financial 宣布推出 Alert+,这是适用于 POSIT 警报的全新工作流程解决方案。 Alert+ 透过为 Virtue 的隐藏执行演算法提供自动路由来实现看不见的流动性,从而增强了 POSIT 警报的功能。

2022 年 10 月,印度商品交易所 (MCX) 与 63 Moon Technologies 合作,提供为期三个月的软体技术服务,以确保持续无缝交易。

2022 年 10 月,伦敦证券交易所集团的营运公司 Refinitiv 宣布推出安全、个人化且无摩擦的全球数位入职解决方案。 Refinitiv 的数位客户入职解决方案提供了完全可设定的使用者介面,让公司提供可透过网路、行动装置或 API 交付的产品应用程式流程。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响

- 技术简介

- 演算法交易策略

- 动量交易

- 套利

- 趋势追踪

- 基于执行的策略

- 情绪分析

- 再平衡指数基金

- 基于数学模型的策略

- 其他演算法交易策略

- 演算法交易策略

第五章市场动态

- 市场驱动因素

- 对快速、可靠和高效的订单执行的需求不断增加

- 降低交易成本增加了对市场监控的需求

- 市场限制

- 即时失去流动性

第六章市场区隔

- 按投资者类型

- 机构投资者

- 私人投资者

- 长期投资者

- 短期投资者

- 按组件

- 解决方案

- 平台

- 软体工具

- 按服务

- 解决方案

- 按部署

- 在云端

- 本地

- 按组织规模

- 中小企业

- 大型企业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章竞争格局

- 公司简介

- Thomson Reuters

- Jump Trading LLC

- Refinitiv Ltd

- 63 Moons Technologies Limited

- Virtu Financial Inc.

- MetaQuotes Software Corp.

- Symphony Fintech Solutions Pvt. Ltd

- Info Reach Inc.

- ARGO SE

- IG Group

- Kuberre Systems Inc.

- Algo Trader AG

第八章投资分析

第九章 市场机会与未来趋势

The Algorithmic Trading Market is expected to register a CAGR of 8.53% during the forecast period.

Key Highlights

- The need for the algorithmic trading industry is anticipated to be driven by favorable governmental rules, rising demand for quick, reliable, and efficient order execution, increasing demand for market surveillance, and declining transaction costs. Large brokerage firms and institutional investors use algorithmic trading to reduce the expenses of bulk trading. Additionally, it is anticipated that the development of artificial intelligence (AI) and financial service algorithms will create attractive market expansion opportunities. A rise in the demand for cloud-based solutions is also anticipated to support the growth of the algorithmic trading market.

- The technological revolution has altered how one can interact with the world and do business. But, far from reaching maturity, the revolution continues to unfold, revealing even more disruptive technologies and approaches capable of disrupting entire industries and spawning significantly new business models. Advanced and intelligent trading systems have evolved with markets and technological advances in recent years. These systems have become increasingly popular in recent years as they enable different levels of automated trading.

- Since the introduction of matching engines in modern exchanges, algorithmic trading has been used globally. By removing human restrictions, such technological advancements have enhanced the capacity of markets to process orders and trades. As a result, the studied market's timeline shifted from seconds to milliseconds, and market surveillance was transferred from the trading pit to computers. Whether conducted by a government or an exchange, market surveillance safeguards market integrity and protects participants from unethical behavior.

- While algorithmic trading has its advantages, it can also amplify the negative trends in the market studied by causing crashes (so-called "flash crashes") and immediate loss of liquidity. The instant loss of liquidity can restrain market growth.

- The COVID-19 pandemic led to increased dependence on technologies owing to the global lockdowns. The volatile market conditions, high trading volume, and drive for rapid digital transformation to cope with the remote working environment have all contributed to the uptick in algorithmic trading.

Algorithmic Trading Market Trends

On-cloud Deployment Segment is expected to drive the Market Growth

- Cloud technologies provide ways to automate processes and efficiently store and maintain data. In addition, cloud-based trading offers the benefits of remote servers to process trades. This reduces onsite IT infrastructure costs and augments the cloud's power to test and model trades.

- In the age of cloud deployment, cloud-based algorithmic trading platforms are projected to play a crucial role in the growth of the market, owing to various benefits, such as obtaining maximum profits, as cloud-based trading solutions enable traders to automate their trading process, easy trade data maintenance, scalability, cost-effectiveness, and effective management.

- Cloud-based trading works on the cloud computing model, which uses networks of remote servers generally accessed over the internet to manage, store, and process data. Attributed to the convenience of the cloud, traders can deploy algorithmic trading in the cloud to check new trading strategies, backtest, and run-time series analysis while executing trades.

