|

市场调查报告书

商品编码

1406575

人工智慧-市场占有率分析、产业趋势与统计、2024年至2029年成长预测Artificial Intelligence - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

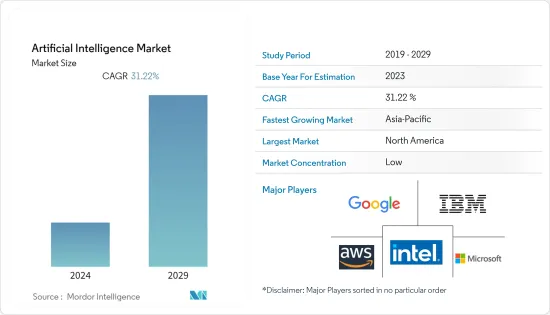

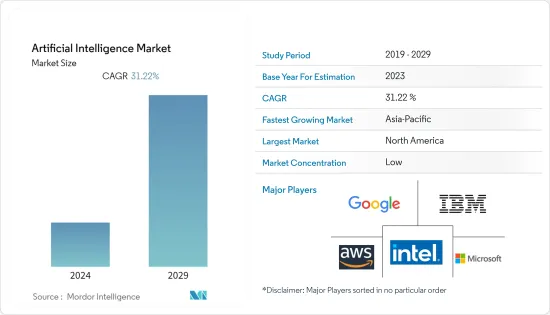

预计人工智慧市场在预测期内的复合年增长率将达到31.22%。

主要亮点

- 人工智慧 (AI),特别是电脑视觉和机器学习 (ML),正在彻底改变产业形势。随着深度学习和资料驱动人工智慧的突破,人工智慧市场正在全球扩张,而机器人获得自主权以在全球市场竞争的需求正在推动对人工智慧产品和服务的需求,预计采用将会加速。

- 近年来,数位科技和网路的使用不断扩大,大大促进了全球人工智慧产业的扩张。各产业的技术突破不断受到高科技巨头大规模研发投入的推动。

- 基于人工智慧的机器学习技术的预测分析解决方案的扩展预计将在预测期内推动人工智慧市场的发展。世界各地的许多最终用户公司利用预测模型进行工业规划和成长。

- 随着互联网的普及和新技术的扩散,全球创建的资料量正在急剧增加。物联网、工业4.0和5G等技术正在推动人工智慧的发展。巨量资料是技术突破所产生的资料大幅增加的结果。

- COVID-19 对市场产生了重大影响。虽然一些行业的人工智慧采用率有所增加,但其他行业的采用率却有所下降。 COVID-19 的灾难为企业高管提供了有关数位转型的重要见解。最引人注目的收穫之一是资料分析和人工智慧可以为业务带来的潜力。

- 例如,人工智慧使公共部门能够将流程、人员和服务带到网路上,促使地方、区域和国家政府采用人工智慧。在短短几个月内,世界各国政府已经学会将人工智慧作为抗病毒的武器。这包括公共教育和患者筛检,以追踪和追踪接触者。

- 无论是 IT 问题、人力资源请求还是有关公司支出政策的问题,员工都需要立即获得帮助,以便透过「在任何地方工作」的能力来提高工作效率。传统服务台不再具备为混合员工提供 24/7 即时协助的规模或速度。服务台通常平均需要三个工作天才能解决员工问题,从而降低了参与度和工作效率。为了解决这些问题,2022 年 7 月,塔塔咨询服务公司 (TCS) 宣布与 MoveWorks 建立合作伙伴关係。该人工智慧平台透过随时查询员工的需求,提供无缝的多语言支援。此类措施预计将提振数位转型的需求,并有助于后 COVID-19 场景下的市场成长。

人工智慧市场趋势

越来越多地采用云端基础的应用程式和服务来推动市场成长

- 云端基础的解决方案是当今数位环境的重要组成部分。多重云端营运的成长趋势以及对云端基础的智慧服务不断增长的需求正在推动所研究市场的需求。现代人工智慧(AI)技术正在为云端处理付加独特的价值并不断提升其价值。方面对于提高整体製程可行性和采用新技术是必要的。

