|

市场调查报告书

商品编码

1407935

汽车板簧:市场占有率分析、产业趋势与统计、2024年至2029年成长预测Automotive Leaf Spring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

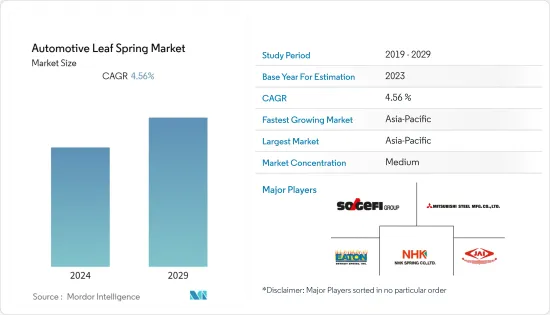

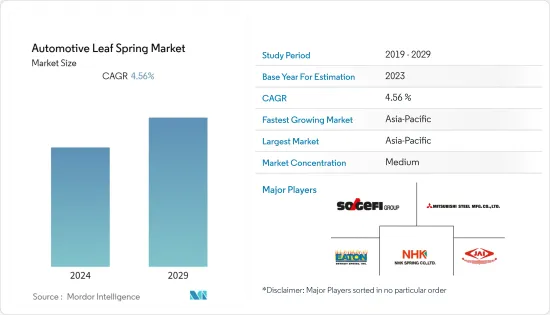

汽车钢板弹簧市场目前的市场规模为58.8亿美元,预计未来五年将达到75.1亿美元,预测期内复合年增长率约为4.56%。

从长远来看,商用车需求的增加以及车辆舒适性需求的增加将推动市场的发展。此外,全球电子商务产业的显着发展预计将带动轻型商用车的需求,以满足汽车製造商的需求,从而增加全球对汽车板簧的需求。此外,运动型多用途车文化在印度、中国和美国国家不断发展,这将推动市场成长。

例如,根据高端汽车製造商梅赛德斯·奔驰的预测,SUV 在印度整体小客车市场中的份额将从五年前的 22% 增长到 2022 年的 47%。

然而,随着时间的推移,弹簧往往会失去其结构并下垂。不均匀的下垂会改变车辆的横向载重并轻微影响操控性。它也会影响轴相对于安装座的角度。加速和煞车扭矩会导致缠绕和振动。这可能会阻碍预测期内的市场成长。

2022年,中国将成为小客车销售量最高的国家,其次是印度和日本,亚太地区将主导汽车板簧市场。

主要亮点

- 例如,根据国际汽车工业组织的数据,中国将在2022年成为小客车销售量最高的国家,达到2,300万辆。此外,该地区的大多数供应商都在寻求使用优质材料製造轻量化解决方案。

此外,由于复合材料板簧重量轻且耐用,因此越来越多地取代传统板簧。因此,上述因素将推动市场成长。

汽车板簧市场趋势

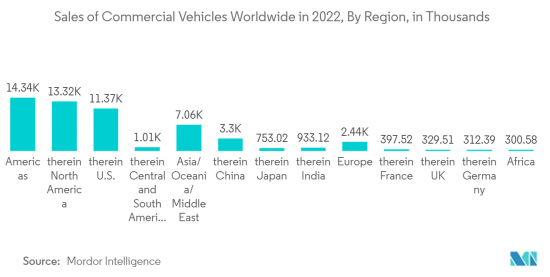

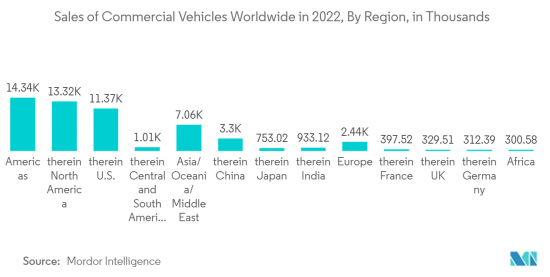

商用车销售量增加推动市场成长

新兴国家和已开发国家可支配收入的增加、建设活动的增加和都市化预计将推动商用车的采用并导致市场成长。考虑到这种情况,製造商正在透过重量规定来致力于车辆设计和客製化车辆的创新。

此外,物流市场正在转向提供以客户为中心的解决方案,增加了对商用车的需求。政府的支持性政策和措施增加了对商用电动车的需求。北美和亚太地区的电动巴士和重型卡车註册量增加。

