|

市场调查报告书

商品编码

1405369

林业机械:市场占有率分析、产业趋势与统计、2024-2029 年成长预测Forestry Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

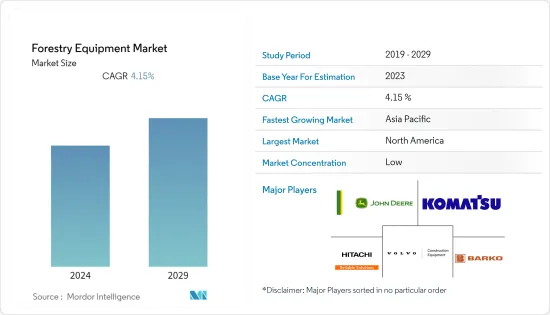

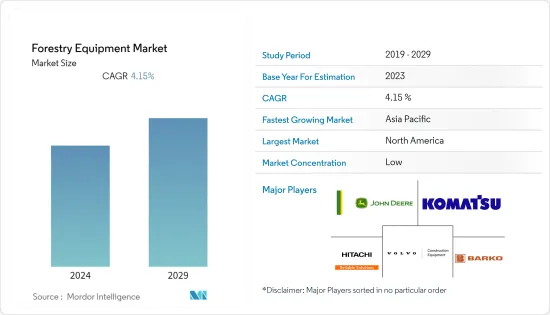

预测期内,林业机械市场预计将从 105.9 亿美元成长至 129.8 亿美元,复合年增长率为 4.15%。

已开发国家和新兴国家的森林保护和管理意识不断增强,以及从手工林业工作向机械化和自动化的转变,推动了市场的成长。

主要亮点

- 在目前的林业范围内,森林管理的角色是规划和实施森林管理和利用实践,以实现特定的环境、经济、社会和文化目标,并且正在迅速扩大。管理目标各不相同,包括保护森林和自然保护区的资源保护,但主要目标往往是木製品的生产。森林管理的基本理念是注重木材生产和“永续采伐”,即在不消耗森林资本的情况下采伐增量木材。

- 健康的森林依赖健康的林产品工业,而林产品工业得到了政府大量投资的支持。例如,2023年4月,美国政府宣布从拜登总统的两党基础设施法案中拨款3,370万美元,用于加强木製品经济并促进永续森林管理。这项投资支持復原力强、健康的森林与林业部门强大的农村经济和就业之间的关键联繫,特别是在依赖国家森林和草原生长和繁荣的社区。

- 此外,在拉丁美洲,林业在恢復历史悠久的大西洋森林的繁荣方面所发挥的作用越来越受到关注,这些森林曾经覆盖巴西、巴拉圭和阿根廷的大片地区。但五个世纪的伐木、农业扩张以及圣保罗和里约热内卢等城市的不断发展使其支离破碎。因此,30多年来,各种组织一直致力于保护和恢復遗迹。据联合国称,约70万公顷土地已恢復,目标是到2030年保护和恢復100万公顷,到2050年保护和恢復1500万公顷。因此,拉丁美洲林业维护活动的增加预计将推动对大型林业机械的需求。

- 然而,高成本和缺乏与林业机械相关的意识预计将减缓市场成长。由于缺乏有关该设备的信息,它尚未在开发中国家普及。

- COVID-19大流行的影响减弱后,建筑和林业机械的需求迅速恢復。预计未来几年需求将持续稳定成长。在良好的经济活动和基础设施计划的推动下,北美的需求尤其保持强劲。南美市场受到初级产品领域活跃活动的支撑。

林业机械市场趋势

削片机和研磨机成为最大的现场加工设备领域

- 林业设备市场的现场加工设备部分预计在预测期内将显着成长。这是由于用作发电厂原料的木质颗粒产量增加。

- 削片机是一种将木材变成木片的机器。与研磨机不同,它们根据设备设定产生尺寸均匀的切屑。在林业工业中,削片机生产用于纸浆木材、颗粒、猪燃料、形势和任何其他需要均匀木片的应用的材料。削片机有多种配置,其典型特征包括进料机构、一组旋转刀、砧座和排放滑槽。