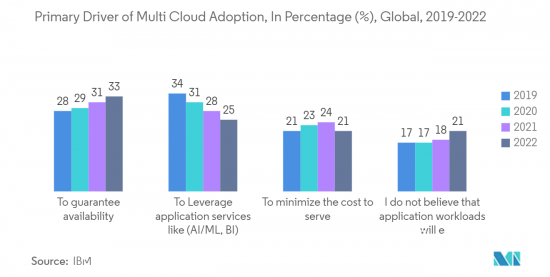

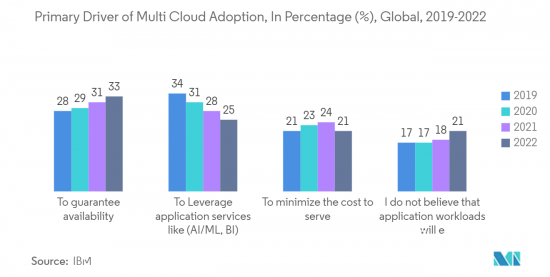

- 人工智慧软体还可以帮助弥合云端处理和最新突破之间的差距。它还有助于满足新企业和新兴企业的需求。据 IBM 称,到 2022 年,25% 的受访者将使用多重云端来利用各种应用服务,包括 AI/ML、巨量资料分析、商业智慧和物联网。

- 持续营运和基础设施需求正在推动对混合运算模型的需求,这些模型可实现长期成本节约、安全性和可扩展性。为了扩展和管理 IT,企业越来越多地投资于跨越私有、公有和边缘环境的混合云端部署模式。例如,2023年2月,Oracle宣布将在沙乌地阿拉伯建立第三个公共云端,以满足快速成长的云端服务需求。位于利雅德的新云端区域是Oracle 15 亿美元投资计画的一部分,该计画旨在增强其在该国的云端基础设施能力。

- 分析先驱 SAS 与 Moro Hub 合作,利用 Moro Hub 领先的云端服务为杜拜企业提供基于人工智慧的解决方案,并加速其数位转型之旅。 2022 年 7 月,SAS 宣布与 Moro Hub 合作,Moro Hub 是杜拜水电局数位部门 Digital Dewa 的一个部门。作为新安排的一部分,SAS 将在单一平台上采用 Moro Hub 的多种云端服务,使其资料管理产品更加敏捷、扩充性和安全。

- 此外,由于扩充性、提高生产力和降低成本等优势,云端方法在金融服务、电子商务和工业等各个行业中越来越受欢迎。

- 云端运算在外包 3D 原型、组件和产品的 3D 列印等应用中的使用正在迅速扩大。 3D 列印製造商的新平台也在推动云端扩展。金属和碳纤维 3D 列印机製造商 Markforged 最近发布了工业 3D 列印软体平台 Digital Forge。该平台旨在连接目前全球运作的数千个 Markforged 系统。

北美占最大市场占有率

- 美国拥有来自世界各地的顶尖科学家和企业家,拥有加速北美人工智慧(AI)发展的着名研究中心,以及联邦政府对最尖端科技的战略投资。支持性创新生态系统。

- 该产业预计将受益于美国政府多项与人工智慧相关的倡议。例如,2022年12月,美国国家科学基金会宣布,美国农业部(USDA)、美国国防安全保障部科技局(US DHSTD)、美国国家标准与技术研究院(NIST)、美国国家标准技术研究院(美国)美国食品与农业研究所 (NIFA) 与美国国防部 (US DoD) 研究与技术副部长办公室合作启动了「透过第二部分进行能力建设和扩展人工智慧创新」计划。透过能力建构计划以及 NSF主导的国家人工智慧研究机构生态系统内的合作,ExpandAIseeks 将增加为人工智慧教育、研究和劳动力发展领域服务于代表性不足群体的机构的参与度。我们的目标是显着增加这一点。

- 此外,美国正在努力正式製定国家人工智慧(AI)倡议,该计划将促进可信赖的人工智慧、加强人工智慧创新、利用新技术加强现有基础设施、透过人工智慧改善教育和培训,重点是六大战略支柱:开发新的机会,加速人工智慧在私营和联邦部门的使用,以改善现有系统,并培育支持人工智慧进一步发展的全球环境。

- 此外,2022年4月,美国商务部和国家标准研究院(NIST)将开展首次国家人工智慧咨询,任务是就如何推进国家人工智慧管治工作向拜登政府提供建议。 (NAIAC)已宣布。