例如,2023年8月,印度政府核准70亿美元在169个城市运行1万辆电动公车。

MHCV(中型和重型商用车)的兴起正在推动亚太等地区的生产,塔塔汽车等汽车巨头正在关注商用车生产的新技术。此外,许多公司正在专注于开发用于电动车和轻型商用车的复合材料板簧,因为复合材料板簧可以最大限度地减少噪音、振动和声振粗糙度。此外,与钢级板簧相比,复合材料板簧重量减轻 40%,应力集中降低 76.39%,变形减少 50%。

印度汽车工业协会预计, 上年度中型和重型商用车销量将从240,577辆增加到359,003辆,轻型商用车销量将从475,989辆增加到603,465辆。

因此,随着商用车销售和产量的增加,对板簧的需求将持续增加,促进市场成长。

预计亚太地区将在市场中发挥关键作用

在亚太地区,电子商务业务的成长正在推动运输业的扩张。根据我们分析,印度是全球人口最多的国家,虽然电商仅占印度零售市场的6%,但却是全球成长最快的市场之一。

随着印度和中国汽车製造业的扩张,亚太地区可能会在全球市场上取得重大开拓。例如,根据国际汽车工业协会的统计,全球排名前五的汽车生产国都在亚太地区,其中中国排名第一,日本排名第二,印度排名第三。

看到亚太地区汽车生产和销售的成长,各公司正专注于开发新技术并投资研发活动以满足需求。

例如,2022年12月,THACO朱莱工业宣布在越南成立THACO INDUSTRIES。公司的策略是大规模开发和製造板簧等产品。我们正在投资建造新的研发中心和机械中心,使我们的产品和服务多样化。

上述因素,加上高销量和大规模投资,将推动市场成长。

汽车板簧产业概况

该地区的汽车板簧市场高度整合,伊顿底特律弹簧公司、索格菲公司、三菱钢铁製造公司、NHK SPRING、贾姆纳汽车工业有限公司等主要参与者占据了主要市场占有率。。

许多参与企业正在投资新技术并专注于新产品的推出,以在竞争中保持领先地位。

- 2022年5月,东风汽车RUS宣布将在俄罗斯推出DF6皮卡。 DF6 是一款车架皮卡车,具有坚固、可靠的结构、舒适性和越野能力。坚固的车身底部配有双横臂前悬吊和后独立板簧,非常适合俄罗斯道路。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 商用车销售量增加

- 市场抑制因素

- 随着时间的推移,弹簧的结构往往会鬆动

- 波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔(市场规模(单位:美元))

- 类型

- 半椭圆形

- 椭圆

- 抛物线

- 其他类型

- 汽车模型

- 小客车

- 轻型商用车

- 大型商用车

- 销售管道

- OEM

- 售后市场

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 西班牙

- 欧洲其他地区

- 亚太地区

- 印度

- 中国

- 日本

- 韩国

- 其他亚太地区

- 其他的

- 南美洲

- 中东/非洲

- 北美洲

第六章 竞争形势

- 供应商市场占有率

- 公司简介

- EATON Detroit Spring, Inc.

- Sogefi SpA

- Mitsubishi Steel Mfg. Co., Ltd.

- NHK SPRING Co.,Ltd.

- Jamna Auto Industiries Ltd.

- Rassini

- Mack Springs Pvt. Ltd.

- EMCO INDUSTRIES

- Roc Springs

- Dendoff Springs Ltd.

第七章 市场机会及未来趋势

The Automotive Leaf Spring Market is valued at USD 5.88 billion in the current year and is expected to reach USD 7.51 billion within the next five years, registering a CAGR of about 4.56% during the forecast period.

Over the long term, the market is driven by the demand increase in demand for commercial vehicles and an increased demand for vehicle comfort. Furthermore, the significant development of the e-commerce industry across the globe is likely to foster the demand for light commercial vehicles to cater to the demand of vehicle manufacturers, increasing worldwide demand for automobile leaf springs. Furthermore, the growing culture of sports utility vehicles in countries like India, China, and the United States will drive the market growth.

For example, according to premium car Manufacturer Mercedes Benz, the share of SUVs in the overall Indian passenger cars market grew to 47% in 2022, which was 22% five years back.

However, the springs tend to lose structure and sag over time. When the sag is uneven, it might change the vehicle's cross weight, which can impair the handling slightly. It can also affect the angle of the axle to the mount. Acceleration and braking torque can generate wind-up and vibration. It might hamper the market growth during the forecast period.

Asia-Pacific dominates the automotive leaf spring market owing to China's highest passenger car sales in 2022, followed by India and Japan.

Key Highlights

- For instance, According to the International Organisation of Motor Vehicle Manufacturers, China contains the highest no sales of passenger vehicles at 23 million units in 2022. Moreover, the majority of suppliers in the region seek to produce lightweight solutions utilizing superior materials as it allows them to adhere to the set standards.

