|

市场调查报告书

商品编码

1408217

塑胶托盘:市场占有率分析、行业趋势和统计、2024-2029 年成长预测Plastic Pallets - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

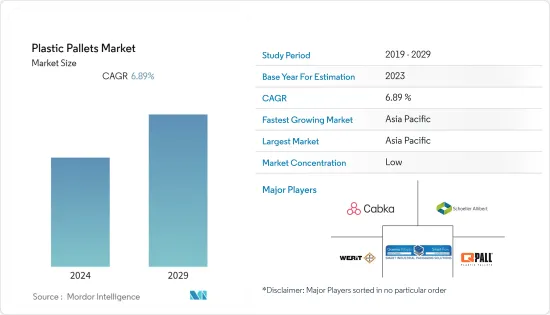

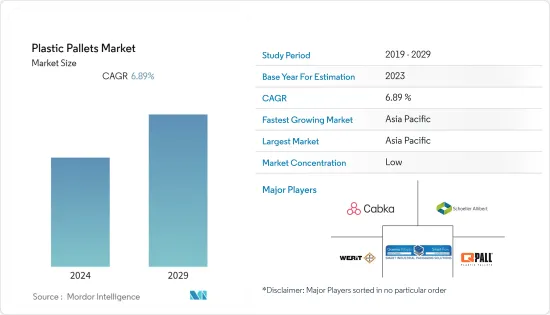

塑胶托盘市场预计将从 50.2 亿美元成长至 70.1 亿美元,预测期内复合年增长率为 6.89%。

塑胶托盘是刚性形式,可在搬运过程中为散装货物提供机械稳定性,以保持品质。搬运是指与起重、堆放、储存产品以及透过陆地或海上运输产品相关的所有活动。塑胶托盘是为了透过堆高机、托盘搬运车和前端装载机等设备移动而开发的,使货物的移动变得更加容易。

主要亮点

- 塑胶托盘的材质有HDPE、聚丙烯等。 HDPE(高密度聚苯乙烯)是塑胶托盘中最常见的树脂。这种材料具有大多数标准应用所需的所有特性,包括耐用性、刚性和防潮性。 HDPE 非常适合在仓库中重复使用的重型材料。

- 电子商务的日益普及导致物流活动的扩大,进而导致全球对托盘的需求激增。此外,随着组织零售的渗透率不断提高,托盘被广泛用于零售空间,用于装卸重型货物,预计这将推动需求。

- 据 Tosca Services LLC 称,几年前,住宅建筑商、製造商和供应链营运商面临挑战,成本升至每 1,000 英尺 1,500 美元,几乎翻了一番。这种变化直接影响了木栈板的使用。木栈板多年来一直是供应链优化的核心,现在已成为主要支出。但为了稳定价格并避免意外成本,企业在 2020 年找到了可重复使用塑胶托盘的长期智慧包装解决方案。可重复使用的塑胶托盘的好处不仅限于价格,还将影响全球运输的未来,从环境法规到供应链可追溯性。

- 然而,有几个因素限制了普及,包括塑胶托盘的高成本和永续性问题。塑胶托盘是一体成型的,一旦损坏就无法修復。此外,塑胶托盘的表面光滑,没有木栈板的粗糙纹理,因此有证据表明产品可能会在其上滑动,从而导致产品损坏。

- COVID-19 和俄罗斯-乌克兰衝突的影响对所研究的市场产生了重大的长期影响。其影响包括消费行为的变化、供应链中断以及大流行造成的政府干预。俄罗斯和乌克兰衝突的影响波及各地区。受影响的主要领域是供应链瓶颈和能源价格,这为原材料供应商带来了问题。俄罗斯和乌克兰是多种原料的重要供应国和生产国。衝突也造成商业投资的不确定性和金融市场的不稳定。

塑胶托盘市场趋势

高密度聚苯乙烯(HDPE)占据主要市场占有率

- 聚乙烯 (PE) 是目前最耐用的塑胶类型之一。它耐化学品且成本低。 PE衍生石油聚合物,可以承受任何环境危害。高密度聚苯乙烯(HDPE) 是最常用于硬质包装的塑胶之一,尤其是在製造业中。 HDPE 以其强度和耐用性而闻名。这种类型的塑胶有时可以进行颜色匹配,其中白色最受欢迎。 HDPE 经常用于塑胶托盘的生产。

