|

市场调查报告书

商品编码

1408008

医疗保健分销 -市场占有率分析、行业趋势/统计、2024-2029 年成长预测Healthcare Distribution - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

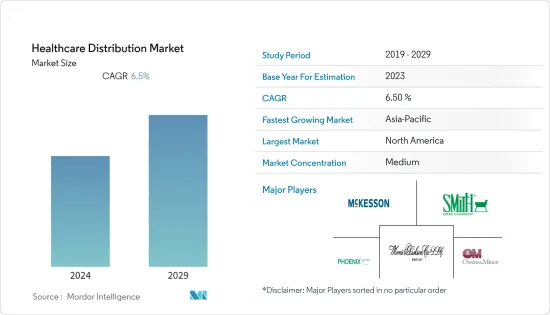

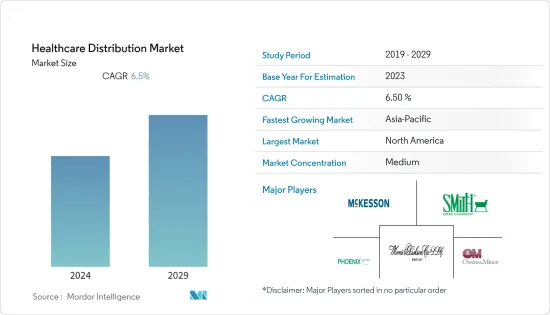

预计医疗保健分销市场在预测期内的复合年增长率为 6.5%。

新冠肺炎 (COVID-19) 大流行已成为与以往不同的全球公共卫生紧急事件。它影响了几乎所有行业,包括医疗保健分销,主要是由于医疗保健供应链的中断。然而,公司透过其策略合作伙伴和製造商供应商已采取各种行动来管理供应链中的这些中断。例如,康德乐 (Cardinal Health) 2021 年 12 月的一份报告发现,该公司与製造商和供应商密切合作,以支持产品的健康供应。据同一消息人士透露,该公司还在物流中心实施了新的仓库管理系统,以应对医疗保健供应链中的挑战。因此,由于企业应对供应链挑战的策略,最初遭受适度负面影响的市场预计将在未来几年发展。

在慢性病经济负担沉重的情况下,分销技术的进步、有利的研发投资环境以及随后药品上市的增加是医疗保健分销市场的关键驱动因素。例如,2022年,美国国家慢性病和数据研究所报告称,近60%的美国成年人至少患有一种慢性病,大约40%的成年人患有多种慢性病(MCC)。我认为。糖尿病、癌症和心血管疾病等慢性病是美国发病的主要原因。因此,对这些疾病的正确管理和诊断需要有效的医疗保健配送服务所需的各种医疗保健产品。因此,慢性疾病患者数量的增加正在推动医疗保健分销市场。

技术进步和市场参与企业的新分销策略预计将推动医疗保健分销市场的发展。例如,2022年5月,日本通运推出了针对製药业的物流服务,可以处理需要超低温(~20℃至-85℃)的产品。这为公司提供了一个能够严格控制温度的医药物流平台。因此,这些医疗物流新平台预计将在预测期内保持市场的显着成长。

