|

市场调查报告书

商品编码

1408488

ServiceNow Store 应用程式:市场占有率分析、产业趋势与统计、2024-2029 年成长预测ServiceNow Store Apps - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

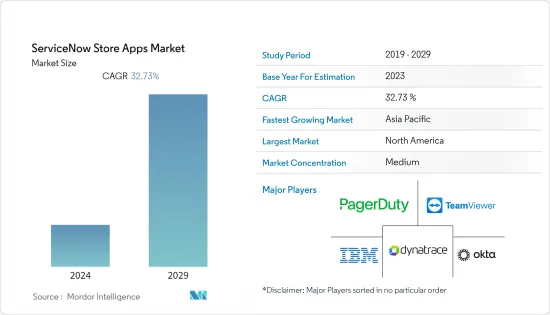

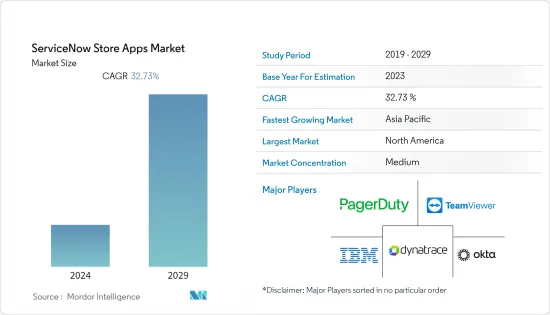

上年度ServiceNow Store应用市场规模为140.3亿美元,预计未来五年将达到435.4亿美元,复合年增长率为32.73%。

主要亮点

- ServiceNow Store 应用程式的全球市场充满活力且正在迅速扩张。 ServiceNow 是云端基础的服务管理解决方案的领先供应商,其 ServiceNow Store 是各种连接器和应用程式的市场,可提高 ServiceNow 平台的效能。

- ServiceNow Store 为各种公司的 IT、应用程式开拓和服务领域(包括人力资源、行销、法律和采购)的客户提供购买和建置选项。您还可以快速、安全地发现、采购和部署应用程式。 ServiceNow 平台吸引了众多公司的投资兴趣,因为它是为每个行业设计和开发的应用程式。组织可以自由部署直觉、使用者友好的应用程式来提高生产力。该平台提供敏捷性和创新来推动业务成长。

- 云端运算的日益普及和对云端基础的解决方案的需求不断增加是推动 ServiceNow Store 应用程式市场价值的根本驱动力。许多大大小小的企业已经透过云端处理成功整合了专业的SaaS解决方案。因此,ServiceNow Store 应用程式的采用正在加速。此外,企业正在利用 ServiceNow Store 应用程式的潜力来实现数位转型。

- ServiceNow 应用程式市场提供了广泛的低程式码开发工具和解决方案。这些工具允许开发人员、分析师和业务用户建立、配置和自订应用程序,而无需进行大量编码。根据低程式码软体开发平台 OutSystems 进行的一项民意调查,低程式码和无程式码解决方案似乎有助于应对这项挑战。 71% 在工作中使用低程式码技术的开发人员表示,他们能够每週工作 40 小时。相较之下,在未采用低程式码的组织中,只有 44% 的开发人员表示了相同的看法。此外,63% 的低程式码开发人员对自己的薪资和福利感到满意,而传统开发人员的比例为 40%。

- 相反,由于市场的动态技术进步,客户的客製化需求不断增加,这给 IT 服务提供者带来了额外的障碍。 IT 服务供应商经常遇到网路不良、硬体需求以及敏感资讯身份验证问题等挑战。基础设施和可扩展性的缺乏正在进一步影响IT服务提供者的业务,并成为这段时期企业成长的最大推动力。

- COVID-19 的爆发促使全部区域的企业采取一切必要措施确保员工和社区的安全。由于远距工作的增加和企业数位转型的扩大,COVID-19对市场产生了有益的影响。公司希望业务流程无缝、高效且可从任何地方存取。此外,许多公司已经完成了数位转型,并决定保持完全远端或混合模式运作。

ServiceNow Store 应用市场趋势

云端基础的预计将占据很大的市场份额

- 随着数位转型,组织已经发展到依赖 IT 提供的创造性应用程式和增强功能的成功。 IT 已成为大多数组织的关键竞争优势。此外,云端迁移和服务选项使 IT 外包不仅仅是一种削减成本的技术。因此,这种新型态是由业务成长、客户体验和竞争破坏的组织动机所驱动的。