- 此外,公共和私营部门参与多个行业人工智慧技术的开发和使用预计将支持加拿大对人工智慧不断增长的需求。例如,2022 年 4 月,一家总部位于渥太华的公司透过人工智慧驱动的类人会议助理提高了虚拟会议的效率。 Uncanny Lab Ltd. 的 Blue Cap 技术改善了主持人和嘉宾的会议。该公司整合的音讯会议平台包括 Google Meets 和 Zoom。自动会议录音、回顾影片和简洁的会议摘要是会议助理的一些基本功能。

- 由于加拿大顶尖的研究人员、充满活力的新兴企业、开放的移民规则、慷慨的研发税收补贴以及进入国际市场的机会,像Google、Facebook 和Uber 这样的大公司在加拿大大量运营。我们建立了核心实验室,与世界上的机构。加拿大政府透过加拿大高等研究院 (CIFAR) 正在资助多项倡议,以展示加拿大在人工智慧领域的领导地位。

人工智慧产业概况

人工智慧市场高度分散,主要参与者包括 IBM 公司、英特尔公司、微软公司、Google有限责任公司(Alphabet Inc.)和亚马逊网路服务公司等。市场参与者正在采取合作伙伴关係、创新、併购和收购等策略来增强产品供应并获得永续的竞争优势。

2022 年 7 月 NBFC 主要 HDFC 週二宣布与领先的客户关係管理 (CRM) 平台销售团队建立合作伙伴关係,以支持其发展重点。 HDFC 表示,Mulesoft 创新的 API主导整合方法和低程式码整合功能透过连接系统实现快速创新,协助创造新体验。

2022 年 7 月,SAS 和 Basserah 合作,为沙乌地阿拉伯的企业提供尖端的资料分析和人工智慧解决方案。透过这种合作关係,两家公司都专注于资料和机器人流程自动化,以便在沙乌地阿拉伯王国寻求成长机会。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 技术简介

- 机器学习

- 电脑视觉

- 自然语言处理(NLP)

- 上下文感知计算和其他技术

第五章市场动态

- 市场驱动因素

- 对预测分析解决方案的需求不断增长

- 由于技术进步,资料生成显着增加

- 越来越多地采用云端基础的应用程式和服务

- 改善消费者体验的需求不断增长

- 市场挑战

- 对高初始成本和劳动替代的担忧

- 缺乏熟练的人工智慧工程师

- 资料隐私问题

- 主要使用案例/应用

- 销售和行销

- 物流管理

- 自动化客户服务

- 威胁情报自动化

- IT自动化等

- COVID-19 对市场的影响

第六章市场区隔

- 按成分

- 硬体

- 软体和服务

- 按最终用户产业

- BFSI

- 时尚/零售

- 医疗保健/生命科学

- 製造业

- 车

- 航太/国防

- 建造

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 拉丁美洲

- 中东/非洲

- 北美洲

第七章 竞争形势

- 公司简介

- IBM Corporation

- Intel Corporation

- Microsoft Corporation

- Google LLC(Alphabet Inc.)

- Amazon Web Services Inc.(amazon.com Inc.)

- Oracle Corporation

- Salesforce Inc.

- SAP SE

- SAS Institute Inc.

- Cisco Systems Inc.

- Siemens AG

- Nvidia Corporation

- Hewlett Packard Enterprise

第八章投资分析

第九章 市场机会及未来趋势

The artificial intelligence market is expected to register a CAGR of 31.22% during the forecast period.

Key Highlights

- Artificial intelligence (AI), particularly computer vision and machine learning (ML), is transforming the landscape of industries. The artificial intelligence market is expanding globally due to breakthroughs in deep learning and data-driven AI, and the necessity to acquire robotic autonomy to compete in a global market is projected to promote the adoption of AI products and services.

- In recent years, the growing use of digital technologies and the Internet considerably aided the expansion of the worldwide AI industry. Technology breakthroughs in a variety of industries are constantly being fueled by the large research and development investments made by tech giants.

- The expansion of predictive analytics solutions based on AI-based ML technology is expected to boost the artificial intelligence market over the forecast period. Many end-user firms are using predictive modeling worldwide for industry planning and growth.

- With increased Internet penetration and new technology, there is a tremendous increase in the amount of data created globally. AI is being encouraged by technologies such as the Internet of Things, Industry 4.0, 5G, and others. Big data is the outcome of a massive increase in data created due to technological breakthroughs.

