|

市场调查报告书

商品编码

1407936

汽车燃油喷射设备:市场占有率分析、产业趋势与统计、2024年至2029年成长预测Automotive Fuel Injector - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

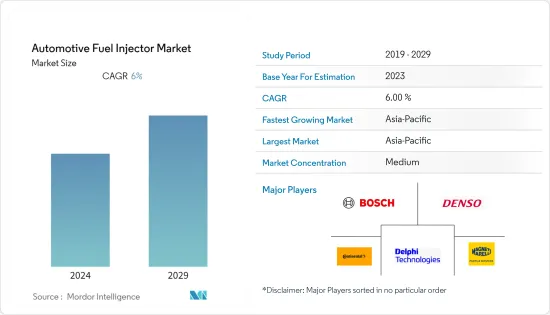

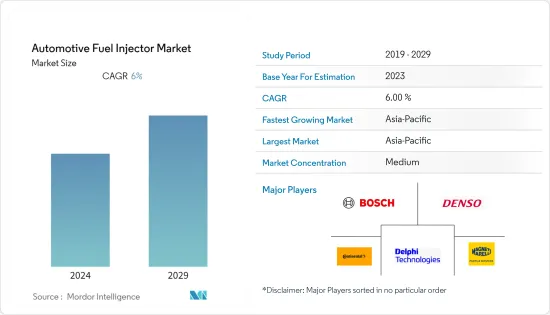

汽车喷油器市场目前价值102.2亿美元。

预计未来五年将达到 146 亿美元,预测期内复合年增长率约为 6%。

由于人口成长、生活方式的改善以及小客车需求的累积,燃油喷射系统预计将以相当大的速度成长。喷射系统是任何车辆引擎的关键部件,因为它管理和监控进入引擎汽缸的燃油量。现代燃油喷射系统不仅管理燃油流量,还提供附加功能,例如多次喷射、先导喷射、后喷射和速率调整(调度)。预计这些也将为市场成长做出重大贡献。

此外,从长远来看,对燃油经济性的需求增加、发动机性能的提高、巴拉特第六阶段等严格排放法规的加强实施以及对发动机小型化和车辆减重的偏好增加等因素预计将有对期内目标市场的成长有正面影响。

在亚太地区,印度和中国等国家可能在目标市场的未来成长中发挥重要作用。这些地区是一些顶级汽车製造商的中心,可满足不断扩大的汽车生产和新车的普及。中国、印度和巴西等国家对 MHCV 的需求不断增长,为燃油喷射系统创造了新的机会。

汽车燃油喷射系统市场趋势

全球摩托车需求不断成长

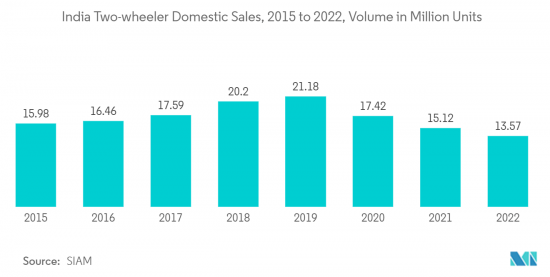

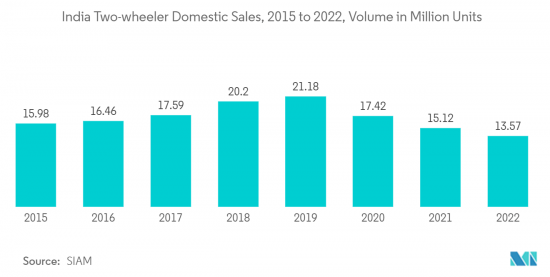

二轮车市场包括摩托车、Scooter和轻型机踏车。日益严重的交通拥堵和不断上涨的燃油价格促使二轮车得到广泛普及,这种车辆燃油效率高,可以轻鬆穿越交通拥堵。另一个因素是人口密度高和都市化速度快,特别是在印度等新兴国家,印度是二轮车的第二大市场。

考虑到二轮车的需求不断增长,製造商正在燃油喷射系统方面进行创新,以实现最大的燃油效率并促进市场成长。例如,2022年3月,Aprilia开发了一款名为Aprilia Ditec System的燃油喷射二行程概念车。它使用非常强大的西门子ECU来管理燃油系统。