- 对基于云端基础的服务的需求,以及企业对将资料迁移到云端以节省资金和资源而不是构建和维护新的资料储存的重要性的日益认识。我们正在推动按需安全的采用该地区的服务。由于其各种优势,云端平台和生态系统预计将成为未来几年加快数位创新步伐和规模的跳板。

- 此外,Qlik 于 2022 年 11 月宣布推出 Qlik Cloud Data Integration,这是一个业务整合平台即服务 (eiPaaS),旨在推进企业资料策略。该平台旨在将所有企业应用程式和资料来源无缝连接到云端,在支援跨组织的资料存取、即时移动性和资料转换方面发挥关键作用。这些改进对于企业充分发挥资料的潜在价值至关重要。

- 希望从本地软体迁移到云端基础的解决方案的公司主要关注标准合规性(「供应商是否遵守最佳安全实践?」)、入侵防御和检测(「供应商是否遵守最佳安全实践?」) ,以及入侵防御和检测(“供应商是否检查重要安全功能的潜在解决方案的功能,例如“它是否表明您的资料是否已洩露?”频宽需求波动的企业主要需要能够在短时间内增加或减少容量。云端技术为组织提供了根据业务需求扩大或缩小频宽所需的弹性。这种方法使公司能够降低成本并获得竞争优势。

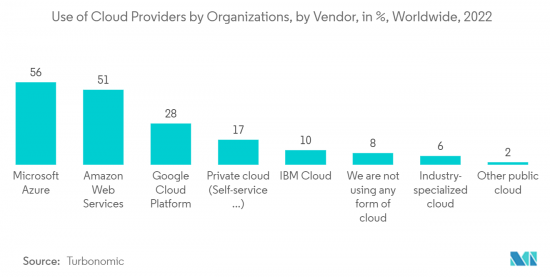

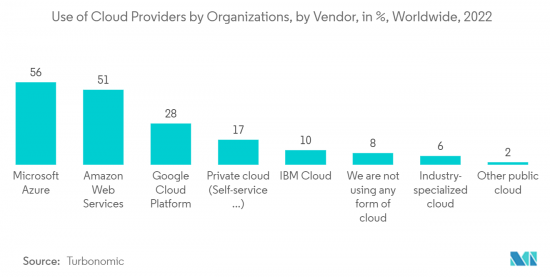

- Turbonomic 的数据显示,不使用云端的受访者比例从 2021 年的 4% 上升到 2022 年的 8%。微软 Azure 以 56% 的份额位居榜首。透过云端平台,您可以整合多个应用程式、推动新的和扩展的管道、管理费用、管理私有云端、存取客户资料、改进服务等等。

预计北美将占据很大的市场份额

- 预计北美将占据市场的主要份额。根据美国小型企业发展管理局的数据,到2022年,美国小型企业数量将达到3,320万家,几乎占全国所有企业的比例(99.9%)。 2022年美国小型企业数量与前一年同期比较增2.2%,2017年至2022年成长12.2%,呈现稳定成长。

- 未来几年,机器学习 (ML) 的快速发展将迎来自动化的新时代,让无人机和机器人以前所未有的速度执行复杂的任务。自动化的激增为机器学习演算法创造了广泛的机会,特别是在网路安全领域,其中速度和准确性是塑造数位未来的关键因素。预计这将在不久的将来刺激 MLaaS(机器学习即服务)市场的成长。

- 此外,联合机器学习的商业性应用的快速成长预计也将成为 MLaaS 需求成长的关键驱动力。例如,根据 Helpnetsecurity 的数据,73% 的美国公司计划在 2022 年将额外的人工智慧和机器学习纳入其网路安全工具中。这凸显了 MLaaS 解决方案在不断发展的数位环境中加强网路防御和确保资料安全日益重要。

- 此外,透过科技帮助企业蓬勃发展的资讯科技 (IT)服务供应商centerxIT 宣布推出 Pzzle,这是一个旨在简化向客户提供 IT 服务的先进平台。 Pzzle 是与 ServiceNow 的开发团队 Dreamtsoft 合作设计的。 Pzzle是业界第一个企业级IT服务管理(ITSM)和快速应用开发平台。透过结合创新速度、产品弹性和多客户端细分架构,Pzzle 扩展了对传统託管服务供应商(MSP) 的支持,以改善客户体验、资料品质和安全性。

