|

市场调查报告书

商品编码

1690889

仓库自动化-市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Warehouse Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

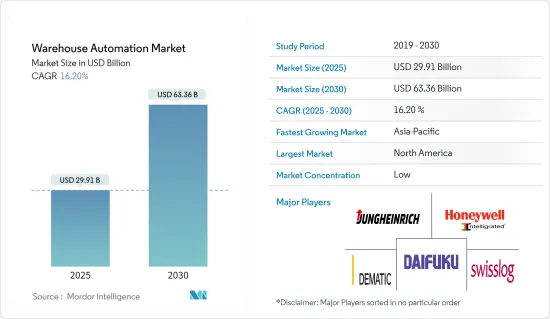

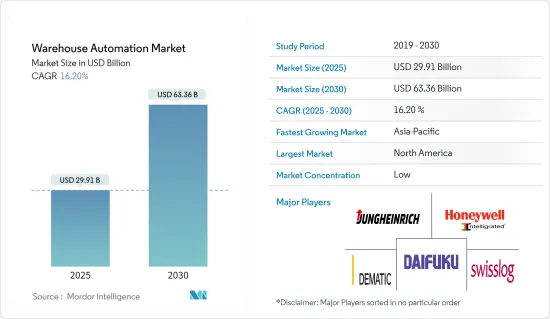

2025 年仓库自动化市场规模估计为 299.1 亿美元,预计到 2030 年将达到 633.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 16.2%。

关键亮点

- 物流自动化是指使用控制系统、机器和软体来提高业务效率。这通常适用于必须在仓库或配送中心进行且需要最少人工干预的流程。自动化物流的好处包括改善客户服务、可扩展性和速度、组织控制和减少错误。

- 仓库自动化可以在最少的人工协助下自动完成库存进出仓库、在仓库内以及从仓库到客户的移动。作为自动化计划的一部分,公司可以消除涉及重复体力劳动或手动资料输入和分析的劳动密集型业务。

- 此外,全球电子商务行业的成长以及对高效仓储和库存管理日益增长的需求正在推动市场研究。仓库管理自动化对于降低整体业务成本和减少产品交付错误非常有用。据着名的第三方物流公司和仓库自动化解决方案的重要终端用户 DHL 称,儘管有这些好处,但 80% 的仓库「仍然在没有任何自动化支援的情况下手动操作」。此外,使用输送机、分类机和取放解决方案的仓库占所有仓库的 15%。同时,目前只有 5% 的仓库实现了自动化。

- 不可预测的需求以及供应链缺乏透明度和协作对许多製造商实现其业务目标构成了重大障碍。然而,希望製造商能够评估复杂性的来源并优化仓库管理,以有效应对波动的需求,同时提高其供应链的可视性。

- 同样,虽然仓库管理系统 (WMS) 可以提高工作流程效率、减少错误、节省与错误相关的成本并缩短订单履行的周转时间,但对于电子商务企业来说,操作 WMS 可能会耗时且成本高昂。运行 WMS 需要大量的前期硬体成本、大量的培训以及额外的每月维护成本。

仓库自动化市场趋势

零售业大幅成长

- 仓库自动化应用于各种零售业,包括电子商务和杂货。仓库自动化具有多种好处,从提高生产力到降低劳动力相关风险。电子商务仓库自动化包括在物流设施中实施技术以提高业务绩效。根据美国商务部人口普查局的数据,2022 年电子商务销售总额为 1.341 兆美元,比 2021 年成长 7.7%(+-0.4%)。 2022 年零售总额较 2021 年成长 8.1%(+-0.9%)。

- 为了满足这一巨大的需求,仓库自动化(将手动仓库转换为自动化履约业务)正在迅速扩展,这对于满足大量客户需求同时控制未来营运成本至关重要。许多零售商现在都转向仓库自动化解决方案,以应对电子商务物流业务日益增长的规模和复杂性,并更快、更经济地满足不断增长的客户需求。