然而,与医疗保健分销服务相关的高成本和投资预计将阻碍该市场的整体成长。

医疗保健分销市场的趋势

预计零售药局在预测期内将大幅成长

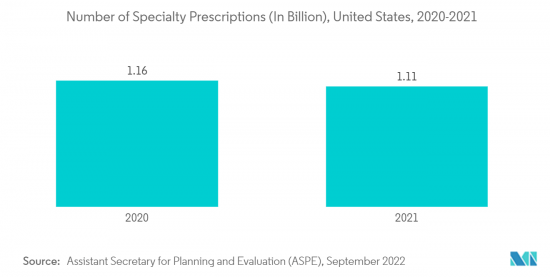

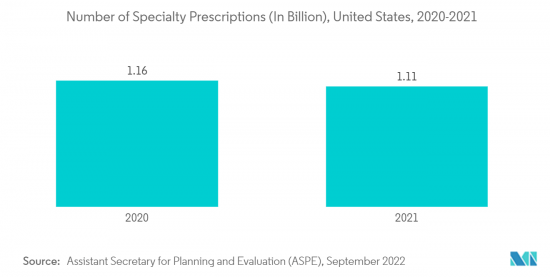

零售药局(通常称为社区药局)向公众和医生供应和销售药品和保健相关产品,以及其他产品,如洗护用品、化妆品、小型保健设备和动物用药品。・出售。零售药局预计将推动这个市场,因为它们处理大量处方笺。在已开发国家,由于医疗保健系统和计划的改善,处方笺数量显着增加。

此外,市场参与企业之间关于零售药局保健产品分销的新协议可能会推动市场成长。例如,2022 年 9 月,McKesson Corporation 延长了与 CVS Health 的合作伙伴关係,并签订了原则协议,将在 2027 年 6 月之前向零售店、其他药房和配销中心分销药品。同样,2022 年 6 月,BD (Becton, Dickinson, and Company) 和 Frazier Healthcare Partners 签署了 BD 收购 Parata Systems 的最终协议。 Parata Systems 是一家为医院、零售药房和其他医疗保健环境提供药房自动化解决方案的创新提供者。因此,这些协议预计将有助于医疗保健产品的有效供应并促进市场成长。

此外,高血压、糖尿病、心血管疾病和癌症等需要长期服药的慢性疾病的盛行率不断上升,也与处方笺的增加直接相关。这可能会在预测期内进一步推动零售药品市场的成长。例如,DiabetesAtlas.org 2021 报告称,预计 2021 年约有 5.366 亿人患有糖尿病,到 2030 年这一数字将增加到 6.427 亿。因此,糖尿病等慢性病的高盛行率增加了对可从零售药局购买的各种药物的需求,预计该领域在预测期内将增长。

预计北美在预测期内将占据主要市场份额

由于製药和生物製药行业的快速扩张、对特种药物和学名药的需求不断增长以及人工智能和区块链等尖端技术在医疗领域的大规模采用等因素,北美有望占据重要的市场占有率。医疗保健领域,预计将占据。

人工智慧技术的使用促进了全球分销实践。例如,SAGE 在 2021 年 9 月发表的一篇论文总结称,透过使用人工智慧技术,企业可以为客户提供摘要的出货资讯。如果追踪技术失败,(人工智慧)人工智慧系统可以追踪交付延迟,使企业能够轻鬆估计向客户交付的时间。这些人工智慧产品交付的更新可能会改善分销服务并促进市场成长。

此外,该地区的大量处方笺增加了对各种医疗保健产品和分销服务的需求。例如,根据 AssureCare LLC 2022 年 11 月发布的报告,2021 年美国处方笺量约为 64.7 亿张,处于较高水平,预计未来几年将进一步增加。此外,新的区域分销协议可能会增加服务并提振市场。例如,2023 年3 月,Endonovo Therapeutics, Inc. 被佛罗里达州西棕榈滩的Academy Medical 选择,以确保退伍军人健康管理局(VHA) 和国防部(DoD) 合约的可用性。Inc.签订了一项服务-残疾退伍军人拥有的小型企业 (SDVOSB) 政府经销商协议销售 Sofpulse 医疗保健设备。因此,增加处方笺和新的医疗保健产品分销合约可能会增加对医疗保健分销服务的需求,并在预测期内促进市场成长。

医疗保健流通产业概述

医疗保健分销市场本质上是分散的,既有在全球运营的公司,也有在区域运营的公司。竞争形势包括 McKesson Corporation、Cardinal Health、Morris and Dickson Company、Smith Drug Company、Owens and Minor Inc.、Patterson Companies、PHOENIX Group、Owens、Medline Industries 等知名公司,市场占有率包括对持有的几家国际和本地公司的分析。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 慢性病发生率高,经济负担大

- 分销技术进步

- 有利的研发投资情境和相关药物上市的增加

- 市场抑制因素

- 医疗保健分配高成本

- 波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔(市场规模-美元)

