|

市场调查报告书

商品编码

1408184

用于物流应用的自主移动机器人:市场占有率分析、行业趋势和统计数据、2024年至2029年的成长预测Autonomous Mobile Robots For Intralogistics Applications - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

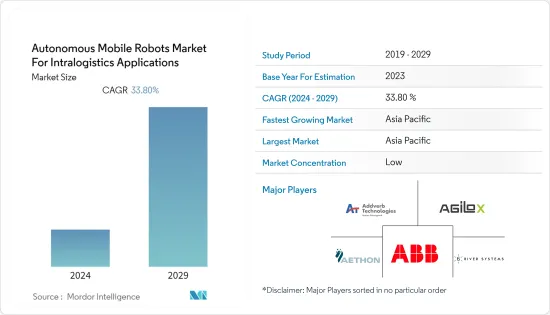

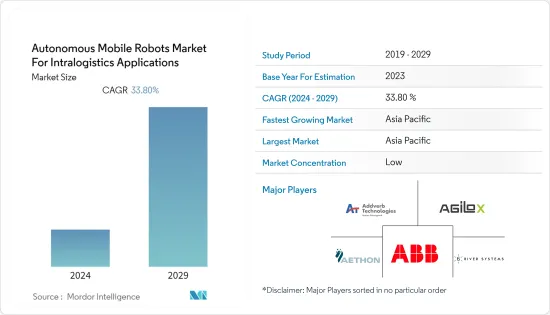

内部物流应用的自主移动机器人市场预计在预测期(2024-2029年)复合年增长率为33.80%

主要亮点

- 随着技术的进步,自主机器人将在未来的供应链中变得更加普遍,并且能够以更类似于人类的能力进行操作。随着自主机器人能够以更一致的品质和生产力水平全天候运作,执行人类无法完成的任务,未来供应链的好处将继续增长。

- 自主移动机器人在全球市场快速成长的一个突出原因是由于其移动性而导致其物理尺寸不受限制,而这是工业机器人普遍反对的。因此,自主移动机器人可以在大型工作空间中运作并探索未知环境,使它们能够在任何需要的地方执行任务。由于自主移动机器人必须在未知和不确定的环境中运行,因此它们比传统工业机器人具有更高的智慧。

- 人工智慧、自动化、物联网、运算能力和机器人等技术的结合将促成新一代智慧工厂的创建。机器人和自动化在过去几年中发生了很大变化。电子、汽车、食品、金属加工和物料搬运等不断增长的行业正在增加对先进自动化的投资,为移动机器人创造了充足的机会。

- 特别是在製造业,由于对灵活物料搬运的需求、大型结构上机器人操作的需求以及工作区域的快速重新配置,自主移动机器人正在获得发展势头。根据物料搬运协会的说法,两个蓝图提供了对未来移动机器人系统的预测。

- 然而,移动机器人高昂的初始成本是许多考虑部署移动机器人的组织通用关心的问题。儘管初期成本较高,但随着时间的推移,移动机器人可以提供显着的投资收益(ROI),特别是在可以提高效率、降低人事费用和提高安全性的环境中。随着 AMR 的成本不断下降且其功能不断增强,考虑实施可能产生的隐性成本非常重要。除了初始设定、部署和重新配置工作之外,还有其他成本,尤其是在机器人不方便使用者使用的情况下。这对市场成长提出了挑战。

- 由于劳动力短缺、为限制病毒传播而关闭製造设施以及全国范围内的封锁,COVID-19 大流行对自动驾驶市场产生了重大影响。由于对机器人消毒解决方案、工厂和仓库的机器人物流解决方案或宅配机器人的高需求,COVID-19大流行进一步提振了市场。

自主移动机器人市场趋势

最大的最终用户产业是製造业

- 近年来,自动化彻底改变了製造业,并提高了生产力、效率和安全性。自动化技术的最新突破是自主移动机器人(AMR)。这些移动机器人因其能够确保人类安全并满足最佳效率的需求而在製造现场赢得了广泛讚誉。技术的进步使製造商能够创建适合业务需求的机器人,并将其有效地部署在各种应用中。

- 近年来,製造业受到劳动力市场紧张、对安全性和可靠性的日益重视以及供应链中断的严重影响。为了应对这些挑战,製造商正在藉助机器人等自动化技术来扩大业务,以满足市场需求。 AMR技术的使用有可能彻底改变和取代传统的生产方法,透过提高效率为製造业带来持久的变化。