- 零售仓库可以采用各种自动化解决方案来完成任何任务,从自动处理设备到储存货物,再到最大限度组织库存的数位系统。领先的零售商正在使用自动导引车 (AGV) 和自主移动机器人 (AMR) 与工人一起工作,以简化其电子商务和全通路设施中的履约业务。

- 此外,为了满足快速扩张的电子商务领域的需求并吸取全球疫情的教训,领先的零售商正在努力提高其仓库的响应能力、弹性和可靠性。例如,2022 年 4 月,亚马逊推出了亚马逊工业创新基金 (AIIF),这是一项 10 亿美元的新兴企业资金筹措计划,专注于自动化和职场机器人技术,以「刺激供应链、履约和物流的创新」。

预计亚太地区将占很大份额

- 由于亚太地区产业数量的增加及其与自动化的整合以提高投资收益(ROI),该地区的仓库自动化市场正在大幅扩张。由于自动化产品的生产、销售和贸易不断增加,预计亚太地区的仓库自动化将由中国主导。

- 此外,中国政府计划根据「中国製造2025」国家计划,将中国从製造业大国转变为全球製造业强国,因此仓库自动化产业预计将受益于中国在製造业领域的主导地位。该计划还包括加强中国机器人供应商的力量,并进一步扩大国内外市场占有率。

- 仓库自动化的需求包括自动化供应链,并得到有利投资的进一步支持。目前,该国正在探索多项投资以进一步促进市场成长,主要主要企业正在向该地区扩张,创业投资公司也正在向有前景的新兴企业投入资金。

- 製造业也已成为印度高成长领域之一。例如,「印度製造」计画使印度成为世界重要的製造地,并让印度经济获得了全球认可。 「印度製造」宣传活动推动了印度推出多款新型工业机器人,为仓库自动化带来了机会。

仓库自动化产业概况

仓库自动化市场竞争激烈。该市场的一些主要全球参与企业包括 Dematic Group、Daifuku Co.Ltd.、Swisslog Holding AG、Honeywell Intelligrated 和 Jungheinrich AG。产品发布、收购和伙伴关係是仓库自动化产业市场参与企业采用的关键策略。

2023年1月,永恆力股份公司收购了美国领先的货架和仓库自动化解决方案提供商印第安纳州的Storage Solutions集团,以加强其在美国仓库自动化市场的地位。

2022 年 9 月,Dematic 与 Upshopto 合作推出一项将与杂货业共同成长的综合履约服务。此次合作将为希望扩大其履约业务的杂货商提供储存和管理消费者资料的工具。 Dematic 正在分享他们的自动化经验,使用简单的软体连接到您目前的 Upshop 流程。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 买家的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 产业价值链分析

- COVID-19 工业影响评估

- 仓库投资场景

- 宏观经济因素对仓库自动化市场的影响

第五章市场动态

- 市场驱动因素

- 电子商务行业的快速成长和客户期望

- 製造复杂性和技术可用性不断提高

- 市场问题

- 高资本投入

第六章市场区隔

- 按组件

- 硬体

- 移动机器人(AGV、AMR)

- 自动储存和搜寻系统(AS/RS)

- 自动输送机和分类系统

- 卸垛/码垛系统

- 自动识别资料收集(AIDC)

- 拣选机器人

- 软体(仓库管理系统(WMS)、仓库执行系统(WES))

- 服务(附加价值服务、维护等)

- 硬体

- 按最终用户

- 食品和饮料(包括製造设施和配送中心)

- 邮政和小包裹

- 零售

- 服饰

- 製造业(耐久财/非耐久财)

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章竞争格局

- 公司简介

- Dematic Group(Kion Group AG)

- Daifuku Co. Limited

- Swisslog Holding AG(KUKA AG)

- Honeywell Intelligrated(Honeywell International Inc.)

