|

市场调查报告书

商品编码

1407057

办公室和客服中心耳机:市场占有率分析、行业趋势与统计、2024-2029 年成长预测Office And Contact Center Headset - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

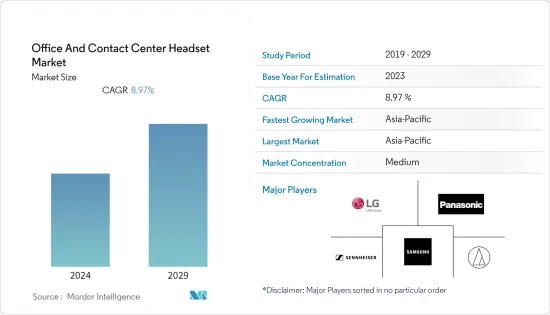

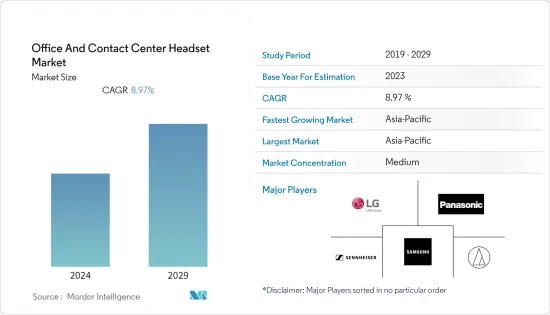

上年度办公室和客服中心耳机市场价值为 25.6 亿美元,预计未来五年将达到 42.8 亿美元,预测期内复合年增长率为 8.97%。

对智慧型手机、平板电脑和笔记型电脑等电子产品的需求激增正在推动耳机市场的发展。线上串流媒体正在加速耳机在家庭中的使用。对高品质音讯和更好的声音接收的需求使其成为用户的首选。

主要亮点

- 由于客户服务中心(主要在新兴国家)的增加以及一流耳机市场的扩大,办公室和客服中心耳机的销售正在增加。对具有蓝牙、NFC 技术和触控控制功能的无线耳机的需求也很强劲。

- 包耳式耳机的多功能性、坚固性、轻盈性和不同颜色是消费者的首选品质,并且可能在预计的时限内进一步推动市场扩张。

- 此外,零售商正在采用耳机来更好地与第一线员工保持联繫。 Jabra 意识到无线耳机在商业上的效用,推出了一款耳机来帮助第一线员工保持联繫。该公司最新的 Jabra Perform 45 超降噪麦克风可消除高达 80% 的环境噪音,让同事能够听到彼此的声音。它还与一键通 (PTT) 按钮集成,无论员工在现场的哪个位置,都可以快速回应紧急问题并解决问题,从而提高员工的工作效率。

- 此外,在预测期内,对云端基础的互联网和视讯会议的需求预计将会增加。随着越来越多的人依靠音讯、视讯和网路会议定期与远端团队联繫,提供最佳音讯、最大限度减少迴声和环境声音并确保机密性耳机变得越来越重要。

- 2023 年 1 月,音讯推出了一款专用直播内容创作者打造的耳机。这些耳机采用麦克风设计,可在使用者移动头部时调整位置。麦克风透过灵活的吊臂放置在靠近使用者嘴部的位置,可减少背景噪音并产生清晰的音讯。

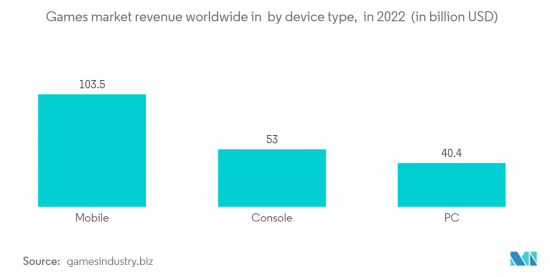

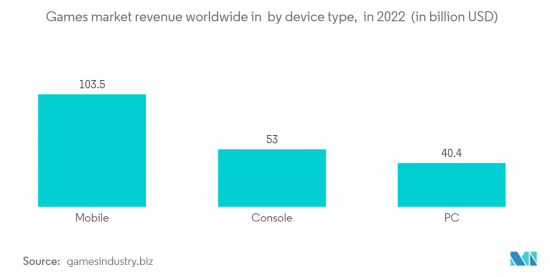

- 随着对游戏机、线上视讯串流、在家工作、数位学习平台等需求的增加,COVID- 大流行大流行极大地刺激了头盔的采用。需求强劲,消费者愿意花钱购买采用蓝牙和 ANC(主动降噪)等最新技术以及更易于携带的时尚设计的头盔。