- COVID-19 significantly impacted the market. While certain industries witnessed an increase in AI adoption, others witnessed a decline. The Covid-19 debacle provided critical insights about digital transformation for company executives. One of the most compelling takeaways was the potential that data analytics and AI bring to a business.

- For example, AI enables the public sector to bring processes, people, and services online and encourages local, regional, and national governments to adopt AI. In only a few months, governments throughout the globe have learned to employ artificial intelligence as a weapon in combating the virus. This includes educating the public and screening patients to track and trace contacts.

- Employees need rapid assistance to be productive with the move to "work from anywhere," whether they have an IT problem, an HR request, or a question regarding the company's expenditure policy. Due to a lack of size or speed, traditional service desks can no longer provide round-the-clock assistance in real time to a hybrid workforce. Service desks often resolve employee issues in an average of three working days, which lowers engagement and productivity. To address these problems, in July 2022, Tata Consultancy Services (TCS) announced a partnership with Moveworks. This AI platform offers employees seamless multilingual support by querying their needs at any moment. Such initiatives are projected to boost the demand for digital transformation and help market growth in the post-COVID-19 scenario.

Artificial Intelligence Market Trends

Growth in Adoption of Cloud-based Applications and Services Drives the Market Growth

- Cloud-based solutions are an essential component of today's digital environment. The expanding trend of multi-cloud operation and the growing need for cloud-based intelligence services drive the demand in the market under study. The latest artificial intelligence (AI) technologies add unique and increased value to cloud computing. This aspect improves overall process viability and is necessary for incorporating new technology.

- AI software can also help bridge the gap between cloud computing and modern breakthroughs. It also assists in satisfying the needs of new enterprises and startups. According to IBM, In 2022, 25 percent of respondents said they were using multi-cloud to leverage different application services like AI/ML, big data analytics, business intelligence, IoT, etc.

- The continuous operations and infrastructure requirement raises the demand for hybrid computing models to reduce long-term costs, security, and scalability. To extend and manage IT, investment in hybrid public cloud deployment models that span private, public, and edge environments has flourished. For example, in February 2023, Oracle announced it would establish a third public cloud in Saudi Arabia to address the fast-expanding demand for its cloud services. The new cloud region, located in Riyadh, is part of Oracle's projected USD 1.5 billion investment to increase cloud infrastructure capabilities in the country.

- SAS, a pioneer in analytics, entered into an arrangement with Moro Hub to leverage Moro Hub's superior cloud services to strengthen its AI-based solutions for businesses in Dubai and accelerate its journey toward digital transformation. SAS announced cooperation with Moro Hub, a branch of Dubai Electricity and Water Authority's digital arm, Digital Dewa, in July 2022 to accomplish this. As part of the new arrangement, SAS will employ Moro Hub's multiple cloud services on a single platform to increase its data management products' agility, scalability, and security.

- Furthermore, due to its benefits, such as scalability, increased productivity, and cost reduction, the cloud method is gaining popularity in a variety of industries, such as financial services, e-commerce, industrial, and others.

- The use of cloud computing to power applications, such as 3D printing for outsourcing 3D prototypes, components, and products, is rapidly expanding. New platforms from 3D printing makers are also assisting cloud expansion. Markforged, a metal and carbon fiber 3D printer maker, recently introduced Digital Forge, an industrial 3D printing software platform. The platform is intended to connect all of the Markforged systems now in operation worldwide, which number in the thousands.

North America Holds Largest Market Share

- The United States has a robust innovation ecosystem supported by strategic federal investments in cutting-edge technology, in addition to the presence of forward-thinking scientists and entrepreneurs who come together from around the world and renowned research centers that have accelerated the development of artificial intelligence (AI) in the North American region.

- The industry is anticipated to benefit from many US government initiatives related to AI. For instance, the Expanding AI Innovation through Capacity Building and Part II program was launched by the US National Science Foundation in December 2022 in coordination with the US Department of Agriculture (USDA), the US Department of Homeland Security, the Science and Technology Directorate (US DHSTD), the National Institute of Standards and Technology (NIST), National Institute of Food and Agriculture (NIFA), and the US Department of Defense (US DoD), Office of the Under Secretary of Defense for Research and Engineering. Through capacity-building projects and collaboration within the NSF-led National AI Research Institutes ecosystem, ExpandAIseeks to significantly increase the participation of institutions that serve underrepresented groups in artificial intelligence education, research, and workforce development.

