|

市场调查报告书

商品编码

1408439

消费者资产追踪:市场占有率分析、产业趋势与统计、2024-2029 年成长预测Consumer Asset Tracking - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

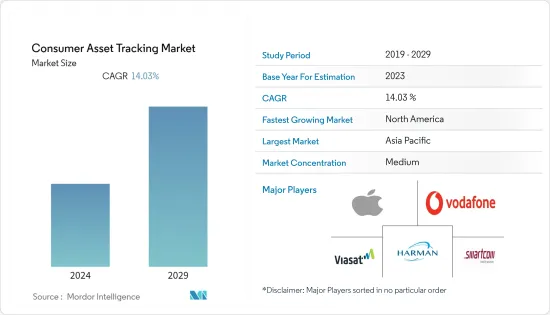

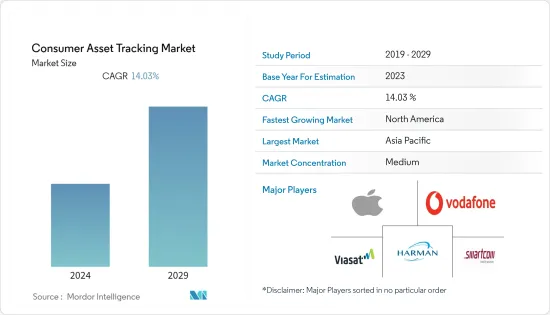

上年度消费者资产追踪市场价值为19.2亿美元,预计未来五年将达到40.4亿美元,复合年增长率为14.03%。

主要亮点

- 近年来,由于追踪和管理我们周围事物的需求不断增加,全球消费者资产追踪市场显着增长。随着贵重物品被盗、遗失和错放的情况不断增加,消费者正在寻找可靠的解决方案来保护自己的财产并提高安全感。

- 消费者资产追踪业务的技术不断发展。全球定位系统 (GPS)、物联网 (IoT) 和云端基础平台等技术的整合显着提高了资产追踪系统的准确性和功能。现在,消费者可以透过用户友好的行动应用程式和网路介面获得即时追踪和监控功能。

- 消费者资产追踪系统的应用可以在许多行业中找到。最常被追踪的设备是个人电子设备,例如智慧型手机、笔记型电脑和平板电脑。其他人则使用资产追踪技术来保护名牌手袋、珠宝和手錶等昂贵物品。

- 为了避免盗窃并在诈欺的使用情况下实现位置跟踪,汽车行业越来越多地在车辆中实施资产跟踪系统。此外,宠物饲主越来越多地使用宠物追踪设备来追踪他们心爱的朋友的行踪。

- COVID-19 大流行显着改变了消费者行为,加速了数位转型,并加速了资产追踪解决方案的采用。疫情过后,人们更关心自己的资产安全,努力保护自己的宝贵资产。这些系统提供即时位置更新和改进的安全功能,增加了对消费者资产监控服务的需求。

消费者资产追踪市场的趋势

基于物联网的连网型设备的使用增加

- 基于物联网的连网型设备的日益普及极大地刺激了全球消费者资产追踪市场。物联网 (IoT) 技术的无缝装置通讯可实现即时资料传输,从而提高资产追踪解决方案的效用和效率。

- 基于物联网的连网型设备提供了一个互连资产网络,可实现有效的资料传输和通讯。这种连接允许资产追踪程式向使用者和集中式平台广播即时位置资料、状态更新和其他相关资料。

- 支援物联网的资产追踪系统使消费者能够快速存取有关资产位置、移动模式和状态更新的资讯。其结果是降低了遗失或被盗的风险,实现了预防性维护,并提高了资产的可见性。

- 基于物联网的资产追踪系统可以收集和通讯各种资料,因为它们可以整合许多感测器,例如 GPS、加速计和温度感测器。这使得用户可以即时追踪资产的位置和物理特征。

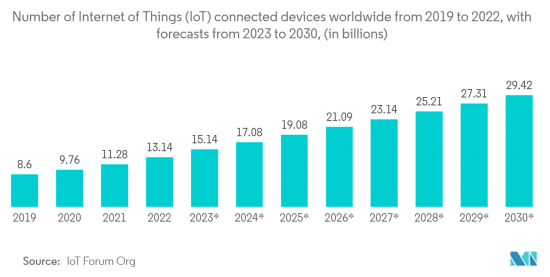

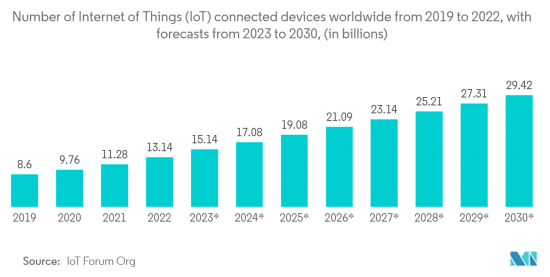

- 随着更多连网型设备进入市场,全球物联网生态系统正经历显着成长。从智慧型手机和穿戴式装置到智慧家庭和工业设备,物联网 (IoT) 设备的成长为资产追踪解决方案的高效运作奠定了坚实的基础。

