|

市场调查报告书

商品编码

1851616

自主移动机器人(AMR):市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Autonomous Mobile Robot (AMR) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

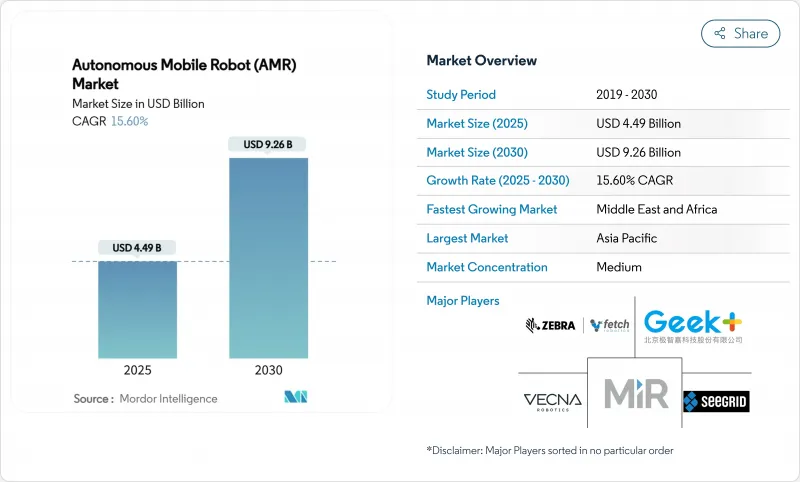

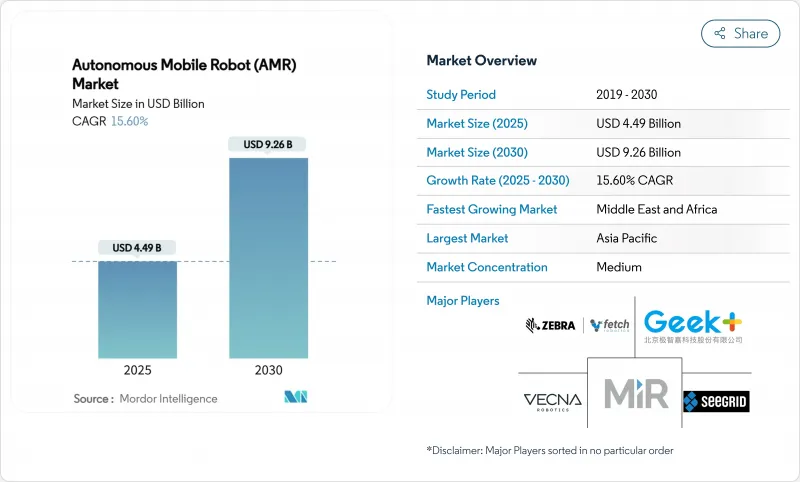

预计自主移动机器人 (AMR) 市场将从 2025 年的 44.9 亿美元成长到 2030 年的 92.6 亿美元,复合年增长率为 15.6%。

人工智慧、5G-Advanced 连接和低成本锂离子电池的快速普及将加速履约、製造和医疗保健领域的商业性化进程。营运商将部署机器人来填补劳动力短缺,无需建造固定输送机即可实现全天候运转,并提高职场的安全性。在亚太地区,中国供应商凭藉以软体为中心的设计理念和极具竞争力的价格,引领着机器人技术的应用;同时,中东的大型企划也催生了对重型系统的新需求。随着供应商竞相整合车队级编配软体并建立通路伙伴关係关係以缩短价值实现时间,竞争将愈演愈烈。欧盟的「未来工厂」津贴等监管激励措施,将透过补贴中小企业的资本支出,进一步推动机器人技术的应用。

全球自主移动机器人(AMR)市场趋势与洞察

电子商务履约需求快速成长

如今,线上零售的关键在于当日送达。亚马逊计划在2025年7月前部署100万台机器人,并利用DeepFleet车队智慧系统将每次拣货的行走时间缩短了10%。 Locus Robotics整合了LocusOne软体,在将生产效率提高两到三倍的同时,将工伤事故减少了80%,拣货量也超过了30亿次。因此,零售商们正在积极采用市场上的紧凑型自主移动机器人解决方案,这些机器人能够灵活适应季节性业务量变化,并最大限度地减少设备更换。 Geek+-Intel设计采用的纯视觉导航技术无需固定标记,从而降低了安装成本和时间。