此外,随着年轻人越来越喜欢运动自行车比赛和远距通勤,二轮车的采用也在增加。这是因为许多公司正在进行摩托车旅游宣传活动,以促进旅游业并促进对二轮车的需求。

2023 年 9 月,皇家恩菲尔德将在印度为有抱负的摩托车赛车手举办田径学校项目,作为其「纯粹运动」宣传活动的一部分。因此,上述因素推动了市场的成长。

亚太地区预计将在市场中发挥关键作用

由于这些地区汽车製造业的增加,亚太市场正在迅速扩张。购买力的上升、对节能汽车的需求增加、更严格的污染标准以及中国和印度等新兴经济体导致对燃油喷射系统的需求增加。

例如,印度政府计划于2023年4月实施比BS-VI标准更为严格的BS-VI第二阶段排放气体标准,以进一步减少车辆有害排放气体。

亚太地区是汽车燃油喷射系统最大的市场,预计在预测期内将出现最快的成长速度。此外,该地区的领先公司正专注于研发活动并改善其现有的商用车产品线,预计将提高市场的盈利。汽车行业的此类市场开拓和技术进步可能会促进预测期内燃油喷射设备市场的成长。

例如,2022年9月,全球领先的燃油和空气管理系统供应商思达耐宣布推出适用于中型和重型商用车动力传动系统的新型氢燃料喷射系统。

因此,上述因素加上技术进步可能会对市场产生正面影响。

汽车喷油嘴产业概况

该市场由 Robert Bosch LLC、Denso Corporation、Continental AG、Magneti Marelli Parts and Services SpA 和 Delphi Technologies (BorgWarner Inc.) 等大公司主导。

许多参与企业正在投资新技术并专注于新市场的推出,以获得超越竞争对手的优势。

- 2022 年 12 月,为汽车市场提供创新和永续移动解决方案的供应商博格华纳宣布将其燃油系统和售后市场部门免税分拆为一家上市公司。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 二轮车在世界各地的普及

- 市场抑制因素

- 电动车需求增加

- 波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔(市场规模(单位:美元))

- 按类型

- 节气门体喷射

- 多点燃油喷射

- 其他类型

- 按燃料

- 柴油喷油器

- 汽油喷油器

- 按车型

- 小客车

- 商用车

- 按销售管道

- OEM

- 售后市场

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 印度

- 中国

- 日本

- 韩国

- 其他亚太地区

- 其他的

- 南美洲

- 中东/非洲

- 北美洲

第六章 竞争形势

- 供应商市场占有率

- 公司简介

- Robert Bosch GmbH

- Denso Corporation

- Continental AG

- Delphi Technologies(BorgWarner Inc.)

- Magneti Marelli Parts and Services SpA

- Mikuni American Corporation

- Hitachi Astemo Indiana, Inc.

- Infineon Technologies AG

- GB Remanufacturing, Inc.

- Valley Fuel Injection & Turbo, Inc.

第七章 市场机会及未来趋势

The Automotive Fuel Injector market is valued at USD 10.22 billion in the current year. It is expected to reach USD 14.60 billion within the next five years, registering a CAGR of about 6% during the forecast period.

Fuel injection systems are predicted to increase at a significant pace due to rising population, improving lifestyles, and the cumulative demand for passenger vehicles. Injection systems are critical components in any vehicle engine because they manage and monitor the amount of fuel entering the engine cylinders. Modern fuel injection systems not only manage the flow of fuel but also provide additional functions such as multiple, pilot, post-injections, and rate shaping (scheduling). These are also expected to significantly contribute to market growth.

Furthermore, over the long term, factors such as an increase in demand for fuel economy, improved engine performance, a rise in implementation of strict emissions rules such as Bharat Stage VI, and an increase in preference for engine downsizing & vehicle weight reduction will positively impact the target market growth during the forecast period.

In Asia-Pacific, countries such as India and China are likely to play a significant role in the growth of the target market in the upcoming days. These areas serve as hubs for some of the top automobile manufacturers and accommodate expanding vehicle production and penetration of new cars. The increasing demand for MHCV in countries such as China, India, and Brazil is creating new opportunities for fuel injection systems.

