|

市场调查报告书

商品编码

1642154

Crown Cap:市场占有率分析、产业趋势与成长预测(2025-2030 年)Crown Caps - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

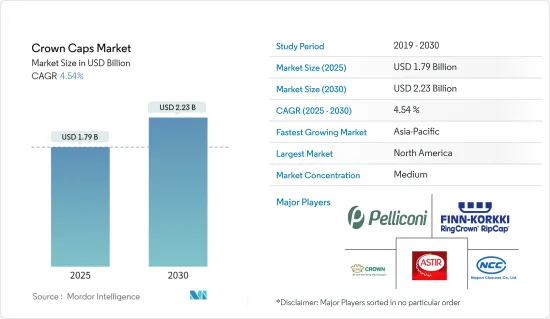

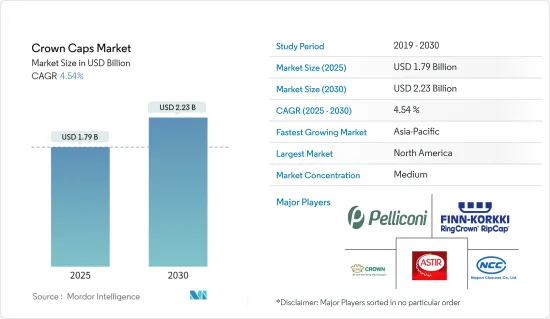

预计 2025 年皇冠盖市场规模为 17.9 亿美元,到 2030 年将达到 22.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.54%。

关键亮点

- 皇冠盖适用于碳酸饮料、能量饮料和酒精饮料。在酒精饮料中,啤酒是重要的终端用户,大多数啤酒包装都使用皇冠盖来密封瓶子。据英国酒精饮料公司帝亚吉欧称,预计2019年至2023年间全球啤酒销量的复合成长率为1.2%。随着玻璃瓶装啤酒销量的增加,预计该市场对皇冠啤酒的需求也将增加。

- 食品和饮料对永续包装材料的需求不断增长,以及联邦政府严格的反塑胶指导方针,可能会导致对金属皇冠盖的需求增加。根据联合国环境规划署(UNEP)2023年5月的最新报告,透过遵循系统的指导方针,我们可以消除80%的塑胶污染。预计这些新变化将在预测期内推动金属皇冠瓶盖市场的成长。

- 此外,由于铝具有无与伦比的隔绝葡萄酒氧气的性能,并且比软木具有成本优势,因此它正在成为整个葡萄酒行业瓶盖应用的主要材料。例如,铝封盖在葡萄酒行业的应用正在增加,根据铝封盖集团的数据,预计全世界将有超过 30% 的瓶装无气泡葡萄酒使用铝封盖。皇冠瓶盖和封盖的另一个主要偏好是易于处理、回收且保质期较长。

- 然而,全球皇冠瓶盖市场目前正面临挑战,随着创新再生 PET 瓶盖和封盖的推出,据说这些瓶盖和封盖对环境的影响较小。 2023 年 3 月,可口可乐推出了一种可固定在瓶子上的塑胶瓶盖。这是为了确保在收集瓶子的同时,瓶盖也被收集起来以便回收。在预测期内,此类倡议可能会成为市场成长的障碍。

- 此外,饮料行业是皇冠盖的重要用户,这表明其在软/碳酸饮料领域的应用可能会增加。精酿啤酒罐的扩张预计将进一步扩大所研究的市场。皇冠盖可帮助精酿啤酒製造商在供应玻璃品脱啤酒时保持更高的品质和高檔的感觉。

皇冠盖市场趋势

非酒精饮料预计将占很大份额

- 碳酸饮料存放在玻璃瓶中味道最好。玻璃瓶的厚层可防止饮料中的二氧化碳气体逸出。这就是饮料看起来发泡的原因。当储存在宝特瓶时,二氧化碳比玻璃瓶中更容易洩漏。金属冠盖因其可回收性高而主要用于玻璃瓶。因此,在全球流行的软性饮料占据了该市场的大部分份额。

- 软性饮料占全球一次性宝特瓶的很大份额。然而,由于政府监管的加强和包装成本的降低,各种软性饮料供应商都在转向使用玻璃瓶,而皇冠瓶盖市场也应该会随着同样的趋势而成长。例如,长期专注于一次性宝特瓶的饮料製造商可口可乐印度私人有限公司将从 2022 年 2 月起在印度再次开始销售可回收玻璃瓶。这项变更将扩大该公司的用户群,并在降低包装成本的同时刺激整个印度市场对金属罐的需求。

- 此外,2023 年 10 月,可口可乐希腊装瓶公司 (HBC) 宣布在其奥地利工厂投资 1,200 万欧元(1,270 万美元),安装新的高速可回收玻璃瓶生产设备。针对奥地利市场,新的玻璃瓶生产线预计将生产可重新密封的400毫升可回收玻璃瓶。增加可重复使用包装的使用将有助于将容器收集整合到饮料配送模式中,从而增加对可重复使用瓶子的皇冠的需求。

- 根据德国包装和装瓶机械製造商克朗斯股份公司发布的2022年年度报告,2022年全球包装饮料消费量将达到约1.4兆公升。此外,到 2022 年,亚太地区的包装饮料消费量将达到 2,880 亿公升,位居第一。预计到 2025 年将达到 3,366 亿公升。根据预测,预计全球各主要地区的包装饮料消费量都将成长,这反过来又将有助于皇冠瓶盖市场的成长。

- 值得注意的是,多家软性饮料製造商不断合併、收购和合作,推出带有皇冠盖的永续、可回收玻璃瓶。 2022年12月,百事可乐位于马耳他的合作伙伴Simonds Farsons将为百事可乐、百事可乐Max、七喜、七喜Free和美年达等旗舰品牌提供定制的单份可再填充玻璃瓶。

亚太地区将经历最快成长

- 快速都市化、中产阶级不断壮大以及消费者购买力不断增强等因素导致对酒精和非酒精饮料的需求不断增加。此外,饮酒人数和透过聚会和社交场合进行社交的愿望急剧增加。不断变化的社会和文化因素也增强了亚太地区酒精饮料市场的潜力,这可能会在预测期内推动皇冠瓶盖和封盖的成长。

- 由于亚太地区拥有两个人口大国——中国和印度,预计该地区将实现最快成长。预计可支配收入的增加将促进这两个国家的皇冠瓶盖市场的成长。随着该地区需求的增加,在那里运营的公司也在扩张以满足其他国家的需求。尤其根据中国国家统计局2023年1月发布的报告显示,2022年中国将向全球整体出口4.7944亿公升啤酒,较2021年的4.242亿升有大幅成长。

- 由于喜欢啤酒的年轻人口不断增长,印度的啤酒消费量正在大幅增加。生活方式和消费者偏好的改变正在推动亚太地区啤酒的普及。此外,加拿大农业和食品部称,印度的啤酒消费量预计将从 2021 年的 22.3 亿公升增长到 2025 年的 26 亿公升。预计这一增长将在预测期内推动印度市场的成长。

- 人们对低酒精饮料的偏好正在稳步增长,由于注重健康的消费者的兴趣日益浓厚,以及口味改良的新系列选择范围广泛,无酒精和低酒精啤酒的销量也在增加。其中一个因素是低酒精啤酒(酒精浓度2.8% 或更低)的价格比高酒精啤酒便宜。

- 此外,预计预测期内中国非酒精饮料产量的增加将支持市场的成长。例如,根据中国国家统计局的数据,2023年7月,全国非酒精饮料产量超过1891万吨,为2023年1月以来的最高水准。预计这一上升趋势将在预测期内持续,从而推动该地区对皇冠瓶盖的需求。

皇冠盖业概况

由于主要国际供应商的存在,皇冠盖市场已半固体。该市场的一些主要企业包括 PELLICONI &C. SPA、Astir Vitogiannis Bros SA、Finn-Korkki Oy 和 Crown Holdings Inc.这些参与企业正专注于扩展其业务策略,以在市场竞争中取得优势。

2022 年 3 月 - Pelliconi 宣布将在旧金山的 Mind the Bridge研发中心内开设前哨基地,以确定食品和饮料行业的新兴趋势和创造性解决方案。 Pelliconi 对发展广泛的趋势感兴趣,从新材料到製造、废弃物管理、永续性、生态系统影响以及产品和製程改进。所有这些都需要在合作伙伴生态系统中实现——供应商、研究机构、工程公司、新兴企业、扩大规模的企业和大学——以获得专业和前沿的专业知识。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素

- 酒精和碳酸饮料的需求不断增加

- 越来越多地采用改进的包装设计来支持产品差异化和品牌推广

- 市场限制

- 饮料业塑胶使用量不断增加

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 COVID-19 对金属包装产业和皇冠盖市场的影响

第六章 市场细分

- 按材质

- 铝

- 钢,镀锡

- 按应用

- 饮料

- 酒精饮料

- 啤酒

- 葡萄酒

- 非酒精饮料

- 食物

- 饮料

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Crown Holdings Inc.

- Astir Vitogiannis Bros SA

- Avon Crowncaps & Containers Nigeria Ltd

- AMD Industries Inc.

- Finn-Korkki Oy

- Nippon Closures Co. Ltd

- PELLICONI & C. SPA

- Samhwa Crown & Closure

- Viscose Closures Ltd

- Evergreen Resources

第八章:未来市场展望

The Crown Caps Market size is estimated at USD 1.79 billion in 2025, and is expected to reach USD 2.23 billion by 2030, at a CAGR of 4.54% during the forecast period (2025-2030).

Key Highlights

- Crown caps find applications across carbonated soft drinks, energy drinks, and alcoholic beverages. Among alcoholic beverages, beer is the significant end-user, with major beer packages using crown caps for sealing their bottles. According to British alcoholic beverage company Diageo, global beer sales are expected to witness a compound growth rate of 1.2% in the period between 2019 and 2023. With the rise in the sale of beer glass bottles, the market is also expected to witness a growth in demand for crowns.

- The rising demand for sustainable packaging material for food and beverages and the strict anti-plastic guidelines by federal governments may contribute to the demand for metal crown caps. As per the recent United Nations Environment Programme (UNEP), held in May 2023, 80% of plastic pollution can be eliminated by following systematic guidelines. These new changes are expected to bolster the growth of the metal crown caps market during the forecast period.

- Moreover, aluminum, as a material for crown applications across the wine industry, is becoming predominant due to the non-par insulation of wine from oxygen and its cost benefits compared to cork. For instance, according to the Aluminum Closures Group, aluminum closures in the wine industry show an upward trend, with more than 30% of the global bottled still wine now expected to be sealed using aluminum. Another primary preference for crown caps and closures is their ease of disposal, recycling advantages, and increased shelf life.

- However, the global crown cap market is currently being challenged by the innovative recycled PET caps and closure closures launched, which are considered to have a lesser impact on the environment. In March 2023, Coca-Cola launched plastic caps that stay attached to the bottles. This is to ensure that the caps of the bottles will also be collected for recycling while collecting the bottles. Initiatives like this may act as barriers to market growth during the forecast period.

- Furthermore, the beverage industry is a significant user of crown caps and is showing trends of the potential increase in adoption for the same in the soft drink/carbonated drink segment. The expansion of microbrew beer canning is expected to expand the market studied further. Crown caps are helping craft beer manufacturers maintain a higher quality and premium look when served in a glass pint.

Crown Caps Market Trends

Non-Alcoholic Beverages are Expected to Hold a Significant Share

- Carbonated drinks taste best when stored in glass bottles. The thick layer of the glass bottle does not allow the carbon dioxide present in the drink to escape through it. This makes the drink look fizzy. When stored in a plastic bottle, the CO2 content easily leaks out of the plastic compared to a glass jar. Owing to their recyclability, metal crown caps are mainly used with glass bottles. Therefore, soft drinks hold a significant share of the market studied, owing to their popularity worldwide.

- Soft drinks hold a prominent share of single-use plastic bottles globally. Nevertheless, various soft drink vendors are currently switching back to glass bottles owing to the increasing government regulation and reduced packaging cost, requiring the crown caps market to grow on a similar trend. For instance, after focusing on disposable plastic bottles for many years, from February 2022, beverage manufacturer Coca-Cola India Pvt. Ltd now and again marketed returnable glass bottles in India. This modification lowers the cost of packaging while expanding the company's user base and pushing the demand for metal cans across the Indian market.

- Furthermore, in October 2023, Coca-Cola Hellenic Bottling Company (HBC) unveiled that it invested EUR 12 million (USD 12.7 million) in a new high-speed returnable glass bottle manufacturing equipment at its Austrian facility. For the Austrian market, the new glass bottles line is anticipated to produce 400 ml returnable glass bottles that can be resealable. By increasing the use of reusable packaging, container collection is integrated into the beverage delivery model, and there would be a rising demand for crowns for reusable bottles.

- As per the 2022 annual report published by Krones AG, a German packaging and bottling machine producer, global consumption of packaged beverages amounted to nearly 1.4 trillion liters in 2022. Also, Asia-Pacific had the highest consumption of packaged beverages, which was 288 billion liters in 2022. It is expected to be escalated to reach 336.6 billion liters in 2025. According to the forecasts, all the major regions across the globe are expected to witness growth in the consumption of packaged beverages, which, in turn, is anticipated to contribute to the growth of the crown caps market.