- 依产品类型

- 药品分销服务

- 成药

- 学名药

- 品牌药品

- 生物药品分销服务

- 重组蛋白

- 单株抗体

- 疫苗

- 医疗器材配送服务

- 药品分销服务

- 按最终用户

- 零售药房

- 医院药房

- 其他最终用户

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 其他亚太地区

- 中东/非洲

- 海湾合作委员会国家

- 南非

- 其他中东/非洲

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 北美洲

第六章 竞争形势

- 公司简介

- McKesson Corporation

- Cardinal Health

- Morris and Dickson Company

- Smith Drug Company

- Owens and Minor Inc

- Patterson Companies

- PHOENIX Group

- Shanghai Pharmaceutical Group

- Medline Industries

- CuraScript SD

- Mutual Drug

第七章 市场机会及未来趋势

The healthcare distribution market is expected to register a CAGR of 6.5 % over the forecast period.

The COVID-19 pandemic was an incomparable global public health emergency. It impacted almost every industry sector, including healthcare distribution, mainly due to disruptions to the healthcare supply chain. However, the companies took various actions to manage these disruptions in the supply chain through their strategic partners and manufacturer suppliers. For instance, as per the report published by Cardinal Health in December 2021, the company worked closely with its manufacturer suppliers to help ensure a healthy supply of products. In addition, as per the same source, the company installed a new warehouse management system in many distribution centers to manage the challenges in the healthcare supply chain. As a result, the market originally had a modest negative impact but is anticipated to develop due to corporate strategies for addressing supply chain difficulties over the coming years.

With the large economic burden of chronic diseases, technological advancement in distribution, favorable R&D investment scenario, and subsequent increase in drug launches are the main driving factors of the healthcare distribution market. For instance, in 2022, the National Institution of Chronic Disease and Data reported that nearly 60% of American adults suffer from at least one chronic disease, and about 40% of adults include multiple chronic conditions (MCC). Chronic conditions like diabetes, cancer, and cardiovascular disease are the leading causes of morbidity in the United States. Hence, proper management and diagnosis of these diseases are needed with various healthcare products necessary for effective healthcare distribution services. Thus, increasing cases of chronic disease are driving the healthcare distribution market.

Technological advancements and new distribution strategies of market players are expected to boost the healthcare distribution market. For instance, in May 2022, Nippon Express Co., Ltd. launched a logistics service capable of handling goods requiring ultra-low temperatures (-20 C to -85 C) for the pharmaceutical industry. With this, the company provided a pharmaceutical distribution platform with strict temperatures. Hence, these new platforms in healthcare distribution are expected to hold significant growth in the market over the forecast period.

However, the high cost and investment associated with healthcare distribution services are expected to hamper the overall growth of this market.

Healthcare Distribution Market Trends

Retail Pharmacy is Expected to Witness a Significant Growth Over the Forecast Period

Retail pharmacies (often known as community pharmacies) supply and sell medicine and medical-related products to the general public and medical practitioners, as well as other goods such as toiletries, cosmetics, small medical devices, and veterinary products. The retail pharmacy deals with many prescriptions and is thus expected to drive this market. In developed countries, the high availability of healthcare schemes and programs led to a significant increase in the number of prescriptions.

Furthermore, the new agreements among the market players for distributing healthcare products in retail pharmacies likely propel the market to grow. For instance, in September 2022, McKesson Corporation signed an agreement in principle to extend its partnership with CVS Health to distribute pharmaceuticals to retail and other pharmacies and distribution centers through June 2027. Similarly, in June 2022, BD (Becton, Dickinson, and Company) and Frazier Healthcare Partners entered a definitive agreement for BD to acquire Parata Systems. It is an innovative provider of pharmacy automation solutions for hospitals, retail pharmacies, and other healthcare settings. Thus, these agreements help supply healthcare products efficiently, which is expected to boost market growth.