Furthermore, because of their lightweight and great durability, composite leaf springs are progressively replacing conventional leaf springs. Thus, the above factors will drive the market growth.

Automotive Leaf Spring Market Trends

Increasing sales of Commercial Vehicles boost the market growth

The rise in disposable incomes in both developing and developed countries and growing construction activities and urbanization are also projected to drive the adoption of commercial vehicles, which will result in the growth of the market. Considering the scenario, manufacturers are working on innovating vehicle design and customizing vehicles according to weight regulations.

Moreover, the logistics market shifted to offering customer-centric solutions, making the growing need for commercial vehicles. Supportive policies and initiatives by governments raised the demand for commercial electric vehicles. Electric buses and heavy-duty truck registrations increased in North America and Asia Pacific.

For instance, in August 2023, the Indian Government approved USD 7 billion to run 10,000 electric buses in 169 cities.

Due to rising MHCV (Medium and Heavy Commercial Vehicle), production is growing in regions like the Asia-Pacific, and automotive giants such as Tata Motors are focusing on new technologies for the production of commercial vehicles. Many companies are also focusing on developing composite leaf springs for electric vehicles and LCVs since composite leaf springs may minimize noise, vibration, and harshness. Furthermore, the composite leaf springs are 40% lighter, with a 76.39% lower stress concentration, and deform 50% less than steel-graded leaf springs.

The Society of Indian Automobile Manufacturers states that sales of medium and heavy commercial vehicles increased from 2,40,577 to 3,59,003 units, and light commercial vehicles increased from 4,75,989 to 6,03,465 units in FY-2022-23, compared to the previous year.

Thus, with the rise in adoption of commercial sales and production, demand for leaf springs will continue to grow and contribute to market growth.

Asia-Pacific is Anticipated to Play a Significant Role in the Market

In the Asia-Pacific region, the increasing e-commerce businesses are fueling the expansion of the transportation industry. According to our analysis, with the largest population in the world and only 6% of India's retail market coming from e-commerce, the market is one of the fastest growing in the world.

With expanding vehicle manufacturing in India and China, the Asia-Pacific region is likely to experience considerable development in the global market. For instance, according to the International Organisation of Motor Vehicle Manufacturers, the top 5 car production countries in the world are dominated by Asia-Pacific, with China being the first, followed by Japan and India.

Seeing the growth in production and sales of vehicles in the Asia-Pacific region, companies are focusing on making investments in R&D activities to develop new technologies and cater to the demand.

For instance, in December 2022, THACO Chu Lai Industrial Park announced the establishment of THACO INDUSTRIES in Vietnam. The corporation sets the strategy for the development and manufacturing of products like leaf springs on a large scale. It invests in diversifying its products and services by the construction of a new R&D center and mechanical center.

The above factors, coupled with high sales of vehicles and major investments, will fuel the market growth.

Automotive Leaf Spring Industry Overview

The Automotive Leaf Spring market in the region is fairly consolidated, with major players like EATON Detroit Spring, Inc., Sogefi SpA, and MITSUBISHI STEEL MFG. CO., LTD., NHK SPRING Co., Ltd., and Jamna Auto Industries Ltd., capturing the major market share amongst others.

Many players are investing in new technologies to gain the upper hand over their competition and focusing on new launches.

- In May 2022, Dongfeng Motor RUS announced the launch of the DF6 pickup truck in Russia. It is a frame pickup with robust and dependable construction, as well as comfort and off-road capability. The strong undercarriage, with double-wishbone front suspension and a rear-dependent leaf spring, is suitable for Russian roads.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increase in Sales of Commercial Vehicles

- 4.2 Market Restraints

- 4.2.1 The Spring tends to Loose Structure With Time

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value USD)

- 5.1 Type

- 5.1.1 Semi-Elliptic

- 5.1.2 Elliptic

- 5.1.3 Parabolic

- 5.1.4 Other Types

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Light Commercial Vehicle

- 5.2.3 Heavy Commercial Vehicle

- 5.3 Sales Channel

- 5.3.1 OEMs

- 5.3.2 Aftermarkets

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 EATON Detroit Spring, Inc.

- 6.2.2 Sogefi SpA

- 6.2.3 Mitsubishi Steel Mfg. Co., Ltd.

- 6.2.4 NHK SPRING Co.,Ltd.

- 6.2.5 Jamna Auto Industiries Ltd.

- 6.2.6 Rassini

- 6.2.7 Mack Springs Pvt. Ltd.

- 6.2.8 EMCO INDUSTRIES

- 6.2.9 Roc Springs

- 6.2.10 Dendoff Springs Ltd.