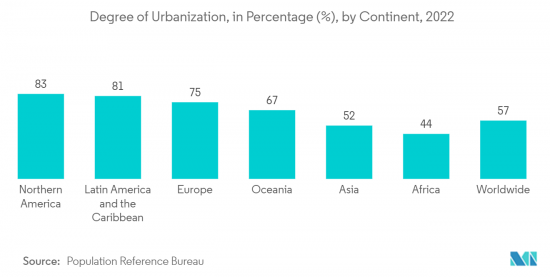

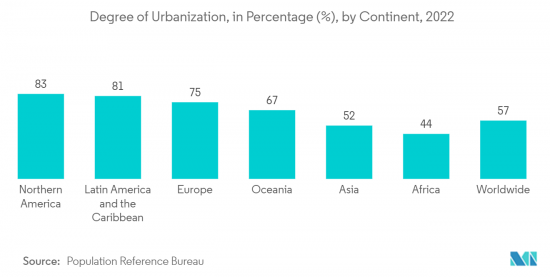

- 林业削片机由提供大规模伐木服务的伐木承包使用。许多企业依靠这些削片机有效地将大树变成木片。世界快速的都市化摧毁了大片林地,为削片机的使用创造了许多机会。根据人口研究所预测,2022年全球都市化率为57%。北美是都市化程度最高的地区,达 83%。

- 此外,种植园已成为木材能源生产的主要贡献者,预计未来还会增加。为促进可再生能源发电厂而增加的投资预计将促进木栈板的製造,从而推动对削片机和研磨机的需求。由于森林是木质颗粒的一级资讯来源,森林面积的扩大可能会导致削片机需求激增。

北美占最大市场占有率

- 预计北美在预测期内将出现强劲增长,这主要是由于售后市场销售的增加和向改进的伐木技术的转变。

- 根据美国农业部统计,美国林产品产业约占美国製造业国内生产总值(GDP)总额的4%,每年生产价值超过2,000亿美元的产品。该地区目前木材开采活动激增,木材和非木材林产品的开采量不断扩大,为林业机械製造商提供了扩大产品供应的机会。

- 在建筑设计中越来越多地使用散装木材,导緻美国的森林管理实践值得称讚。因此,对木材产品(包括纸张和生物质能)的需求将会激增,导致对装载机、覆盖机和其他现场设备等各种林业机械的需求增加,以促进该地区林业工业的木材采伐。是期待。

- 林业是加拿大最重要的产业,对经济和就业做出了重大贡献。林产品总价值每年超过 380 亿加元(325 亿美元),占所有製成品的 10%。此外,加拿大是木材开采和生产的领先国家之一,导致了大规模的伐木作业。

- 例如,2022 年末,美国北卡罗来纳州伊登顿 52 英亩的原始森林被清除,用于伐木和伐木,以生产用于生质能源的木质颗粒。根据能源资讯管理局 (EIA) 的数据,2021 年美国生产了约 175 亿加仑生质燃料,消耗了约 168 亿加仑。随着生质能源能源发电需求的不断增加,木质颗粒的需求也预计将大幅成长,为林业机械创造应用机会。

林业机械行业概况

林业机械市场高度分散,主要参与者包括迪尔公司、日本小松公司公司、沃尔沃建筑设备公司(AB沃尔沃)、日立建机(HCM)和巴科液压有限责任公司。市场参与者正在采取合作伙伴关係和收购等策略来增强其产品供应并获得永续的竞争优势。

- 2023 年 5 月 -日本小松公司推出日本小松公司951XC,这是一款用于在陡坡和鬆软地面上进行最终切割的收割机。 8轮设计与稳定的日本小松公司概念结合,提供稳定性、高效的机动性和低接地压力。日本小松公司951XC 也与日本小松公司C164 结合进行了优化,小松 C164 是专门为砍伐大树而设计的收割机头。此外,静液压传动有利于充分利用引擎动力,在困难地形和高爬坡能力上具有显着优势。

- 2023 年 2 月 - 迪尔公司为其履带/木材装载机产品线推出了新的中型型号。约翰迪尔的新型 2956G 专为各种规模的伐木承包而设计,他们正在寻找一台能够提供发动机马力和液压功能的最佳组合,同时将机器重量保持在90,000 磅以下的机器。这是理想的解决方案。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 产业价值链分析

- COVID-19 和宏观经济趋势对产业的影响

第五章市场动态

- 市场驱动因素

- 自动化程度的提高推动了林业机械的需求

- 伐木公司更换过时且低效的林业机械

- 市场抑制因素

- 林业机械高成本

- 缺乏林业机械资讯

第六章市场区隔

- 依产品类型

- 伐木设备

- 电锯

- 收割机

- 伐木归堆机

- 伐木机

- 货运代理

- 集材机

- 其他提取设备

- 现场处理设备

- 削片机和研磨机

- 德林弗·鸫

- 其他现场加工机械

- 其他林业机械

- 装载机

- 覆盖机

- 其他林业机械

- 选购零件/附件

- 锯链、导桿、圆盘、齿

- 收割机和其他切割头

- 其他零件/附件

- 伐木设备

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争形势

- 公司简介

- Deere and Company

- Komatsu Ltd.