Moreover, the growing incidence of chronic diseases like hypertension, diabetes, cardiovascular diseases, and cancer, which require prolonged medication, is directly related to increased prescriptions. It can further drive the growth of the retail pharmacy market during the forecast period. For instance, DiabetesAtlas.org 2021 reported that about 536.6 million people were estimated to suffer from diabetes in 2021, and this number will increase to 642.7 million by 2030. Thus, the high prevalence rate of chronic diseases like diabetes increases the need for various pharmaceuticals that can be procured from retail pharmacies and is expected to grow in the segment over the forecast period.

North America is Expected to hold Significant Share in the Market Over the Forecast Period

North America is expected to hold a significant market share owing to factors such as the rapid expansion of the pharmaceutical and biopharmaceutical industry, rising demand for specialty drugs and generics, and large-scale adoption of advanced technologies such as Artificial Intelligence and blockchain in the healthcare sector.

The use of artificial intelligence technology boosted distribution practices globally. For instance, the article published by the journal SAGE in September 2021 summarizes that by using Artificial intelligence technology, businesses can offer shipment updates to customers. When tracking technology fails, an (Artificial Intelligence) AI system can track the delay in the delivery so companies can easily estimate delivery time to their customers. These updates on product delivery through AI increase the distribution services and likely boost the market to growth.

Furthermore, the significant number of prescriptions in the region increases the demand for various healthcare products and distribution services. For instance, as per the report published by AssureCare LLC in November 2022, in the United States, around 6.47 billion prescriptions were dispensed in 2021, which is high and is expected to increase more over the coming years. In addition, the new regional distribution agreements increase the services and likely boost the market. For instance, in March 2023, Endonovo Therapeutics, Inc. signed a Service-Disabled Veteran-Owned Small Business (SDVOSB) Government Reseller Agreement (Agreement or Contract) with Academy Medical, Inc. of West Palm Beach, FL, to distribute SofPulse medical devices to ensure its availability to the Veterans Health Administration (VHA) and Department of Defense (DoD) contracts. Thus, increasing prescriptions and new agreements to distribute healthcare products will likely raise the demand for healthcare distribution services and boost the market growth over the forecast period.

Healthcare Distribution Industry Overview

The healthcare distribution market is fragmented in nature due to the presence of several companies operating globally as well as regionally. The competitive landscape includes an analysis of a few international as well as local companies that hold the market shares and are well known as McKesson Corporation, Cardinal Health, Morris and Dickson Company, Smith Drug Company, Owens and Minor Inc., Patterson Companies, PHOENIX Group, Owens, Medline Industries, and other Companies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 High Incidence and Large Economic Burden of Chronic Diseases

- 4.2.2 Technological Advancement in Distribution

- 4.2.3 Favorable R&D Investment Scenario, and Subsequent Increase in Drug Launches

- 4.3 Market Restraints

- 4.3.1 High Cost of Healthcare Distribution

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD)

- 5.1 By Product Type

- 5.1.1 Pharmaceutical Product Distribution Services

- 5.1.1.1 Over The Counter Drugs

- 5.1.1.2 Generic Drugs

- 5.1.1.3 Branded Drugs

- 5.1.2 Biopharmaceutical Product Distribution Service

- 5.1.2.1 Recombinant Proteins

- 5.1.2.2 Monoclonal Antibodies

- 5.1.2.3 Vaccines

- 5.1.3 Medical Devices Distribution Services

- 5.1.1 Pharmaceutical Product Distribution Services

- 5.2 By End-User

- 5.2.1 Retail Pharmacies

- 5.2.2 Hospital Pharmacies

- 5.2.3 Other End-Users

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 McKesson Corporation

- 6.1.2 Cardinal Health

- 6.1.3 Morris and Dickson Company

- 6.1.4 Smith Drug Company

- 6.1.5 Owens and Minor Inc

- 6.1.6 Patterson Companies

- 6.1.7 PHOENIX Group

- 6.1.8 Shanghai Pharmaceutical Group

- 6.1.9 Medline Industries

- 6.1.10 CuraScript SD

- 6.1.11 Mutual Drug