|

市场调查报告书

商品编码

1408389

公共云端-市场占有率分析、产业趋势/统计、2024-2029 年成长预测Public Cloud - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

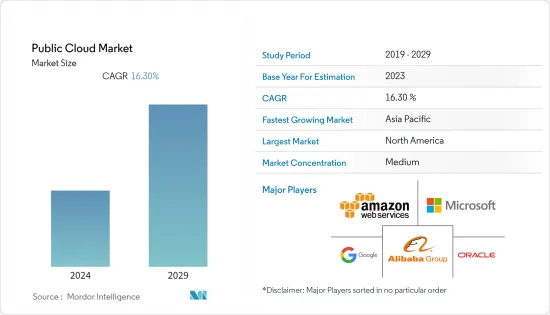

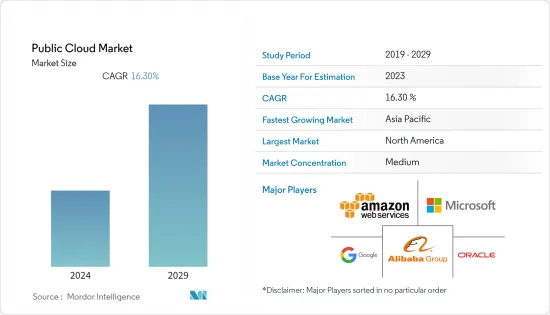

全球公共云端市场目前市场规模为5,186.9亿美元,预计五年后将达1,1036亿美元,预测期内复合年增长率为16.3%。

采用公共云端的关键市场驱动因素之一是它为各种规模的企业提供无与伦比的可扩展性和弹性。传统的本地基础设施通常需要协助来应对需求的突然激增,从而导致成本高昂的过度配置或资源利用不足。许多提供者允许您快速增加或减少资源以回应不断变化的需求。

主要亮点

- 公共云端服务彻底改变了公司管理 IT 预算的方式。计量收费模式允许企业存取广泛的服务,而无需支付初期成本。传统上,采购和营运硬体意味着大量投资,但云端的营运支出方法改变了财务游戏规则。与此结合,计量收费定价模式有利于新兴企业和资本有限的小型企业,并允许大型企业优化其 IT 支出。除此之外,公司可以在不花费大量资金的情况下尝试新想法,这鼓励了实验并为市场提供了动力。

- 根据泰雷兹集团预测,截至2022年,超过60%的业务资料将储存在云端。这一比例在 2015 年达到了 30%,随着企业越来越多地将资源转移到云端环境以提高安全性、可靠性和业务敏捷性,这一比例还在继续增加。这些因素为经过市场研究的供应商在未来几年扩大其服务范围创造了巨大的成长机会。企业越来越多地采用云端运算也扩大了所涵盖的市场范围。例如,总部位于印度的市场供应商 Druva Inc. 报告称,由于存在大量非结构化资料,许多公司将企业资料作为主要目标。该公司还报告称,这些资料占企业储存系统储存资料的 80% 以上。

- Flexera Cloud Report 2022 对 753 名受访者进行了调查。该公司发现,受访者对 SaaS 和 IaaS/PaaS 决策有重大影响,78% 的受访者参与 SaaS 决策,而更积极参与公有云决策的受访者占 77%。这类似于受访者主动管理公共云端IaaS、PaaS 和 SaaS 的持续使用和成本的方式 (69%)。此外,根据 Fortinet 2022 年云端安全报告,云端用户认为云端承诺提供自适应容量和可扩展性 (53%)、提高敏捷性 (50%) 以及提高可用性和业务永续营运(45%)。我们保证这正在发生。

- 此外,安全风险可能是市场成长的一个问题。到目前为止,第三方经营团队一直谨慎对待这项服务。此外,资料外洩的威胁始终存在,这也对市场发展提出了挑战。企业IT管理的关键目标是流程标准化。传统上,管治的需要源自于提供监督和指导。无论您现有的系统是私有云端云还是公共云端,管理整合多个系统的混合云端都变得更加复杂。根据 RightScale 的云端状况报告,云端管治是企业和小型企业面临的最大挑战。企业受访者表示这是一个担忧,主要是因为他们拥有多重云端策略。