- 企业对业务流程的即时製化和可扩展性的日益增长的需求预计将推动应用开发,以满足最终用户的需求。企业向行动性的转变正在推动智慧型手机的使用,支持携带设备的趋势并推动快速的应用开发市场。弥合基本 IT 技能差距并加快编码员和非编码员编码流程的组织要求正在推动应用开发市场快速发展。

- 着名的软体开发公司往往擅长提供一流的软体解决方案,因为他们很难吸引顶尖人才并有效满足客户的功能需求。我们有雄厚的财力来实现这一点。相反,小型企业可能会被客户的大量功能请求淹没,并且可能需要额外的资源来充分回应这些紧迫的请求。

- 当一家信誉良好的大型公司在行业中拥有长期地位时,客户可以合理地期望其产品包含根据其需求量身定制的全面功能。然而,值得注意的是,这种程度的专业知识和广泛的功能集通常伴随着高昂的价格。

ServiceNow 商店应用程式产业概览

全球 ServiceNow Store 应用程式市场正在经历多家主要企业的逐步整合,包括 IBM Corporation、Okta, Inc.、PagerDuty、TeamViewer 和 Dynatrace LLC。这些公司保持着强大的影响力,并积极投资于策略合作伙伴关係和服务开拓,以扩大市场占有率。

2023 年 5 月,安全企业生产力应用程式的领先供应商 Discover Technologies 的 DTech Apps 宣布对其 Tasker 和 DocIntegrator 应用程式进行重大更新。这些更新旨在透过利用 Now 平台的功能实现企业任务管理和流程挖掘的现代化。 DTech Apps 与 ServiceNow 的合作伙伴解决方案卓越中心合作,促进内建 ServiceNow 解决方案的开发。此次合作包括一个专家团队,他们提供技术和业务指导,以加快上市时间并改善客户成果。这些新解决方案旨在改善全球员工体验,提供可在平台和行动装置上存取的高度适应性、直觉且用户友好的应用程式。

2023 年 5 月,mabl(一家专注于低程式码、智慧型测试自动化的着名 SaaS 供应商)宣布推出新颖的负载测试功能。此功能允许工程团队评估其应用程式在生产级压力下的性能。负载测试选项无缝整合到 mabl 的 SaaS 平台中,使用户能够最大限度地发挥现有功能测试的价值,将效能测试移至开发生命週期的早期,并降低基础设施和营运成本。这项创新增强了组织的测试能力,以确保强大的应用程式效能和可靠性。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 买方议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 云端服务和云端运算的采用增加

- 数位平台的兴起与先进技术的采用

- 市场抑制因素

- 初期成本和许可成本高昂

第六章市场区隔

- 按类型

- 云端基础

- 基于网路的

- 按公司规模

- 中小企业 (SME)

- 大公司

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争形势

- 公司简介

- IBM Corporation

- Okta, Inc.

- PagerDuty

- teamviewer

- Dynatrace LLC

- xMatters, Inc.

- SAILPOINT TECHNOLOGIES INC.

- Talkdesk, Inc.

- Cisco Systems Inc.

- Microsoft Corporation

第八章投资分析

第九章 市场机会及未来趋势

The ServiceNow store apps market was valued at USD 14.03 billion in the previous year and is expected to register a CAGR of 32.73%, reaching USD 43.54 billion by the next five years.

Key Highlights

- The global market for ServiceNow store apps is vibrant and quickly expanding. ServiceNow is a top provider of cloud-based service management solutions, and its ServiceNow store acts as a market for different connectors and applications that improve the performance of the ServiceNow platform.

- The ServiceNow Store provides clients in IT, application development, and service domains across various enterprises, including HR, marketing, legal, and purchasing, with a buy versus build option. It also allows for discovering, procuring, and deploying applications quickly and securely. The ServiceNow platform is an interest for investment from various firms as the applications are designed and developed for every department. The organizations are offered the liberty to deploy intuitive, user-friendly apps, increasing productivity. The platform provides agility and innovation to drive business growth.