- Moreover, the United States has been working to formalize the National Artificial Intelligence (AI) Initiative, which concentrates on six strategic pillars: advancing trustworthy AI, enhancing AI innovation, enhancing current infrastructure through new technologies, developing new opportunities for education and training through AI, facilitating private and federal sector utilization of AI to improve current systems, and fostering an international environment that supports further advancements in AI.

- Further, in April 2022, the US Department of Commerce and the National Institute on Standards (NIST) announced members of the inaugural National Artificial Intelligence Advisory Committee (NAIAC) tasked with advising the Biden administration on how to proceed with the national AI governance efforts.

- The inclusion of the public and private sectors in the development and use of AI technology across several industries is also anticipated to support Canada's expanding need for AI. For example, in April 2022, an Ottawa-based business enhanced the effectiveness of virtual meetings with its AI-powered, human-like meeting assistant. Uncanny Lab Ltd.'s bluecap technology improves meetings for hosts and guests. Platforms for teleconferencing that the firm integrates with include Google Meets and Zoom. Automatic meeting transcriptions, review films, and succinct meeting summaries are among its fundamental capabilities that serve as a meeting assistant.

- Major corporations like Google, Facebook, and Uber have established core research laboratories that work with numerous institutions all over Canada thanks to the country's top researchers, vibrant start-ups, open immigration rules, considerable tax subsidies for R&D, and access to international markets. The Canadian government finances several initiatives to demonstrate Canada's leadership in AI through the Canadian Institute for Advanced Research (CIFAR).

Artificial Intelligence Industry Overview

The artificial intelligence market is highly fragmented, with the presence of major players like IBM Corporation, Intel Corporation, Microsoft Corporation, Google LLC (Alphabet Inc.), and Amazon Web Services Inc. Players in the market are adopting strategies such as partnerships, innovations, mergers, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In July 2022, NBFC-giant HDFC on Tuesday announced its partnership with the leading customer relationship management (CRM) platform, Salesforce, to support its growth priorities. HDFC stated that Mulesoft's innovative API-led integration approach and low code integration capabilities would help the company innovate quickly around connecting systems and help create new experiences.

In July 2022, SAS and Basserah partnered to deliver leading data analytics and AI solutions to Saudi businesses. With this partnership, both companies are focusing on data and robotics process automation for growth opportunities in the Kingdom of Saudi Arabia.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.3.1 Machine Learning

- 4.3.2 Computer Vision

- 4.3.3 Natural Language Processing (NLP)

- 4.3.4 Context-aware Computing and Other Technologies

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Predictive Analytics Solutions

- 5.1.2 Massive Growth in Data Generation due to Technological Advancements

- 5.1.3 Growth in Adoption of Cloud-based Applications and Services

- 5.1.4 Rising Demand for Enhanced Consumer Experience

- 5.2 Market Challenges

- 5.2.1 High Initial Costs and Concerns over Replacement of Human Workforce

- 5.2.2 Lack of Skilled and Expert AI Technicians

- 5.2.3 Concerns Regarding Data Privacy

- 5.3 Key Use-cases/Applications

- 5.3.1 Sales and Marketing

- 5.3.2 Logistics Management

- 5.3.3 Automated Customer Service

- 5.3.4 Automated Threat Intelligence

- 5.3.5 IT Automation, Among Others

- 5.4 Impact of COVID-19 on the Market

6 MARKET SEGMENTATION

- 6.1 By Components

- 6.1.1 Hardware

- 6.1.2 Software and Services

- 6.2 By End-user Industry

- 6.2.1 BFSI

- 6.2.2 Fashion and Retail

- 6.2.3 Healthcare and Lifesciences

- 6.2.4 Manufacturing

- 6.2.5 Automotive

- 6.2.6 Aerospace and Defense

- 6.2.7 Construction

- 6.2.8 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 South Korea

- 6.3.3.5 Rest of Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Intel Corporation

- 7.1.3 Microsoft Corporation

- 7.1.4 Google LLC (Alphabet Inc.)

- 7.1.5 Amazon Web Services Inc. (amazon.com Inc.)

- 7.1.6 Oracle Corporation

- 7.1.7 Salesforce Inc.

- 7.1.8 SAP SE

- 7.1.9 SAS Institute Inc.

- 7.1.10 Cisco Systems Inc.

- 7.1.11 Siemens AG

- 7.1.12 Nvidia Corporation

- 7.1.13 Hewlett Packard Enterprise