- AMR 越来越多地应用于汽车行业,并提供了许多前景。 AMR 可有效优化营运、降低成本并提高多个领域的生产力,包括组装和物料搬运。其多功能性使其能够有效地执行汽车製造中的焊接、组装和零件运输等各种任务。此外,由于所需零件的形状和尺寸多种多样,包括焊接车间和车辆组装厂在内的汽车产业在自动化材料处理方面面临挑战。因此,该行业对 AMR 有需求。

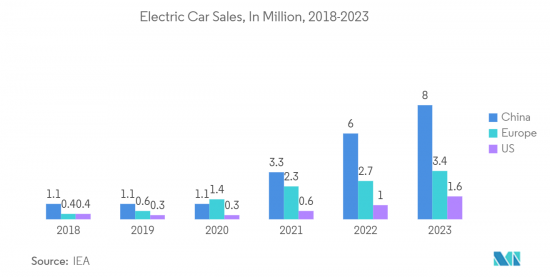

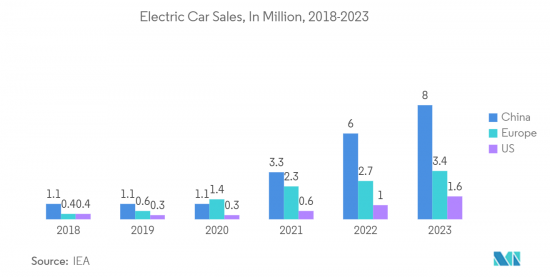

- 电动车(EV)市场正在快速成长,需要快速部署充电基础设施来支援它。自动充电的整合已成为建立可靠、安全且经济可行的充电系统的关键要素。 AMR充电站是允许机器人在需要时自主充电的设施。对充电站不断增长的需求预计将为 AMR 技术的进步提供重大机会。

- 2023 年 3 月,中国 NaaS Technology Inc. 宣布推出一款自主移动充电机器人,以满足日益增长的电动车(EV) 充电需求。这款尖端设备拥有主动车辆追踪、智慧型充电和自动付款等先进功能,在充电过程中透过机械手臂无缝连接到电动车充电埠。 NaaS Technology Inc. 在纳斯达克上市,交易代码为 NAAS,截至 2022 年 12 月 31 日,已成功连接超过 515,000 个充电器。因此,充电站的投资和安装将会增加,此类机器人充电设备的采用预计将带动市场需求。

亚太地区占主要市场占有率

- 亚太地区非製造业投资大幅成长。这主要是由于该地区工业的快速成长以及策略性采用自动化技术以提高投资收益。机器人技术的不断普及、电子商务的扩张以及新型仓储设施的建立预计将使亚太 AMR 市场成为主导力量。

- 例如,香港凭藉其优越的地理位置、繁荣的营商环境以及新兴企业的交通基础设施,成功吸引了许多跨国公司和新创公司。 High Robotics是该地区的知名公司,透过引进全球首创的自主案件处理机器人(ACR)系统,有效解决了劳动力短缺问题并增强了电子商务产业。这项突破性技术将传统基于机架的自主移动机器人 (AMR) 的适应性与自动储存和搜寻系统 (ASRS) 的准确性和生产力无缝集成,彻底改变了仓库管理。

- 中国拥有全球最大的製造业,产生很大份额的市场需求。此外,根据工业和资讯化部 (MIIT) 的数据,儘管因 COVID-19 限制措施导致生产和物流中断,但与前一年同期比较该国工业产值仍同比增长 3.6%。根据工信部预测,2022年製造业产值预估成长3.1%,占中国国内生产总值(GDP)的28%。

- 印度的製造业经历了显着成长,并已成为一个重要部门。国家製造业政策和 PLI 计画等政府倡议旨在加强製造业对 GDP 的贡献并使其与全球标准接轨。因此,在工业 4.0 的普及和製造业扩张的推动下,在可预见的未来,该国的市场成长预计将大幅上升。

- 此外,AMR 也对製造业产生重大影响。其应用不仅限于工厂和仓库,还延伸到其他产业。然而,在 AMR 投入公共使用之前,还需要进行大规模的安全性试验。新加坡正在积极进行此类试验,预计 AMR 的商业用途将迅速增加。该地区如此重大的技术创新预计将在市场上创造巨大的需求。此外,东南亚国家对抗菌素抗药性日益增长的需求预计将推动市场需求。