北美预计将占据很大份额

- 在建构和普及消费者资产追踪系统方面,北美处于物联网 (IoT)、云端处理和人工智慧 (AI) 等技术发展的前沿。该地区提供强大的法律规范和基础设施来支持资产追踪技术的新发展。

- 与其他地区相比,北美消费者对资产监控系统的了解和认知度更高。高采用率是该地区精通技术的人和早期采用者拥抱新技术(尤其是消费者资产追踪)的结果。

- 消费者资产追踪领域的一些市场参与企业位于北美。这些公司在市场上占有重要地位,并提供广泛的现代解决方案来满足不同消费者的需求。他们的研发工作正在为整体市场的扩张做出贡献。

- 智慧城市的理念着重于利用技术发展城市基础设施和提高生活质量,在北美越来越受欢迎。消费资产监控有助于自行车、停车位、共用资源等公共资源的高效率管理,并改善资源配置与利用,协助智慧城市发展。

- 北美的法规环境具有支持性并促进新技术的发明和引进。监管机构对资料安全和隐私的保证将增强消费者对资产监控产品的信心并推动市场扩张。

消费者资产追踪产业概述

消费者资产追踪市场的特征是国内外参与者众多,且形势激烈。着名的市场领导包括苹果、沃达丰集团、Viasat 集团、哈曼、Smartcom Mobility Solutions 等。技术进步为这些公司提供了巨大的竞争优势,同时也有助于在市场内建立众多的合作关係。

2023 年 4 月,Digital Matter 宣布推出一项突破性创新,推出最持久的电池供电物联网 (IoT) 资产追踪器。凭藉其「逐秒」追踪功能,Remora3 树立了新的行业标准。其强大的追踪性能超越了现有的电池供电设备,并为物联网资产追踪应用开启了前所未有的可能性,而这些应用以前只能透过有线解决方案实现。

2023 年 5 月,专注于行动物联网 (M-IoT) 的领先新兴企业BeWhere 发布了最新的资产追踪设备 BeSol+ 和 BeTen+。 BeSol+ 是广受好评的 BeSol 的演变,现在拥有业界领先的 5 分钟即时报告频率,无需外部电源。这项令人印象深刻的成就包括太阳能充电、低功耗 5G 和 2G通讯、GPS、GLONASS、GNSS、Wi-Fi、BLE 室内和室外定位技术、强大的7 安培充电电池和大型太阳能电池板等创新功能。透过安装成为可能

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第 2 章执行摘要

第三章调查方法

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 基于物联网的连网型设备的使用增加

- 增加5G和先进网路基础设施的开发

- 市场抑制因素

- 与软体和采购相关的高成本

第六章市场区隔

- 依资产类型

- 家庭/儿童追踪

- 宠物追踪

- 车辆追踪

- 其他资产追踪(包括箱包和行李、钥匙、钱包、服装类、电子产品、工具和运动器材)

- 透过家庭/儿童追踪

- 家庭追踪

- 孩子追踪

- 透过车辆追踪

- 小客车追踪

- 商用车辆追踪

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 中东/非洲

- 拉丁美洲

第七章 竞争形势

- 公司简介

- Apple Inc.

- Vodafone Group

- Viasat Group

- IoT Venture

- Fitbark

- Tractive

- Smartcom Mobility Solutions

- Harman

- Modus

- PowUnity

第八章投资分析

第九章 市场机会及未来趋势

The consumer asset tracking market was valued at USD 1.92 billion in the previous year and is expected to register a CAGR of 14.03%, reaching USD 4.04 billion by the next five years.

Key Highlights

- The growing demand for people to track and manage their personal items has led to a major increase in the global consumer asset tracking market in recent years. Consumers are looking for dependable solutions to safeguard their belongings and improve their sense of security as occurrences of theft, loss, and misplacing of priceless goods are on the rise.

- There are ongoing technology developments in the consumer asset tracking business. The accuracy and functionality of asset tracking systems have been greatly improved by the integration of technologies like the global positioning system (GPS), the Internet of Things (IoT), and cloud-based platforms. Real-time tracking and monitoring capabilities are now available to consumers via user-friendly mobile applications and web interfaces.

- Applications for consumer asset tracking systems can be found in many industries. Among the most often tracked items are personal electronics like smartphones, and laptops and tablets. In addition, users are utilizing asset-tracking technology to safeguard pricey items like designer handbags, and jewelry, and watches.

- In order to avoid theft and enable location tracking in the event of unauthorized use, the automobile industry is increasingly adopting asset-tracking systems for vehicles. Additionally, pet owners are increasingly using pet tracking gadgets to keep tabs on their cherished friend's whereabouts.

- The COVID-19 pandemic significantly changed consumer behavior, accelerated digital transformation, and sped up the adoption of asset-tracking solutions, which had a substantial impact on the worldwide consumer asset-tracking market. After the epidemic, people were more worried about the security of their assets as they tried to save their priceless possessions. Since these systems offered real-time location updates and improved security features, there was a greater need for consumer asset monitoring services.