- COVID-19 改变了企业的运作方式。随着 COVID-19 大流行导致需求增加,企业开始寻求全球超大规模资料中心业者,以协助他们实施云端服务,以提高业务的生产力和可扩展性。云端处理可以透过降低成本、提高弹性和弹性以及最大限度地提高资源利用率来帮助您竞争。疫情期间,组织被迫采用远距工作场景,导致资料外洩事件和网关增加。根据 Hosting Tribunal 的数据,到 2020 年,大约 94% 的企业已经在使用云端服务,预计约 83% 的企业工作负载将位于云端。

公共云端市场趋势

SaaS(软体即服务)预计将占很大份额

- SaaS(软体即服务)是一种云端基础的模型,云端供应商透过互联网开发应用程式并将其交付给最终用户。独立软体供应商 (ISV) 可以与第三方云端供应商签订合同,以在此模型中託管其应用程式。 SaaS 应用程式包括申请系统、客户关係管理 (CRM)、服务台、人力资源解决方案等。组织正在采用 SaaS 模型来降低商业软体的初期成本、在单一电脑上安装软体的需求、随着公司发展而服务的可扩展性、与其他软体应用程式的整合以及对所有使用者的即时可用性。多种好处,包括更新。例如,Dropbox 就是 SaaS 的一个例子。云端储存允许企业储存、共用和协作处理文件和资料。使用者可以同步和备份檔案并从任何装置存取它们。

- 各行业的参与企业正在收购市场进入者,以扩大其影响力并进入新参与企业。例如,2022年9月,总部位于阿布达比的B2B物流SaaS平台Lyve Global宣布收购跨境电商物流和解决方案供应商Shopini World,将业务拓展全部区域。该市场的参与企业正在寻求透过策略性收购和合併来扩大其服务范围,以满足该国对 SaaS 不断增长的需求。

- 同样在 2022 年 6 月,纯云端原生安全供应商 Aqua Security 今天宣布其云端原生安全 SaaS 在新加坡全面上市 (GA),为更广泛的 APJ 地区提供服务。客户可以立即受益于 SaaS 服务提供的资料主权、平台安全性和弹性,并可以在云端原生攻击发生之前进行预防。新加坡的软体即服务允许政府、银行、金融服务和其他受监管部门的 Aqua 客户利用治理和合规性来实现全面的云端原生安全、风险管理和合管治。您可以透过本地方式利用我们的服务满足资料主权要求的服务。

- 2023年5月,全球云端基础资料管理软体供应商Stibo Systems收购了微软的I参与合作伙伴计画。 Stibo Systems 在 Microsoft 的支援和指导下改进了其云端服务。这种整合使客户能够提高其云端投资和资源的短期和长期绩效。

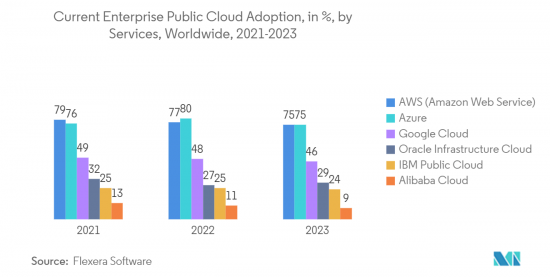

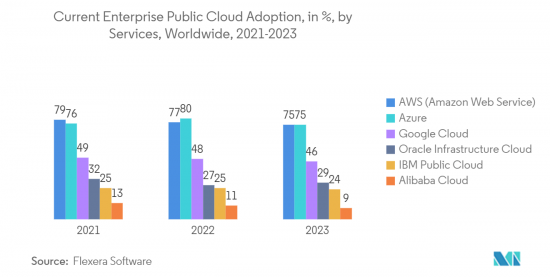

- Flexera Software 表示,在 2023 年对 627 家公司进行的云端调查中,75% 的企业受访者表示他们正在采用 Microsoft Azure 进行公共云端使用。 AWS、Microsoft Azure、Google Cloud 或超大规模供应商是全球领先的云端运算平台供应商。公共云端服务提供了地理上分布的资料中心网络,使企业能够在更靠近最终用户的位置部署应用程式和服务,无论其位置如何。这种全球部署可确保低延迟访问,从而提高效能和使用者体验。