经合组织市场仓库工人短缺

经合组织国家的雇主反映,夜班和高峰时段的职缺持续存在。欧洲职业安全与健康署强调,自动化对于弥补劳动年龄人口的减少至关重要。斯凯奇公司用机器人取代输送机后,节能高达80%,证明了在技术纯熟劳工短缺的情况下,自动化投资的回报是检验的。如今,雇主们正在围绕机器人监管和维护重新设计岗位,使仓库工作不再那么耗费体力,也更具吸引力。

互通性标准碎片化

儘管 ISO 3691-4 和 ANSI/RIA R15.08 详细规定了安全性,但它们忽略了车队通讯协定,迫使买家只能使用单一供应商的产品,从而推高了整合成本。中间件供应商正试图填补这一空白,但专有数据格式会延缓部署速度并降低他们的议价能力。

细分市场分析

到2024年,无人地面车辆将占销售额的46.0%。人形机器人虽然相对较新,但由于它们能够在不改变布局的情况下在人为设计的空间内导航,预计将以19.22%的复合年增长率增长。亚马逊正在试用一款人形搬运机器人,该机器人可从Rivian电动货车上装载小包裹,这标誌着自主移动机器人市场正在向户外领域扩展。无人空中和无人水下机器人目前仍处于小众市场,但对于能源资产的巡检至关重要。一旦人形自主移动机器人的运作可靠性达到仓库性能标准,其市场规模可能会迅速成长。

传统机器人车队依赖单一任务优化的专用外形规格,缺乏多功能性。人形机器人可望简化车队,使单一平台即可在不同角色间切换,例如货架搬运和分类。因此,投资正从纯粹的行动硬体转向人工智慧的视觉和抓取能力,以期达到媲美人类的灵巧程度。这种转变将降低生命週期成本,并催生新的服务模式,例如机器人即服务订阅模式。

到2024年,凭藉在拥挤通道中毫米级的重复定位精度,雷射雷达SLAM将占41.5%的市场份额。基于视觉的系统正以21.22%的复合年增长率快速成长,无需昂贵的感测器和反射目标,即可降低中型营运商的资本支出。 Geek+公司展示了其采用英特尔RealSense深度摄影机和板载AI技术,实现了与雷射雷达媲美的精度。随着边缘处理器能够在低功耗预算下处理即时影像分割,视觉导航自主移动机器人的市场规模将进一步扩大。

混合感测器融合技术结合了摄影机、光达和惯性感测器,使机器人车队能够在遇到灰尘、眩光或频宽等情况时自动切换模式。这种自适应方法能够满足港口仓库目前对室内外混合作业的需求。认证各种感测器性能的标准将加速多感测器技术的应用,并确保机器人在公共人行道上安全通行。

自主移动机器人 (AMR) 市场细分:按类型(无人地面车辆、人形机器人、其他)、按导航技术(雷射雷达 SLAM、视觉导航、磁力/引导/二维码引导、其他)、按终端用户行业(仓储物流、製造业、汽车业、其他)以及按地区。市场预测以美元计价。

区域分析

亚太地区预计2024年将贡献37.8%的收入。像极智多星这样的中国企业出口超过三分之一的产品,充分利用了成本优势和政府鼓励试点计画的扶持政策。许多日本和韩国工厂为了缩短投资回报期,也向中国品牌购买机器人。北美在自主移动机器人市场保持第二大地位,这得益于亚马逊遍布全球的业务网络以及丰富的软体新兴企业生态系统,这些企业为第三方物流供应商构建了编配层。