- 随着消费者越来越精通技术,他们期待耳机能提供帮助他们有效率地执行多任务、清晰沟通和保持专注的功能。耳机製造商必须不断研究和分析客户使用这些通讯设备的行为,以开发具有最新技术和必要功能的产品,以满足业务需求。

办公室和客服中心耳机市场趋势

有线耳机占主要份额

- 切换到有线耳机后,使用无线耳机时可能发生的连线或蓝牙问题将降至最低。虽然蓝牙等技术支援数位讯号连接无线耳机,但有线耳机整合了类比讯号,可以处理更多资料并提供更好的音质。

- 全球耳机需求不断成长,预计到 2027 年将达到约 12.8 亿台。与无线耳机相比,使用者更喜欢价格实惠的有线耳机。成本很大程度取决于开发技术,但蓝牙型号和游戏耳机总是偏高。

- 儘管技术不断进步,蓝牙耳机有时仍会遇到烦人的问题,例如连线中断错误或即使在用户完成通话后仍会出现连线。有线耳机直接连接到您的设备,以实现平稳、持续的连接。

- 2023年2月,森海塞尔推出了IE 200有线耳机,该耳机具有自然频率响应曲线,几乎没有耳机常见的谐波失真,克服了传输不稳定和品质差的问题。该品牌还改进了编织电缆,以减少操作噪音。

- 此外,目前市场上推出的大多数安卓手机都没有耳机插孔,这增加了对Type C耳机的需求。因此,买家面临着在蓝牙耳机和USB Type-C耳机之间做出选择的两难。蓝牙耳机很棒。然而,由于它们是无线的,因此它们可能会被放错地方,并且不被大多数人所偏爱。

- 因此,一些公司专注于推出Type-C耳机,以获得更好的通讯和声音。例如,2022年8月,一加宣布将在印度推出升级版USB Type-C有线耳机。该耳塞与任何 Type-C USB 连接埠相容,并且可以轻鬆与 OnePlus 装置配对。用户还可以更改声音增强设定并享受更多客製化的声音。

- 此外,客服中心主要选择 UC 耳机和商务耳机,因为它们业务优势,例如提高员工工作效率和有效的客户沟通。

亚太地区可望维持市场主要成长

- 製造业是亚洲国家经济成长的重要推手。政府鼓励国际公司投资并将製造业务转移到亚太地区。到2023年,由于自由贸易协定、有效的供应链和实惠的价格,亚太地区预计将引领全球经济成长。

- 越南政府正在重点发展可以鼓励其他产业(尤其是製造业)扩张的服务业。在美国和中国之间的贸易紧张局势中,越南已成为商业投资的可行选择。越南希望采取措施加强本土企业的竞争和资金筹措,同时放宽对服务贸易和外国投资的限制。

- 印度政府正在推动「印度製造」计划,以加速国内製造。提高进口耳机、耳机、智慧型手錶等穿戴式装置的价格,以鼓励国内製造。在国际品牌利用 PLI 计画的同时,国内品牌也采取倡议扩大其产品製造组合。例如,印度穿戴新兴企业Boat每年生产超过1,000万件穿戴式产品。

- 此外,该地区对业务流程外包的强烈需求也推动了对商务用耳机的需求。目前,印度在该地区业务流程外包市场占有主导地位。印度的 BPO 产业十分成熟,管理大量初级和次级(非必要)业务。其中包括客户服务客服中心、IT 系统进步、 IT基础设施和技术支援。此类业务中音讯和视讯会议的激增正在推动商务用耳机的市场需求。

办公室和客服中心耳机产业概述

办公室和客服中心耳机市场规模不大,随着公司透过改进功能和创新理念加强产品系列有进一步增长的潜力。降噪、蓝牙连接和精确语音拾音是这些耳机公司长期以来在其产品中内建的功能。为了在市场上竞争,这些耳机品牌采用策略定价和最新技术。然而,该市场包括三星电子有限公司、LG电子、松下公司等。

2023 年 3 月,Mart Networks 选择 Jabra 为肯亚的远距工作人员开发视讯和耳机设备。 Jabra 主要为企业生产产品,并开发 Engage AI 等平台,协助客服中心座席增强和改善客户经验。该工具在通话期间提供即时情绪评分,帮助客户服务代理了解客户和代理商的情绪和参与程度。