- HDPE 托盘因其多功能性、成本效益和强度而成为最常用的塑胶托盘。具有高衝击强度,吸收衝击,即使在运输或储存过程中意外跌落或受到较大外力也能保持稳定。 HDPE 托盘耐腐蚀、耐热,并且与大多数化学物质相容。然而,必须避免与氧化剂和碳氢化合物的广泛接触。这种类型的塑胶也很受欢迎,与 PP 类似,但 HDPE 更硬、更坚固。此外,它比 PP 能承受更高的温度。当需要承载较大重量或存在卫生法规时,请使用这些托盘。

- 领先的 HDPE 托盘供应商致力于使用 100% 可回收塑胶聚合物製造生态塑胶托盘。从製造方法来看,大多数供应商采用射出成型製造HDPE塑胶托盘。 HDPE 常用于工业产品和汽车产业。因此,HDPE 是全球领先的塑胶托盘,并且预计将继续保持领先地位。嵌套式塑胶 HDPE 托盘旨在节省空间并降低运输成本。独特的设计使它们在空时可以相互嵌套,与传统的木栈板相比,显着增加了回程卡车的负载容量。最终用户群对 HDPE 托盘的需求正在不断增加。

- 食品和饮料行业中塑胶托盘的使用消除了与木栈板相关的许多风险以及由此产生的食品污染。塑胶托盘比木栈板更容易清洗和消毒。塑胶材质不吸水,因此表面污染物在清洗过程中很容易被破坏。 HDPE一次性塑胶托盘因其在常温下对有机和无机化学品具有高抵抗力而广泛应用于食品和饮料行业。

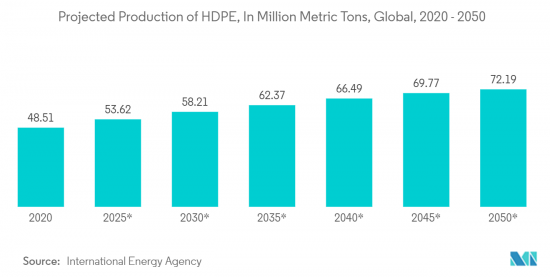

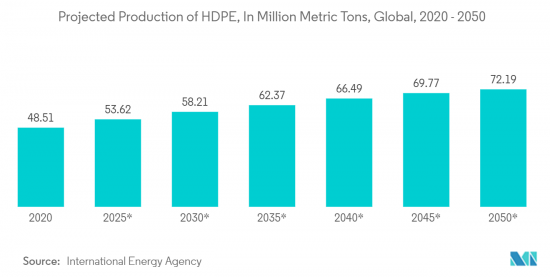

- 根据尼尔森公司2023年3月发表的报导,HDPE是使用最广泛的塑胶托盘树脂。 HDPE 具有大多数标准应用所需的所有特性,包括耐用性、刚性和防潮性。 HDPE 适用于重型、重复性应用,例如仓库中的应用。总部位于巴黎的自治政府间组织国际能源署 (IEA) 表示,全球 HDPE 产能预计将从 2020 年的 4,851 万吨激增至 2050 年的 7,219 万吨。随着预测期内HDPE产能的上升,HDPE托盘市场也有望占据一定比例。

亚太地区预计将经历显着成长

- 塑胶托盘具有防虫和防真菌功能。它重量轻、成本效益高、品质高,适合长期使用。它还具有高度可靠性和环境安全性。使用四向伸缩堆高机即可轻鬆装卸。适当的尺寸和紧凑的设计让您可以将其放置在任何地方,即使在狭窄的区域也能节省空间。塑胶托盘之所以有吸引力,是因为它们可以回收利用,但在中国和印度,它们并不是优先考虑的对象。

- 自2009年危机以来,中国的出口表现在过去十年中持续成长,但2016年除外,当时全球需求再次下降。

- 根据世界贸易组织(WTO)的数据,中国不仅是世界上人口最多的国家之一,而且已成为世界上最大的生产国和出口国。

- 在印度,对水产品和电子产品的需求正在成长,不吸湿的塑胶托盘预计也会成长。塑胶托盘可以有控制地解决木栈板常见的虫害、腐烂、吸臭、熏蒸、除静电等问题,并且可以在使用过程中快速、彻底地清洁,还具有能够要清洗又洗。