- Volvo CE(AB Volvo)

- Hitachi Construction Machinery Co. Ltd.(HCM)

- Barko Hydraulics LLC.

- Develon(HD Hyundai Infracore)

- Kesla Oyj

- Ponsse Oyj

- Rottne Industri AB.

- Eco Log Sweden AB

- Mahindra Group

- AGCO Corporation

- Caterpillar Inc.

- Kubota Corporation

- Bell Equipment Limited

第八章投资分析

第9章市场的未来

The forestry equipment market is expected to grow from USD 10.59 billion to USD 12.98 billion over the forecast period, registering a CAGR of 4.15%.

The market is growing owing to the rising awareness about forest preservation and management in several developed and developing countries and the transition in forestry operations from manual work to mechanized and automated modes of operation in forests.

Key Highlights

- With the present scope in the forest industry, the role of forest management has been growing rampantly with the aim of planning and implementing practices for the stewardship and use of forests to meet specific environmental, economic, social, and cultural objectives. While the objectives of management vary widely and include the protection of resources in protected forests and nature reserves, the primary objective has often been the production of wood products. A basic tenet of forest management has been a significant focus on wood production, which is 'sustained yield,' or harvesting the wood increment without drawing down on the forest capital.

- This has been largely supported by significant government investment as healthy forests depend on a healthy forest products industry. For instance, in April 2023, the US government announced USD 33.7 million from President Biden's Bipartisan Infrastructure Law for projecting funds to strengthen the wood products economy and promote sustainable forest management. This investment supports a crucial link between resilient, healthy forests and strong rural economies and jobs in the forestry sector, especially in communities that depend on national forests and grasslands to grow and thrive.

- In addition to this, the role of forestry is gaining prominence in Latin America to bring back the historic flourishing Atlantic Forest that once covered a vast swath of Brazil, Paraguay, and Argentina. But five centuries of logging, agricultural expansion, and the relentless growth of cities like Sao Paulo and Rio de Janeiro reduced it to fragments. Thus, various organizations have been working for more than three decades to preserve and restore what remains. As per the UN, approximately 700,000 ha of land have already been restored, and the goal is to protect and revive 1 million ha by 2030 and 15 million ha by 2050, an area bigger than all of Nepal, Greece, or Nicaragua. Thus, the increase in forestry maintenance activities in Latin America is expected to propel the demand for large forestry machines.

- However, the high cost and lack of awareness associated with forestry equipment is expected to slow down the growth of the market. Due to the lack of information about the equipment, the adoption is still not widespread in developing countries.

- The market saw a rapid recovery in demand for construction and forestry equipment following a decline in the impacts of the COVID-19 pandemic. The demand is expected to show a favorable increase in the upcoming years as well. Notably, demand in North America continued to be robust, driven by good economic activity and infrastructure projects. The South American market was supported by high activity in the commodity segment.

Forestry Equipment Market Trends

Chippers and Grinders to be the Largest On-site Processing Equipment Segment

- The on-site processing equipment segment within the forestry equipment market is projected to experience substantial growth throughout the forecast period. This can be attributed to the escalating production of wood pellets utilized as feedstock for power plants.

- Chippers are machines that can reduce trees into wood chips. They are distinct from grinders in that they generate chips of uniform size, contingent upon the equipment settings. Within the forestry industry, chippers produce material for pulpwood, pellets, hog fuel, landscaping, and any other application that necessitates uniform chips. Chippers are available in a diverse range of configurations, and their typical features comprise a feed mechanism, a set of rotating knives, an anvil, and a discharge chute.

- Lean clearing contractors employ forestry chippers and those providing large-scale tree-clearing services. Many contractors rely on these chippers to effectively reduce large trees into wood chips. Rapid urbanization worldwide destroyed vast forested areas, creating numerous opportunities for using chippers. According to the Population Reference Bureau, worldwide urbanization was 57% in 2022. North America registered the highest degree of urbanization, with 83%.

- Furthermore, it is anticipated that forest plantations may emerge as significant contributors to the production of wood energy, with a projected increase in the future. Escalating investments in promoting renewable power plants are expected to boost the manufacture of wooden pallets, thereby driving the demand for chippers and grinders. Since forests are the primary source of wooden pellets, expanding forest areas is likely to result in a surge in chipper demand.

North America Holds Largest Market Share

- North America is anticipated to experience significant growth during the projected period, primarily due to the rising aftermarket sales and the shift toward modified cut-to-length logging techniques in the region.