预计北美将占据很大的市场份额

- 北美是公共云端采用的主要创新者和先驱。该地区为云端微服务供应商奠定了坚实的基础,刺激了市场成长。其中包括 Amazon Web Services Inc.、Oracle Corporation、IBM Corporation、Microsoft Corporation 等。由于先进技术的日益采用,该地区在云端微服务市场中越来越受欢迎。此外,北美企业正在采用金融、电子商务和旅游服务的公共云端架构,这些架构的需求量很大,因为它们可以经济高效地储存资讯和资料,并提高敏捷性、效率和可扩展性。云端运算、人工智慧、巨量资料、分析、行动社交媒体、网路安全和物联网等成熟技术的使用正在推动创新和转型,并推动北美商业生态系统的成长。

- 根据 Stormforge 发布的一份报告,18% 的北美受访者表示,他们的组织每月在云端使用上的支出在 10 万美元到 25 万美元之间。此外,44% 的受访者预计他们的云端支出将在未来12 个月内增加,另外32% 的受访者预计他们组织的云端支出将在未来12 个月内大幅增加。我确实如此。美国是北美主要国家之一,如此巨大的云端支出可能会为所研究的市场创造成长机会。

- 根据美国小型企业发展管理局预测,2022年,美国小型企业数量将达3,320万家,约占全国企业的99.9%。 2022年美国小型企业数量的扩张反映持续成长,比上一年(2021年)成长2.2%,比2017年至2022年成长12.2%。如此庞大的中小企业数量很可能为市场参与企业提供开发新的公有公共云端解决方案以占领市场市场占有率的机会。

- 市场参与企业正在合作更好地服务客户。例如,2022年6月,企业云端资料管理供应商Informatica宣布扩大与资料云端新兴企业Snowflake的合作,并进行新产品改进,以增加共同用户的价值。使用者可以利用智慧资料管理云端 (IDMC) 平台的强大功能,使用新的 Informatica Enterprise Data Integrator(目前正在开发的 Snowflake Marketplace 的本机应用程式)来整合来自 Snowflake Data Cloud 的各种企业应用资料。我可以。

- 同样,2023 年 7 月,房地产解决方案领域的全球参与企业MRI Software 宣布,透过在加拿大推出首个云端实例,将其产品扩展到加拿大市场。加拿大的 MRI 客户现在可以轻鬆存取 MRI 的最新解决方案,并透过在国内託管资料来确保遵守隐私和安全法规。加拿大客户现在可以透过新的云端实例利用该公司的下一代房地产平台 MRI Agora。 MRI Agora 以人工智慧为先的基础为基础,透过连网资料和共用服务帮助企业自动执行日常任务。 MRI Agora Insights 揭示了可操作的投资组合趋势并推动更好的业务决策。

公共云端产业概况

全球公共云端市场由多个参与者主导,包括亚马逊网路服务公司(AMAZON.COM, Inc.)、阿里云(阿里巴巴集团控股有限公司)、Google 有限公司(Alphabet Inc.)、微软公司、甲骨文公司和SAP SE.参与企业存在并且适度整合。公司持续投资于策略合作伙伴关係和产品开拓,以大幅提高市场占有率。以下是一些最近的市场开拓:

2023 年 4 月,VMware, Inc. 宣布推出 VMware 跨云端託管服务。这是一组监管建议,旨在提高合作伙伴和消费者的利益,并使高技能成员能够发展其託管服务实践。 VMware 的跨云端託管服务建立在 VMware 所征服的基础之上,即建立一个由 4,000 多家云端服务参与企业组成的生态系统,为全球数以万计的客户提供服务,使合作伙伴能够更轻鬆地使用设施管理服务。这提高了我们合作伙伴的盈利,并为成长和扩张开闢了新的可能性。

