|

市场调查报告书

商品编码

1405343

功能安全 -市场占有率分析、产业趋势与统计、2024 年至 2029 年成长预测Functional Safety - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

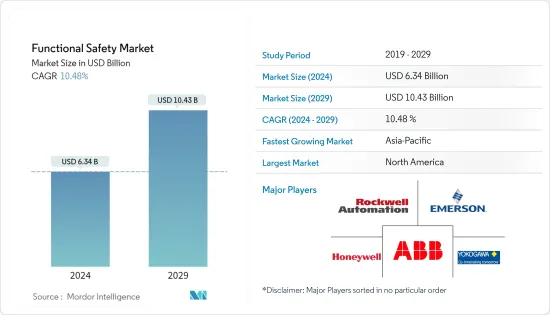

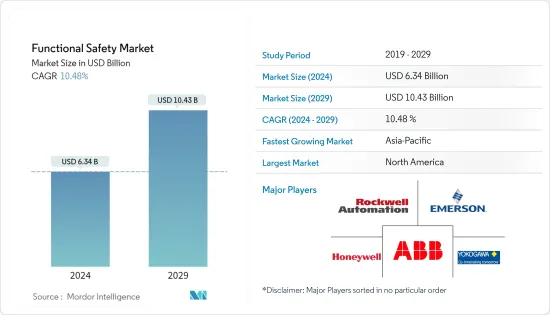

功能安全市场规模预计到2024年为63.4亿美元,预计到2029年将达到104.3亿美元,在预测期内(2024-2029年)复合年增长率为10.48%。

主要亮点

- 市场成长是由各行业越来越多地采用功能安全系统以及不断提高的工业安全标准所推动的。石油和天然气设施容易发生事故,对社会和环境造成负面影响。包括紧急关闭系统在内的功能安全措施可以显着降低石油和天然气设施的灾害风险。

- 连网型设备使用的增加和软体解决方案无线 (OTA) 安装速度的加快预计也将推动对功能安全系统的需求。工业革命 4.0 增加了对可靠安全系统保护个人和财产的需求。这些是预计在预测期内促进市场收益成长的因素。

- 透过采用功能安全系统和资料为中心的方法,我们为各行各业的公司提供必要的能力,以自动预防危险故障并在发生此类故障时进行控制。我们也提供人类无法模仿的设施。

- 功能安全系统正在推动全球市场需求,但这些系统日益复杂,加上高昂的维护成本和初始系统建设成本,阻碍了企业对功能安全系统技术的投资,导致市场渗透的延迟。

功能安全市场趋势

汽车是成长最快的最终用户产业

- 功能安全已成为各行业的重中之重,特别是随着技术的进步和自动化设备的不断增强。自动化在包括服务在内的广泛应用中发挥着越来越重要的作用。在医疗保健和建筑等行业,必须确保故障设备、机器人和自动化的设计能够预防事故并消除不良后果。

- 过去几年,汽车产业经历了许多变化,将技术进步融入多种类型的车辆中。过去,汽车是机械式的,具有为前灯和火星塞供电的基本电气系统。随着技术的进步,汽车已经配备了先进的安全功能,例如安全气囊展开系统。

- 越来越多的功能依赖此类感测器,促使工程师开发出更准确的感测器来满足汽车应用的需求。鑑于这些趋势,业界对功能安全的采用预计将会增加。这使得汽车製造商能够快速回应市场需求,减少製造停机时间,提高供应链效率并扩大生产力。

- 配备汽车电控系统(ECU) 的现代汽车的广泛使用需要先进的安全措施。功能安全流程对于 ECU 软体开发流程变得极为重要。为了减少软体或硬体故障造成的风险和损害,汽车功能安全方案有助于诊断故障(电气和电子)并确定应采取的措施和程序。

- 电动和自动化是汽车领域的两个重要趋势。从长远来看,电动车在行业中的出现正在对感测器的需求产生巨大影响。更多的电动车意味着更多的感测器,用于电池监控、各种定位和汽车运动部件检测等应用。