- Jungheinrich AG

- Murata Machinery Ltd

- Knapp AG

- TGW Logistics Group GmbH

- Kardex Group

- Mecalux SA

- BEUMER Group GmbH & Co. KG

- SSI Schaefer AG

- Vanderlande Industries BV

- WITRON Logistik+Informatik GmbH

- Oracle Corporation

- One Network Enterprises Inc.

- SAP SE

第八章投资分析

第九章:市场的未来

The Warehouse Automation Market size is estimated at USD 29.91 billion in 2025, and is expected to reach USD 63.36 billion by 2030, at a CAGR of 16.2% during the forecast period (2025-2030).

Key Highlights

- Automation in logistics refers to using control systems, machinery, and software to enhance the efficiency of operations. It usually applies to the processes that must be performed in a warehouse or distribution center, which requires minimal human intervention. Some benefits of automation logistics are improved customer service, scalability and speed, organizational control, and reduction of mistakes, among others.

- Warehouse automation automates inventory movement into, within, and out of warehouses to customers with minimal human assistance. As part of an automation project, a business can eliminate labor-intensive duties that involve repetitive physical work and manual data entry and analysis.

- Moreover, the growth in the e-commerce industry worldwide and the growing need for efficient warehousing and inventory management are driving the market studied. Automation in warehousing offers extreme convenience when cutting down overall business costs and reducing errors in product deliveries. According to DHL, a prominent 3PL company and a significant end-user of warehouse automation solutions, despite the advantages, 80% of warehouses are 'still manually operated with no supporting automation.' Furthermore, warehouses, i.e., those that use conveyors, sorters, and pick and place solutions, account for 15% of the entire warehouses. In contrast, only 5% of current warehouses are automated.

- Unpredictable demand and a lack of transparency and collaboration with the supply chain present a significant barrier to reaching business goals for many manufacturers. However, when manufacturers evaluate the sources of complexity and optimize warehouse management, they are expected to efficiently meet variable demand while increasing their view of the supply chain.

- Similarly, while warehouse management systems (WMS) can improve workflow efficiency, reduce errors, save on costs associated with errors, and get faster turn-around time for order fulfillment, running a WMS can be time-consuming and expensive for an e-commerce business. It requires huge upfront costs for hardware, extensive training, and additional monthly costs for upkeep.

Warehouse Automation Market Trends

Retail to Have a Significant Growth

- Warehouse automation is used in various retail activities, including e-commerce and grocery. For warehouses, automation has multiple advantages, from boosting production to lowering labor-related risks. E-commerce warehouse automation consists of implementing technologies in logistics facilities to boost operational performance. According to the Census Bureau of the Department of Commerce, Total e-commerce sales for 2022 were USD 1,034.1 billion, an increase of 7.7 percent (+-0.4%) from 2021. Total retail sales in 2022 increased by 8.1 percent (+-0.9%) from 2021.

- To address this massive demand, warehouse automation is rapidly expanding to transform manual warehouses into automated fulfillment operations, which are proving vital to meeting customer demand at scale while managing operating costs in the future. Currently, many retailers are increasingly implementing warehouse automation solutions that seek to handle the growing scale and complexity of their e-commerce logistics operations and meet the ever-increasing demand of their customers more quickly and cost-effectively.

- A retail warehouse can be outfitted with various automated solutions to carry out all tasks, from automatic handling equipment for storing products to digital systems that maximize product organization. Big retailers are utilizing automated guided vehicles (AGVs) and the next level of automation-automated mobile robots (AMRs)-working alongside workers to simplify the fulfillment operations of their e-commerce and omnichannel facilities.

- Moreover, to meet the rapidly expanding e-commerce sector and consider the lessons learned from the worldwide pandemic, leading retailers strive to make warehouses responsive, resilient, and dependable. For instance, in April 2022, Amazon established the Amazon Industrial Innovation Fund (AIIF), a USD 1 billion startup funding program that will be used to "spur supply chain, fulfillment, and logistics innovation," focusing on automation and workplace robotics.