- Increased adoption of cloud computing and the growing demand for cloud-based solutions are fundamental driving forces escalating the ServiceNow store apps market value. Many big and small businesses have successfully integrated specialized SaaS solutions through cloud computing. This, as a result, has accelerated the adoption of ServiceNow store apps adoption. Additionally, businesses are leveraging the potential of ServiceNow store apps to achieve digital transformation.

- The ServiceNow app market offers a wide range of low-code development tools and solutions. These tools enable developers, analysts, and business users to build, configure, and customize the application without the need for extensive coding. According to a poll conducted by OutSystems, which provides a low-code software development platform, low-code and no-code solutions appear to be assisting in addressing this difficulty. 71% of developers polled who reported utilizing low-code technologies in their professions indicated they could work a 40-hour work week. In comparison, only 44% of developers at organizations that do not employ low code expressed the same. In addition, 63% of low-code developers were satisfied with their salaries and perks, compared to 40% of traditional developers.

- On the contrary, the growing client customization requests owing to the dynamic technological advancement in the market have further created hindrances for IT service providers. They frequently encounter challenges regarding networking shortages, hardware requests, and authentication fallouts over sensitive information, as most of the workforce works remotely. The lack of infrastructure and scalability further affects the business of IT service providers, which has become the most significant factor for the company's growth during this period.

- The outbreak of COVID-19 prompted firms across the region to undertake all the necessary steps to secure the safety of their employees and the community. COVID-19 had a beneficial impact on the market, owing to the rise in remote working and the expanding digital transformation of enterprises. Businesses are looking for business processes that are seamless, efficient, and accessible from any location. Further, many businesses have completed their digital transformation, and many have decided to remain fully remote or operate on a digital and in-office hybrid model.

ServiceNow Store Apps Market Trends

Cloud-Based is Expected to Hold Significant Share of the Market

- With digital transformation, organizations have evolved dependent on the success of creative applications and extensions that IT could provide. IT has become a critical competitive edge for most organizations. Moreover, IT outsourcing has become more than a simple cost-reduction technique with cloud migrations and service options. Therefore, this new form is driven by organizational motivations regarding business growth, customer experience, and competitive disruption.

- The increasing realization among businesses about the importance of holding money and resources by moving their data to the cloud setup instead of building and maintaining new data storage drives the demand for cloud-based services and, hence, the adoption of on-demand security services in the region. Owing to multiple benefits, cloud platforms and ecosystems are expected to serve as a launchpad for an outbreak in the pace and scale of digital innovation over the next few years.

- Further, in November 2022, Qlik introduced Qlik Cloud Data Integration, its Business Integration Platform as a Service (eiPaaS), with the goal of advancing corporate data strategies. This platform aims to seamlessly connect all enterprise applications and data sources to the cloud, playing a pivotal role in enhancing data access, real-time mobility, and data transformation across the organization. These improvements are instrumental for enterprises in fully unlocking the potential value of their data.

- Companies that have been considering moving from on-premise software to a cloud-based solution are primarily checking the potential solutions for their capabilities concerning crucial security features that include standards compliance ('does the vendor comply with the best security practices'), intrusion prevention and detection ('will they know if the company or the vendor data has been breached'), among others. Businesses that have fluctuating bandwidth demands primarily need to be able to scale up and down their capacity at short notice. Cloud technology provides organizations with the flexibility they need to grow and reduce their bandwidth with the needs of their operation. This approach can cut costs and give companies an edge over the competition.

- According to Turbonomic, the percentage of respondents not using any cloud rose to eight percent in 2022 from four percent in 2021. Microsoft Azure was on the top with 56%. Deployment of cloud platforms also allows for the integration of multiple applications, the facilitation of new and extended channels, the management of expenses, the management of the private cloud, improved access to client data, and the improvement of services.

North America is Expected to Hold Significant Share of the Market

- North America is expected to hold a significant share of the market. According to the United States Small Business Administration Office of Advocacy, in 2022, the digit of small businesses in the United States reached 33.2 million, accounting for nearly all (99.9 percent) businesses in the country. The growth in the number of small firms in the United States in 2022 reflects a steady increase, with a 2.2 percent boost from the previous year and a 12.2 percent increase from 2017 to 2022.

- In the coming years, the rapid advancement of machine learning (ML) is ushering in a new era of automation, with the deployment of drones and robots performing complex tasks at an unprecedented pace. This surge in automation is creating extensive opportunities for ML algorithms, particularly in the realm of cybersecurity, where speed and precision are pivotal factors shaping the digital future. This, in turn, is poised to fuel the growth of the machine learning as a service (MLaaS) market in the foreseeable future.