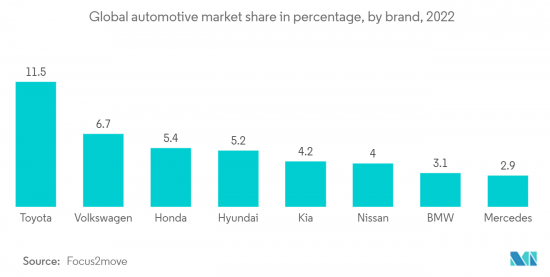

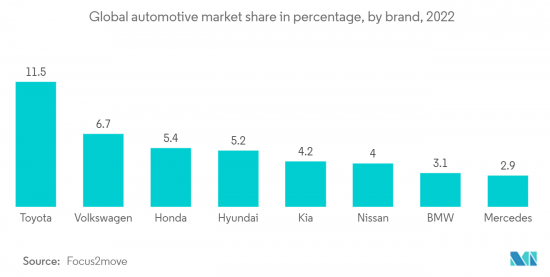

- 汽车工业是重要产业之一,在全球自动化製造设备中占有很大份额。 2022年,丰田在全球最大汽车品牌排名中位居榜首,市场占有率约11.5%。每个汽车製造商的生产设施都自动化以保持效率。以电动车(EV)取代传统汽车的趋势日益增长,预计将进一步增加汽车产业的需求。

预计北美将占据较大市场占有率

- 美国是全球最大的功能安全系统市场之一。该国以其创新能力而闻名,并处于第四次工业革命新兴技术重要发展的前沿。美国新发现的页岩资源和油气计划的增加也是市场潜力的指标。美国是霍尼韦尔国际公司、罗克韦尔自动化公司、班纳工程公司和通用电气公司等领先供应商的所在地。

- 政府也注重提高能源发电能力,并正在投资此类计划。例如,2022年10月,美国能源局(DOE)宣布爱达荷国家实验室(INL)将从总统通膨削减法案中获得1.5亿美元贷款,用于其基础设施现代化并推进核能研发。这笔资金将支持INL先进试验器(ATR)和材料与燃料综合体(MFC)的近十几个计划,这两个项目都已经运作了50多年,并将在支持政府机构、企业等方面发挥重要作用。在全球合作的核能技术开发中发挥作用。核能约占国内电力产量的5%和国内清洁能源总产量的50%,对于实现拜登总统到2035年100%清洁电力的目标至关重要。

- 此外,2022 年 10 月,美国能源局(DOE) 宣布透过三个资助机会提供超过 2,800 万美元的资金,以支持研究和开发倡议作为清洁能源的重要来源。

- 在扩大低负载水力发电和抽水蓄能、建设新的抽水蓄能设施、现代化水力发电厂、永续性和环境影响等问题上与有影响力的声音进行接触,都是《两党基础设施法案》的一部分,并得到了资金的支持。这样的发电工程投资措施必将增加国内功能安全设备的需求。

- 根据加拿大政府统计,加拿大製造业约占国内生产毛额1740亿加元,占国内生产毛额的10%以上。製造业是研发的最大投资者,正在引进新技术,因此市场可望扩大。

功能安全产业概述

功能安全市场的特点是多家全球知名公司在一个相当竞争的市场中竞争。该市场的主要竞争包括罗克韦尔自动化公司、艾默生电气公司和霍尼韦尔国际公司。这些市场参与企业正在积极努力透过各种策略(包括产品创新)来加强竞争。因此,市场内竞争对手之间的敌对行动预计将继续加剧。

2022 年 10 月,艾默生迈出了一大步,宣布推出 PlantWeb 数位生态系统。这个创新的生态系统汇集了 AspenTech 由工业人工智慧支援的资产优化软体组合。这项策略倡议使艾默生成为拥有最全面的数位转型产品组合的产业领导者。

2022年9月,横河电机公司收购了Votiva Singapore Pte Ltd,这是一家东南亚着名的IT顾问公司,专门从事业务线系统(ERP)和客户关係管理(CRM)软体的部署。横河马达依靠其 ERP 系统作为解决方案的核心组件,旨在支援製造业客户的智慧製造和数位转型(DX)。此次收购将使横河电机能够扩大其在东南亚的地理覆盖范围,并加强其在该地区的ERP解决方案咨询、实施和技术支援服务。透过此次收购,Votiva Singapore Pte Ltd将更名为横河电机Votiva Solutions,加强横河电机在东南亚市场的影响力与影响力。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 评估 COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 不断提高的工业安全标准

- 功能安全系统在工业的采用率不断提高

- 市场抑制因素

- 复杂性增加、初始成本和维护成本较高

第六章市场区隔

- 设备类型

- 安全感应器

- 安全控制器/模组/继电器

- 安全交换器

- 可程式安全系统

- 紧急停止装置

- 最终控制元件(阀门、致动器)

- 其他设备类型

- 安全系统

- 燃烧器管理系统 (BMS)

- 涡轮机械控制 (TMC) 系统

- 高可靠性压力保护系统(HIPPS)

- 火灾/气体监控系统

- 紧急关闭系统(ESD)

- 监控和资料采集(SCADA)系统

- 集散控制系统(DCS)

- 最终用户产业

- 油和气

- 发电

- 食品和饮料

- 製药

- 车

- 其他最终用户产业

- 地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 拉丁美洲

- 中东/非洲

- 北美洲

第七章竞争形势

- 公司简介

- Rockwell Automation Inc.