自主移动机器人产业概况

由于地区间应用的增加和技术进步,用于物流应用的自主移动机器人市场的特征是日益分散。这种充满活力的环境为 Agilox、6 River Systems, LLC、Addverb Technologies Limited、Aethon 和 ABB Ltd 等主要企业提供了利润丰厚的机会。这些现有竞争之间的竞争非常激烈,主要供应商正在寻求策略性投资以扩大市场占有率。

2023 年 6 月,ABB 有限公司宣布启用新的机器人包装和物流总部,该总部战略性地位于乔治亚北部乔治亚州阿尔法利塔。这个最先进的设施将成为 ABB 在物流和包装领域机器人自动化解决方案的独特中心。

2023 年 4 月,Addverb Technologies Limited 宣布与 Logsquare 建立策略合作伙伴关係,专注于为中东客户提供创新的自动化解决方案。此次合作旨在提高供应链效率、优化业务流程并提高收益。此次合作的核心是将 Adverb 的自主移动机器人 (AMR) 产品组合和软体(包括其车队管理系统 (FMS))整合到 Logsquare 的综合客户解决方案中。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概览 – AMR 机器人现状

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 竞争公司之间敌对关係的强度

- 替代品的威胁

- 产业价值链分析

- 宏观趋势的影响

- 专利分析

- 监管状况

- ROI分析/投资报酬分析

第五章市场动态

- 市场驱动因素

- 最终用户产业对自动化的需求不断增加

- 与劳工相关的挑战和技术进步

- 市场挑战/抑制因素

- 通讯和连接问题(导航和感知)

- 高资本要求

第六章市场区隔

- 按外形尺寸

- 拖车/拖拉机/拖船

- 拣货/履行(单元装载/甲板装载/组装)

- 货物装卸(堆高机/平衡重)

- 按使用环境

- 製造业(汽车、电气/电子、食品和饮料、化学品/药品)

- 非製造业(物流中心/配送中心/仓库)

- 按地区

- 美国

- 欧洲

- 亚太地区(不包括中国和印度)

- 中国

- 印度

- 世界其他地区

第七章竞争形势

- 公司简介

- ABB Ltd

- Aethon

- Addverb Technologies Limited

- 6 River Systems, LLC

- Agilox

- Guozi Robotics

- Locus Robotics

- Clearpath

- Dematic

- Fetch Robotics

- Greek+

- HikRobot

- Omron

- Seegrid

- Suzhou Junion Intelligent Technology Co., Ltd

- Grey Orange Pte Ltd

- KION GROUP AG

- MOBILE INDUSTRIAL ROBOTS(MIR)(TERADYNE INC.)

- Vecna Robotics, Inc.

第八章 供应商市场占有率

- 整体 AMR 市场

- 订单履行 AMR 市场

- 物料搬运 AMR 市场

第9章市场的未来

The Autonomous Mobile Robots Market For Intralogistics Applications Industry is expected to register a CAGR of 33.80% during the forecast period(2024-2029).

Key Highlights

- Autonomous robots will become more common in the future supply chain as technology advances, allowing them to operate with more human-like abilities as autonomous robots develop the ability to work around the clock with higher consistent levels of quality and productivity, performing tasks that humans cannot, the advantages for the supply chain of the future are growing.

- The prominent reason for favoring the rampant growth of autonomous mobile robots in the global market is their unlimited movement by their physical size due to their mobility, which is largely opposed by industrial robots. As a result, autonomous mobile robots are capable of operating in a large workspace and exploring unknown environments and, therefore, are significantly performing tasks wherever needed. Owing to the need to operate in unknown and uncertain environments, autonomous mobile robots are incorporated with much higher-level intelligence than traditional industrial robots.

- The combination of technologies such as artificial intelligence, automation, the Internet of Things, computing power, and robotics enables the building of a new generation of smart factories. Robotics and automation have changed significantly over the past few years. In the continuously growing range of industries such as electronics, automotive, food, metalworking, and material handling, increasing investment in advanced automation creates ample opportunities for mobile robots.

- Notably, in the manufacturing sector, autonomous mobile robots have been gaining significant momentum as they address the demand for flexible material handling, the need for robots to operate on large structures, and the requirement for rapid reconfiguration of work areas. As per the material handling institute, two roadmaps provide predictions for future mobile robot systems.