Automotive Fuel Injector Market Trends

The High Demand of 2-wheelers across the Globe

The 2-wheeler market includes motorcycles, scooters and mopeds. The rise in traffic congestion and growth in fuel prices contributes to the increasing adoption of 2-wheelers as they provide high fuel efficiency and are easy to navigate through traffic congestion. The other factors such as rapidly growing urbanization with high population density, majorly in developing countries such as India, which is the 2nd largest market for 2-wheelers.

Considering the rising demand for 2-wheelers, the manufacturers are making innovations in fuel injector technology to take out maximum fuel efficiency and contribute to the market growth. For instance, in March 2022, Aprilia developed a fuel-injected 2-stroke concept named as Aprilia Ditech System. It uses a very powerful Siemens ECU to manage the fuel system.

Moreover, the adoption of 2-wheelers is increasing as a growing trend of bike racing as a sport among youth and for commuting long distances. This is because lots of companies are launching motorcycle tourism campaigns to promote tourism and are propelling the demand for 2-wheelers.

In September 2023, Royal Enfield track school program for aspiring bike racers in India as a part of the "Pure Sport" campaign. Thus, the above factors will drive the market growth.

Asia-Pacific Region is Anticipated to Play a Significant Role in the Market

The Asia-Pacific market is expanding rapidly, owing to rising vehicle manufacturing in these areas. Rising purchasing power, increased demand for fuel-efficient automobiles, stricter pollution standards, and rising nations economies such as China and India all resulted in increased demand for fuel injection systems.

For example, in April 2023, the Indian Government implemented the BS VI Phase 2 emission norms, which are even stricter than the BS-VI norms, and they will further reduce harmful emissions from vehicles.

Asia-Pacific is expected to be the largest market for automotive fuel injection systems, with the fastest growth rate during the forecast period. Additionally, prominent companies in the region are focusing on R&D activities and improving their existing commercial vehicle lineup, which is projected to supply the market with profitable potential. Such development and technological advancements in the automobile sector will contribute to the growth of the fuel injector market over the forecast period.

For instance, in September 2022, Stanadyne, a leading global fuel and air management systems supplier, unveiled a new hydrogen fuel injector for medium-duty and heavy-duty commercial vehicle powertrains.

Thus, the above factors, coupled with technological advances, will hold a positive impact on the market.

Automotive Fuel Injector Industry Overview

The market is dominated by major players, including Robert Bosch LLC, Denso Corporation, Continental AG, Magneti Marelli Parts and Services S.p.A., and Delphi Technologies (BorgWarner Inc.).

Many players are investing in new technologies to gain the upper hand over their competition and focusing on new launches.

- In December 2022, BorgWarner company, delivering innovative and sustainable mobility solutions for the vehicle market, announced to execution of a tax-free spin-off of its Fuel Systems and Aftermarket segments into a separate, publicly traded company.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Adoption of 2-wheelers across the Globe

- 4.2 Market Restraints

- 4.2.1 Rise in demand of Electric Vehicles

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value USD)

- 5.1 By Type

- 5.1.1 Throttle Body Injection

- 5.1.2 Multipoint Fuel Injection

- 5.1.3 Others Types

- 5.2 By Fuel

- 5.2.1 Diesel Fuel Injectors

- 5.2.2 Gasoline Fuel Injectors

- 5.3 By Vehicle Type

- 5.3.1 Passenger Vehicle

- 5.3.2 Commercial Vehicle

- 5.4 By Sales Channel

- 5.4.1 OEM

- 5.4.2 Aftermarket

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 India

- 5.5.3.2 China

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Rest of World

- 5.5.4.1 South America

- 5.5.4.2 Middle-East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Robert Bosch GmbH

- 6.2.2 Denso Corporation

- 6.2.3 Continental AG

- 6.2.4 Delphi Technologies (BorgWarner Inc.)

- 6.2.5 Magneti Marelli Parts and Services S.p.A.

- 6.2.6 Mikuni American Corporation

- 6.2.7 Hitachi Astemo Indiana, Inc.

- 6.2.8 Infineon Technologies AG

- 6.2.9 GB Remanufacturing, Inc.

- 6.2.10 Valley Fuel Injection & Turbo, Inc.