2022 年 12 月,Netflix 与 Boat 签署协议,为 Netflix 推出该产品的串流版本。除了耳机之外,还包括颈带和TWS耳机。这款耳机配备主动降噪 (ANC) 功能,并采用折迭式设计。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- 产业价值链分析

- 评估 COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 在可预见的未来,远距工作预计仍将是主要趋势。

- 政府和医疗保健产业的需求不断增加

- 先进的噪音消除和向无线连接的转变预计将推动需求

- 市场挑战

- 具有现代功能的消费级耳机比专业级耳机更受青睐

- 由于短缺问题导致桌上型电话使用量减少

第六章市场区隔

- 按类型

- 办公室

- 客服中心

- 按连线类型

- 有线

- 无线的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 拉丁美洲

- 中东/非洲

- 北美洲

第七章竞争形势

- 主要供应商概况

- Samsung Electronics Co. Limited

- LG Electronics

- Panasonic Corporation

- Sennheiser electronic GmbH & Co. KG

- Audio-Technica Corporation

- Sony Corporation

- Plantronics, Inc.

- Jabra

第八章 投资场景

第九章市场展望

The Office and Contact Center Headset Market was valued at USD 2.56 billion in the previous year and is expected to register a CAGR of 8.97% during the forecast period to become USD 4.28 billion by the next five years.

The surge in demand for gadgets like smartphones, tablets, and laptops drives the headsets market. Online streaming has accelerated the use of headphones in homes. The need for high-quality audio for better sound reception is the top choice among users.

Key Highlights

- The increase in the number of customer service centers, specifically in emerging nations, and the expanding market for top-notch earphones have resulted in increasing sales of office and contact center headsets. There is also a significant desire for wireless headphones that come with Bluetooth and NFC technology and touch-sensitive controls.

- The versatility, sturdiness, and lightweight attributes of over-ear headphones, as well as their availability in different colors, are qualities that have made them preferred among consumers, which will further propel the expansion of the market in the projected timeframe.

- Moreover, retailers are adopting headsets for better connectivity with frontline workers. Recognizing the utility of wireless headsets in businesses, Jabra launched headsets for frontline workers to keep them connected. The ultra-noise-canceling microphone in the Jabra Perform 45, the latest edition from the company, can cancel out up to 80% of background noise, allowing Coworkers to hear each other. It is also integrated with a Push-to-talk (PTT) button to make workers more productive by enabling them to respond to any urgent questions and solve problems quickly no matter where the employees are on the shop floor.

- Furthermore, the need for cloud-based internet and video meetings is predicted to rise during the forecast period. As a greater number of people rely on audio, video, and web meetings to regularly connect with remote teams, the significance of headsets that deliver top-notch audio, minimize echoes and ambient sound, and ensure confidentiality is growing.

- In January 2023, Audio-Technica launched headsets exclusively for live-streaming content creators. The USP of these headsets is the microphone design that adjusts and allows positioning even as the user moves his head. The mic is placed close to the user's mouth by a flexible boom arm, which reduces background noise and produces clear audio.

- The COVID-19 pandemic significantly prompted the adoption of headgear as there was rising demand for gaming consoles, online video streaming, work-form home, and e-learning platforms. The demand is robust, and consumers are looking to spend on headgear embedded with the latest technologies like Bluetooth, ANC (active noise cancellation), and sleek design to make it more portable.

- As consumers get tech-savvy, they look forward to headsets that offer features to multitask efficiently, communicate clearly, and stay focused. The headset manufacturers should constantly research and analyze the customer behavior towards these communication devices and develop products with the latest technology and required features as per business needs.

Office And Contact Center Headset Market Trends

Wired Headsets to Hold Major Share

- Any potential connectivity or Bluetooth issues that occur while using wireless headphones are minimized after switching to wired headphones. While technology like Bluetooth supports digital signals that connect wireless headphones, the wired ones are integrated with analog signals that can handle more data and deliver excellent sound quality.

- The global headset demand is increasing and is expected to reach around 1.28 billion units by 2027. Users prefer wired headsets as they are more affordable than wireless ones. Although the cost largely depends on the technology that goes into developing them, Bluetooth models and gaming headset costs will always be on the upper side.

- Despite their technological advancements, Bluetooth headphones sometimes suffer from annoying issues like connection drop errors or showing connection even if the user completes a call. A wired headset gives smooth and continuous connectivity as it is directly plugged into the device.