欧洲正受益于结构性补贴。欧盟的「未来工厂」倡议为自动化硬体的资本支出提供高达20%的报销,从而加速了中型製造商的采用。随着津贴从2025年起生效,欧洲自主移动机器人的市占率可望上升。中东和非洲是成长最快的地区,复合年增长率达19.0%,这主要得益于沙乌地阿拉伯的「2030愿景」以及NEOM承诺为建筑机器人投入7.746亿美元。高昂的物流成本和待开发区仓库使得营运商能够从一开始就围绕机器人进行设计。

南美洲仍处于起步阶段。在巴西和墨西哥,进口自动化设备的税收减免政策鼓励了试点部署,但外汇波动减缓了普及速度。在非洲,部署主要集中在南非和摩洛哥,这两个国家的汽车组装厂需要将设备准时交付生产线旁。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 快速的履约需求

- 经合组织市场仓库工人短缺

- 锂离子电池价格跌破每千瓦时70美元

- 欧盟「未来工厂」补贴计画自2025年起

- 5G高阶专用网路部署

- 人工智慧赋能的「群体编配」平台

- 市场限制

- 互通性标准碎片化

- 网实整合实体安全漏洞

- 大容量自主移动机器人需要较高的初始投资

- 工会反对机器人密度限制

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按类型

- 无人地面车辆(UGV)

- 人形

- 无人驾驶飞行器(UAV)

- 无人水面航行器(UMV)

- 透过导航技术

- 光达猛击

- 基于视觉(2D/3D 相机)

- 磁感应/二维码指南

- 混合式多感测器融合

- 按有效载荷能力

- 体重低于100公斤

- 100-500 kg

- 500-1,000 kg

- 超过1000公斤

- 按最终用户行业划分

- 仓储和物流

- 製造业

- 车

- 饮食

- 卫生保健

- 零售与电子商务

- 国防与安全

- 采矿和矿产

- 能源与电力

- 石油和天然气

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 亚太其他地区

- 中东

- 以色列

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Zebra Technologies Corporation(Fetch Robotics)

- Teradyne Inc.-Mobile Industrial Robots(MiR)

- Geek+Technology Co., Ltd.

- Vecna Robotics, Inc.

- Seegrid Corporation

- Aethon, Inc.(ST Engineering)

- Omron Corporation

- Clearpath Robotics Inc.(OTTO Motors)

- HIK Robot Co., Ltd.

- SoftBank Robotics Group Corp.

- SMP Robotics Systems Corp.

- Locus Robotics Corp.

- Amazon.com, Inc.(Kiva/System Robotics)

- Agilox Services GmbH

- Balyo SA

- Vendor Positioning Analysis

- Investment Analysis

第七章 市场机会与未来展望

The autonomous mobile robot market is valued at USD 4.49 billion in 2025 and is forecast to reach USD 9.26 billion by 2030, expanding at a 15.6% CAGR.

Fast adoption of artificial intelligence, 5G-Advanced connectivity and lower-cost lithium-ion batteries together accelerate commercial feasibility across fulfilment, manufacturing and healthcare environments. Operators deploy robots to offset persistent labour shortages, to gain 24/7 throughput without building fixed conveyor infrastructure and to improve workplace safety. Asia-Pacific leads adoption thanks to Chinese suppliers that blend software-centric design and aggressive pricing, while Middle East mega-projects generate fresh demand for heavy-duty systems. Competitive intensity rises as vendors race to embed fleet-level orchestration software and to secure channel partnerships that shorten time-to-value. Regulatory incentives, such as EU "Factory of the Future" grants, further stimulate uptake by subsidizing capital outlays for small and mid-sized enterprises.

Global Autonomous Mobile Robot (AMR) Market Trends and Insights

Rapid e-commerce fulfilment demand

Online retail now hinges on same-day delivery expectations. Amazon surpassed 1 million deployed robots by July 2025 and cut travel time per pick by 10% through DeepFleet fleet intelligence, proving that mobile automation can quadruple throughput using the same headcount. Locus Robotics crossed 3 billion picks after integrating its LocusOne software, which doubled to tripled productivity while reducing injuries by 80%. Retailers are therefore adopting compact autonomous mobile robot market solutions that flex with seasonal volumes and require minimal facility changes. Vision-only navigation, showcased in the Geek+-Intel design, trims installation cost and time because no fixed markers are needed.