- As per the United States Department of Agriculture, the forest products industry in the United States contributes to roughly 4% of the nation's overall manufacturing Gross Domestic Product (GDP), generating an excess of USD 200 billion in products annually. The area is currently experiencing a surge in timber extraction activities, and the escalating extraction of both timber and Non-timber forestry products is anticipated to present opportunities for Forestry equipment manufacturers to augment their product offerings.

- The escalating use of mass timber in architectural design is propelling commendable forest management practices in the United States. The consequent surge in demand for wood products, including paper and biomass for energy, is anticipated to stimulate the need for various forestry equipment, such as loaders, mulchers, and other on-site equipment, to facilitate timber harvesting in the region's forest industry.

- Canada's foremost industry is forestry, with significant economic and employment contributions. Forest products' total worth surpasses CAD 38000 million (USD 32500 million) annually, representing 10% of all manufactured goods. Additionally, Canada ranks among the leading nations in timber extraction and production, resulting in extensive logging operations.

- For instance, in late 2022, a 52-acre indigenous woodland located in Edenton, North Carolina, United States, was subjected to clear-cutting for the purposes of timber harvesting and the chipping of whole trees to produce wood pellets for bioenergy. According to the Energy Information Administration (EIA), approximately 17.5 billion gallons of biofuels were manufactured in the United States in 2021, with approximately 16.8 billion gallons being consumed. As the demand for bioenergy generation continues to increase, the requirement for wood pellets is expected to escalate significantly, thereby creating opportunities for the application of forestry equipment.

Forestry Equipment Industry Overview

The forestry equipment market is highly fragmented, with the presence of major players like Deere and Company, Komatsu Ltd., Volvo CE (AB Volvo), Hitachi Construction Machinery Co. Ltd. (HCM), and Barko Hydraulics LLC. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- May 2023 - Komatsu launched the Komatsu 951XC, a harvester for final logging in steep terrain and on soft ground. The eight-wheel design, integrated with the stable Komatsu concept, ensures a machine with stability, efficient maneuverability, and low ground pressure. The Komatsu 951XC is also optimized with the Komatsu C164 - a harvester head specially designed for logging large trees. Further, the hydrostatic transmission facilitates engine power to be utilized entirely, providing considerable advantages in difficult terrain and enhanced climbing ability.

- February 2023 - Deere and Company introduces a new mid-size model to its line-up of crawler log loaders. It is designed for logging contractors of all sizes; John Deere's new 2956G is an ideal solution for customers looking for a machine that provides the best combination of engine horsepower and hydraulics capability while maintaining a machine weight of less than 90,000 lbs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 and Macro Economic Trends on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Automation to Boost the Forestry Equipment Demand

- 5.1.2 Replacement of Older, Less Productive Forestry Machinery by Logging Firms

- 5.2 Market Restraints

- 5.2.1 High Cost of Forestry Equipment

- 5.2.2 Lack of Information About Forestry Equipment

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Felling Equipment

- 6.1.1.1 Chainsaws

- 6.1.1.2 Harvesters

- 6.1.1.3 Feller Bunchers

- 6.1.2 Extracting Equipment

- 6.1.2.1 Forwarders

- 6.1.2.2 Skidders

- 6.1.2.3 Other Extracting Equipment

- 6.1.3 On-Site Processing Equipment

- 6.1.3.1 Chippers and Grinders

- 6.1.3.2 Delimbers and Slashers

- 6.1.3.3 Other On-Site Processing Equipment

- 6.1.4 Other Forestry Equipment

- 6.1.4.1 Loaders

- 6.1.4.2 Mulchers

- 6.1.4.3 Other Forestry Equipment

- 6.1.5 Separately Sold Parts and Attachments

- 6.1.5.1 Saw Chain, Guide Bars, Discs, and Teeth

- 6.1.5.2 Harvesting and Other Cutting Heads

- 6.1.5.3 Other Parts and Attachments

- 6.1.1 Felling Equipment

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia Pacific

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Deere and Company

- 7.1.2 Komatsu Ltd.

- 7.1.3 Volvo CE (AB Volvo)

- 7.1.4 Hitachi Construction Machinery Co. Ltd. (HCM)

- 7.1.5 Barko Hydraulics LLC.

- 7.1.6 Develon (HD Hyundai Infracore)

- 7.1.7 Kesla Oyj

- 7.1.8 Ponsse Oyj

- 7.1.9 Rottne Industri AB.

- 7.1.10 Eco Log Sweden AB

- 7.1.11 Mahindra Group

- 7.1.12 AGCO Corporation

- 7.1.13 Caterpillar Inc.

- 7.1.14 Kubota Corporation

- 7.1.15 Bell Equipment Limited