2022年10月,Google云端宣布全球领先的线上消费零售商Wayfair已完成其资料中心服务和应用程式向云端的迁移,Google云端作为其整体云端策略的基础做到了。此举将使 Wayfair 能够提高企业敏捷性和创新能力,管理突发容量,并扩展机器学习 (ML) 和人工智慧 (AI) 的新用途,从诈骗侦测到个人化客户协助。现在可以处理各种问题场景。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 5G、人工智慧、机器学习和物联网等新技术发展的兴起

- 与云端采用相关的经济影响

- 市场抑制因素

- 资料隐私和资料安全

第六章 市场细分

- 按发展

- SaaS(Software-as-a-Service)

- PaaS(Platform-as-a-Service)

- IaaS(Infrastructure-as-a-Service)

- 按组织规模

- 中小企业

- 大型组织

- 按最终用户产业

- BFSI

- 医疗保健

- 政府机关

- 製造业

- 资讯科技/通讯

- 其他最终用户

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争环境

- 公司简介

- Amazon Web Services Inc. (AMAZON.COM, Inc.)

- Alibaba Cloud (Alibaba Group Holding Limited)

- Google LLC (Alphabet Inc.)

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- IBM Corporation

- Salesforce Inc.

- Vmware Inc.

- Adobe Inc.

第八章投资分析

第九章 市场未来展望

The Global Public Cloud market is valued at USD 518.69 billion in the current year and is expected to register a CAGR of 16.3% during the forecast period to reach USD 1,103.60 billion in five years. One of the primary market drivers for public cloud adoption is the unmatched scalability and elasticity it offers to businesses of all sizes. Traditional on-premises infrastructures often need help to handle sudden spikes in demand, leading to costly overprovisioning or underutilization of resources. Numerous providers allow businesses to scale their resources up or down rapidly in response to changing requirements.

Key Highlights

- Public cloud services have transformed the way companies operate their IT budgets. The pay-as-you-go model lets organizations access diverse services without incurring upfront costs for Software and hardware. Traditionally, procuring and operating hardware meant substantial investments, but the cloud's operational expenditure approach changes the financial landscape. In confluence with this, the pay-as-you-go pricing model benefits startups and small businesses with limited capital and allows larger enterprises to optimize their IT spending. Apart from this, it encourages experimentation, as companies try out new ideas without committing to significant expenses, which provides an impetus to the market.

- According to Thales Group, As of 2022, over 60 percent of all business data is stored in the cloud. As businesses progressively move their resources into cloud environments to enhance security, dependability, and business agility, this balance hit 30% in 2015 and has since increased. These factors create a massive growth opportunity for the market-studied vendors to expand their offerings in the coming years. The growing adoption of cloud computing among enterprises also broadens the scope of the studied market. For instance, India-based market vendor Druva Inc. reported that many companies primarily target enterprise data due to a large amount of unstructured data. The company also reported that this data claim accounts for over 80% of the data stored in enterprise storage systems.

- Flexera Cloud Report 2022 surveyed 753 respondents; the company stated that respondents heavily influence SaaS and IaaS/PaaS decisions; 78% are involved in SaaS decisions, compared to 77% of respondents active in public cloud decisions. This is similar to how respondents actively manage continuing usage and costs for public cloud IaaS, PaaS, and SaaS (69 %). Further, according to the Fortinet Cloud Security Report 2022, Cloud users guarantee that the cloud is delivering on the promise of adaptable capacity and scalability (53%), increased agility (50 percent), and improved availability and business continuity (45%) Such massive adoption of cloud solutions would drive the market.

- Moreover, security risks are likely to concern market growth. To date, the third-party executives have handled services with care. Further, the threat of data breaches is always on, which also challenges market progress. The primary purpose of IT governance in the enterprise is process standardization. Traditionally, the need for governance originated to provide supervision and direction. Whether the existing systems are private or public clouds, managing a hybrid cloud incorporating multiple systems will be more complex. According to the RightScale State of the Cloud report, cloud governance was the top challenge for enterprises and SMBs. Enterprise respondents cited it as a concern, mainly because they have a multi-cloud strategy.