- However, the high initial cost of mobile robots is a common concern for many organizations considering their adoption. Despite the high initial cost, mobile robots can provide a significant return on investment (ROI) over time, particularly in environments where they can increase efficiency, reduce labor costs, and improve safety. As the costs of AMRs continue to decrease and their abilities improve, it is important to consider the potential hidden expenses that may arise from their implementation. In addition to the initial setup, deployment, and reconfiguration efforts, other costs come under, particularly if the robot is not user-friendly. This poses a challenge to the growth of the market.

- The COVID-19 pandemic had a significant impact on the autonomous mobile market due to the shortage of workforce, the shutdown of manufacturing facilities to restrict the spread of the virus and nationwide lockdowns. The COVID-19 pandemic further boosted the market with the high demand for robotics disinfection solutions, robotic logistics solutions in factories and warehouses, or robots for home delivery.

Autonomous Mobile Robots Market Trends

Manufacturing to be the Largest End-user Industry

- In recent years, automation has revolutionized the manufacturing sector, resulting in enhanced productivity, efficiency, and safety. Among the latest breakthroughs in automation technology are autonomous mobile robots (AMRs). These mobile robots have gained considerable recognition in manufacturing facilities due to their ability to ensure human safety and meet the demand for optimal efficiency. Technological advancements have empowered manufacturers to create robots tailored to their operational requirements and effectively implement them for various applications.

- The manufacturing sector has experienced significant impacts from a highly constrained labor market, increased emphasis on safety and dependability, and supply chain disruptions in recent times. To address these challenges, manufacturers are seeking to satisfy market demands by expanding their operations with the aid of automation technology, such as robotics. The use of AMR technology has the potential to revolutionize and supplant conventional production methods, resulting in lasting changes to the manufacturing industry by revealing greater efficiencies.

- AMRs are increasingly being utilized within the automobile industry, presenting numerous prospects. AMRs effectively optimize operations, diminish expenses, and enhance productivity across various areas, such as assembly lines and material handling. Their versatility enables them to proficiently undertake diverse tasks, including welding, assembly, and part transportation within car manufacturing. Moreover, the automotive industry, encompassing welding shops and vehicle assembly plants, encounters challenges in automating material transport due to the diverse shapes and sizes of required parts. Consequently, the demand for AMRs in this sector has arisen.

- The electric vehicle (EV) market is experiencing rapid growth, necessitating the prompt implementation of a supporting charging infrastructure. The integration of autonomous charging has emerged as a crucial element in establishing a dependable, secure, and economically viable charging system. The AMR charging station is a facility that empowers robots to autonomously recharge as needed. The increasing demand for charging stations is anticipated to present substantial opportunities for the advancement of AMR technology.

- In March 2023, China-based NaaS Technology Inc. unveiled its inaugural autonomous mobile charging robot, catering to the escalating need for electric vehicle (EV) charging. Boasting advanced functionalities such as active vehicle tracking, intelligent charging, and automated payment settlement, this cutting-edge device seamlessly connects with EV charging ports through a mechanical arm during charging sessions. NaaS Technology Inc., traded on NASDAQ under the ticker symbol NAAS, has successfully linked over 515,000 chargers by December 31, 2022. Therefore, the rising investments and establishment of charging stations are expected to adopt such robotic charging facilities, which is expected to drive the demand for the market.

Asia Pacific to Hold Significant Market Share

- The Asia-Pacific region is witnessing a significant surge in investments within the non-manufacturing sector, primarily driven by the region's burgeoning industries and their strategic incorporation of automation technologies to enhance return on investment. The escalating adoption of robotics, the expansion of e-commerce, and the establishment of novel warehousing facilities are anticipated to establish the Asia Pacific AMR market as the dominant force.

- For instance, Hong Kong has successfully enticed numerous multinational corporations and startups due to its advantageous geographical position, thriving business environment, and well-developed transportation infrastructure. Hai Robotics, a prominent company in the region, has effectively tackled the scarcity of labor and bolstered the ecommerce industry by introducing the world's pioneering autonomous case-handling robotic (ACR) system. This groundbreaking technology seamlessly integrates the adaptability of traditional rack-moving autonomous mobile robots (AMR) with the precision and productivity of automated storage and retrieval systems (ASRS), thereby revolutionizing warehouse management.

- China has the largest manufacturing industry in the world and generates a significant share of the market demand. Moreover, the country's industrial output grew by 3.6% in 2022 from the previous year, as per the Ministry of Industry and Information Technology (MIIT), despite production and logistics disruptions from COVID-19 curbs. The output of the manufacturing sector was estimated to have risen by 3.1% in 2022, accounting for 28% of China's gross domestic product (GDP), according to the MIIT.

- Manufacturing in India has become a prominent sector, experiencing substantial growth. The government's initiatives, including the National Manufacturing Policy and the PLI scheme, aim to enhance the manufacturing industry's contribution to GDP and align it with global standards. Consequently, the country's market growth is anticipated to witness a significant upsurge in the foreseeable future, driven by the increasing prevalence of Industry 4.0 and the expanding manufacturing sector.

- Furthermore, AMRs have significantly impacted the manufacturing industry. Their application has extended beyond factories and warehouses to support other industries. However, the implementation of AMRs for public use requires extensive safety trials. Singapore, anticipating a surge in commercial AMR use, is actively engaged in conducting such trials. Such significant innovations in the region are expected to create a significant demand for the market. Moreover, the rising need for AMRs in Southeast Asian countries is expected to drive the demand for the market.

Autonomous Mobile Robots Industry Overview

The autonomous mobile robots market for intralogistics applications is characterized by high fragmentation, with an increasing number of applications and technological advancements across regions. This dynamic environment offers lucrative opportunities to key players such as Agilox, 6 River Systems, LLC, Addverb Technologies Limited, Aethon, and ABB Ltd. The competition among these established competitors is intense, prompting major vendors to seek strategic investments aimed at expanding their market share.

In June 2023, ABB Ltd. announced the inauguration of its new robotic packaging and logistics headquarters, strategically located north of Atlanta in Alpharetta, Georgia. This state-of-the-art facility is poised to serve as ABB's exclusive hub for robotic automation solutions within the logistics and packaging sectors.

In April 2023, Addverb Technologies Limited unveiled a strategic partnership with Logsquare, focusing on delivering innovative automation solutions to customers in the Middle East. The collaboration aims to enhance supply chain efficiency, optimize operational processes, and boost revenue. Central to this partnership is the integration of Addverb's autonomous mobile robot (AMR) portfolio and software, including its fleet management system (FMS), into Logsquare's comprehensive customer solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview - Current Scenario of AMR Robotics

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyer/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Macro Trends

- 4.5 Patent Analysis

- 4.6 Regulatory Landscape

- 4.7 ROI Analysis/Payback Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Automation across the End-user Industries

- 5.1.2 Labor-related Challenges Coupled with Advancements in Technology

- 5.2 Market Challenges/Restraints

- 5.2.1 Communication and Connectivity Issues (navigation and Perception)

- 5.2.2 High Capital Requirements

6 MARKET SEGMENTATION

- 6.1 By Form Factor

- 6.1.1 Tow/Tractor/Tug

- 6.1.2 Order Picking/Fulfillment (Unit Load/Deck Load/Assembly Line)

- 6.1.3 Load Carrying (Forklifts/Counterbalance)

- 6.2 By Environment of Operation

- 6.2.1 Manufacturing (Automotive, Electrical & Electronics, Food & Beverage, Chemical & Pharmaceuticals)

- 6.2.2 Non-Manufacturing (Logistics Centers/Distribution Centers/Warehouses)

- 6.3 By Geography

- 6.3.1 United States

- 6.3.2 Europe

- 6.3.3 Asia Pacific (Excluding China and India)

- 6.3.4 China

- 6.3.5 India

- 6.3.6 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 Aethon

- 7.1.3 Addverb Technologies Limited

- 7.1.4 6 River Systems, LLC

- 7.1.5 Agilox

- 7.1.6 Guozi Robotics

- 7.1.7 Locus Robotics

- 7.1.8 Clearpath

- 7.1.9 Dematic

- 7.1.10 Fetch Robotics

- 7.1.11 Greek+

- 7.1.12 HikRobot

- 7.1.13 Omron

- 7.1.14 Seegrid

- 7.1.15 Suzhou Junion Intelligent Technology Co., Ltd

- 7.1.16 Grey Orange Pte Ltd

- 7.1.17 KION GROUP AG

- 7.1.18 MOBILE INDUSTRIAL ROBOTS (MIR)(TERADYNE INC.)

- 7.1.19 Vecna Robotics, Inc.

8 VENDOR MARKET SHARE

- 8.1 Overall AMR Market

- 8.2 Order Fulfilment AMR Market

- 8.3 Material Movement AMR Market