- In February 2023, to overcome breaks in transmission and loss of quality, Sennheiser launched IE 200 wired earphones that feature a natural frequency response curve and virtually nonexistent harmonic distortion usually found in earphones. The brand has also improved the braided cable, which reduces handling noise.

- Moreover, these days, demand for type-C earphones is increasing as most Android phones are coming into the market without an earphone jack. This puts the purchasers in a dilemma, as they must choose between the numerous Bluetooth headphones or USB Type-C earphones. Bluetooth headphones are excellent. However, they are not favored by a majority of people, as they are cordless and, therefore, can be easily misplaced.

- Thus, several players are also focusing on introducing type C earphones for better communication and sound. For instance, in August 2022, OnePlus announced to introduce an upgraded USB Type-C wired earphones in India. These earphones are compatible with any Type-C USB port and pair easily with OnePlus devices. It will also allow users to modify the sound enhancement setting for a more customized sound.

- Furthermore, call centers are primarily choosing UC and business headsets due to the advantages they offer to their business operations, including enhanced employee productivity and effective client communication.

Asia-Pacific is Anticipated to Hold Major Market Growth

- Manufacturing is a crucial driver of economic growth for Asian countries. The Governments are encouraging international players to invest and shift their manufacturing operations in the APAC region. In 2023, the Asia-Pacific area is anticipated to lead global economic growth because of free trade agreements, effective supply chains, and affordable prices.

- The government of Vietnam is concentrating on services that can encourage the expansion of other industries, particularly manufacturing. Vietnam has become a viable choice for commercial investments amid the US-China trade conflict. Vietnam is eager to ease some limitations on the trade in services and foreign investment while enacting measures to increase competition and indigenous enterprises' access to financing.

- The government of India is promoting the Make in India Project to accelerate manufacturing in the country. The prices of the headphones, earbuds, and other wearables like smartwatches being imported into the country were hiked to boost local manufacturing. Though international brands have taken advantage of the PLI scheme, homegrown brands are taking initiatives to expand their portfolio in product manufacturing. For instance: The Indian wearables startup Boat manufactured over 10 million wearables products annually.

- Moreover, the region's robust need for business process outsourcing has predominantly fueled the requirement for professional headsets. Presently, India holds a leading position in the business process outsourcing market within the region. India's BPO sector is well-established and manages numerous primary and secondary (non-essential) business operations. These encompass customer service call centers, IT system advancement, IT infrastructure, and technical assistance. This upsurge in audio and video conferencing interactions during these operations amplifies the market demand for professional headsets.

Office And Contact Center Headset Industry Overview

The office and contact center headset market is moderate and has the potential to grow further as companies enhance their product portfolio with improved features and innovative ideas. Noise Cancellation, Bluetooth connectivity, and precise voice pick-up are features these headset companies have integrated into their products over time. To compete in the market, these headset brands are using strategic pricing and the latest technology. However, the market is dominated by players such as Samsung Electronics Co. Limited, LG Electronics, Panasonic Corporation, etc.

In March 2023, Mart Networks selected Jabra to develop video and headset devices for remote workers in Kenya. Jabra manufactures its products primarily for business enterprises and is developing platforms like Engage AI that help contact center agents enhance and improve the customer experience. The tool is helpful for customer service agents as it displays real-time sentiment scores during the call, thereby understanding the sentiments and engagement levels running on the customer side and agents.

In December 2022, Netflix signed a contract with Boat to launch stream edition products for Netflix. Along with headsets, neckbands and TWS earbuds will also be included. The headset will be loaded with Active Noise Cancellation (ANC) and a foldable design.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of COVID-19 impact on the industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Remote Work is expected to remain a major trend in the near future

- 5.1.2 Growing demand from Government & Healthcare vertical

- 5.1.3 Advanced noise cancellation and move towards wireless connectivity expected to drive demand

- 5.2 Market Challenges

- 5.2.1 Consumer-grade headsets with recent features are being preferred over professional-grade headsets

- 5.2.2 Decline usage of desktop phones coupled with shortage issues

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Office

- 6.1.2 Contact Center

- 6.2 By Connectivity Type

- 6.2.1 Wired

- 6.2.2 Wireless

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of the Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of the Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Key Vendor Profiles

- 7.1.1 Samsung Electronics Co. Limited

- 7.1.2 LG Electronics

- 7.1.3 Panasonic Corporation

- 7.1.4 Sennheiser electronic GmbH & Co. KG

- 7.1.5 Audio-Technica Corporation

- 7.1.6 Sony Corporation

- 7.1.7 Plantronics, Inc.

- 7.1.8 Jabra