Consumer Asset Tracking Market Trends

Increasing usage for IoT based connected devices

- The rising adoption of IoT-based connected devices is significantly stimulating the global consumer asset-tracking market. The usefulness and efficiency of asset tracking solutions are improved by the Internet of Things (IoT) technology's seamless device communication, which enables real-time data transmission.

- A network of interconnected assets is provided by IoT-based connected devices, allowing for effective data transfer and communication. Asset tracking programs can broadcast to users or centralized platforms real-time location data, status updates, and other pertinent data due to this connectivity.

- Asset tracking systems that are IoT-enabled give consumers rapid access to information about the whereabouts, motion patterns, and condition updates of their assets. As a result, the danger of loss or theft is reduced, preventive maintenance is made possible, and asset visibility is improved.

- The ability to incorporate many sensors, including GPS, accelerometers, and temperature sensors, allows IoT-based asset-tracking systems to collect and communicate a variety of data. This makes it possible for users to keep track of the whereabouts of assets as well as their physical characteristics in real-time.

- As more connected devices reach the market, the global IoT ecosystem has experienced substantial growth. The growth of Internet of Things (IoT) devices offers a solid foundation for asset-tracking solutions to function efficiently, ranging from smartphones and wearables to smart homes and industrial equipment.

North America is Expected to Hold Significant Share

- For the creation and uptake of consumer asset tracking systems, North America has been at the forefront of technical developments such as the Internet of Things (IoT), cloud computing, and artificial intelligence (AI). The area offers a strong regulatory framework and an infrastructure that supports new developments in asset-tracking technologies.

- In comparison to other locations, North American consumers are more knowledgeable about and aware of asset monitoring systems. Higher adoption rates are the result of the region's tech-savvy populace and early adopters being receptive to new technologies, particularly consumer asset tracking.

- Several significant market participants in the consumer asset tracking sector are based in North America. These businesses have a significant market presence and provide a wide range of modern solutions to meet different consumers' needs. Their efforts in research and development help the market as a whole to expand.

- With an emphasis on utilizing technology to advance urban infrastructure and raise quality of life, the idea of smart cities is gaining popularity in North America. By facilitating effective management of public resources like bicycles, parking spaces, and shared resources, consumer asset monitoring contributes to the development of smart cities by improving resource allocation and use.

- The regulatory climate in North America is supportive, which promotes invention and the uptake of new technology. Regulatory agencies guarantee data security and privacy, boosting consumer trust in asset monitoring products and promoting market expansion.

Consumer Asset Tracking Industry Overview

The consumer asset tracking market is characterized by a multitude of both domestic and international players operating within a highly fragmented and fiercely competitive landscape. Prominent market leaders include Apple Inc., Vodafone Group, Viasat Group, Harman, and Smartcom Mobility Solutions, among others. Technological advancements have become instrumental in providing a substantial competitive edge to these companies while also fostering numerous collaborative partnerships within the market.

In April 2023, Digital Matter introduced a groundbreaking innovation in the form of the longest-lasting battery-powered Internet of Things (IoT) asset tracker. The Remora3, equipped with "second-by-second" tracking capabilities, has set new industry standards. Its aggressive tracking performance surpasses all existing battery-powered devices, opening up unprecedented possibilities for IoT asset-tracking applications that were previously achievable only through wired solutions.

In May 2023, BeWhere, a forward-looking startup specializing in the mobile Internet of Things (M-IoT), unveiled its latest asset trackers: the BeSol+ and BeTen+. An evolution of the company's highly regarded BeSol, the BeSol+ now boasts an industry-leading 5-minute live reporting frequency, even without an external power source. This remarkable achievement is made possible through the incorporation of innovative features, including solar recharging, Low-Power 5G and 2G communications, GPS, GLONASS, GNSS, Wi-Fi, BLE indoor and outdoor location technologies, a robust 7-amp rechargeable battery, and a larger solar panel.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing usage for IoT based connected devices

- 5.1.2 Increased 5G and advanced networks infrastructure development

- 5.2 Market Restraints

- 5.2.1 High costs associated with software and procurement

6 MARKET SEGMENTATION

- 6.1 By Asset Type

- 6.1.1 Family and Child Tracking

- 6.1.2 Pet Tracking

- 6.1.3 Vehicle Tracking

- 6.1.4 Other Asset Tracking (includes bags and luggage, keys, wallets, clothes, electronics, tools and sports equipment)

- 6.2 By Family and Child Tracking

- 6.2.1 Family tracking

- 6.2.2 Child Tracking

- 6.3 By Vehicle Tracking

- 6.3.1 Passenger Vehicle Tracking

- 6.3.2 Commercial Vehicle Tracking

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Middle-East & Africa

- 6.4.5 Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Apple Inc.

- 7.1.2 Vodafone Group

- 7.1.3 Viasat Group

- 7.1.4 IoT Venture

- 7.1.5 Fitbark

- 7.1.6 Tractive

- 7.1.7 Smartcom Mobility Solutions

- 7.1.8 Harman

- 7.1.9 Modus

- 7.1.10 PowUnity