Scarcity of warehouse labour in OECD markets

OECD operators report persistent vacancies for night and peak-season shifts. The European Agency for Safety and Health at Work highlights automation as essential for offsetting shrinking working-age populations. Skechers logged 80% energy savings after replacing conveyors with robots, validating the return on investment where skilled labour is scarce. Employers now redesign rolls around robot supervision and maintenance, making warehouse jobs less physically demanding and more attractive.

Fragmented interoperability standards

ISO 3691-4 and ANSI/RIA R15.08 detail safety, yet they omit fleet communication protocols, forcing buyers into single-vendor ecosystems and inflating integration cost. Middleware suppliers attempt to bridge gaps, but proprietary data formats slow deployment and reduce bargaining power.

Other drivers and restraints analyzed in the detailed report include:

- Falling Li-ion battery cost below USD 70/kWh

- AI-enabled swarm orchestration platforms

- Cyber-physical security vulnerabilities

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Unmanned ground vehicles controlled 46.0% revenue in 2024. Humanoids, although young, are forecast to expand at 19.22% CAGR because they navigate human-designed spaces without layout changes. Amazon is piloting humanoid couriers that load parcels from Rivian electric vans, hinting at outdoor extension of the autonomous mobile robot market. Unmanned aerial and marine robots remain niche but critical for inspection in energy assets. The autonomous mobile robot market size for humanoids is likely to rise quickly once manipulation reliability reaches warehouse performance benchmarks.

Traditional fleets rely on specialized form factors that optimize one task but lack versatility. Humanoids promise fleet simplification because one platform can switch roles, from shelving to sorting. Investment has therefore shifted from pure mobility hardware to artificial intelligence vision and grasping capability that matches human dexterity. This transition will lower life-cycle cost and unlock new service models such as robot-as-a-service subscriptions.

LiDAR SLAM held 41.5% share in 2024 because of millimetre-level repeatability in congested aisles. Vision-based systems, expanding at 21.22% CAGR, eliminate expensive sensors and reflective targets, which reduces capital outlay for mid-market operators. Geek+ demonstrated LiDAR-equivalent accuracy through Intel RealSense depth cameras and onboard AI. The autonomous mobile robot market size for vision navigation will further increase as edge processors handle real-time image segmentation at lower power budgets.

Hybrid sensor fusion combines cameras, LiDAR and inertial sensors so fleets can switch modes when dust, glare or bandwidth constraints appear. This adaptive approach supports mixed indoor-outdoor operations that warehouses at ports now demand. Standards that certify performance across modalities will accelerate multi-sensor adoption, ensuring safety as robots cross public walkways.

Autonomous Mobile Robot (AMR) Market Report Segmented by Type (Unmanned Ground Vehicles, Humanoids and More), Navigation Technology (LiDAR SLAM, Vision-Based, Magnetic/Inductive/QR Guided and More), End-User Industry (Warehouse & Logistics, Manufacturing, Automotive and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific generated 37.8% of 2024 revenue. Chinese firms such as Geek+ export over one-third of production, leveraging cost advantages and government support programs that expedite piloting. Many Japanese and Korean factories now source robots from Chinese brands to cut payback periods. North America remains the second-largest autonomous mobile robot market owing to Amazon's multi-site expansion and a deep ecosystem of software startups that tailor orchestration layers for third-party logistics providers.

Europe benefits from structured subsidies. The EU "Factory of the Future" initiative reimburses up to 20% of automation hardware capital expenditure, which accelerates adoption among mid-sized manufacturers. The autonomous mobile robot market share for Europe will rise as grants kick in post-2025. The Middle East and Africa is the fastest-growing region at a 19.0% CAGR, driven by Saudi Arabia's Vision 2030 and NEOM's USD 774.6 million commitment to construction robotics. High logistics spend and greenfield warehouses allow operators to design around robots from day one.