- 在日本,零售业普遍使用塑胶托盘展示架。这些显示器用于降低运输过程中损坏的风险并方便货物的运输。只有托盘需要搬运,而不是里面的物品。因此,货架选择对于处理精緻物品的零售店来说是理想的选择。

- 零售业是任何经济体的最大贡献者之一,也是在整个供应链中运输各种消费品的物流解决方案的最大消费者之一。近年来,物流变得更加专业化,现已成为参与企业的关键区别之一。零售业是对物流业务效率要求最高的行业之一,其中托盘、板条箱和货柜等塑胶物流解决方案发挥重要作用。这些因素强化了零售物流业务的两个预期效益:提高永续性和逆向物流。

塑胶托盘产业概况

塑胶托盘市场分散。市场上主要企业包括 Cabka Group GmbH、Q-Pall BV、ORBIS GmbH 和 Schoeller Allibert Group BV。这些公司专注于透过合作和投资扩大业务。

例如,2023 年 7 月,Geoplatics.com 和 Q-Pall 在英国推出了重型托盘。这种重型开放式塑胶托盘由荷兰 Q-Pall 製造,主要用于为製造商和其他行业处理散装物料和原材料,包括运输和储存化学品桶和散装袋。此托盘尺寸为 1200 毫米 x 1200 毫米 x 165 毫米,是原始 Q-pal 1212 HR 6R 的改良版本。此托盘的静态负载为 7,500 公斤,动态负载为 2,000 公斤,是重型应用的可靠选择。

2023 年 4 月,可重复使用包装领域的参与企业奥比斯公司宣布,40 x 48 英吋可重复使用托盘 P3 在快速生命週期分析中完成了 280 个週期。这是典型 40 x 48 英吋纯木纵梁托盘生命週期的 25 倍以上。 P3 是一种高密度、轻质、可堆迭且卫生的可重复使用包装解决方案,可与手动和自动物料搬运设备无缝整合。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- 评估 COVID-19 和最近的乌克兰-俄罗斯衝突对塑胶托盘市场生态系统的影响

第五章市场动态

- 市场驱动因素

- 提高塑胶托盘和泳池服务的再生性

- 电子商务及相关物流需求的扩大

- 市场挑战

- 木栈板的存在以及製造商对木栈板的依赖

第六章市场区隔

- 依材料类型

- 高密度聚苯乙烯(HDPE)

- 聚丙烯(PP)

- 其他材料(聚氯乙烯(PVC)、PET、聚烯烃(PO))

- 按用途

- 食品和饮料

- 化学

- 建造

- 零售

- 车

- 其他用途

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 其他亚太地区

- 拉丁美洲

- 中东/非洲

- 北美洲

第七章 竞争形势

- 公司简介

- WERIT Kunststoffwerke W. Schneider GmbH & Co. KG

- Gamma-Wopla NV and Smart-Flow NV

- Q-Pall BV

- CABKA Group Gmbh

- Schoeller Allibert Group BV

- Omnipack sro

- Orbis Corporation

- NAECO SL

- Plasgad Plastic Products ACS Ltd

- CHEP(Commonwealth Handling Equipment Pool)

第八章市场的未来

The plastic pallets market is expected to grow from USD 5.02 billion to USD 7.01 billion, registering a CAGR of 6.89% over the forecast period.

Plastic pallets are rigid forms that provide mechanical stability to bulk goods during handling to preserve quality. Handling comprises all activities related to lifting, stacking, product storage, and transportation by land or sea. Plastic pallets are developed to be moveable by equipment such as forklifts, pallet jacks, and front loaders to facilitate the mobility of goods.

Key Highlights

- Plastic pallets are made of HDPE, polypropylene, etc. HDPE, or high-density polyethylene, is the most common resin in plastic pallets. This material has all the properties most standard applications demand: durability, stiffness, and moisture resistance. HDPE is ideal for the demanding and repeated use found in warehouses.

- The increasing popularity of e-commerce resulted in the expansion of logistics activities and, in turn, surged the demand for pallets worldwide. Furthermore, increasing penetration of organized retail is anticipated to drive the demand for pallets as these are widely used in retail spaces for the loading and unloading of heavy merchandise.

- According to Tosca Services LLC, home construction, manufacturers, and supply chain operators faced challenges as costs rose to USD 1500 per 1000 feet a couple of years back, nearly doubling in prices. This volatility has directly impacted the use of wooden pallets. These wood pallets, central to supply chain optimization for years, have become a significant expense. However, to stabilize pricing and avoid unanticipated costs, companies have found a long-term smart packaging solution in reusable plastic pallets in 2020. The benefits of reusable plastic pallets go beyond price and will influence the future of global shipping in everything from environmental regulation to supply chain traceability.

- However, several factors, such as the high cost of plastic pallet and their sustainability issues, limit their widespread penetration. A plastic pallet is made in the one-piece molding process, so it cannot be repaired once damaged. Since the plastic pallet is not as rough as the wooden pallet and its surface is smooth, it causes the goods to face signs of sliding on it, damaging the products.

- The impact of COVID-19 and the Russia-Ukraine conflict had significant long-term effects on the market studied. The impact brought changes in consumer behavior, supply chain disruptions, and government interventions caused by the pandemic. The impact of the Russia-Ukraine conflict has been witnessed across various regions. Major sectors affected were the supply chain bottlenecks and energy prices that caused problems for raw material suppliers. Russia and Ukraine are significant suppliers and producers of several raw materials. The conflict also added uncertainty to business investment and volatility to financial markets.

Plastic Pallets Market Trends

High-Density Polyethylene (HDPE) to Hold Major Market Share

- Polyethylene (PE) is one of the most durable types of plastic currently available. It is resistant to chemicals and has a low cost. PE has been derived from petroleum polymers and can withstand any environmental hazard. High-density polyethylene (HDPE) is one of the most common types of plastic used for rigid packaging, especially in manufacturing. HDPE is known for its strength and durability. This type of plastic might also be color-matched and is popular in white. HDPE is frequently used in the production of plastic pallets.

- HDPE pallets are the most used plastic pallets due to their versatility, cost-effectiveness, and strength. They have high impact strength, absorb shock, and maintain stability even if accidentally dropped or subjected to a significant force during transportation or storage. HDPE pallets are corrosion and heat-resistant and compatible with most chemicals. However, its preferred applications are expected to avoid extensive contact with oxidizing agents and hydrocarbons. This type of plastic is also popular and similar to PP, but HDPE is stiffer and stiffer. In addition, it can withstand higher temperatures than PP. These pallets are used when larger weights need to be held or when sanitary regulations exist.

- Major HDPE pallet vendors concentrate on producing green plastic pallets using 100% recyclable plastic polymers. Regarding manufacturing methods, most vendors use injection molding to produce HDPE plastic pallets. The industrial goods and automotive industries are common in which HDPE is used. As a result, HDPE is the leading plastic pallet in the world and is expected to remain the leader in the coming years. Nested plastic HDPE pallets are designed to save space and reduce transportation costs. The unique design allows them to be nested inside each other when empty, allowing load significantly more in the truck on the way home than traditional wooden pallets. There is a rising demand for HDPE pallets across the end-user segments.

- The use of plastic pallets in the food and beverage industry eliminates many of the risks associated with wood pallets and associated food contamination. The plastic pallets are easier to clean and sanitize than the wood pallets. The plastic material does not absorb water, so any surface contamination is readily destroyed during cleaning. HDPE disposable plastic pallets are extensively used in the food and beverage industry as they are highly resistant to organic and inorganic chemicals at normal temperatures.

- As per the article published by the Nelson Company in March 2023, HDPE is the most widely used plastic pallet resin. HDPE has all the characteristics that most standard applications require, including durability, rigidity, and resistance to moisture. It is suitable for the heavy and repetitive applications found in warehouses. According to the International Energy Agency, a Paris-based autonomous intergovernmental organization, the global production capacity of HDPE is expected to shoot up from 48.51 million metric tons in 2020 to 72.19 million metric tons in 2050. With the rising capacity of HDPE during the forecast period, the market for HDPE pallets is also expected to gain a percentage contribution.

Asia-Pacific Expected to Witness Significant Growth

- Plastic pallets are highly resistant to insects and fungi. It is lightweight, cost-effective, and offers high quality, so it can be used for a long time. It also offers high and dependable performance and is safe for the environment. It is easy to pull on and off in the four-way stretch forklift. The correct size and compact design allow it to be placed everywhere to free up space in tight places. Plastic pallets are attractive for their recyclable qualities, but this is not a high priority in China and India.

- China's export performance has consistently increased over the past ten years, except in 2016, when global demand decreased again after the crisis in 2009

- In addition to being one of the world's most populated nations, China has established itself as the world's largest producer and exporter, according to the World Trade Organization (WTO).

- In India, the growing demand for seafood and electronics is expected to support the growth of plastic pallets as they do not absorb moisture. They are prone to common issues with wood pallets, such as infestation, rot, odor absorption and fumigation, and elimination of static electricity in a controlled manner, along with the convenience of quick and thorough cleaning or washing between uses.

- In Japan, the use of plastic pallet displays is a common practice in retail. These displays are utilized to facilitate the transportation of goods with reduced risk of damage during transport. The only items that need to be handled are the pallets, not the contents. Therefore, the shelving option is ideal for retail stores that offer delicate products.

- The retail industry is one of the most significant contributors to any economy and one of the biggest consumers of logistics solutions, transporting various consumer goods throughout the supply chain. Logistics has become more professionalized in recent years and is now one of the key distinguishing factors among the multiple players in the sector. Retail is one of the most demanding sectors in terms of logistics operation efficiency, where plastic logistic solutions such as pallets, crates, and containers play a crucial role. These factors reinforce two expected benefits in the logistics operations of the retail industry: sustainability and improving reverse logistics.

Plastic Pallets Industry Overview

The plastic pallets market is fragmented. Major players in the market include Cabka Group GmbH, Q-Pall BV, ORBIS GmbH, Schoeller Allibert Group BV, and more. These companies focus on expanding their business through collaborations, investments, etc.

For instance, in July 2023, Geoplatics.com and Q-Pall launched heavy-duty pallets in the United Kingdom. This heavy-duty, open-deck plastic pallet manufactured by Netherlands-based Q-Pall has been mainly designed to handle large amounts of materials and ingredients for manufacturers and other industries, including those transporting and storing chemical drums and bulk bags. The pallet, which measures 1200 mm x 1200 mm x 165 mm, is an enhanced version of the original Q-pall 1212 HR 6R. With a static load of 7,500 kg and a dynamic load of 2,000 kg, it is a highly reliable option for heavy-duty applications.

In April 2023, ORBIS Corporation, a global player in reusable packaging, announced that its 40 by 48-inch reusable pallet, the P3, completed 280 cycles in the FastTrack lifecycle analysis. This equates to more than 25 times the lifecycle of a typical 40-by-48-inch white wood stringer pallet. The P3 is a high-density, lightweight, stackable, hygienic reusable packaging solution that seamlessly integrates with both manual and automated material handling equipment.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 and the Recent Ukraine-Russia Standoff on the Plastic Pallets Market Ecosystem

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Reusability and Pooling Services of Plastic Pallets

- 5.1.2 Growing E-commerce and Subsequent Demand From Logistics

- 5.2 Market Challenges

- 5.2.1 Existence of and Manufacturers Reliance on Wooden Pallets

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 High-Density Polyethylene (HDPE)

- 6.1.2 Polypropylene (PP)

- 6.1.3 Other Materials (Polyvinyl Chloride (PVC), PET and Polyolefin (PO))

- 6.2 By Application

- 6.2.1 Food and Beverage

- 6.2.2 Chemical

- 6.2.3 Construction

- 6.2.4 Retail

- 6.2.5 Automotive

- 6.2.6 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.2.5 Spain

- 6.3.2.6 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 WERIT Kunststoffwerke W. Schneider GmbH & Co. KG

- 7.1.2 Gamma-Wopla NV and Smart-Flow NV

- 7.1.3 Q-Pall BV

- 7.1.4 CABKA Group Gmbh

- 7.1.5 Schoeller Allibert Group BV

- 7.1.6 Omnipack s.r.o.

- 7.1.7 Orbis Corporation

- 7.1.8 NAECO SL

- 7.1.9 Plasgad Plastic Products ACS Ltd

- 7.1.10 CHEP (Commonwealth Handling Equipment Pool)