- Emerson Electric Company

- Honeywell International Inc.

- Yokogawa Electric Corporation

- ABB Ltd

- Schneider Electric SE

- Siemens AG

- General Electric Company

- Omron Corporation

- SICK AG

- Panasonic Industry Europe GmbH(Panasonic Corporation)

- Pepperl+Fuchs

- Banner Engineering Corporation

第八章投资分析

第9章 市场的未来

The Functional Safety Market size is estimated at USD 6.34 billion in 2024, and is expected to reach USD 10.43 billion by 2029, growing at a CAGR of 10.48% during the forecast period (2024-2029).

Key Highlights

- The increasing adoption of functional safety systems in a wide range of industries and the growing industrial safety standards are the factors driving the market growth. Oil and gas facilities are prone to accidents that can negatively impact society and the environment. Functional safety measures, including emergency shutdown systems, can significantly minimize the risk of disasters in oil and gas facilities.

- The increasing use of connected devices and the rapid installation of software solutions using over-the-air (OTA) are also expected to drive the demand for functional safety systems. Industrial Revolution 4.0 has increased the need for reliable security systems to protect individuals and property. These are the factors anticipated to contribute to the market's revenue growth during the forecast period.

- The adoption of functional safety systems and a datacentric approach provides enterprises in a wide range of industries with the required functionality that enables automatic prevention of dangerous failures and control in instances of such occurrences. They also offer facilities that humans cannot mimic.

- Although functional safety systems are driving the demand for the market across the world, the increasing complexity of these systems, coupled with high maintenance costs and the high initial cost of setting up these systems, is dissuading enterprises from investing in functional safety systems technology, thus leading to slow market penetration.

Functional Safety Market Trends

Automotive to be the Fastest-growing End-user Sector

- Functional safety must be a top priority across various industries, especially with the advancements in technology and the continuous enhancements in automation equipment. Automation is assuming an increasingly crucial role in a wide array of applications, including services. It is imperative to ensure that malfunctioning equipment, robotics, and automation in sectors like medical and construction are designed to prevent accidents and eliminate any undesirable consequences.

- The automotive industry has undergone various changes over the past few years, integrating technological advancements into multiple types of vehicles. Previously, cars were mechanical, mostly with basic electrical systems that offered power for headlights and spark plugs. As technology progressed, vehicles were now equipped with advanced safety purposes, such as airbag deployment systems.

- The increase in these sensor-dependent features has driven engineers to develop more accurate sensors with automotive applications in mind. The industry's adoption of functional safety is predicted to increase due to these trends. It will enable automakers to react faster to market requirements, reduce manufacturing downtimes, enhance supply chains' efficiency, and expand productivity.

- The widespread use of modern vehicles powered by automotive electronic control units (ECU) has necessitated sophisticated safety measures. The process of functional safety has grown to be crucial to the process of developing ECU software. To reduce risks and damage in software or hardware failures, functional safety schemes for automobiles help diagnose malfunctions (electric and electronic) and specify the actions and procedures to be used.

- Electrification and automation are the two significant trends in the automotive sector. The emergence of electric vehicles in the industry has dramatically impacted the demand for sensors in the long term. More electric cars mean increased demand for sensors and a rise in sensors for applications, such as battery monitoring, various positioning, and detection of moving parts of automobiles.

- The automotive industry is among the prominent sectors that hold a significant share of the world's automated manufacturing facilities. In 2022, the ranking of the world's largest car brands was topped by Toyota, with a maarket share of around 11.5 percent. The production facilities of various automakers are automated to maintain efficiency. The growing trend of replacing conventional vehicles with electric vehicles (EVs) is expected to augment the automotive industry's demand further.

North America Expected to Hold Significant Market Share

- The United States is one of the largest markets for functional safety systems globally. The country is renowned for its innovation capabilities and is at the forefront of significant developments surrounding the emerging technologies of the 4th Industrial Revolution. Newfound shale resources in the United States and an increasing number of oil and gas projects are additional indicators of market potential. Prominent vendors such as Honeywell International, Rockwell Automation, Banner Engineering Corp, and General Electric are headquartered in the country.

- The government is also focusing on increasing its energy generation capacity and is investing in such projects. For instance, in October 2022, the US Department of Energy (DOE) announced that the Idaho National Laboratory (INL) would receive USD 150 million in financing from the President's Inflation Reduction Act to modernize its infrastructure and advance nuclear energy research and development. The funding will help almost a dozen projects at INL's Advanced Test Reactor (ATR) and Materials Fuels Complex (MFC), both of which have been in operation for more than 50 years and play a critical role in developing nuclear technologies for governmental organizations, business, and global collaborations. With nuclear energy accounting for approximately 5% of domestic electricity production and 50% of all domestic clean energy production, it is essential to achieving President Biden's target of 100% clean electricity by 2035.

- Furthermore, in October 2022, the United States Department of Energy (DOE) announced more than USD 28 million across three funding opportunities to support research and development initiatives that promote and sustain hydropower as a crucial source of clean energy.

- The expansion of low-impact hydropower and pumped storage hydropower, the construction of new pumped storage hydropower facilities, and engagement with influential voices on issues like hydropower fleet modernization, sustainability, and environmental impacts will all be supported by funding provided by Bipartisan Infrastructure Law. Such initiatives of power-generating project investments certainly increase the demand for functional safety devices in the country.

- According to the Government of Canada, the Canadian manufacturing industry accounts for approximately CAD 174 billion of its GDP, representing more than 10% of the country's total GDP. The manufacturing sector is the largest investor in R&D and implements new technologies that are expected to create scope for the market.

Functional Safety Industry Overview

The functional safety market is characterized by several prominent global players competing in a fairly competitive landscape. Key contenders in this market include Rockwell Automation Inc., Emerson Electric Company, and Honeywell International Inc. These market players are actively working on enhancing their competitive edge through various strategies, including product innovation. As a result, the competitive rivalry within the market is anticipated to remain intense.

In October 2022, Emerson made a significant move by launching its PlantWeb digital ecosystem. This innovative ecosystem integrates the AspenTech portfolio of asset-optimizing software, which harnesses the power of industrial artificial intelligence. This strategic move positions Emerson as a leader in the industry, offering one of the most comprehensive digital transformation portfolios available.

In September 2022, Yokogawa Electric Corporation acquired Votiva Singapore Pte Ltd, a prominent Southeast Asian IT consultancy specializing in the deployment of enterprise resource planning (ERP) and customer relationship management (CRM) software. Yokogawa relies on ERP systems as a core component of its solutions designed to support smart manufacturing and digital transformation (DX) for customers in the manufacturing industry. With this acquisition, Yokogawa gains the ability to expand its geographic reach in Southeast Asia, offering enhanced consulting, implementation, and technical support services for ERP solutions in the region. As a result of this transaction, Votiva Singapore Pte Ltd will be rebranded as Yokogawa Votiva Solutions, solidifying Yokogawa's presence and influence in the Southeast Asian market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Standards of Industrial Safety

- 5.1.2 Increasing Adoption of Functional Safety Systems in Industries

- 5.2 Market Restraints

- 5.2.1 Increasing Complexity, High Initial Costs and Maintenance Costs

6 MARKET SEGMENTATION

- 6.1 Device Type

- 6.1.1 Safety Sensors

- 6.1.2 Safety Controllers/Modules/Relays

- 6.1.3 Safety Switches

- 6.1.4 Programmable Safety Systems

- 6.1.5 Emergency Stop Devices

- 6.1.6 Final Control Elements (Valves, Actuators)

- 6.1.7 Other Device Types

- 6.2 Safety Systems

- 6.2.1 Burner Management Systems (BMS)

- 6.2.2 Turbomachinery Control (TMC) Systems

- 6.2.3 High-Integrity Pressure Protection Systems (HIPPS)

- 6.2.4 Fire and Gas Monitoring Control Systems

- 6.2.5 Emergency Shutdown Systems (ESD)

- 6.2.6 Supervisory Control and Data Acquisition (SCADA) Systems

- 6.2.7 Distributed Control Systems (DCS)

- 6.3 End-user Industry

- 6.3.1 Oil and Gas

- 6.3.2 Power Generation

- 6.3.3 Food and Beverage

- 6.3.4 Pharmaceutical

- 6.3.5 Automotive

- 6.3.6 Other End-user Industries

- 6.4 Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Rockwell Automation Inc.

- 7.1.2 Emerson Electric Company

- 7.1.3 Honeywell International Inc.

- 7.1.4 Yokogawa Electric Corporation

- 7.1.5 ABB Ltd

- 7.1.6 Schneider Electric SE

- 7.1.7 Siemens AG

- 7.1.8 General Electric Company

- 7.1.9 Omron Corporation

- 7.1.10 SICK AG

- 7.1.11 Panasonic Industry Europe GmbH (Panasonic Corporation)

- 7.1.12 Pepperl+Fuchs

- 7.1.13 Banner Engineering Corporation