- The COVID-19 altered how companies function. Due to a rise in demand driven by the COVID-19 pandemic, businesses have turned to global hyper scalers for help implementing cloud services to increase the productivity and scalability of their operations. Cloud computing can increase competitiveness by lowering costs, improving flexibility and elasticity, and maximizing resource use. During the pandemic, organizations were pushed toward adopting remote working scenarios, leading to increased incidents and gateways for data breaches. According to the Hosting Tribunal, in 2020, about 94% of enterprises were estimated to be already using cloud services, and about 83% of enterprise workloads were on the cloud.

Public Cloud Market Trends

Software-as-a-Service (SaaS) is Expected to Hold Significant share

- Software as a service (SaaS) is a cloud-based model in which a cloud provider develops applications and makes them available to end users over the internet. An independent software vendor (ISV) may contract a third-party cloud provider to host the application in this model. SaaS applications include a billing invoicing system, Customer Relationship Management (CRM), help desk, and Human Resource solutions. Organizations are deploying the SaaS model to utilize multiple advantages, including the reduced upfront costs of commercial software, the need to establish software on individual machines, service scalability with a firm's growth, integrations with other software applications, and instant updates to all users. For instance, Dropbox is a real example of SaaS. Cloud storage allows firms to store, share, and collaborate on files and data. The users can sync and back up files to access them from any device.

- The players from various industries are acquiring the market players to expand their presence and enter new markets. For instance, in September 2022, Lyve Global, an Abu Dhabi-based B2B logistics SaaS platform, announced the acquisition of Shopini World, a cross-border e-commerce logistics and solutions provider, to expand its business across the Middle East and North Africa region. The players in the market are looking for strategic acquisitions and mergers to expand their offerings and cater to the rising demand for SaaS in the country.

- Further, in June 2022, Aqua Security, the pure-play cloud-native security provider, today announced the general availability (GA) of cloud-native security SaaS in Singapore, serving the broader APJ region. Customers can immediately take benefit of the data sovereignty, platform security, and flexibility delivered by the SaaS service to prevent cloud-native attacks before they happen. With SaaS (Software as a Service) in Singapore, Aqua customers in government, banking, financial services, and other regulated sectors can leverage the service for comprehensive cloud-native security, risk management, and compliance through an in-region service that addresses their governance and data sovereignty requirements.

- In May 2023, Stibo Systems, a global provider of master data management software, joined Microsoft's Partner Program as an independent software exporter to create and host cloud-based Software as a Service on Microsoft Azure. Stibo Systems improved its cloud services with support and guidance from Microsoft. This integration will enable clients to improve the short and long-term performance of their cloud investments and resources.

- According to Flexera Software, a state of cloud report surveyed 627 in 2023 states that 75 percent of enterprise respondents indicated adopting Microsoft Azure for public cloud usage. AWS, Microsoft Azure, and Google Cloud, or hyperscalers, are among the leading cloud computing platform providers worldwide. Public cloud services offer a geographically distributed network of data centers, allowing businesses to deploy applications and services close to their end users regardless of location. This global reach ensures low-latency access, improving performance and user experience.

North America is Expected to Hold Significant Share of the Market

- North America is among the leading innovators and pioneers in adopting public cloud. The region has a strong foothold of cloud microservice vendors, which adds to the market's growth. Some include Amazon Web Services Inc., Oracle Corporation, IBM Corporation, and Microsoft Corporation. Due to the growing adoption of advanced technologies, this region is gaining traction in the cloud microservices market. Moreover, there is an increasing demand from North American firms, as they have adopted public cloud architecture in financial, e-commerce, and travel services, which helps store information and data cost-effectively and boosts agility, efficiency, and scalability. The use of developed technologies, such as cloud computing, AI, big data and analytics, mobility/social media, cybersecurity, and IoT, among others, has led to innovation and transformation, thereby stimulating growth in the business ecosystem of North America.

- According to a report published by Stormforge, 18% of respondents from North America state that their organization has a monthly cloud spend that ranges between USD 100,000 and USD 250,000. Further, 44% of respondents expect cloud spending to increase somewhat over the next 12 months, while another 32% indicate that they expect their organization's cloud spending to increase significantly over the next 12 months. The United States is one of the major countries in North America, and such huge spending on the cloud would create an opportunity for the studied market to grow.