- Notably, several soft drink manufacturers are constantly making mergers, acquisitions, and partnerships for the launch of sustainable and recyclable glass bottles that come with crown caps. In December 2022, a new refillable, one-serve, custom-made glass bottle was launched by the Malta-based Pepsico partner, Simonds Farsons, for flagship brands, including Pepsi-Cola, Pepsi Max, 7up, 7up Free, and Mirinda.

Asia-Pacific to Witness Fastest Growth

- Factors like rapid urbanization, growing middle-class income, and higher consumer purchasing power contribute to the rise in alcoholic and non-alcoholic beverage demand. In addition, the number of people who drink alcohol and the desire to socialize through partying and social gatherings have increased dramatically. Changing social and cultural factors have also strengthened the potential of the alcoholic beverage market in the Asia-Pacific region, which may propel the growth of crown caps and closures during the forecast period.

- Asia-Pacific is expected to witness the fastest growth because of the presence of two highly populated countries, i.e., China and India. In these two countries, the increase in disposable income is expected to supplement the growth of the crown caps market. Owing to the increasing demand in the region, companies operating in the region have grown to cater to the demand of other countries as well. Notably, as per the report published in January 2023 by the National Bureau of Statistics of China, the country exported 479.44 million liters of beer globally in 2022, significantly up from 424.20 million liters in 2021.

- A considerable increase in beer consumption has been observed in India due to its growing youth population that prefers beer. Changing lifestyles and consumer preferences have considerably boosted the adoption of beer in the Asia-Pacific region. Moreover, according to Agriculture and Agri-Food Canada, beer volume consumption in India is expected to increase from 2.23 billion liters in 2021 to 2.6 billion liters in 2025. This increase is expected to bolster the market growth in India during the forecast period.

- There has been consistent growth in preference for beverages with low levels of alcohol, and the sales of no-alcohol and low-alcohol beers have been rising with the growing interest from health-conscious consumers and a wider choice of new ranges with improved taste. Another driving factor is that beers with low levels of alcohol, those with 2.8% alcohol by volume (ABV) and less, are now cheaper than their high-alcohol equivalents.

- Moreover, the growing production of non-alcoholic beverages in China is expected to support market growth during the projected timeframe. For instance, according to the National Bureau of Statistics of China, the country produced over 18.91 million metric tons of non-alcoholic beverages in July 2023, which represented the highest production in the few months after January 2023. This upswing is expected to continue in the forecast period, and it is anticipated to increase the demand for crown caps in the region.

Crown Caps Industry Overview

The crown caps market is semi-consolidated due to the presence of key international vendors. Some of the key players in this market are PELLICONI & C. SPA, Astir Vitogiannis Bros SA, Finn-Korkki Oy, and Crown Holdings Inc., among others. These players focus on expanding their business strategies to gain a competitive edge over the market.

March 2022 - Pelliconi announced opening an Outpost within the Mind the Bridge Innovation Center in San Francisco to identify new trends and creative solutions for the food and beverage industry. Pelliconi is interested in developing trends ranging from new materials to manufacturing, waste management, sustainability, and ecological impact, as well as product and process improvements. To acquire specialized, cutting-edge know-how, all of this must be accomplished within an ecosystem of partners (suppliers, research institutes, engineering firms, startups, scaleups, and universities).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand for Alcoholic and Carbonated Drinks

- 4.2.2 Growing Adoption of Improved Packaging Designs to Aid Product Differentiation and Branding

- 4.3 Market Restraints

- 4.3.1 Increasing Utilization of Plastic in the Beverage Industry

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 IMPACT OF COVID-19 ON METAL PACKAGING INDUSTRY AND CROWN CAPS MARKET

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Aluminum

- 6.1.2 Steel and Tin-plated

- 6.2 By Application

- 6.2.1 Beverage

- 6.2.1.1 Alcoholic Beverages

- 6.2.1.1.1 Beer

- 6.2.1.1.2 Wine

- 6.2.1.2 Non-alcoholic Beverages

- 6.2.2 Food

- 6.2.1 Beverage

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Crown Holdings Inc.

- 7.1.2 Astir Vitogiannis Bros SA

- 7.1.3 Avon Crowncaps & Containers Nigeria Ltd

- 7.1.4 AMD Industries Inc.

- 7.1.5 Finn-Korkki Oy

- 7.1.6 Nippon Closures Co. Ltd

- 7.1.7 PELLICONI & C. SPA

- 7.1.8 Samhwa Crown & Closure

- 7.1.9 Viscose Closures Ltd

- 7.1.10 Evergreen Resources