South America remains early stage. Duty exemptions on imported automation in Brazil and Mexico encourage pilots, yet currency volatility slows wide rollout. Africa's uptake concentrates in South Africa and Morocco where automotive assembly plants demand just-in-time delivery to lineside.

- Zebra Technologies Corporation (Fetch Robotics)

- Teradyne Inc. - Mobile Industrial Robots (MiR)

- Geek+ Technology Co., Ltd.

- Vecna Robotics, Inc.

- Seegrid Corporation

- Aethon, Inc. (ST Engineering)

- Omron Corporation

- Clearpath Robotics Inc. (OTTO Motors)

- HIK Robot Co., Ltd.

- SoftBank Robotics Group Corp.

- SMP Robotics Systems Corp.

- Locus Robotics Corp.

- Amazon.com, Inc. (Kiva/System Robotics)

- Agilox Services GmbH

- Balyo SA

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid e-commerce fulfilment demand

- 4.2.2 Scarcity of warehouse labor in OECD markets

- 4.2.3 Falling Li-ion battery $/kWh below USD 70

- 4.2.4 Post-2025 EU "Factory of the Future" grants

- 4.2.5 5G-Advanced private network roll-outs

- 4.2.6 AI-enabled "swarm orchestration" platforms

- 4.3 Market Restraints

- 4.3.1 Fragmented interoperability standards

- 4.3.2 Cyber-physical security vulnerabilities

- 4.3.3 High up-front capex for heavy-payload AMRs

- 4.3.4 Union push-back on robot density limits

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Unmanned Ground Vehicles (UGV)

- 5.1.2 Humanoids

- 5.1.3 Unmanned Aerial Vehicles (UAV)

- 5.1.4 Unmanned Marine Vehicles (UMV)

- 5.2 By Navigation Technology

- 5.2.1 LiDAR SLAM

- 5.2.2 Vision-based (2D/3D camera)

- 5.2.3 Magnetic / Inductive / QR Guided

- 5.2.4 Hybrid & Multi-Sensor Fusion

- 5.3 By Payload Capacity

- 5.3.1 Up to 100 kg

- 5.3.2 100 - 500 kg

- 5.3.3 500 - 1,000 kg

- 5.3.4 Above 1,000 kg

- 5.4 By End-user Industry

- 5.4.1 Warehouse and Logistics

- 5.4.2 Manufacturing

- 5.4.3 Automotive

- 5.4.4 Food and Beverage

- 5.4.5 Healthcare

- 5.4.6 Retail and E-commerce

- 5.4.7 Defense and Security

- 5.4.8 Mining and Minerals

- 5.4.9 Energy and Power

- 5.4.10 Oil and Gas

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Middle East

- 5.5.4.1 Israel

- 5.5.4.2 Saudi Arabia

- 5.5.4.3 United Arab Emirates

- 5.5.4.4 Turkey

- 5.5.4.5 Rest of Middle East

- 5.5.5 Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Egypt

- 5.5.5.3 Rest of Africa

- 5.5.6 South America

- 5.5.6.1 Brazil

- 5.5.6.2 Argentina

- 5.5.6.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Zebra Technologies Corporation (Fetch Robotics)

- 6.4.2 Teradyne Inc. - Mobile Industrial Robots (MiR)

- 6.4.3 Geek+ Technology Co., Ltd.

- 6.4.4 Vecna Robotics, Inc.

- 6.4.5 Seegrid Corporation

- 6.4.6 Aethon, Inc. (ST Engineering)

- 6.4.7 Omron Corporation

- 6.4.8 Clearpath Robotics Inc. (OTTO Motors)

- 6.4.9 HIK Robot Co., Ltd.

- 6.4.10 SoftBank Robotics Group Corp.

- 6.4.11 SMP Robotics Systems Corp.

- 6.4.12 Locus Robotics Corp.

- 6.4.13 Amazon.com, Inc. (Kiva/System Robotics)

- 6.4.14 Agilox Services GmbH

- 6.4.15 Balyo SA

- 6.5 Vendor Positioning Analysis

- 6.6 Investment Analysis

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment