|

市场调查报告书

商品编码

1406195

连网型汽车与停车产业:市场占有率分析、产业趋势与统计、2024-2029 年成长预测Connected Vehicle And Parking Space Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

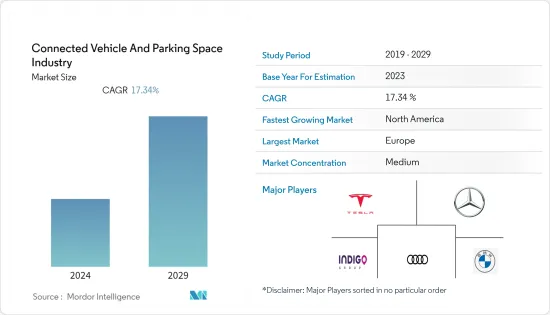

连网型汽车和停车产业的市场规模目前为 530.1 亿美元,预计未来五年将成长至 1,455.5 亿美元,预测期内收益复合年增长率为 17.34%。我是。

从长远来看,连网型汽车的发展正在不断进步。预计这将是一项巨大的技术进步,将使汽车能够与周围环境进行通讯。从拥有汽车转向更多行动相关服务的趋势将持续加速。汽车数量预计将大幅下降,尤其是在都市区。德国ADAC汽车协会预计,到2040年,私家车的普及将下降近30%。

同时,停车场产业也在一些国家逐渐受到关注。这主要是由于停车产业(包括路外停车和路内停车)变化缓慢。根据PYMTS.com的最新研究,美国有超过4000个车库和路边停车场,其中大部分由商业房地产开发商、REITs和一些城市拥有。该公司也表示,主要城市30%以上的交通量是为了寻找停车位而产生的。

市场上配备最新安全和舒适功能(例如 ADAS(高级驾驶员辅助系统)和汽车资讯娱乐系统)的车辆数量显着增加。此外,为了满足乘客舒适度和安全意识的提高,增加具有整合 ADAS 功能的车辆产量,以及政府法律规章强制执行安全措施,预计将推动市场需求。此外,自动驾驶和自动驾驶车辆的接受度不断提高也有助于市场扩张,使得市场在预测期内可能会大幅成长。

连网型汽车和停车产业市场趋势

连网型汽车市场预计将大幅成长

小型小客车对 ADAS(高级驾驶辅助系统)的需求不断增长,预计将成为市场成长的动力。政府对车辆安装 ADAS 的法律规章不断加强,预计将进一步提振需求。

可支配收入的增加、经济的稳定以及对物质生活方式的日益偏好正在推动豪华车的销售。大多数豪华车车主居住在美国、加拿大、日本、西班牙和韩国。然而,近年来,印度和中国开发中国家的豪华车销售量激增。

由于摄影机和雷达的普及,人们对车辆安全评估意识的提高以及零件价格的下降可能是 ADAS 行业的重要驱动力。主要汽车製造商正在实施 ADAS 系统,以提高安全评级并吸引更多客户。领先的汽车製造商已开始扩大产能,以满足未来连网型汽车的需求。

- 2022年11月,BMW宣布投资超过10亿欧元(10.6亿美元)在匈牙利兴建新的汽车製造工厂。这些扩张预计将推动全球汽车惯性系统市场的需求。

- 2022年5月,Toyota 连网型 North America发布了座舱辨识概念技术。它使用毫米波解析度4D 成像雷达来侦测车内的乘员(包括某些宠物)。

- 2022年1月,Volvo汽车集团(Volvo汽车)推出了改良SUV XC60 T8插电式混合和轿车S90 T8插电式混合。配备前后停车辅助系统,车距增加至前车约80cm,后车距约1.5m。

鑑于全球范围内的上述发展,预计在预测期内将出现显着增长。

欧洲预计将占据停车场产业最大的市场占有率

欧洲的智慧城市计划预计将提供增强的行动解决方案,以减少污染、拥塞、乘客寻找停车位的时间并提高可及性。

欧盟 (EU) 认为,数位化与适当的政治策略相结合将提高停车效率并创造新的停车服务,以更好地服务于城市的永续城市交通计划(SUMP)。它表示这是其产品的主要支柱。

动态定价是该地区大多数停车提供者提供的持续定价策略。动态定价是许多行业(例如航空公司和酒店)的标准做法。为了让停车更方便,这些提供者正在审查停车政策并更新分区法规,以指导和鼓励清洁、以流动性为导向的开发。

欧洲各国政府规范土地和其他资源的使用,并强调这些资源的有效利用。例如,荷兰政府推出了考虑区域土地利用的空间规划法。

过去十年来,停车领域引入了多项技术创新,包括动态资讯系统、用于搜寻、支付和预订的行动应用程式、自动车牌识别(AMPR)系统、感测器和付费停车摄影机。奥斯陆(挪威)和马德里(西班牙)等城市最近针对路内和路内停车推出了动态定价模型。

车连网型及停车产业产业概况

几家主要企业主导着连网型车辆和停车产业,包括宝马集团、梅赛德斯-奔驰集团、特斯拉公司和 Indigo 集团。由于进入市场所需的投资成本较高,市场进入障碍较高。市场主要企业最近的主要发展包括:例如,类似:

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 对汽车先进舒适系统的需求不断增长

- 市场抑制因素

- 高级功能带来的高成本

- 波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔(市场规模)

- 按车型

- 小客车

- 商用车

- 按停车类别

- 街外

- 在街上

- 按停车位

- 住宅和商务用私人土地

- 不受监管的公共访问

- 室外护栏规定

- 路边停车规定

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 亚太地区其他地区

- 世界其他地区

- 南美洲

- 中东/非洲

- 北美洲

第六章竞争形势

- 公司简介

- Connected Car Vendors

- BMW AG

- Audi AG

- Mercedes-Benz AG

- Tesla Inc.

- Volkswagen AG

- Hyundai Motor Company

- Honda Motor Company

- Parking Space Providers

- GROUP Indigo

- Amano Inc

- Swarco AG

- Q-Free ASA

- Wohr Parking Systems Pvt. Ltd

第七章 市场机会及未来趋势

The connected vehicles and packing space market is valued at USD 53.01 billion in the current year and is expected to grow to USD 145.55 billion by the next five years, registering a CAGR of 17.34% in terms of revenue during the forecast period.

Over the long term, the development of connected vehicles is taking place. It is expected to be a huge technological advancement that will allow vehicles to communicate with their surroundings. It will further fuel the trend from car ownership to more mobility-related services. In urban areas, particularly, the decline in the number of vehicles is expected to reduce dramatically. According to the ADAC automobile association in Germany, the adoption of a private car to decline by close to 30% by 2040.

At the same time, the parking industry is also slowly gaining traction across several countries. It is mainly due to the slow-changing nature of the parking industry, which includes both on-street as well as off-street parking. According to the latest survey by PYMTS.com, there are more than 4,000 garages and surface parking lots in the United States, and commercial real estate developers own most of this property to REITs and even some cities. Also, the company stated that over 30% of the traffic in the major cities is created in search of parking space.

The integration of modern safety and comfort features in vehicles, such as advanced driver assistance systems, vehicle infotainment, and many others, is increasing significantly in the market. Additionally, increased production of automobiles with integrated ADAS features in response to increased passenger comfort and safety awareness, as well as government legislation mandating safety measures, are expected to drive market demand. Furthermore, the growing acceptance of self-driving or automated vehicles contributes to the market's expansion, which in turn is likely to witness major growth for the market during the forecast period.

Connected Vehicle And Parking Space Industry Market Trends

Connected Passenger Car Vehicle Market is Expected to Grow Significantly

The increasing demand for advanced driver assistance systems (ADAS) in small passenger vehicles is expected to drive market growth. Increased government legislation mandating the installation of ADAS in automobiles is expected to drive up demand even more.

Increased disposable income, economic stability, and a growing preference for materialistic lifestyles are driving sales of luxury automobiles. The vast majority of luxury automobile owners resided in the United States, Canada, Japan, Spain, and South Korea. However, sales of luxury automobiles in developing countries such as India and China increased steeply in recent years.

Increased awareness of vehicle safety ratings, as well as lower component prices due to the widespread use of cameras and radars, will be important growth drivers for the ADAS industry. Major automakers are implementing ADAS systems to improve safety ratings and attract more customers. Major automakers began expanding their production capacity to meet future demand for connected vehicles. For instance,

- In November 2022, BMW declared an investment of over EUR 1 billion (USD 1.06 billion) for building a new car manufacturing facility in Hungary. These expansions are expected to fuel the demand for the global automotive inertial systems market.