Asia-Pacific is Expected to Hold Significant Share

- The market for warehouse automation in the Asia-Pacific is expanding significantly due to the rising number of industries in the region and their integration with automation to increase the return on investment (ROI). The Asia-Pacific warehouse automation is predicted to be dominated by China with the growing production, sales, and trade of automation products.

- Moreover, The warehouse automation industry is expected to benefit from China's dominance in the manufacturing sector as the Chinese government plans to transform China from a manufacturing giant to a global manufacturing power under the national plan "Made in China 2025". This plan includes strengthening Chinese robot suppliers and further surging their market shares in China and abroad.

- The demand for warehouse automation includes an automated supply chain, further supported by favorable investments. The country has been marked with several investments to further the market's growth studied, with major key players expanding into the region and introducing funds by venture capitalists in emerging start-ups with potential.

- Manufacturing has emerged as one of the high-growth sectors in India as well. For instance, the Make in India program places India on the world map as a significant manufacturing hub and provides global recognition to the Indian economy. The Made in India campaign has bolstered multiple new launches in industrial robots in the country, thus driving opportunities for warehouse automation.

Warehouse Automation Industry Overview

The warehouse automation market is highly competitive. Some key global players in this market are Dematic Group, Daifuku Co. Limited, Swisslog Holding AG, Honeywell Intelligrated, and Jungheinrich AG. Product launch, acquisition, and partnership are key strategies market players operating in the warehouse automation industry adopt.

In January 2023, JungheinrichAG acquired Indiana-based Storage Solutions group, a leading provider of racking and warehouse automation solutions in the United States, to gain enhanced access to the US warehousing and automation market.

In September 2022, Dematic partnered with Upshopto to offer integrated fulfillment services that grow with the grocery industry. With the help of the alliance, grocery stores wishing to expand their fulfillment businesses will have access to tools that let them store and manage their consumer data. Dematic will offer its experience in automation along with simple software to connect with current Upshop processes.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Industry

- 4.5 Warehouse Investment Scenario

- 4.6 Impact of Macro-economic Factors on the Warehouse Automation Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Exponential Growth of the E-commerce Industry and Customer Expectation

- 5.1.2 Increasing Manufacturing Complexity and Technology Availability

- 5.2 Market Challenges

- 5.2.1 High Capital Investment

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.1.1 Mobile Robots (AGV, AMR)

- 6.1.1.2 Automated Storage and Retrieval Systems (AS/RS)

- 6.1.1.3 Automated Conveyor & Sorting Systems

- 6.1.1.4 De-palletizing/Palletizing Systems

- 6.1.1.5 Automatic Identification and Data Collection (AIDC)

- 6.1.1.6 Piece Picking Robots

- 6.1.2 Software (Warehouse Management Systems(WMS), Warehouse Execution Systems (WES))

- 6.1.3 Services (Value Added Services, Maintenance, etc.)

- 6.1.1 Hardware

- 6.2 By End-User

- 6.2.1 Food and Beverage (Including Manufacturing Facilities and Distribution Centers)

- 6.2.2 Post and Parcel

- 6.2.3 Retail

- 6.2.4 Apparel

- 6.2.5 Manufacturing (Durable and Non-Durable)

- 6.2.6 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Dematic Group (Kion Group AG)

- 7.1.2 Daifuku Co. Limited

- 7.1.3 Swisslog Holding AG (KUKA AG)

- 7.1.4 Honeywell Intelligrated (Honeywell International Inc.)

- 7.1.5 Jungheinrich AG

- 7.1.6 Murata Machinery Ltd

- 7.1.7 Knapp AG

- 7.1.8 TGW Logistics Group GmbH

- 7.1.9 Kardex Group

- 7.1.10 Mecalux SA

- 7.1.11 BEUMER Group GmbH & Co. KG

- 7.1.12 SSI Schaefer AG

- 7.1.13 Vanderlande Industries BV

- 7.1.14 WITRON Logistik + Informatik GmbH

- 7.1.15 Oracle Corporation

- 7.1.16 One Network Enterprises Inc.

- 7.1.17 SAP SE