- According to the United States Small Business Administration Office of Advocacy, in 2022, the digit of small enterprises in the United States reached 33.2 million, accounting for approximately (99.9 percent) of firms in the country. The expansion in the number of small firms in the United States in 2022 reflects constant growth, with a 2.2 percent rise from the previous year(2021) and a 12.2% increase from 2017 to 2022. Such a huge number of SMEs would create an opportunity for the market players to develop new public cloud solutions to capture the market share

- The players in the market are collaborating to provide better services to their customers. For instance, in June 2022, Informatica, an enterprise cloud data management supplier, announced an expanded collaboration with Snowflake, the Data Cloud startup, and new product improvements to boost value for joint users. Users could use the power of the Intelligent Data Management Cloud (IDMC) Platform to integrate a wide range of enterprise application data in the Snowflake Data Cloud with the new Informatica Enterprise Data Integrator, a native application in Snowflake Marketplace that is currently in development.

- Similarly, in July 2023, MRI Software, a global player in real estate solutions, announced that it had expanded its offerings to the Canadian market by launching its first cloud instance in Canada. MRI clients in Canada can now easily access the latest solutions from MRI and host their data in the country, ensuring compliance with privacy and security regulations. Canadian clients can use MRI Agora, the company's next-generation real estate platform, through the new cloud instance. Based on an AI-first foundation, MRI Agora empowers businesses to automate mundane tasks through connected data and shared services. MRI Agora Insights unearths actionable portfolio trends to drive better business decisions.

Public Cloud Industry Overview

The Global Public Cloud market is moderately consolidated with the presence of several players like Amazon Web Services Inc.(AMAZON.COM, Inc.), Alibaba Cloud (Alibaba Group Holding Limited), Google LLC (Alphabet Inc.), Microsoft Corporation, Oracle Corporation, SAP SE, etc. The companies continuously invest in strategic partnerships and product developments to gain substantial market share. Some of the recent developments in the market are:

In April 2023, VMware, Inc. announced VMware Cross-Cloud managed services, a set of prescriptive recommendations with improved partner and consumer benefits that will enable highly skilled members to grow their managed services practices. Building on VMware's conquest in creating an ecosystem of more than 4,000 cloud service players that serve tens of thousands of clients worldwide, VMware Cross-Cloud managed services will make facility-managed services faster for partners and easier to consume by clients. This will enhance partner profitability while opening new possibilities for growth and expansion.

In October 2022, Google Cloud announced that Wayfair, one of the world's most prominent online destinations for the home, has completed migrating its data center services and applications to the cloud, with Google Cloud as the basis of its overall cloud strategy. The move enables the retailer to increase enterprise agility and technical innovation, manage burst capacity, and scale new uses of machine learning (ML) and artificial intelligence (AI) for scenarios ranging from fraud detection to personalized customer outreach.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rise in development of new technologies such as 5G, Artifical Intelligence, Machine Learning and Internet of Things

- 5.1.2 Economic benefits leading to cloud adoption

- 5.2 Market Restrains

- 5.2.1 Data Privacy and Data Security

6 MARKET SEGEMENTATION

- 6.1 By Deployment

- 6.1.1 Software-as-a-Service (SaaS)

- 6.1.2 Platform-as-a-Service (PaaS)

- 6.1.3 Infrastructure-as-a-Service (IaaS)

- 6.2 By Organization Size

- 6.2.1 SME's Organization

- 6.2.2 Large Organizations

- 6.3 By End User Industry

- 6.3.1 BFSI

- 6.3.2 Healthcare

- 6.3.3 Government

- 6.3.4 Manufacturing

- 6.3.5 IT and Telecom

- 6.3.6 Others End Users

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETETIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amazon Web Services Inc. (AMAZON.COM, Inc.)

- 7.1.2 Alibaba Cloud (Alibaba Group Holding Limited)

- 7.1.3 Google LLC (Alphabet Inc.)

- 7.1.4 Microsoft Corporation

- 7.1.5 Oracle Corporation

- 7.1.6 SAP SE

- 7.1.7 IBM Corporation

- 7.1.8 Salesforce Inc.

- 7.1.9 Vmware Inc.

- 7.1.10 Adobe Inc.