- In May 2022, Toyota Connected North America introduced cabin awareness concept technology. It uses millimeter-wave, high-resolution 4D imaging radar to detect occupants (including certain pets) in automobiles.

- In January 2022, Volvo Car Group (Volvo Cars) launched the upgraded XC60 T8 plug-in hybrid SUV and S90 T8 plug-in hybrid sedan. The cars are equipped with Front & Rear Park Assist, where the distance monitored extends approx. 80 cm (2.5 ft) in front and 1.5 m (5 ft) behind the vehicle.

- In August 2021, Robert Bosch GmbH collaborated with Mahindra & Mahindra to develop a connected vehicle platform. This collaboration helps to expand and improve the linked platform in automobiles.

With the development mentioned above across the globe, it is likely to witness major growth during the forecast period.

Europe is Expected to Hold the Largest Market Share in Parking Industry

The smart city projects in Europe are looking forward to enhanced mobility solutions to reduce pollution, congestion, and time for passengers in search of parking spaces and improve accessibility.

The European Union mentioned that digitization and working in tandem with appropriate political strategies are the main pillars for improving parking efficiency and offering new parking services to serve better cities' Sustainable Urban Mobility Plans (SUMP).

Dynamic pricing is one of the ongoing pricing strategies offered by most of the parking space providers in the region. Dynamic pricing is the standard practice in many industries, e.g., in the airline and hotel industry. To make parking space easily available, these providers are revamping parking policies and updating zoning rules to induce and encourage clean, mobility-oriented developments.

The European government regulates the use of its land and other resources and emphasizes better utilization of these resources. For instance, the government of the Netherlands introduced the Spatial Planning Act, which looks at the land use in the region.

Over the past ten years, the parking sector experienced the introduction of several technological innovations, such as dynamic information systems, mobile apps to find, pay, and reserve, automated number plate recognition (ANPR) systems, sensors, and cameras for paid parking. Oslo (Norway) and Madrid (Spain) are some of the cities that recently commenced both on-street and off-street parking with a dynamic pricing model.

Connected Vehicle And Parking Space Industry Industry Overview

Several key players, such as BMW Group, Mercedes-Benz Group AG, Tesla Inc., Indigo Group, and others, dominate the connected vehicles and parking space industry. Due to the high investment cost needed to enter the market, there is a high barrier to entry in the market. Some of the recent developments made by key players in the market are as follows. For instance,

- In February 2022, BMW launched the i4, an all-electric four-door sports sedan. The i4 comes with the standard feature of a parking assistant program that employs ultrasonic sensors to help the driver select and use parking spaces that are either parallel or perpendicular to the road.

- In February 2022, Nvidia and Jaguar Land Rover announced a partnership to develop software-defined features to improve automated driving in their vehicle from 2025. The emphasis is on AI-based features, including advanced visualization and driver and occupant monitoring through the Drive IX software.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise in demand for Advanced Comfort Systems In Vehicles

- 4.3 Market Restraints

- 4.3.1 High Cost Assoicated with Advanced Features

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value (USD))

- 5.1 By Vehicle Type

- 5.1.1 Passenger Car

- 5.1.2 Commercial Vehicles

- 5.2 By Parking Category

- 5.2.1 Off-Street

- 5.2.2 On-Street

- 5.3 By Parking Space

- 5.3.1 Residential and Work Private Property

- 5.3.2 Non-regulated Public Access

- 5.3.3 Off-street open-air barrier regulated

- 5.3.4 Off-street purpose built regulated

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Spain

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.2 Connected Car Vendors

- 6.2.1 BMW AG

- 6.2.2 Audi AG

- 6.2.3 Mercedes-Benz AG

- 6.2.4 Tesla Inc.

- 6.2.5 Volkswagen AG

- 6.2.6 Hyundai Motor Company

- 6.2.7 Honda Motor Company

- 6.3 Parking Space Providers

- 6.3.1 GROUP Indigo

- 6.3.2 Amano Inc

- 6.3.3 Swarco AG

- 6.3.4 Q-Free ASA

- 6.3.5 Wohr Parking Systems Pvt. Ltd