- Furthermore, the burgeoning commercial adoption of federated ML is anticipated to be a key driver of the growing demand for MLaaS. For instance, according to Helpnetsecurity, a remarkable 73% of businesses in the United States have plans to incorporate additional artificial intelligence and machine learning into their cybersecurity tools in 2022. This underscores the increasing significance of MLaaS solutions in fortifying cyber defenses and ensuring data security in an ever-evolving digital landscape.

- Moreover, centrexIT, an information technology (IT) services provider helping businesses thrive through technology, had Pzzle, an advanced platform designed to streamline IT service delivery to clients. It is designed in partnership with Dreamtsoft, the development team behind ServiceNow. Pzzle is the industry's first enterprise-grade IT service management (ITSM) and rapid application development platform. By combining the speed of innovation, product flexibility, and multi-client segmented architecture, Pzzle expands traditionally managed service provider (MSP) support and improves the client experience, data quality, and security.

- The development of rapid application development is anticipated to be driven by the increasing requirement for instantaneous customization and scalability of business processes in enterprises to satisfy the needs of end users. The move to mobility in enterprises is boosting the use of smartphones and supporting the trend of bringing your device, boosting the rapid application development market. The requirement for organizations to close gaps in essential IT skills and speed up the coding process for both coders and non-coders is driving the rapid application development market forward.

- Prominent software development firms often excel in delivering top-notch software solutions due to their substantial financial capabilities, which enable them to attract top talent and effectively address customer feature requests. Conversely, smaller businesses may find themselves inundated with a multitude of feature requests from their clients but might require additional resources to adequately respond to these pressing demands.

- When a well-established, larger company has a long-standing presence in the industry, clients can reasonably expect the product to encompass a comprehensive set of features tailored to their needs. However, it's worth noting that this level of expertise and extensive feature set often comes with a higher price tag.

ServiceNow Store Apps Industry Overview

The Global ServiceNow Store App market exhibits moderate consolidation, with several key players, including IBM Corporation, Okta, Inc., PagerDuty, TeamViewer, and Dynatrace LLC, among others. These companies maintain a strong presence and are actively investing in strategic partnerships and service developments to expand their market share. Notable recent developments in the market include:

In May 2023, DTech Apps by Discover Technologies, a leading player in secure enterprise productivity apps, announced significant updates to their Tasker and DocIntegrator applications. These updates aim to modernize enterprise task management and process mining by leveraging the capabilities of the Now Platform. DTech Apps has partnered with ServiceNow's Partner Solutions Center of Excellence to facilitate the development of their Built-on ServiceNow solution. This collaborative effort involves a dedicated team of experts who provide technical and business guidance, thereby accelerating time-to-market and enhancing customer outcomes. These new solutions are designed to enhance the experience of the global workforce, offering adaptable, intuitive, and user-friendly applications accessible on both the platform and mobile devices.

In May 2023, mabl, a prominent SaaS provider specializing in intelligent test automation with low code, introduced a novel load-testing feature. This feature enables engineering teams to assess how their applications perform under production-level pressure. The load-testing option seamlessly integrates into mabl's SaaS platform, empowering users to maximize the value of their existing functional tests, shift performance testing to earlier stages of the development lifecycle, and reduce infrastructure and operational costs. This innovation enhances the testing capabilities of organizations, ensuring robust application performance and reliability.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rise in adoption of cloud services and cloud computing

- 5.1.2 Rise in digital platforms and adoption of advance technologies

- 5.2 Market Restraints

- 5.2.1 High upfront and licensing costs

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Cloud-Based

- 6.1.2 Web- Based

- 6.2 By Enterprise Size

- 6.2.1 Small and Medium Enterprises (SMEs)

- 6.2.2 Large Enterprises

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Okta, Inc.

- 7.1.3 PagerDuty

- 7.1.4 teamviewer

- 7.1.5 Dynatrace LLC

- 7.1.6 xMatters, Inc.

- 7.1.7 SAILPOINT TECHNOLOGIES INC.

- 7.1.8 Talkdesk, Inc.

- 7.1.9 Cisco Systems Inc.

- 7.1.10 Microsoft Corporation