- It is well known that most stock transactions are automated in significant stock markets using applications or bots implementing a trading strategy. Recently, an emerging trend in the financial services industry has been the movement of trading solutions, like algorithmic trading solutions, to the cloud. More and more traders have been using algorithmic trading solutions based on the cloud for the past few years.

- One of the significant benefits of the cloud is business agility, leveraging the ability to easily and quickly access technology and continuous innovation provided by cloud service providers, along with a pay-as-you-go model, which enables a trader to experiment and pilot new technologies and solutions without high upfront investments. More specifically, there are various use cases and benefits for capital markets firms extending their on-premises solutions to the cloud or building cloud-native solutions. According to Flexera Software, As of 2023, 72 percent of the enterprise respondents indicated that they had deployed a hybrid cloud in their organization.

North America is Expected to Hold Significant Market Share

- North America is expected to have the most significant market share in the market studied. The main drivers of market growth throughout the forecast period are the rising investments in trading technologies (such as blockchain), the growing presence of algorithmic trading suppliers, and the expanding government backing for international trading in the region.

- As algorithmic trading strategies, including high-frequency trading (HFT), have grown more widespread in the US securities markets, the potential for these strategies to adversely impact market and firm stability has likewise increased.

- Modern technology is rapidly transforming the formats of conventional investment models by automating all associated trading procedures, enabling the development of a secure and effective ecosystem that will be accessible to all potential investors.

- The algorithmic trading market in North America operates within a regulatory framework governed by agencies such as the U.S. Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). These regulatory bodies have implemented rules and guidelines to ensure market integrity, fair practices, and risk management.

- Algorithmic trading has gained substantial traction among institutional investors, including asset management firms, hedge funds, and pension funds. These entities employ algorithmic trading strategies to enhance efficiency, optimize execution, and manage risk. The availability of sophisticated trading platforms and access to market data have facilitated the widespread adoption of algorithmic trading.

Algorithmic Trading Industry Overview

The algorithmic trading market is highly fragmented with the presence of major players like Thomson Reuters, Jump Trading LLC, Refinitiv Ltd, 63 Moons Technologies Limited, and Virtu Financial Inc. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In June 2023, Virtu Financial launched Alert+, a new workflow solution available in POSIT Alert that enhances the features of POSIT Alert by providing automated routing to Virtu's Covert execution algorithm to seek non-displayed liquidity.

In October 2022, Multi Commodity Exchange of India Limited (MCX) partnered with 63 Moons Technologies for software technology services for three months to continue to experience seamless trading.

In October 2022, Refinitiv, an LSEG business, announced the introduction of a secure, personalized, and frictionless global digital onboarding solution to assist businesses in streamlining their approach to onboarding customers. Refinitiv's digital customer onboarding solution offers a fully configurable user interface, allowing organizations to provide the product application process that can be delivered via the web, mobile, and API.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Market

- 4.4 Technology Snapshot

- 4.4.1 Algorithmic Trading Strategies

- 4.4.1.1 Momentum Trading

- 4.4.1.2 Arbitrage Trading

- 4.4.1.3 Trend Following

- 4.4.1.4 Execution-based Strategies

- 4.4.1.5 Sentiment Analysis

- 4.4.1.6 Index-fund Rebalancing

- 4.4.1.7 Mathematical Model-based Strategies

- 4.4.1.8 Other Algorithmic Trading Strategies

- 4.4.1 Algorithmic Trading Strategies

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for Fast, Reliable, and Effective Order Execution

- 5.1.2 Growing Demand for Market Surveillance Augmented by Reduced Transaction Costs

- 5.2 Market Restraints

- 5.2.1 Instant Loss of Liquidity

6 MARKET SEGMENTATION

- 6.1 By Types of Traders

- 6.1.1 Institutional Investors

- 6.1.2 Retail Investors

- 6.1.3 Long-term Traders

- 6.1.4 Short-term Traders

- 6.2 By Component

- 6.2.1 Solutions

- 6.2.1.1 Platforms

- 6.2.1.2 Software Tools

- 6.2.2 Services

- 6.2.1 Solutions

- 6.3 By Deployment

- 6.3.1 On-cloud

- 6.3.2 On-premise

- 6.4 By Organization Size

- 6.4.1 Small and Medium Enterprises

- 6.4.2 Large Enterprises

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Thomson Reuters

- 7.1.2 Jump Trading LLC

- 7.1.3 Refinitiv Ltd

- 7.1.4 63 Moons Technologies Limited

- 7.1.5 Virtu Financial Inc.

- 7.1.6 MetaQuotes Software Corp.

- 7.1.7 Symphony Fintech Solutions Pvt. Ltd

- 7.1.8 Info Reach Inc.

- 7.1.9 ARGO SE

- 7.1.10 IG Group

- 7.1.11 Kuberre Systems Inc.

- 7.1.12 Algo Trader AG